Hello everyone, this is our weekly crypto digest. Here you’ll find everything from a weekly market summary and top news to the hottest new listings on exchanges, and even memes to cheer you up. To get these updates as soon as we post them, follow us on Twitter.

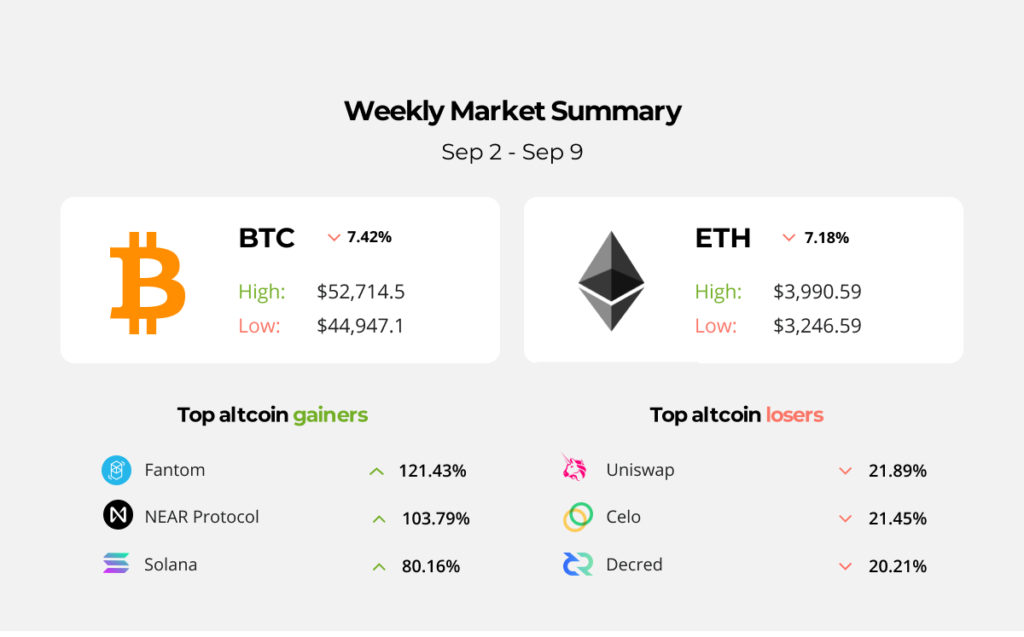

Weekly Market Summary

Visa’s vice president of new business in Brazil, stated the company is working on developing apps (APIs) to unite traditional banks with cryptographic products soon. It would be possible to make investments in cryptocurrencies and ETFs within banking platforms with no intermediates.

Binance Exchange announced the successful integration of Contract Chain (C-Chain) Avalanche (AVAX) and opened deposits for C-Chain AVAX tokens.

In addition to supporting C-Chain AVAX token deposit and withdrawal, Binance will continue to support Avalanche X-Chain and BEP-20 AVAX token deposit and withdrawal.

C-Chain is a standard blockchain with Avalanche smart contracts and a super-fast implementation of the Ethereum virtual machine.

Quick weekly news:

- Solana extends rally with another new high — Why is SOL price up by 70% in one week?

- El Salvador says merchants must process BTC transactions

- DeFi Tokens Hit Hard as Crypto Market Correction Continues

- Former reserve bank official pushes for India to accept crypto

Other notable events include:

– SEC threatens Coinbase with legal action

– BTC to hit $175,000 and ETH to $35,000 – Standard Chartered

SEC threatens Coinbase with legal action

The US SEC has threatened the American cryptocurrency exchange Coinbase with a lawsuit over the cryptocurrency profitability program LEND (4% APY), which it considers a security.

“They refuse to tell us why they think it’s a security, and instead subpoena a bunch of records from us (we comply), demand testimony from our employees (we comply), and then tell us they will be suing us if we proceed to launch, with zero explanation as to why.” said Brian Armstrong after he revealed that the SEC threatened to sue Coinbase.

He added that there are other cryptocurrency companies in the market that are currently providing similar lending services to their clients and urged the SEC to provide regulatory clarity on the topic.

BTC to hit $175,000 and ETH to $35,000 – Standard Chartered

British international banking and financial services giant Standard Chartered has published a report on two cryptocurrencies: BTC and ETH.

The bank believes that BTC will double in value and reach $100,000 by the beginning of next year.

“As a medium of exchange, Bitcoin may become the dominant peer-to-peer payment method for the global unbanked in a future cashless world,” Standard Chartered said in a study.

The bank’s analysts also added that the value of Ethereum will reach $26,000-35,000, although BTC should be around $175,000 to reach this level.

- Spot trading: At the spot trading front, Ethereum (ETH) and Solana (SOL) have become new favorites.Cardano (ADA) and Bitcoin (BTC) were pushed to third and fourth places.

- Derivatives: Bitcoin (BTC) and Uniswap (UNI) have become the most traded currencies as to trading derivatives. Ethereum (ETH) is following these two head to head with Litecoin (LTC) and SushiSwap (SUSHI) taking fourth and fifth places.

New Pairs on Binance:

- Polymath (POLY/BUSD)

- Aelf (ELF/USDT)

New Listings on Kucoin:

- Tellor (TRB/USDT TRB/BTC)

- SingularityDAO (SDAO/ETH SDAO/USDT)

- Ripple 3x Long ETF (XRP3L/USDT XRP3S/USDT)

- Numeraire (NMR/USDT SKL/BTC SKL/USDT NMR/BTC)

- Ndau (NDAU/USDT)

- Yield Guild Games (YGG/USDT)

- Balancer (BAL/ETH BAL/BTC BAL/USDT)

- Storj (STORJ/BTC STORJ/ETH STORJ/USDT)

- Orchid (OXT/USDT OXT/BTC OXT/ETH)

- Augur (REP/USDT REP/BTC REP/ETH)

By the way, our PRO plan includes new Exchange Listing alerts for all 27 exchanges in our app. Become a PRO and receive an instant notification when a new coin is listed on Coinbase Pro, Binance, or an exchange of your choice!

Bonfire is a Binance Smart Chain-based community-oriented, frictionless, yield-generating contract. Every transaction on the Bonfire blockchain takes a 10% tax: 5% is dispersed among all users and 5% is added to the liquidity pool. It makes it hard to manipulate the system both for bots and swing traders.

Bonfire aims to forge a path in the altcoin market by bringing true utility to an inherently deflationary asset. Bonfire is developing an ecosystem of decentralized applications that reward users specifically for holding Bonfire tokens. Bonfire’s most valuable asset is the global community that has been built around it.

DYOR

Uniswap is a popular decentralized trading protocol, known for its role in facilitating automated trading of DeFi tokens. As an example of an automated market maker (AMM), Uniswap launched in November 2018 but has grown in popularity this year as a result of the DeFi phenomena and associated splash in token trading.

Uniswap seeks to keep token trading automated and completely open to anybody who owns tokens, while also boosting the efficiency of trading versus that on traditional exchanges.

Uniswap took a step further in September 2020, developing and issuing its governance token, UNI, to prior protocol users. This increased both the possibility for profit and the ability for users to shape its future – an attractive feature of decentralized entities.

Recent announcements:

U.S. SEC investigates crypto exchange developer Uniswap Labs

Uniswap (UNI): Price Technical Analysis, Updates, Developments, Community, Events

DYOR:

We have prepared top-performing coins of Sep 9 for you.

Near Protocol has managed to become the best performing asset among TOP-100, gaining 44.93% within the last 24 hours.

Quant was the worst-performing asset among TOP-100 (again), losing 4.13% within the last 24 hours.

To get up-to-date reports on gainers and losers during the week, follow us on Twitter.

Top cryptomeme of the week

We hope you found this digest useful and informative! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter. Happy trading with the Good Crypto app!