Trade on DEX across Ethereum, Arbitrum, and Base networks via GoodCrypto and compete with other traders to share a $5,000 prize pool and win exclusive NFTs b...

Marathon Digital cashes out 63% of BTC mined in May

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

Marathon Digital cashes out 63% of BTC mined in May

In the wake of the Bitcoin halving event that slashed mining rewards, Marathon Digital has liquidated 63% of its Bitcoin mined in May, totaling 390 BTC. This move, detailed in their monthly report, is part of an industry-wide adjustment to the reduced rewards, now at 3.125 BTC per block. While Marathon’s strategy contrasts with peers like Riot Platforms and CleanSpark, who retained most of their May mining yields, it has bolstered Marathon’s cash reserves to $290.4 million.

Marathon Digital is not only navigating the post-halving landscape by optimizing production – winning 32% more blocks in May than in April – but also by pursuing international expansion. With projects in Kenya and Paraguay aimed at leveraging renewable energy, the company is positioning itself for global market penetration, targeting 50% of its revenue from international operations by 2028.

SEC’s Gensler signals delay in spot Ether ETF approvals

SEC Chair Gary Gensler, in a CNBC interview on June 5, hinted at a potential slowdown in the approval process for spot Ether ETFs, suggesting that the SEC will take its time reviewing S-1 registration statements. Despite the SEC’s initial steps toward allowing ETFs on U.S. exchanges, with 19b-4 filings from major asset managers like VanEck and Fidelity approved in May, Gensler’s comments indicate that final approvals could be months away. He also noted that cryptocurrency firms often engage in activities not permitted for traditional exchanges, reinforcing the SEC’s firm stance on enforcement, as seen in recent lawsuits against prominent crypto companies.

Gensler’s tenure as SEC chair is expected to continue until 2026, during which the commission’s approach to cryptocurrency regulation, including the approval of ETFs, will remain a critical area of focus. The delay in spot Ether ETF approvals contrasts with the SEC’s earlier greenlighting of spot Bitcoin ETF applications, which marked a significant milestone for the industry.

Bitcoin ETFs draw $500m despite search interest dip

U.S.-based Bitcoin ETFs have garnered significant investment, with inflows reaching $488.1 million on June 5, despite a notable decline in public search interest for Bitcoin and crypto-related terms. The Fidelity Wise Origin Bitcoin Fund captured the lion’s share of these inflows, with $220.6 million, while BlackRock’s iShares Bitcoin Trust followed with $155.4 million. This investment surge comes even as the Grayscale Bitcoin Trust, which had been experiencing outflows, saw a positive shift with $14.6 million in inflows.

Contrasting with the financial momentum, Google Trends data indicates a stark decrease in the number of searches for ‘Bitcoin’ and ‘Bitcoin ETFs’ in the U.S., scoring 31 and 1 out of 100, respectively, on June 5. This suggests that, despite Bitcoin’s price rally past $71,000 and the substantial ETF inflows, the retail investor excitement that drove the 2021 bull run has not yet returned to the market. The low search interest could imply that the current market growth is driven by more institutional or seasoned investors, rather than a broad base of retail participants.

U.S. president granted authority to restrict digital asset access

A newly enacted U.S. law has granted the President unprecedented powers to restrict access to digital assets, raising alarms among digital asset advocates and users. The law, which has been met with criticism for its wide-reaching implications, allows the President to prohibit transactions between U.S. persons and foreign entities deemed to be supporting terrorism, including foreign digital asset transaction facilitators. Scott Johnsson, a key figure in the digital asset community, expressed concern on June 6 about the potential for this law to enforce a de facto ban on certain protocols or smart contracts, pushing users towards centralized, KYC-compliant chains.

The law’s broad definition of digital assets includes any digital representation of value on cryptographically secured distributed ledgers, communication protocols, smart contracts, and software that facilitates digital asset trades. Senator Mark Warner is cited as having strategically inserted legislative elements that expanded the President’s power over digital assets. Critics like Johnsson warn that this could be an attempt to exert greater control over the digital asset space under the pretext of counterterrorism efforts. The law’s provisions echo the Terrorism Financing Prevention Act, which targets “emerging threats involving digital assets,” and could significantly impact how users interact with digital assets and blockchain technology.”

negative MACD divergence trading strategy

✍️Trading with MACD divergence involves comparing the trend’s momentum to price action. In a typical scenario, a negative MACD divergence might occur when the price ascends while the MACD indicator descends. This discrepancy can signal a potential reversal, prompting traders to adjust their strategies accordingly.

Consider the BTC/USDT example above. While it might initially appear to show a positive divergence (a bullish signal), closer inspection reveals a descending trend in the MACD indicator despite the price’s upward movement. This suggests a weakening momentum and a bearish bias, creating a channel with mixed signals.

- 🔍Divergence: Occurs when the price makes higher highs or lower lows, while the MACD makes lower highs or higher lows, respectively.

- 📈Convergence: Happens when the price makes lower highs or higher lows, while the MACD makes higher highs or lower lows, respectively.

Ready to dive deeper into MACD strategies and unlock your trading potential? 🚀 Read the full article!

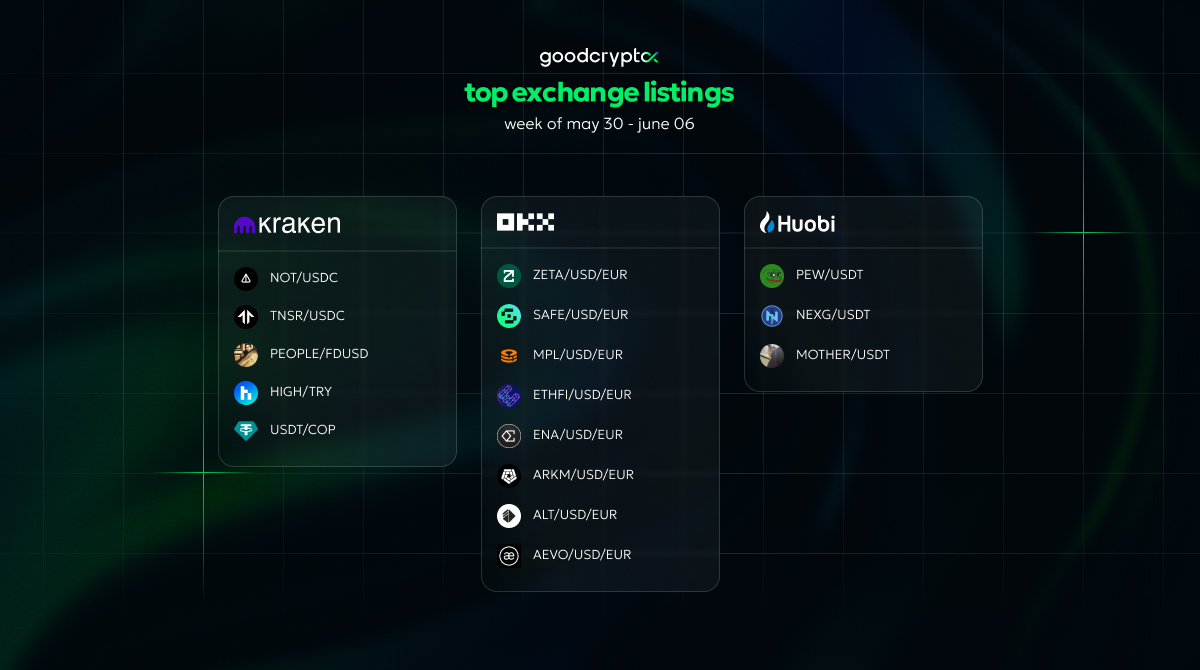

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

June 6, 2024