Trade on DEX across Ethereum, Arbitrum, and Base networks via GoodCrypto and compete with other traders to share a $5,000 prize pool and win exclusive NFTs b...

The newest proof of reserves from OKX discloses $8.9 billion in assets

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Scammers broke into Circle CSO’s Twitter account

On March 22, Circle, the issuer of the USD Coin stablecoin, confirmed in an official post that the Twitter account belonging to its chief strategy officer and head of global policy, Dante Disparte, had been hacked. The compromised account reportedly published a Tweet advertising phony loyalty rewards to long-term USDC users, which has since been deleted.

Before the hack, Disparte’s account shared updates on the company’s regulatory advancements and its involvement in the Paris Blockchain Week. Unfortunately, this security breach occurred shortly after the stablecoin experienced a brief depegging when deposits remained in the custody of the now-defunct Silicon Valley Bank. The issue has been resolved, but there remains a small variance in the stablecoin’s peg at the time of writing.

As of writing, the alleged scammer’s four tweets using Disparte’s account have been taken down, while only three generic comments on recent USDC events remain visible.

Coinbase suspends support for Signature Bank’s Signet

Reportedly, Coinbase has ceased its support for Signature Bank’s Signet payment platform more than a week after the New York regulators shut down the crypto-friendly bank.

According to The Wall Street Journal’s report on March 20, Coinbase users will not be able to use Signet to send funds outside of banking hours until further notice. The crypto exchange has been searching for another payment network provider and awaiting the outcome of the Signature situation.

The closure of Signature Bank on March 12 was the third bank failure, following Silvergate Bank on March 8 and Silicon Valley Bank on March 10. While financial regulators stated that they intervened to strengthen public confidence in the banking system, reports have indicated that Signature had no solvency issues at its closure.

The U.S. Federal Deposit Insurance Corporation announced that all of Signature’s deposits and loans, except for roughly $4 billion in crypto deposits, would be sold to New York Community Bancorp’s Flagstar Bank. In addition, the government corporation intends to offer digital banking accounts to customers with crypto deposits.

Coinbase, Celsius, and Paxos all had funds tied up with Signature at the time of the bank’s closure. Coinbase expects to recover $240 million in corporate assets, while Paxos reported $250 million held at the bank, and Celsius acknowledged some exposure but did not disclose the exact amount.

The newest proof of reserves from OKX discloses $8.9 billion in assets

According to the latest release, OKX’s reserves across Bitcoin, Ether, and Tether are valued at $8.9 billion, with BTC, ETH, and USDT having reserve ratios of 103%, 103%, and 102%, respectively. OKX has also increased transparency by making full liabilities, the total balance of user deposits, publicly accessible after upgrading its PoR system.

Lennix Lai, the Managing Director of Global Institutional at OKX, emphasized that the industry requires crypto-native solutions to address crypto-native challenges. He stated that the inherent transparency of blockchain and crypto/Web3 technology is incredibly valuable.

Following the FTX scandal, many exchanges, including Binance, Crypto.com, and Bybit, have released Merkle-Tree-based verification proofs to maintain the industry’s integrity. Lai believes that the new industry mantra is “don’t trust – verify,” and OKX has already enabled over 300,000 users to view the reserves or verify their liabilities.

The new transparency mechanism used by OKX maintains user privacy by splitting and shuffling account liabilities in the tree through a solution called “splitting leaf nodes.” OKX will also add zero-knowledge proof to its PoR in the coming weeks, according to Lai.

‘AI-powered’ project steals $1 million from users

Following the attention garnered by ChatGPT v4’s AI capabilities, an alleged “AI-based” decentralized application named Harvest Keeper is suspected of having swindled nearly $1 million from its users in a scam.

CertiK, a blockchain security platform, has confirmed that Harvest Keeper has taken roughly $933,000 of user assets at the time of writing. In addition, CertiK states that users have lost around $219,000 from ice phishing transactions on the Ethereum, BNB Chain, and Polygon networks. CertiK urges users to withdraw any permissions they gave the project and avoid interacting with its website.

Harvest Keeper claims to be an AI project that maximizes trading profits and guarantees a 4.81% return on user deposits. In addition, the platform boasts a 101% return on investment within 21 days and an 8% referral reward. Harvest Keeper’s Twitter account has almost 30,000 followers, and its Telegram channel has over 32,000 followers.

Supertrend Indicator: What Is It?

The Supertrend Indicator is a buy-sell indicator that helps traders determine precise entry and exit points on a chart by following the price trend of a particular asset. It is represented on the chart by a green and red line, which changes color (green for uptrend and red for downtrend) with each trend reversal. The Supertrend Indicator is similar to the Simple Moving Average (SMA) and can be used to determine trading strategies. While knowing what the Supertrend Indicator is and how it works is helpful, it doesn’t explain its functionality in detail.

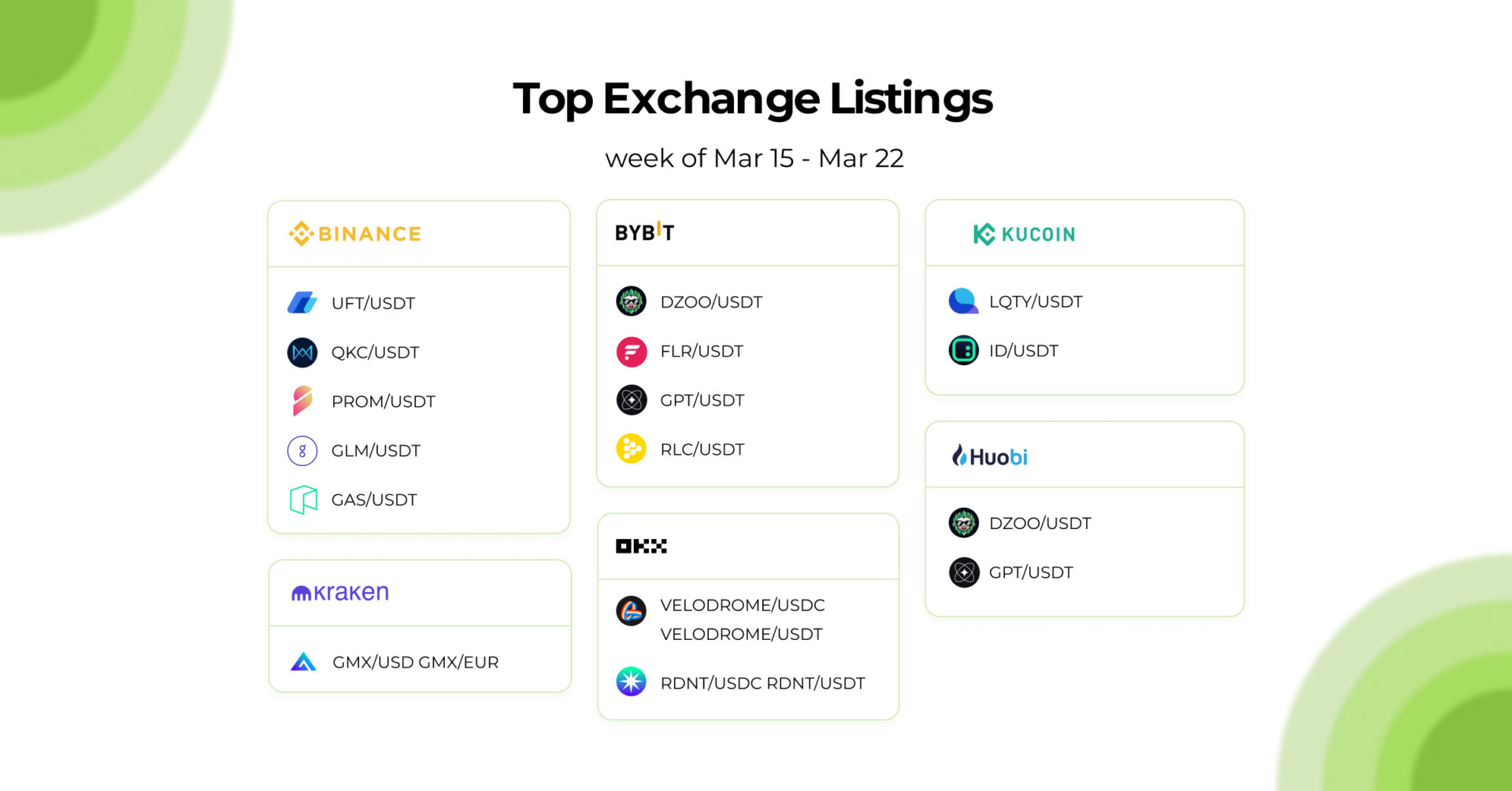

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

March 23, 2023