Trade on DEX across Ethereum, Arbitrum, and Base networks via GoodCrypto and compete with other traders to share a $5,000 prize pool and win exclusive NFTs b...

A New York judge requires Tether to provide USDT supporting documentation

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

A New York judge requires Tether to provide USDT supporting documentation

Judge Katherine Polk Failla of the United States District Court for the Southern District of New York ordered Tether to demonstrate the 1-to-1 support of its brand-name stablecoin, Tether (USDT). In addition, the business must submit several records to the court, including “general ledgers, balance sheets, income statements, cash-flow statements, and profit and loss statements.”

The order was released on Tuesday as part of a case first brought by a group of investors against iFinex, the parent company of Tether and Bitfinex. The lawsuit details allegations that the company manipulated the crypto market by issuing unbacked Tether to increase the price of cryptocurrencies like Bitcoin (BTC).

The iFinex petitions to halt the order were denied by Judge Polk Failla on the grounds that the business had already provided “sufficient enough” documentation to the Commodity Futures Trading Commission and the New York Attorney General. According to her, the Plaintiffs’ request for “undoubtedly important” papers is well-founded since they “appear to go to one of the Plaintiffs’ core allegations.”

The business asserted that the verdict did not support any of the allegations made in a pending lawsuit:

“We had already agreed to produce documents sufficient to establish the reserves backing USDT, and this dispute merely concerned the scope of documents to be produced. As always, we look forward to dispensing with plaintiffs’ baseless lawsuit in due course.”

‘Happy to return’ Voyager Digital’s $200 million loan, Alameda Research

Alameda Research, a quantitative trading firm, will repay Voyager Digital, which is going through bankruptcy, for an estimated $200 million. In September 2021, Alameda borrowed money in crypto. The amount was close to $380 million at the time.

The parties have struck a deal, and according to a recent filing in the Bankruptcy Court of Southern District of New York, Alameda will repay about 6,553 Bitcoin (BTC) and 51,000 Ether (ETH) by September 30. Voyager will then be required to refund the collateral, which as of press time amounted to $160 million in the form of 4.65 million FTX Tokens (FTT) and 63.75 million Serum (SRM).

Jesse Powell of Kraken will retire as CEO but remain as board chair

After more than 11 years as CEO of the cryptocurrency exchange Kraken, Jesse Powell will stand down from his position.

According to a statement released by the company on Wednesday, Powell will be followed as CEO by chief operating officer Dave Ripley, who has been with Kraken since 2016. The cryptocurrency exchange’s soon-to-be-former CEO will continue working there as the board’s chair while the business looks for a replacement.

As Powell rose to become the new leader, Ripley claimed that his aims were “in lockstep” with Powell’s. Powell allegedly stated that the expansion of Kraken was the reason for his decision to back off, saying, “It’s just gotten to be more draining on me, less fun.” However, he continued by saying he still intended “to stay very engaged with the company.”

To safeguard users, BNB Chain introduces a new community-run security system

AvengerDAO is a new community-driven security project that BNB Chain has created, the native blockchain of Binance, to help defend users against fraud, hostile actors, and potential vulnerabilities. AvengerDAO gives an extra protection level whenever a user on the BNB Chain interacts with any apps or counterparties.

The decentralized autonomous organization (DAO), which focuses on security, was created in collaboration with renowned security companies and well-known cryptocurrency projects like Certik, TrustWallet, PancakeSwap, and Opera, to mention a few.

In an exclusive interview with Cointelegraph, Gwendolyn Regina, investment director of BNB Chain, described how the community will be in charge of making security choices. She stated that to determine the kinds of typical security vulnerabilities that exist, the community will conduct a poll of the current security auditing service providers. She continued:

“We think that when additional professional security audit firms join the DAO as members, we will collectively get a deeper understanding of the security landscape and work on enhancing it.”

How To Build Successful Grid Trading Strategies?

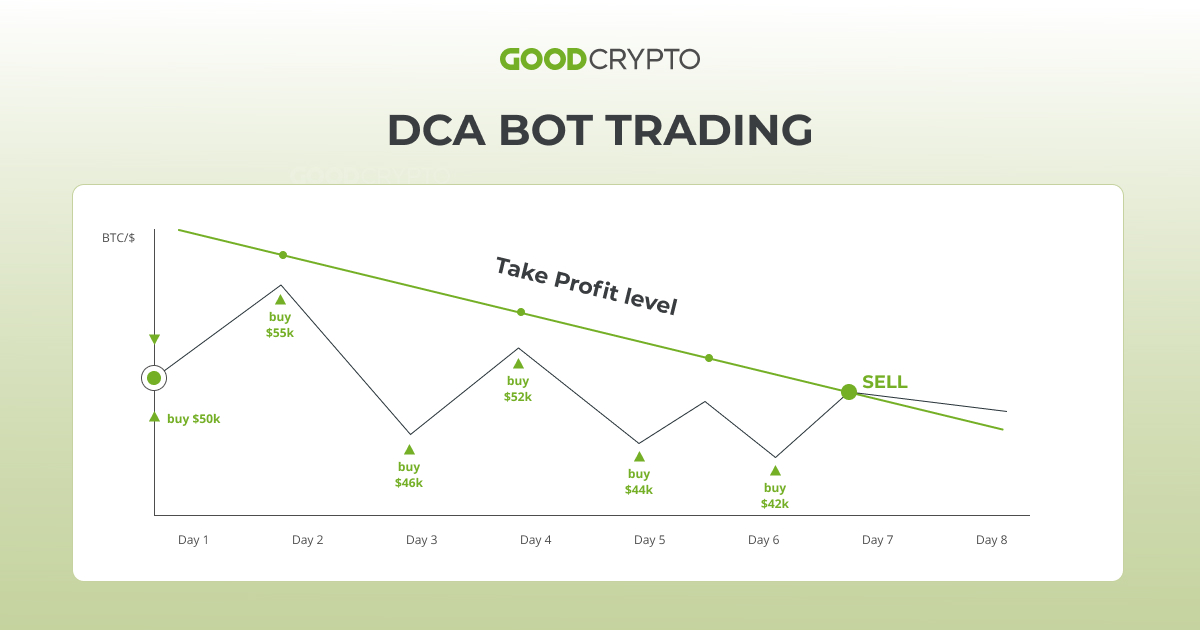

Some of the greatest crypto bots to utilize during uptrends or downtrends are dollar cost averaging (DCA) bots. A DCA bot lowers the average price of an asset by taking advantage of volatility by buying and selling at regular intervals.

Trading DCA entails regularly paying a predefined amount for a cryptocurrency asset, independent of its price at the time, as seen in the graphic above/below. To learn more about this approach, visit our guide Cryptocurrency Portfolio and Risk Management.

However, a DCA bot method operates quite differently. The DCA trading bot, in this instance, initiates a trade and establishes a percentage-based take profit target. Then, the bot closes the trade and earns money if the price reaches the objective. On the other hand, if the market does not move in the direction that the DCA crypto bot expects, the program will continue to purchase assets at lower prices, hence lowering the asset’s average price.

More details of this and other DCA bot strategies are in this article.

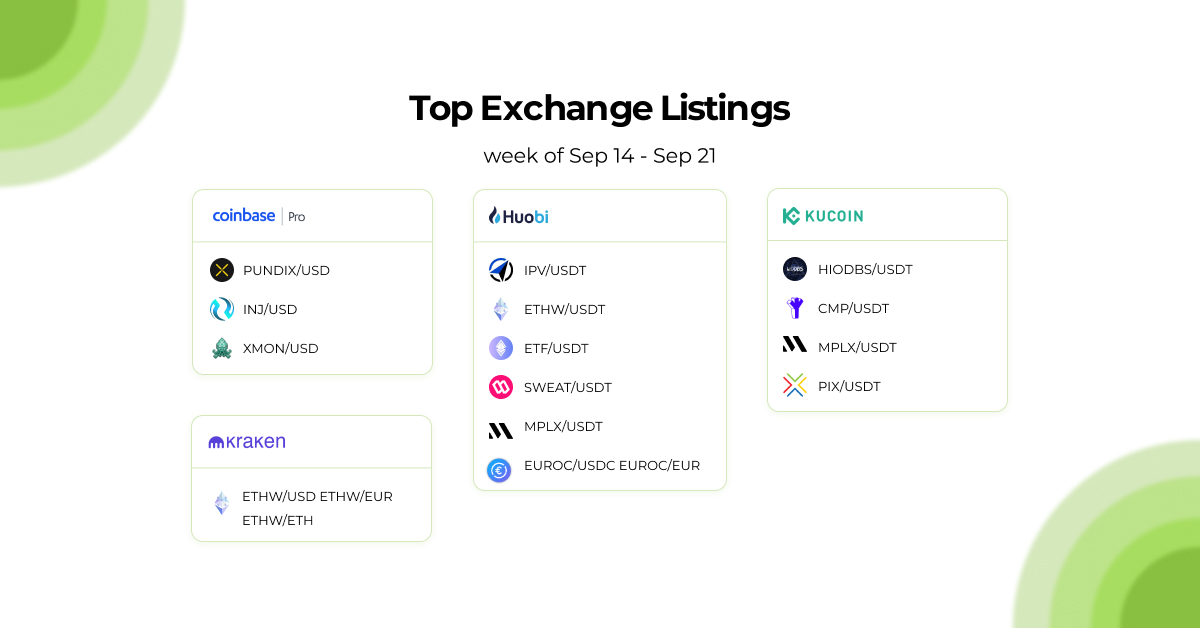

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

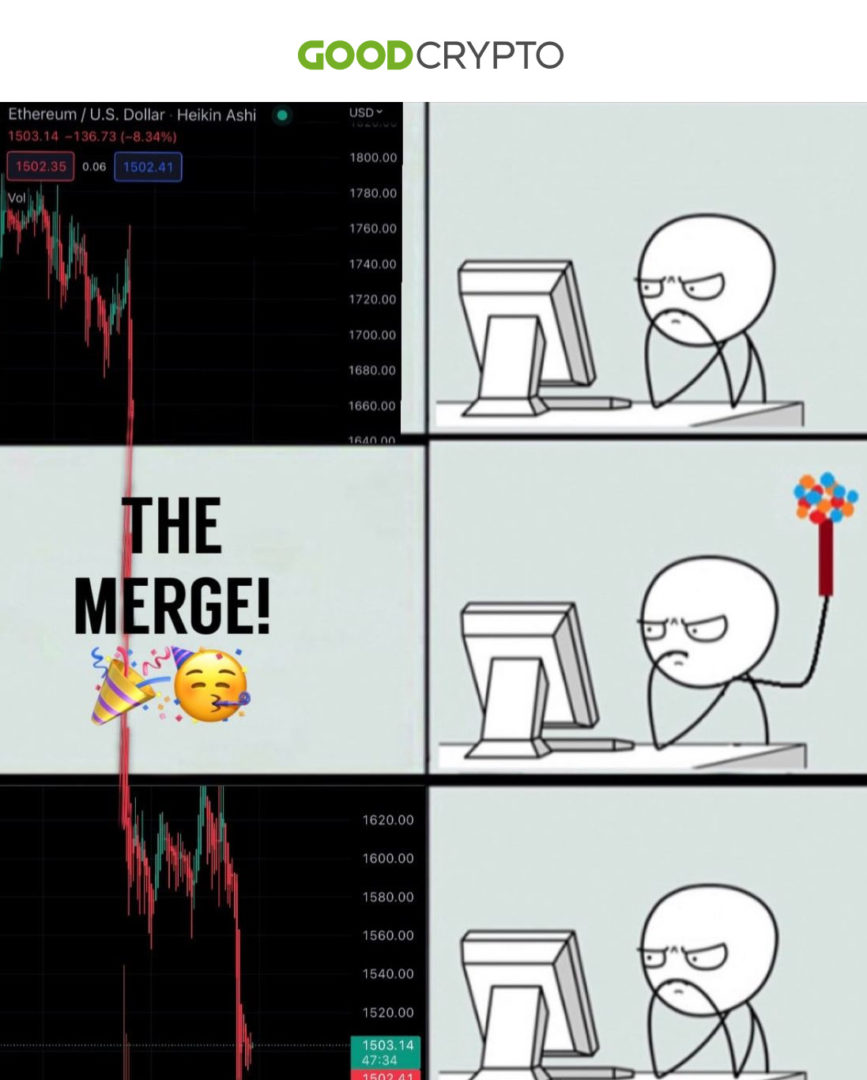

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

September 22, 2022