We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Kraken vs Coinbase Pro: a full guide for 2023

Which one to choose: Kraken or Coinbase Pro? Both are definitely among the most reputable trading venues under the Moon, both give ground only to the ultimate champion, Binance, in terms of 24-hour trading volume, offer services either for professional or novice traders, allow clients to buy crypto with a credit card and have been present on the market for quite some time now. Do you want to trade on a mobile app while not being worried about the security of your funds, then, Coinbase Pro and Kraken are good to go. However, there are a few important nuances, so read on to see which one suits you better.

- 1. Kraken vs Coinbase: Comparison Table

- 2. Kraken Review

- 3. Coinbase Pro Review

- 4. Kraken vs Coinbase Pro Fees

- 5. How to transfer from Coinbase Pro to Kraken?

- 6. Conclusion

Kraken vs Coinbase: Comparison Table

Here is a short overview of both exchanges’ key features for you to grasp the differences in an easier way!

| Features | ||

| Payment Methods Accepted | U.S. Bank Account, Debit Card Buy | U.S. Bank Account, Debit Card Buy |

| Fiat currencies | USD, EUR, CAD, JPY, GBP, CHF, AUD | GBP, EUR, USD |

| Maker Fee | 0.00% – 0.16% | 0.00% – 0.40% |

| Taker Fee | 0.10% – 0.26% | 0.05% – 0.60% |

| Trading Volume 24hrs | $452,235,924.21 | $1,155,958,239.47 |

| Mobile App | Android, IOS | Android, IOS |

| Margin Trading | ✓ | x |

| Futures Trading | ✓ | x |

| Trading in the U.S. | ✓ | ✓ |

| Professional Trading Terminal | ✓ | ✓ |

| TradingView Charts | ✓ | only on Coinbase Advanced Trade |

| Advanced Order Types | x | x |

| Markets | 634 | 156 |

| Fiat withdrawal to debit/credit card | x | ✓ |

| KYC | ✓ | ✓ |

| Federal Insurance | x | ✓ |

Kraken Review

Kraken home page

Kraken is a safe, clean and popular cryptocurrency trading platform located in the U.S. and operating in the niche since 2011. It trades crypto/fiat pairs, suggesting such fiat options as U.S. Dollar (USD), Canadian Dollar (CAD), Japanese Yen (JPY), Swiss Franc (CHF), British Pound (GBP) and Australian Dollar (AUD). The venue also offers TradingView charting functionality and different interfaces for traders with contrasting levels of expertise.

This is, basically, an all-in-one service that offers a lot of options, but does Kraken have a wallet and can you store their funds there? In fact, yes, Kraken is a hot wallet, but a very advanced one where not only you can store your coins, but also trade and stake them, that’s why the correct term for the venue would be an exchange. However, on the funding page of the platform you can find account balances that look very much like a regular crypto wallet with withdrawal and deposit options.

As of writing, the exchange’s 24-hour trade volume is $441,068,884.42, it lists more than 221 altcoins, offers 634+ markets, deep liquidity with spreads as tight as 1 pip and mid-market fees.

Along with Coinbase, the Kraken trading platform was selected to provide Bitcoin market data to the Bloomberg terminal, it was the first time when regular traders gained access to crypto markets. But also the exchange became popular in the crypto community because of Mt Gox clients who signed up to Kraken to claim their lost money. According to Kraken CEO Jesse Powell, the team decided to volunteer their “resources and expertise in an attempt to minimize damage to creditors, restore faith in the Bitcoin community and demonstrate trusted leadership in the industry.” When the MtGox trustee finishes approving claims and selects a distribution date, Kraken may provide payout support for that distribution.

Due to its regulatory compliance and American headquarters, not only individuals but also institutions and big corporations can do business on top of Kraken: banks, brokers & FCMs, mutual, pension and hedge funds, insurance firms, endowments and other asset managers, proprietary trading firms, high-frequency trading firms, algorithmic trading ventures, crypto-related businesses, ATMs, crypto payrolls and wallet services.

So, is Kraken a good exchange? Rest assured, while trading on it, you are in good company. But to ease your decision-making process, read this next Kraken review where everything is discussed in detail.

Trading on Kraken: How to Buy Crypto on Kraken?

Trading Terminal for professional traders on Kraken

Here is a list of fancy things you can do as an individual while using Kraken. The list includes margin trading, futures trading, and last but not least, staking.

But before we dive deeper into those trading types, let’s quickly mention that spot trading is one of the main features on the Kraken trading platform, which you will easily learn from all the Kraken reviews existing out there. In fact, it is so important that there are three different interfaces developed by the exchange specifically for this kind of trading, which we’ll discuss in a separate section. So just stay tuned.

Spot Trading on Kraken

In contrast to any other trading type existing out there, spot trading refers to the purchase of the crypto asset for instant delivery to your exchange account. That’s what you can call the ‘basic’ trading type that simply entails exchanging one asset for the other (on the spot). Every trader should become comfortable with Spot Trading first, before trying out margin trading and derivative instruments.

Spot Trading on Kraken or any other exchange means that you can only sell or exchange what you already have. This decreases the potential upside but limits your risk as well.

Now, let’s take a look at some stats. Kraken offers more than 120 coins and seven fiat options for Spot Trading, including the popular ones – USD, EUR and GBP. There are 634+ Spot markets (trading pairs) on Kraken.

Spot Trading Fees on Kraken are much lower than on Coinbase Pro, but higher than on Binance and Binance.US. Let’s compare actual numbers, but keep in mind that when your trading volume increases, the fees decrease proportionally no matter which exchange you trade on.

| Commission | ||||

| Maker Fees | 0,16% | 0,40% | 0,10% | 0,10% |

| Taker Fees | 0,26% | 0,60% | 0,075% | 0,075% |

Maker fee is applied when your order is placed in the order book and matched against another order later. In this case you provide liquidity – or ‘make the market’. On many exchanges Maker fees are lower than the Taker, or, in some cases you can even get a rebate.

Taker fee is applied when the order you send gets matched against another order that is already sitting in the order book. In this case you remove or ‘take’ liquidity from the market.

All you need to do to start Spot Trading on Kraken is to click the New Order button once you have deposited either fiat or crypto to your Kraken wallet. As previously mentioned, Kraken provides not one but three interfaces for Spot Trading (including a Pro trading terminal).

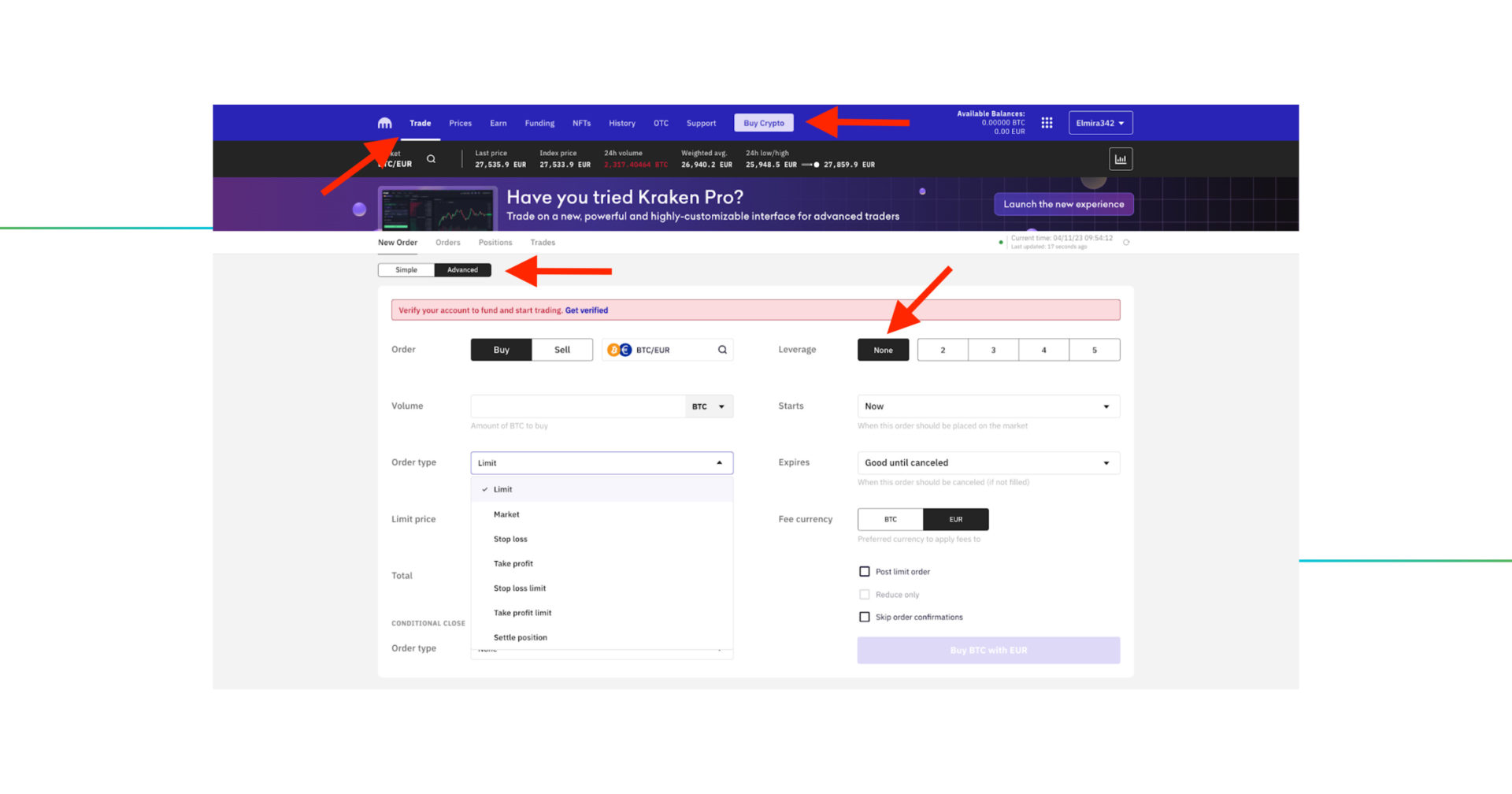

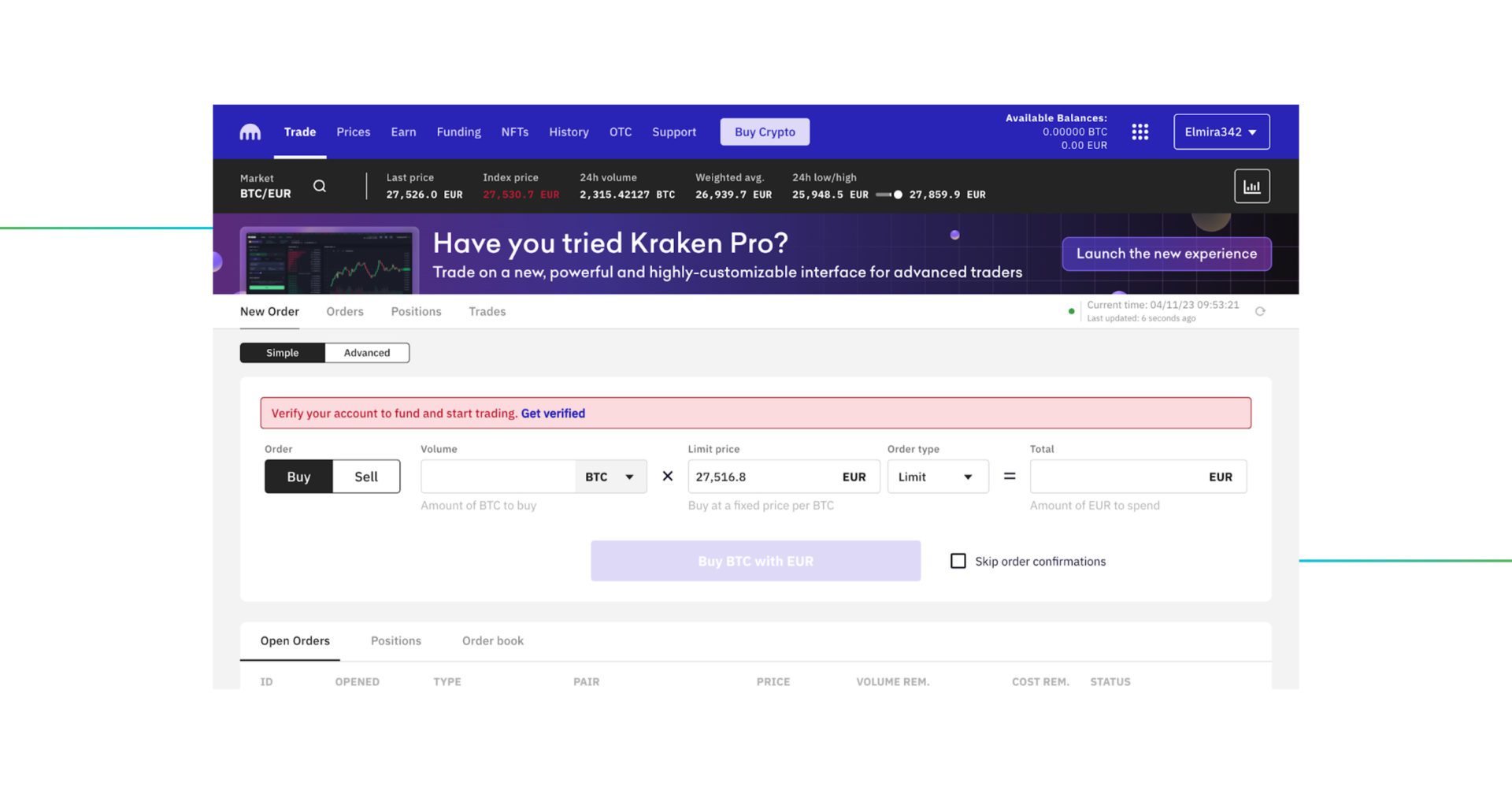

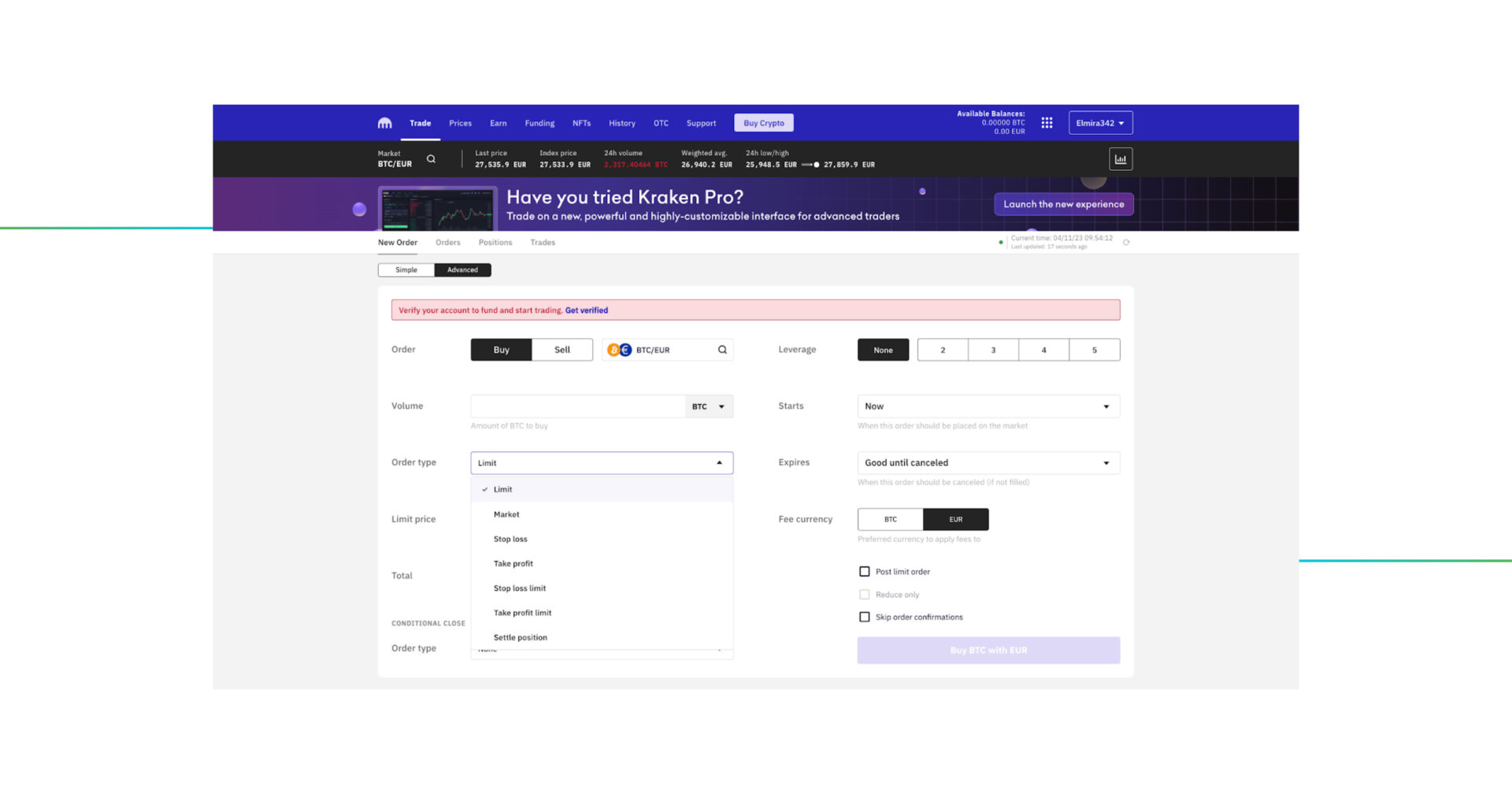

Kraken advanced trading interface

Since their advanced interface is a little bit jumbled, in order to do spot trading there you kind of need to turn off the margin trading feature by pressing the button “none” pictured up above. As to their simple interface, no need to press the button since this interface is good to go for spot trading only.

While using both the simple interface, you can choose between two order types: market and limit orders; as to the advanced option, it provides you with many more options: limit, stop loss, take profit, stop loss limit, take profit limit and the settle position option, which gives you a chance to close all or part of a spot position on margin by transferring to Kraken directly from your account balance.

If you want to extend these options, just go and download the Good Crypto App to trade with Trailing Stop, Trailing Stop Limit, and Reverse Trailing Stop orders on Kraken. You’ll also be able to attach concurrent Stop Loss and Take Profit, and use Trailing Take Profit and Trailing Stop Loss on Kraken.

Margin Trading on Kraken

In general, margin trading is a more complicated trading type than spot trading and may not be a good fit for you if you are not a pro. Leveraged positions can get liquidated easily, and this is a quick and painful way to lose money. But if you think you know what you’re doing, the Kraken cryptocurrency exchange allows you to magnify your gains from market swings by executing more complex trading strategies. You can use margin trades to go long or short by up to 5X the earning potential.

The example is when you place a margin trade with a leverage of 2.0, you only need to have half of the size of the position on your balance. If it is 5.0, you only need to have a fifth of the position size.

To open a margin position, Kraken charges you 0.02%. To keep it open, Kraken charges you 0.02% per four hours (in so-called rollover fees).

The set of cryptocurrencies available for margin trading on Kraken currently includes Bitcoin (BTC), Ethereum (ETH), Tether (USDT), Monero (XMR), Augur (REP) and many more.

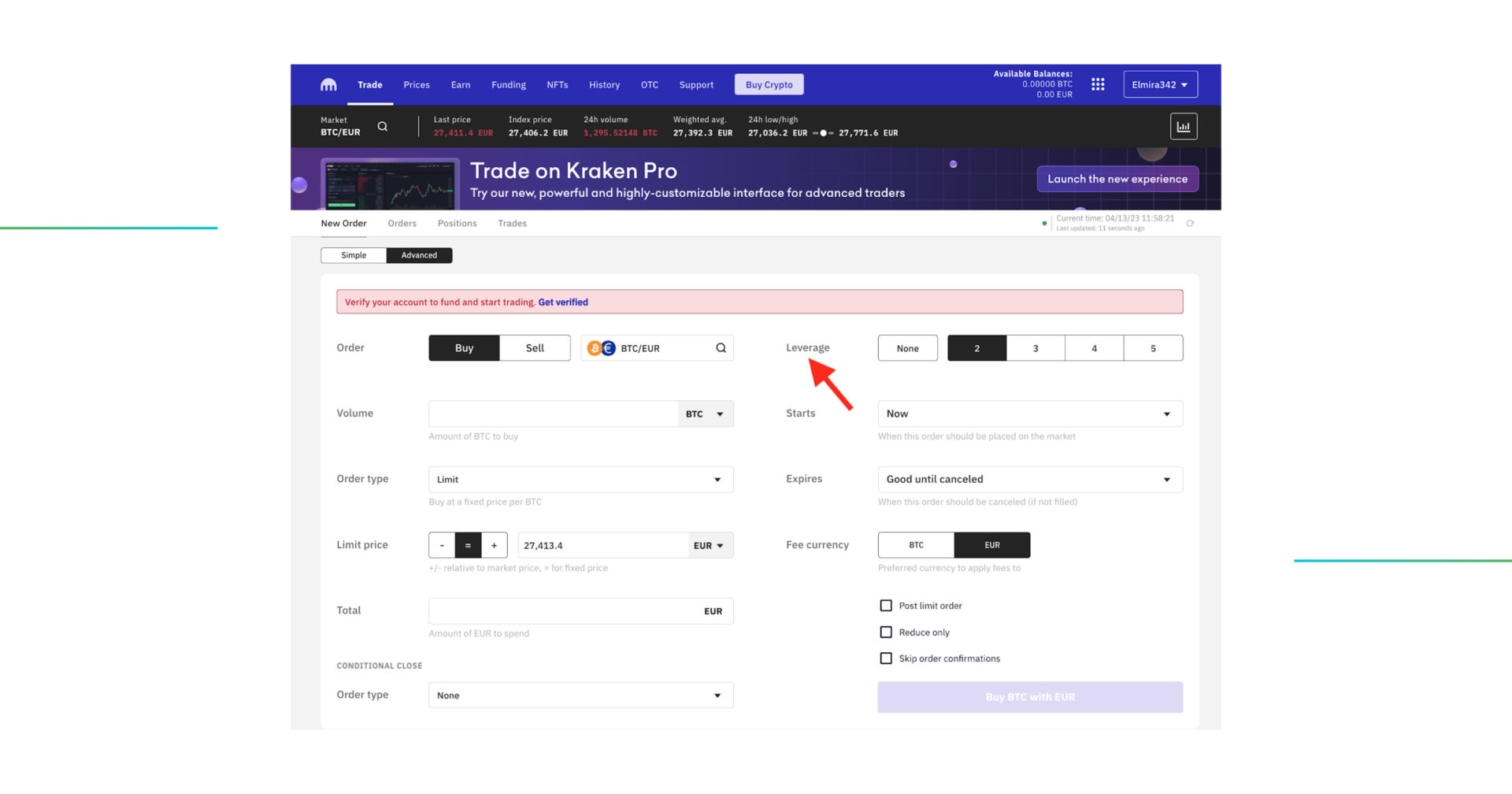

So, how to trade on Kraken, or, rather, how to margin trade on Kraken? In order to open a margin position, you will need to proceed to the intermediate-level tab and click leverage, choose the leverage itself: 2, 3, 4 or 5, define the amount you’re about to trade, the order type, the expiration date, such as “good until canceled”, and, then, the fee currency.

Kraken margin trading

Again, make sure you understand how margin trading works before giving it a shot. As the Kraken help page states, it’s very important to be proactive and constantly monitor your position. “If your margin level falls below the margin call level, you authorize us to liquidate either all of your open positions, or only enough to get your margin level above 100%, at our reasonable discretion.”

Note that the margin liquidation level on this platform is approximately 40%, although the exact threshold varies in accordance with the price volatility in applicable markets.

Kraken Futures Trading

There are basically two main reasons why Kraken users generally trade futures: they hedge against market fluctuations and speculate on market direction. Let’s discuss both cases.

First of all, how can you hedge against the risks? Let’s say, you open a spot position in an attempt to go long, however, it’s a truth universally acknowledged that the market might very well go down, too. So, in order to balance your risks, you go and open a short position. This is where Kraken Futures comes in handy. As stated on the website of the exchange, futures require less money to open positions than if you were spot trading (1x) or margin trading (3-5x). With 50x futures, you trust as low as 2% of your money to the exchange. So, if the market goes down, you’ll gain on shorting futures, if the market goes up, you’ll gain on going long on the spot market and lose only 2% on shorting.

In this case, where you have a 50x leverage, the initial margin is 2% and the maintenance margin is 1%.

Second, you can speculate on market direction. Here is how futures trading works on Kraken as described by the platform itself: “You believe that the price of Bitcoin will increase against USD and buy 10,000 Bitcoin-Dollar Futures at 5,000 USD per Bitcoin. Every Futures has a contract size of 1 USD. The price of Bitcoin actually increases and you are able to sell the Futures at 6,000.”

The magic lies in the fact that you earn on Bitcoin market swings not even having Bitcoin, and the difference in price is paid by the buyer of your futures – the other trader you’ve previously made a deal with.

Cryptocurrency futures contracts on Kraken can be perpetual, monthly and quarterly, which is basically the range defining the payment day. If it is a perpetual contract, then you can hold the position as long as you have funds in your account; if it is another position, say, monthly, it will be closed at the end of the period.

To keep your perpetual contracts open on Kraken, you have to pay a rollover fee, up to 0.02%, once in 4 hours, depending on the coin.

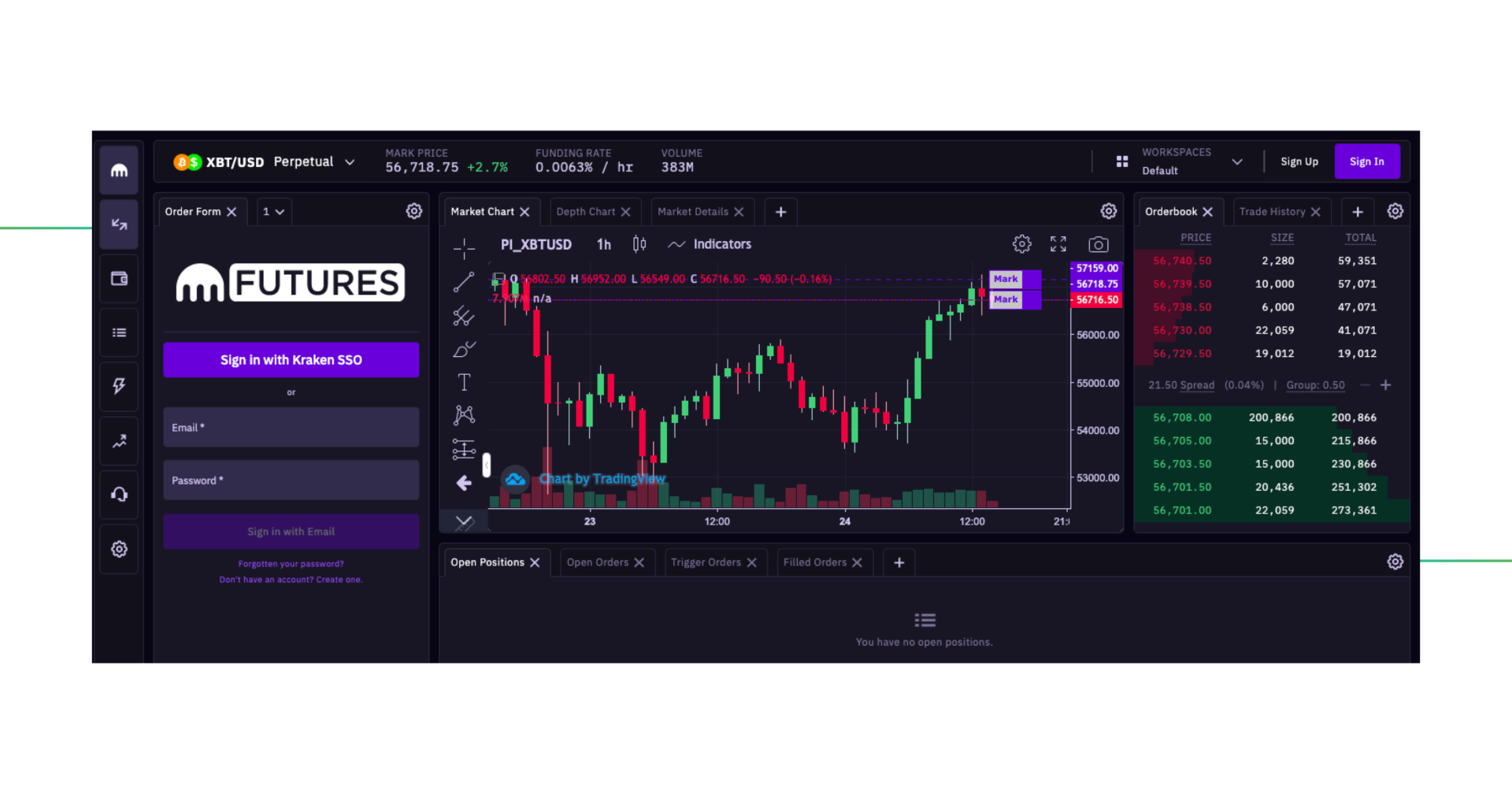

Kraken futures trading

A quick disclaimer: Kraken trading is a process better to be learned on paper first. That’s why the exchange offers a demo futures platform, and it’s recommended for all novices to try it first.

Once ready for real trading, make sure you meet all requirements: you are intermediate or PRO verified and you don’t come from one of the restricted areas.

Kraken now offers futures on the U.S. Dollar price of Bitcoin (FI_XBTUSD), futures on the U.S. Dollar price of Ether (FI_ETHUSD), futures on the U.S. Dollar price of Litecoin (FI_LTCUSD), futures on the U.S. Dollar price of Ripple XRP (FI_XRPUSD) and futures on the U.S. Dollar price of Bitcoin Cash (PI_BCHUSD).

Compared to margin trading, you cannot lose more funds than you have in your futures wallet.

Now let’s look at Kraken Futures trading fees. If your 30-day trading volume is less than USD100,000, your maker fee is going to be 0.02%, and taker fee – 0.05%. As futures trading is geared towards professional high turnover traders, the fees are lower than the spot trading fees. Plus, maker fee is 2.5x lower than the taker fee, incentivizing traders to provide liquidity to the exchange rather than remove it. As your trading volume grows, say, up to $1,000,000, you will have to pay 0.015% in maker fees and 0.04% in taker fees.

You can get familiar with the latest fee schedule on Kraken Futures here.

Kraken Staking

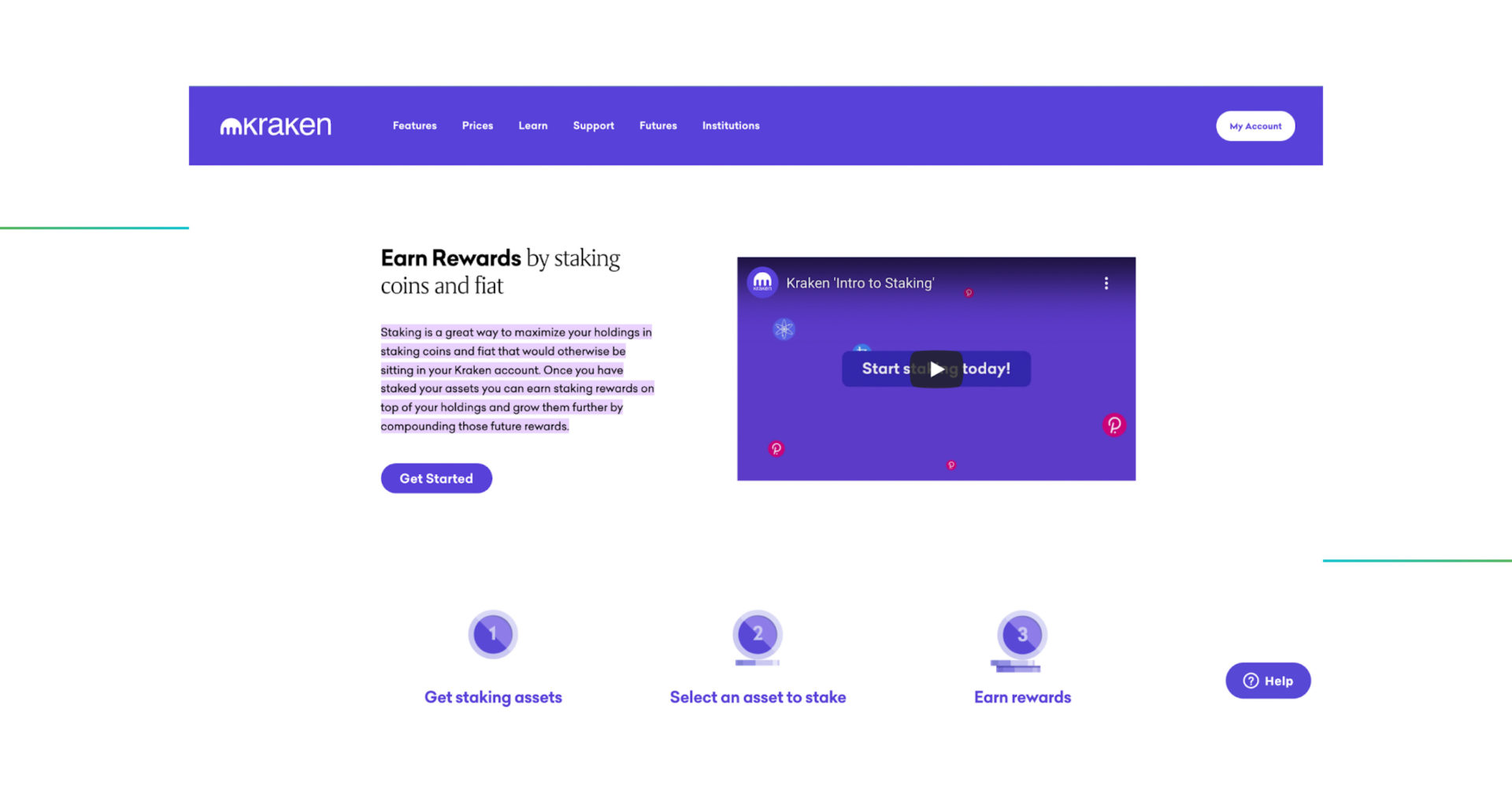

A few years ago when there was no fuss about DeFi, crypto enthusiasts loved earning rewards by staking their coins in the Proof-of-Stake blockchains. As defined by Kraken, “A Proof of Stake “validator node” can be added to the pool by staking coins for a certain period of time, giving Proof of Stake validators a source of income without needing powerful mining hardware.”

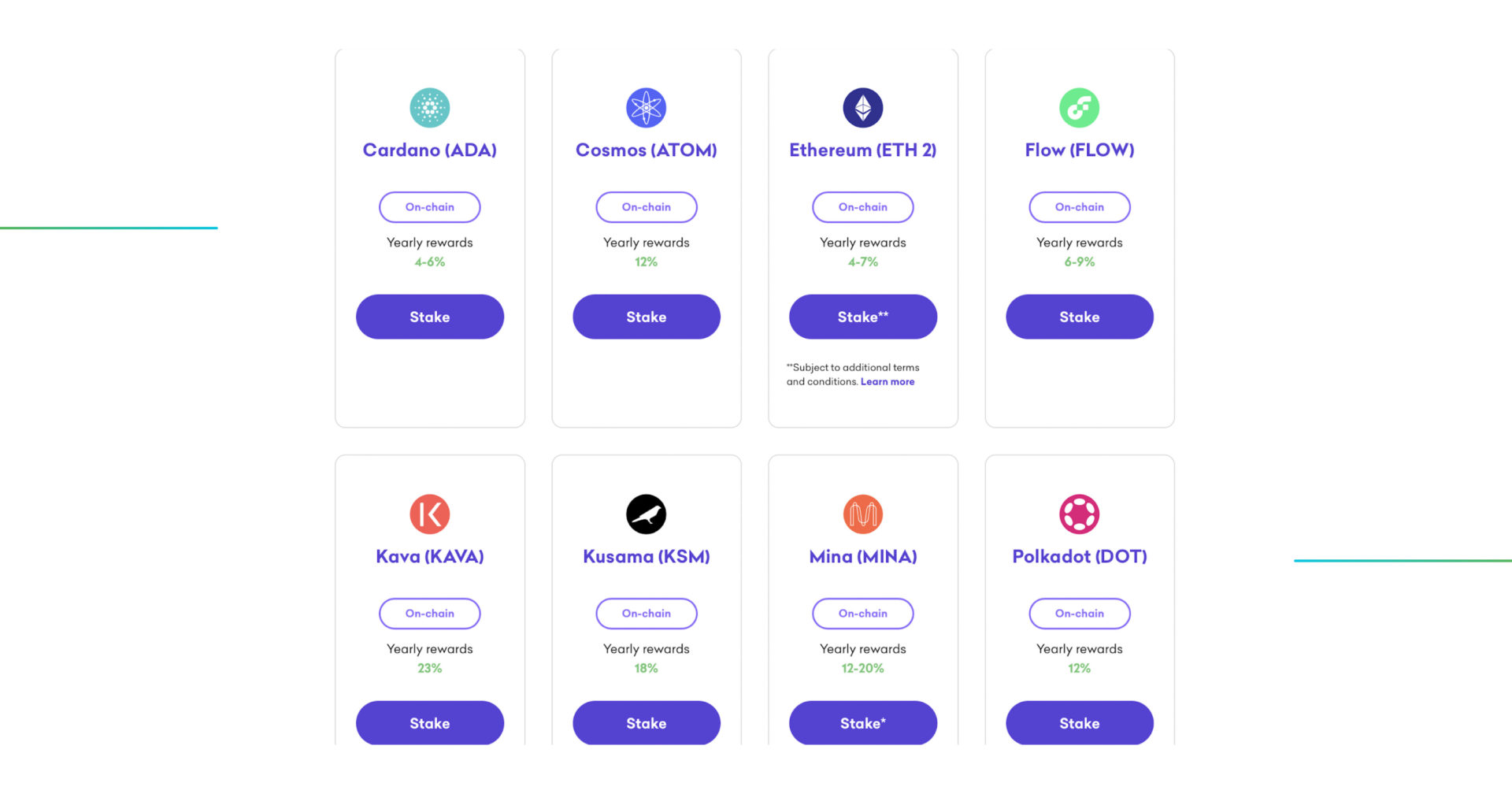

Staking on Kraken

Staking coins on Kraken include Algorand (ALGO), Cardano (ADA), Cosmos (ATOM), Ethereum (ETH), Flow (FLOW), Kava (KAVA), Kusama (KSM), Polygon (MATIC), Mina (MINA), Polkadot (DOT), Solana (SOL), Secret (SCRT), Tezos (XTZ), The Graph (GRT) and Tron (TRX).

In order to stake coins, you should first buy assets or fund your Kraken account with one of the assets that are eligible for staking. Then it’s necessary to choose the asset to stake and, finally, earn rewards that you will receive twice a week.

Staking options on Kraken

Kraken UI Types

Kraken is a veteran crypto exchange offering a lot of fun for traders of all kinds. Essentially, the fun is based on the fact that there are four different interface types for spot trading: for novices (a simple interface), for the bold ones ready to leverage (a medium interface), for those who know the difference between order types (an advanced interface) and for professional traders who know how to use integrated charting services, numerous technical indicators, and a streamlined interface for entering, canceling and replacing orders (Kraken Terminal). Let’s take a look at each of the interfaces in detail.

Simple Interface

Kraken simple interface

With the simple interface, you can sell and buy crypto without giving too much thought to how it happens under the hood. Market orders and Limit orders are both available.

Market order comes in handy when you are not interested in the asset price but want to buy it as soon as possible, basically, at the current market rate. A Limit order is good to go if a trader wants to pay a certain amount of money and is ready to wait as long as it takes for a price to swing.

Advanced Interface

Kraken advanced interface

With the advanced interface, you can put some extra features to your trade: Stop Loss, Take Profit, Stop Loss Limit, Take Profit Limit, and “Settle Position”, however, a lot of useful options are not presented.

While Kraken’s advanced functionality is impressive, you can get even more trading tools to make your Kraken trading experience even better if you choose to place orders via Good Crypto. With the GoodCrypto app, you will also be able to trade with Trailing Stop, Trailing Stop Limit, and Reverse Trailing Stop orders on Kraken. You’ll also be able to attach concurrent Stop Loss and Take Profit, and use Trailing Take Profit and Trailing Stop Loss on Kraken.

Kraken Terminal

And last but not least – Kraken Terminal. This interface is a great tool for those who know how to use integrated charting services, the orderbook, the wall of trades, numerous technical indicators and a streamlined interface for entering, canceling and replacing orders. It is developed for the needs of professional traders who love market data and are used to a more advanced, professional dashboard.

Having said that, we believe any trader, regardless of her experience, would benefit from using Kraken advanced terminal for her daily trading since Kraken’s other trading interfaces lack even basic price charts.

Strangely, the terminal is not that easy to find on the homepage of the exchange, so here is the link just in case.

And last but not least – some of you might recognize the familiar look & feel of Kraken’s terminal – it resembles Cryptowatch – a popular multi-exchange trading terminal. And you are not mistaken – Kraken did indeed acquire Cryptowatch some time ago to offer an advanced terminal to its users. By the way, here is our Cryptowatch review for those of you who’d like to dig deeper.

But the Kraken trading terminal is going to be closed and so the exchange offers an alternative – to make trades on Kraken Pro, created especially for advanced traders or use Cryptowatch. Kraken Pro combines spot and margin trading, as well as staking.

Kraken Pro Terminal

Kraken Verification Procedure

Kraken verification levels are divided into four groups:

- Kraken starter verification,

- Kraken express verification (for USA only)

- Kraken intermediate verification,

- Kraken pro verification.

No matter what verification level you are about to get, there are basic requirements for all traders to meet. You will have to:

- add 2FA to the sign-in process,

- provide your email,

- full name,

- date of birth,

- phone number,

- and physical address, which will give you a starter level.

But if you want a pro level, provide additional information:

- valid ID,

- proof of residence,

- occupation information,

- social security number and photo.

How long does it normally take to verify on Kraken? The Intermediate Level takes 4-5 minutes, Pro – Personal Level – a few days, and Pro Business – 5 days.

See all the requirements for the verification process here.

Let’s get to the nitty-gritty of the subject sooner, though, and talk about withdrawal limits in crypto equivalent. If you have a starter account, you can withdraw max $5,000 per day. The Pro level gives you a chance to withdraw $10,000,000. On a monthly basis, it is possible to withdraw an unlimited amount of money.

Unfortunately, starters cannot withdraw fiat. Intermediate-level traders can withdraw $100,000 maximum per day, and pro market players – $10,000,000 daily. For more information, refer to this page on Kraken.

Security: Is Kraken Safe?

So, is Kraken a good exchange in terms of safety? There have not been reports on the venue being hacked in the past, which gives the platform obvious advantages over its competitors. But how safe is Kraken?

Kraken offline storages have a very good reputation. According to the exchange, 95% of all deposits are kept in air-gapped, geographically distributed cold storages, and their servers reside in secure cages under 24/7 surveillance by armed guards and video monitors. Also, the platform runs a bug bounty program to leverage the expertise of the broader security research community and, according to the website, has an expert team dedicated to testing their own systems via every imaginable attack vector.

The list of security features on Kraken includes 2FA, email confirmation for withdrawals, API permissions with different limitations, constant real-time monitoring for suspicious activity, no phone/sms account recovery and SSL encryption when browsing.

So, maybe, it’s the right time and place to say, “Please enjoy”? Nope. Let’s look at Coinbase Pro first, just to see if it may be even better!

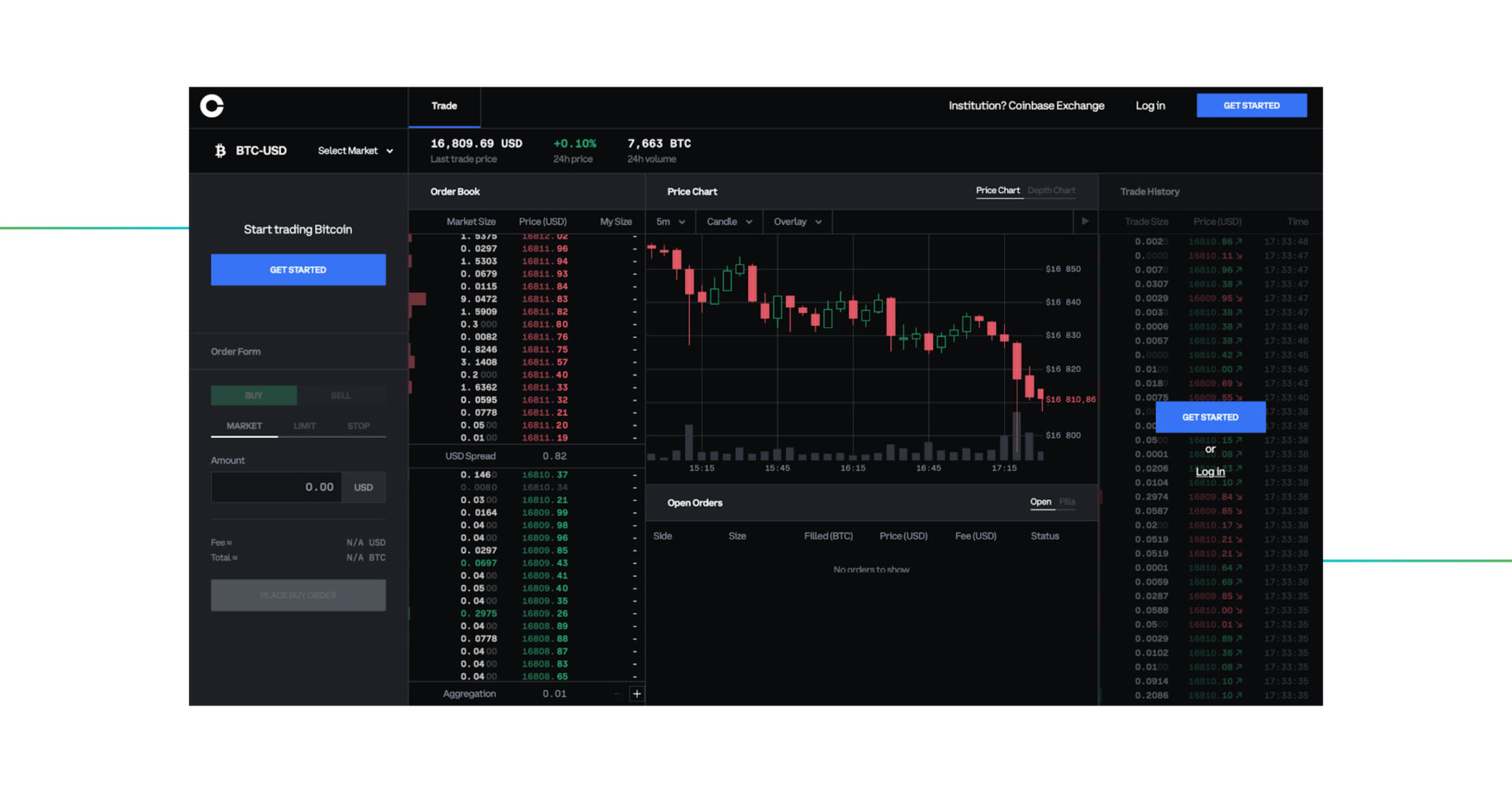

Coinbase Pro Review

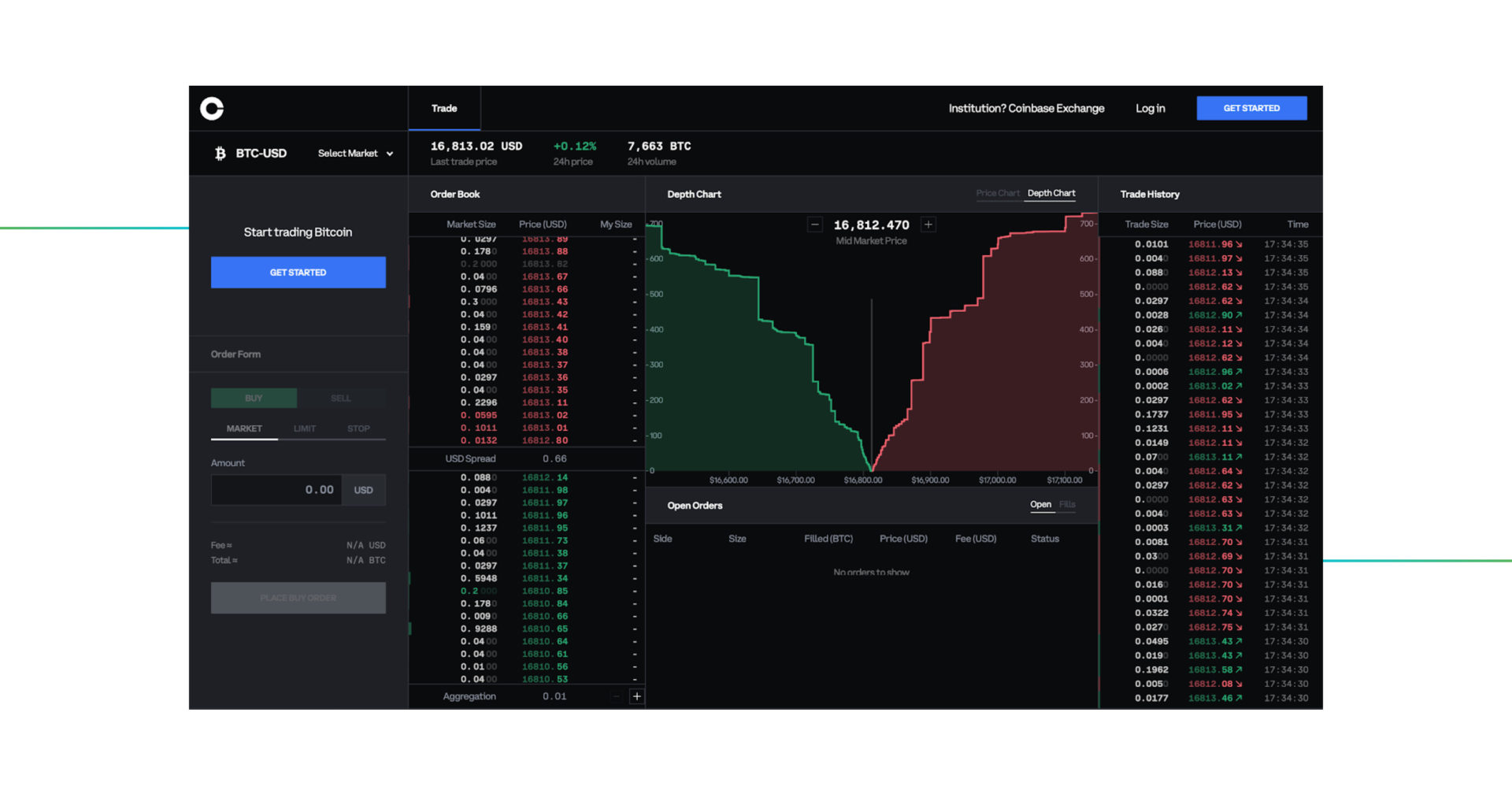

Coinbase Pro homepage

Coinbase Pro – you may know it as former GDAX – is a trading platform run by Coinbase. One of its distinguishing features is that it has got an easy fiat onboarding for those who live in the U.S., the U.K., and the EU. Its interface is intuitive and well-laid to use either for novices or advanced traders, but one of the characteristics that makes Coinbase Pro truly stand out is that U.S. dollar balances have FDIC insurance, meaning all clients who store less than $250,000 on their accounts are federally secured by the U.S. government – quite a nice approach not seen on Kraken or any other crypto exchange!

Coinbase Pro follows the same KYC procedure and verification process as their wallet, so it’s hard to stay anonymous on this exchange, but the good news is that if you’re already verified on Coinbase.com, you won’t need to get verified again.

This platform is the first crypto trading exchange that is about to go public with the ticker COIN, even though it will skip the traditional initial public offering (IPO) process of hiring investment banks to attract attention and finance the deal. With the current 24-hour trade volume of $914,474,829.12, the exchange has deep liquidity and slightly higher fees than on Kraken. There are more than 150 coins listed on top of this exchange, and the list includes most of those you’ve become accustomed to, yet, this is less than other exchanges.

Trading on Coinbase Pro: How to Buy Crypto on Coinbase Pro?

Compared to Kraken, this trading venue only offers spot functionality – in November 2020, Coinbase margin trading was disabled in response to new guidance from the Commodity Futures Trading Commission.

Such a development made the overall Coinbase trading process less flexible and entertaining considering the latest market movements.

So, how to buy Bitcoin on Coinbase Pro?

The trading terminal on Coinbase Pro is pretty much straightforward. It has the order form, order book, price chart and trade history as shown in the picture above.

The existing order types are market, limit and stop orders. Coinbase Pro defines these order types on the Trading Rules page:

- A Market Order is an Order to buy or sell a specified quantity of an Asset at the best available price of existing Orders on the Order Book.

- A Limit Order is an Order to buy or sell a specified quantity of an Asset at a specified price.

- A Stop Order is an instruction to post an Order to buy or sell a specified quantity of an Asset but only if and when the last trade price on the Order Book equals or surpasses the Stop Price.

But even though an easy-to-use order form makes day trading on Coinbase very comfortable, the exchange still lacks major customized orders, such as Trailing Stop Buy, Trailing Stop Limit Buy, Reverse Trailing Stop Loss (Buy the Dip) and Reverse Trailing Stop Limit (Buy the Dip). The good news is that you can use all of those, along with connected orders, by installing Good Crypto App.

Compared to Kraken’s TradingView charting functionality, the same feature on Coinbase Pro leaves room for improvement. The chart can be only customized based on time range, chart type (candlestick and line), and overlay (12- and 26-Day EMAs).

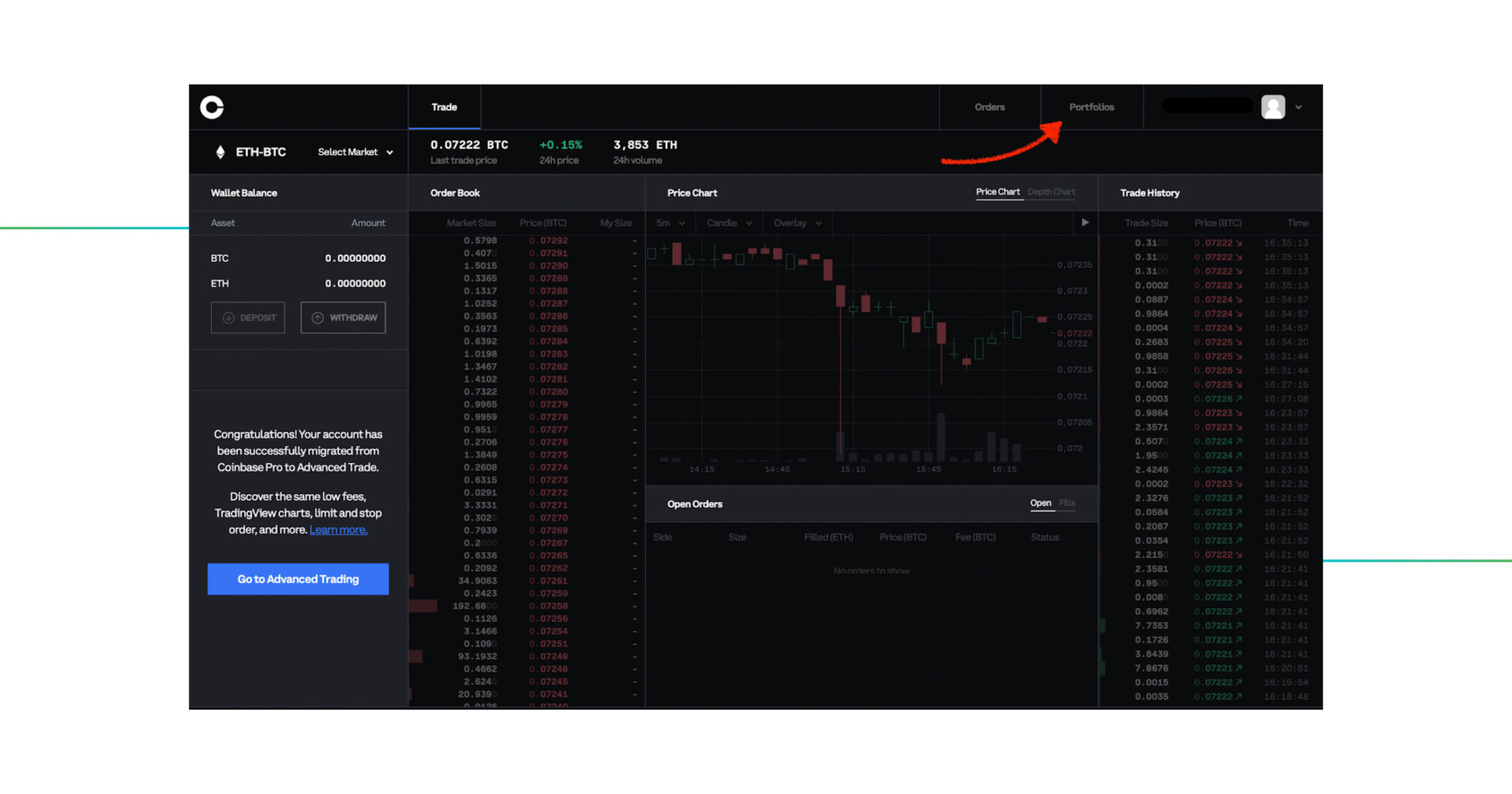

However, not long ago, Coinbase launched Coinbase Advanced Trade. This trading platform is intended to replace Coinbase Pro, offering sophisticated tools, including interactive charts powered by TradingView, advanced order types, and access to all other Coinbase features that can enhance trading capabilities and streamline customers’ trading experience.

Just like on Kraken, on Coinbase Pro, there’s a depth chart, a visual representation of the order book, showing bid and ask orders over a range of prices, along with the cumulative size.

In order to deposit or withdraw money, you can use your bank account, swift account or ACH transfers – if you’re in the U.S.

If you want to withdraw via PayPal, you have to send your coins to Coinbase.com first and then send them to PayPal.

You can deposit from the other wallet or from Coinbase.com – with the latter method, it will be an instant payment.

In order to learn how to trade on Coinbase Pro, you can use the demo version of their platform.

How to Get Verified on Coinbase Pro?

If you’re verified on one of the Coinbase venues, for example, the Coinbase wallet, you won’t need to get verified again. The oft-repeated recommendation from the support desk is to verify your identity using the Coinbase mobile app.

As their website states, 90% of customers are able to resolve issues with Coinbase ID verification by using the Coinbase mobile app and the camera on their mobile phone. Once the app is installed, go to Settings > Identity Verification.

The US customers will need to upload a state ID or a driver license and answer a set of questions.

The clients from the UK also answer a set of questions and, then provide a driver license, a government-issued ID, or a passport.

As for the EU, Australian, Canadian, and Singaporean customers, they have to upload two different forms of supported IDs: either a driver license, a passport or a national ID card. The support desk suggests that it’s better to contact them if verifying IDs from two different countries.

So, compared to Kraken’s starter level that requires your email, address and telephone number, not your ID, Coinbase Pro doesn’t give you a chance to stay anonymous at all.

How long does Coinbase verification take? If verifying via the mobile app, enable your webcam to scan your Identification Document, take a photo of your face and wait for 2-3 minutes for the verification process to complete.

Coinbase Security: Is Coinbase Safe?

Are you wondering how safe is Сoinbase? Let’s dive a little deeper, then. First of all, if you store less than $250,000 in your wallet, you’re federally secured by the U.S. government in case there’s a breach of the platform’s physical security, cyber security, or by employee theft.

Also, the exchange encourages responsible disclosure of security vulnerabilities via their bug bounty program. But remember that Coinbase Pro doesn’t refund you if your password was too weak, and an attacker managed to hack your account.

Also, you can always make your account more secure yourself by applying a few safety measures. These are just some of them:

- Use a password that is long, random, and unique to your Coinbase account.

- Use a time-based One Time Password (TOTP) and a security key – a physical hardware authentication device designed to authenticate access through one-time-password generation.

- Secure your email by checking it on https://haveibeenpwned.com/ in a third-party data breach and, if so, change any passwords associated with that email address

- Lock Down Your Mobile Account by placing a port freeze and SIM lock on your account.

As they state on their website, Coinbase Pro stores your funds through a combination of online “hot storage” and offline “cold” storage, maintaining 98% or more of customer digital currency in cold storage, with the remainder on secure hot servers to serve the liquidity needs of their customers.

Kraken vs Coinbase Pro Fees

So, is it Coinbase or Kraken? If up until now you haven’t decided yet, no worries, this table with the following fee structure should put the record straight.

| Fee Type | ||

| SEPA Withdrawal | €0.0 EUR – €35 EUR | €0.15 EUR |

| SEPA Deposit | €0 | €0.15 EUR |

| Wire Transfer Withdrawal | $4 – $35 USD | $25 USD |

| Wire Transfer Deposit | $0 – $10 | $10 USD |

| ACH Transfer Withdrawal | x | $0 USD |

| ACH Transfer Deposit | x | $0 USD |

| Maker Fee | 0.00% – 0.16% | 0.00% – 0.40% |

| Taker Fee | 0.10% – 0.26% | 0.05% – 0.60% |

| Debit Card Buy | 3.75% + €0.25, only Euro is supported |

3.99% |

You can also send your money from your Coinbase Pro wallet to your Coinbase wallet account and, then, use an instant card withdrawal option.

| Fee Type | ||

| The Instant Card Withdrawal, UK or EU customers |

x | £0.55 – 2% or €0.55 – 2% |

| The Instant Card Withdrawal, U.S. customers |

x | $0.55 – 1.5% |

Find all the current fees on Kraken here. Follow this or this link to get familiar with the latest Coinbase Pro fees.

Haven’t decided yet? You can always switch between exchanges whenever you like, see how!

How to Transfer From Coinbase Pro to Kraken?

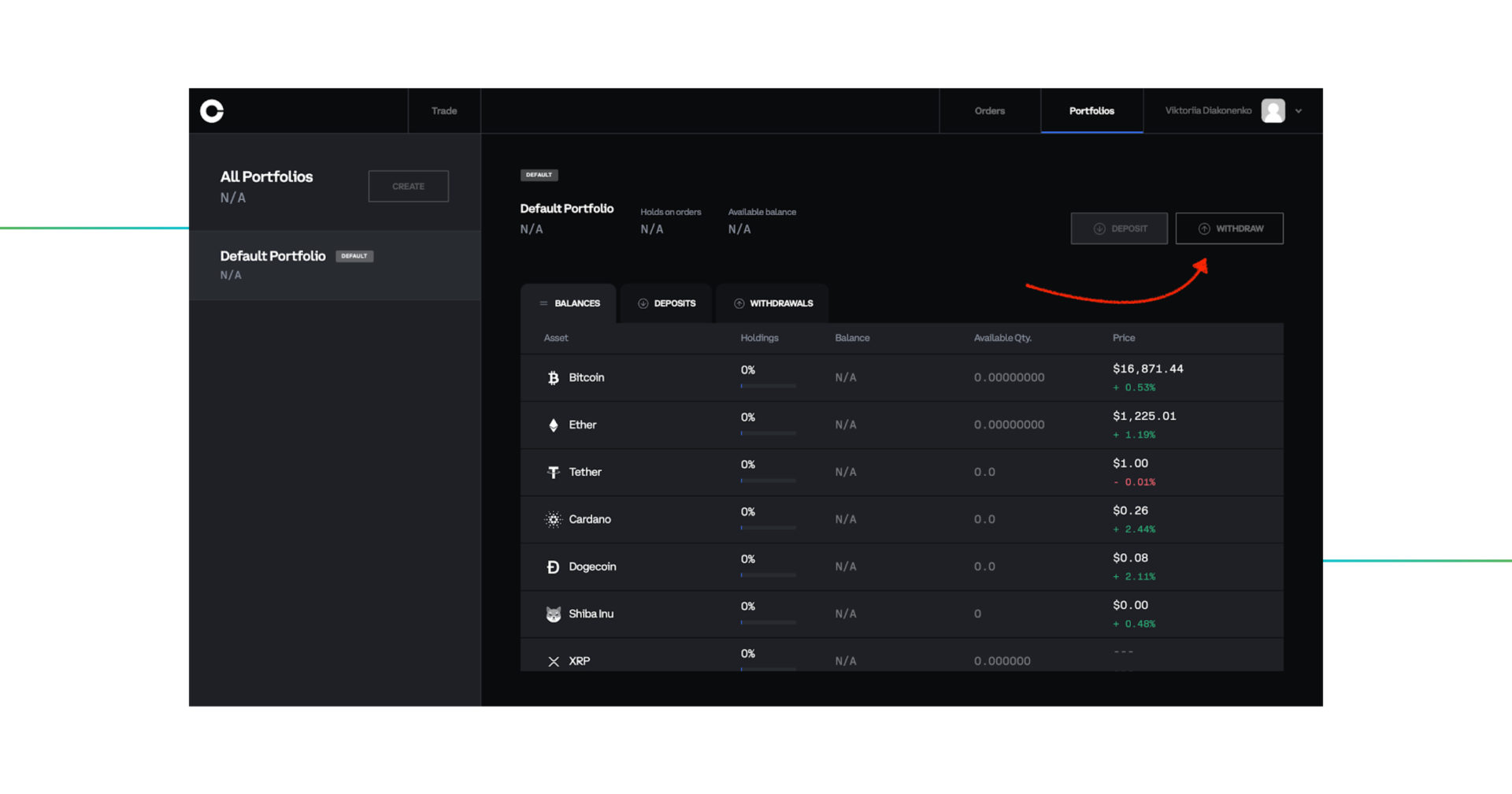

In order to transfer money from Coinbase Pro to Kraken, you need to go to the Portfolios tab on Coinbase Pro as shown below…

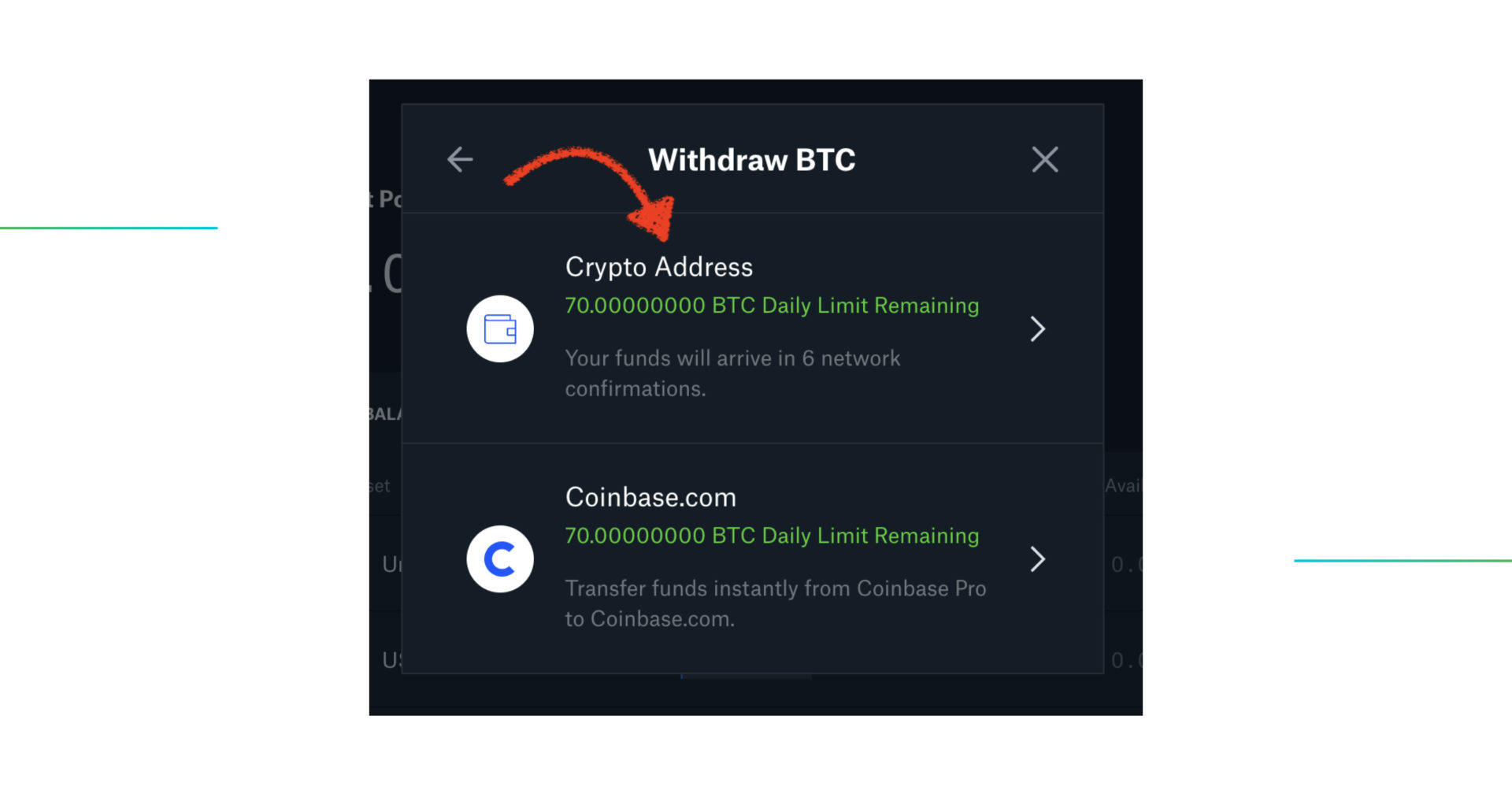

click the Withdraw button…

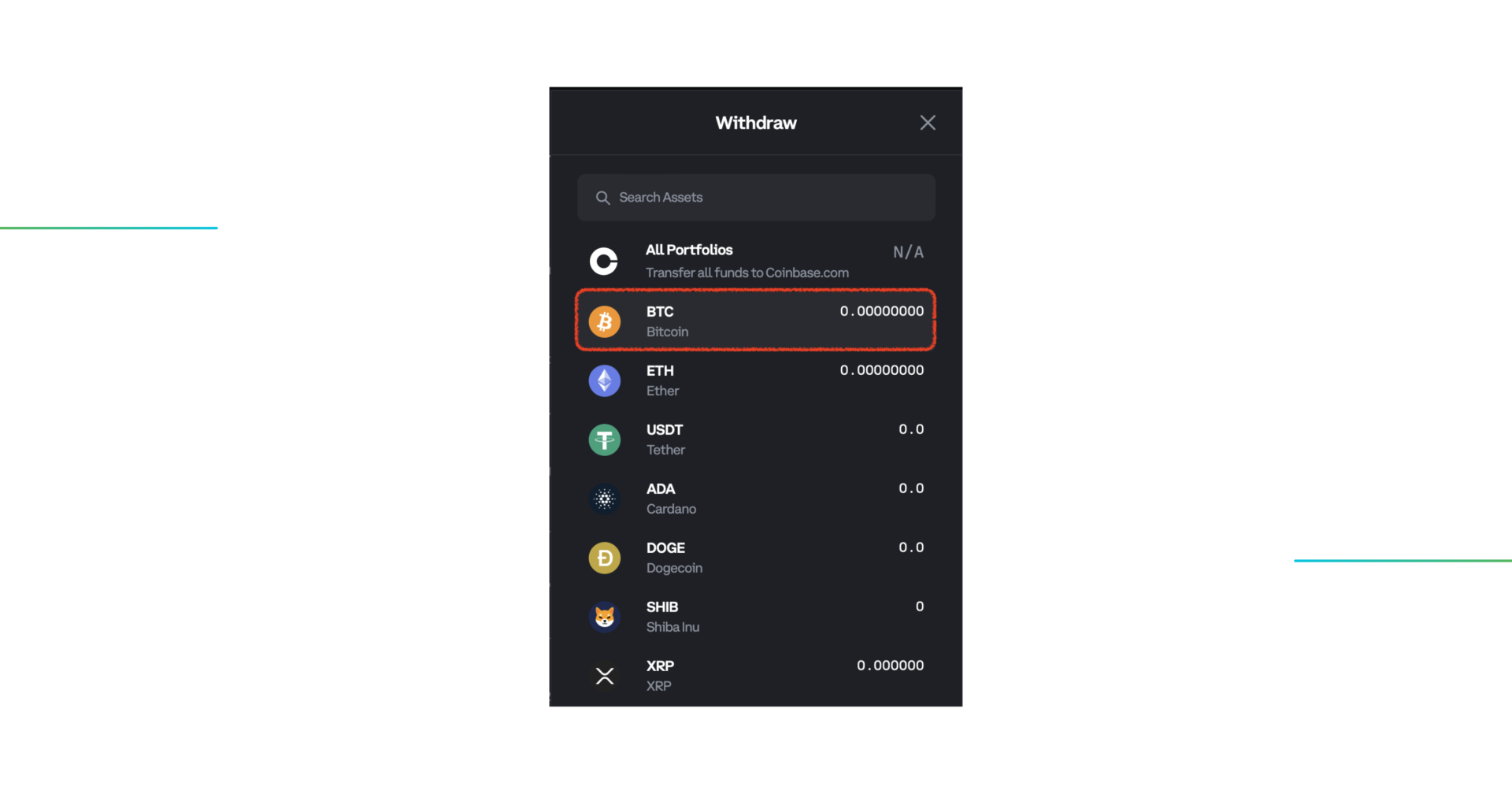

choose one of the crypto coins you’re about to transfer to Kraken, say, to your Kraken bitcoin wallet…

and select the first option:

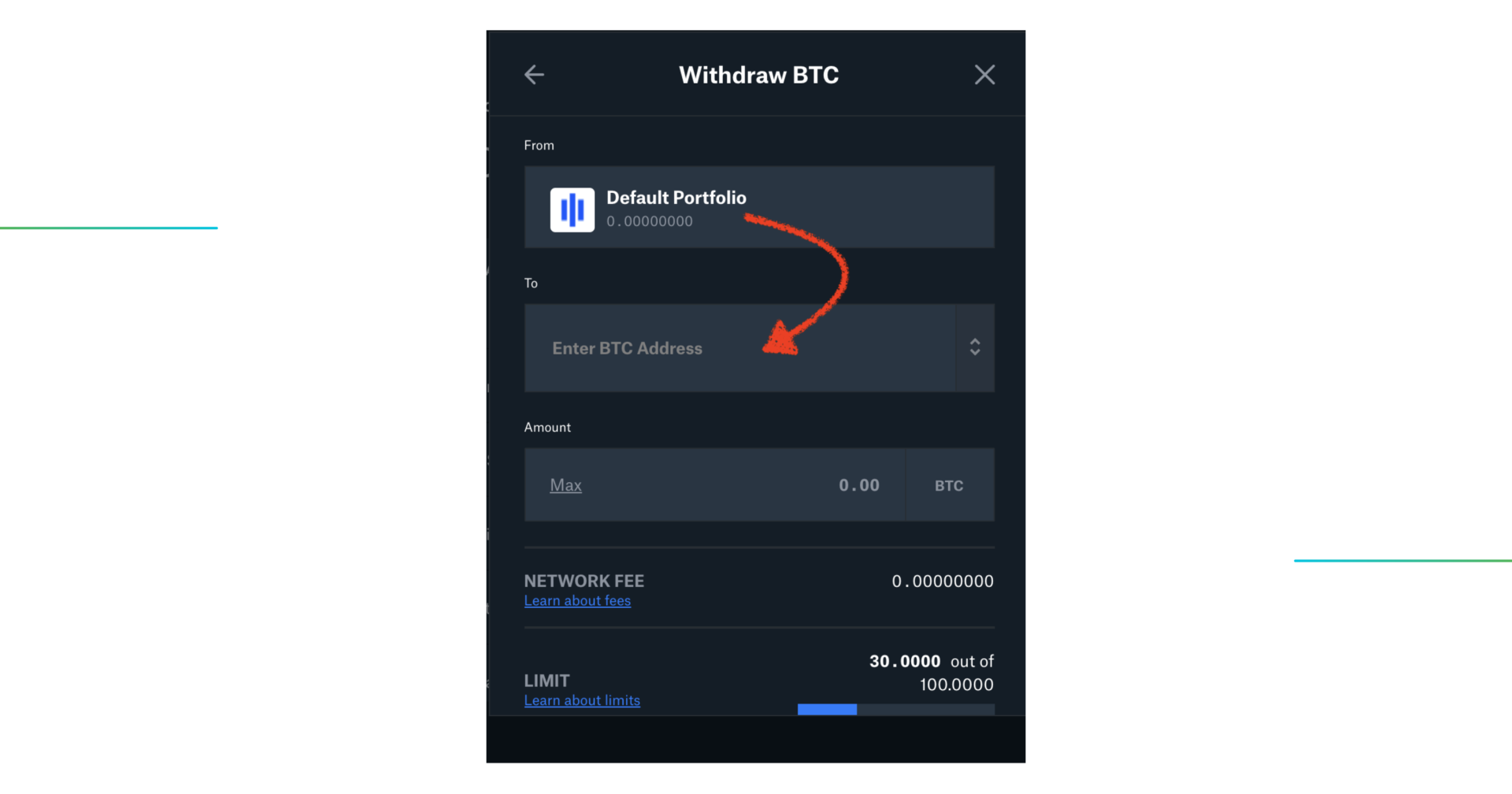

This is where you can finally enter your Kraken’s public address if you know it:

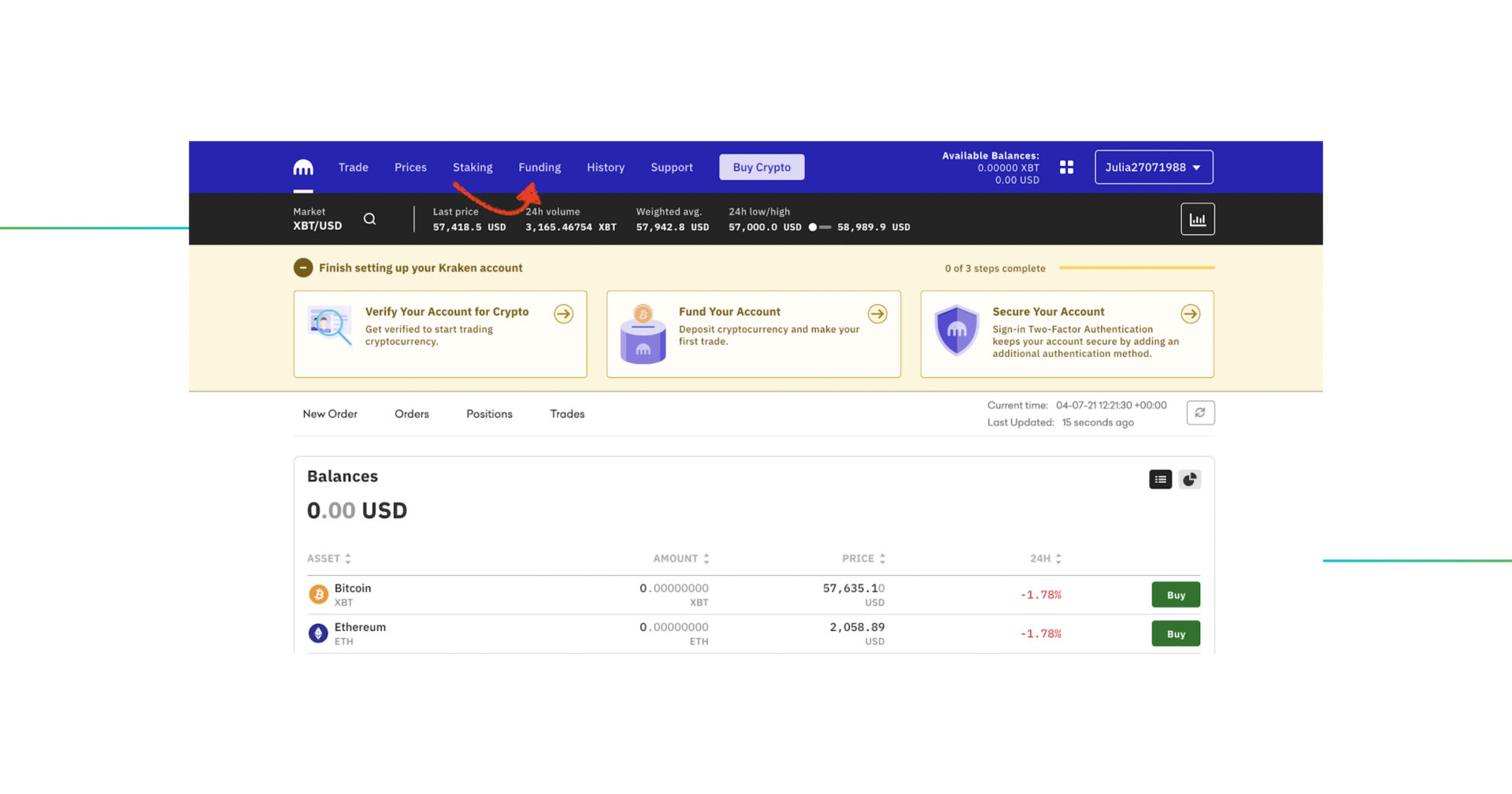

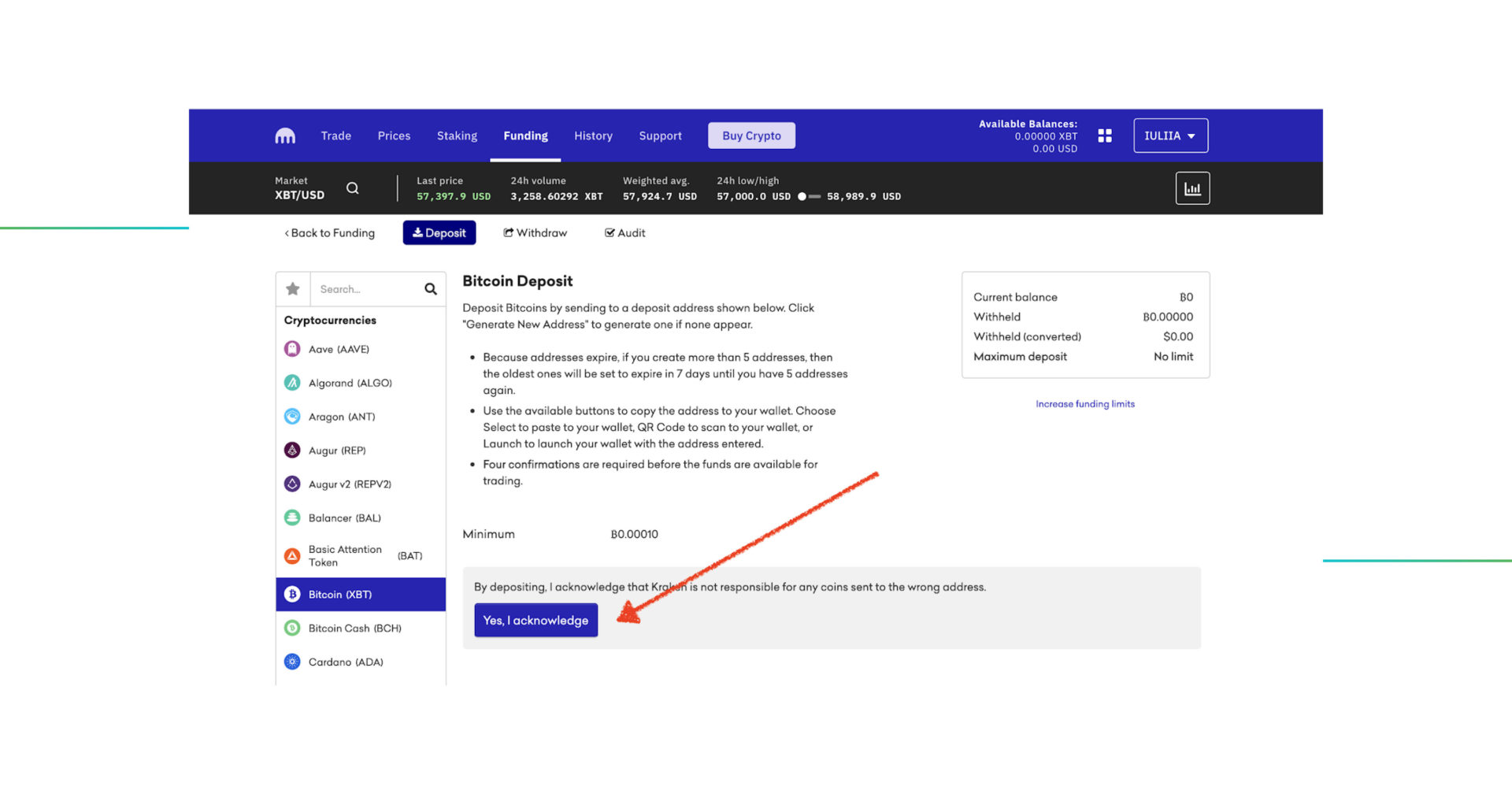

If you don’t know it, it’s time to retrieve it. For that, you need to log in to your Kraken account and proceed to the funding tab on the main menu of the homepage:

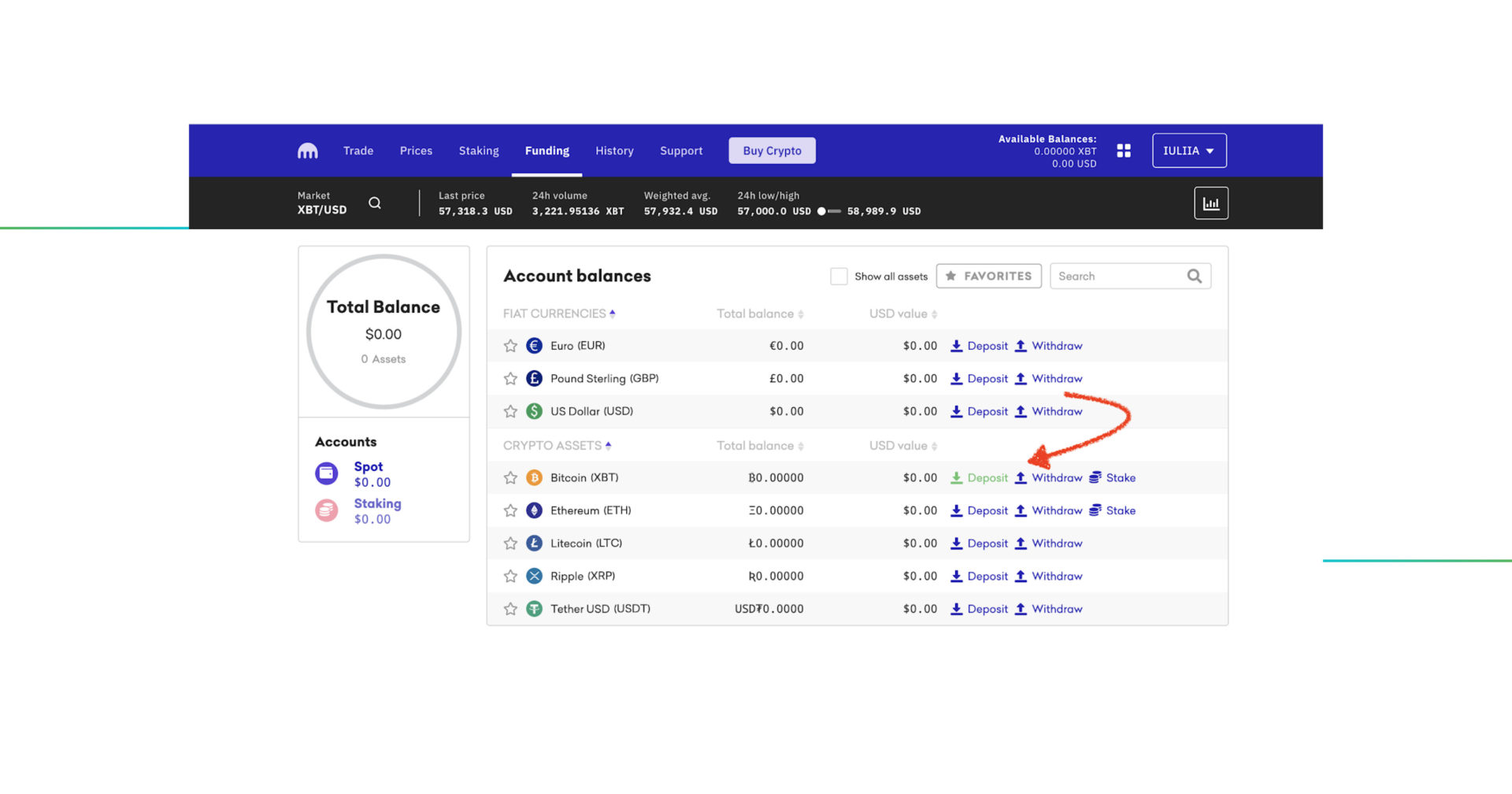

Choose the deposit option and click on it:

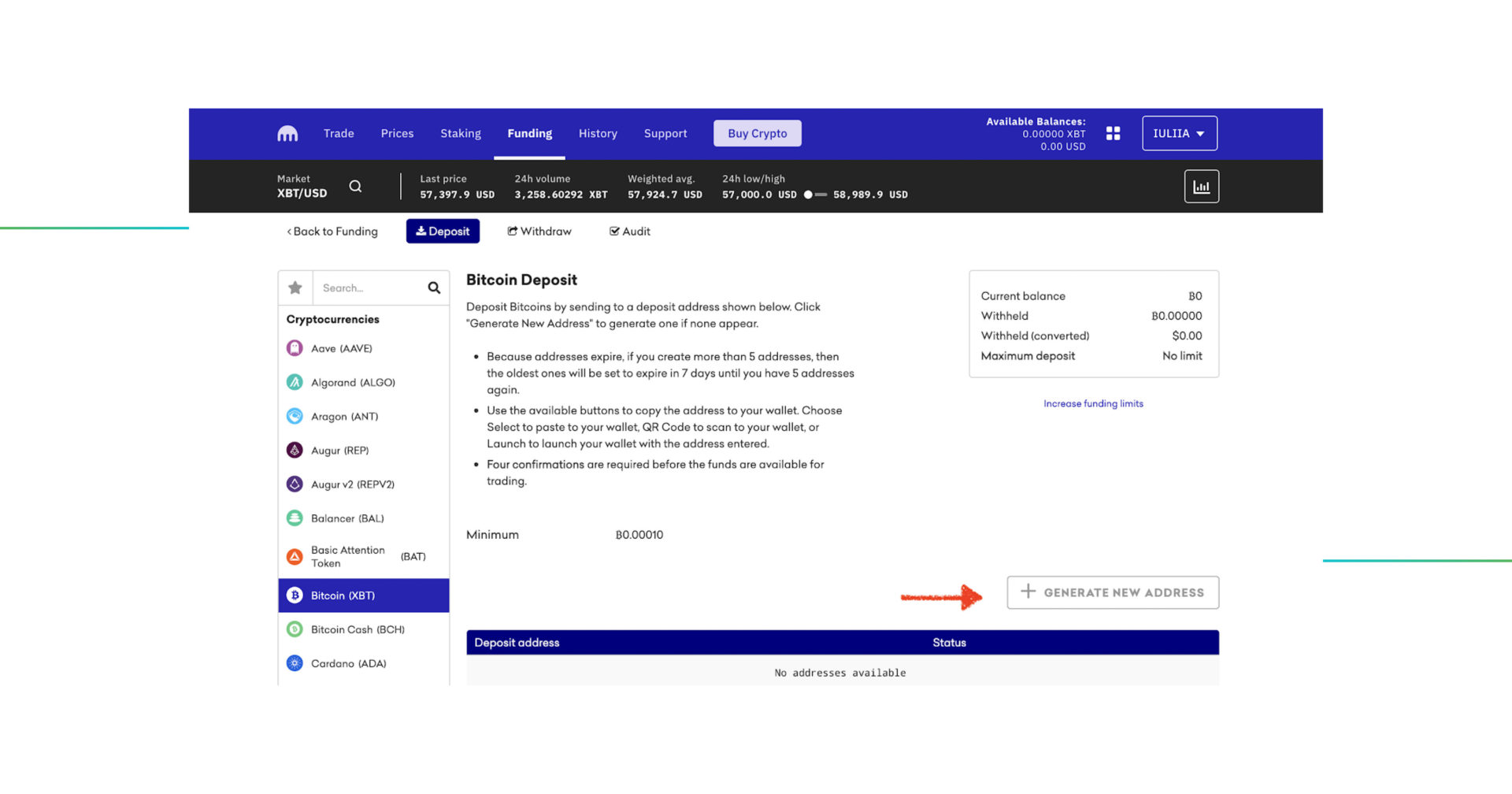

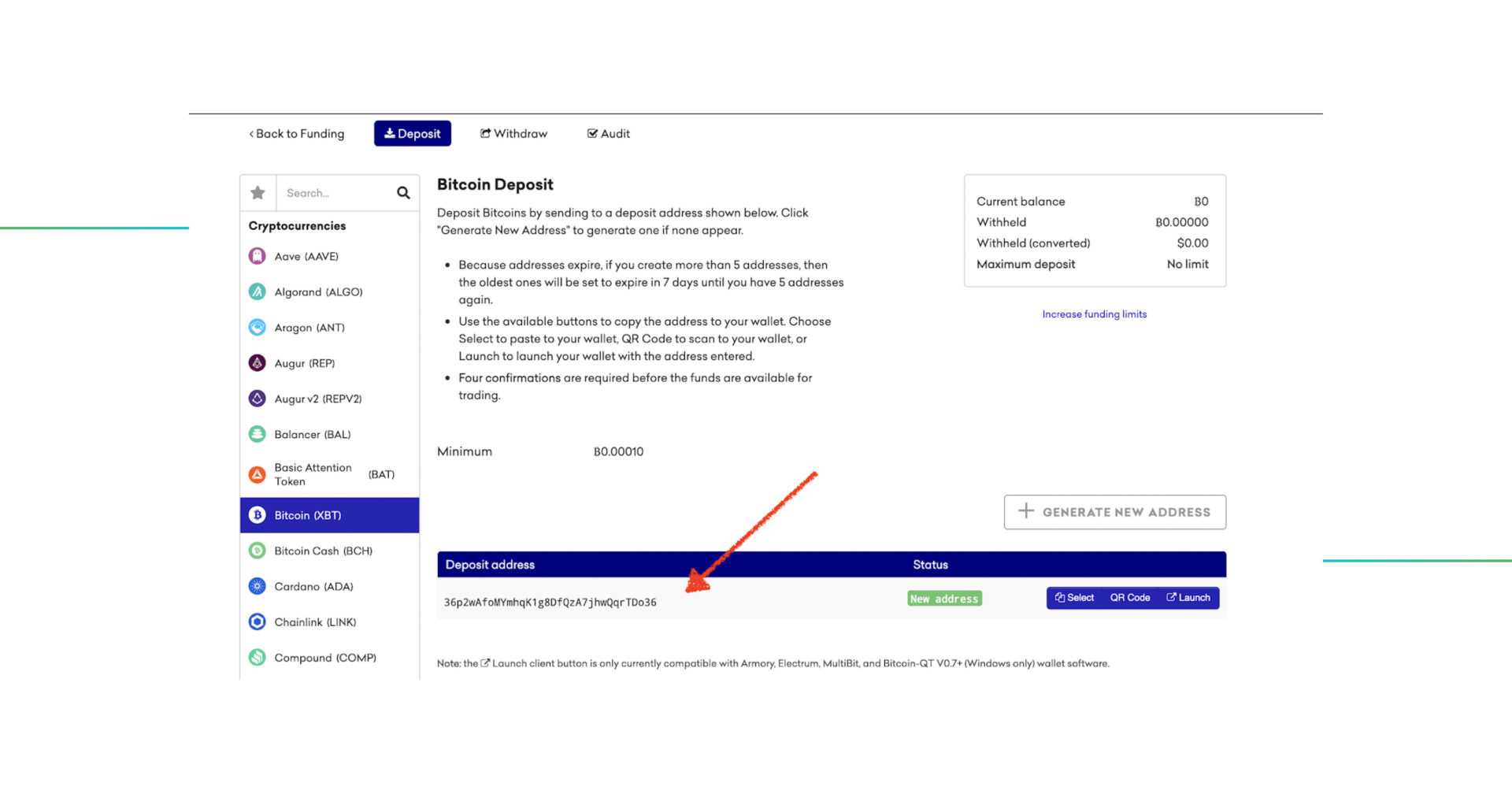

And here you go! This is the deposit address you need to enter into the field on Coinbase Pro:

Conclusion

Still not sure, which trading venue to choose in the Coinbase Pro vs Kraken battle? Here is a quick overview of the exchanges’ basic features.

Kraken offers such fiat options as U.S. Dollar (USD), Canadian Dollar (CAD), Japanese Yen (JPY), Swiss Franc (CHF), British Pound (GBP) and Australian Dollar (AUD). It provides TradingView charting functionalities and different interfaces for traders with different levels of expertise. On the other hand, Coinbase Pro has a lesser choice of fiat markets, its charts are more simplistic and there are no different interfaces. However, Coinbase Pro’s distinguishing feature is an easy fiat onboarding for those who live in the US, the UK, the EU. Furthermore, you can switch to Coinbase Advanced Trade terminal and enjoy trading with the most sophisticated features, advanced order types and TradingView charts The balances on Coinbase Pro have FDIC insurance, meaning all clients who store less than $250,000 on their accounts are federally secured by the U.S. government, and you can verify yourself easily via their mobile app.

As for customized order types, neither Kraken nor Coinbase Pro offers the same range of orders as the Good Crypto App. On Coinbase Pro, you can place only Market, Stop and Limit orders. With the advanced interface Kraken offers, you can only use Stop Loss, Take Profit, Stop Loss Limit and Take Profit Limit while trading, which is much less than the lineup of Good Crypto’s Trailing Stop Buy, Trailing Stop Limit Buy, Reverse Trailing Stop Loss (Buy the Dip) and Reverse Trailing Stop Limit (Buy the Dip).

That being said, do you want more than just spot trading? Then, go for futures and margin trading on top of Kraken. Do you live in the States, want to deposit via ACH and are OK with the government protecting your funds? Maybe, Coinbase Pro is a good option for you. Do you want to trade using the full range of advanced custom orders? Whatever exchange you choose, place trades via Good Crypto.

Get the App. Get Started.

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

January 12, 2023