We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

3Commas Review: Automated Trading Terminal & Crypto Trading Bots

- 1. 3Commas Trading Terminal Overview

- 2. 3commas Key Features

- 2.1. 3Commas crypto trading bots: how do they work?

- 2.2. Commas DCA Bot

- 2.2.1. How Does the 3Commas DCA Bot Work?

- 2.2.2. How to Setup 3commas DCA Bots?

- 2.2.3. How to Use 3commas DCA Bots in Your Trading Strategy?

- 2.3. 3commas TradingView Bot: Customize Your Trading Strategy

- 2.4. 3commas Grid Bot Options

- 2.4.1. How Does the 3Commas Grid Bot Work?

- 2.4.2. How to Use 3Commas Grid Bot in Your Strategy?

- 2.5. Options Bot: Hard Financial Instrument to Master

- 2.6. 3commas SmartTrade Terminal

- 2.7. 3commas Dynamic Trading Terminal

- 2.8. 3commas Backtesting Tool Overview

- 3. 3commas Crypto Trading Signals

- 3.1. Premium CQS Signals on 3commas

- 3.2. Personal 3commas Tradingview Signals

- 3.3. What is 3commas QFL Signals?

- 4. 3commas Exchanges List

- 5. Main 3commas Settings Review

- 6. 3commas Pricing: Is It Worth Your Money?

- 7. Is 3commas Safe to Use?

- 8. The Best 3commas Alternative

- 9. Conclusion

In this 3Commas review, we take a look at one of the most acclaimed cryptocurrency trading bot platforms available on the market. Here, you will learn what is 3Commas, important details of the 3Commas interface, and how to trade with 3Commas. Additionally, we will provide a 3Commas quick guide on how to use the 3Commas app and set up a 3Commas profitable trading strategy.

Let’s get this 3Commas review started with some basics about this crypto trading bot platform and some general info about the founding team behind it.

3Commas Trading Terminal Overview

Yuriy Sorokin, Egor Razumovskii, and Mikhail Goryunov founded the 3Commas platform in 2017 in Tallinn, Estonia. The goal was to provide traders with a platform for crypto trading bots that help them set up automatic trading.

Although they were facing some serious competition, the 3Commas automatic trading systems quickly became one of the community’s favorites. The team’s expertise in the niche allowed them to push out one of the best cryptocurrency trading bot experiences available.

In a nutshell, 3Commas trading bots save enormous amounts of time by allowing you to place hundreds of trades, which would be manually impossible. Additionally, because trades follow a predetermined strategy, the 3Commas bot profitability is more consistent than manual trading. This is because the 3Commas automated trading bot removes FUD and FOMO out of the equation, two major factors in many traders’ downfalls. To continue this 3Commas review, let’s go over its main features and explain in detail what are 3Commas bots.

3commas Key Features

The main component of the 3Commas automated cryptocurrency trading platform comes in the form of a web app found on 3Commas.io. This version provides the best crypto trading bot personalization possibilities. However, for those that wish to still monitor their 3Commas automated trading bots on the go, there’s also a mobile app for both iOS and Android.

So, to begin this 3Commas review, let’s check out the 3Commas trading bot features and see how they work.

3Commas crypto trading bots: how do they work?

3Commas automatic trading bots are, by far, the pivotal feature of this platform. They consist of three different types of bots including DCA bots (dollar-cost average), a trading grid bot, and an options trading bot. All of these require a different 3Commas bot configuration, which we will cover in detail further down this 3commas trading bot review.

In essence, the 3commas bot, regardless of its type, opens and closes trades automatically. But how do 3Commas bots choose to buy something? Simply put, the 3commas bot will open trades once certain conditions set up by the user are met. When profits reach their target threshold, the bot will sell the assets and increase your portfolio value.

Many ask themselves – can you lose money with 3Commas bots? The answer is a resounding YES! Even the best crypto bot strategy isn’t flawless and you should always set up stop losses to reduce risks.

On that note, let’s continue this 3Commas review, by examining your options on how to setup 3Commas bots effectively.

Commas DCA Bot

The DCA bot is the most popular type of bot on the platform. As their name would suggest, DCA bots on 3Commas work by averaging the price when buying or selling cryptocurrencies on your behalf. You have two types of DCA bots at your disposal:

- A DCA Long bot will average down the price to bring you closer to a profit. It will help you close a position in the green even though the price didn’t reach your initial exit target.

- A DCA Short bot will accumulate more of the base crypto you are trading in case of a market downturn. It will help you increase your portfolio for when the market takes a more favorable turn and have more coins to sell at a higher price.

In either case, both types of bots reduce the average price of the crypto you are buying to provide you with an opportunity for profit.

How Does the 3Commas DCA Bot Work?

To help you understand how the DCA bot works, let’s have an in-depth look at the 3Commas DCA long bot. The bot enters a trading position following a buy order (limit or market) and a take profit position when you wish to cash in.

If the market goes your way, the bot sells the assets at the required target and you pocket the difference, it’s as simple as that. However, this DCA bot strategy takes a whole other dimension when the market goes against you.

For instance, if the price moves under your initial purchase level, the bot will buy more assets, reducing the average price. At the same time, the take profit level is lowered to correspond to the new average purchase price. Consequently, the price doesn’t need to reach the initial take profit level, and making profits in a price range becomes much more feasible. Thus, even if the price never returns to the initial purchase levels, you still have a good chance of closing the trade with a profit at hand.

Let’s illustrate this with a quick example:

Imagine you enter a position at a price of $100, with a take profit of 20% above this price level ($120 to be exact). In the following days, the price fluctuates to 90, 80, 70, 90 and finally settles at 110. Without DCA, your take profit would remain at $120 and the trade would remain open.

With a DCA bot, the average price move to $90 (100+90+80+70+90+110)/6=90). This allows you to get 20% at a lower take profit price point of $108 ($90+20%=108), allowing you to close the deal in the green, even though the $120 level hasn’t been reached yet.

In the above example, you can see how the DCA bot can make 5% profits in a swing trend. The initial take profit target would have been $46.200. However, by averaging the price though multiple buy-ins, the bot was allowed to exit with a 5% profit at $44.450.

How to Setup 3commas DCA Bots?

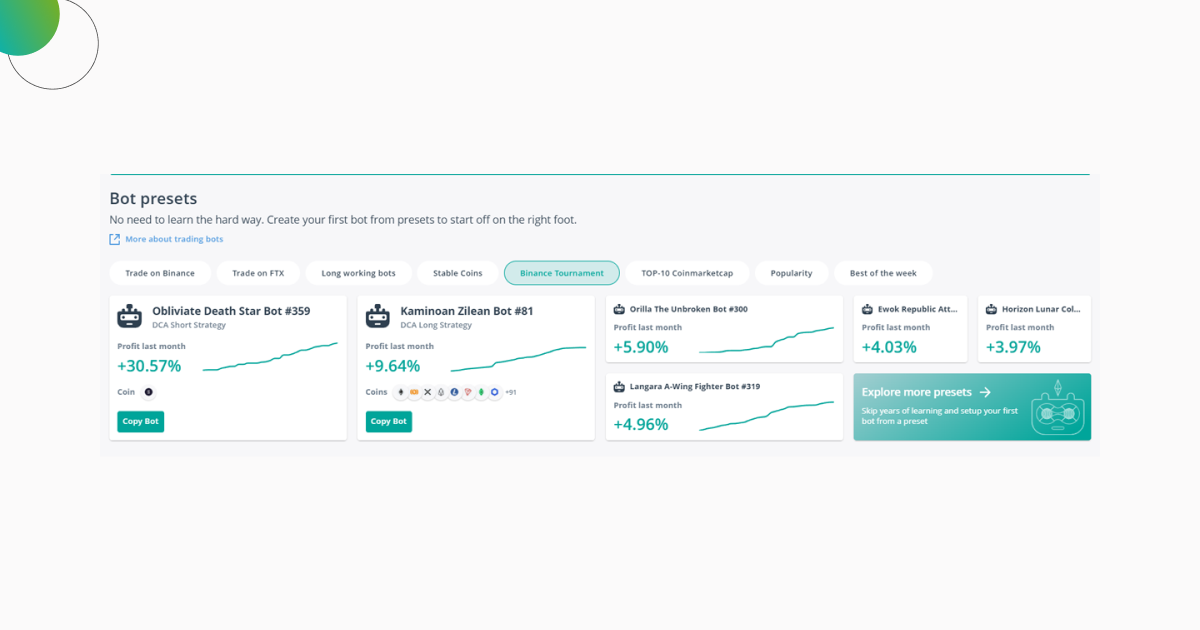

Usually, the initial method on how to use 3commas bots will be the creation of a dollar-cost average (DCA) bot. The process for creating DCA bots can range from very simple to significantly advanced. There are generally two main approaches on how to use 3Commas bot for DCA:

- Easy – choose an already-established 3Commas strategy and copy it to the letter.

- Hard – choose to create one yourself which requires good general knowledge of trading indicators and signals.

Moreover, you can also modify existing DCA bots to better fit your general risk appetite.

How to Use 3commas DCA Bots in Your Trading Strategy?

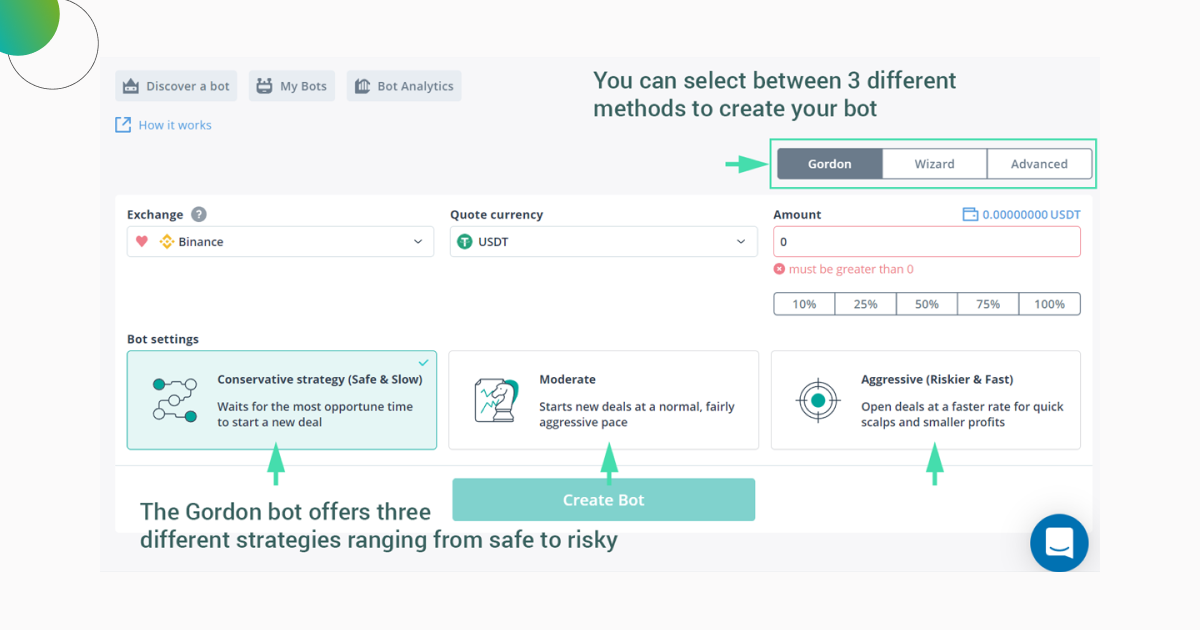

When creating a 3Commas strategy, you have three options at your disposal for deploying your DCA bot:

- The Gordon bot creates a simple bot using 3 parameters based on risk/reward and a percentage of your portfolio.

- The Wizard offers a simplified interface for traders to set up their own bot.

- The Advanced creator allows you to tweak every single detail on how the bot will behave.

In case you want to apply your own 3commas strategies, you should use the app’s extensive manual to learn the ins and outs of the advanced bot creator. Conversely, if you just want to simply jump in and start trading, the Gordon bot should be able to fulfill your most basic needs.

3commas TradingView Bot: Customize Your Trading Strategy

Another neat feature of the 3 commas crypto platform is that you can control your DCA bots using signals set up in TradingView. Users that are already familiar with TradingView charts, indicators, and TradingView alerts can put this knowledge to good use.

In fact, if you know how to create alerts on Tradingview, you are actually very close to creating your own 3commas tradingview bot. The main advantage of this 3commas signals bot is that you can use an advanced 3commas strategy Tradingview that isn’t included in the bot creation wizard.

For a more detailed explanation of how this works, check out the video:

3commas Grid Bot Options

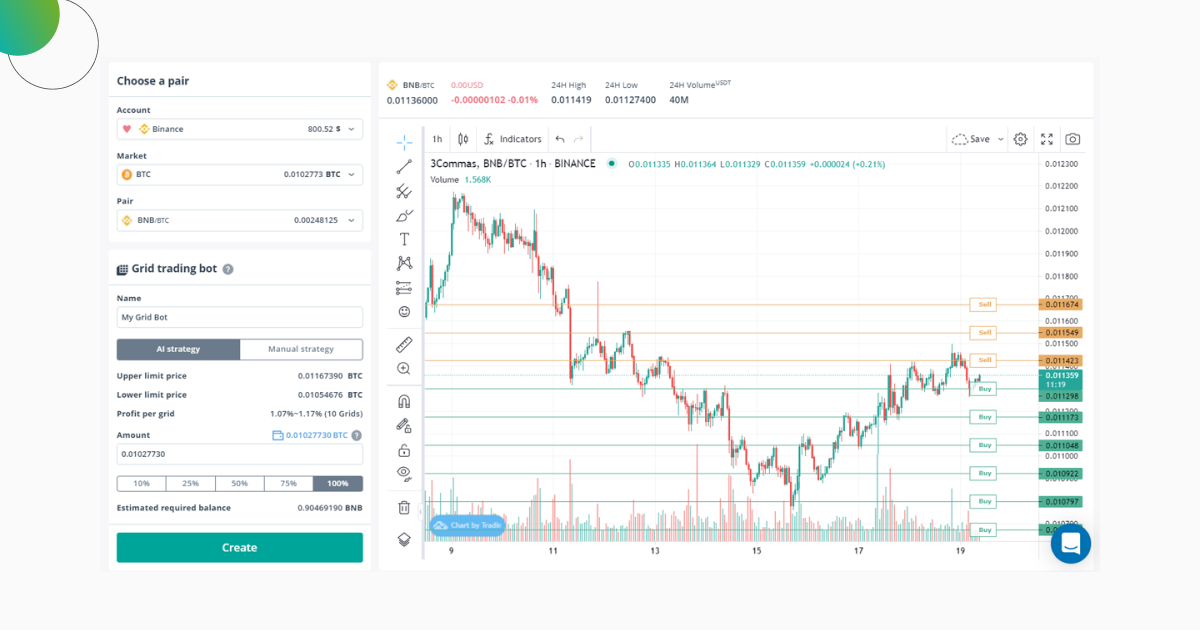

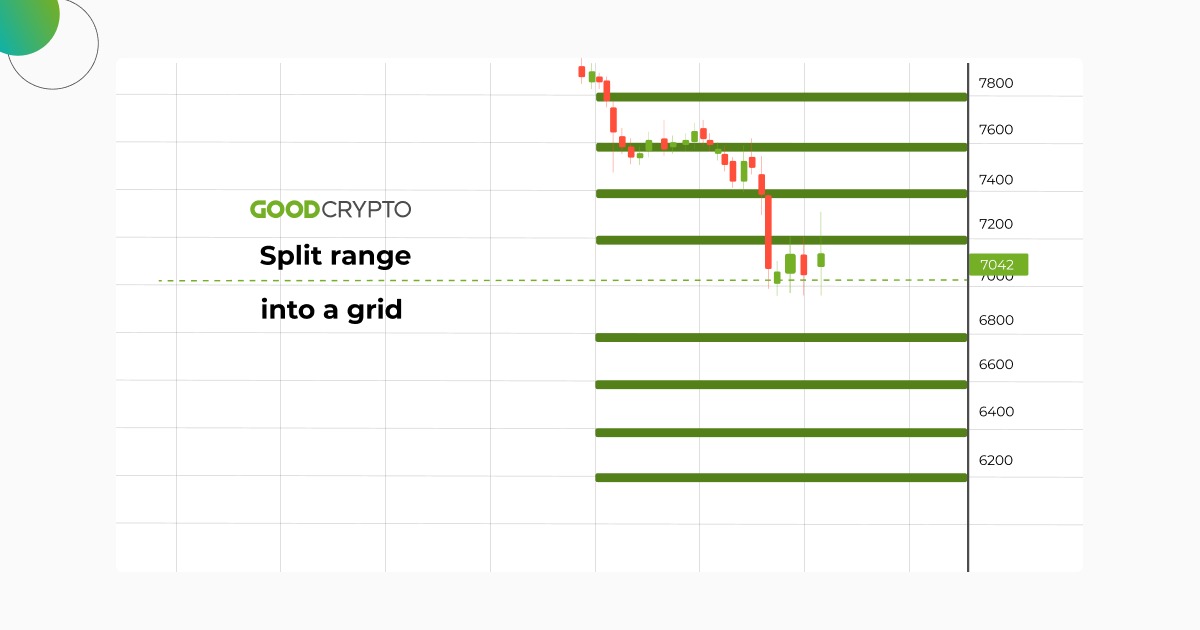

The next point in our 3Commas review is the 3Commas grid bot. This tool automates the buying and selling of assets based on a grid composed of buy and sell levels. Grid trading is most useful for cryptocurrencies that trend sideways and allow you to take frequent profits from their minimal movements.

To give our honest 3commas grid bot review, we can say that it’s one of the simplest bots to set up on the platform as the gridbot requires very little technical analysis. The best grid trading bot can run unmonitored for weeks, raking in steady profits.

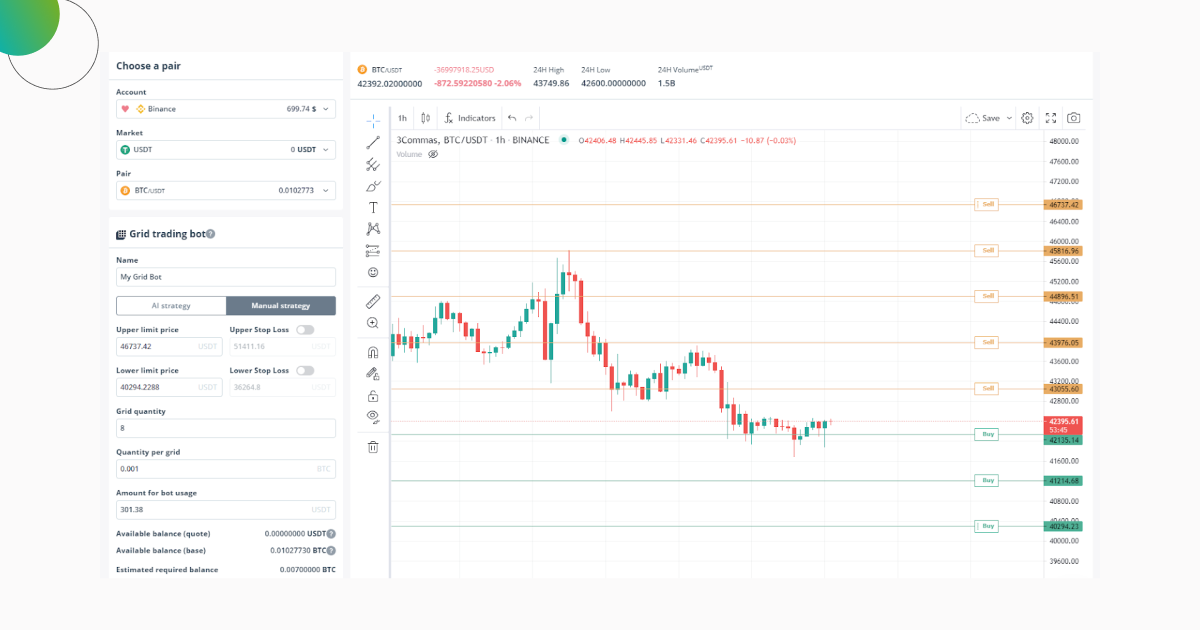

How Does the 3Commas Grid Bot Work?

As we mentioned previously, the 3Commas grid bot works within a specified price range, making it ideal for turning a profit in a sideways market. Its goal is to capture minimal price movements by splitting this range into multiple grid levels. At each level, the bot places a buy or sell Limit Order, allowing you to buy or sell depending on the direction of the price.

Additionally, a grid bot allows you to methodically enter a position. For example, it enables you to set up a strategy and avoid buying an asset at the current level if you believe the price is too high or to buy an asset in small portions. The icing on the cake is that the grid bot will make a profit on price fluctuations while an asset’s price will be moving to the final desired entry level. The same works for exiting a position: when you want to sell an asset by portions while earning on the price fluctuations.

How to Use 3Commas Grid Bot in Your Strategy?

To better understand how you can use the grid bot in your strategy, let’s illustrate it with a practical example.

Let’s say that Bitcoin is trading within a range of $40.000 (lower limit) and $46.000 (upper limit). We divide this range into 8 price levels, where the bot will either buy or sell BTC. Two scenarios occur when a grid bot trades on your behalf:

- If the price goes up and crosses one of the “SELL” levels, the order is filled, and the grid bot sells BTC for profit. At this moment, the bot opens a new buy order one level lower.

- If the price goes down and crosses one of the “BUY” levels, the bot fills the limit buy order created earlier. At the same time, the bot creates a new sell order one level higher.

This buying, selling, and setting new orders carries on until either the top or bottom of the range is reached or the user stops the grid bot 3Commas manually. You can also set up manual stop loss above and under the grid. This will allow the bot to run its course until either of these limits is reached.

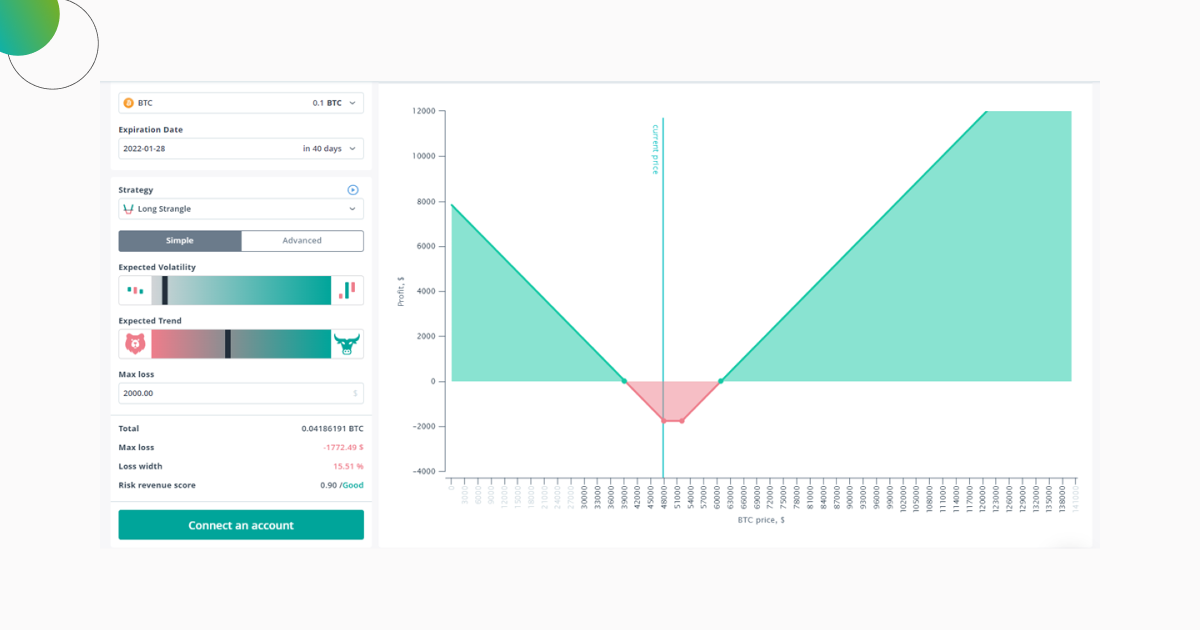

Options Bot: Hard Financial Instrument to Master

The last type of bot in this crypto trading bot review for 3Commas is the options bot, only available for the Deribit crypto options exchange.

Options are derivative financial instruments that give the holder the right, but not the obligation, to sell (PUT) or buy (CALL) an asset at some time in the future. Options trading involves two important elements:

- The strike price is the price at which you agree to buy or sell the asset in the future.

- The premium is the cost of the contract, or in other words, the price you have to pay in case you choose not to fulfill it.

When the contract expires, the holder doesn’t have to pay the full strike price of the contract, but just the premium of the option.

Let’s say you buy a BTC put contract that expires in 3-months, with a strike price of $42.000 and a premium of $1000. This means that you have a bearish sentiment on Bitcoin and hope its price goes down at the options contract expiry. Three outcomes might occur:

- The price of BTC drops to $36.000 at the end of the contract period and you exercise the right to sell it at $42.000, making a profit.

- The price of BTC remains the same and you break even.

- BTC’s price has gone up to $52.000 and you choose not to sell it at a loss, but instead pay the $1000 premium, limiting your losses.

This options trading bot on 3Commas includes some complex options strategies that users can tweak following their market sentiment and volatility predictions. To learn how to apply these strategies, make sure you check the exhaustive option trading bot manual on 3Commas. It’s a demanding tool to master, as it requires good knowledge of how options trading works.

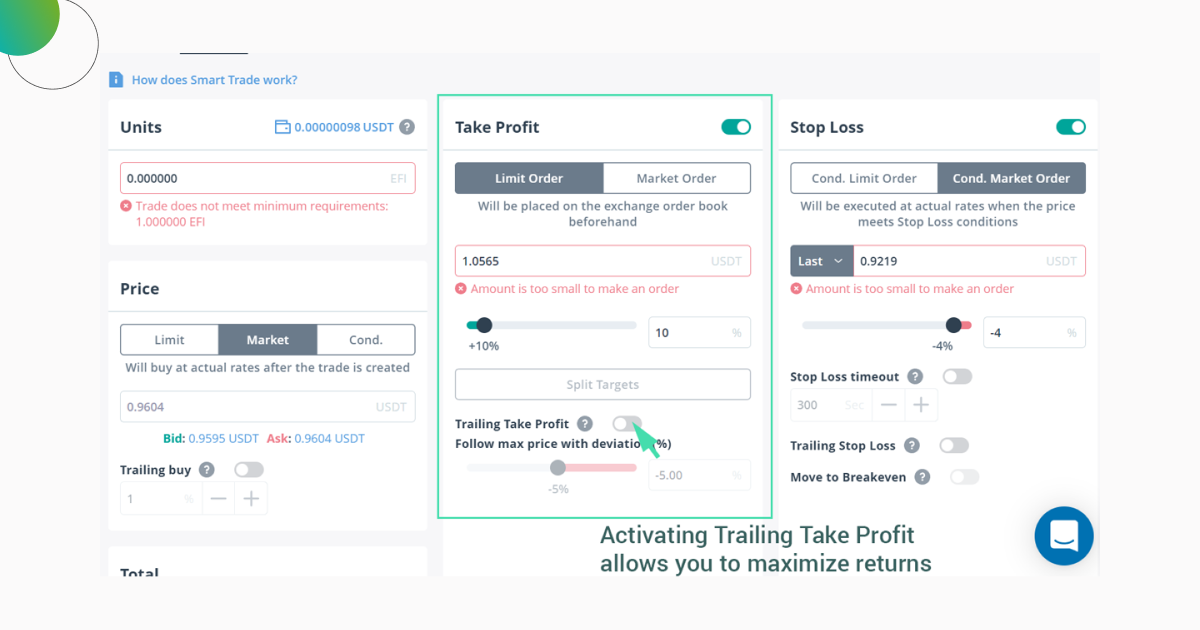

3commas SmartTrade Terminal

The 3Commas Smart Trade Terminal is the second-most important feature of the 3 commas crypto trading platform. By using the SmartTrade feature, you can access a streamlined 3commas trading interface that allows you to place manual orders on your preferred crypto exchanges.

In addition to traditional orders, the smart trade 3commas offers some form of automation through 4 different tools:

- Smart Trade 3Commas allows you to buy and sell cryptos.

- Smart Sell allows you to sell already owned coins.

- Smart Cover allows you to increase your portfolio by selling crypto from your portfolio and rebuy at a lower price down the line.

- Smart Buy allows you to cover a dangerous short position so you don’t get liquidated.

All of these are supported by the 3commas smart trade take profit feature which includes a trailing stop. This means that 3 Commas will continue holding the position open even if the take profit target is reached, as long as the price goes up. Once the price starts to fall under a certain percentage set by the user, the smart trade feature will close the position. Consequently, Smart trade 3Commas allows you to follow the price movement to the top and take profit only when your trade reaches market exhaustion.

3commas Dynamic Trading Terminal

The 3commas trading terminal is similar to SmartTrade in every way, with the exception that it doesn’t provide price trailing. It’s handy for placing trades manually without having to juggle between multiple exchanges at once.

3commas Backtesting Tool Overview

To wrap up our feature section in our 3Commas review, we would have loved to see a 3Commas backtesting mechanic. Unfortunately, however, 3Commas doesn’t offer an automated backtesting tool worthy of that name.

The closest resemblance to a crypto backtesting tool is the Paper Trading mechanism. This will allow you to live test your 3commas strategy to see if it’s profitable without using real money.

3commas Crypto Trading Signals

The 3Commas trading platform provides a marketplace of crypto trading signals upon which users can base their trading bots. Some of these signals are free, while others require a paid subscription. As a rule of thumb, the best crypto signals with the most consistent results are also the most expensive.

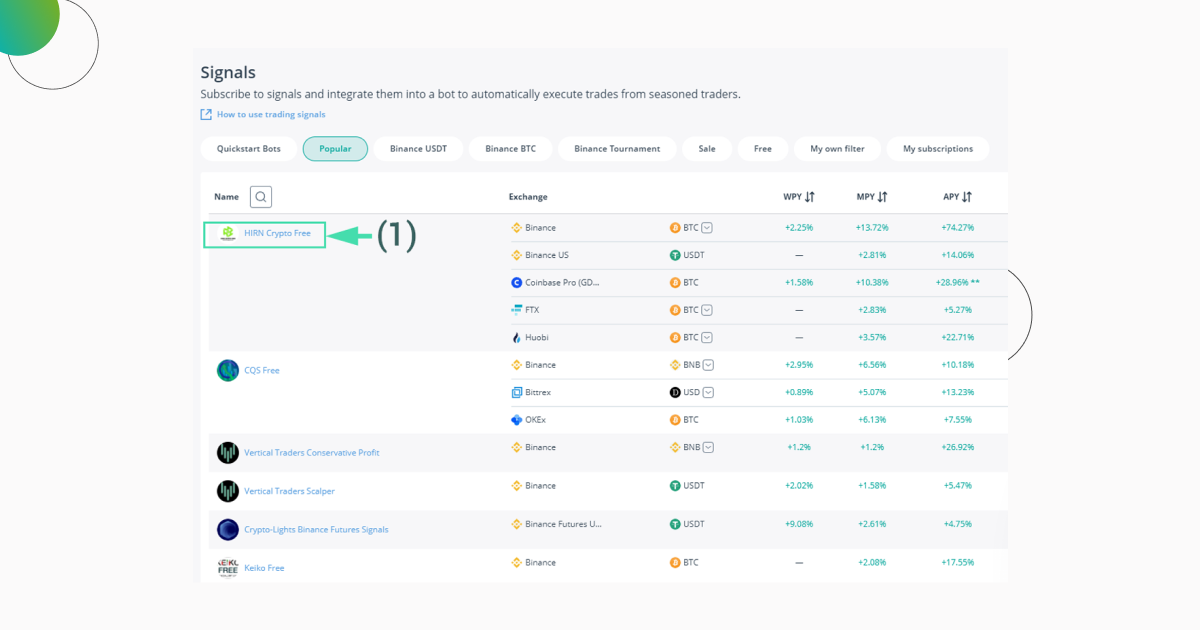

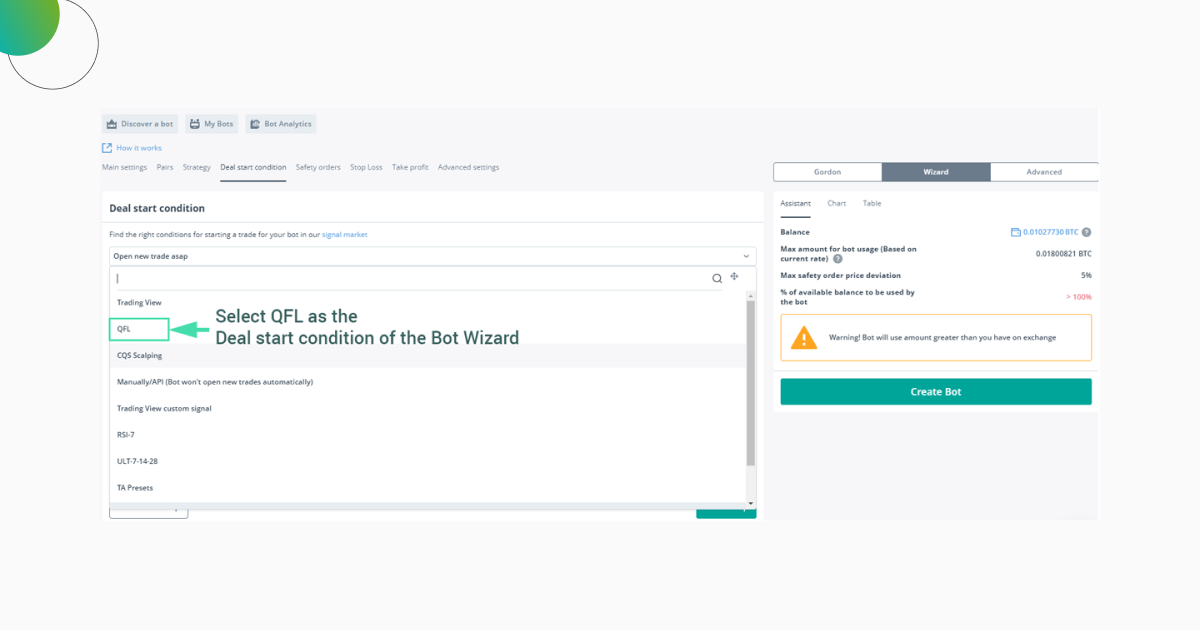

The process of subscribing to a signal provider is quite straightforward. In the marketplace, simply choose one that you want to use as the base for your bot and subscribe to it (1).

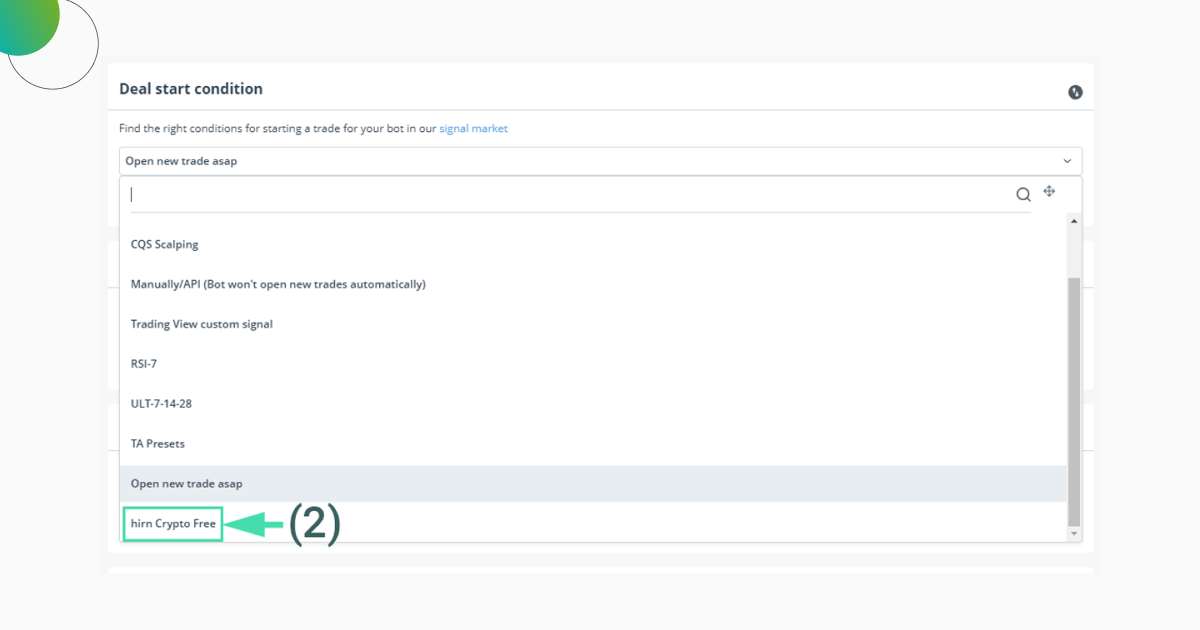

Then simply proceed to create your bot. By using the Wizard or the Advanced bot creation mode, you will be able to select your signal as your deal state condition.(2)

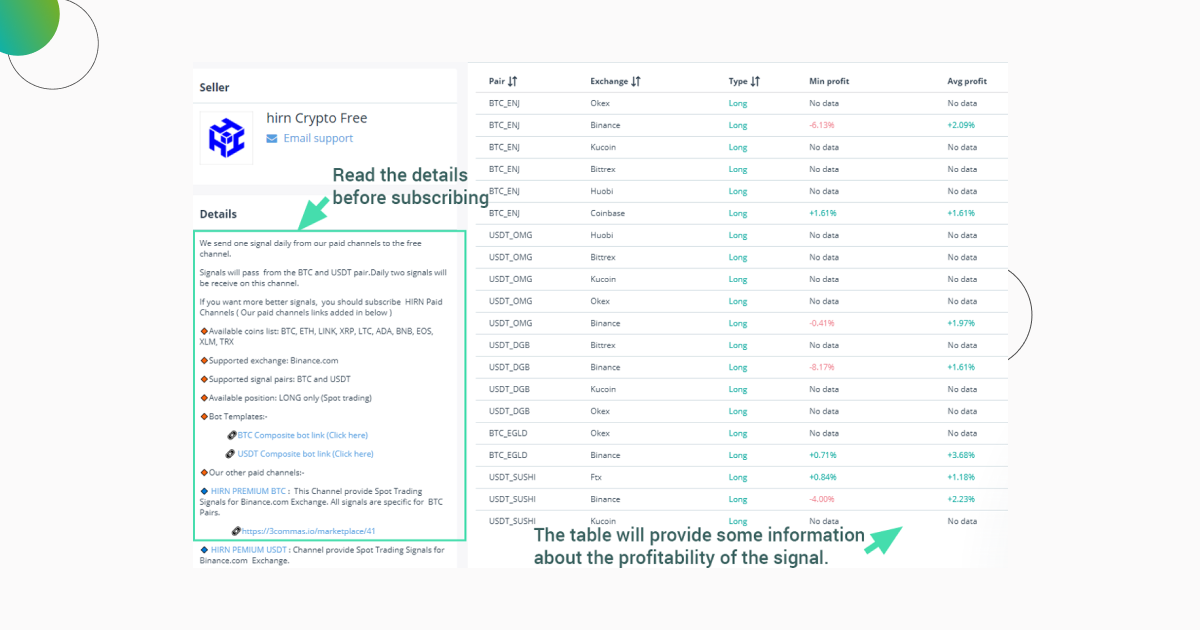

This signal will control your bot and open and close trades on your behalf. Before you activate it, make sure you thoroughly read about how this particular signal works and its intended use. You will be able to find all of this information in the datasheet of the signal on the marketplace.

Finally, make sure you check the profitability information of the 3Commas bot strategies that use these signals. It’s worth mentioning that these scores are granted by 3Commas itself and represent an impartial view of the bot’s performances.

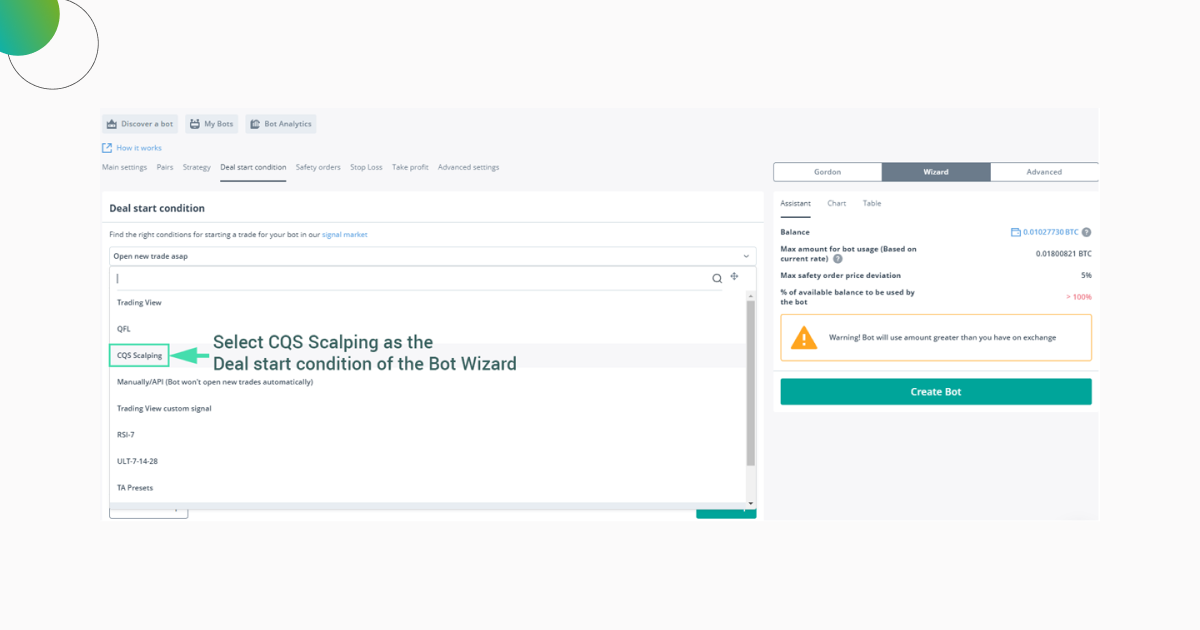

Premium CQS Signals on 3commas

The Crypto Quality Signals or CQS on 3commas, is one of the most popular signal providers of the platform. Their 3commas CQS scalping signals strategy allows traders to accumulate profits through hundreds of small-profit trades.

Personal 3commas Tradingview Signals

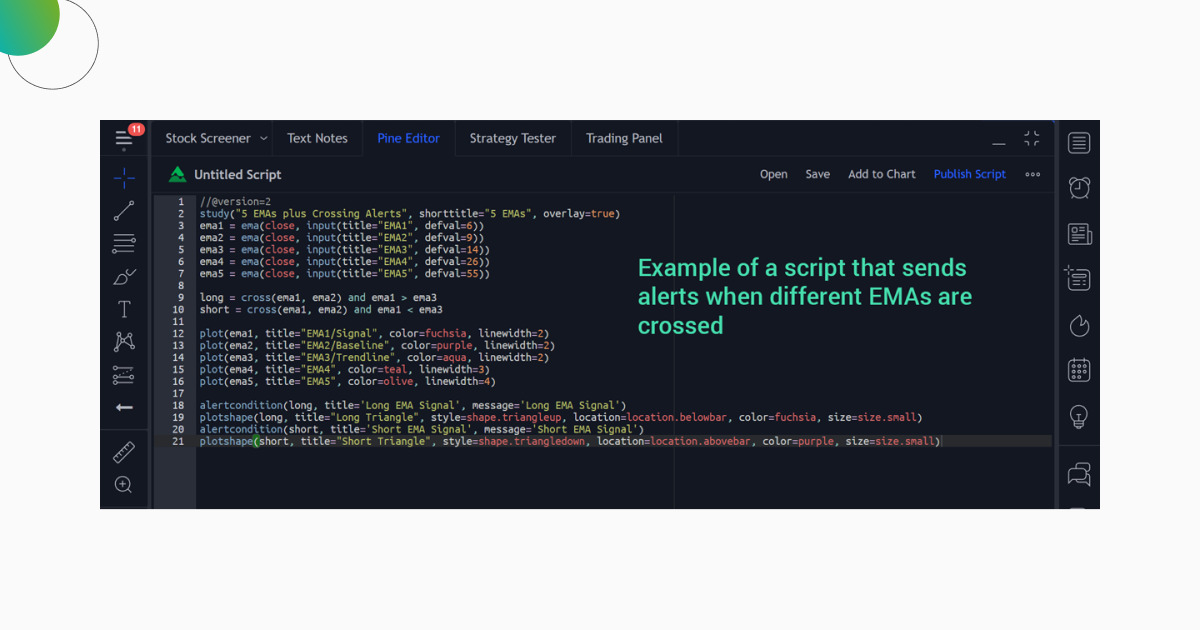

Like we mentioned previously, you can set up your own 3commas Tradingview signals by connecting the app with your Tradingview alerts. The major advantage is that your Tradingview signals can include advanced indicators (MACD, Fib retracement, etc.) that are not available in the advanced bot creator.

This is quite an advanced tool, as it requires that you configure your Tradingview account to send messages to 3Commas each time it generates an alert. It also requires extensive knowledge of Tradingview scripts and the usage of the Pine editor. If you wish to learn how to do this, check out the video.

What is 3commas QFL Signals?

Finally, there’s the 3commas QFL, which stands for Quickfingers Luc. The QFL method for bots as buy signals attempts to find dead cat bounces and is best used for accumulating profits during a macro downtrend.

3commas Exchanges List

A crucial point in this 3Commas bot review is the 3commas exchanges coverage. So, what exchanges does 3commas work on?

Fortunately, 3Commas delivers exceptionally well on this front. It supports no less than 17 different centralized exchanges including:

- Binance

- FTX

- Huobi

- OKEx

- Bybit

- KuCoin

- Gate.io

- BitMEX

- Kraken

- Bitfinex

- Deribit

- Binance US

- Bitstamp

- Gemini

- Bittrex

- Coinbase Pro (GDAX)

- Poloniex

The 3Commas Binance partnership allows it to include all of the variations of the exchange, including its futures markets. Moreover, its terminal provides 3commas Bitfinex bots, as well as a ByBit 3Commas futures market. Worth noting is that the 3commas Coinbase partnership only covers the Coinbase Pro (GDAX) version of the US trading platform.

Main 3commas Settings Review

The 3Commas settings menu is quite straightforward. Here, you will be able to increase your security level and personalize the notifications of your bots, among other things.

Additionally, in the 3 commas settings, you can enable a lite mode to hide some of the more complicated features of the platform. This will enable 3commas simple bot settings which will prevent you from tampering with the bots. This can be useful for beginners, as they won’t be able to modify the 3commas bot settings inadvertently which could lead to bad trades.

Remember, the perfect settings for 3commas for your needs will always depend on your trading skillset and understanding of the platform’s mechanics.

3commas Pricing: Is It Worth Your Money?

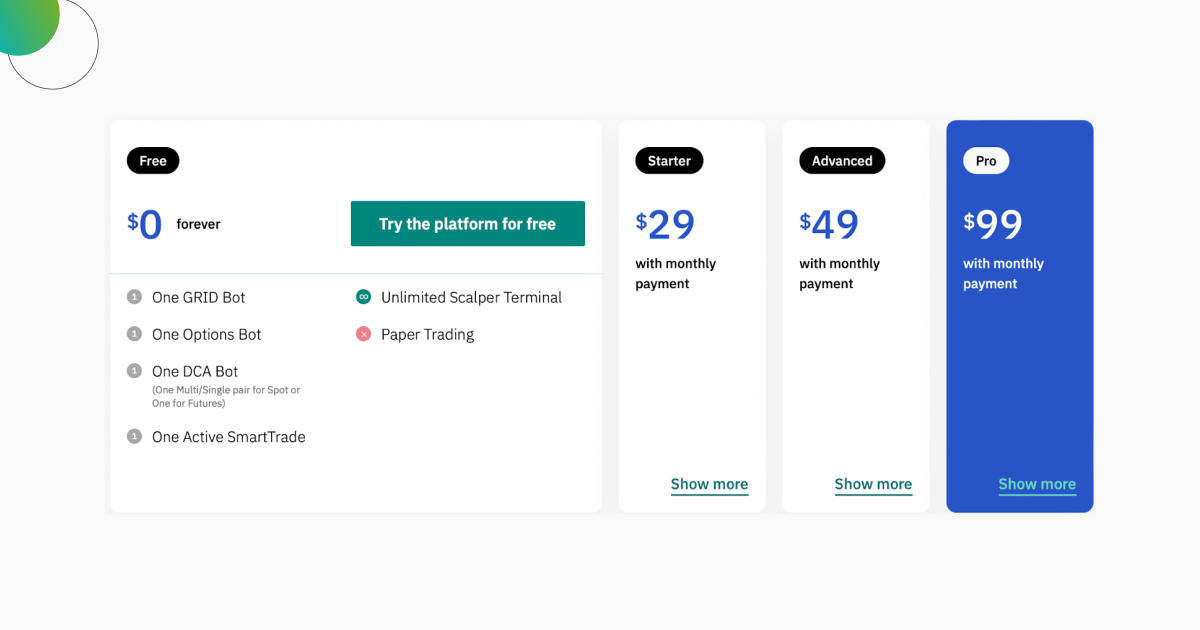

The 3Commas pricing page shows us 4 different plans:

- Free (0$/mo) which includes the portfolio manager, one bot of each type, unlimited scalper terminal and a single active Smart Trade.

- Starter ($29/mo) which includes all of the above, unlimited smart trades, unlimited scalper terminal and paper trading.

- Advanced ($49/mo) which includes all of the above plus unlimited DCA bots.

- Pro ($99/mo) which removes all the bot limits altogether. Realistically, this is the only plan that a serious trader would consider, as all the other ones might hinder your trading options considerably.

Note that the 3commas price does not include 3commas bot usage fees or the trading fees from the exchanges themselves. Fortunately, there’s no additional 3commas commission for the trades you will be executing through the platform.

Is 3commas Safe to Use?

Because it will trade on your behalf, asking yourself “Is 3commas safe to use?” is more than a reasonable question.

While some might have some 3commas trading security risks concerns, there’s no history of major hacks or security breaches. Moreover, it’s secured by multiple 2FA, including a Google Authenticator and an email code in case you switch IPs between logins. All of this lets us believe that 3Commas is quite safe to use.

The Best 3commas Alternative

While there are dozens of bot platforms out there, Cryptohopper stands out as the most logical 3commas alternative. Both platforms provide similar features where users can either personalize their bot or purchase signals on a marketplace. The pricing of 3Commas vs Cryptohopper is also quite comparable.

However, if you are looking for free alternatives to 3commas for portfolio management, want to connect to more exchanges, or are looking for a mobile-first solution, you should look no further than our very own GoodCrypto app.

- Good Crypto’s free version will allow you to manage your portfolio across more exchanges than 3Commas and allows monitoring of non-custodial wallets as well.

- Additionally, the pro version of our app will allow you to access functions similar to 3Commas’ Smart trading like trailing stops, Grid and DCA trading, and many more, for only $9.99/mo, compared to $49.5/mo for 3commas.

- Finally, you’ll get access to Smart Alerts of various types and the Defi Gem Monitor, which helps crypto investors detect new coins with tremendous speculative potential based on TVL and Price Increase within a given period.

All in all, GoodCrypto is a mobile-first trading terminal that might be able to cover all of your dynamic trading needs for a fraction of the price of 3Commas.

Conclusion

To conclude our 3Commas review, we can easily say that it’s one of the best automatic trading platforms currently available. It offers a huge amount of features and incredible bot personalization possibilities. However, this also results in a sometimes overly complex platform that can be quite daunting, even for experienced traders.

If you are intimidated by 3Commas, make sure you give our GoodCrypto app on iOS, Android, or Web a try before committing to a subscription. You might be able to find everything you need in a much more user-friendly and streamlined package altogether.

Get the App. Get Started.

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

December 19, 2022