Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

6 Best Crypto Bots for Grid Trading: Trading Apps Review

- 1. Comparison of Best Crypto Trading Bots for Grid Trading

- 1.1. Grid Trading Bots: Summary

- 2. What is Grid Trading?

- 3. How Does Grid Trading Work?

- 4. The Best Crypto Trading Bot Apps Allowing Grid Trading

- 4.1. 3commas Grid Bot

- 4.1.1. 3Commas pricing

- 4.1.2. 3Commas features

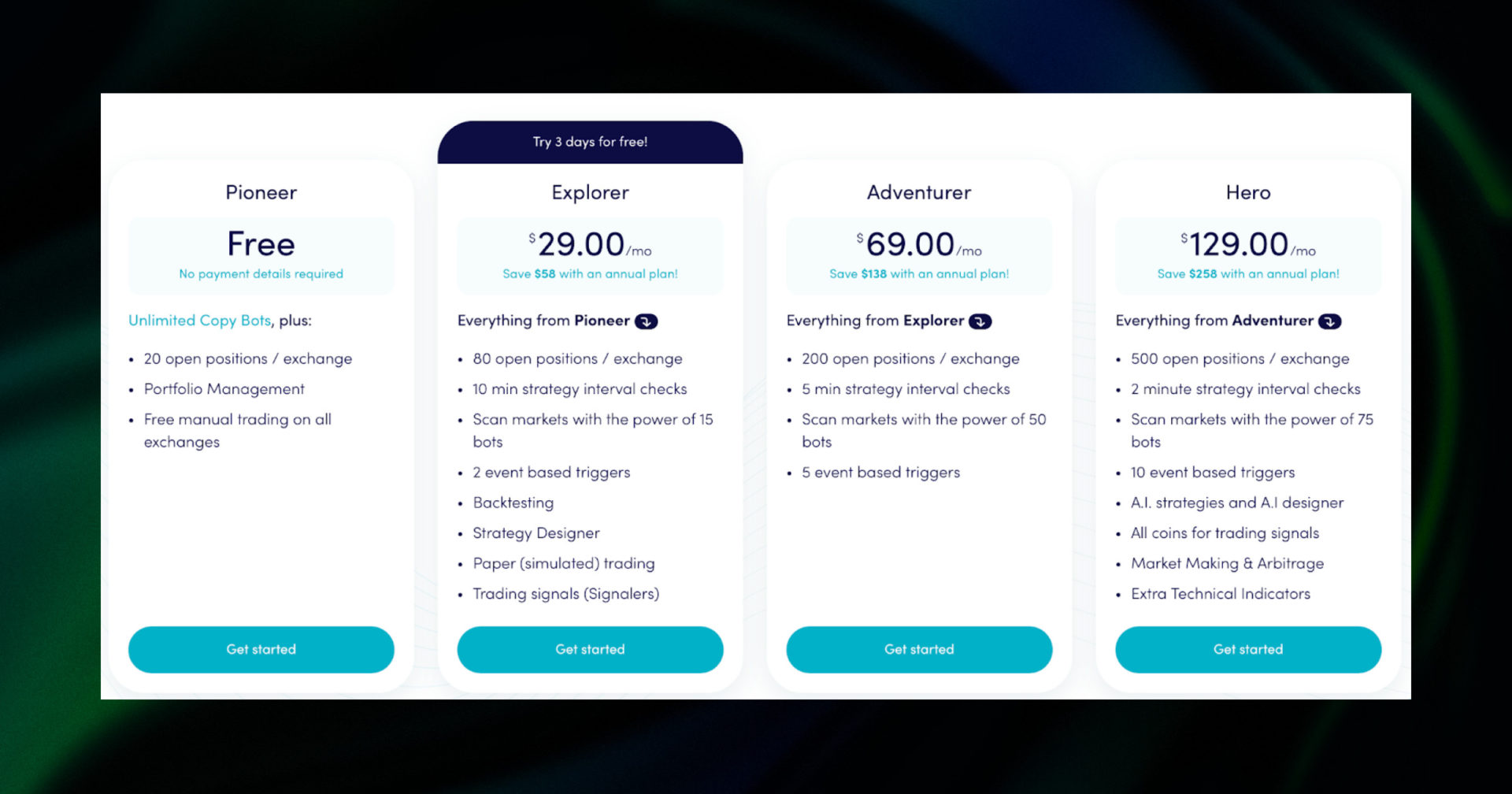

- 4.2. Cryptohopper Grid Bot

- 4.2.1. Cryptohopper pricing

- 4.2.2. Cryptohopper features

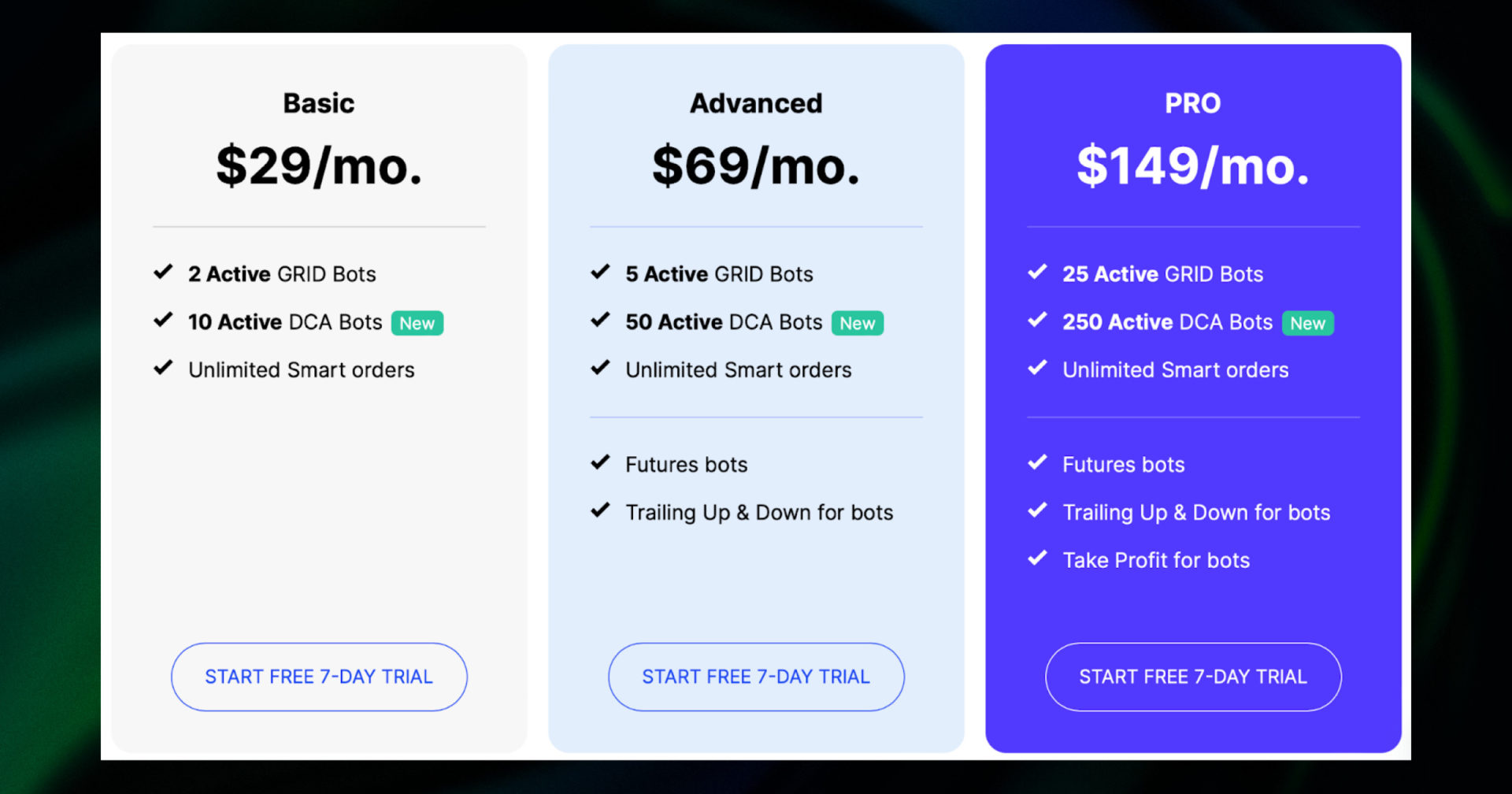

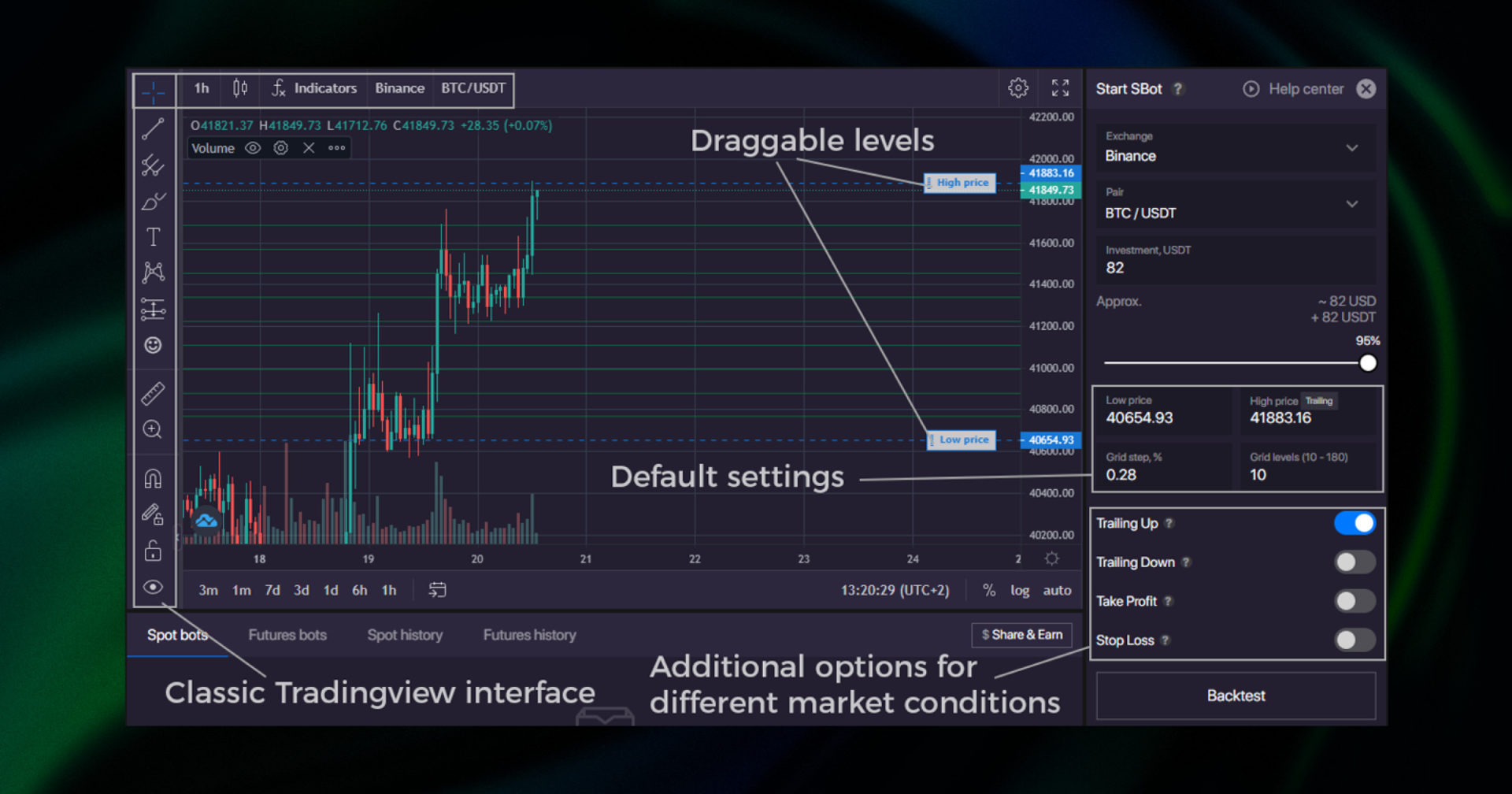

- 4.3. Bitsgap Grid Bot

- 4.3.1. Bitsgap pricing

- 4.3.2. Bitsgap features

- 4.4. Bituniverse Grid Trading Bot

- 4.4.1. Bituniverse features

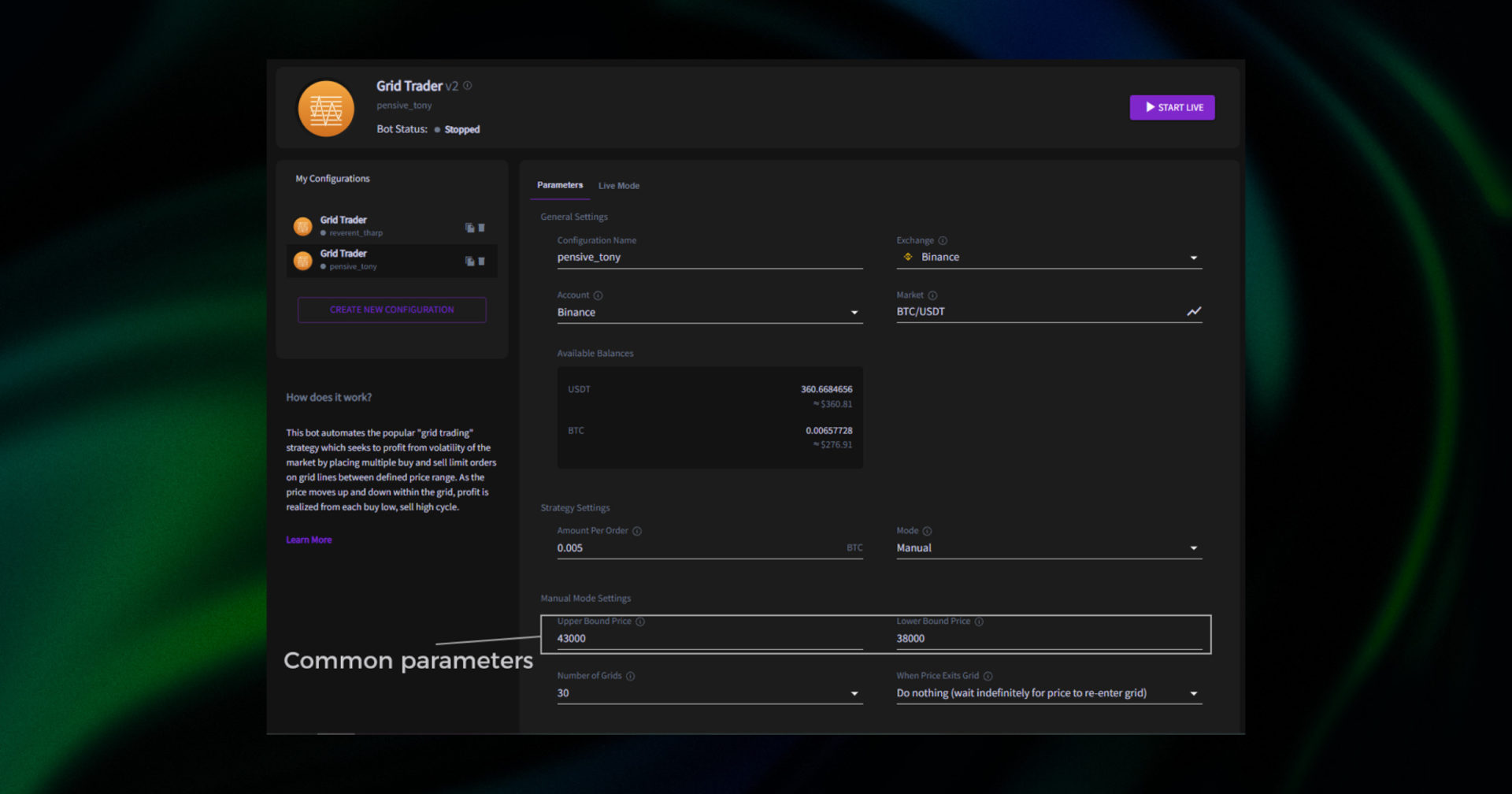

- 4.5. Quadency Grid Bot

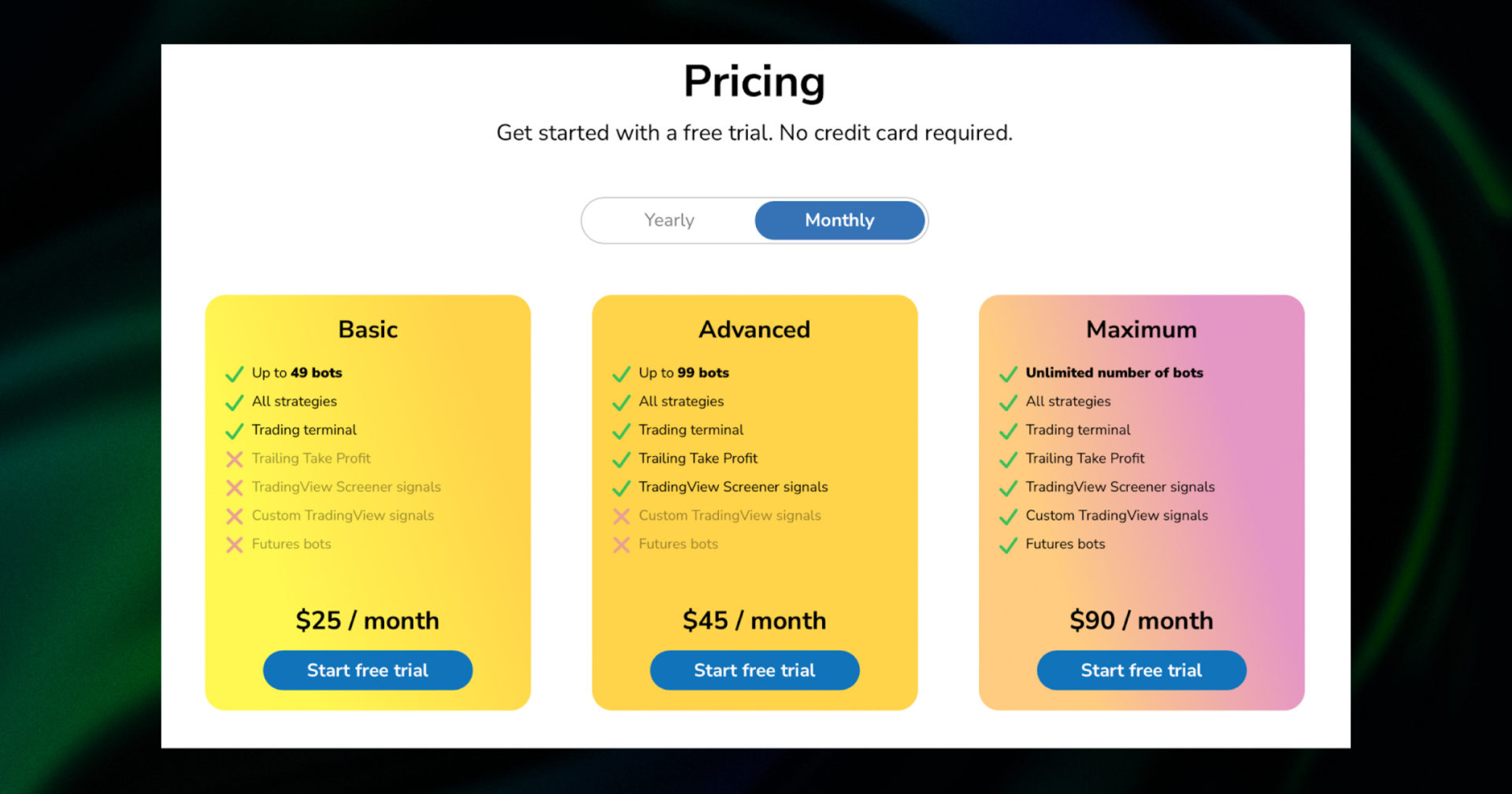

- 4.6. Tradesanta Grid Bot

- 4.6.1. Tradesanta pricing

- 4.6.2. Tradesanta features

- 5. Grid Trading With The Good Crypto: Grid Bot Overview

- 5.1. GoodCrypto pricing

- 5.2. GoodCrypto features

- 6. How To Find The Best Crypto Pairs For Grid Trading?

- 7. Is Grid Trading Profitable

- 8. Pros and Cons of Grid Trading

- 9. Conclusion: What grid bot to use?

Trading crypto can be quite profitable, albeit extremely stressful at the same time. Hence, using a bot trading app can be very helpful to alleviate some of this tedium. And thanks to its relative simplicity, grid trading is an extremely popular method of setting up automated trading strategies.

In this GoodCrypto article, we explore crypto grid trading and analyze the best crypto trading bot app available on the market. We compare their most essential trading grid features to provide you with a comprehensible crypto trading bots comparison table.

So, if you are looking to get started with grid trading crypto, this post should give you a pretty good idea of how grid trading works and the best crypto bot trading app to set up your strategy. First things first, let’s see what is grid trading and why it’s so popular.

Comparison of Best Crypto Trading Bots for Grid Trading

For those getting started with grid trading, this grid trading bots comparison table should give you a good idea of what features the top competitors in this niche are offering.

|

3commaas |

Cryptohopper |

Bitsgap |

Quadency |

TradeSanta |

GoodCrypto |

|

|

Cost/ Number of active bots |

$59/mo 50 bots |

$69/mo 1 bot |

$149/mo 25 bots |

Free |

$90/mo unlimited |

$14.990/mo unlimited |

|

Cross Platform |

Yes |

Yes |

No |

Yes |

Yes |

Yes |

|

Types of markets |

Spot + Derivatives |

Spot |

Spot + Derivatives |

Spot |

Spot + Derivatives |

Spot + Derivatives |

|

Number of spot exchanges |

13 |

17 |

16 |

13 |

8 |

30 |

|

Number of derivatives exchanges |

5 |

0 |

3 |

0 |

2 |

8 |

|

Max grid levels |

162 |

N/A |

100 |

50 |

N/A |

100 |

|

Visualization aids |

Good |

No |

Great |

No |

No |

Great |

|

Analytics |

Good |

Average |

Great |

N/A |

Good |

Great |

|

Ease of use |

4/5 |

1/5 |

5/5 |

2/5 |

2/5 |

5/5 |

|

Our Score |

4/5 |

1/5 |

4.5/5 |

0.5/5 |

2/5 |

4.7/5 |

Grid Trading Bots: Summary

The top Three Grid Trading Bots on the crypto market are represented by – Good Crypto, Bitsgap, and 3Commas. The winners in each grid trading bots assessment category:

- Cost/number of active bots – GoodCrypto with 10 active bots for only $14.99/mo.

- Types of markets and number of exchanges – GoodCrypto with 36 spot markets and 8 derivatives.

- Max grid levels – 3Commas with 201 grid lines.

- Visualization aids and analytics – GoodCrypto with draggable price levels and an exhaustive PnL page for every bot.

Keep reading our grid bot review to find out how we got to these results.

What is Grid Trading?

Grid trading is an automated trading method that allows you to set up a buy and sell strategy using a crypto bot trading app. A crypto grid trading strategy works best when it’s applied on a ranging market. This means that when using grid bot trading, the price should be trending sideways, without any momentum in a particular direction. The goal with bot grid trading is to split this range into multiple buy and sell levels, and capitalize on each price movement that crosses these levels.

How Does Grid Trading Work?

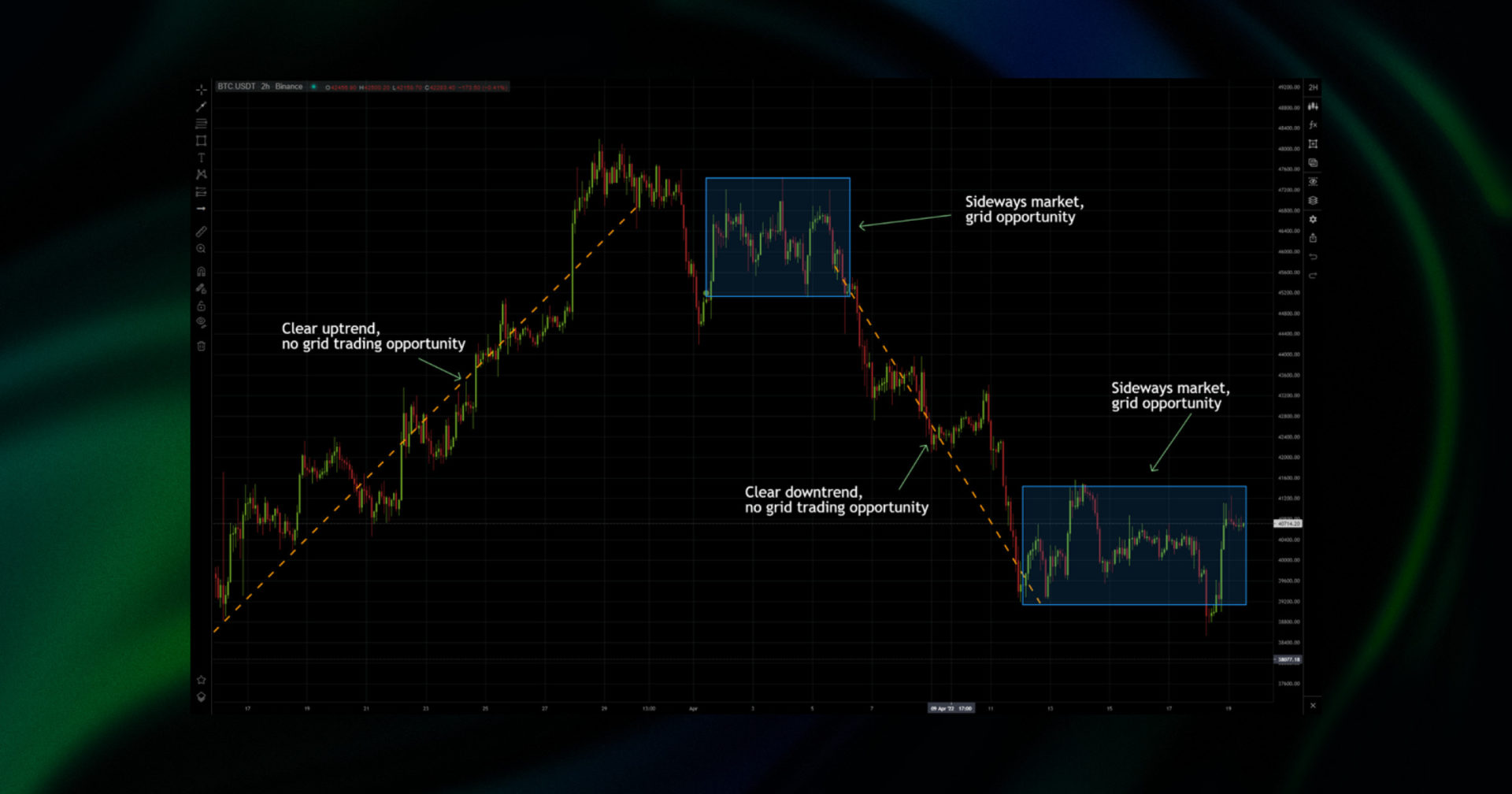

To make things easier to understand, let’s give you a quick rundown on how does grid trading work. To have the grid trading bot explained simply, we will use the charting tools and grid settings of GoodCrypto.

As we mentioned, grid trading works best in a sideways market, because it capitalizes on making multiple trades within a range. This means that you need to assess the top and bottom levels of the market range, which will serve as a basis for your grid trading system. Next, you need to form your trade grid by placing equally distant lines between these levels, where the bot will place limit trade orders on your behalf.

However, the best way to have grid trading explained in the simplest manner, is to provide you with a grid trading example.

In the BTC/USD 2H chart above you can see two distinct openings for setting up a grid trade. Let’s zoom in on the most recent opportunity.

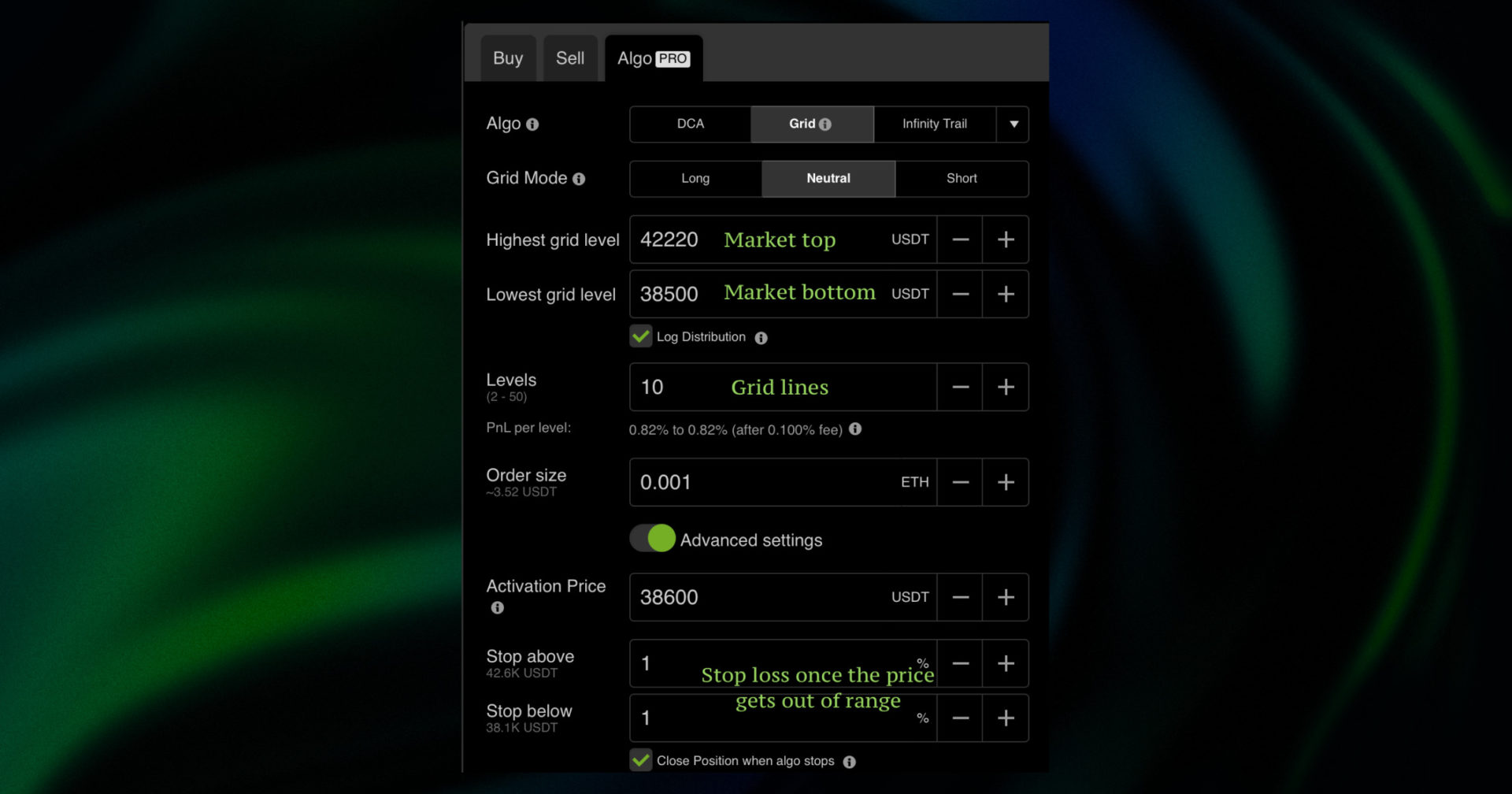

Here, we can define a range between support at $38500 and resistance at $42200, where we believe the price will keep trending.

By entering your preferences (number of grid lines, stop loss), the grid trading algorithm will populate the chart and open the required limit orders.

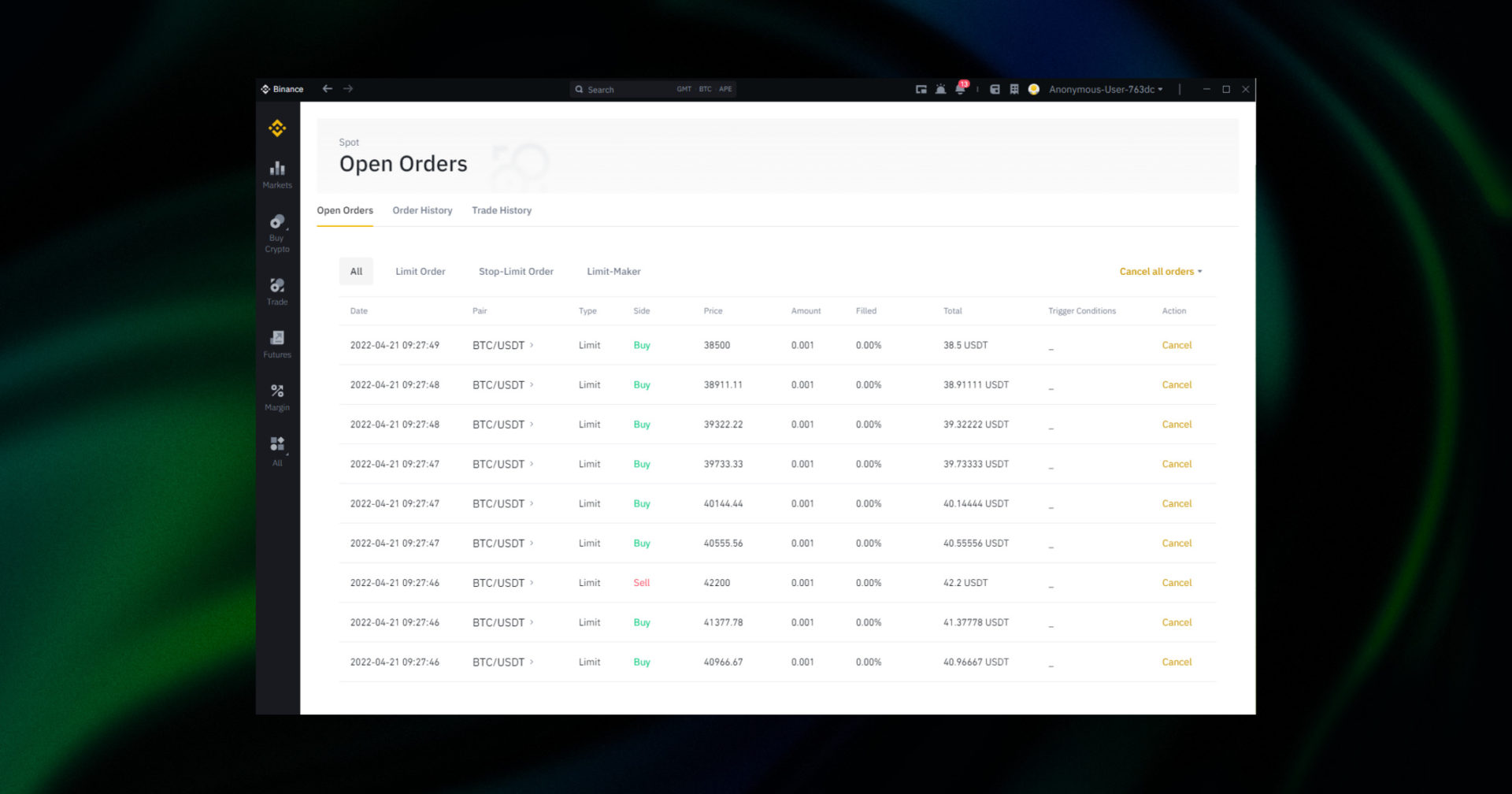

If you consult the open orders on your exchange, you will notice that the bot has opened orders for every grid line. Every small circle with a dot represents an actual open order on the exchange, providing you direct visualization of what orders have been placed. This way, you don’t have to go back and forth between the GC app and the exchange to see what orders have been effectively opened.

Every time the trading bot crypto app fulfills an order, it will open an opposing order on the previous level. The visualization aid will draw a filled circle on the chart (red/sell or green/buy), signaling that the order has been executed. This automatic trading carries on until the price exits the range, hits the stop loss, or the user stops the bot manually.

With those basics about grid crypto trading out of the way, let’s have a look at the trading crypto bots comparison.

The Best Crypto Trading Bot Apps Allowing Grid Trading

For those of you that wish to get a more in-depth view of the best trading bot apps, we thoroughly tested the grid crypto trading features of what the market has on offer. To select the best bot trading apps, we reviewed their most relevant characteristics and features in this regard.

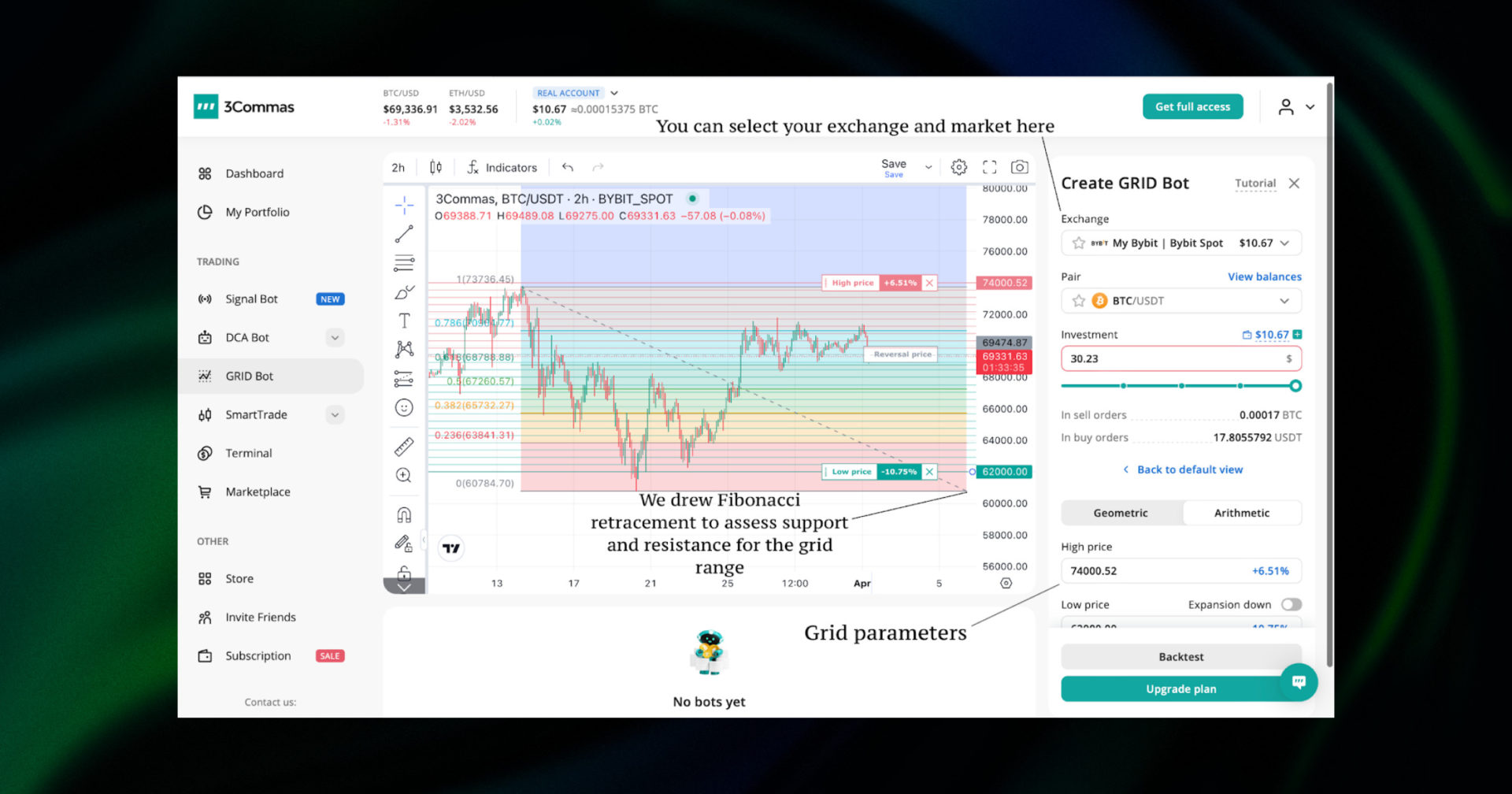

3commas Grid Bot

3Commas is a versatile trading platform that offers a wide variety of features that you can consult in our in-detail review. However, what interests us today is the 3commas grid bot and its features.

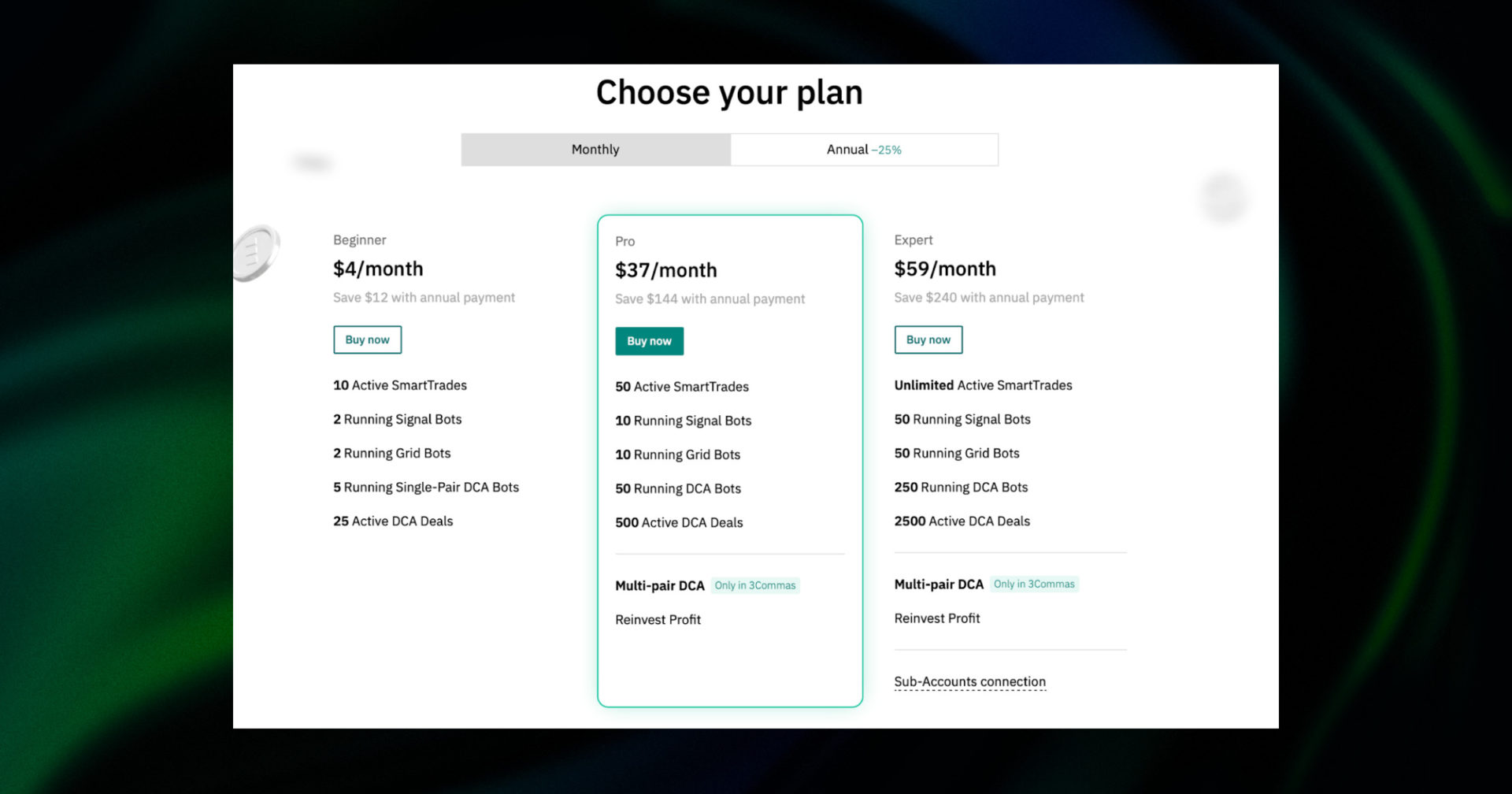

3Commas pricing

The basic features of the grid bot 3commas can be accessed for free. However, the free plan only allows for a single active grid crypto trading bot, which might be insufficient for most traders.

The beginner plan offers an additional 3commas grid trading bot. However, if you want to add more bots to your 3commas grid bot strategy, you will have to opt-in for the Pro or Expert plan. The Pro plan will cost you $49/mo ($37/mo if paid yearly), while Expert plan, featuring 50 active grid bots, is available at $79/mo ($59/mo if paid yearly), which is quite steep compared to the competition.

Only the Pro plan allows additional grid bots on 3Commas

3Commas features

To emphasize versatility, the grid trading bot 3commas supports 14 exchanges in total. Out of these, the 3commas grid bot ai strategy can be used on 11 spot exchanges and 4 derivatives exchanges.

Regarding the interface, the 3commas grid bot setup is quite intuitive. Choosing the 3commas ai grid bot will place your grid automatically, while the manual mode will allow you to fine-tune your selection. The 3commas bot settings allow you to place as many as 162 grid lines. This should allow you to set up your 3commas grid bot strategy for intraday trading by executing a high frequency of orders.

The right centre of the interface offers live visualization of the grid, directly on the chart. Additional features include draggable top and bottom lines, which can be quite handy if you want to line them up with the Fibonacci retracement.

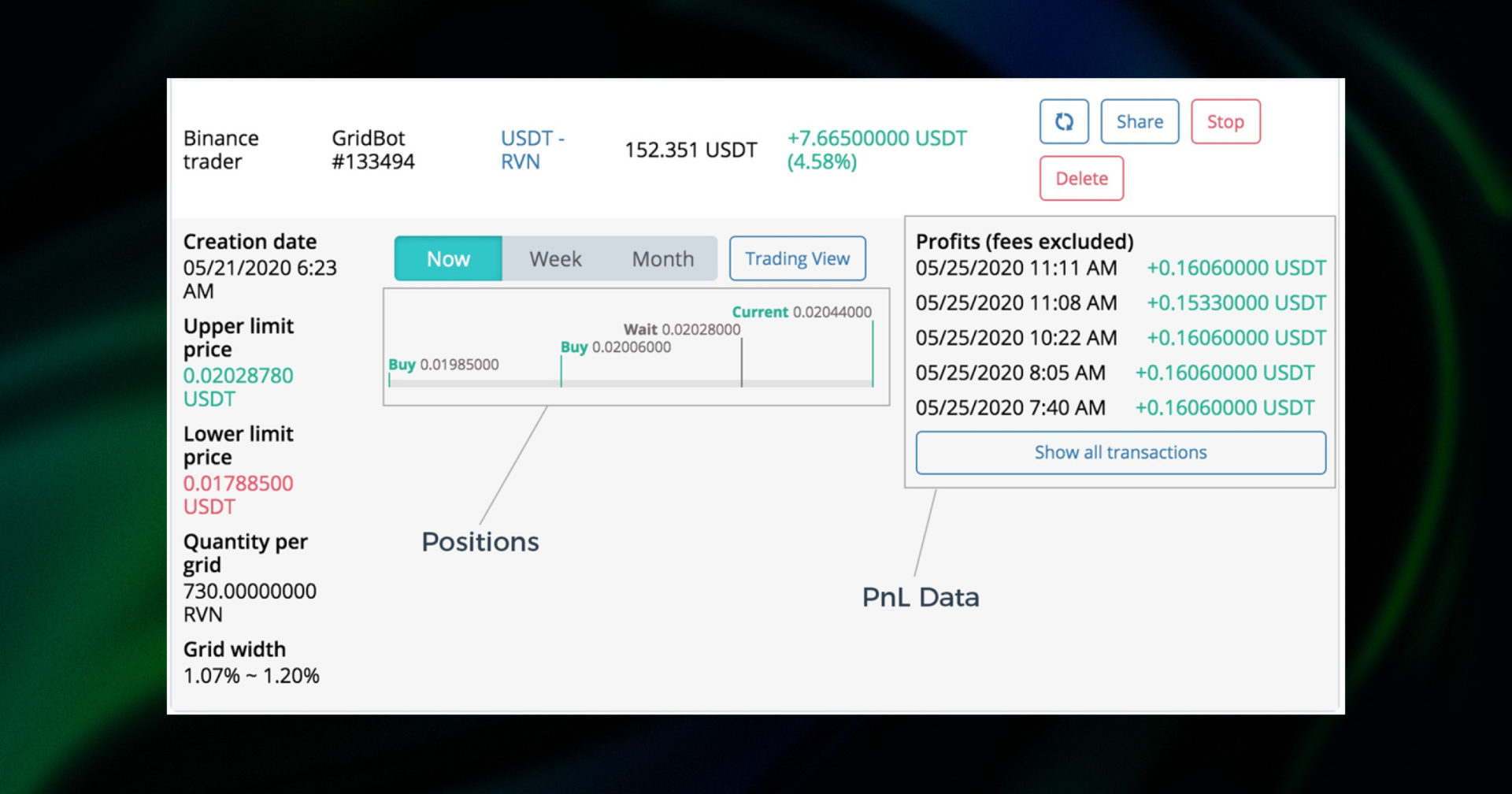

Finally, it’s worth noting that the 3commas grid bot profit and loss (PnL) information will appear just under the grid trading 3commas interface. You will be able to find the data for every bot you launched and details for every trade the bot has executed.

All in all, 3Commas provides one of the clearest and most user-friendly interfaces for grid trading on the market.

Cryptohopper Grid Bot

Cryptohopper is a social trading platform that offers a wide variety of strategies to its users, accessible through a bot marketplace. Here, users can download strategies and templates from other traders for free or in exchange for a single-time fee.

The platform also allows you to create your own bots by using more than 30 different indicators and charting patterns. Keep in mind that this process can be somewhat complicated if you are a beginner.

However, if you are looking for a run-of-the-mill Cryptohopper grid bot, you might be disappointed. The platform doesn’t offer a configurable grid bot out of the box like GoodCrypto or 3Commas, for example. Instead, you can:

- Download a pre-made grid bot from a strategy provider on the marketplace (e.g. the IAG Grid Trading Strategy)

- Create your own by learning the advanced features of Cryptohopper.

So you can still do some Cryptohopper grid trading, albeit in an unconventional manner.

Cryptohopper pricing

Unlike other platforms, Cryptohopper doesn’t restrict the number of bots. Instead it limits the number of active positions and trading pairs, with each plan opening more opportunities. Consequently, the best choice here might be the Adventurer plan for $69/mo. This will allow for 200 open positions, which is the sweet spot for intraday trading.

Cryptohopper features

We can’t really elaborate on the grid bot features of Cryptohopper, as the platform doesn’t offer a traditional grid bot setup. That said, the platform supports 17 exchanges, but you can only trade on spot markets.

The main feature of what makes Cryptohopper so popular is mirror trading. You can buy signals on the marketplace and follow proven strategies without having to configure anything by yourself. The only caveat is finding an existing Cryptohopper grid bot strategy will be difficult, if not impossible.

This means that you will have to go through the very steep learning curve of creating one yourself. And although the platform provides ample tutorials and guides, get ready for hours of trial and error using Cryptohopper’s intuitive interface.

Bitsgap Grid Bot

Bitsgap is an automated trading platform that offers a wide variety of services including DCA, grid bots, and BTD bot (only for spot trading).

Additionally, the platform provides users with previously tested grid strategies on hundreds of different trading pairs. This allows you to use the Bitsgap grid bot in proven and profitable scenarios. All in all, Bitsgap grid trading provides some good versatility and a powerful and intuitive bot creation interface.

Bitsgap pricing

Unfortunately, Bitsgap doesn’t come in a free version. However, you can access a 7-day free trial and upon its completion, you will be required to opt for one of its three plans.

Bitsgap’s Advanced subscription which costs $69/mo will give you access to most of its features, including 5 active grid bots and futures trading.

Bitsgap features

Bitsgap supports 16 exchanges total, however, you will be able to use the grid bot on only 15. Additionally, you can trade derivatives on 3 of those exchanges.

The interface is quite intuitive, providing you with a live view of your grid on the selected trading pair chart. Since Bitsgap uses the Tradingview API, you will find most of the usual indicators and charting tools here. This includes draggable top and bottom ranges which directly translate into your bot settings.

The Bitsgap grid levels are limited to 100, which is ample for any type of trading you might want to partake in. However, the best features lie in the bot setup. You can either set a fixed order size or a grid step in percentages. This latter option allows you to easily assess the profits you might make with each trade.

Some additional, and welcome features of the bot include:

- A trailing up function that automatically moves the grid upwards as the market goes up.

- A trailing down function that automatically moves the grid downwards as the market goes down.

- A take-profit function that will shut down the bot once your account has reached a certain profit threshold.

- A stop-loss function that will shut down the bot and sell its base currency once the price reaches the Stop Loss condition.

- A pump protection function that will prevent the bot from following the price up in case of a pump and down in case of a dump.

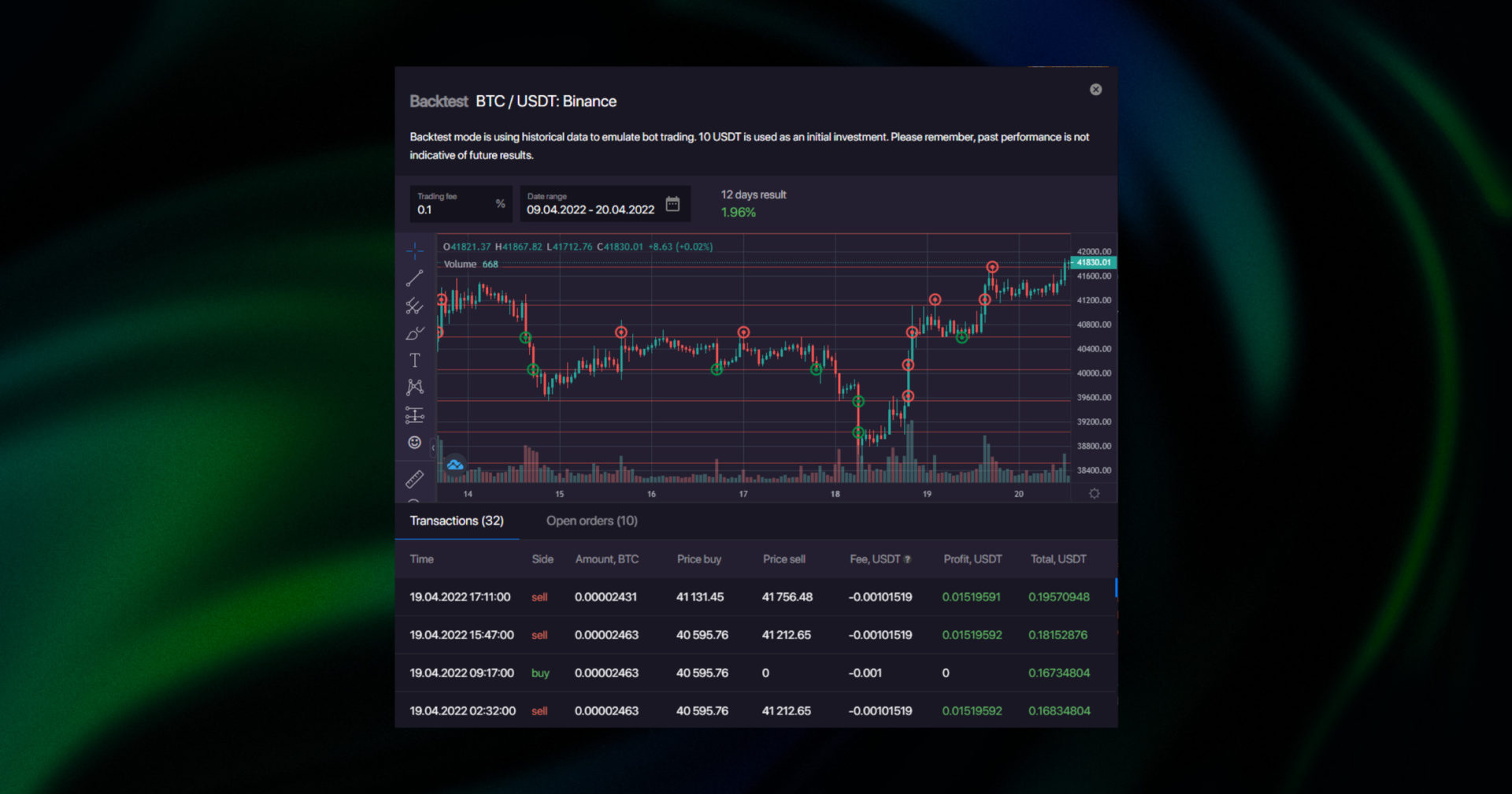

You can also backtest your strategy to see how it fares in similar market conditions in the past.

Finally, Bitsgap provides a detailed profit/loss window for your bots.

In this window, you will have a complete view of bots’ performances, including PnL percentages, amounts, and benchmarks.

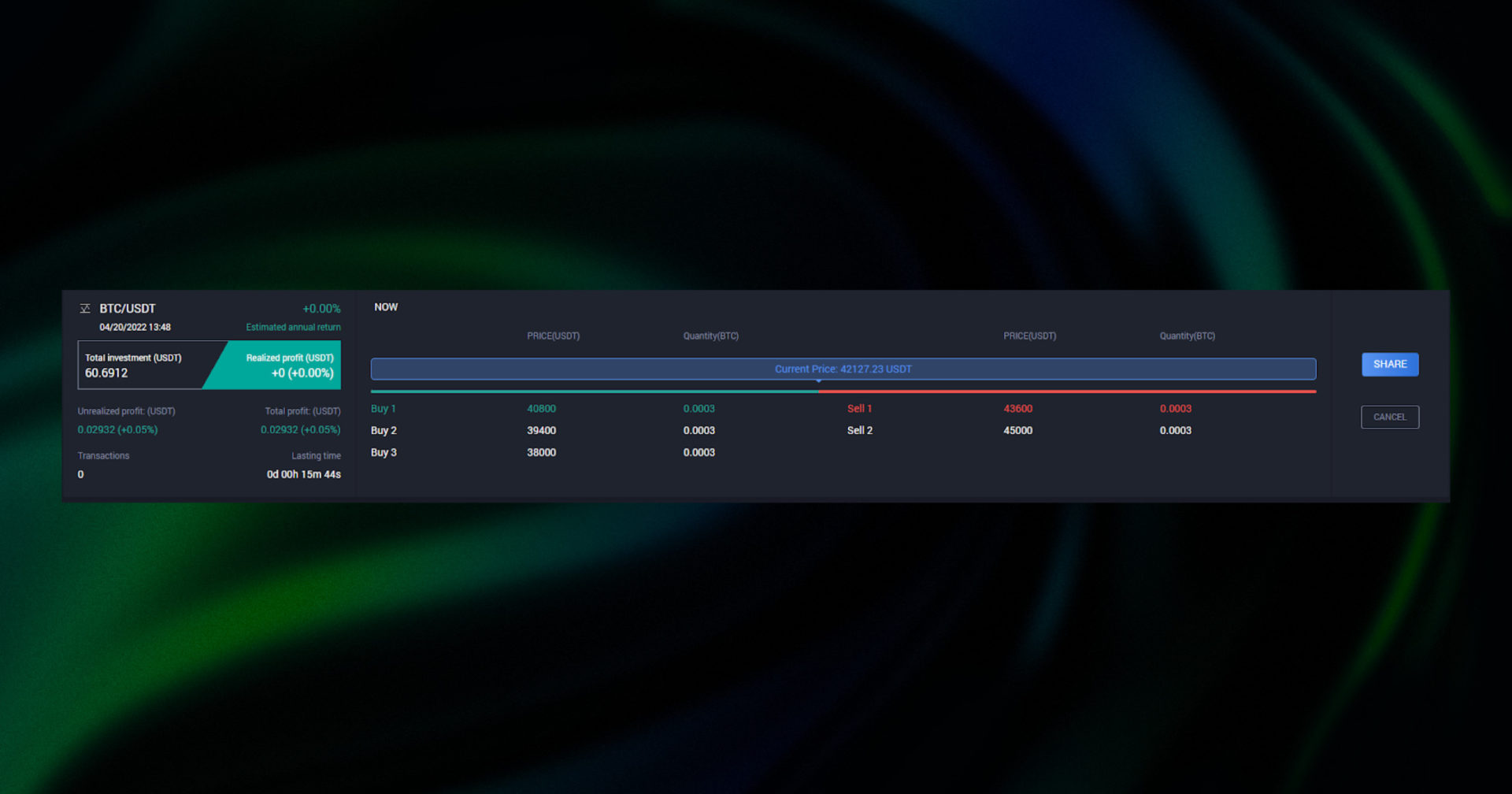

Bituniverse Grid Trading Bot

BitUniverse is a free trading platform that offers spot trading and the ability to create automated market orders. The BitUniverse grid trading bot is accompanied by trailing take profit orders and stop limit orders. It supports 26 exchanges, but only spot trading is available.

Bituniverse features

The BitUniverse grid trading is quite easy to grasp. The platform allows you to create a BitUniverse grid bot using either an AI-enhanced strategy, or set your parameters manually. The former often represents the best grid trading strategy BitUniverse for beginners. Moreover, the app allows you to set up to 99 grid levels, which is a fair tradeoff considering it’s entirely free.

Just like the competition, you will be able to use your favorite charting tools here. However, a feature that is lacking is the visualization of your BitUniverse grid on your chart. You can set up your usual BitUniverse grid trade parameters manually, but you won’t be able to see the grid levels. It’s extremely inconvenient.

The only way to see your BitUniverse grid profits is through your bot list. This interface is a bit barebones and includes only the essential information about your PnL.

However, BitUniverse ceased operations on July 30, 2023, due to the high maintenance costs of supporting APIs from major exchanges. Until that date, their users could continue using the platform without updates or technical support at their own risk. For those interested in trading bots, they recommended trying Pionex exchange, a separate product launched by BitUniverse in 2017.

Quadency Grid Bot

Quadency is another free trading platform that offers automated trading setups. You can use a wide variety of different bots that work with common chart indicators, such as MACD, RSI, etc. The platform only supports spot trading and integrates 7 different exchanges.

The Quadency grid bot is one of the most simplistic bots we’ve had to test in this article. To launch a bot, you will be able to select between an automatic or manual strategy. However, neither is very intuitive as you don’t get any visualization during the Quadency grid trader customization.

Quadency doesn’t offer any visualization tools during bot creation

If you choose the manual setup, you will run into the following issue: Quadency doesn’t provide a position threshold. This means that you will need to manually calculate the position size in correlation to the range and the number of gridlines.

In either case, we never managed to run a single bot instance. For one, the automatic settings were constantly returning errors. The manual bot, on the other hand, managed to launch but stopped immediately afterward. All in all, not the greatest experience for grid trading.

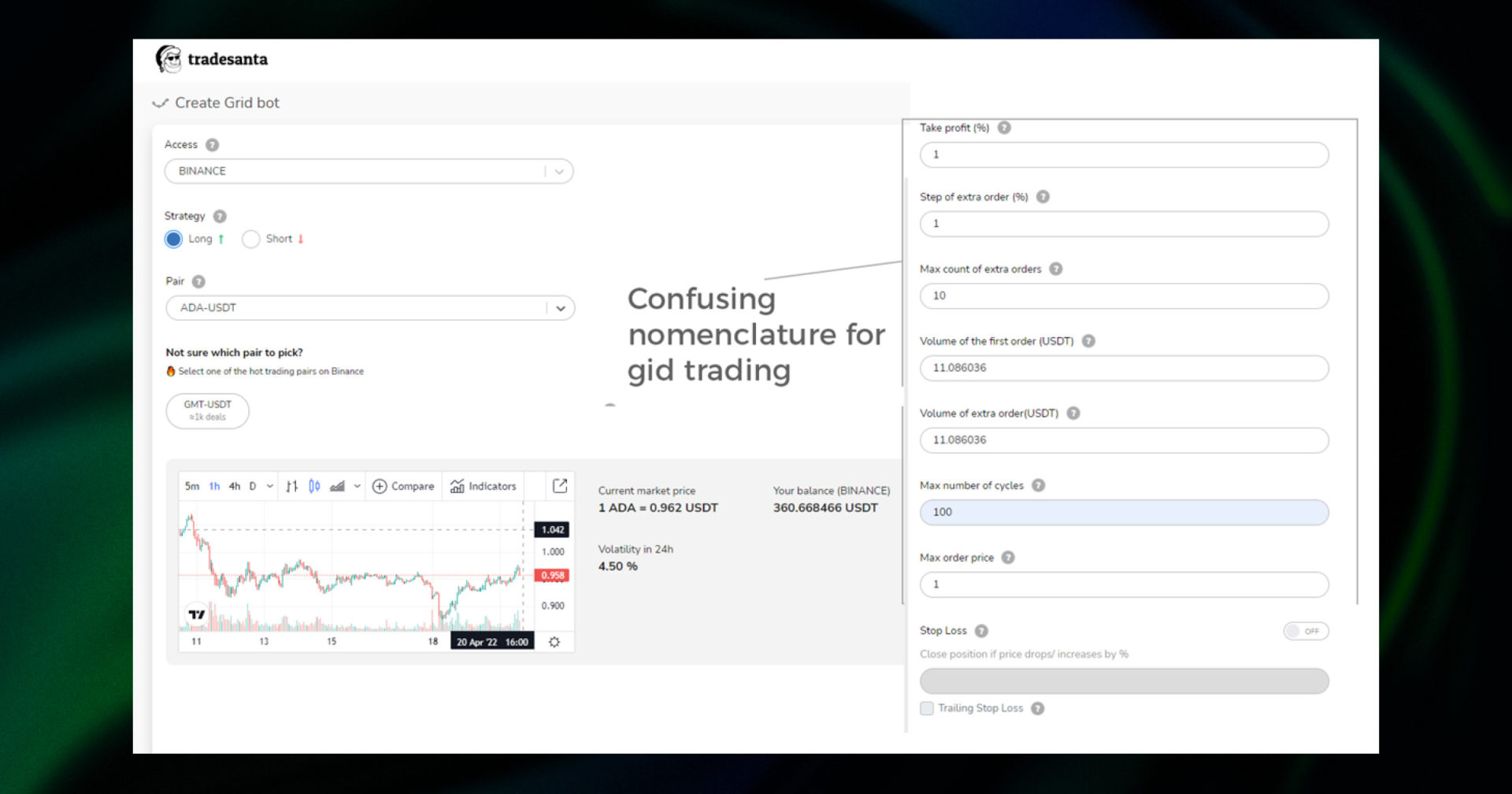

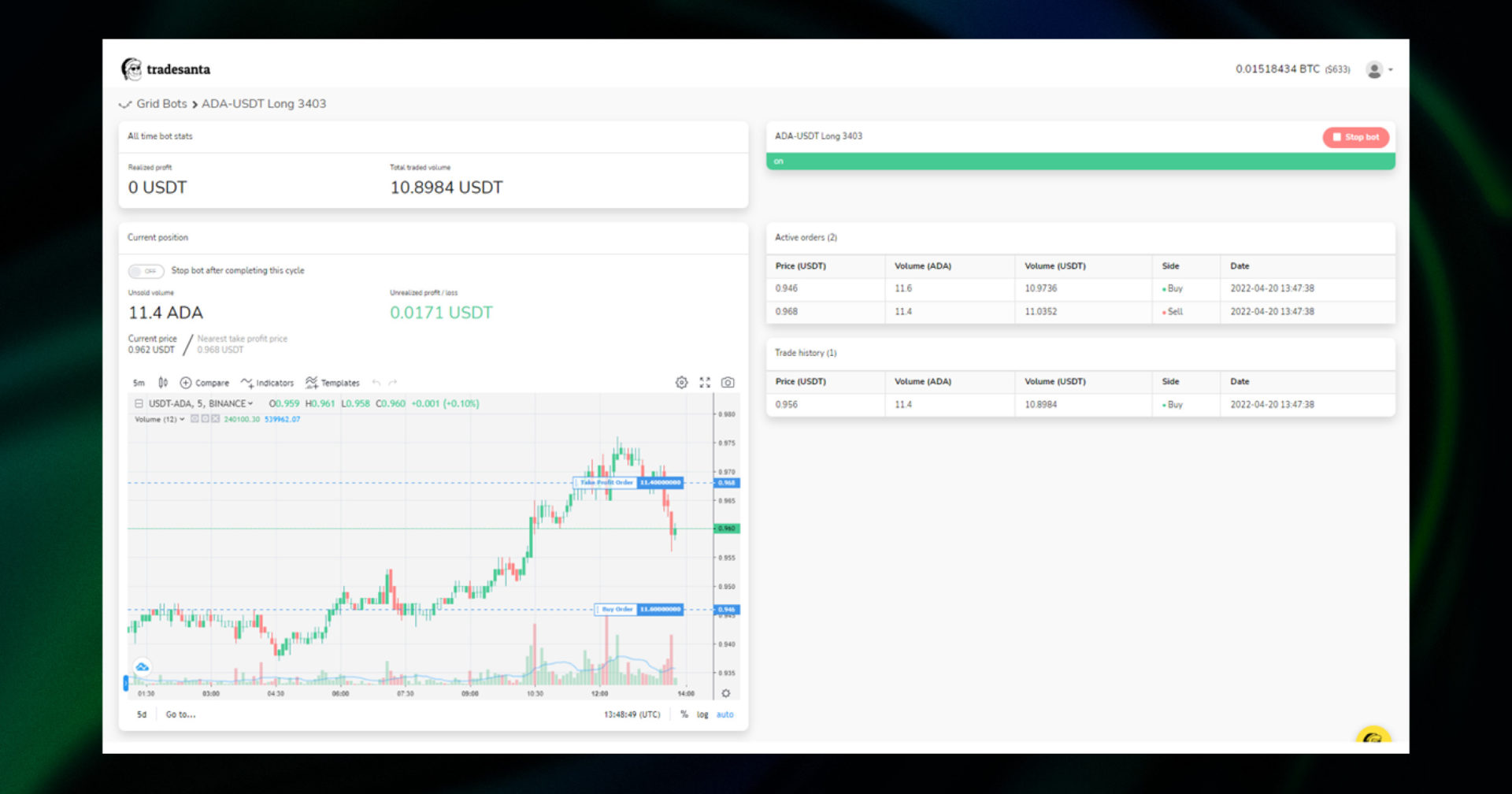

Tradesanta Grid Bot

Tradesanta is a well-known automated trading platform that offers DCA, grid, and futures bots. Similar to 3Commas and Cryptohopper, it includes a bot marketplace where you can copy strategies. The difference here is that copying bots is entirely free on Tradesanta. It supports 9 exchanges in total, and you can trade derivatives on 3 of them.

Tradesanta pricing

Tradesanta offers a free 3-day trial, and upon expiry, you will have the choice between three plans. Each one offers a good number of bots and features.

That said, if you want to trade with derivatives, you will need to opt for the highest plan tier. While this subscription includes everything, $90 is a considerable investment just to be able to access the futures markets.

Tradesanta features

The Tradesanta grid bot comes in two types – long and short. Long bots will buy coins with the quote currency and sell them at a higher price. Conversely, short bots will sell the base currency and buy it at a lower price.

Worth noting is that the Tradesanta grid bot doesn’t create a grid of open orders, but instead starters with a limit order. Once this first order is completed, it creates two extra orders – one take-profit order above the first order and one below.

Consequently, the interface can be a bit unintuitive when creating your bot. You will need to manually set the profit percentages and entry price. Because of this, we found that using the usual range analysis might not be applicable with Tradesanta. Moreover, the platform provides no visualization upon bot creation, which is a huge drawback.

Finally, the bot performance page is comprehensive and provides all the information that you might need regarding your PnL fluctuations.

Grid Trading With The Good Crypto: Grid Bot Overview

Our article would be incomplete if we didn’t mention our very own GoodCrypto app. GoodCrypto is a jack-of-all-trades cryptocurrency platform, offering portfolio and wallet management, as well as support for advanced crypto grid bot trading. In addition to crypto grid bots, the app offers algorithmic trading, including DCA (coming soon) and infinity trailing.

What’s more, you can use the Good Crypto grid trading bot on no less than 36 different exchanges. You can also trade derivatives on 8 of these exchanges.

GoodCrypto pricing

Save from the free offers on this list, GoodCrypto is the most democratic platform in this article, which makes it the best crypto grid bot for the money. For just $14.99/mo, you can access all of the pro features of the platform that are commonly present in more expensive bot apps. Additionally, you can benefit from a solid discount on the yearly plan, as it will cost you just $99.99/year ($8.63/mo).

As we mentioned, there’s only one subscription tier for the grid trading crypto bot which opens access to all of the advanced features of the app.

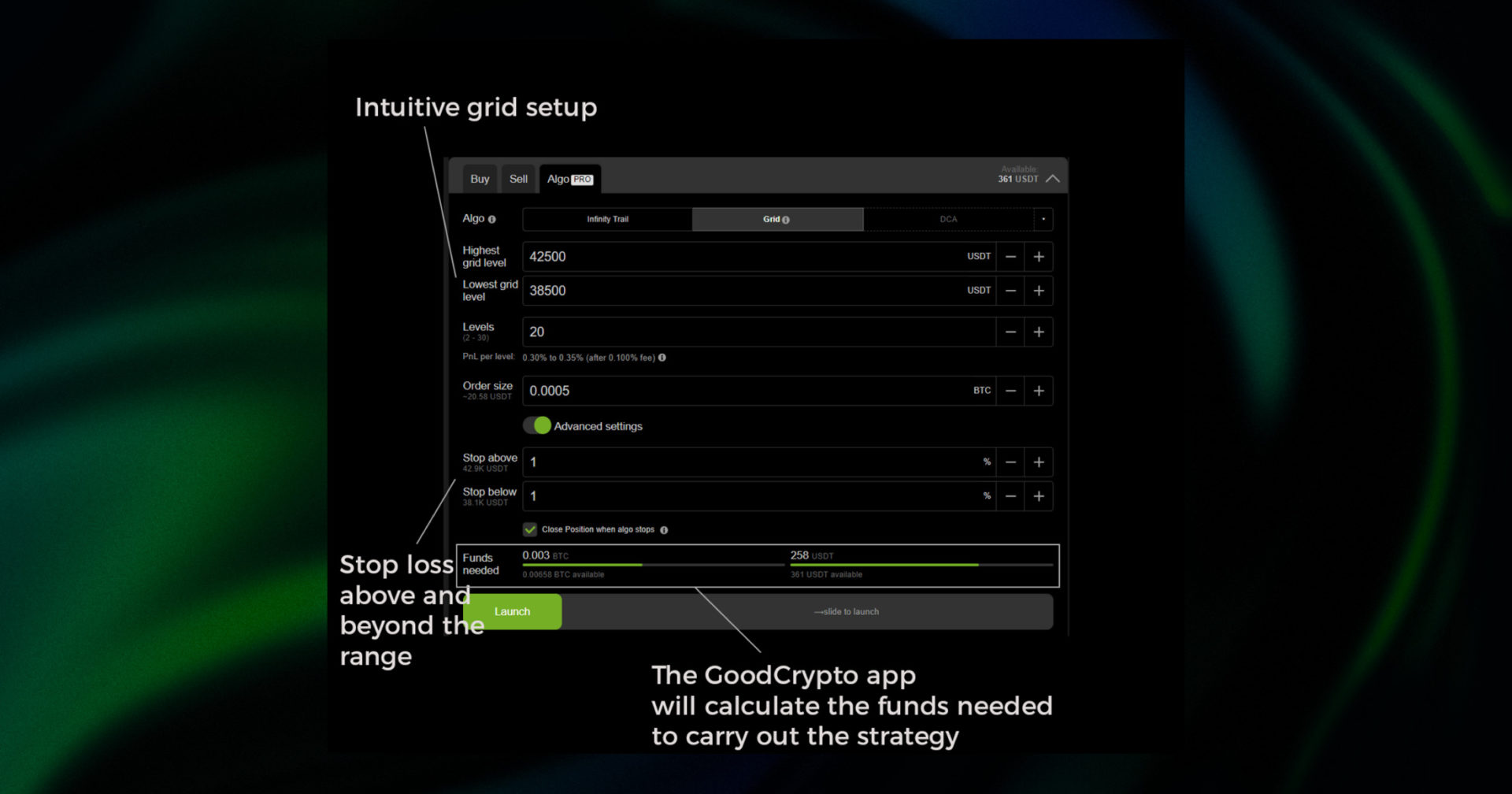

GoodCrypto features

One of the reasons why GoodCrypto is often considered the best grid bot in crypto is the extremely user-friendly interface. The charting tools provide everything you need to conduct your analysis and assess the top and bottom prices for your grid crypto bot. This includes advanced charting tools such as Fibonacci retracement, and more than 70 other technical indicators available in Trading View.

At the same time, the trading bot grid is very easy to set up using intuitive commands. The app provides you with draggable prices and stops, an invaluable tool when configuring your Good Crypto grid bot.

Furthermore, once you’ve set up your trading grid bot range and the number of grid lines (up to 100), the app will automatically calculate your maximum position. This is extremely handy when you want to tweak the risk you take when grid trading with bots.

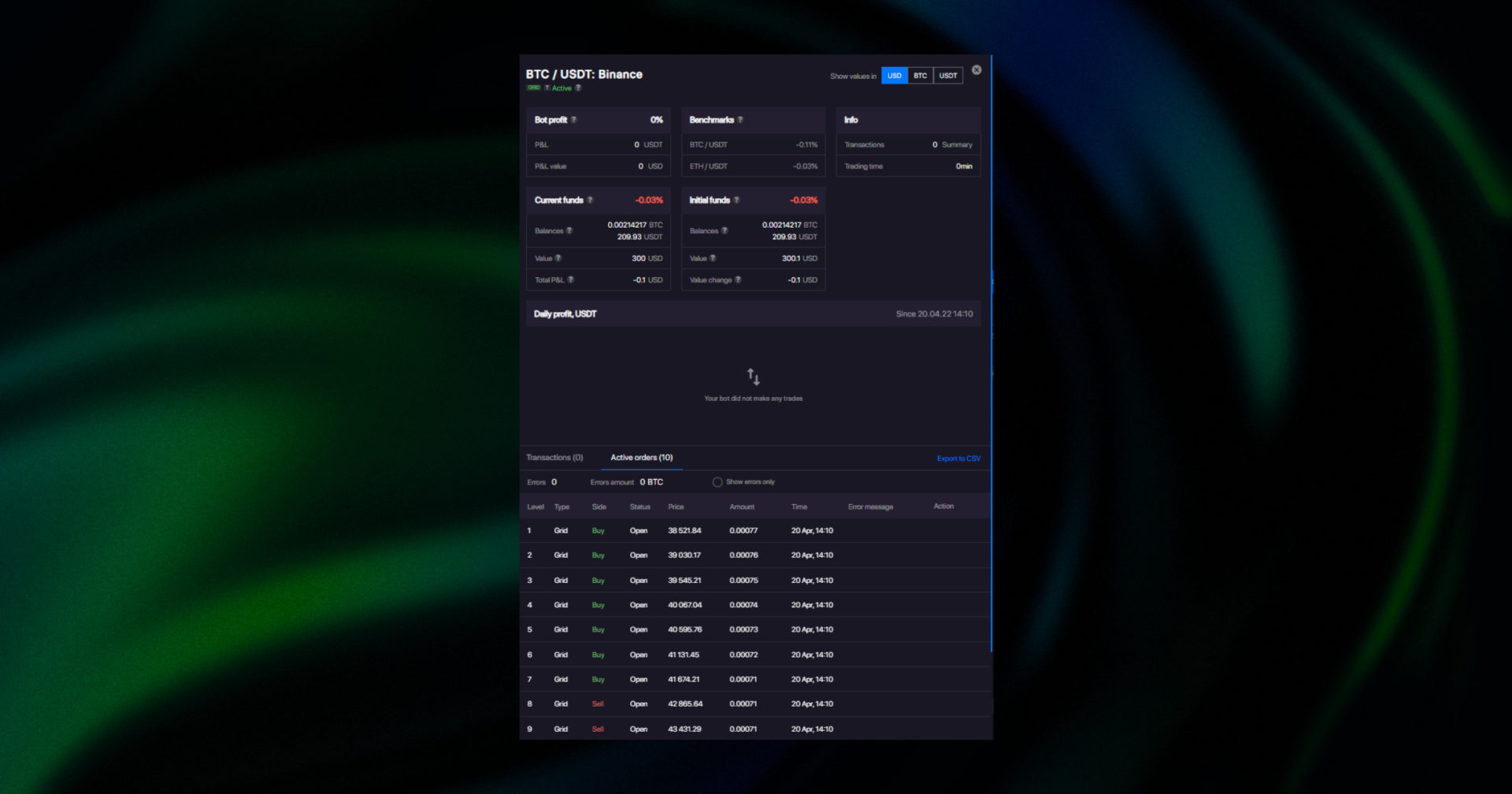

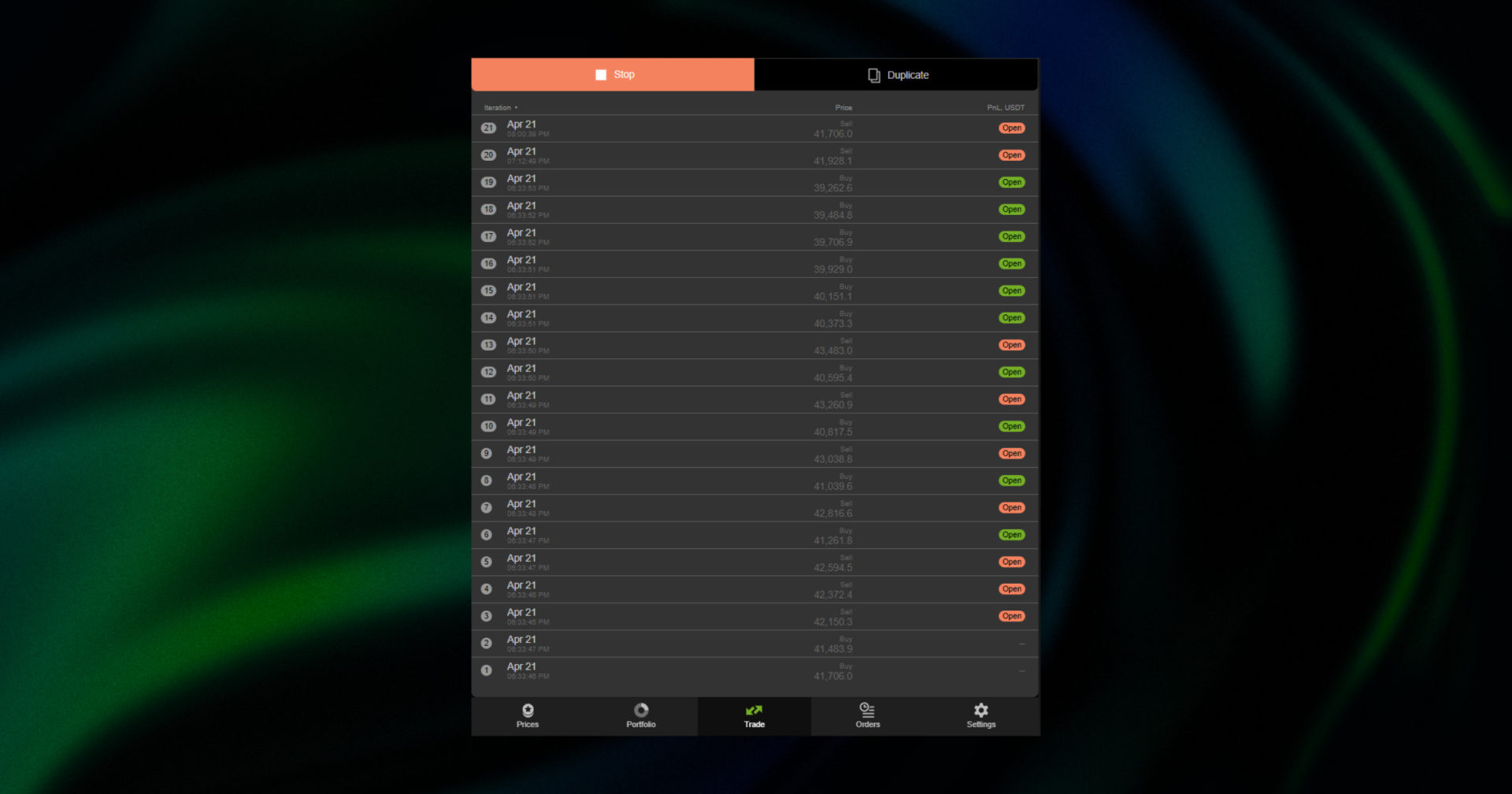

The PnL portion is also quite practical, as it will provide you with all the transactions your bot has made as well as a comprehensive rundown of its performance.

The profitability section contains some incredibly useful information, such as:

- The total PnL of your bot while it’s running (realized+unrealized).

- Realized PnL, of the positions already closed by the bot.

- Unrealized PnL, which is a reflection of the profit or loss that could be realized if the position were closed at that time. This is handy if you wish to stop the bot preemptively.

- The projected APY % of your crypto grid bot, which helps you assess the current bot profitability and compare it to other grid bots as well as investment opportunities like LP and farming protocols.

- The number of open and closed positions, as well as their location on the chart.

Finally, at the bottom of the bot performance page, you will get a full overview of all opened and closed positions and their performance.

Worth noting is that GoodCrypto is a cross-platform app. So every trade you launch on your web app, you will be able to follow on your Android and iOS devices.

How To Find The Best Crypto Pairs For Grid Trading?

Finding the best crypto pairs for grid trading can be quite challenging if the market gains any sort of momentum. So, your best bet to start looking for the best crypto pair for grid trading is to wait for Bitcoin to trade sideways.

Then, it will be a test of patience to scan the market for the best coin for grid trading. To be more precise, you should be looking for coins that show decent volatility (choppy price action), but remain in a certain price range.

The chart above shows you an example of a best currency pair for grid trading with Algorand/BNB. The price has high fluctuations, while simultaneously remaining in a zone between 0.0017 and 0.0018 BNB, which equates to a volatility of 5.5%.

Is Grid Trading Profitable

So, is grid trading profitable? The answer is yes, especially if you are doing it on a regular basis. A grid bot trading can provide ~100 – 300% APY in profits. Depending on the trading pairs, the profitability can even be much higher. The longer the grid bot works, the better.

It’s one of the safest and simplest ways to make profits in a ranging market. That said, there’s still some grid trading risk involved. Crypto markets can gain momentum very quickly and stop you out of your grid, reducing your profits considerably.

Pros and Cons of Grid Trading

Let’s begin wrapping up this article by stating the pros and cons of grid trading.

Pros

- Easy-to-grasp concept;

- Easy to implement;

- Works on different timelines;

- Small profits can quickly accumulate.

Cons

- Only works in a sideways market;

- It can be tricky to find the best pairs for grid trading;

- The market can quickly turn and stop you out of your grid.

In a nutshell, grid trading is usually considered a low-risk, low-reward strategy that is very easy to carry out once you get the hang of it.

Conclusion: What grid bot to use?

To conclude this review, we can say that GoodCrypto gives you the best value for grid bot creation and implementation. For a monthly plan of $14.99, you can launch 10 bots simultaneously, trade on 36 different exchanges, including derivatives on 8 of them.

Moreover, the app boasts an intuitive interface, encompassing powerful charting tools and self-explanatory terminology. This will allow even the utmost beginner to get started with grid bot trading, without resorting to complicated technical analysis.

What’s more, the GoodCrypto is much more than just a grid bot platform. Through the app, you will be able to:

- Manage your portfolio across all supported exchanges.

- Connect non-custodial wallets to have a better insight into your holdings.

- Place advanced orders (trailing stop, TP+SL combo) even if the exchange doesn’t support this feature.

- Use charting tools to conduct sound technical analysis.

- Receive custom alerts for trades, indicators, price changes, etc.

- And lots of upcoming features such as DEX trading, live alerts for DEX gems, and many more.

All in all, GoodCrypto provides the powerful features and reliability of premium bot apps, while simultaneously remaining accessible to every budget. It democratizes grid bot trading and puts this profitable strategy in everyone’s grasp.

Find Good Crypto on both the iOS App Store and the Android Play Store and discover the most advanced cryptocurrency application on the market for free!

Get the App. Get Started.

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

June 3, 2022