Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

Amid market volatility, Binance adds $1 billion to the SAFU fund

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

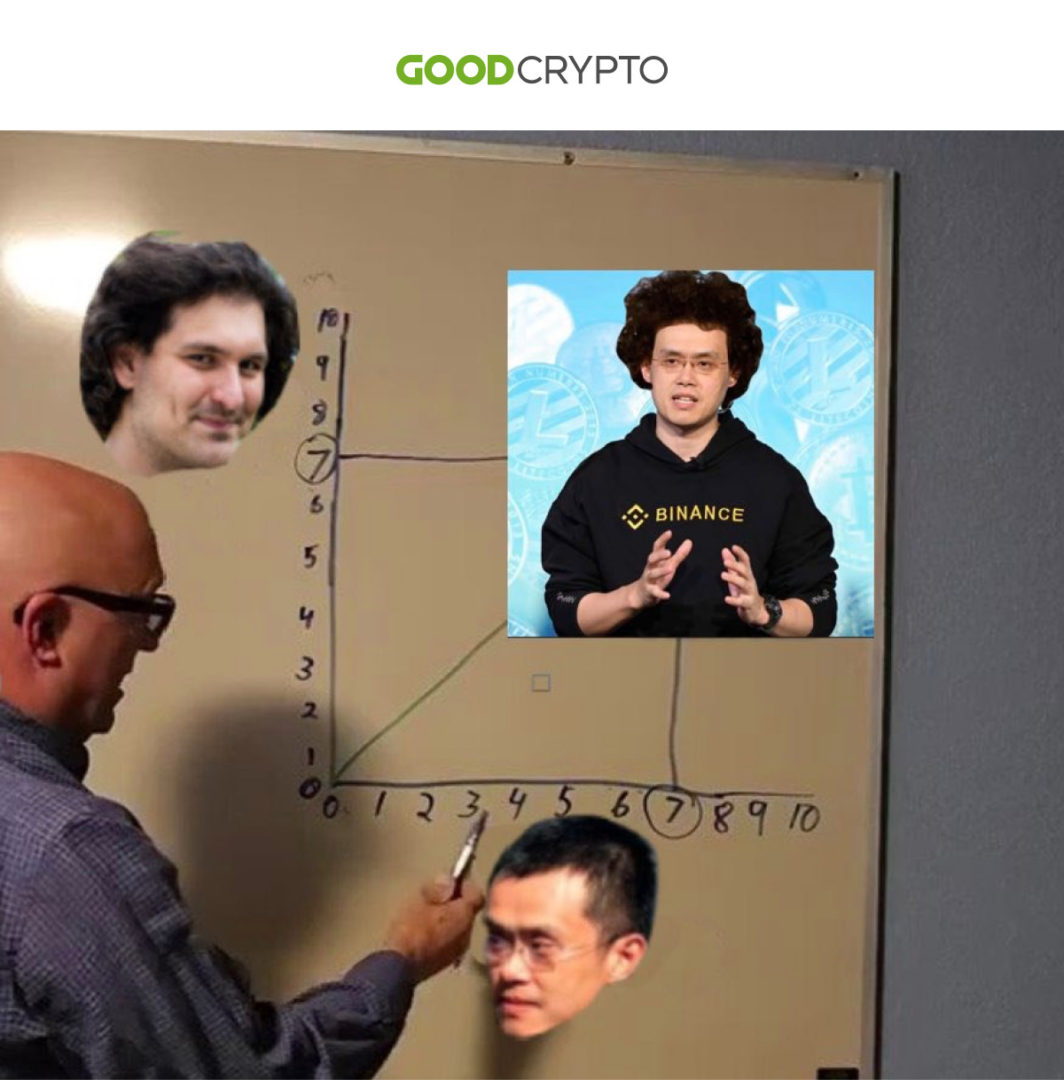

Binance conducts due diligence and decides not to acquire FTX

Less than 48 hours after Binance CEO Changpeng “CZ” Zhao announced his plan to rescue struggling rival FTX, Binance tweeted that after due diligence was completed on FTX, they would cancel the help. The mishandled customer complaints and US agency investigations are beyond the scope of Binance to be able to help.

Binance gave its clients liquidity as a way to support the struggling cryptocurrency exchange, but then decided against it since the problems were “beyond our control or ability to help.”

Additionally, Binance stated that every time a large industry player fails, retail consumers will suffer. However, Binance also stated that the ecosystem is “becoming more resilient” and that it is their belief that “outliers that misuse user funds will be weeded out by the free market.”

Following Binance’s announcement, FTX’s website abruptly went offline. It later came back online with a banner warning that the exchange is unable to process withdrawals and that it is strongly discouraged from making deposits.

During the market turmoil, Coinbase and Kraken’s services are limited

On November 8, amid the market panic, customers reported on Twitter that both Coinbase and Kraken’s services were offline or having sporadic latency issues. The announcement came after the cryptocurrency exchange Binance said it may buy out its competitor FTX.

According to Twitter users, services on both exchanges were reportedly limited, with connectivity issues to the platforms and unverified rumors of blocked withdrawals.

In its support profile, Coinbase stated that “experiencing network connection issues for Coinbase.com, Coinbase Pro, and Coinbase Prime. This could result in difficulty signing in. If you’re already signed in you may experience slow loading across web and the mobile app.” According to the exchange, the issue was caused by the platform receiving many new user sign-ups and transactions on November 8.

Kraken declined to comment on the problems via its public channels, but it did point out that it uses proof-of-reserve checks, allowing customers to check their exchange balances as well as the assets it backs.

Kraken reported that the connectivity issues had been fixed after a remedy was put in place in a late November 8 status update, but it did not specify what caused the issue.

Amid market volatility, Binance adds $1 billion to the SAFU fund

Changpeng “CZ” Zhao, CEO of Binance, assured his community that the network would be adequately funded even while the liquidity problem and the acquisition of the cryptocurrency exchange FTX continued.

The exchange has once more exceeded its Secure Asset Fund for Users (SAFU) at $1 billion equivalent, according to a tweet from CZ on November 9 citing “recent price fluctuations.”

The tweet contained links to two reserve accounts, one of which holds the Binance stablecoin (BUSD) and the network’s native currency, both worth $700 million in equal value. The second wallet exposed $300 million worth of bitcoin holdings.

To back up user holdings in the event of an issue, 10% of the trading fees were allocated into a fund as part of Binance’s SAFU in 2018. The fund initially reached $1 billion in February of this year.

The majority of the responses to the tweet from the crypto community on Twitter were supportive, praising CZ for his deed. “All cryptocurrency firms should have a Secure Asset Fund for Users (SAFU) just like Binance,” one user said.

Others questioned if the cap on funds in reserve was adequate.

In a tweet on November 8, Zhao promised to develop a Proof-of-Reserve system at Binance to give “full transparency” through the use of Merkle Trees, a data structure used more effectively and securely encrypt blockchain data.

Days before FTX’s bankruptcy problems, Nexo avoids a $219 million bullet

A tweet from Nov. 8 claims that the ongoing situation involving the cryptocurrency exchange FTX and the trading company Alameda Research has had no impact on the crypto lender Nexo. Nexo added that it had withdrawn the entirety of its FTX balance “within the past few days.“

The CEO of blockchain analytics company Nansen, Alex Svanevik, validated the information and provided statistics demonstrating that Nexo withdrew more than $219 million from FTX between November 1 and November 8. This places Nexo as the top entity for money outflow over the previous week.

The company seems to have avoided a serious danger because on November 8 FTX announced that it would stop all withdrawals from non-fiat consumers. As it continued to analyze the situation, Nexo stated that the tiny loan it had made to Alameda Research was less than 0.5% of its total assets. Digital assets, according to Nexo, were fully pledged as security for the loan and were sold on November 6. The trade produced “100% principal recovery and $0 losses for the company,” according to the firm.

Why having the right trading strategy is essential, but so is execution?

Following your game plan is your top priority for successful trading, which is frequently ignored. It is crucial to always keep in mind that you must follow the guidelines outlined in the claimed strategy, even while having an effective, thoroughly backtested trading method is detrimental.

Emotional trading is the most challenging part of trading, acknowledged in the trading community to affect many traders. Among them are the following:

- Expanding your pre-set stop-losses to “give the trade additional breathing room” is known as “chase your losers”

- Using too much leverage while you’re losing a lot of money

- Employing the indicators you’re using to place trades before the real signals are generated

- Cutting the profitable trades too soon

Trading pros will tell you that most of your profit and loss is determined by how well you execute your deals. Thus, the secret to effective strategy implementation is creating clear guidelines, following them, and continually evaluating whether you need to enhance your execution.

So, how do you determine whether you’ve executed well? What questions should you ask yourself? Find out this and more in the Day-Trading Cryptocurrency: a Conjunction of Strategy and Execution article.

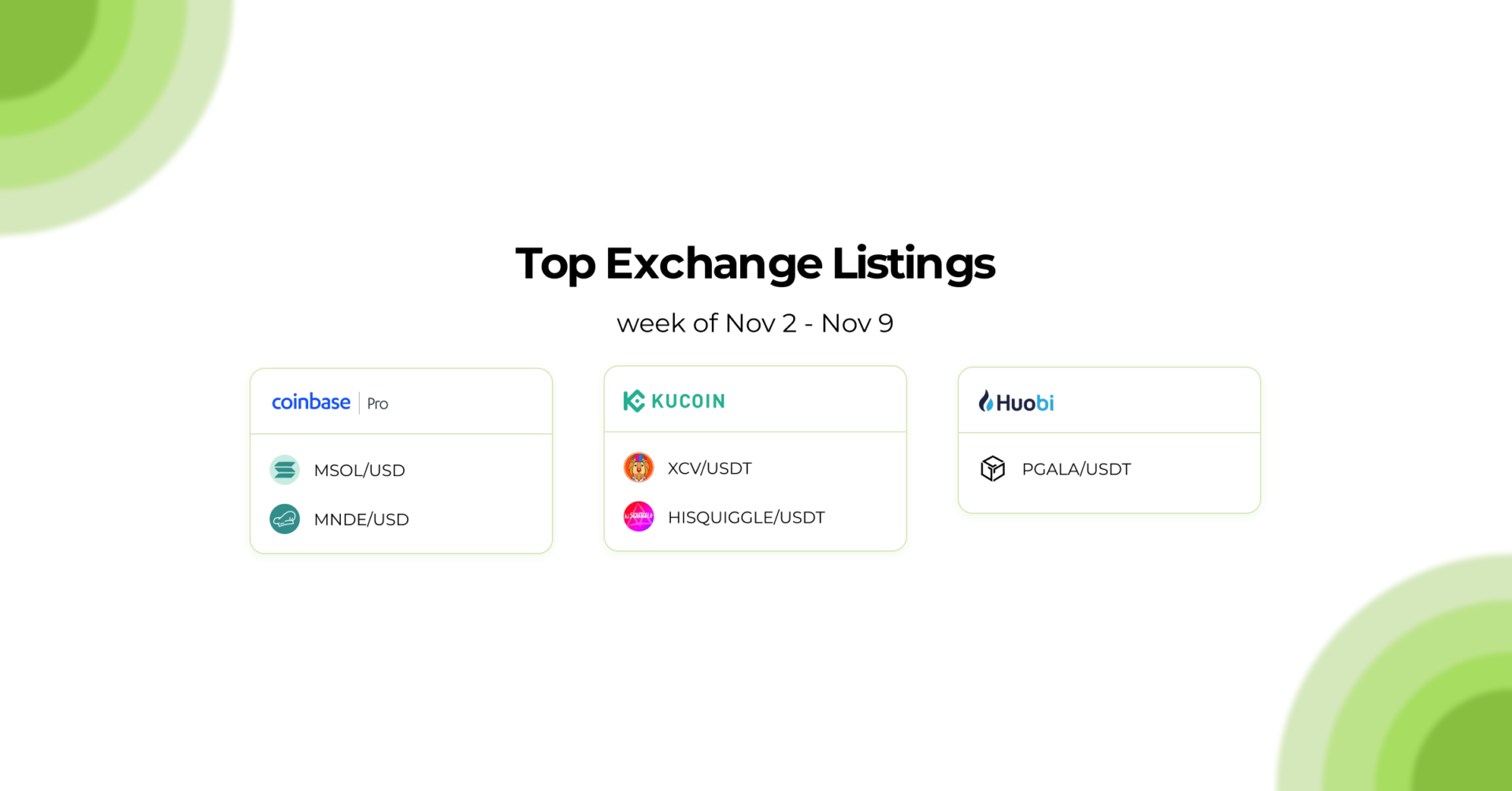

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

November 11, 2022