We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Crypto Trading Bots: What Bots and Strategies to Use to Make Your Trading Lucrative

- 1. What Is Crypto Trading Bot?

- 2. How Do Trading Bots Work?

- 3. The Best Crypto Trading Bots Overview: Top Crypto Trading Bots Strategies to Use

- 3.1. Сrypto Arbitrage Bot: How to Make Money on Arbitrage Trading using Arbitrage Bots?

- 3.2. How to Use Grid Trading Bots To Make Profits?

- 3.2.1. What is Grid Trading?

- 3.2.2. How To Build Successful Grid Trading Strategies?

- 3.3. DCA Bot Overview: How to Use DCA Bots To Gain?

- 3.3.1. What is Dollar Cost Averaging in Crypto Trading?

- 3.3.2. How to Build Successful DCA Crypto Strategy?

- 3.4. Market Making Bots: How Do They Work?

- 3.4.1. What is Market Making In Trading?

- 3.4.2. How To Build Successful Market Making Strategy?

- 3.5. Crypto Scalping Bot: How to Use It In Scalping Trading?

- 3.5.1. How To Build Scalping Trading Strategy?

- 4. Сrypto Bot Trading Strategies: Which One Is Better To Choose?

- 4.1. How To Apply Trading Range Strategy Using Bots?

- 4.1.1. Range Trading Strategies Example

- 4.2. Trend Trading: How to Choose The Best Trend Trading bot?

- 4.2.1. Trend Trading Strategy Example

- 5. Are Trading Bots Profitable?

- 5.1. Are Trading Bots Worth It? Pros and Cons of Using Them

- 6. GoodCrypto Algo Bots. The Best Crypto Trading Bots For Automatic and Profitable Trading

- 6.1. Crypto Bot Settings: How To Set Up a Trading Bot in GoodCrypto App

- 6.2. Monitor your bots

- 7. Conclusion

Crypto trading bots are convenient software tools that allow you to automate nearly all your trading activity.

In this article, we will explain what is bot trading and explore all the forms a crypto trading bot can take. We also delve into some effective strategies for using bots to make money and how to set up some passive income bots. Finally, we will conclude with a short guide of our GoodCrypto crypto trading bot and explain what makes it arguably the best cryptocurrency trading bot currently on the market.

What Is Crypto Trading Bot?

Before we delve deeper into algorithmic trading cryptocurrency, let’s lay down some basics about what are trading bots. An algorithmic trading bot is a software tool that allows you to automate market entries and exits. In essence, you can connect a bot for trading crypto to various cryptocurrency exchanges through an API and let it handle all trades on your behalf.

Following a predetermined strategy, algo trading bots will buy and sell cryptocurrencies multiple times with the goal to increase the value of your portfolio. The advantages of algo trading crypto are numerous:

- The bot for crypto trading will allow you to remain active 24/7 in the relentless market, capitalizing on price movements even when you are taking a break;

- Crypto trading bots can open and close dozens of positions instantly, a feat that would be impossible to do by hand;

Bitcoin trading bots are immune to emotion, FOMO, and FUD. They follow a precise strategy, considerably increasing trading success rates and consistency. - Their ability to execute multiple trades a day allows crypto bot users to take minimal risks with smaller trades. And even though profits from each individual trade are low, the high frequency of trades allows for the accumulation of considerable income.

Now that you know what are crypto trading bots, let’s explore how trading bots work and answer the million-dollar question “do crypto bots actually work?”.

How Do Trading Bots Work?

So, how do crypto bots work? As we briefly mentioned, crypto trading bots use APIs to communicate with the cryptocurrency exchange on behalf of your account. This allows them to use your funds to buy and sell cryptocurrencies using a predetermined strategy.

And if you are wondering do trading bots work and allow you to make money, the answer is yes. However, it’s not such a clear-cut case. For your bot to be successful, you will need to first learn how to use bots to trade cryptocurrency. Also, you’re to comprehend when to use a certain type of trading bot and how to customize each bot properly according to the market cycle and conditions.

That said, there are many different bot types, and some of the best crypto trading bots are actually quite beginner-friendly. Let’s have an in-depth look at the major types of top crypto trading bots.

The Best Crypto Trading Bots Overview: Top Crypto Trading Bots Strategies to Use

Each type of algo trading bot should be used under specific market conditions: trending market, flat market, and so forth. Moreover, the best trading bots use a wide variety of strategies to start accumulating capital, which makes them fall into 5 major categories.

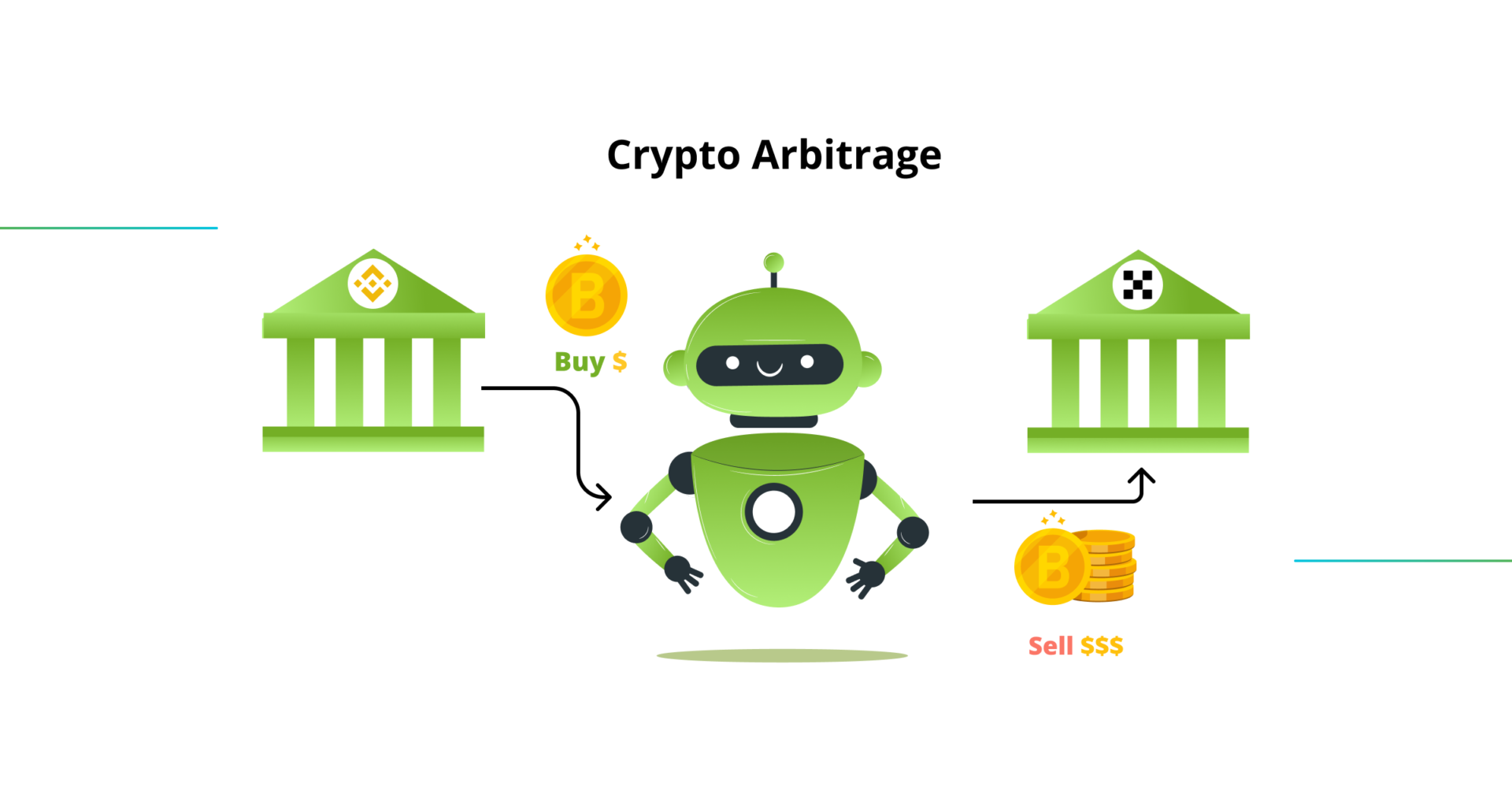

Сrypto Arbitrage Bot: How to Make Money on Arbitrage Trading using Arbitrage Bots?

To understand how an arbitrage bot works, let’s briefly explain arbitrage trading first. Crypto arbitrage capitalizes on the price discrepancies of cryptocurrencies on different exchanges. Because of their high volatility and low liquidity, a difference in price can appear on separate exchanges. In essence, buying a cryptocurrency cheaper on one exchange and selling it at a higher price on another is theoretically how to make money on arbitrage.

In practice, however, crypto arbitrage trading is very difficult to pull off. By the time you have bought assets on one exchange to sell them on another, the price usually normalizes, and you miss your arbitrage cryptocurrency trading opportunity. Additionally, the trade will trigger fees on both exchanges, which impacts the profit potential, and there are also withdrawal fees to consider for transferring your assets from one exchange to another for rebalancing.

A crypto arbitrage bot automates this process by handling your assets on multiple exchanges at once. Arbitrage bots survey the market, detect price discrepancies and act immediately upon them. To achieve this, the arbitrage bot needs a certain amount of capital present on multiple exchanges at once.

Let’s say you wish to create a Bitcoin arbitrage bot that uses the BTC/USDT market pair. To this end, you will need to connect your arbitrage crypto bot to two or more crypto exchanges. Moreover, on each exchange, you will need to have deposited both BTC and USDT. If a price discrepancy occurs, the bot will buy BTC where it’s cheaper and sell it where it’s more expensive, resulting in a net BTC capital increase. The cryptocurrency arbitrage bot then rebalances your holdings across the exchanges and resumes to scan the market for inconsistencies.

How to Use Grid Trading Bots To Make Profits?

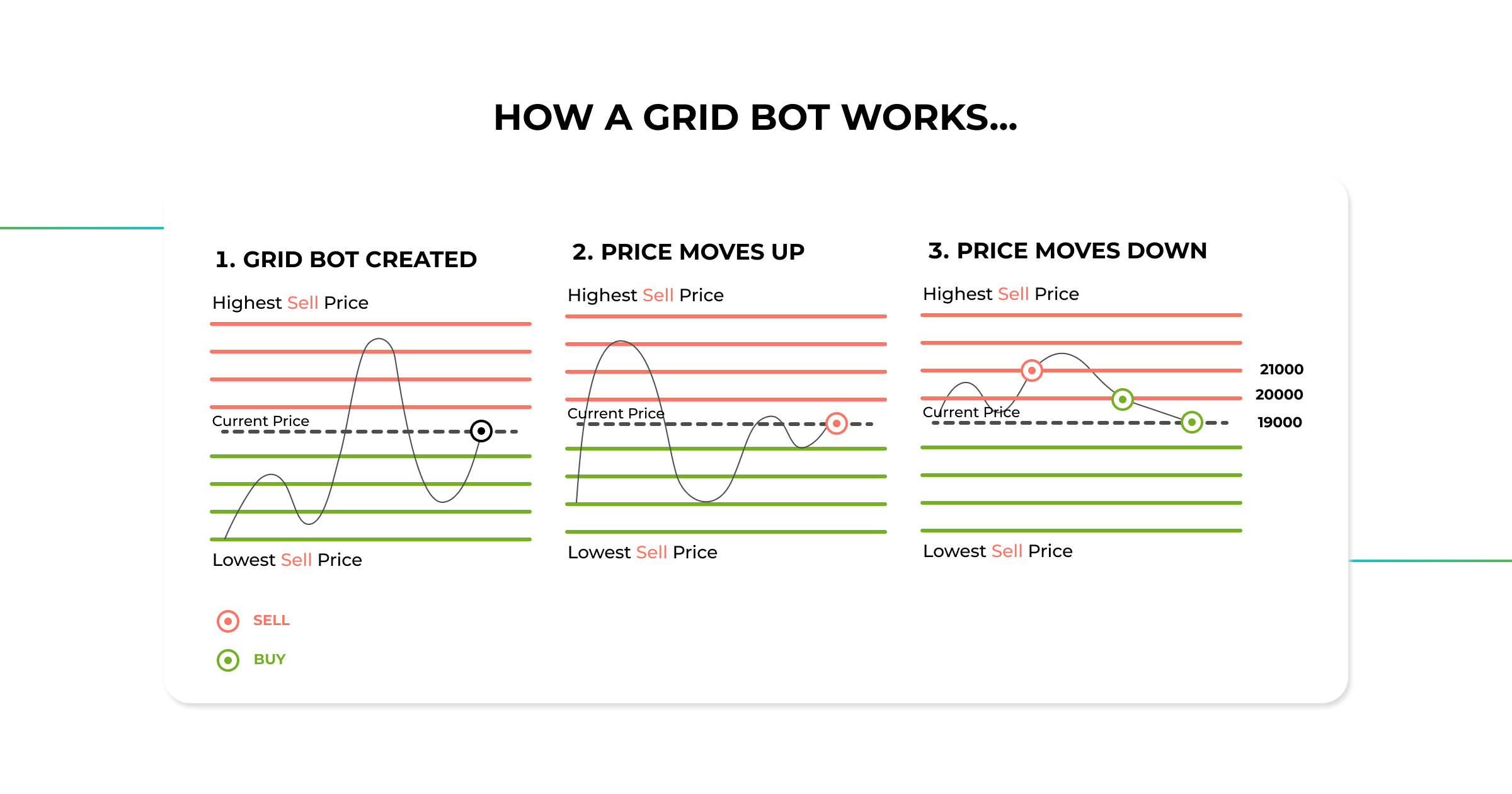

Second on our list of best bots for trading crypto is the grid trading bot. Grid trading bots assist traders in applying a grid trading strategy. When an asset is trending within a range, the gridbot will place buy and sell orders at predefined intervals between the top and bottom of this range.

3.2.1. What is Grid Trading?

Grid trading is an automated trading strategy that triggers buy and sell orders at predetermined price levels. These price levels are obtained by setting starting high and low price points when the price action is trending sideways. Traders then create a trading grid between these levels with the grid trading crypto bot making regular market entries and exits, thus increasing portfolio value thanks to minimal price movement. Usually, a grid of trading orders initially contains the same number of sell and buy orders from both sides of the market price. Once one of these orders is filled, a trader or system creates a new one on the opposite side to secure the profit.

Since grid trading crypto requires 24/7 market monitoring and multiple market entries and exits, grid bot trading perfectly fits this narrative.

How To Build Successful Grid Trading Strategies?

Now that you know what is grid trading, let’s have a look at some grid trading strategies that can help you start making profits.

First, you need to understand that for a grid bot strategy to be profitable, the price needs to fluctuate within a range. If the price momentum is unidirectionally going up or down, grid trading bots will be unable to make profits.

Hence, the main principles for creating a successful grid trading strategy will be to:

- Find an asset that fluctuates within a range. For example, BTC.

- Set up top and bottom price levels. Let’s say $37,000 as a bottom and $39,000 as a top.

- Divide this range into proportionate levels where buy and sell signals will be triggered. For instance,15 sell orders and 15 buy orders. The profit distance should be divided equally among them.

- Set stop losses in case the range exceeds either the top or bottom price levels. Best practices dictate that the stops should be set at 1% above or below the range limits.

- Don’t forget about trading fees! Your profit at each grid level must be higher than the trading fees paid for the trade execution. Alternatively, you can find exchanges that either provide rebates for each trade, like Bitmex or that don’t charge any commissions for certain trading pairs (i.e. BUSD pairs on Binance).

As you can see, grid bot trading is quite simple to set up, as long as you have sufficient experience in detecting price ranges.

DCA Bot Overview: How to Use DCA Bots To Gain?

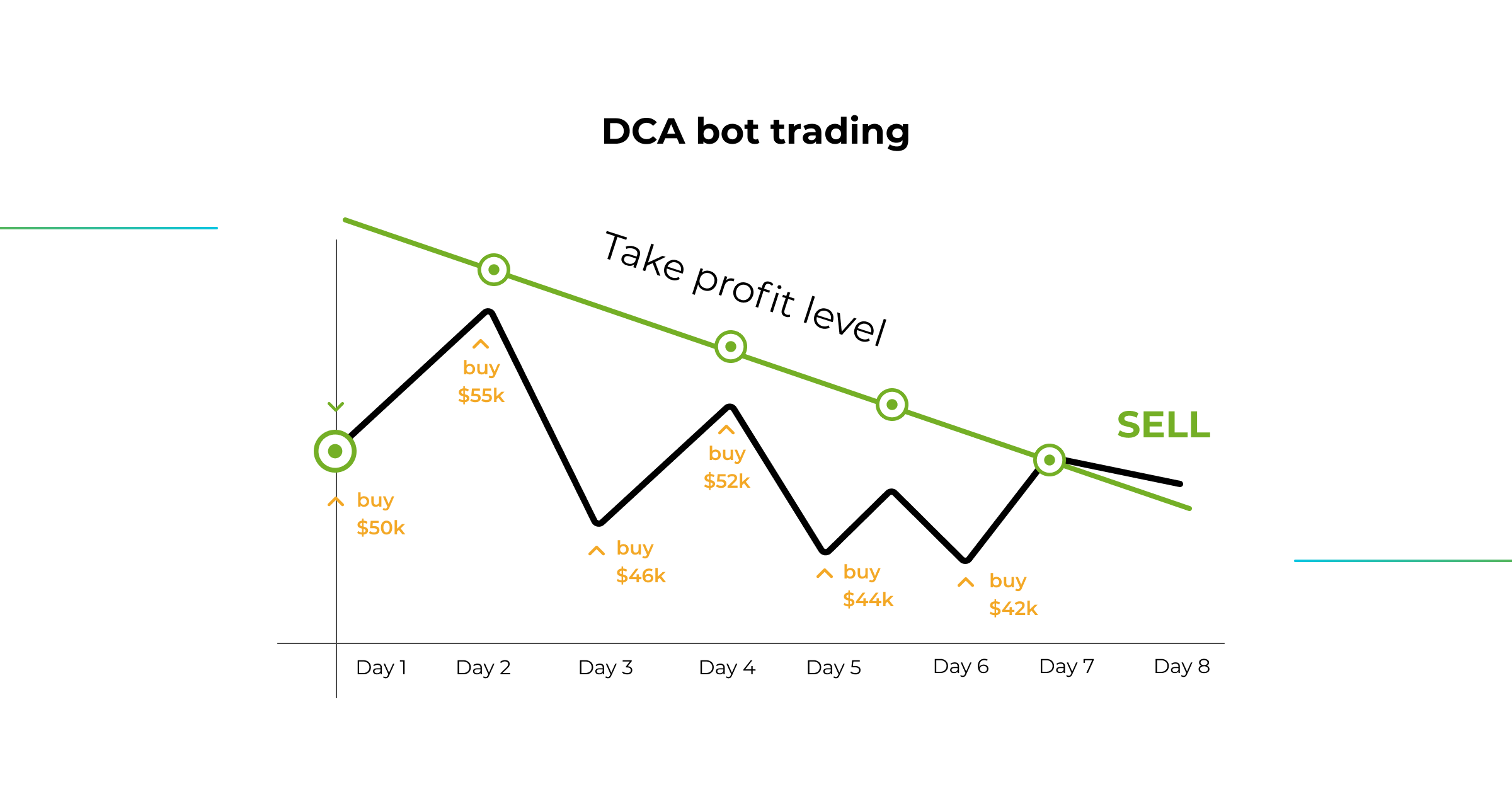

Dollar-cost averaging bots or DCA bots are some of the best crypto bots to use during uptrends or downtrends. A DCA bot takes advantage of volatility and buys and sells at regular intervals to reduce the average price of an asset.

What is Dollar Cost Averaging in Crypto Trading?

Still wondering what is dollar cost averaging? Well, executed manually, DCA trading is a beginner-friendly strategy that allows investors to accumulate crypto. As depicted in the image above, trading DCA implies purchasing a crypto asset at regular intervals, for a predetermined amount, regardless of its current price. You can read more about this strategy in our guide on Cryptocurrency Portfolio and Risk Management.

A DCA bot strategy works a bit differently, however. In this case, the DCA trading bot opens a position and sets a take profit target in percentages. If the price meets the target, the bot closes the position and makes a profit. On the other hand, if the market doesn’t go in the desired direction of the DCA crypto bot, the software will keep buying assets at a lower price, effectively reducing the average price of the asset.

At the same time, the crypto DCA bot lowers the take profit target proportionally. This means that once the price regains upwards momentum, the DCA crypto trading bot will be able to close the position much sooner while making the same amount of profit that was initially expected.

Worth noting is that this DCA strategy can be applied in both a market uptrend and downtrend. Dollar cost averaging in crypto is equally useful when shorting and will allow you to accumulate more assets for selling once the market becomes more favorable.

How to Build Successful DCA Crypto Strategy?

So, now that we’ve covered the basics of what is a DCA bot, let’s see how you can use DCA trading bots in practice. Setting up a DCA crypto bot can be trickier than the aforementioned classic grid trading bot. When comparing a DCA bot vs Grid bot, the DCA bot crypto requires an upwards or downwards price trend while the grid trading bot requires sideways trending prices.

So, setting up a DCA crypto strategy will require you to:

- Detect a trend continuation or reversal using technical analysis. You can do this by applying trading pattern formations or Fibonacci retracements, for example.

- Choose the type of dollar cost averaging bot you are going to use, depending on the market direction (long or short).

- Apply your DCA trading strategy by setting entry prices and take profit percentages.

- Set stop losses to limit the damage in case your DCA trading strategy structure gets broken.

For those wondering is dollar cost averaging a good strategy, DCA trading crypto can be very effective due to the high volatility of cryptocurrencies. However, a crypto DCA strategy requires decent TA skills and advanced knowledge of the market. Because of its relative simplicity and high popularity, beginners often choose a DCA trading bot without understanding how it works, which can result in severe losses.

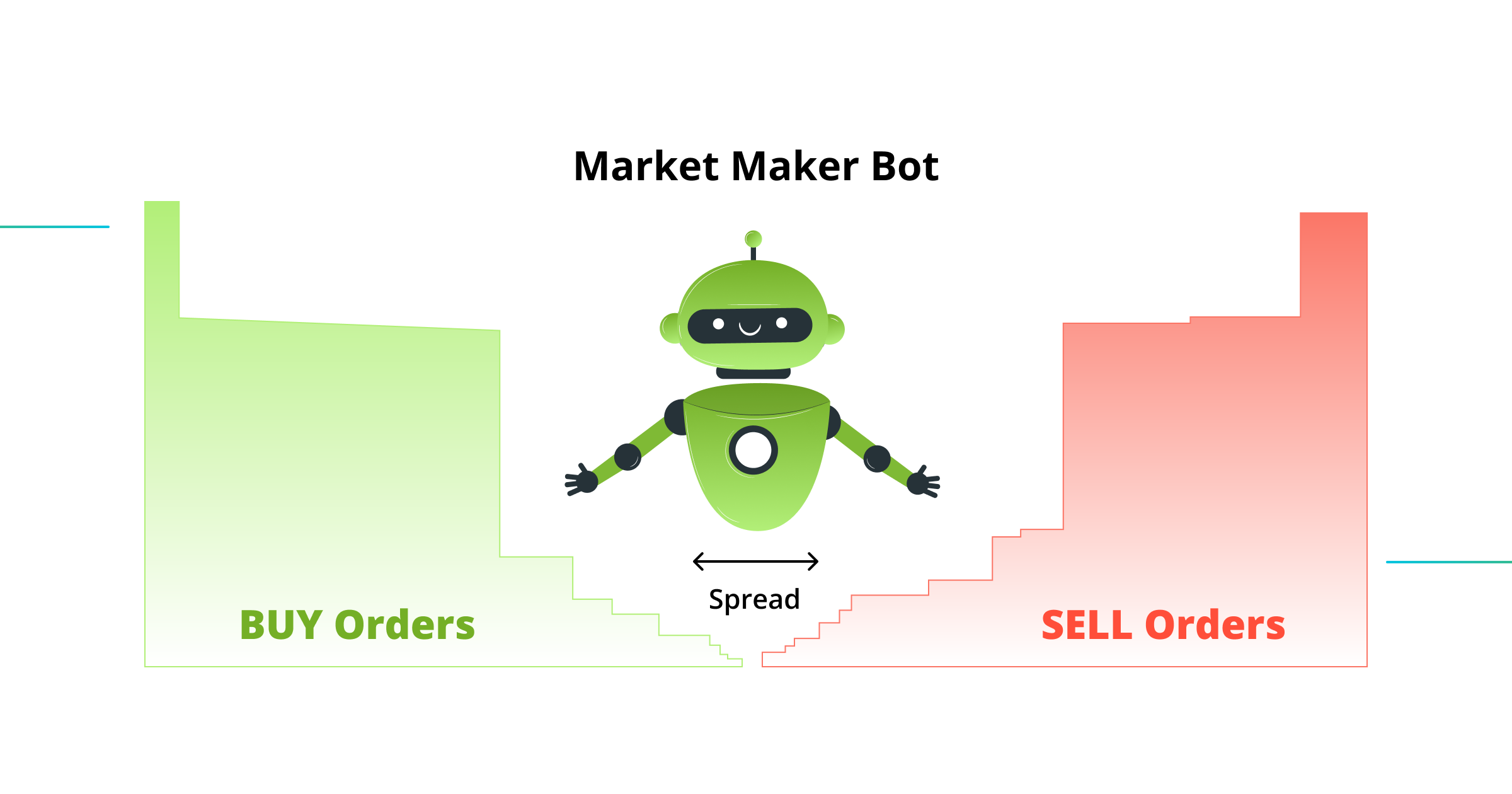

Market Making Bots: How Do They Work?

From all the bots on our list, market making bots are probably the least common. This is because market making in crypto requires hefty capital for it to be effective. A market making bot surveys crypto exchanges to find opportunities for providing liquidity. The market maker bot does this by filling up the order book with buy and sell orders, allowing other participants in the market to fulfill their requests.

But what is market making in crypto, really?

What is Market Making In Trading?

Market making plays an essential role in the crypto markets, as it provides liquidity for traders to be able to execute their orders whenever they need it. At the same time, market making trading avoids building a significant net position in a certain asset. To sum up, a market maker is an intermediary that helps buyers and sellers match their demand while making a profit on each deal.

How To Build Successful Market Making Strategy?

The main goal of a market making strategy is to manage risks and gain from the small spread between ask and bid orders. This means that the market maker needs to continuously buy and sell crypto around the market price. And because this market price changes all the time, a good market making strategy is nearly impossible to conduct without a crypto market making bot.

The market making crypto bot executes high-frequency orders on both sides of the order book. The process on how to practice market making strategy goes as follows:

- Find an exchange that is struggling to provide liquidity in a certain trading pair.

- Have a considerable amount of liquidity in a given cryptocurrency.

- Set up the spread percentage and depth at which the cryptocurrency market making bot will fill orders.

While this sounds extremely simple, a crypto market making strategy is actually quite advanced. The trader needs to have thorough experience with risk mitigation to set up a profitable bot.

Crypto Scalping Bot: How to Use It In Scalping Trading?

A scalping bot relies on frequent trades, opening and closing dozens of positions in a short time span. As a result, scalping trading has a goal to make small profits on small price swings that accumulate over time. The crypto scalping bot takes fewer risks, as losses on singular micro-trades won’t have a considerable impact on the portfolio.

How To Build Scalping Trading Strategy?

Building a reliable scalping trading strategy requires scalping bots that can receive signals from advanced technical indicators. Read more about technical indicators in our blog.

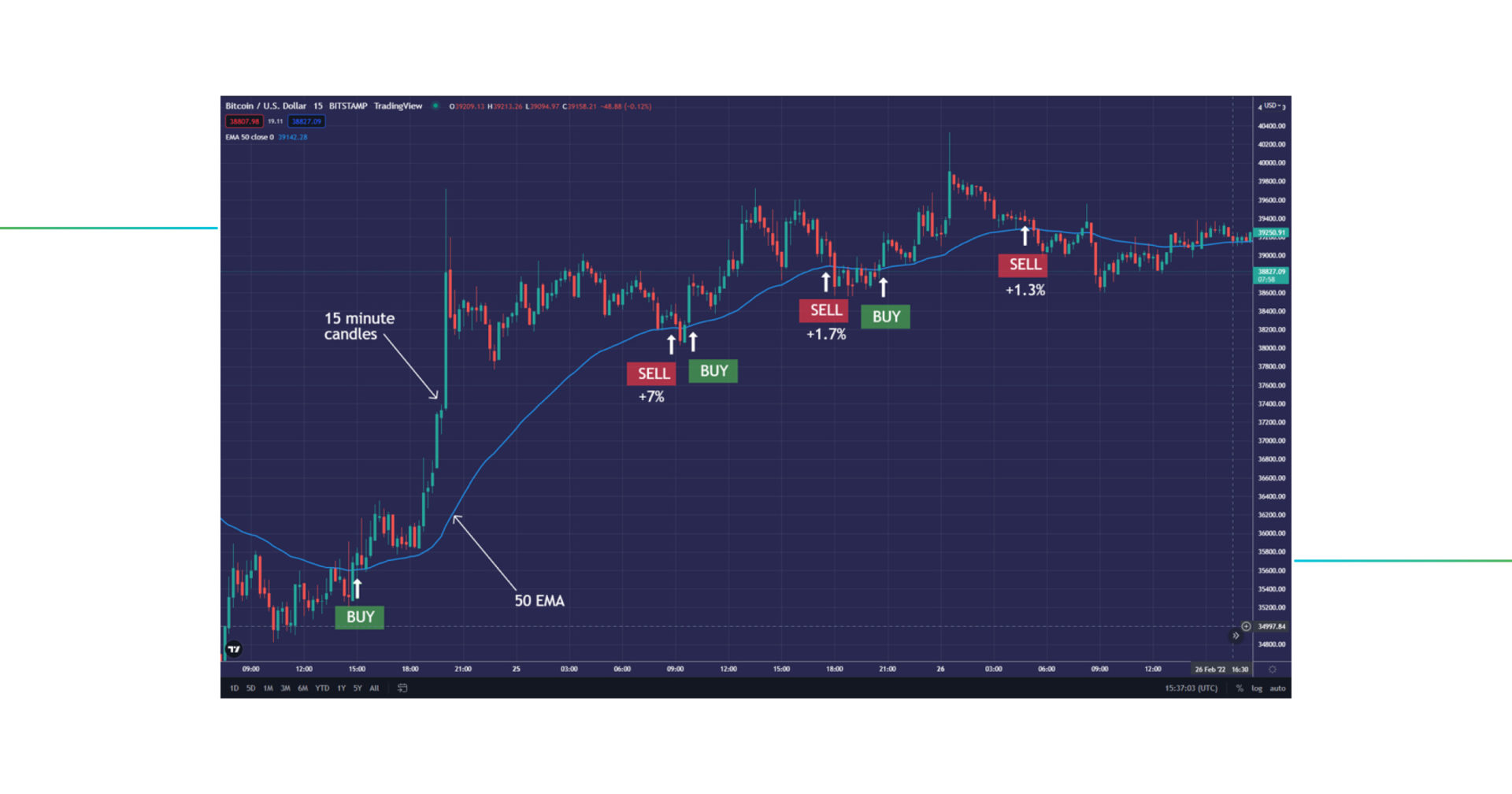

For example, the best scalping bots often use the 50-period exponential moving average (50 EMA) on a 15-minute chart to provide buy and sell signals. In this case, a candle crossing the EMA upwards provides a buy signal to the scalping crypto bot. A sell signal is sent to the cryptocurrency scalping bot in case it crosses it downwards.

Other popular indicators for scalping trading strategies include the stochastic RSI (convergence and divergence) and the MACD (based on the histogram). Read more about how to trade with these indicators in our blog articles.

Сrypto Bot Trading Strategies: Which One Is Better To Choose?

Now that you have a good overview of the different types of best trading bots for crypto, you must be wondering what crypto bot trading strategies you should use for consistent profits. First of all, each bot strategy suits a different type of trader or situation. That said, two bot trading strategies stand out as the best trading bot strategies that you can realistically apply to various market conditions.

How To Apply Trading Range Strategy Using Bots?

Trading range is a common strategy that allows traders to make profits when the market is trending sideways. It involves continuously purchasing and selling a certain asset when you believe it will remain in the same price range. The goal is to make a profit from minor fluctuations within the range and exit your position once the price exceeds it.

Because range trading crypto requires traders to repeatedly open and close positions, it’s a strategy that perfectly harmonizes with bots. In our list of types of crypto bots, we singled out the grid bot as the best crypto trading bot for beginners for trading within a range. The reason behind this is that grid bots relentlessly buy and sell crypto at predefined levels, and require minimal setup knowledge. Let’s illustrate this with a practical example.

Range Trading Strategies Example

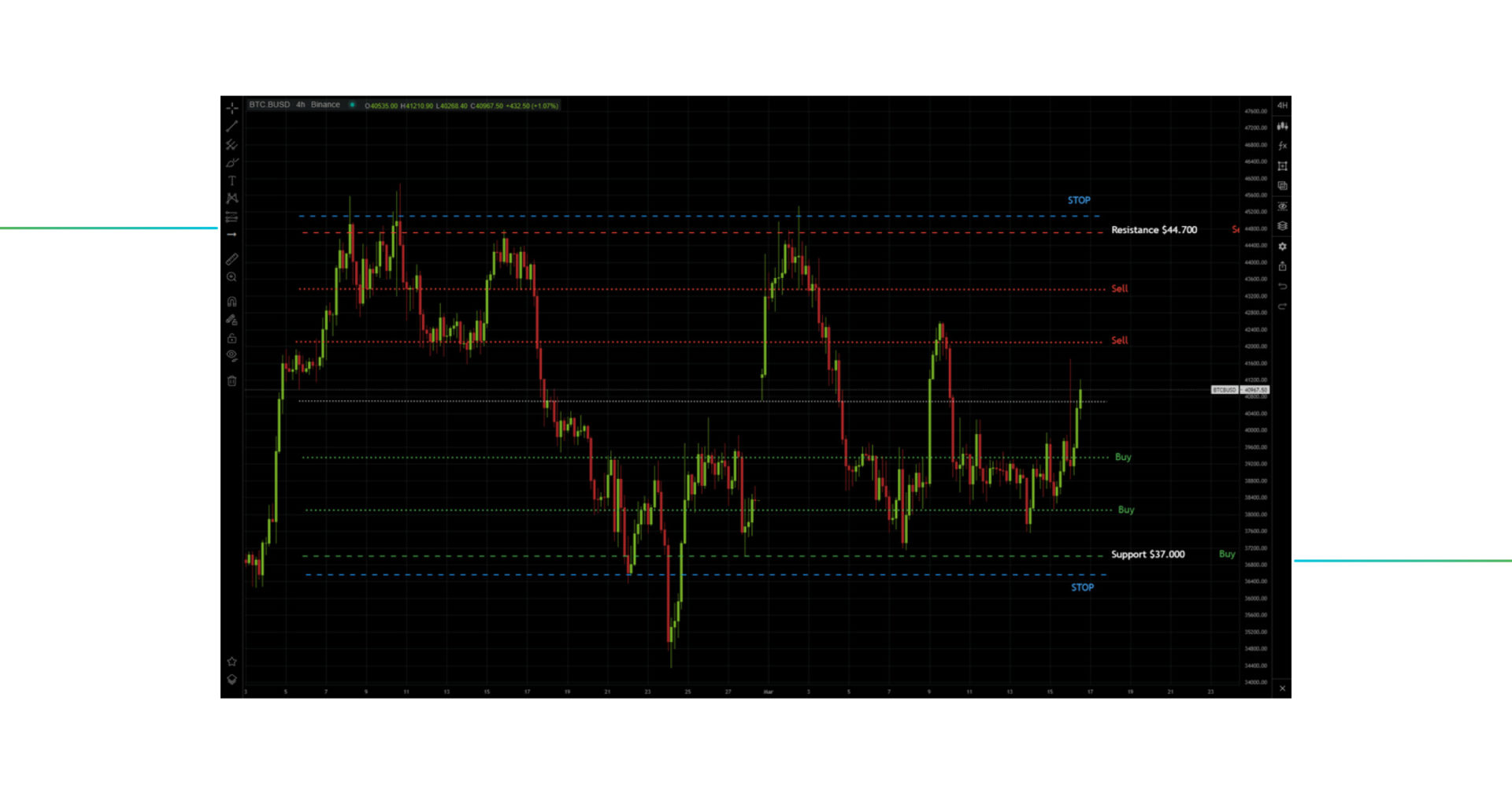

For range trading, you first need to identify the top and bottom levels. To achieve this, you will need to spot some significant price levels that act as support and resistance. Each one of these can be determined by a horizontal line that connects at least 3 price action zones, well-dispersed over a significant time period.

In our example for BTC/USDT, we’ve chosen $44.700 and $37.000 as resistance and support, respectively. The good thing here is that once you’ve set up the top and bottom of your range trading strategy, you’ve done most of the work already.

Your next step will be to choose the number of price levels that your bot will use as triggers for opening and closing positions. Additionally, you will need to choose the size of each position.

However, keep in mind that the number of grid lines depends on a combination of the size of your capital and your order size. For example, if you have 0.1 BTC, you will only be able to create 5 grid lines for 0.03 BTC orders. This is because, in this case, the bot can only have 3 open buy orders before your capital is entirely spent.

Once you have done all of this, you can run your bot and wait for it to start trading on your behalf. Each time a position is opened or closed, the bot will place an opposite order on the adjacent grid level. This way, the bot will continue to accumulate capital as long as the price stays within the defined range.

Trend Trading: How to Choose The Best Trend Trading bot?

Trend trading is another extremely popular method for making profits in the ever-volatile crypto market. Trend trading implies that the trader attempts to profit from an upwards or downwards price movement until this momentum is broken. When this happens, traders will usually take profit and wait for another trend to initiate.

However, realistically, price rarely goes in just one direction. Pure upwards or downwards trends can be difficult to assess. Moreover, when trend trading manually, you need to wait for a particular take profit level to close your position. This can lead to unrealistic price targets that you might never reach.

In this instance, DCA bots come into play as they allow you to average out the price by making multiple purchases at different price levels and adjusting the take profit level accordingly. DCA bots take advantage of the sustained price movements, with the benefit of providing more sustainable profit levels. For this reason, they are considered the best trend trading bot. Let’s take a look at the following example.

Trend Trading Strategy Example

Example №1: DCA Strategy

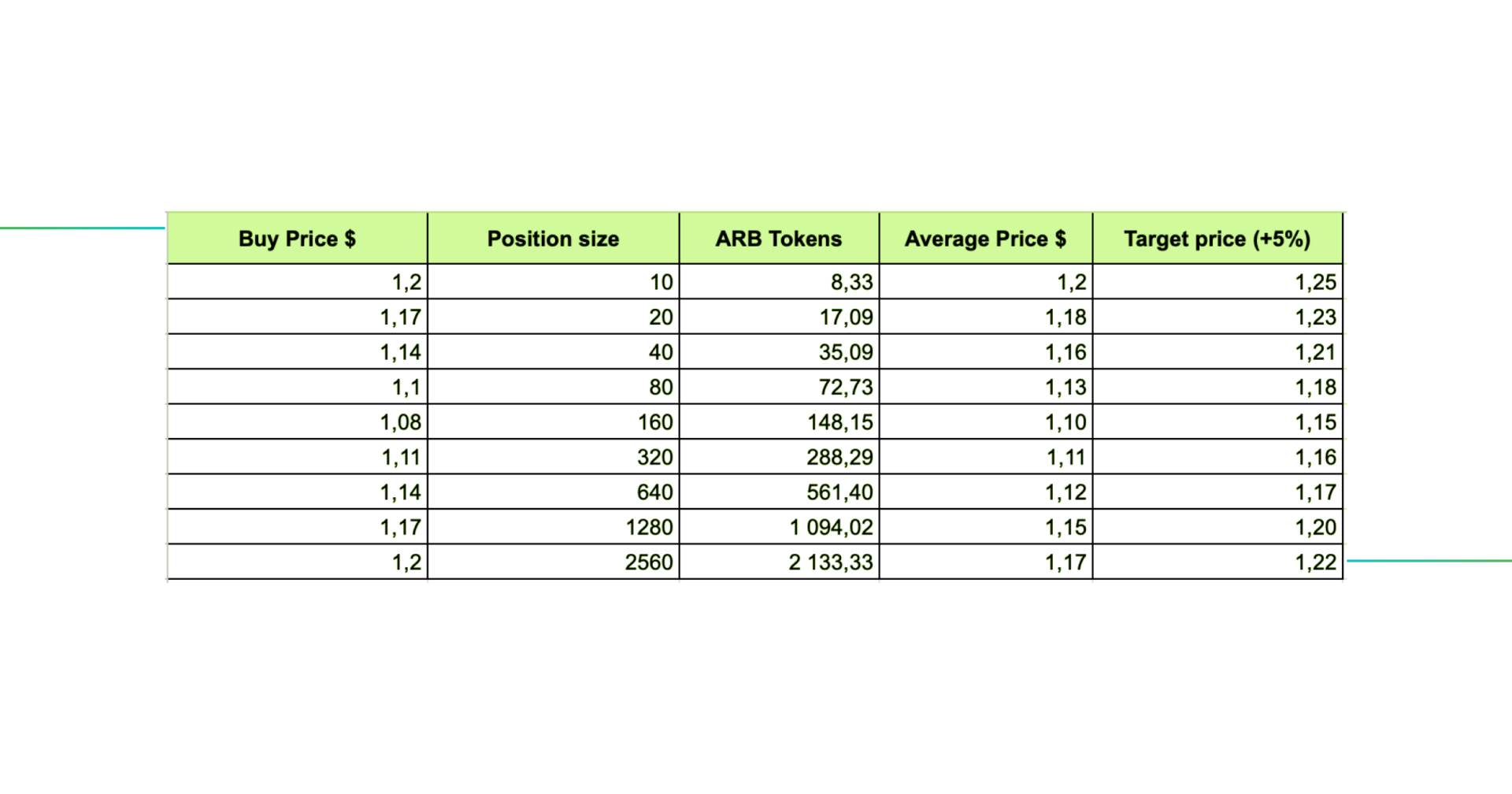

To set up a trend trading bot, your first step will be to find a cryptocurrency that is following some kind of price momentum. We chose ARB/USDT as it is following a steady upwards trend.

Our market analysis lets us believe that this trend will continue until it reaches the recent all-time high of $1,26, allowing us to set up a target take profit of 5%. However, this uptrend might not be as smooth as we like it to be. For this reason, a DCA bot will purchase ARB gradually over time at different prices and adjust this take profit level accordingly.

Moreover, DCA bots are able to open larger positions at a cheaper price, allowing you to reach your take profit target even faster. In the table below, you can see how the subsequent purchases and different order sizes can quickly reduce the profit threshold from $1,25 to $0.22. And at the same time, the profit percentage remains the same, while the profit threshold is reached at a lower price.

That said, you should remain vigilant and keep an eye on your trend trading strategy at all times. In case the trend is broken on a macro level, you should shut down your trend trading bot immediately, as it might start making losses.

Example №2: DCA Trading Bot Strategy

The Dollar Cost Averaging bot is a game-changer for traders of all levels. It works on any trending market, allowing you to accumulate assets over time or make regular profits with low risk and without direct involvement. Choose Auto (TA Signal) or Manual modes to take advantage of price fluctuations and generate stable returns.

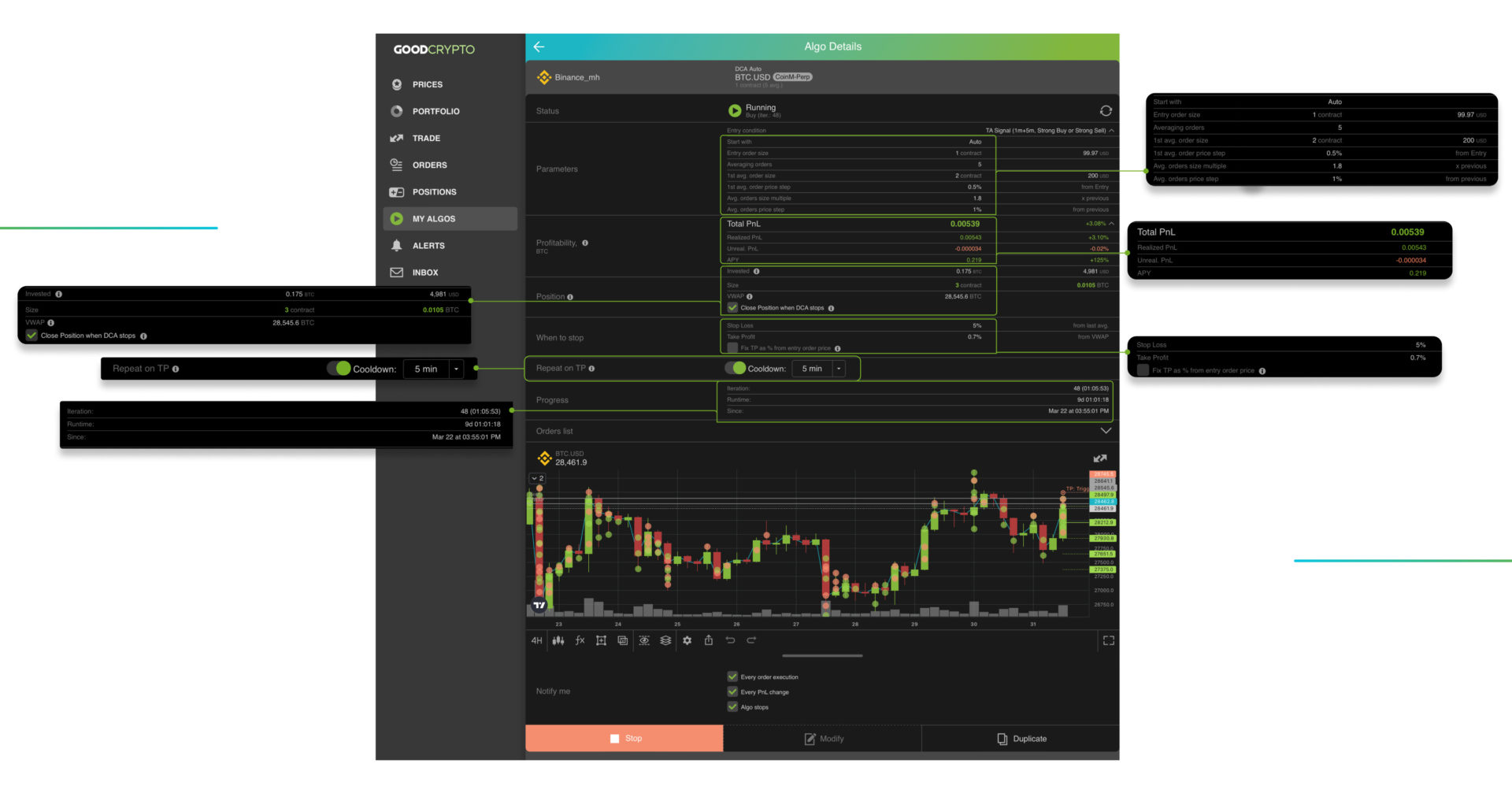

Let’s dive into a real-life DCA bot case study by GoodCrypto using the bot on the BTC/USD pair to understand how the DCA bot works in practice.

We launched the DCA bot in Auto (TA Signal) mode and it made 48 iterations (meaning 48 cycles where the T/P level was hit in a row) and used x20 leverage. We achieved an impressive realized profit of 0.00539 BTC (approx. 150$) by the closing time just in 9 days! It is more than 3%, with a 125% APY rate. Considering that we used x20 levarage, the profit is more than 60% (3%x20) to the initial investment.

If you want to learn more about this case and the DCA bot, check out our article here.

Are Trading Bots Profitable?

With all that in mind, you might be asking yourself – are trading bots profitable? The answer to the question is assuredly positive. However, understand that your own trading and research skills will greatly impact your crypto bot profit. An experienced trader can expect a crypto trading bot daily profit between 0.1% – 0.5%. Masterfully customized crypto trading bots may provide 200% – 900% APY. If you are a beginner, you will be lucky to break even at the start. So, choose the best trading bot that will suit your trading needs to improve your trading strategies and take your trading to the next level.

Are Trading Bots Worth It? Pros and Cons of Using Them

So, are trading bots worth it? To answer this question, let’s go through their pros and cons.

Crypto trading bots pros:

- Automate repetitiveness and save time spent on trading;

- Can place multiple trades instantaneously;

- Boost trading volume;

- Remain active 24/7;

- Follow a precise strategy that makes them more effective;

- Don’t succumb to emotions;

- May provide a stable passive income.

Crypto trading bots cons:

- Require advanced trading knowledge and research skills

- Need frequent monitoring of the market;

- Security may be an issue;

- Some trading bot strategies (scalping, market making, and even grid bot) can quickly build up trading fees.

All in all, if you are willing to put in the effort, crypto trading bots can be worth your while.

GoodCrypto Algo Bots. The Best Crypto Trading Bots For Automatic and Profitable Trading

Our GoodCrypto app allows you to set up some of the best crypto trading bots available on the market. The GoodCrypto algo bots currently come in three types:

- Infinity trail – which continuously opens trailing stop orders. As a buy order is filled, the bot opens a sell order of the same size.

- DCA Bot – the bot works by accumulating assets over time and averaging down the entry price if the price moves against the trader.

- Grid bot – which functions exactly as we described previously in this article.

Let’s have a look at how you can set up a trading bot with our crypto trading bot app.

By using the bots integrated within our GoodCrypto app, you will benefit from the following advantages:

- Streamlined bot setup that uses self-explanatory parameters. You will be able to easily configure your algo within minutes and get it rolling on your favorite exchanges.

- Reliable smart signals and 25 technical indicators based on 15 Moving Averages and 10 Oscillators that can execute thousands of orders instantaneously and follow your personalized setup to the letter.

- A unique offering with our infinity trailing only available on GoodCrypto. Moreover, our grid bot algo provides additional grid lines (up to 100) when compared to similar products, allowing you to trade within a wider price range.

- Our industry-leading security protocols make use of the exchange’s APIs to provide you with a safe and worry-free trading experience.

- Compared to the competition, our algo trading is the most cost-effective bot service available for the features it presents. For $14.99/mo you can access advanced bot features, for which competitors charge 5x more on average.

All in all, if you are looking for an efficient, safe, and versatile algorithmic trading crypto bot, you should give GoodCrypto a try.

Crypto Bot Settings: How To Set Up a Trading Bot in GoodCrypto App

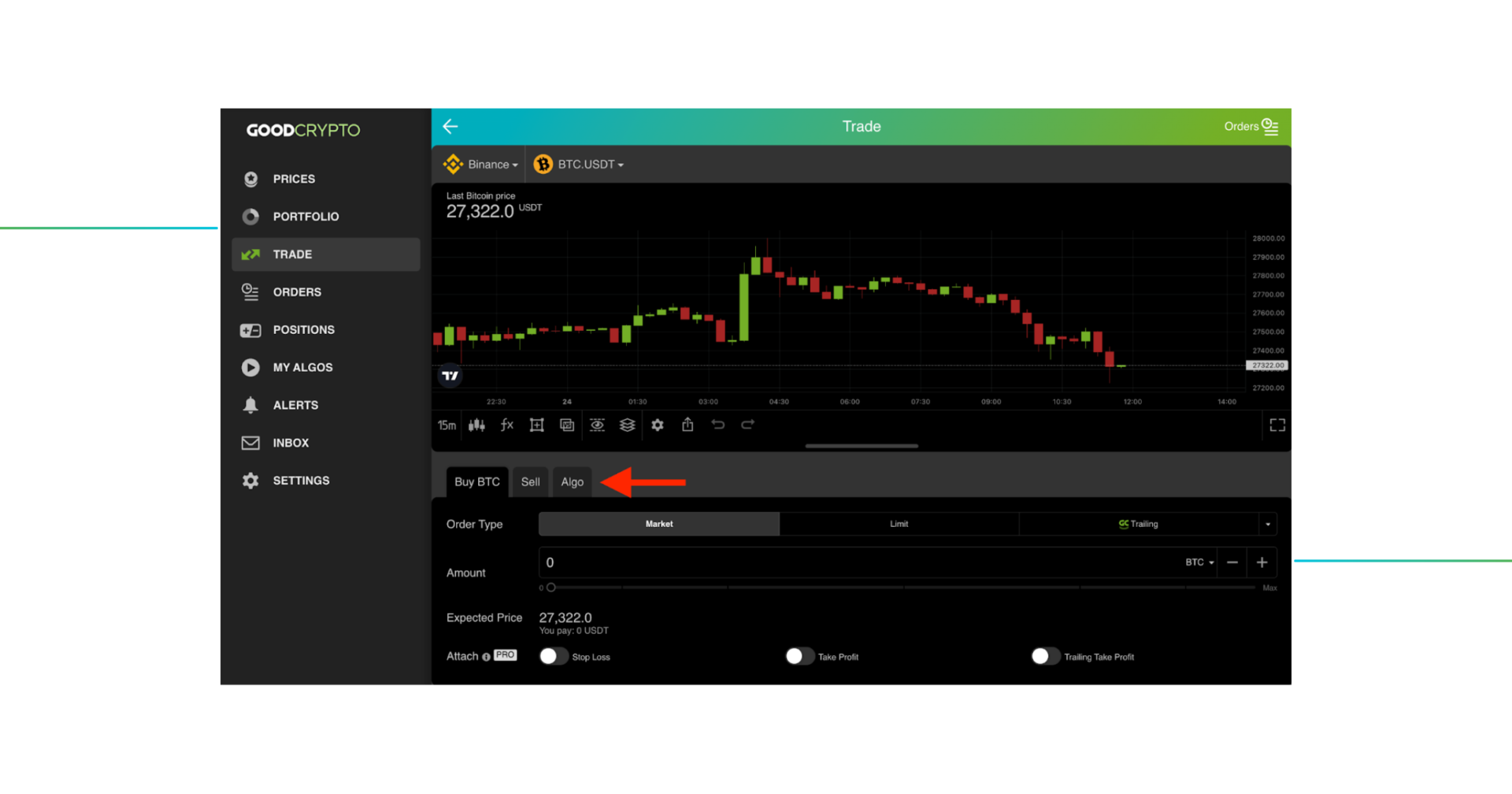

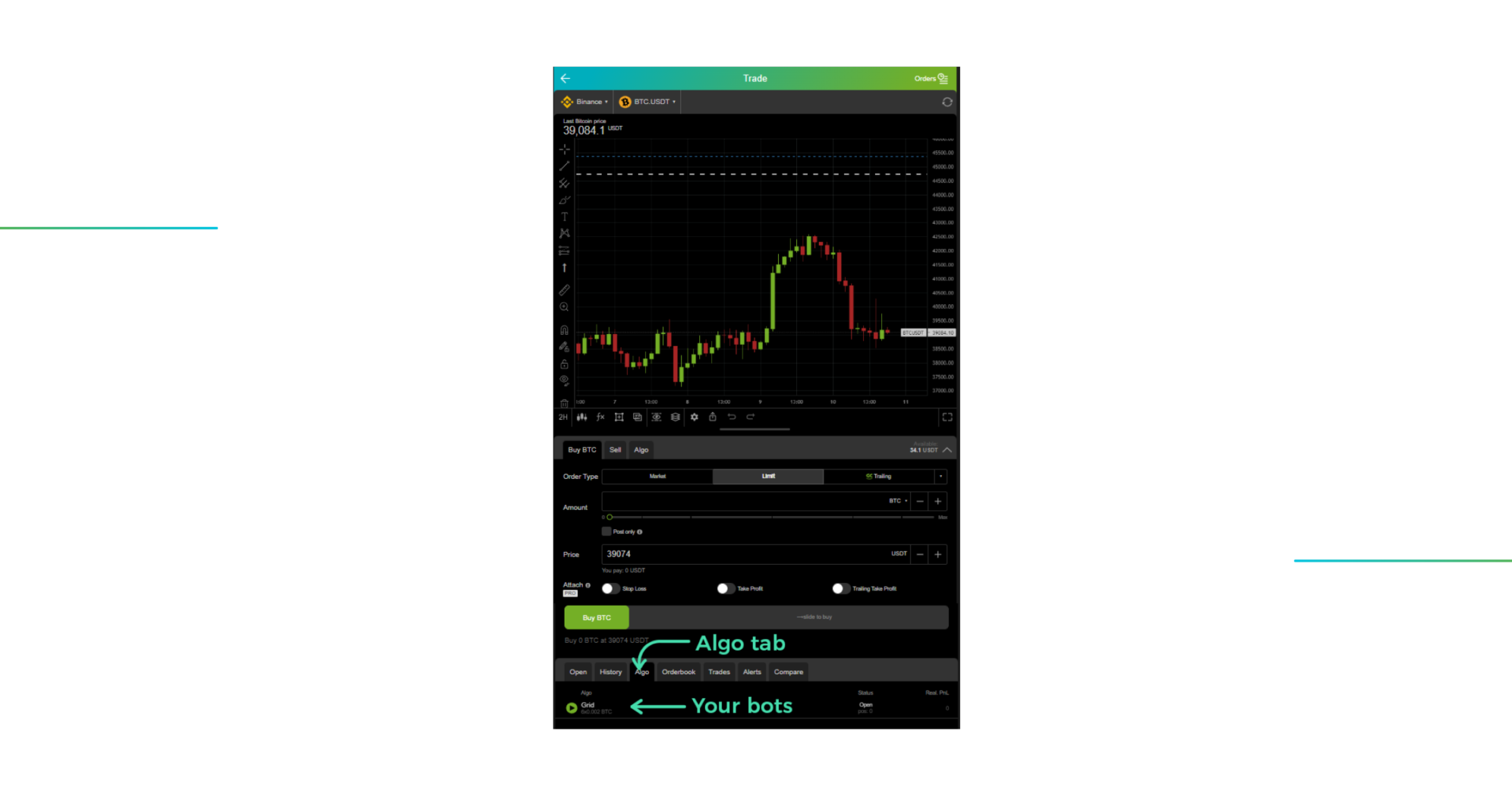

To get started with the GoodCrypto app crypto bot settings, head onto the ”Algo” tab of the app. There, you will be able to choose between the three types of bots available.

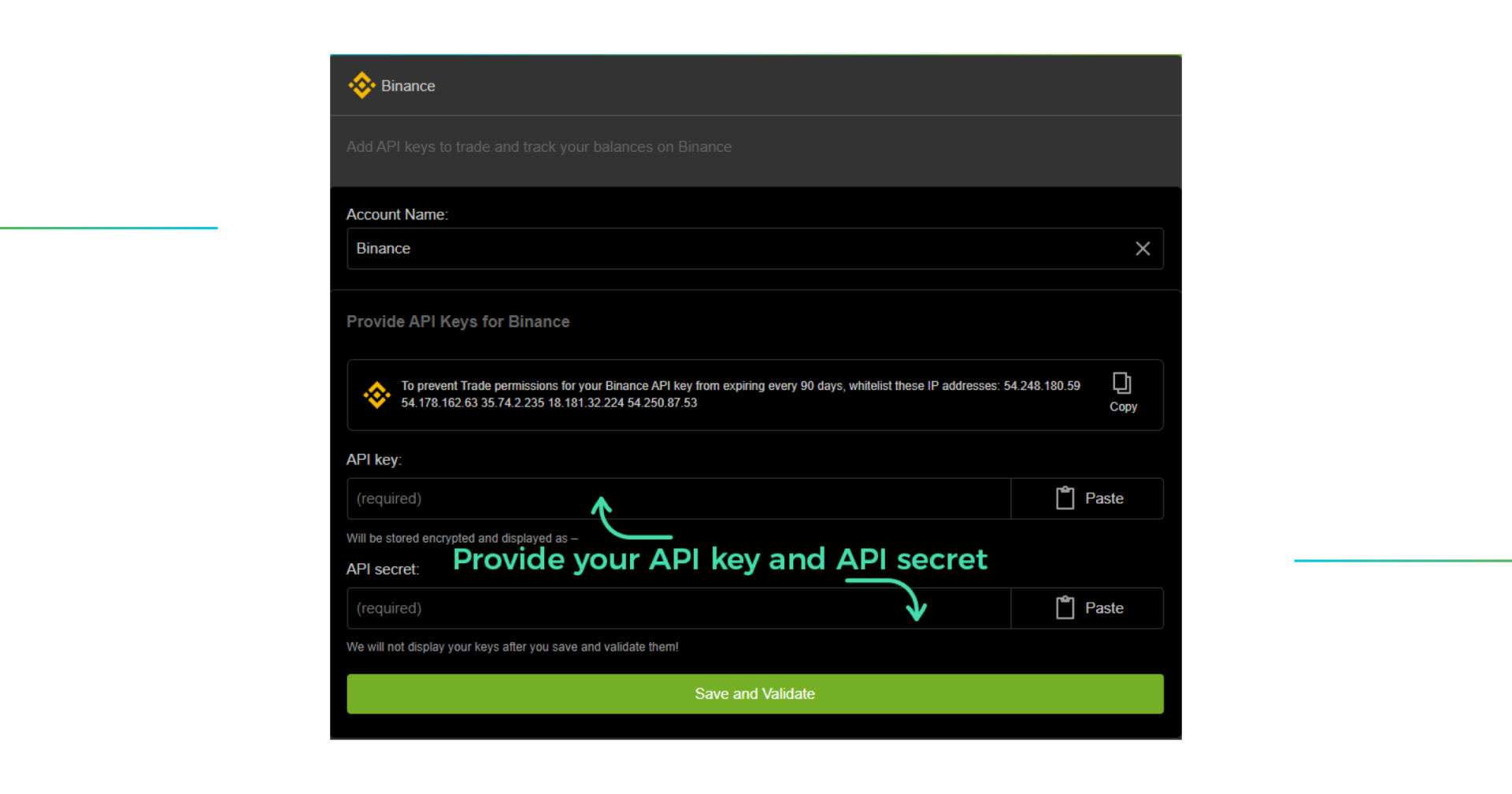

1. Begin by adding the API key of your preferred exchange in your trading bot settings. This will allow your bot to set orders on your behalf.

2. Once you have your exchange connected, you can build a crypto trading bot yourself.

3. If you are trading on a range, choose the grid bot. Otherwise, choose the infinity trail to apply a trading range strategy. Also, DCA bot can be used in any trending market, it accumulates assets gradually and lowers the average entry price in case the market moves against the trader. Choose from an Auto or Manual mode of the DCA bot to explore all the advantages of automated trading.

Let’s explore the GoodCrypto Grid bot, as it provides the widest range of options.

Here’s what each field represents:

- Highest grid level – is the price resistance which will act as the top of the grid.

- Lowest grid level – is the price support which will act as the bottom of the grid.

- Levels – the number of grid lines that you wish to create between the top and bottom ranges. Note that the number of levels will be limited by a combination of your capital and order size.

- Order size – is the position size that the bot is allowed to trade with. Your maximum order size will be the amount of your capital divided by the number of grid lines.

- In the advanced settings, you can set stops that are a bit further from your predefined top and bottom. This way, the grid bot will stop functioning only once the range is broken significantly.

- The Funds Needed chart will provide you with a live estimation of the required capital in order to launch the bot.

- Choose your currency, set up your trading strategy, and start your bot by sliding the button to the right.

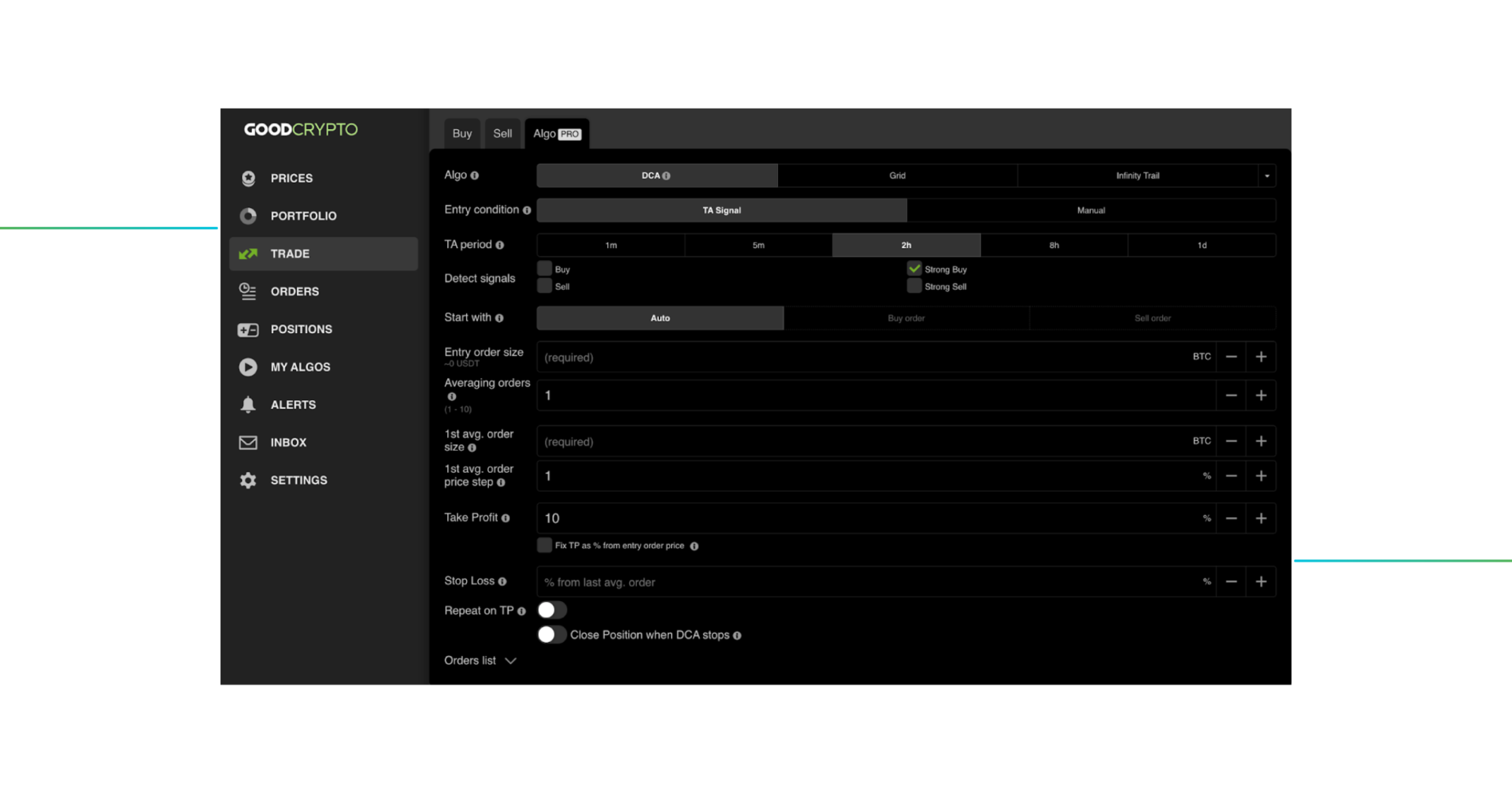

Now, let’s take a closer look at DCA bot by GoodCrypto. With the DCA bot you don’t need to buy a large number of assets at once, which can lead to unexpected losses. Instead, increase your chances to generate profit meanwhile minimizing potential risks. This bot has two modes, auto and manual, so your trading strategy can be precisely tailored.

So in Auto (TA Signal) mode of the DCA bot there are 25 technical indicators in your disposal which rely on 15 Moving Averages and 10 Oscillators. You can choose to what signals the bot should react (Buy/Sell/Stong Buy/Strong Sell) and TA period (1m/5m/2h/8h/1d)

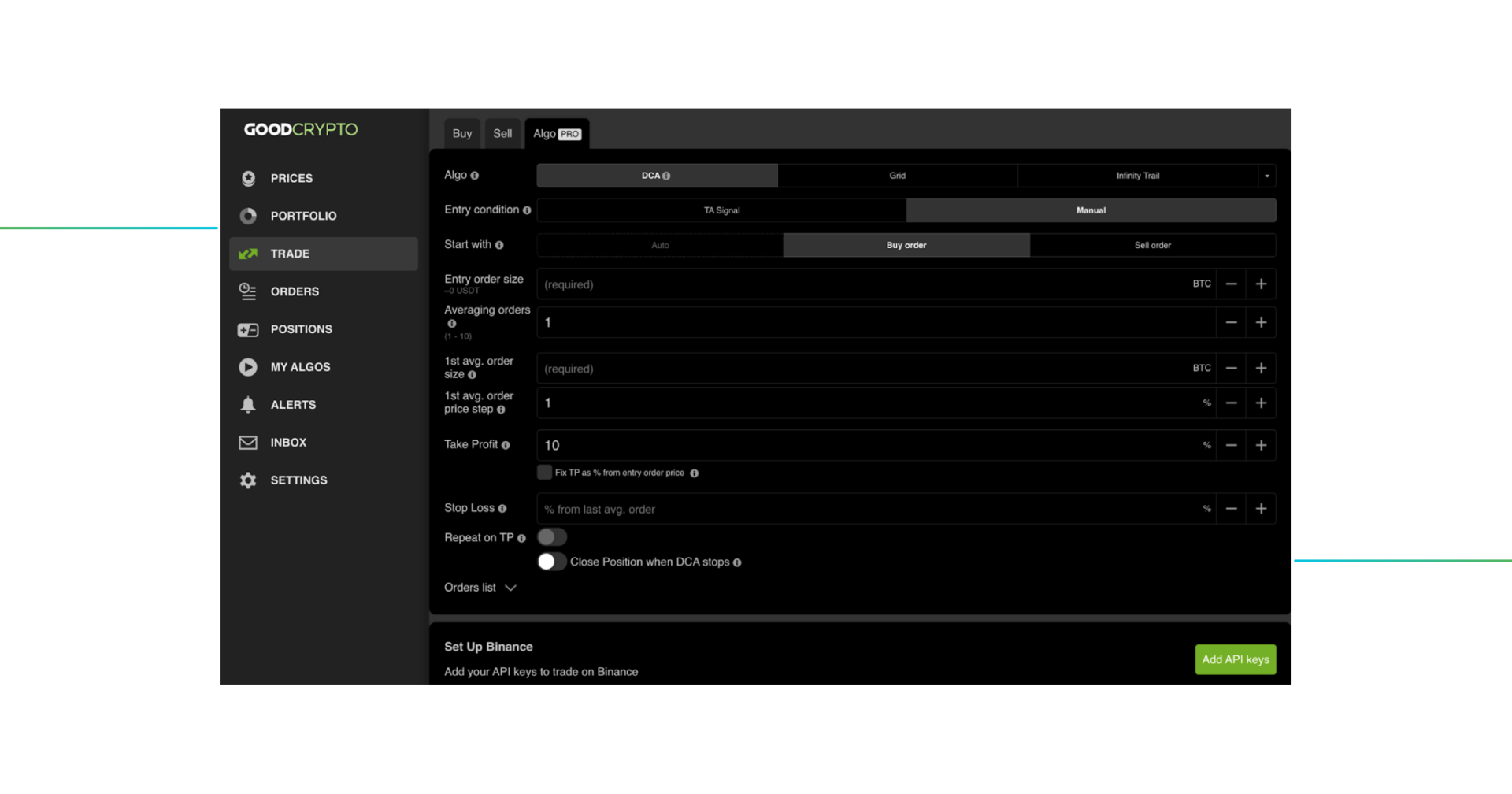

Want to have a full control over the DCA bot? Then Manual mode is your best choice, thus you’ll be able to adjust it.

Let’s dig a little deeper into the Manual mode of the bot. Select the the order you’re going to start from – Buy or Sell. In other words, launch Short or Long DCA bot.

Also, we couldn’t help but mention the best feature – Repeat on Take Profit. Why stop DCA bot when there is an oppportunity to get more profit?

But wait – there’s more! If you prefer futures trading but don’t want to miss out on algo trading – launch Futures DCA bot! Use this best trading bot and enjoy seamless and hassle-free trading!

And that is how to make your own crypto trading bot using our GoodCrypto App.

Monitor your bots

Once you have launched your bot, you can monitor its activity by clicking on the “Algo” tab on the bottom part of the GoodCrypto app or in the “My Algos” tab at the left sidebar menu.

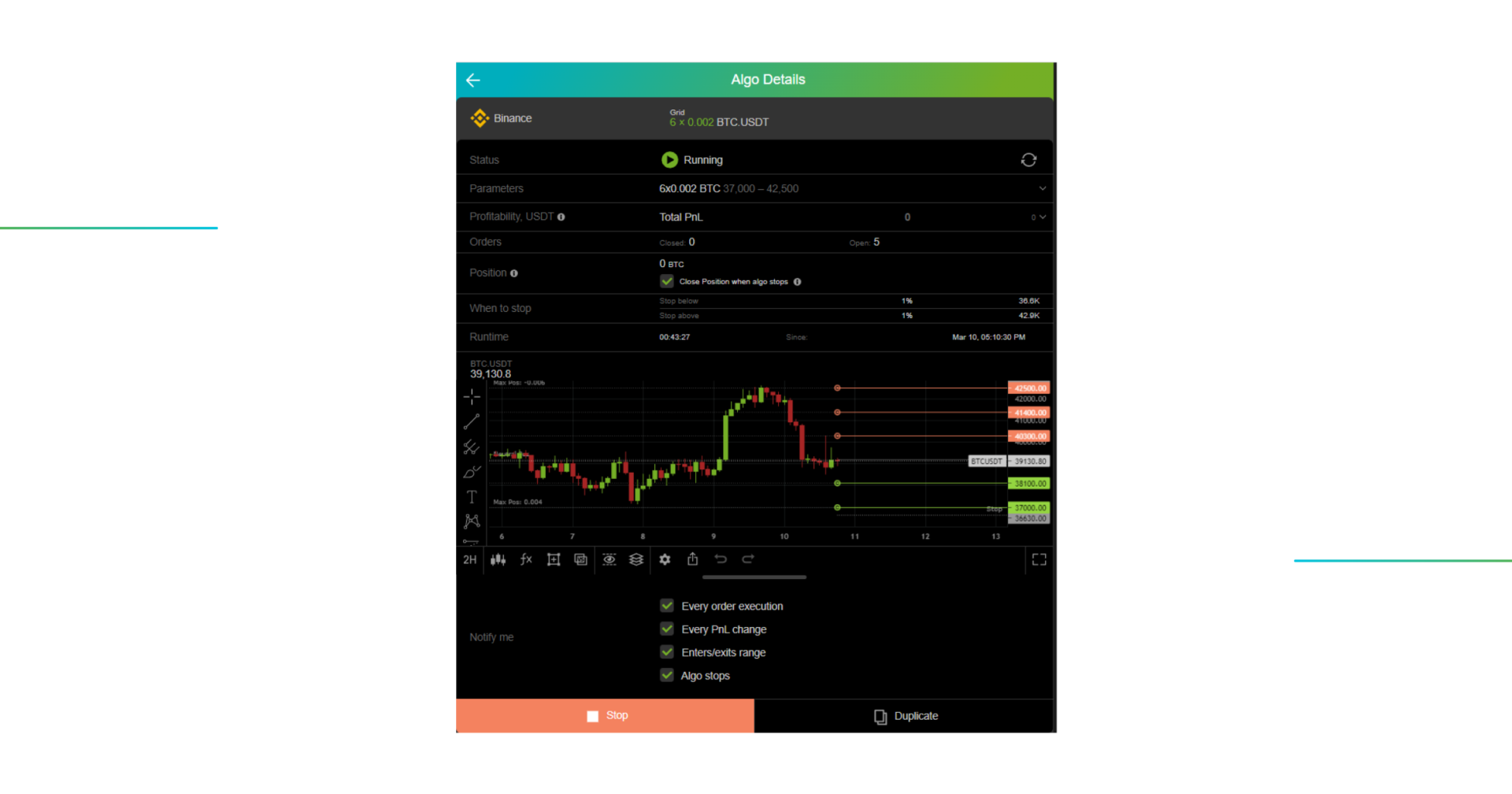

By clicking on one of your active bots, you can consult its statistics, including:

- The parameters used to create it (number of grid lines, position size, top, and bottom).

- How long it has been running.

- Its profit/loss ratio.

- Open positions and trading history.

- A visual representation of the grid where the bot will buy and sell assets.

Additionally, you can activate a wide range of notifications to keep you posted on the bot’s progress. And finally, the “Stop” ‘button on the bottom will allow you to manually deactivate the bot.

Conclusion

Trading cryptocurrencies is one of the best methods to capitalize on their profit potential. However, the crypto markets never close, which can be quite stressful, especially if you are a day trader. Capitalizing on every occasion or missing out on them can take a severe toll on your psyche.

This is where crypto bot trading or, in other words, cryptocurrency algorithmic trading, comes into play. Automated crypto trading bots allow you to take advantage of market movement, even when you are sleeping.

To answer the question are crypto trading bots worth it, we can say that, like with any subscription-based service, it depends on your usage. If you use them regularly, the best trading bots effectively remove the human error factor from trading. They also provide a sustainable opportunity for passive income.

Downloading our GoodCrypto app on Android or iOS will allow you to have a fully functional algo trading bot right in your pocket. No less than three different bot types will allow you to take advantage of different market conditions, for a much more affordable price than the competition.

Get the App. Get Started.

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

May 30, 2023