Trade on DEX across Ethereum, Arbitrum, and Base networks via GoodCrypto and compete with other traders to share a $5,000 prize pool and win exclusive NFTs b...

A 444% increase in DeFi trading volumes is caused by SEC action against Binance and Coinbase

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

The SEC requests a restraining order against Binance

The United States Securities and Exchange Commission (SEC) has filed an emergency motion in the U.S. District Court for the District of Columbia, seeking a temporary restraining order against Binance, Binance.US, and CEO Changpeng Zhao (CZ) on June 6. The SEC’s motion requests several actions to be taken.

Among the requested actions is the freezing of assets belonging to Binance.US and the repatriation of both fiat and cryptocurrency held by U.S. customers or for their benefit. The motion also seeks to prevent the defendants from altering, destroying, or concealing records and imposes additional conditions on the discovery process.

According to the filing, the SEC believes this expedited relief is necessary to safeguard customer assets, prevent the dissipation of available assets, and address concerns regarding financial transfers and the custody of customer assets, given the defendants’ history of violating U.S. laws and evading regulatory oversight.

Accompanying the motion is a proposed order awaiting the judge’s signature. The proposed order outlines various measures, including transferring assets belonging to U.S. customers back to Binance.US within 10 days. It also requires the defendants to transfer all customer crypto assets to new wallets with new private keys, which BAM Trading officers and employees in the United States will hold. Customer assets will remain redeemable, although transfers over $100,000 will have special handling requirements.

Additionally, the defendants would be obligated to provide the SEC with a comprehensive list of customer fiat and crypto assets and a list of Binance.US customers and their corresponding balances.

A 444% increase in DeFi trading volumes is caused by SEC action against Binance and Coinbase

In response to recent legal actions by the United States securities regulator against major cryptocurrency exchanges Coinbase and Binance, the median trading volume on the top three decentralized exchanges (DEX) has surged by a remarkable 444% in the past 48 hours.

CoinGecko’s aggregated data reveals that the total daily trading volumes on Uniswap v3 (Ethereum), Uniswap v3 (Arbitrum), and PancakeSwap v3 (BSC), which collectively represent 53% of the DEX trading volume in the last 24 hours, have witnessed an increase of over $792 million between June 5 and June 7.

Furthermore, Curve, a DEX specializing in stablecoin trading, experienced a notable spike of 328% in trading volume. Currently, the majority of trading activity on Curve revolves around the U.S. dollar-pegged stablecoins USD Coin and Tether.

During the meme coin frenzy in May, trading volumes on DEXs briefly surpassed those of Coinbase as crypto investors flocked to platforms like Uniswap and other decentralized protocols to purchase tokens such as Pepe (PEPE) and Turbo (TURBO), which were not listed on major centralized exchanges.

As DEX volumes surged, Binance witnessed significant net outflows, with a staggering $778 million leaving the exchange. It’s important to note that despite the outflows, Binance still maintains a substantial reserve, with a stablecoin balance exceeding $8 billion.

These market developments come amidst a wave of legal actions by the Securities and Exchange Commission (SEC) against crypto exchanges. On June 6, the SEC sued Coinbase, alleging the exchange offered unregistered securities and operated as an unregistered securities broker. Similarly, on June 5, the SEC sued Binance, Binance.US, and Binance CEO Changpeng Zhao (CZ), accusing them of failing to register as a securities exchange and operating illegally in the United States. CZ was sued as a “controlling person” in the charges.

After a minor withdrawal delay, Kraken resolves gateway difficulties

Cryptocurrency exchange Kraken recently encountered an issue affecting various crypto funding gateways, including popular options like Bitcoin, Ether, and ERC-20 tokens. The incident resulted in operational delays for deposits and withdrawals. On June 6, Kraken’s status page informed users about the delay, stating that updates would be provided promptly.

The initial notice was posted at around 7:44 am UTC, followed by two subsequent updates at 8:06 am UTC and 8:13 am UTC, indicating that the team was actively working on resolving the issue. However, the specific cause of the problem was not disclosed on the status page.

At 8:35 am UTC, the status page returned to normal, with all updates regarding the delays and issues removed. Cointelegraph has reached out to Kraken for further information regarding the root cause of the problem.

Additionally, Kraken announced that its futures platform would be temporarily unavailable for approximately 10 minutes starting at 10:30 am UTC on June 6. This scheduled downtime is attributed to site maintenance purposes.

With lessening deposit delays and layer-1 costs, optimism successfully completes the “Bedrock” hard fork

The Optimism network has successfully concluded its “Bedrock” upgrade, bringing several improvements to the ecosystem. According to OP Labs, the network developer, the upgrade has reduced deposit times, lowered layer-1 fees, and introduced additional security features. This upgrade is part of a broader initiative to establish a “Superchain” of scalable Web3 networks using Optimism’s OP Stack software.

OP Labs CEO Karl Floersch highlighted that Bedrock incorporates various gas optimizations, resulting in a 40% reduction in data availability fees on Ethereum. These cost savings translate into lower gas fees for users on the Optimism network.

Furthermore, the upgrade enables the network to recognize chain reorganizations on Ethereum, reflecting these changes in the user’s Optimism balance. As a result, deposit times have been significantly reduced to just one minute. Previously, transferring deposits from Ethereum to Optimism took approximately 10 minutes due to the requirement of finality on L1.

To enhance security, Bedrock introduces a two-step withdrawal process, which helps mitigate bridge exploits and enhance overall network safety.

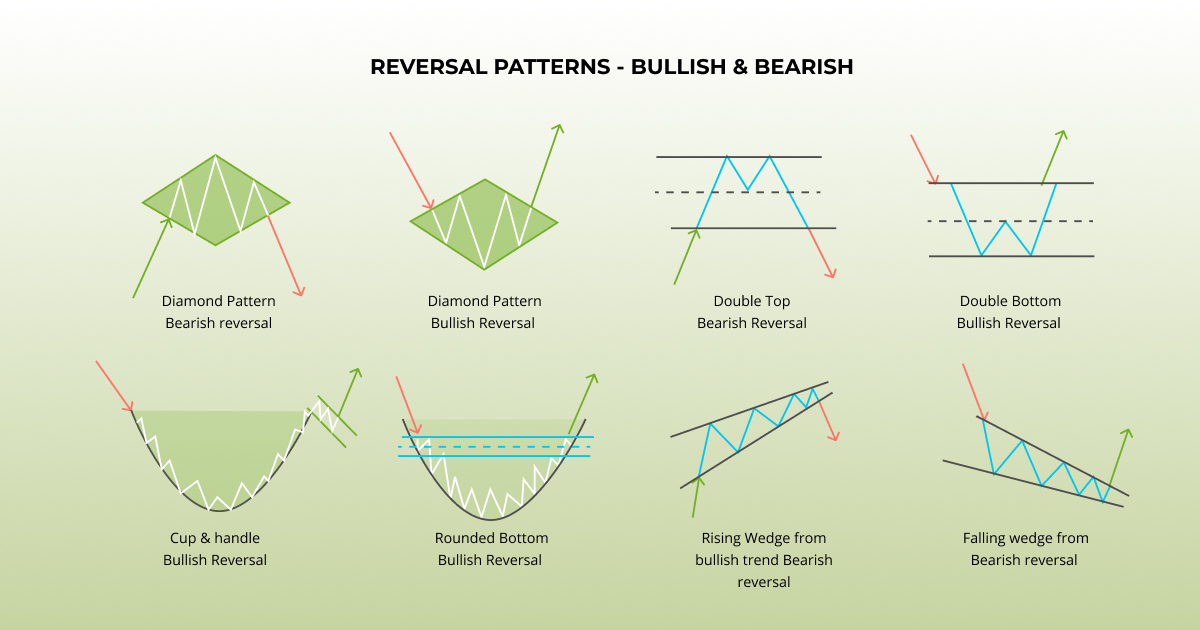

Both bearish and bullish reversal patterns are presented

You can observe two primary trading patterns in day trading: crypto reversal and continuation. Let’s begin by discussing reversal chart patterns, which often generate higher trading volumes and offer the potential for significant profits.

Reversal patterns can be classified into two distinct categories:

- Bearish reversal pattern signals indicate a trend reversal to the downside and serve as sell signals.

- Bullish reversal pattern signals indicate a trend reversal to the upside and provide buy signals.

Identifying and trading reversal patterns can be highly lucrative. To assist you in swiftly recognizing these patterns, we have created a trading patterns cheat sheet that visually represents various chart reversal patterns. Given the wide range of potential crypto day trading forecasting patterns, having a comprehensive overview will prove invaluable.

This article focuses on expert traders’ most frequently used crypto chart patterns in their daily trading activities.

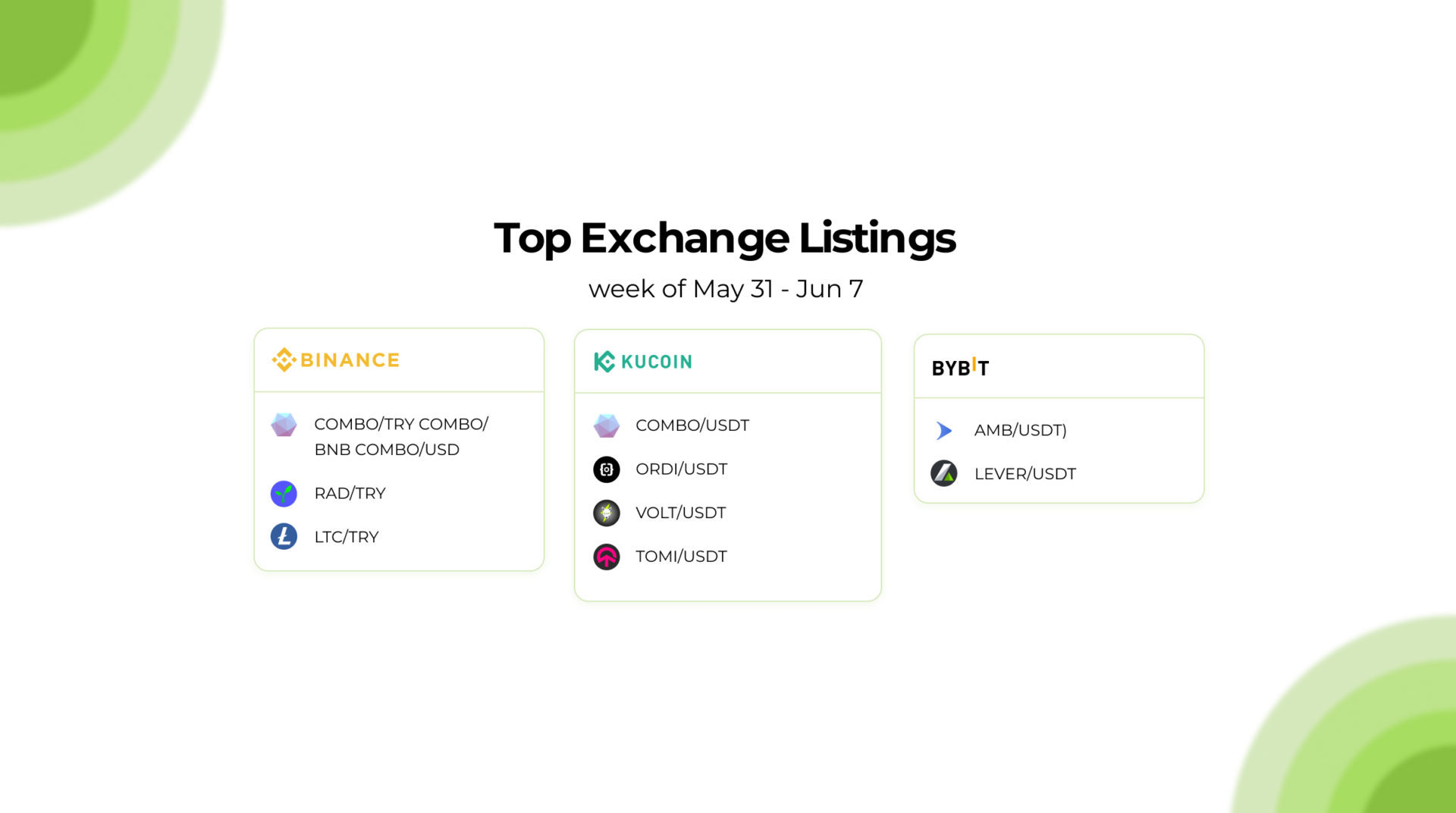

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

June 8, 2023