Hey there! 👋

This week finally brought us some positive news and exciting events for the web3 industry. Let’s explore them today in the weekly digest by GoodCrypto. If you’d like to stay updated on the crypto market, follow us on Twitter.

quick weekly news

Bitcoin price hits $62.6K as Fed ‘crisis’ move sparks US stocks warning

Yesterday, on September 18th, 2024, the Federal Reserve held a meeting, which we anticipated and mentioned in our Monday market overview on Telegram. During the meeting, the Fed announced a 0.5% reduction in the interest rate, causing Bitcoin to surge to $62,000 the following day, on September 19th.

It’s important to note that this is the first rate cut by the U.S. Fed since September 2021. This is significant news for all financial markets, including crypto and Bitcoin, pushing the leading cryptocurrency to local highs slightly above $62,600. It now seems poised to rally toward the $64,000 mark, according to a post from CoinTelegraph.

At the moment, the monitoring resource CoinGlass reports that over the last 24 hours, more than $136 million in short positions have been liquidated, roughly 2.5 times more than liquidated longs.

Source: CoinGlass

However, if you’re considering entering a long position now, it’s advisable to hold off. On its Twitter, CoinGlass stated that after the rally to the local highs of $62,600, we should see leverage decrease or traders take profits, suggesting caution against getting carried away.

Meanwhile, Arthur Hayes, the former CEO of the crypto exchange BitMEX, is closely watching the Bank of Japan’s upcoming rate decision on September 20th. According to his post, if the yen remains weak, Bitcoin is likely to perform well. However, if the yen strengthens, Bitcoin may face downward pressure due to shifts in the yen-dollar carry trade correlation.

On the other hand, trading resource The Kobeissi Letter issued a warning for risk-asset traders, questioning: “If the Fed has only started with 50 basis point rate cuts during crises, why start with 50 bps this time?” According to its posts, the times when the Fed began cutting rates by 50 basis points were during major crises in 2001 and 2007, suggesting the economy may not be as strong as the Fed claims. However, The Kobeissi Letter also notes that this could be the first time the Fed avoids a recession by cutting rates by 50 bps in a stable manner.

Donald Trump uses Bitcoin to buy burgers at NYC bar

On September 18th, 2024 the NYC restaurant famous for accepting Bitcoin, Pubkey, posted on its X account that Donald Trump used Bitcoin to purchase hamburgers in its bar. This event occurred just two days after Donald announced the release of its token through the World Liberty Financial crypto platform, run by its family member.

It’s worth noting that the candidate for president of the United States was initially skeptical of Bitcoin, calling it a “scam” and saying that crypto is “based on thin air” in 2019. However, he is now actively advocating for Bitcoin miners as part of his 2024 campaign and even participated in the Bitcoin conference in Nashville.

Trump also claims that despite NYC voting for the Democratic candidate since 1988, he has a real chance to overturn the situation and is not giving up his attempt to win the 2024 U.S. presidential election. This contrasts with his competitor, Democratic nominee Kamala Harris, who has yet to make any statements regarding the future of crypto. Executives from major crypto companies have speculated that she is unlikely to significantly distance herself from the Biden administration’s policies on blockchain and cryptocurrency.

However, there is still some hope for her stance, as one of her senior advisers mentioned in August 2024 that the U.S. vice president would “support policies” for the industry’s growth.

SUI could soon be Solana’s fiercest competitor

According to analysis from K33 Research, Solana is currently the top alternative layer-1 network next to Ethereum, but Sui may become a rival to Solana. On September 18, K33’s DeFi analyst David Zimmerman released a post explaining that Sui’s performance relative to Solana, combined with its architecture and the upcoming game console release, could make it a top contender among “alt L1s.”

He also draws attention to the SOL/ETH and SUI/ETH graphs, where Solana gained only 6% during August, while SUI/ETH surged by over 115%. The past few weeks clearly show how $SUI outperformed the crypto market, experiencing 54% growth over the last 30 days.

According to the CoinTelegraph, Zimmerman further highlights that Sui boasts a theoretical maximum of 297,000 transactions per second (TPS), compared to Solana’s theoretical maximum of 65,000, which is significant when considering Sui as a potential rival to Solana. However, in real terms, Solana’s and Sui’s current maximum TPS are around 3,000 and 854, respectively, according to CoinGecko stats.

Adding to the momentum, Circle, the day before K33 Research’s post, announced the launch of its stablecoin on the Sui blockchain, indicating further support for the network from prominent crypto companies.

However, Sui does have one significant weakness—its total supply. According to Zimmerman, Sui, launched in 2023, has a very high FDV (Fully Diluted Valuation) and a low initial market capitalization percentage, with only 27% of Sui’s total token supply in circulation. This could lead to potential sell-offs when future token unlocks occur.

Nevertheless, Zimmerman remains optimistic about Sui’s potential. His thoughts align with the upcoming release of its new gaming console, SuiPlay0x1, which will feature a native “Eternals” non-fungible token (NFT), potentially unlocking exclusive rewards for users and incentivizing console purchases.

Real-world asset tokenization is the crypto killer app – Polygon exec

Colin Butler, Global Head of Institutional Capital at Polygon Labs, recently stated that real-world asset tokenization for institutions may become the “real killer” application, as it significantly reduces costs and settlement times. Butler explains that the cost-cutting benefits, along with the potential for double-digit reductions in costs, will enable financial firms to explore new business models that were previously unavailable due to competitive markets and slim margins.

“It is just a much better form of collateral for the global financial system — Like all the FX trades, all the options, stocks, and bonds. That’s why this could be the category killer for crypto—it’s a larger addressable market by orders of magnitude than anything else crypto claims to solve.”

In his previous interview with CoinTelegraph, he said that the tokenized real-world asset (RWA) industry currently represents a global market opportunity of over $30 trillion, potentially bringing liquidity to private credit, bonds, and U.S. Treasury bills.

In contrast, Real Vision’s chief crypto analyst, Jamie Coutts, offers more modest projections, suggesting that by 2030, the figure for tokenized real-world assets will be closer to $1.3 trillion. Still, even with these conservative estimates, this would have a significant impact on digital asset markets, injecting fresh capital.

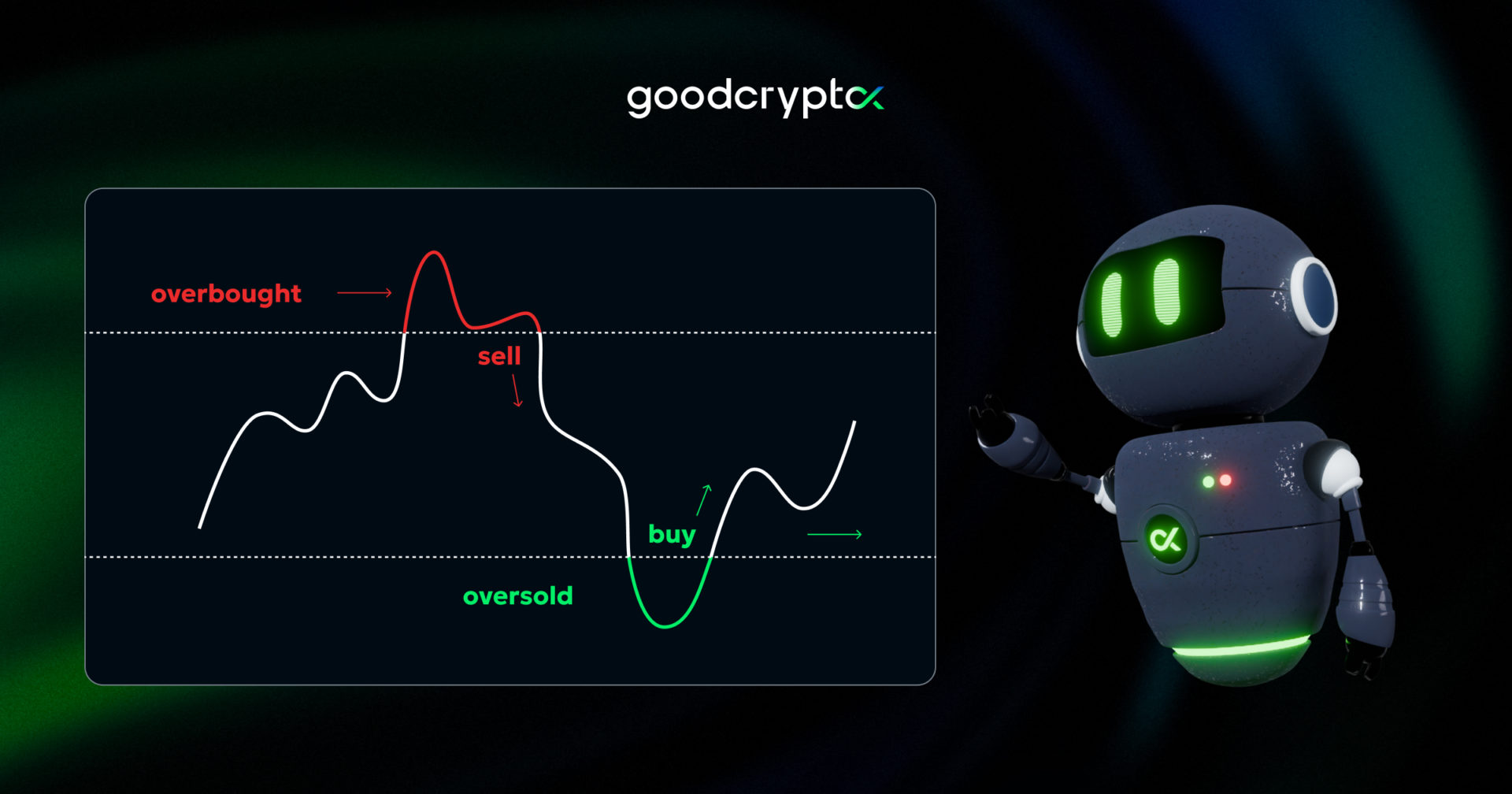

RSI indicator trading strategies

RSI is a momentum oscillator that compares recent price gains against recent price losses. It helps users identify moments when the price is overbought or oversold and is especially effective when combined with signals from other trading indicators.

RSI Indicator Trading Strategies:

🔸 Determining the highs and lows: When the market lacks a clear trend, the RSI indicator can help identify potential overbought and oversold ranges, allowing you to buy low and sell high.

🔸 Finding bullish and bearish divergences: Divergences occur when the price makes a lower high or lower low while the oscillator makes a higher high or higher low. When you notice a re-test, such as in a bottom or top formation, look for divergence in the RSI. For example, if a double top shows a bearish divergence, it may indicate a selling opportunity. Conversely, if a double bottom shows a bullish divergence pattern, consider entering a long position.

Want to learn more about this powerful tool and its trading strategies? Check out the ultimate guide to the RSI indicator by GoodCrypto! 📈

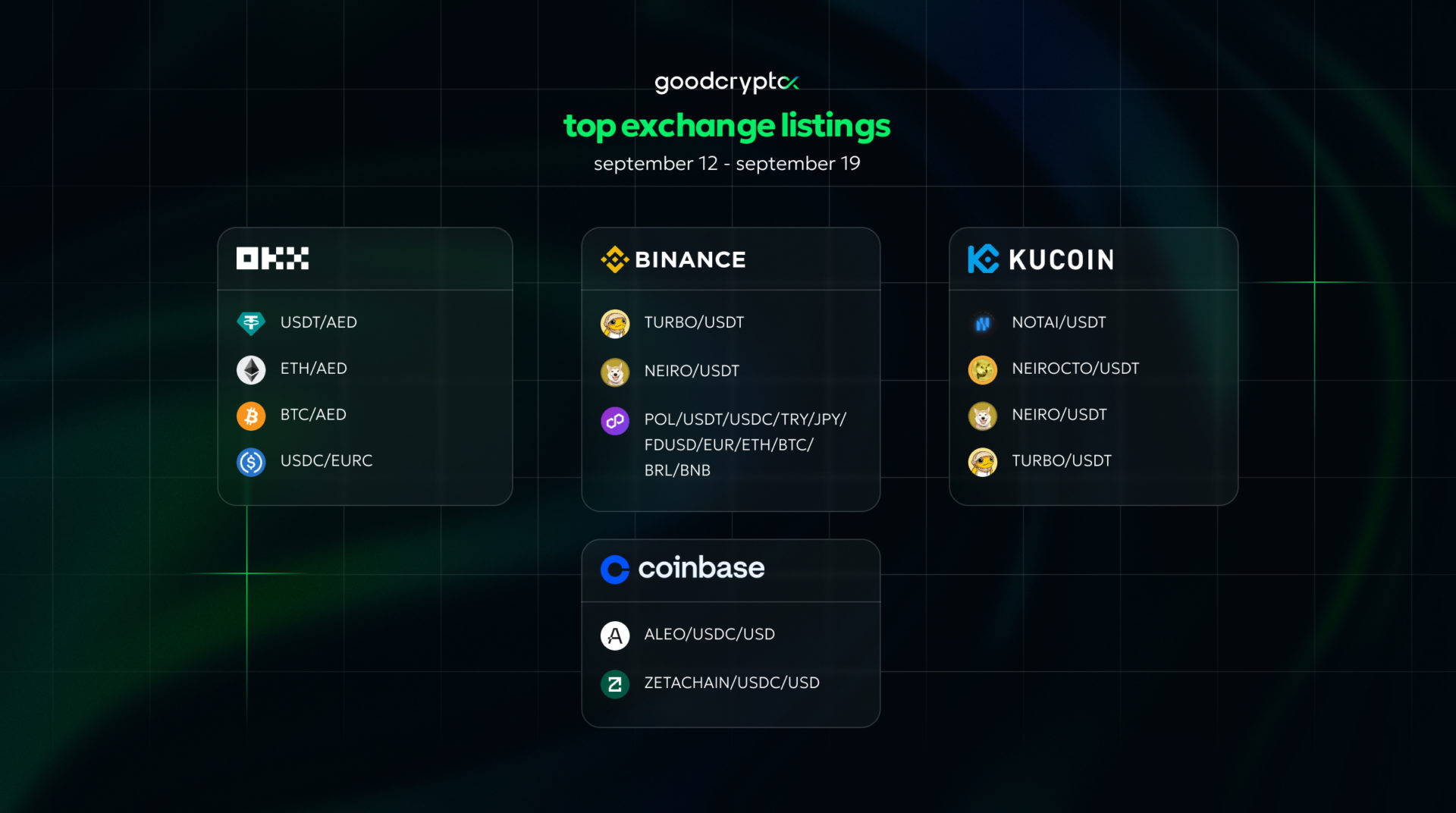

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!