We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Ethereum considers increasing minimum staked ETH for validators

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Binance implements Bitcoin Lightning Network for improved transactions

Binance, a leading cryptocurrency exchange, has begun operating nodes on the Bitcoin Lightning Network to enhance deposit and withdrawal processes. While the Lightning integration is still undergoing technical work, Binance has confirmed its commitment to providing updates.

The decision to integrate the Lightning Network comes in response to congestion issues experienced on the Bitcoin network in May. Binance recognizes the potential of the Lightning Network in alleviating bottlenecks and enabling faster BTC withdrawals.

The Lightning Network is a layer-two protocol designed to address scalability concerns by facilitating off-chain transactions and settling on the Bitcoin blockchain when necessary. By improving speed, scalability, and privacy, the Lightning Network aims to make Bitcoin transactions more efficient, particularly for microtransactions, while reducing fees and congestion on the main network.

Core Scientific files Chapter 11 bankruptcy plan

Bankrupt Bitcoin miner Core Scientific has filed its Chapter 11 bankruptcy plan, aiming to restructure and emerge stronger from the proceedings. The plan, filed in the United States Bankruptcy Court, was negotiated with key stakeholders to establish a consensus on the company’s future. Core Scientific has experienced improved liquidity since filing for bankruptcy, attributing it to higher Bitcoin prices, increased network hash rate, and reduced energy costs.

According to the bankruptcy plan, on the effective date, allowed debtor-in-possession (DIP) claim holders will be fully satisfied, receiving payment in cash or agreed-upon alternative treatment. Liens securing DIP claims will be terminated, releasing the company’s assets from secured interest.

In a significant development, Core Scientific obtained court approval to secure a loan of up to $70 million from B. Riley, one of its major creditors. This loan will be used to repay the existing debtor-in-possession financing loan from B. Riley.

Ethereum considers increasing minimum staked ETH for validators

In a recent Ethereum core developer consensus meeting, a proposal was made to raise the maximum amount of staked Ether required to become a validator from 32 ETH to 2048 ETH. While the minimum staking amount would remain at 32 ETH, the proposed increase aims to address the inflation of the validator set size and make the network more efficient over time.

Additionally, the proposal includes the implementation of auto-compounding validator rewards, enabling validators to earn more on their staked ETH. Excess rewards beyond the 32 ETH cap must be transferred to another account to generate staking income. Raising the cap would allow validators, including large node operators like exchanges, to compound their earnings effectively.

These proposed changes aim to enhance the Ethereum network’s decentralization, efficiency, and financial benefits for validators.

CertiK receives a $500,000 bounty for identifying a critical threat to Sui network

Blockchain security firm CertiK has been rewarded with a $500,000 bounty from the Sui network after uncovering a potential threat that could have disrupted the entire layer-1 blockchain.

The vulnerability, known as “HamsterWheel,” differs from conventional attacks by trapping nodes, allowing them to perform operations without processing new transactions, ultimately hampering network functionality.

CertiK discovered the vulnerability and promptly alerted Sui before its mainnet launch. The Sui network swiftly implemented necessary fixes to mitigate the potential damage caused by this attack. Recognizing the significance of bug bounty programs and proactive security measures, Sui rewarded CertiK for its invaluable efforts.

Understanding the Supertrend Indicator: a powerful buy/sell tool for precise entry and exit points

The Supertrend Indicator acts as a reliable buy/sell tool, aiding traders in pinpointing optimal entry and exit points on their charts. It aligns with the price trend of a specific asset, offering invaluable insights.

Supertrend Indicator Essentials:

- Buy/Sell Indicator: Enhances decision-making accuracy

- Green and Red Lines: Signal trend reversals (Green for uptrend, Red for downtrend)

- Comparable to Simple Moving Average (SMA)

While comprehending the Supertrend Indicator’s definition is crucial, unlocking its functionality is vital to harnessing its potential.

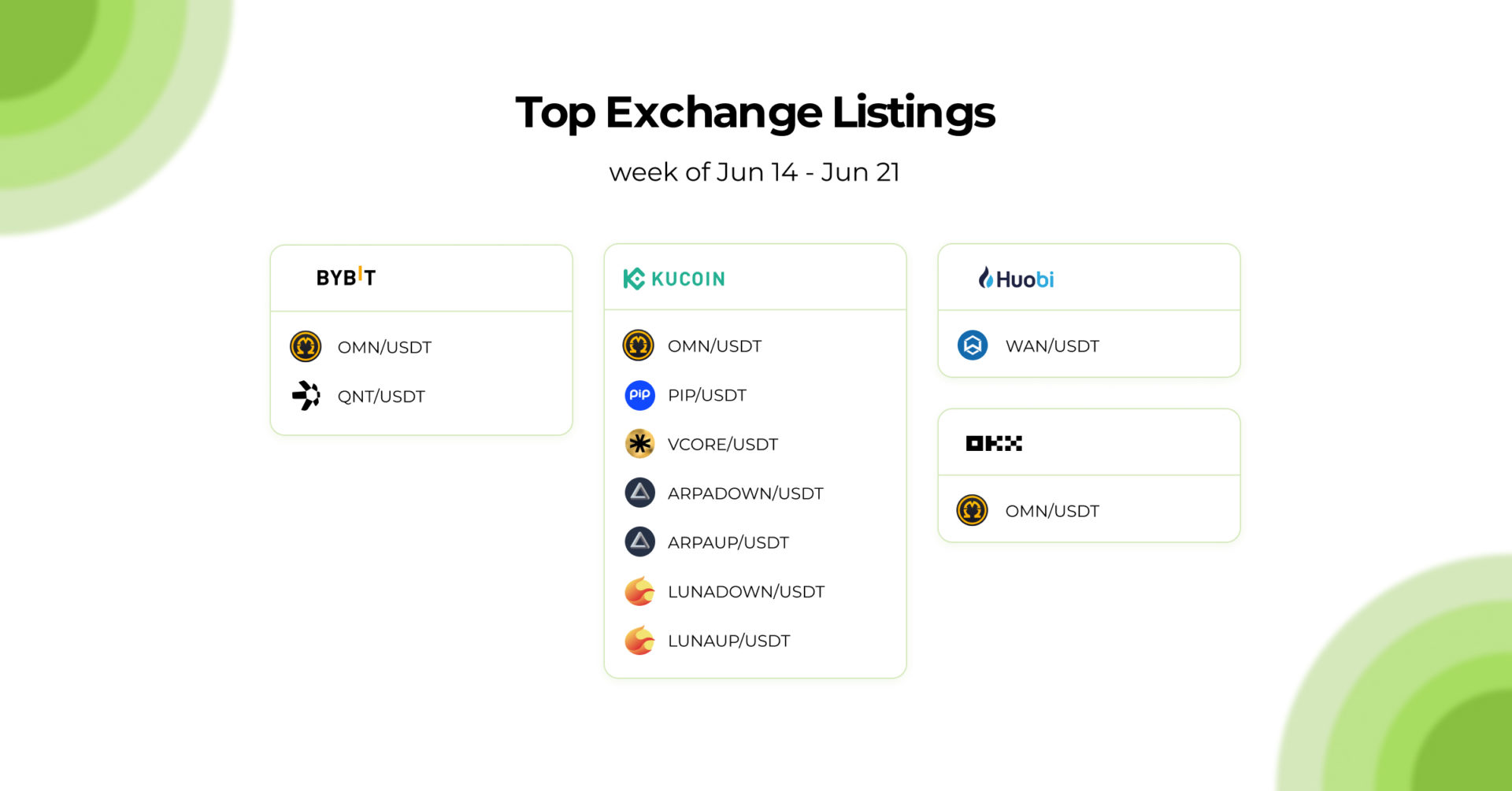

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

June 22, 2023