Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

FTX will provide $6 million in ‘one-time’ compensation to phishing victims

The $6 million in compensation will be given by the cryptocurrency exchange FTX to those who lost money due to a phishing scam that allowed hackers to make unauthorized trades on the accounts of some FTX users.

Sam Bankman-Fried, the founder and CEO of FTX, stated in a Twitter thread on October 23 that the exchange usually does not reimburse users who have been “phished by fake versions of other companies in the space,” it will do so in this specific example.

According to Bankman-Fried, FTX would “not do this going forward” and that this was a “one-time thing.” He stated, “THIS IS NOT A PRECEDENT,” making it clear that only FTX subscribers’ accounts will be refunded.

In a recent phishing attempt, hackers obtained user account application programming interface (API) keys, enabling them to utilize their cryptocurrency exchange accounts for unlawful trading. The hack was discovered on October 21 when 3Commas claimed it received notification that some of its members were engaging in illicit trading activity.

In order to prevent further losses, FTX and 3Commas suspended the suspicious accounts after conducting an initial assessment. They also disabled the hacked API keys.

Since July, crypto ad revenues have decreased, and Google is feeling the bear market

In its most recent earnings call, Alphabet, the parent company of Google, highlighted declining search advertising spending in the cryptocurrency and financial services segments.

On October 25, Alphabet announced its third-quarter financial report, highlighting a 6% rise in revenue, reaching $69.1 billion compared to the previous year’s third quarter. However, compared to Q2 2022, revenues were down marginally from $69.7 billion.

However, a breakdown of Google Services’ profitability, which includes its advertising revenue, revealed a year-over-year growth in this category from $58.8 billion to $61.3 billion.

During Alphabet’s results call on October 25, Philipp Schindler, the chief business officer of Google, pointed out specific struggle in the banking and cryptocurrency sectors, with large drops in advertising spending quarter-over-quarter:

“We did see a pullback in spending by some advertisers in certain areas in search ads. For example, in financial services, we saw a pullback in insurance, loan, mortgage and crypto subcategories.”

The “Second Great Stablecoin War” has been sparked by the growth in market share of one stablecoin

The new remarks from Bankman-Fried come a month after Binance moved through with plans to convert several stablecoins supported on its exchange into BUSD on Sept. 6. Since then, BUSD’s market share of all stablecoins has increased.

According to Coin Metrics, a crypto data aggregation sure, BUSD’s market share of all stablecoins increased from 10.01% on September 7 to 15.48% on October 22.

The stablecoin now trails only Tether USD (USDT) at $68.4 billion and USD Coin (USDC) at $43.9 billion in market capitalization, which has increased 3.3% over the past 30 days to $21.7 billion.

The FTX CEO wrote on Twitter on October 23 that “Binance converts USDC –> BUSD, and we see the change in supplies,” adding that “thus begins the second great stablecoin war” in response to the asset’s increase after the conversion.

Bankman-Fried pointed out that USDT and USDC emerged as the two leaders after the first “Stablecoin War” between five stablecoins took place in 2018.

Even while its market share of stablecoins decreased from 88% in 2020 to 48% today, USDT still maintains a sizable advantage over USDC, which increased from 10% to 32% during the same period.

However, Binance’s stablecoin price increase is even more notable, rising more than 30 times from 0.5% to 15.48% in the same period.

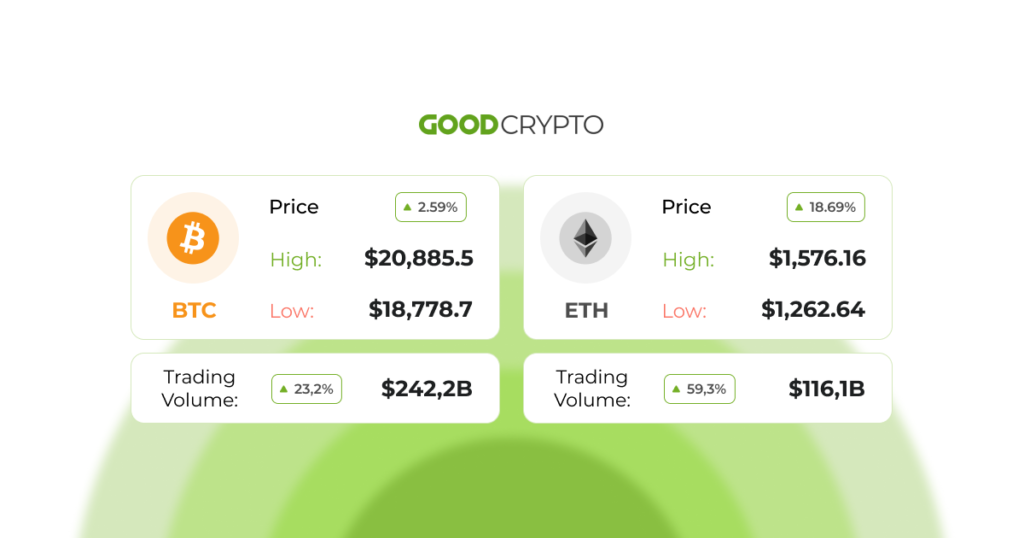

The price of Bitcoin reaches $20K as daily cryptocurrency short liquidations reach $400M

On October 25th, data from TradingView and Cointelegraph Markets Pro showed that the BTC/USD exchange rate reached a high of $20,191 on Bitstamp.

The movement and rising American stocks were themselves supported by a weakening dollar that had lost ground against most of its trade partners’ currencies for the day.

As a result, Bitcoin made its first rise above $20,000 since October 7th.

Michal van de Poppe, founder and CEO of trading company Eight, responded, “Finally, the volatility will kick in.“

While no end is yet apparent, trader and analyst Il Capo of Crypto noted that BTC was beating altcoins in terms of gains. He tweeted, “There’s fuel to keep going.”

Candlestick Patterns Explained

Candlestick trading patterns don’t always point to a market trend change. Instead, Candlestick patterns are known as continuations, which signify that the transaction will continue. The market’s sideways or neutral price movement and resting intervals are linked to the continuation patterns.

With this candlestick patterns cheats sheet, you can rapidly identify all the many kinds of candlestick patterns.

This article will cover many of the most common candlestick trading patterns. Don’t hesitate to become more familiar with market signals using the Candlestick Patterns analysis.

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!