The DeFi revolution is roaring, but navigating its vast expanse can feel like charting uncharted waters with a blindfold on. Yet, for the discerning investor...

Cryptowatch review

Cryptowatch is a real-time crypto markets platform, founded in 2014 by Artur Sapek. Now, 7 years later, it’s owned by Kraken, where he now works as a lead developer.

Cryptowatch provides cryptocurrency market data and charts for over 25 cryptocurrency exchanges. Data is provided in real-time directly from exchanges through their APIs and covers over 4,000 markets. Although it has been around for a few years, it seems like Cryptowatch is lacking some functionalities, including a mobile application. Trading is provided for no more than 9 exchanges and futures trading is only possible on Kraken.

This review gives an honest perspective on the service Cryptowatch provides and shows you why Good Crypto raises the bar even further, making it a bold winner when comparing both services.

- 1. Cryptowatch crypto platform overview

- 2. Cryptowatch desktop application

- 3. Cryptowatch in your browser

- 4. Features of the Cryptowatch app

- 5. Trading with Cryptowatch

- 6. Paid features

- 7. An overview of the Cryptowatch app

- 8. Good Crypto, the best Cryptowatch alternative

Cryptowatch crypto platform overview

What is Cryptowatch? In short, Cryptowatch is a browser-based crypto charting platform and multi-exchange trading terminal, providing traders with charts, order books, market data, and the possibility to trade on several crypto exchanges. Recently, a desktop application was launched, but it lacks many features.

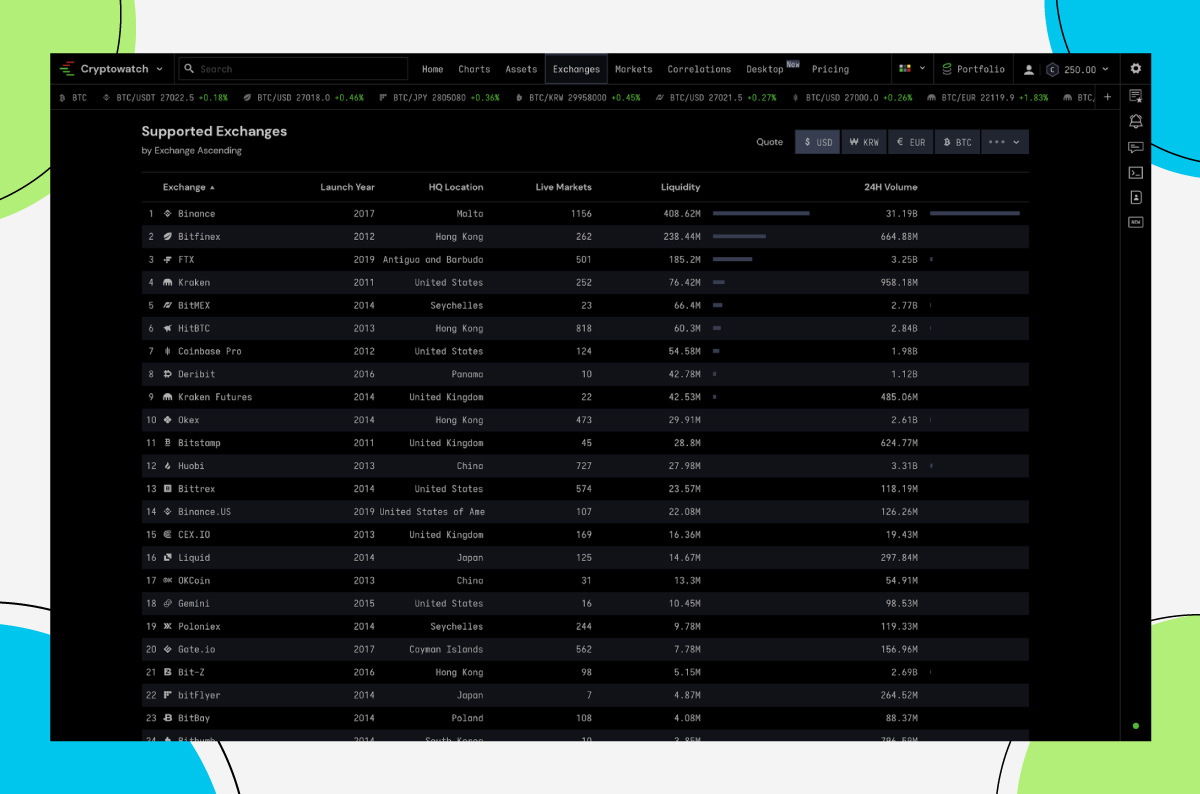

Cryptowatch tracks the markets on 28 exchanges: Binance, Binance.US, Bisq, Bit-Z, BitBay, Bitfinex, bitFlyer, Bithumb, BitMEX, Bitstamp, Bittrex, CEX.IO, Coinbase Pro, Coinone, Deribit, FTX, FTX.US, Gate.io, Gemini, HitBTC, Huobi, Kraken + Kraken Futures, Liquid, Luno, OKCoin, Okex, Poloniex, and Uniswap V2.

Cryptowatch Bitcoin and Cryptowatch crypto trading is possible on Binance, and Binance.US, Bitfinex, Bitstamp, Coinbase Pro, Kraken and Kraken futures, FTX, and FTX.US, and also Poloniex. Portfolio tracking is possible for these 9 exchanges, and also BitMEX, Bittrex, HitBTC, Huobi, and Okex.

Cryptowatch has paid features, accessible through a “credits” system. We’ll look deeper into it later. Let’s initiate the review with the free desktop application since it’s a basic version of Cryptowatch.

Cryptowatch desktop application

Available for free, the crypto desktop application is advertised as “blazing-fast”.

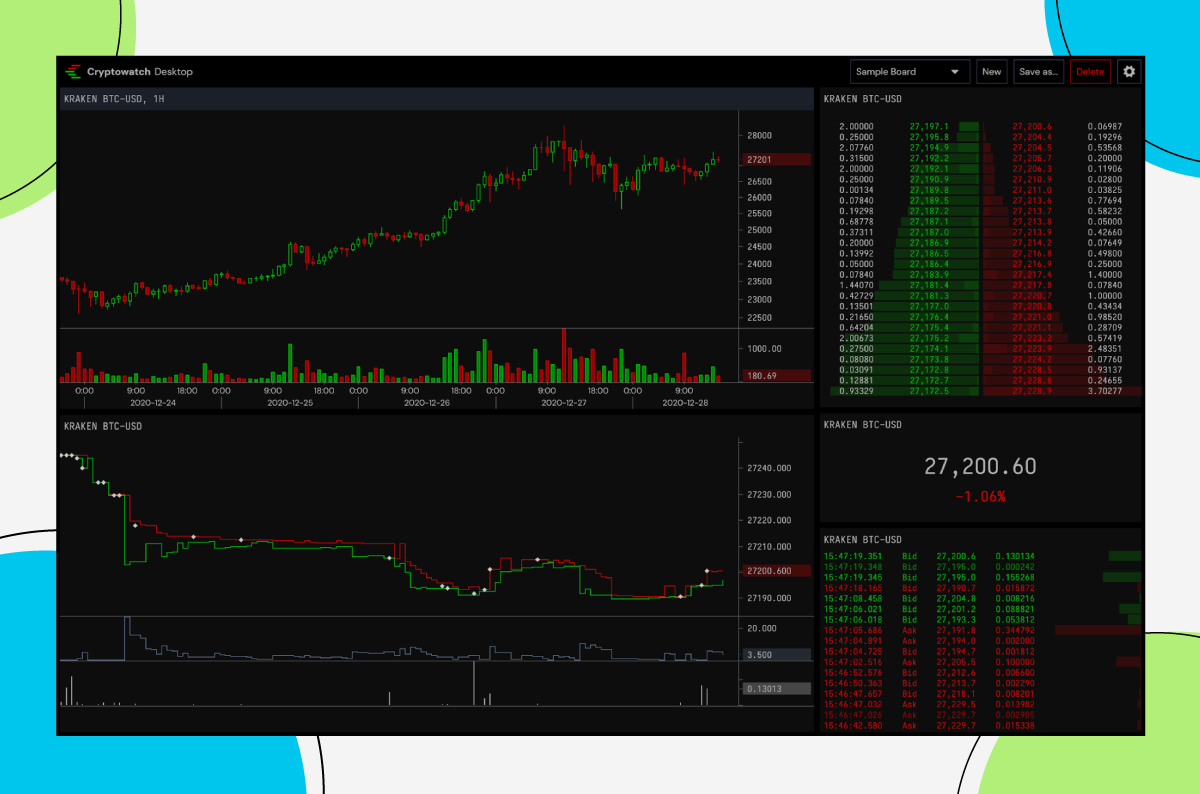

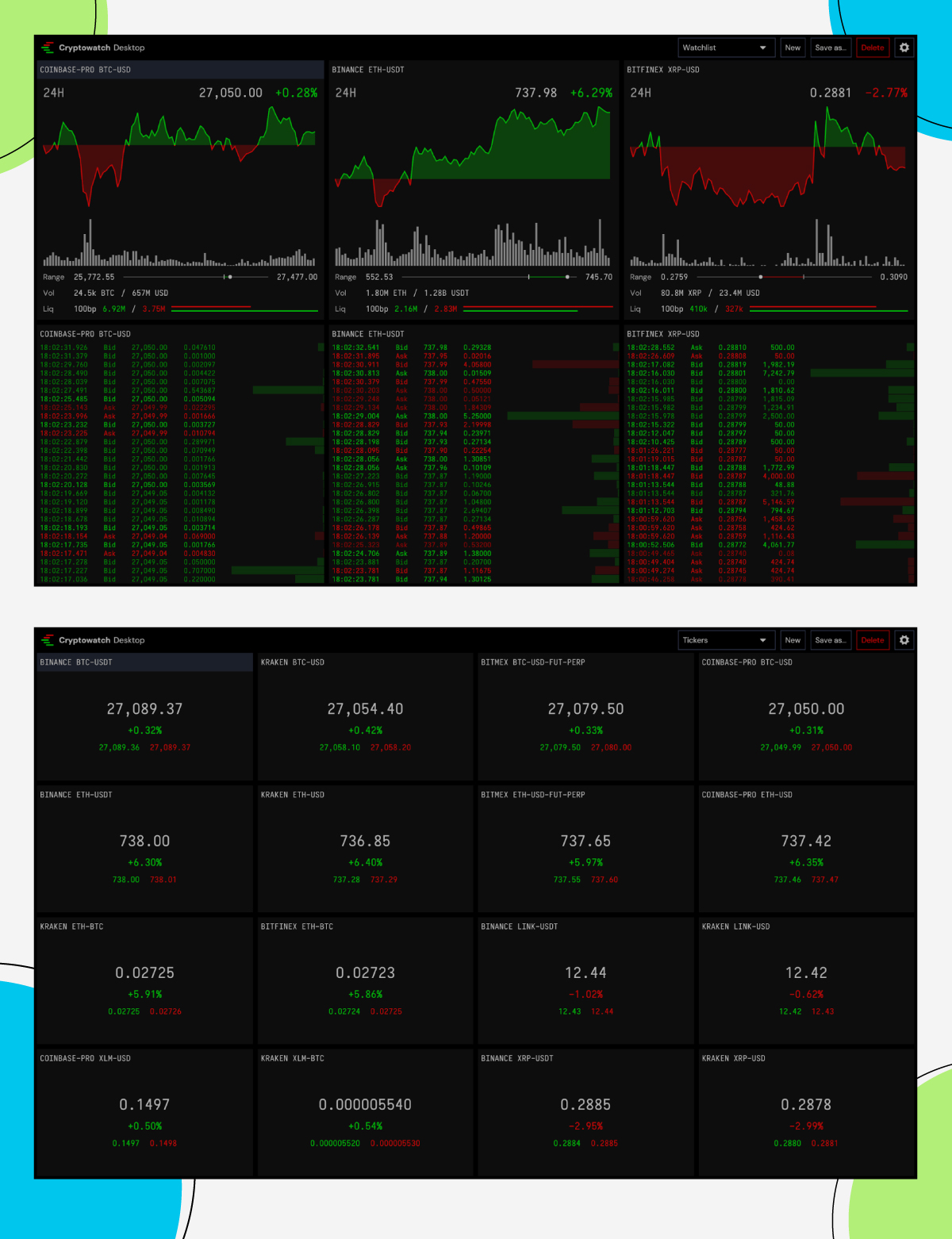

The Cryptowatch application works with Boards. When initiating, it will show a BTC/USD chart from Kraken, the order book, and the recent history of trades. Everything is live and instantly updated.

A board can be divided and filled with Modules. Modules can be candle charts, order books, summaries, tick charts, tickers, time scales, a custom text box, and watch lists.

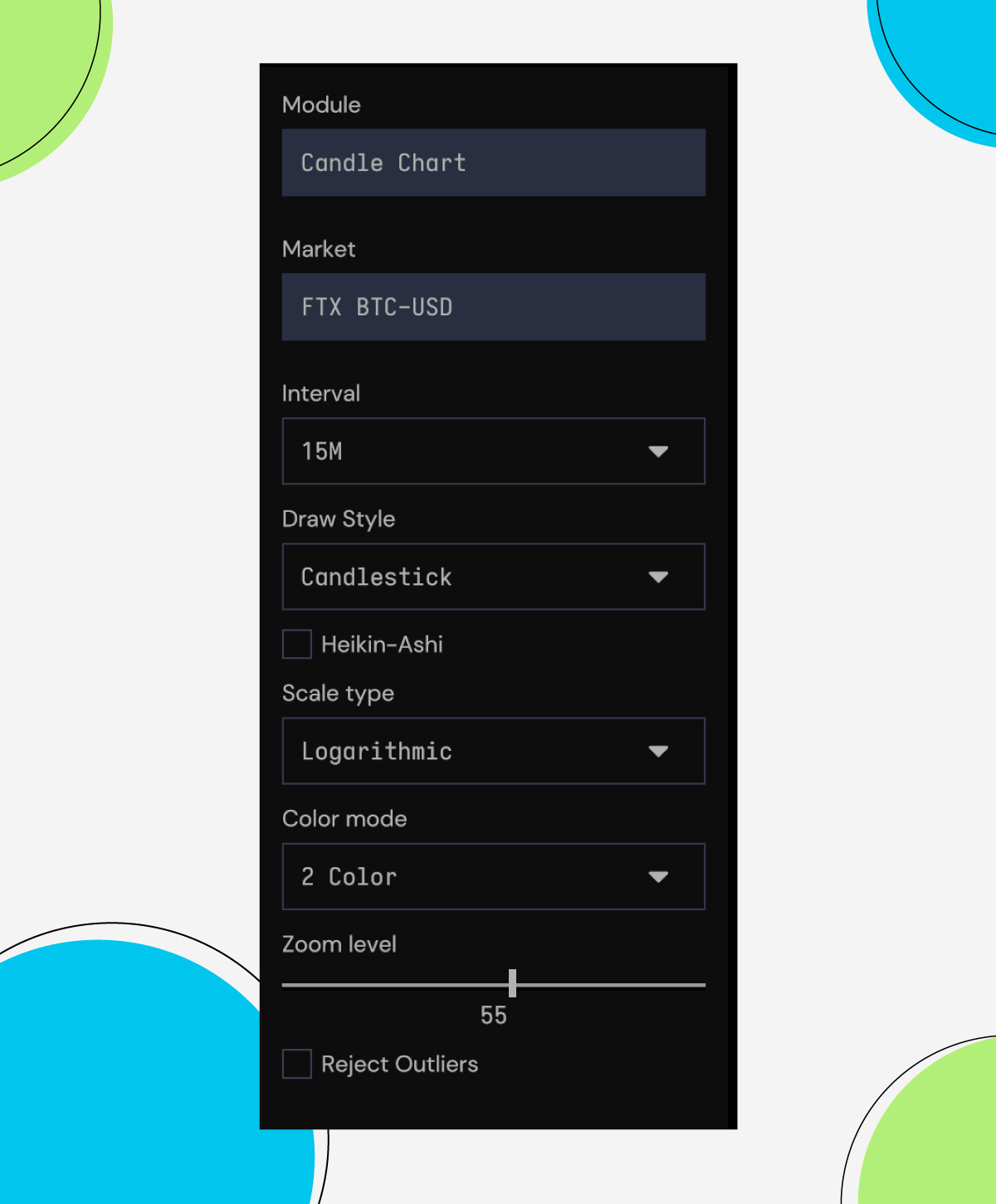

In the example on the left, we see the options for charts. The intervals go from 1 minute to 1 week, offering both short-term charts as well as a long-term overview. Experienced traders will immediately notice the lack of indicators. There’s not even a simple RSI or MACD indicator, nor an EMA and other basics. Very disappointing, although a lot of attention goes to charts in this application, there is no way of making an extensive technical analysis.

Draw styles include the normal candlesticks, candle body only, or OHLC and HLC. Each one of those can also be shown as Heikin-Ashi, which is based on averages.

Candles can be shown in 2 colors or 4.

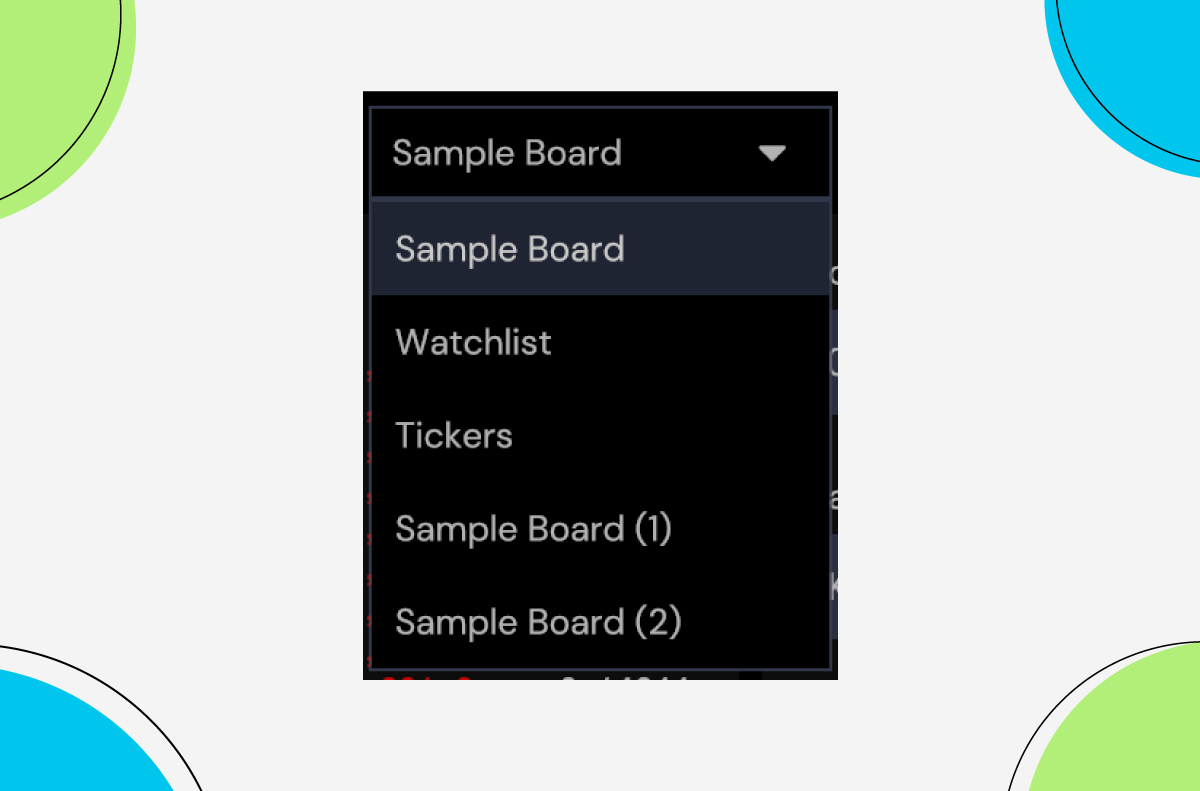

Besides the sample board, the application comes with a watchlist and tickers.

An example of a custom-made board. The application does not take a lot of computation power as advertised.

Conclusion on the desktop application

The Cryptowatch application works fast and does not require a lot of computational power, yet it can show a lot of information on one screen, several charts, live data, tickers, and so forth. Sadly enough there’s not much the application offers besides showing basic live information. There are no technical indicators included, there is no portfolio feature or any way to connect with exchange accounts, trading is not possible, and the interface looks rather ugly with no possibility to adjust the colors. Launching a cryptocurrency application, especially for desktop, without an option to trade seems quite useless… Strange!

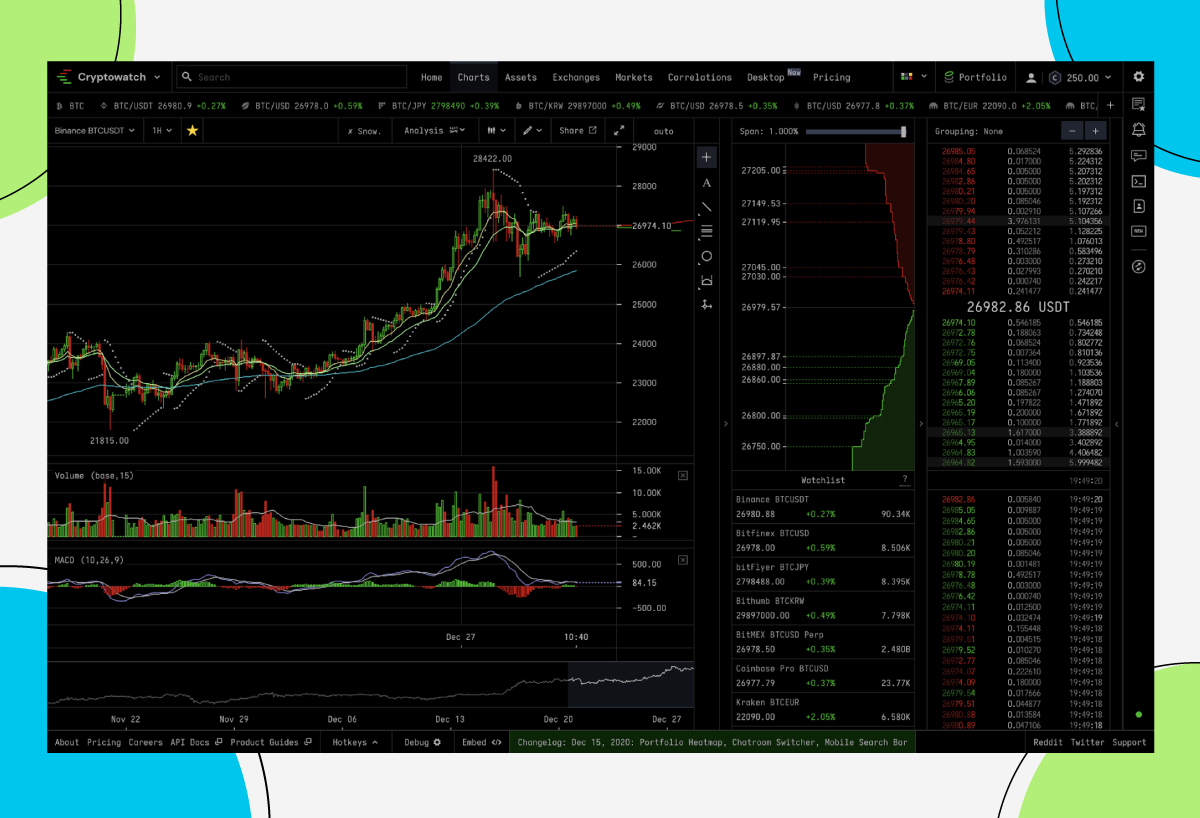

Cryptowatch in your browser

If you want to trade, then you’ll have to stick to the browser version of Cryptowatch. The need for a fast and light desktop version of Cryptowatch is immediately obvious when visiting the browser version. Opening charts is a heavy load, and scrolling is laggy. The page froze when testing the platform and the computer became suddenly extremely hot. The performance is slow and not very responsive as loading a page takes several seconds. Sadly enough, there is no mobile version of the application, leaving you clueless about your trades once you leave your desktop.

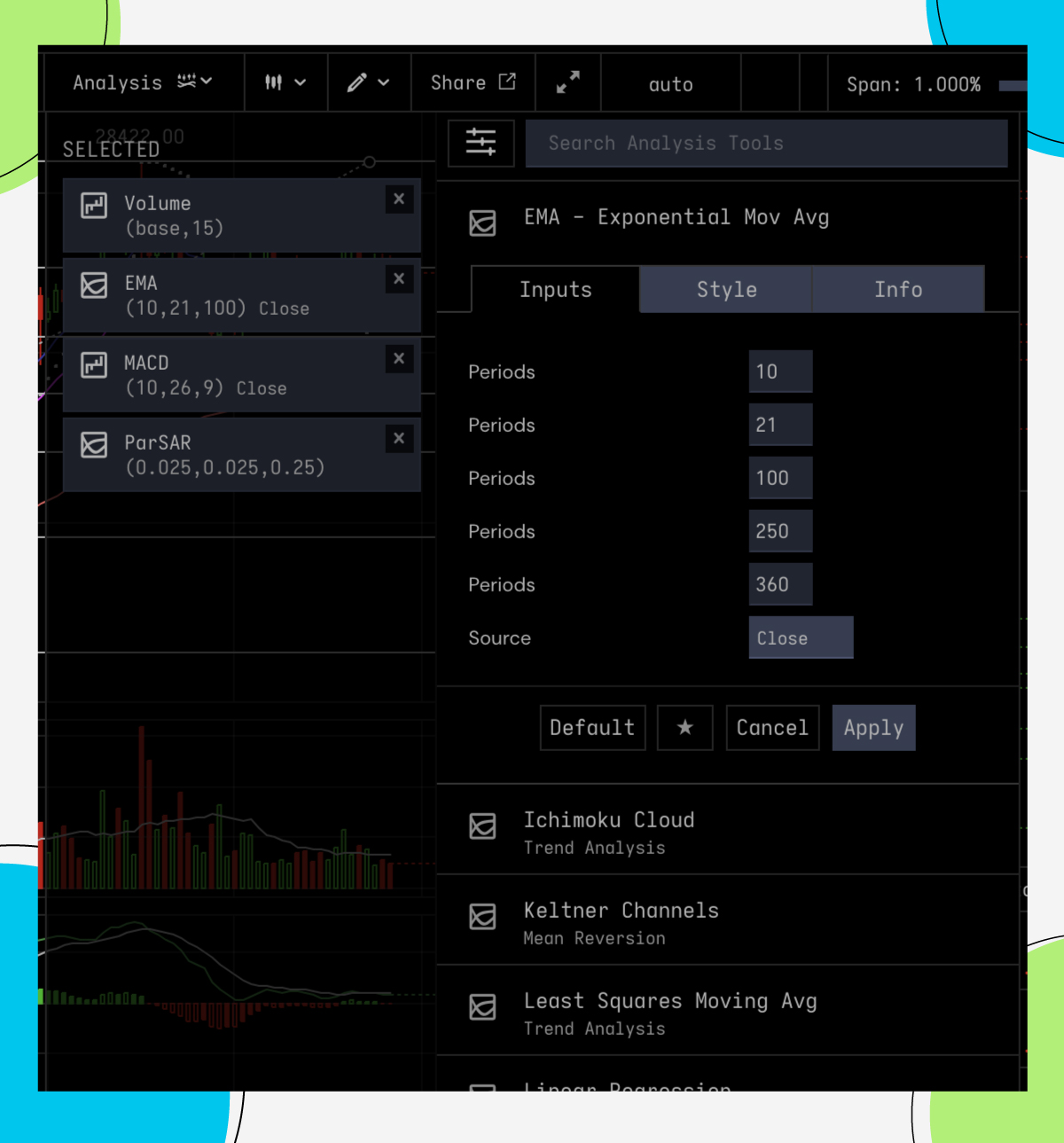

Luckily, the browser version has charts that come with indicators! Every indicator can be customized to the settings you prefer.

This was missing in the desktop version, indicators, and the possibility to make a decent technical analysis based on oscillators and other tools. Professional use of Cryptowatch is, consequently, only possible on the browser version of the application.

The first impression makes it very clear that this platform is not for beginners. Every page is filled with a lot of information which is overwhelming. Luckily, there are different themes and users can even adapt specific colors to their liking.

The reason why professional traders would enjoy this is that the traditional red and green colors are psychologically influencing you during trading. Some prefer no colors at all and look at charts in black and white.

Two examples of how the interface themes significantly change your experience on the platform.

Features of the Cryptowatch app

Leaving our first impression behind, what features does Cryptowatch offer?

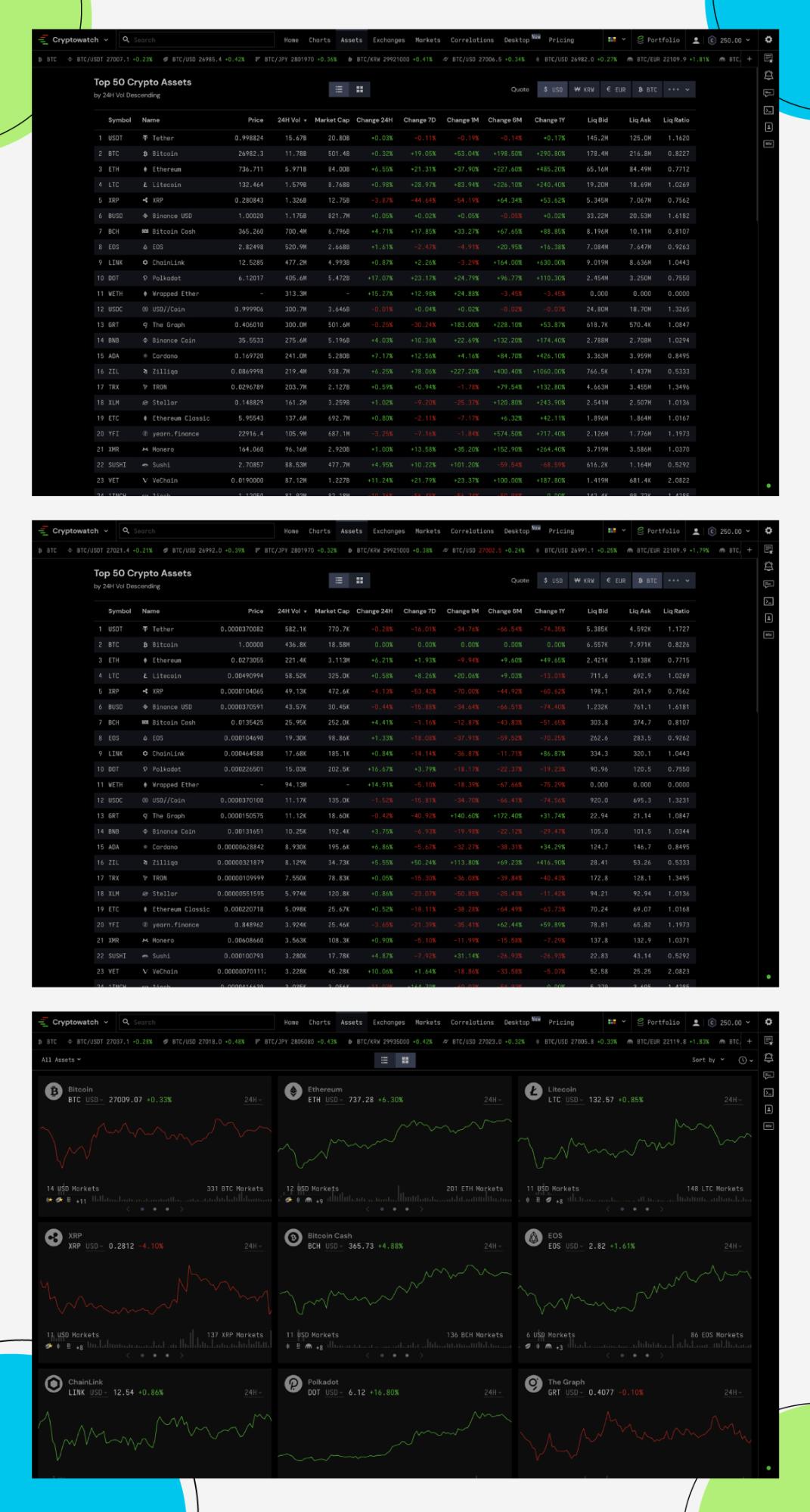

Assets

Cryptowatch’s strength is the big amount of data it collects and presents to you. The assets section is a good example, showing the performance of currencies over different periods, and with the possibility to change the main currency.

In the examples provided, you can see how it’s important to interpret markets both in their USD value and their BTC value. The list can also be shown as a grid, making it less overwhelming.

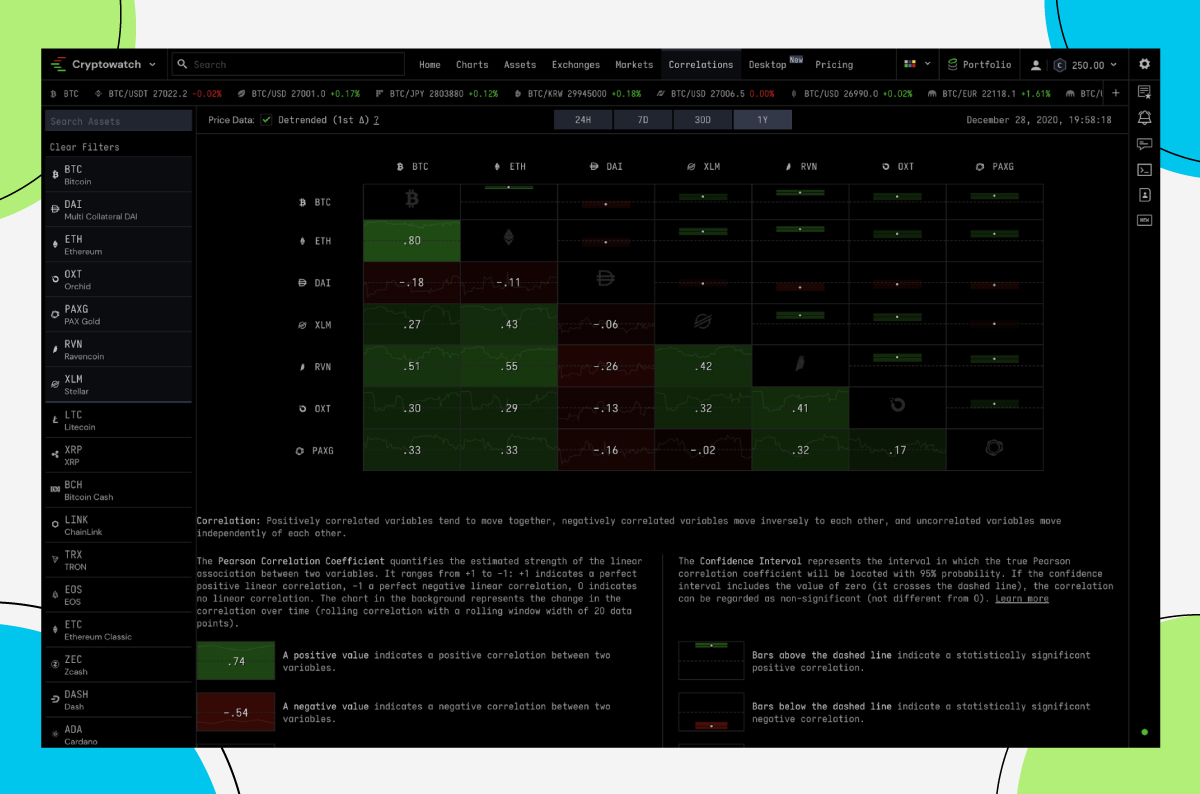

Correlation

Cryptowatch allows you to dive deeper into data and compare markets based on their correlation with the currency you want. Trading correlations is not for beginners, but it can give you insight into which markets are related to each other. If correlation on a long-term trend is significant, then the chance is that it will balance itself out in the short term. This means, 2 markets in strong relation with each other that move in correlation, will likely show the same behavior in the future.

How can this be traded? Let’s say XTZ and DASH are showing a high correlation in their long-term movements. One day, DASH has a strong positive movement but XTZ doesn’t. Based on the information you have showing their correlation, you could expect XTZ to catch up and also make a positive movement in the near future.

Exchanges

The exchanges list gives an overview of the volume and other details. Don’t be confused though, this is not a list of exchanges Cryptowatch offers to trade on. Trading on Cryptowatch is only possible on 9 exchanges: Binance and Binance.US, Bitfinex, Bitstamp, Coinbase Pro, Kraken and Kraken futures, FTX and FTX.US, and also Poloniex. Let’s go deeper into what Cryptowatch offers in regards to trading.

Trading with Cryptowatch

Cryptowatch allows trading on the previously mentioned exchanges through the Cryptowatch account API connectivity. The platform asks for no extra fees except for the standard exchange fees and trading is offered free. Margin trading is only available for Kraken, Bitfinex, and Poloniex. Ever since the 2018 bear market, margin trading is very popular. It allows traders to make a profit even while the trend is going down. So can you short on Cryptowatch? Yes, but only on 4 exchanges (+ Kraken Futures), which is very disappointing.

Cryptowatch is not bringing a lot of extra value to the table when it comes to order types. When connecting with an exchange, you will only be able to create the types of trades offered by that exchange. When placing a trade, your balance is frozen and there’s no automated trading. Usually, traders go to third-party applications to find more options, and Cryptowatch is not offering this. Advanced order types will need to be found elsewhere, the best one being Good Crypto.

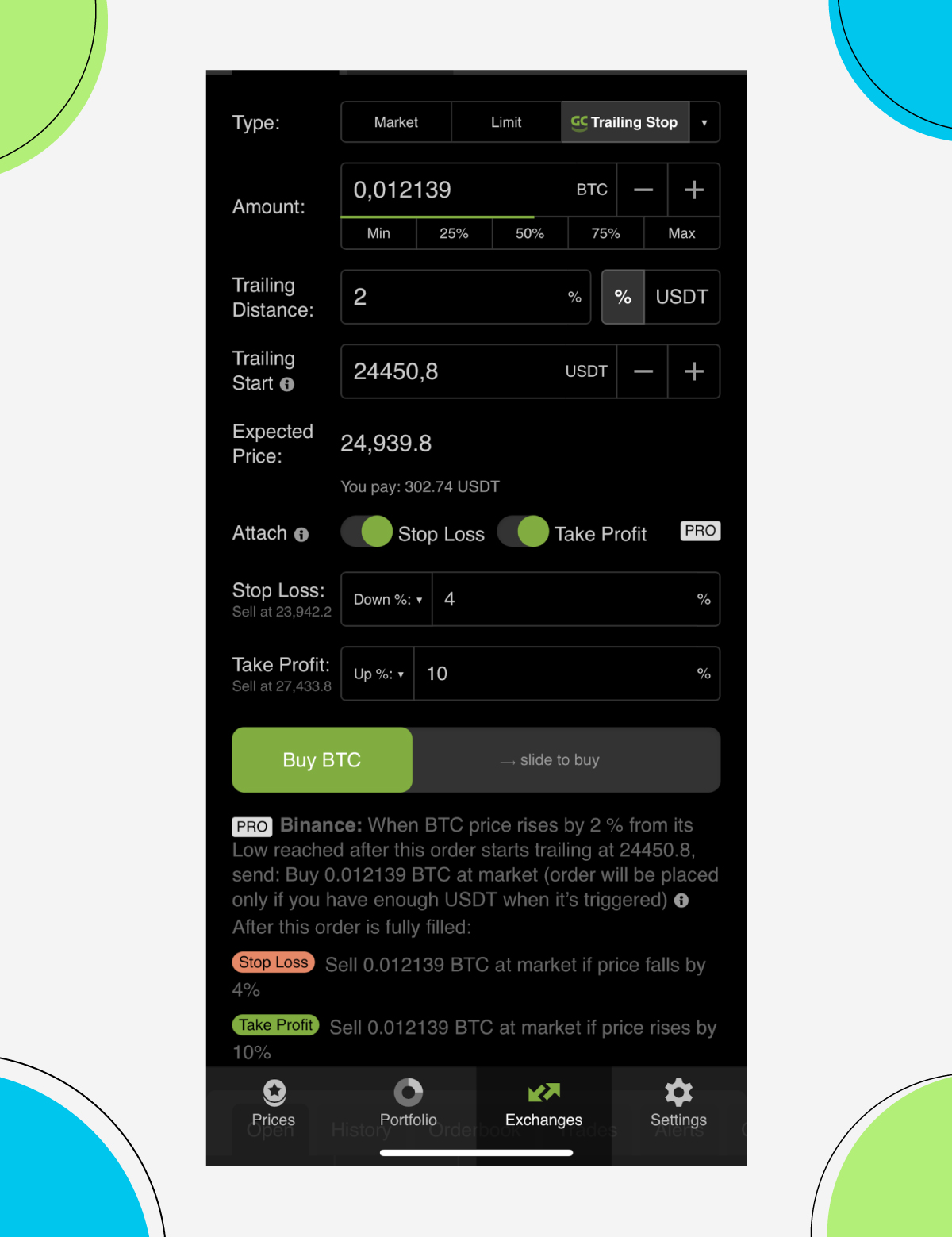

The Good Crypto platform is developed based on a whole different order engine. This allows traders to create several orders at once, without freezing their account balance. It enables advanced order types like Trailing Stop-Loss orders, trailing take profit orders, and so forth. In the example on the left, you can see that both take profit and stop loss are attached to the order.

Let’s break it down: A Trailing Stop Buy order is placed. It will start trailing the market price when it reaches $24,939.8. If the market price falls – the order will move the trigger lower to maintain a 2% trailing distance. Once the price bounces back 2% or more – the Buy order will be executed.

Once the Trailing Buy order fills, both Stop Loss and Take Profit orders will be placed automatically by the system. Stop Loss will be triggered if the price goes down 4%. If the price rises by 10%, a Take Profit order will be triggered. If this happens, you deserve a drink!

Once either Stop Loss or Take Profit executes – the other order will be canceled automatically. Neat, right?

Good Crypto empowers traders with an advanced, programmable way of creating trades. Placing a trade can come with a condition. When order A fills, it will automatically place orders B and C, per example. In other words, when trading BTC/USD, and your Buy order at $20,000.00 fills, you can automatically place a Sell order at $30,000.00 and a Stop Loss order at $18,000.00. This is the real power of a third-party trading application, creating an environment where making profits is much easier.

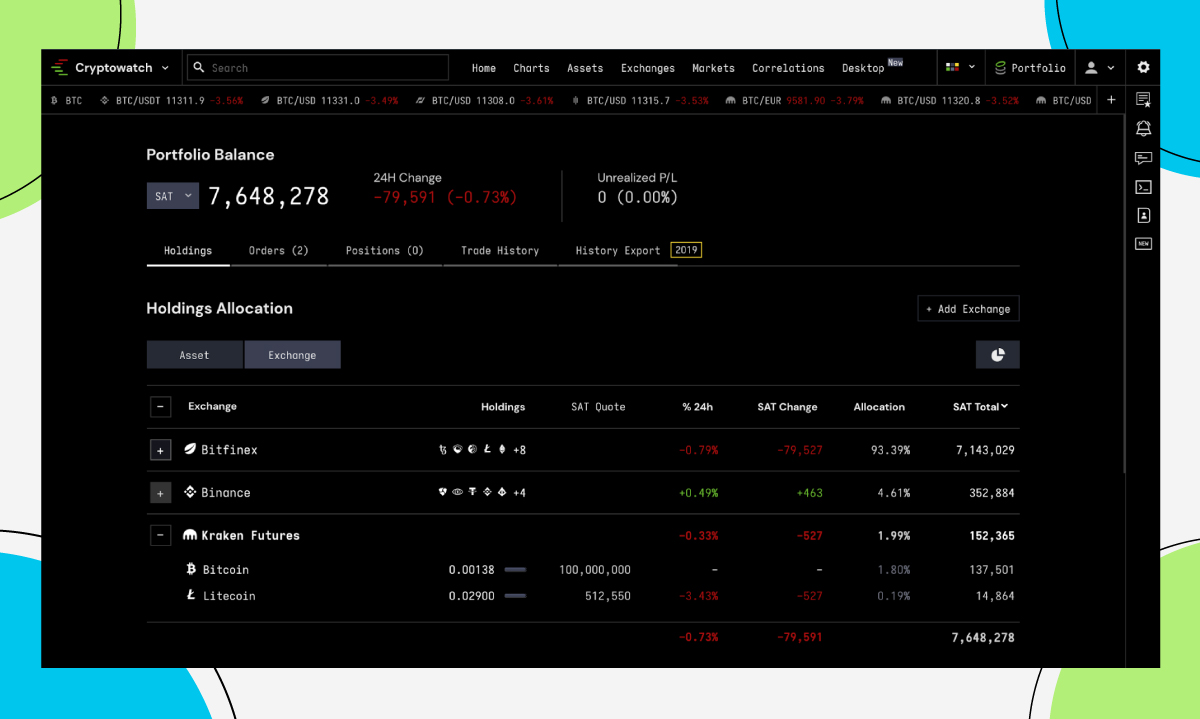

Portfolio

Once connected with your exchanges, you can see your trade history and balances in the Cryptowatch portfolio dashboard. Your open positions, performance, and unrealized profit or loss will be shown all together.

Cryptowatch allows you to connect with Kraken, Kraken Futures, Binance, BinanceUS, Bitfinex, BitMEX, Bitstamp, Bittrex, Coinbase Pro, HitBTC, Huobi, FTX, Okex, and Poloniex.

Is Cryptowatch safe? Connection is established easily through API, which is the most common way to have a platform communicate with your exchange accounts. Setting up an API connection is very secure as long as you take good care of your keys. Don’t expose or share them and you will be safe. That being said, you should always limit the amount of funds stored on exchanges. A blockchain wallet is still the safest place for your funds.

However, Cryptowatch blockchain wallets tracking is not possible. Good Crypto, on the other hand, allows both exchange accounts and blockchain wallets to be tracked and collected into an aggregated portfolio overview. All your historical data, every trade, and transactions made are tracked. Creating an overview is important, and will make sure that none of your investments are being overlooked by being stored in different places. Tracking every investment in one place also gives you the possibility to act accordingly in case of a global dump, or a bull run.

In addition, the philosophy of cryptocurrencies is to own your own wealth, which can only be achieved by being the owner of the private keys of your blockchain wallet. A blockchain wallet is a public key, and a private key proves your ownership. A centralized exchange works like a bank, all the funds stored on their platform are in their ownership and technically are not yours. The movement of “not your keys, not your coins” is a saying that tries to inform people of this issue. Visit the website of proofofkeys.com for more information.

Finally, we can conclude that Good Crypto cares about its users by providing a tracker for the most secure way of storing cryptocurrencies.

Paid features

Cryptowatch pricing mechanism works via a rather complex system of Credits. When signing up, every user receives 250 credits. One credit is worth $0.01. $1 provides you with 100 Credits.

As mentioned, trading comes without an extra fee. Credits are mostly in place for developer tools and alerts. Per alert, you pay one Credit. Besides alerts Credits are charged for API calls, costing about 0.002 to 0.015 Credits per call. Zapier integration will cost you 15 Credits per execution.

Good Crypto offers free price alerts in their mobile application, making it redundant to pay for the same service on Cryptowatch. Only developers and advanced users will find a benefit to pay for API calls and WebSocket API.

An overview of the Cryptowatch app

Cryptowatch is not for beginners and can be very overwhelming at first. All the data offered on Cryptowatch can be confusing and only a small number of traders will be able to find value in everything the platform offers. But, these traders are not being offered professional tools to trade with, like advanced orders.

On the other hand, it provides Zapier integration and provides the possibility to create an automated trading system in which more advanced users and developers will find a lot of value. However, these advanced features come with a cost.

Somehow the platform feels like an extension of Kraken. It doesn’t offer margin trading for the most liquid futures markets that exist, and there are no advanced order types for any of the exchanges.

Maybe the most disappointing is that the Cryptowatch app is not cross-platform. There’s neither a Cryptowatch iOS nor a Cryptowatch Android application. This leaves traders clueless about their portfolio once having left the desktop. On top of that, the desktop application which Cryptowatch recently launched lacks all the features needed to both trade and make a proper investment analysis.

Hopefully, this Cryptowatch crypto review gave more clarity to what is offered and what is lacking.

Pros

- A lot of market data collected in one place

- Correlations, a unique feature

- Multiple interface themes and adjustable colors

- Live market data

- Several developer tools like Zapier integration and WebSocket API

Cons

- No mobile application

- The desktop application is very restricted with no trading and no indicators

- The browser version runs heavy, heating the device, and is laggy

- Overwhelming for users with little understanding of the markets

- Trading comes with no extra order types, the orders offered by the exchange are the only order types you can trade with

- Trading is only possible on a few exchanges, and margin trading only on 3

- Portfolio tracking only on 14 exchanges, and no tracking for blockchain wallets

- A confusing Credits system that seems only useful for advanced users or developers

- Alerts are paid, while Good crypto offers them for free

Good Crypto, the best Cryptowatch alternative

Cryptowatch competitor Good Crypto is an application that works cross-platform and brings advanced trading functionalities onto your mobile phone. Tracking your investments and trades can happen on the go. Free alerts will update you with the market movements and let you know if orders are filled.

Good Crypto raises the bar and takes the lead over all the other applications on the market, leaving Cryptowatch behind.

- Track your portfolio performance in real-time

- Automatically have your trades and balances updated

- Connect and trade on almost 30 exchanges, all in one application

- Advanced order types that work with all the 30 exchanges in the app

- Conditional orders that do not freeze your balances

- Track your blockchain wallets and enable alerts for transactions

- Have an easy to understand overview of all your holdings combined with a clear distribution by assets, exchanges, and wallets

- Follow the cryptocurrency market, over 10,000+ trading pairs, and discover new currencies based on their performance and market cap

- See the live order books and trade history for all these pairs

- Schedule a market summary notification that gives you a 24h recap at the time of your choosing

- Receive alerts for sudden movements of the top currencies, DeFi hyped projects, newly listed currencies, and soon advanced alerts based on technical indicators

- Trade on top of almost 30 exchanges with advanced order types and automation described before

- Futures trading possible on the most liquid markets like BitMEX, ByBit, FTX, and Binance Futures

Not convinced yet?

Find Good Crypto on both the iOS App Store and the Android GooglePlay Store and discover the most advanced cryptocurrency application on the market!

Do you have questions?

Connect with the public chat room in Telegram and ask anything, 24/7.

Get the App. Get Started.

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

March 12, 2021