Bitcoin is digital gold. Users all over the world make fast, safe, and cheap transactions without the intervention of centralized authorities using BTC. Trad...

Get the App. Get started.

Bitcoin is digital gold. Users all over the world make fast, safe, and cheap transactions without the intervention of centralized authorities using BTC. Traders earn on BTC fluctuations, miners struggle for block rewards, while the whole network lives, operates, and attracts new participants day by day. However, making profit on cryptocurrency markets depends on an unhttps://link.goodcrypto.app/gc-welcome-blogderstanding of price formation trends and mechanisms. Concepts such as Bitcoin bid-ask, orderbook, and spread play an important role in the vast majority of trading strategies. In this article we will discuss the importance of measuring liquidity, as well as how to calculate the liquidity of Bitcoin and what does volatility have to do with it.

To understand whether an asset is liquid, it is worth analyzing how easy it is to exchange to any other asset or traditional money, which is the most liquid asset. This parameter includes two aspects: simplicity (what it takes to exchange the asset to fiat/other asset) and price reaction (slippage and possible liquidity fails on the markets). If the asset is liquid, then the trader can make transactions quickly and with minimal slippage.

To fill a big market order, most likely, you’d have to go through the order book bids or asks (depending whether you buy or sell an asset). This would ultimately increase the spread of supply and demand, as well as shift the current asset price into one of the directions. In this scenario, not only a trader falls victim to a tangible slippage, but the asset price itself and its volatility increases.

Believe it or not, Bitcoin has remained among the most stable assets during the global financial crisis, which started this spring and, in fact, lasts until the date of writing this article. Previously, the BTC market price didn`t correlate with other “classic” assets and indices, like S&P500. Though, 2020 has shown that the correlation between the most crucial indices, gold/silver, and BTC is present and it’s relevant enough to be taken into consideration while analyzing the asset.

JPMorgan analysts argue that during the periods of uncertainty, BTC and cryptocurrencies appear to be a safe haven for private and institutional investors. This happens because more and more people have trust in a certain level of anonymity of BTC, which is still far higher than in traditional money. In case of emergency, BTC would remain on one's balance, while traditional money could disappear because of hyperinflation, or a crash of the economy.

Of course, Bitcoin's liquidity dipped during the crash of the market but recovered much faster than liquidity in the traditional markets. According to experts, the Bitcoin market depth is already above the average for the year, while the liquidity of more traditional assets hasn't recovered yet.

Thus, we can congratulate ourselves - we’ve successfully passed the stress test of the financial crisis!

The main cryptocurrency’s price is constantly changing, so many are sure that this means high volatility. Though, in the real world, everything works differently.

Keep in mind, that volatility is everywhere - financial markets, the political arena, and even your relationship with your neighbors. In fact, sharp and unpredictable changes in scenarios can be considered volatility. But often these changes have negative consequences.

Volatility is the antithesis of stability. It scares and attracts at the same time. Investors don't like volatility until a sharp spike in the asset price makes some traders twice richer overnight or within a few hours. Obviously, when the opposite situation happens, traders aren’t too excited.

However, there is a misconception that low liquidity leads to high volatility. On the one hand, it's logical and these two parameters are connected, but not exactly. Studies have shown that high volatility leads to low liquidity, and not vice versa. Market participants try to compensate for the risks from fluctuations by keeping an unstable asset in their possession.

Due to the high volatility, Bitcoin is considered a high-risk asset. But Bitcoin is a unique asset, and in order to better understand the cryptocurrency market, you need to understand a few points.

Volatility can be divided into several types, one of which is considered to be a jump-diffusion model. Usually, this model is implied when it comes to financial instability. Sharp leaps are usually considered an indicator for analyzing the cryptocurrency market.

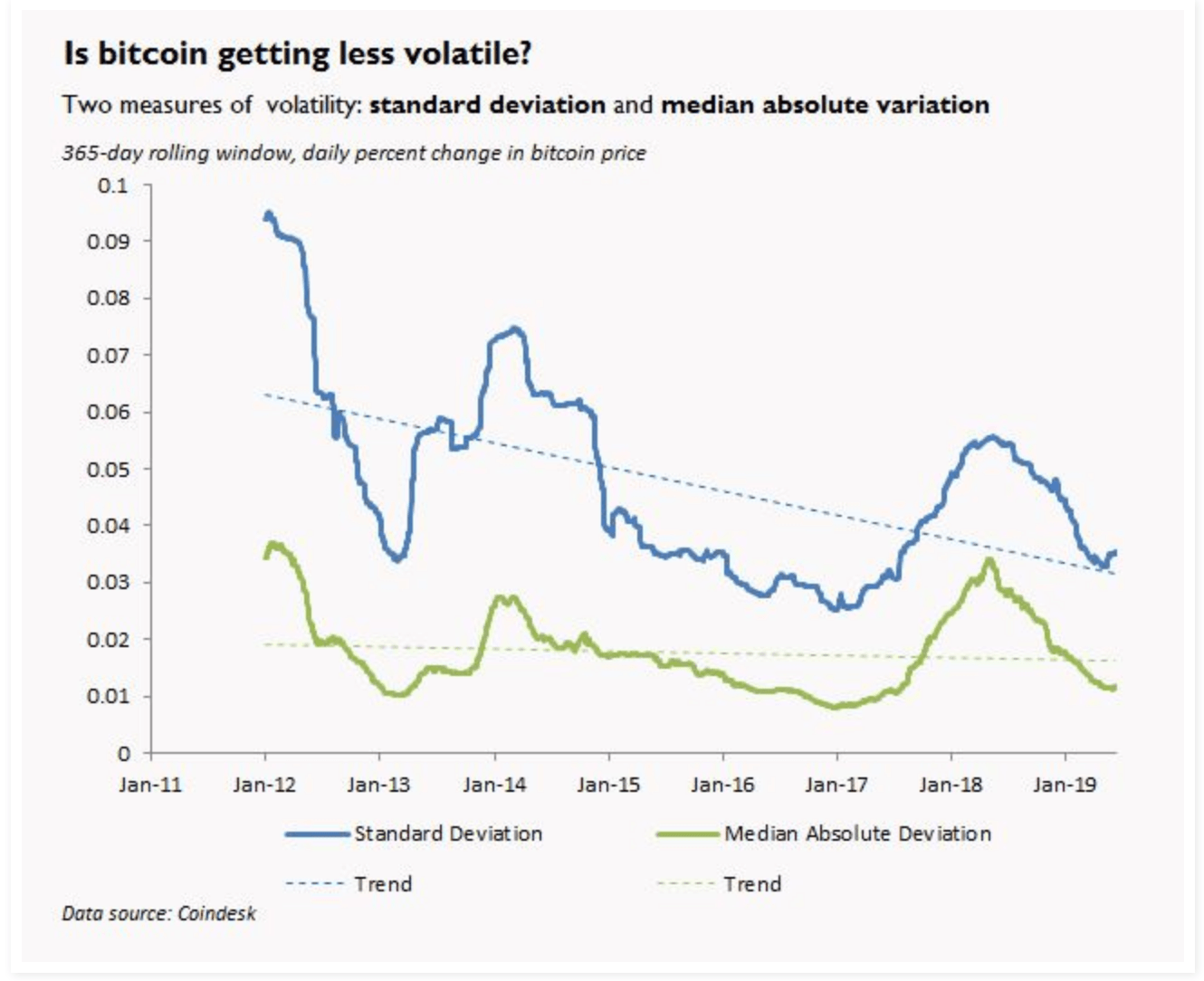

To make predictions and collect statistics on fluctuations, the calculation of standard deviation is commonly used. For example, when analyzing the Bitcoin volatility for a certain period, it is noted that the asset price fluctuated between $ 9,000 and $ 11,000. At the same time, absolutely all values from $ 9000 to $ 11,000 are taken, including the most extreme points.

You can guess that this calculation method exaggerates the role of sharp ups and downs, which don`t happen too often. For example, a major player entered the market with a market order, triggering a massive amount of maker orders and increasing the BTC price for, let’s say, 5%. Afterwards, the market returns to the previous levels and continues its standard fluctuations of ± 1-2%. Of course, this will affect the volatility analysis, but the price stayed at this level for only a couple of minutes, because apart from the whale entering the market, there were no buyers at the higher levels.

However, with the Bitcoin popularity and liquidity growth, the likelihood of such sudden pumps or dumps decreases, as more and more large orders appear on the market, and it is much more difficult to break them alone.

Interestingly, the Bitcoin volatility hasn't changed too much over the past 7 years, although millions of new players have appeared on the market, while the BTC price and liquidity have increased by tens of thousands of percent.

In general, only the number of sudden one-time jumps has decreased. The question is why the liquidity is growing and the amount of sudden BTC “shaves” increases as well?

Bitcoin can be considered a real asset since it doesn't depend on the price of others. It can`t be called either a stock or a bond, but there is an opportunity to draw parallels with real estate or even natural resources. It is also impossible to estimate the flow of income from Bitcoin, since no reports on incoming and outgoing financial injections are received, and it's impossible to calculate at least an approximate profitability. Therefore, it is difficult to determine its real value.

So what affects the Bitcoin price? The answer is shockingly simple - it’s us and our mood. The price of Bitcoin will be equal to the price which we’re ready to pay for it.

That is why Bitcoin is called digital gold, because it is not a cash-generating asset, and its price is determined by the players’ mood. This precious metal experienced a sharp jump in value in 1980, tripling in price.

However, the volatility of Bitcoin is still much higher. But why is this happening? Of course, technology can still be called new, although it was launched 12 years ago.

At the same time, Bitcoin is shrouded in news, hundreds of articles are written about it every day which obviously affects the price. The mood is a determining factor in the Bitcoin price. But you need to understand that uncertainty will continue to affect the price of the first digital coin until its ultimate potential and use case is determined. This can’t happen in one day and it is unlikely to happen tomorrow, so the bitcoin volatility will remain high, even if millions of new players will enter the market and liquidity will grow tenfold.

Will Bitcoin always be volatile? The situation won’t change as long as the barrier of uncertainty will remain in its place. As soon as it’s lifted - the coin will, most certainly, become more stable, its fair price would be easier to calculate.

Until then, the price will continue to depend only on the market mood.

However, it's not totally bad - after all, high volatility can become your trading assistant.

It’s not a secret that amid the development of the crypto industry, more research and new tools for analyzing crypto sentiment and making better forecasts appear, which allows investors to earn more and minimize risks.

On the other hand, high volatility is closely linked to big profits. If this was not the case, the world would not have known about bitcoin millionaires, and there won't be any stories of people tripling their deposits within the course of a few hours or days.

We cannot escape from volatility, but could it be that we don’t need to escape from it?

Share this post:

September 15, 2020