- 1. What Is Supertrend Indicator?

- 1.1. How Does Supertrend Work?

- 2. How to Use Supertrend Indicator in Crypto Trading?

- 2.1. How To Read Supertrend Indicator?

- 3. Supertrend Indicator Formula and Calculation

- 4. What Are The Best Supertrend Settings For Crypto Trading?

- 5. How to Create A Profitable Supertrend Strategy for Crypto Trading?

- 5.1. 1 Minute Scalping Strategy Overview

- 5.2. Double Supertrend Strategy Overview

- 5.3. 3 Supertrend Strategy Overview

- 5.4. Moving Average Convergence/Divergence (MACD) Supertrend Strategy

- 5.5. Supertrend Exponential Moving Average (EMA) Trading Strategy

- 6. How To Use Supertrend For Swing Trading & Day Trading?

- 6.1. Best Supertrend Settings for Swing Trading

- 6.2. Supertrend Indicator for Day Trading

- 6.3. Supertrend Indicator Settings for Intraday Trading

- 7. How GoodCrypto App Enhances your Trading Capabilities

- 8. Conclusion

Choosing a buy and sell indicator for trading crypto can be a humbling endeavor. There’s a vast range of choices of buy sell indicators that can overwhelm even the most experienced traders. However, many of them converge towards the supertrend indicator as the best way to set up the crypto buy and sell signals.

This GoodCrypto article will explain the basics behind the super trend indicator. It will show you why supertrend is one of the best and simplest buy and sell indicators at your disposal. To this end, we will teach you how to use supertrend indicator as well as the best supertrend indicator settings for crypto trading.

Finally, you will learn how to make supertrend indicator strategies by yourself and combine super trend with other established methods. Let’s begin with a supertrend indicator definition to give you a clearer picture of what this trend following indicator represents.

What Is Supertrend Indicator?

So, what is supertrend indicator, in a nutshell? The first step of having the supertrend indicator explained is to understand that it is a buy sell indicator. As such, supertrend will inherently help you with setting up precise entry and exit points on your chart. As its name suggests, the supertrend indicator chart is plotted following the price trend of a certain asset.

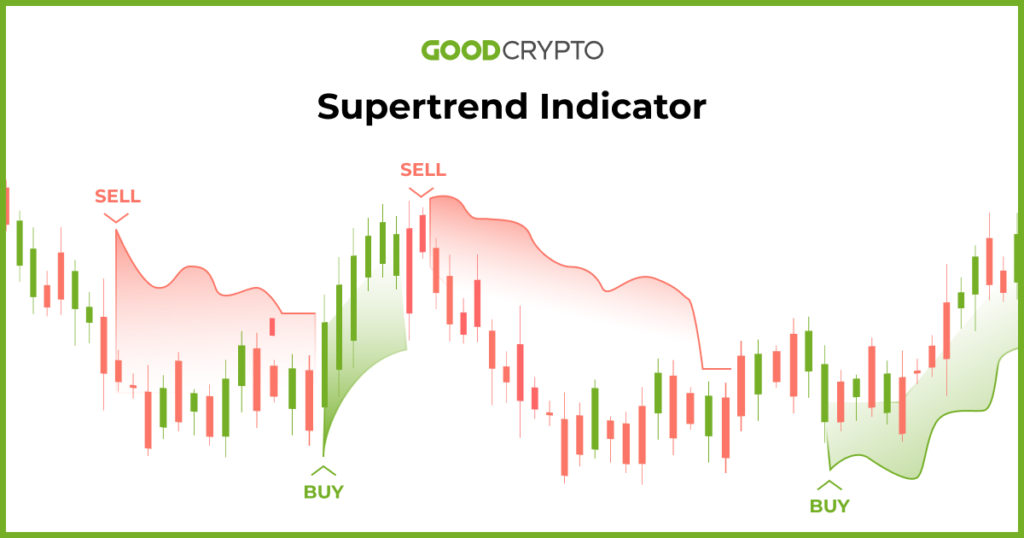

As to the question of what makes up the supertrend indicator you can see on the chart above that it’s represented by a green and red line. Every time there’s a trend reversal, the color of the line changes (green – uptrend, red – downtrend). As such, if you are wondering what is the equivalent to the supertrend indicator, the closest that comes is the simple moving average (SMA). While that answers what is the supertrend indicator, it doesn’t really help you understand how does supertrend work.

How Does Supertrend Work?

Supertrend is one of the trend following indicators that will help you set your buy and sell points at very precise levels. But how does supertrend indicator work to achieve this?

Well, as we mentioned, two lines make up the supertrend indicator, a red and a green line. These lines allow you to assess:

- The direction of the trend;

- Whether you should buy or sell and when to do it.

To plot the lines, the supertrend indicator uses the average true range (ATR) in combination with a multiplicator. This allows you to set market entries based on both momentum and volatility.

As to answering on what chart does supertrend indicator work the best, you can freely use it on any timeline you think a trend is forming. That said, supertrend is a lagging indicator, so a well-established trend will increase the supertrend indicator performance.

How to Use Supertrend Indicator in Crypto Trading?

Now that you know what is supertrend, let’s explore the best ways how to use supertrend indicator. As a matter of fact, using the supertrend indicator is fairly simple, especially if you are new to setting crypto buy sell signals.

When using supertrend indicator, you will notice two lines that delimit two zones – a green and a red one. As the trend swings and goes from bullish into bearish, or vice versa, the color of the line changes. This is called the crossover point and acts as a buy sell signal indicator:

- If the line turns from green to red, this creates a sell signal

- If the line turns from red to green, this creates a buy signal.

The line itself will be a good level to set up your stop loss.

While this is the simplest method of how to trade supertrend indicator it doesn’t get any more complicated than that. You just need to realize that supertrend is a true trend indicator. As such, it will generate false signals when the price is in range (not in a trend). Consequently, you will need to learn what to use with supertrend indicator in combination with to avoid these, which we cover below in our strategies section.

How To Read Supertrend Indicator?

The best way to teach you how to read supertrend indicator is to provide you with a concrete example.

First, open the GoodCrypto app and select one of your preferred assets, let’s say BTC/USDT. Then, select the indicators menu and browse for Supertrend (ST). Simply click on it and it will appear on your chart.

If you zoom in on your chart, you will notice that the free supertrend indicator in our app will provide you with precise BUY and SELL signals in the form of arrows. Consequently, trading supertrend indicator will be an easy task going forward. This is especially true if you know how to avoid false signals in supertrend indicator.

Supertrend Indicator Formula and Calculation

Before we delve into the best supertrend settings and supertrend trading strategy, let’s first see how to calculate supertrend indicator. Understanding the supertrend indicator formula will be invaluable down the road when you will need to combine additional indicators.

As we mentioned earlier, the supertrend formula takes the average of the high and low price in correlation with the ATR. So, the supertrend calculation goes as follows:

Upper line = (high + low) / 2 + multiplier x ATR

Lower Line = (high + low) / 2 – multiplier x ATR

The multiplier in the supertrend indicator calculation will allow the lines to follow the price closer or further. For example, a multiplier around 3 will provide more signals for micro-trend shifting, whereas a larger one will serve to follow macro trends more effectively.

What Are The Best Supertrend Settings For Crypto Trading?

If you are new to trading supertrend indicator, it’s best to leave the default supertrend indicator settings of ART at 10 and multiplier at 3. Many traders consider these as the best settings for supertrend indicator, as they perform admirably on different timeframes, such as intraday and multiday trading. Drastically changing the supertrend settings will result in huge signal discrepancies, and the supertrend indicator might act erratically.

That said, you can still fine-tune the indicator if you know how to setup supertrend indicator correctly. The general rule of thumbs is to keep the multiplier close to 3. In the example below you can see how the larger multiplier (4) follows the trend from afar while the smaller one (2) stays close to the price and changes more quickly. You can see that this setting even gives a false signal at one point, given the high volatility of BTC.

While the supertrend indicator best parameters are those provided by default, changing them can be useful in some cases. For example, if you are willing to use the best supertrend settings for swing trading and avoid false signals from price spikes, you can set the supertrend indicator setting for the multiplier at 3.5.

Testing different settings on different timeframes will also allow you to find which values to enter as your best supertrend indicator settings. Explore them freely to see what fits your risk profile the best and whether the super trend signal indicator seems logical in retrospect.

Now that you know what is the best setting for supertrend indicator, let’s have a look at how you can apply these in a practical supertrend strategy.

How to Create A Profitable Supertrend Strategy for Crypto Trading?

The first thing you need to do when creating a super trend strategy is to assess whether the price is moving in a trend. Using a supertrend indicator strategy when the price is in a range will produce uneven results and might even result in severe losses over time.

Once you have assessed that the price is trending (up or down), you can start setting up your best supertrend strategy. The choice of the supertrend indicator trading strategy will mainly depend on the timeframe that you are willing to trade. For instance, a supertrend strategy for intraday will require multiple buy and sell signals on the same day and will require a shorter timeframe (e.g. 1 minute candles).

Also, you will need to find the best combination with supertrend indicator with another indicator that will help you avoid false signals. So with those basics out of the way, let’s have a look at our selection of supertrend indicator trading strategy.

1 Minute Scalping Strategy Overview

We consider the 1 minute scalping strategy as one of the easiest and most efficient for supertrend strategy intraday trading. As the name suggests, the 1 minute trading strategy uses 1-minute candles. The goal is to make multiple trades in one day on small price fluctuations and accumulate profits through quantity. It follows two major rules:

- You should focus only on shorts if the price is trending below the 200 EMA.

- You should focus only on longs if the price is trending above the 200 EMA.

With that in mind, here’s how to implement a profitable 1 minute scalping strategy:

- Use the buy/sell signal provided by the supertrend 1 minute strategy.

- Set a small take profit target, between 0.3% and 0.5%.

- Use the supertrend lines as your stop loss level.

To make your 1 minute trading strategy crypto even more profitable, you can use the trailing stop order on GoodCrypto. This will allow you to set a loose take profit level and follow the trend until it flips, maximizing your profits without a fixed target.

You can see in the example above that we managed to open and close 3 positions using the supertrend 1 minute strategy. Each one netted us around 0.4%, closing at a total of 1.2% for the day, which is an excellent result for intraday trading.

Double Supertrend Strategy Overview

The double supertrend strategy uses the supertrend to help you get additional visual aids on where to set up your entry signals. The 2 supertrend strategy requires you to set up two supertrend lines with different parameters:

- The default supertrend line with a (10,3) setting.

- A customized supertrend line with ATR set to 25 and a multiplier at 5 (purple line in our example).

The goal of these dual supertrend lines is to give you an additional confirmation signal. At the moment the custom supertrend crosses the default supertrend, a signal gets generated (similar to crossing moving averages).

For example, in a bullish trend, the custom trend crossing the default supertrend downwards confirms a buy signal. You can apply this supertrend indicator strategy to a bearish trend as well, by inversing crosses into sell signals.

3 Supertrend Strategy Overview

Traders often consider the triple supertrend strategy as the most profitable one. And as you might have guessed by now, the 3 supertrend strategy relies on 3 different supertrend lines.

- Supertrend 1, set to ATR at 10 and multiplier at 1

- Supertrend 2, set to ATR at 11 and multiplier at 2

- Supertrend 3, set to ATR at 12 and multiplier at 3

Just like the 1 minute strategy, this 3 supertrend indicator strategy requires a confirmed trend above or below the 200 EMA. Additionally, you should use the RSI for assessing overbought and oversold positions. Once you have established this part, here’s how to set your 3 supertrend strategy:

- Long position when the price is above the 200 EMA, 2 out of 3 supertrends are green and the RSI is below 40.

- Short position when the price is below the 200 EMA, 2 out of 3 supertrends are red and the RSI is above 60.

Your stop loss should be set at the middle supertrend line.

Above, you can see how the three conditions are fulfilled to open a short position using the three supertrend strategy.

Moving Average Convergence/Divergence (MACD) Supertrend Strategy

The MACD supertrend strategy combines the default supertrend with MACD to give you a clearer view of when to enter the market or take profits. The goal is to use two momentum indicators to filter out false signals of the supertrend and MACD when used alone.

The MACD strategy concept is quite simple since a buy signal is formed when:

- The MACD blue line crosses above the MACD red line

- The price is above the supertrend.

A sell signal, on the other hand, is created when these conditions are inversed.

As per usual, the stop loss can be set right on top or just below/above the supertrend line, depending on your risk appetite.

Supertrend Exponential Moving Average (EMA) Trading Strategy

Last on our list is the supertrend EMA strategy. Like with the previous method, we will combine supertrend with EMA to get additional confirmation on when to go long or short.

To achieve this, you will need to use the default (10,3) supertrend settings and plot two EMAs, one on the 3 period and one on the 20 period.

- A buy signal is confirmed when the price is above the green supertrend line and the 3 EMA crosses over the 20 EMA.

- A sell signal is confirmed when the price is below the red supertrend line and the 20 EMA crosses over the 3 EMA.

This EMA trading strategy is particularly handy, as you can either set up a fixed take profit level (e.g. 4%) or use the next EMA cross to exit your position.

How To Use Supertrend For Swing Trading & Day Trading?

One of the best features of the supertrend indicator is that you can use it on different timeframes. As such, it’s entirely possible to use supertrend for swing trading, day trading, or intraday trading. Let’s have a look at how to make this happen.

Best Supertrend Settings for Swing Trading

If you want to swing trade with supertrend strategy, the process is quite simple. Swing trading implies long-term strategies, so your timeframe will reflect this.

The best supertrend settings for swing trading are usually the 4-hour and 1-day charts, combined with the default 10,3 supertrend line. Additional indicators will be useful for better precision. For instance, you can consult volume based indicator such as the on-balance volume (OBV) to confirm the trend.

Supertrend Indicator for Day Trading

Day traders aim to close their positions before the end of the day. The supertrend indicator for day trading can allow you to find trading opportunities early in the day and take your profits on time.

When day trading using supertrend, you will want to choose between one of these chart timeframes: 15 minutes, 30 minutes, and 1 hour. Any of the more versatile strategies will do the trick, such as the double supertrend. This means that you will set your signals using the default supertrend settings (10,3) in addition to a custom supertrend set up at (25,5).

Supertrend Indicator Settings for Intraday Trading

Intraday trading requires you to open and close multiple positions in a single day. Consequently, the 1 minute scalping strategy crypto will be your go-to method for intraday trading using supertrend. Another useful timeframe to consider when tweaking your supertrend indicator settings for intraday will be the 5-minute chart.

Regarding the best supertrend settings for intraday, you can leave the default values of (10,3). Of course, the best practice to avoid false signals on short timeframes is by combining the supertrend with additional indicators. For instance, MACD and RSI will allow you to confirm the breakout before committing to a trade.

How GoodCrypto App Enhances your Trading Capabilities

Our GoodCrypto app will provide you with all the required tools to set up your super trend charts. You will be able to consult and tweak all of the supertrend indicators discussed in this article. Moreover, you can set up a supertrend alert indicator that will prompt you whenever an opportunity opens up.

More than just a charting tool, GoodCrypto provides additional advantages that will make your trading adventure that much easier.

- Track your portfolio across 35 supported centralized and decentralized exchanges.

- Check 20,000+ trading pairs and their price fluctuations in real-time.

- Receive push notifications and customized alerts for your preferred assets.

- Use advanced order types on all supported exchanges, including trailing stops to maximize profits.

- Automate your trading with integrated bots that place orders on your behalf.

- Trade on all devices thanks to our multi-platform support for PC, Android, and iOS.

- Leverage your trades and access advanced financial instruments such as crypto futures.

- And many more.

To sum up, GoodCrypto can become your all-in-one app for trading crypto. It will save you time and alleviate the stress that comes with day trading.

Conclusion

The supertrend indicator is one of the easiest ways to scan the markets for buy and sell opportunities. It requires very little tweaking and provides very good results on its default settings, and on different timeframes.

Like with other trend-signal indicators, supertrend will offer a better success rate when used in correlation with other indicators. Using one of the combined strategies depicted in this article will help you avoid false signals and increase your trading success rate considerably.