We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Before the merger Ethermine introduces staking as a service

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Before the merger Ethermine introduces staking as a service

The biggest Ethereum mining pool in the world, Ethermine, announced opening a staking pool service for members. As soon as the eagerly awaited merging transforms Ethereum to a proof-of-stake architecture this month, users will be able to stake as little as 0.1 ETH to a vast pool of user contributions that will be collectively staked to produce and earn fresh ETH.

The startup, controlled by the Austrian business Bitfly, will charge a sliding fee for this service; the rate gets lower the more ETH is committed. Users who give less than 32 ETH will be assessed a 15% fee.

However, Ethermine Staking won’t be available in the US.

Co-founder of MakerDAO advises DAI-USD de-pegging to reduce the attack surface

In response to recent discussions about decoupling its native token from USD Coin (USDC) in light of the sanctioning of Tornado Cash, MakerDAO co-founder Rune Christensen explained to the community in a written statement why free-floating Dai (DAI) might be the only option for the decentralized autonomous organization (DAO).

Christensen admitted to underestimating the hazards associated with risk-weighted assets (RWA) in his blog post titled “The Path of Compliance and the Path of Decentralization: Why Maker has no choice but to prepare to free float Dai.“

He said:

“Physical crackdown against crypto can occur with no advance notice and with no possibility of recovery even for legitimate, innocent users. This violates two core assumption that we used to understand RWA risk, making the authoritarian threat a lot more serious.”

Christensen stated that the protocol could not satisfy regulators and advised that “we must choose the path of decentralization, as was always the intent and the purpose of Dai.“

“The only choice is then to limit attack surface by reducing RWA exposure to a maximum fixed percentage of the total collateral,” he says, adding that “this requires free floating away from USD.” He thinks that decentralizing Maker will lessen the impact of crackdowns on the overall protocol.

Sam Bankman-Fried refutes the allegation that FTX intends to buy a stake in Huobi

According to CEO Sam Bankman-Fried, or SBF, the significant share in Huobi will not be acquired by the international cryptocurrency exchange FTX. In a tweet on Monday, SBF expressly refuted a Bloomberg story that said FTX intended to buy cryptocurrency exchange Huobi. On August 12, Cointelegraph reported that Huobi co-founder Leon Li was thinking about selling his majority stake in the business, which is worth more than $1 billion.

“We are not planning to acquire Huobi,” said SBF.

By mistake, Crypto.com sent $10.5M to a customer rather than issuing a refund of $100

Two Melbourne women, Manivel Thevamanogari and her sister Gangadory Thevamanogari received an AUD$10.5 million deposit from Singaporean cryptocurrency exchange Crypto.com after the latter made a mistake and incorrectly issued an AUD$100 refund, according to local news source 7News. An employee reportedly entered an account number in place of the refund amount in the payment area, which caused an incorrect transfer to their bank account.

The event happened in May 2021 but went undetected until a December 2021 yearly audit. Following filing a case, the Victoria Supreme Court has decided that the firm must return the money. It turns out that Manivel has already spent AUD$1.35 million on a five-bedroom luxury property in Craigieburn, so apparently, not all of the money was saved up. Nevertheless, she was given the go-ahead to sell the property and refund the money or risk being charged with contempt of court. In October, the matter will be heard in court again.

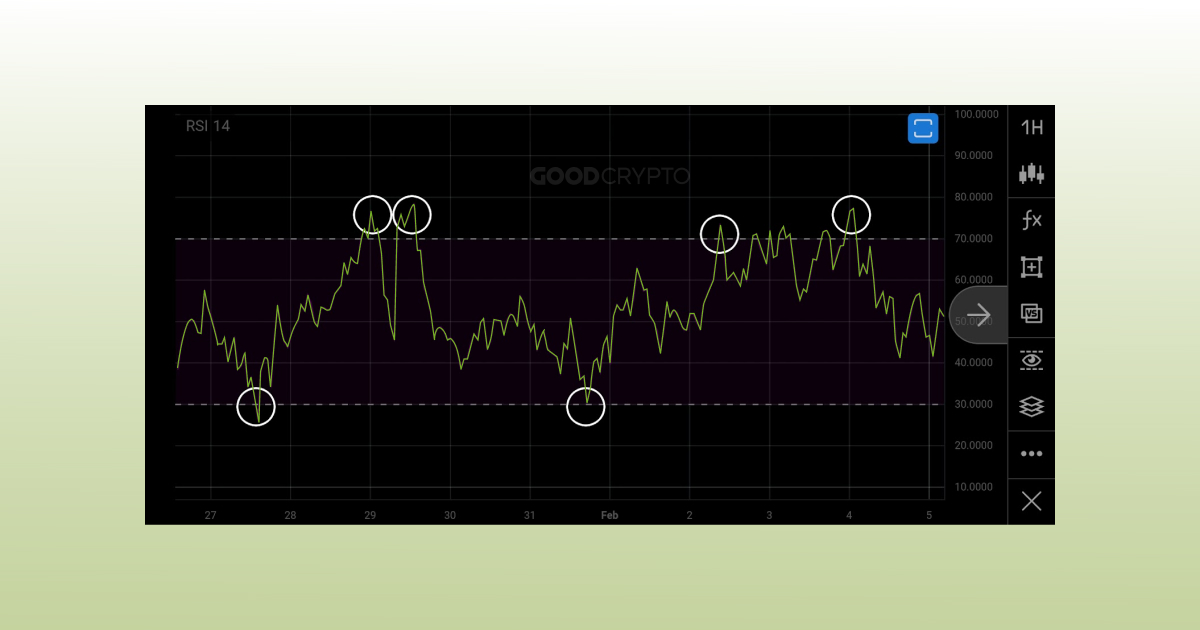

How do you make a trading decision based on the RSI indicator?

When the market is in a range, one strategy is to look at overbought and oversold indications, as seen on the cryptocurrency RSI chart above. Neither catching the absolute bottom nor the absolute high is certain. Simply buying based on an oversold signal is risky because a market might continue to decline even after the signal was provided. Making a trading strategy only based on the RSI is not advised since doing so would be insufficient. It does, however, greatly assist you in decision-making and understanding. To validate indications that appeared and make wise trading choices, combine RSI with various forms of Moving Averages and Bollinger Bands.

Find more Crypto Trading Strategies based on the RSI Indicator in the Article!

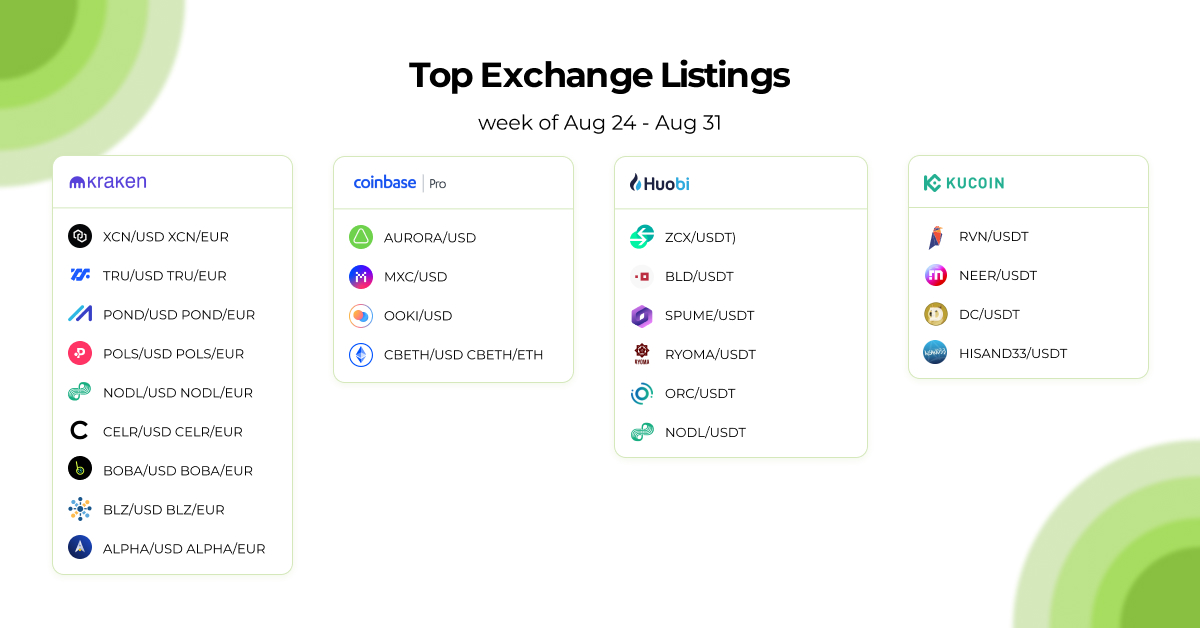

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

September 1, 2022