We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Bitsgap Review: Advanced Trading Terminal with Sophisticated Trading Bots

- 1. Bitsgap App Overview

- 1.1. How Does Bitsgap Work?

- 2. Bitsgap Key Features

- 2.1. Bitsgap Bot Diversity: How Do They Work?

- 2.1.1. Bitsgap Grid Bot Strategy

- 2.1.1.1. Bitsgap Scalper Bot

- 2.1.2. Bitsgap DCA Bot Strategy

- 2.1.3. Bitsgap Futures Bot Strategy

- 2.2. Bitsgap Bot Personalization Options

- 2.2.1. Bitsgap Take Profit: For Bots Included

- 2.2.2. Bitsgap Stop Loss Orders

- 2.2.3. Bitsgap Trailing Orders

- 2.3. Bitsgap Smart Trading

- 2.4. Bitsgap DEMO Feature

- 3. Bitsgap Signals: How Сan They be Useful?

- 4. Bitsgap Arbitrage

- 5. Bitsgap Strategy For Automated Trading

- 5.1. Strategy #1: Day Trading Crypto

- 5.2. Strategy #2 Swing Trading Crypto

- 5.3. Strategy #3: Range Trading

- 6. Bitsgap Supported Exchanges List

- 7. Bitsgap Best Settings Review

- 7.1. Bitsgap Login Procedure

- 8. Bitsgap Plans and Pricing

- 8.1. Bitsgap Taxes and Fees

- 9. Is Bitsgap Legit and Safe to Use?

- 10. Bitsgap Competitors. What Is The Best Bitsgap Alternative?

- 11. Conclusion

Trading bots are one of the best tools to make your crypto trading more efficient, consistent, and less time-consuming. Previously on GoodCrypto, we covered the Bisgap grid bot among 5 other similar platforms.

This Bitsgap review will provide you with all the extensive details of one of the leading trading bot platforms on the market. We will explain what is Bitsgap, how does Bitsgap work, and review Bitsgap’s features.

The article will also provide an in-depth overview of some Bitsgap trading strategies, and go over some key characteristics like Bitsgap crypto pricing, Bitsgap bot diversity, and much more.

Let’s get started with this Bitsgap review 2022 by giving an overview of the Bitsgap app and its particularities.

Bitsgap App Overview

Armed with his knowledge from Cointraffic, a Crypto advertising network, Max Kalmykov founded Bitsgap in 2017 to, in his words:

“To make trading cryptocurrencies easy, efficient, and stress-free. For traders with any experience.”

Headquartered in Estonia, Bitsgap started as a cloud-based trading platform, mainly focused on providing arbitrage opportunities on 6 different exchanges. Over the years, the app evolved into a full-fledged trading terminal paired with automated trading bots, with new features regularly being added.

Today, Bitsgap is a cryptocurrency trading app that provides a wide variety of trading bots and smart trading features. The main goal of “Bits gap” is to alleviate the pressure of trading by automating almost every aspect of it.

Consequently, Bitsgap bot trading will allow you to connect to various cryptocurrency exchanges and place orders that will execute automatically when certain conditions are met. Additionally, it allows traders to use smart trading features such as Bitsgap stop loss and Bitsgap trailing, even when these options aren’t available on the exchanges themselves.

You can use the Bitsgap crypto bot mostly for spot trading, as futures markets are only available for Binance. We will provide an in-depth Bitsgap futures bot overview further down in this article.

As a result, it comes out as a handy all-in-one trading platform that allows you to automate your trading and manage your portfolio across multiple exchanges.

❗️Worth noting is that there’s no Bitsgap mobile app as the platform comes in a web-based version only. So if you are looking for a Bitsgap Android or Bitsgap iOS version, you will be quickly disappointed.

How Does Bitsgap Work?

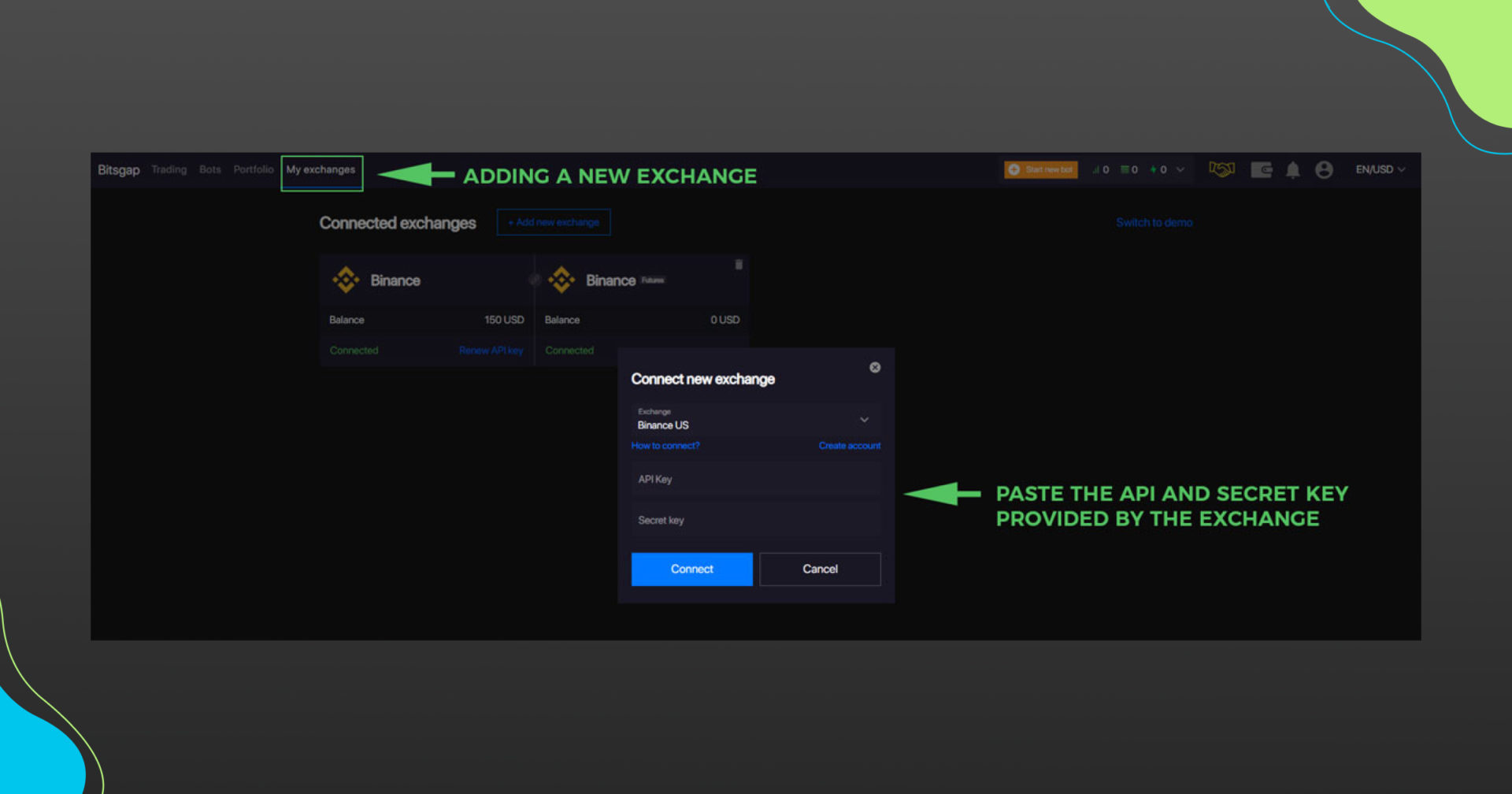

The Bitsgap app connects to your cryptocurrency exchange account through an API key and will place trades on supported exchanges. As such it will serve as a third-party interface for opening and closing orders, both manually and automatically.

Here’s a quick Bitsgap how-to-use guide aimed at getting you started on the platform:

- Create an account by providing an email address.

- Connect one or several crypto exchanges supported by the platform to this account.

- Start manually placing orders or create a Bitsgap crypto trading bot that will trade on your behalf.

Next, let’s get into the nitty-gritty of the Bitsgap crypto bots, see how each one of them works and show you how to set up Bitsgap bot.

Bitsgap Key Features

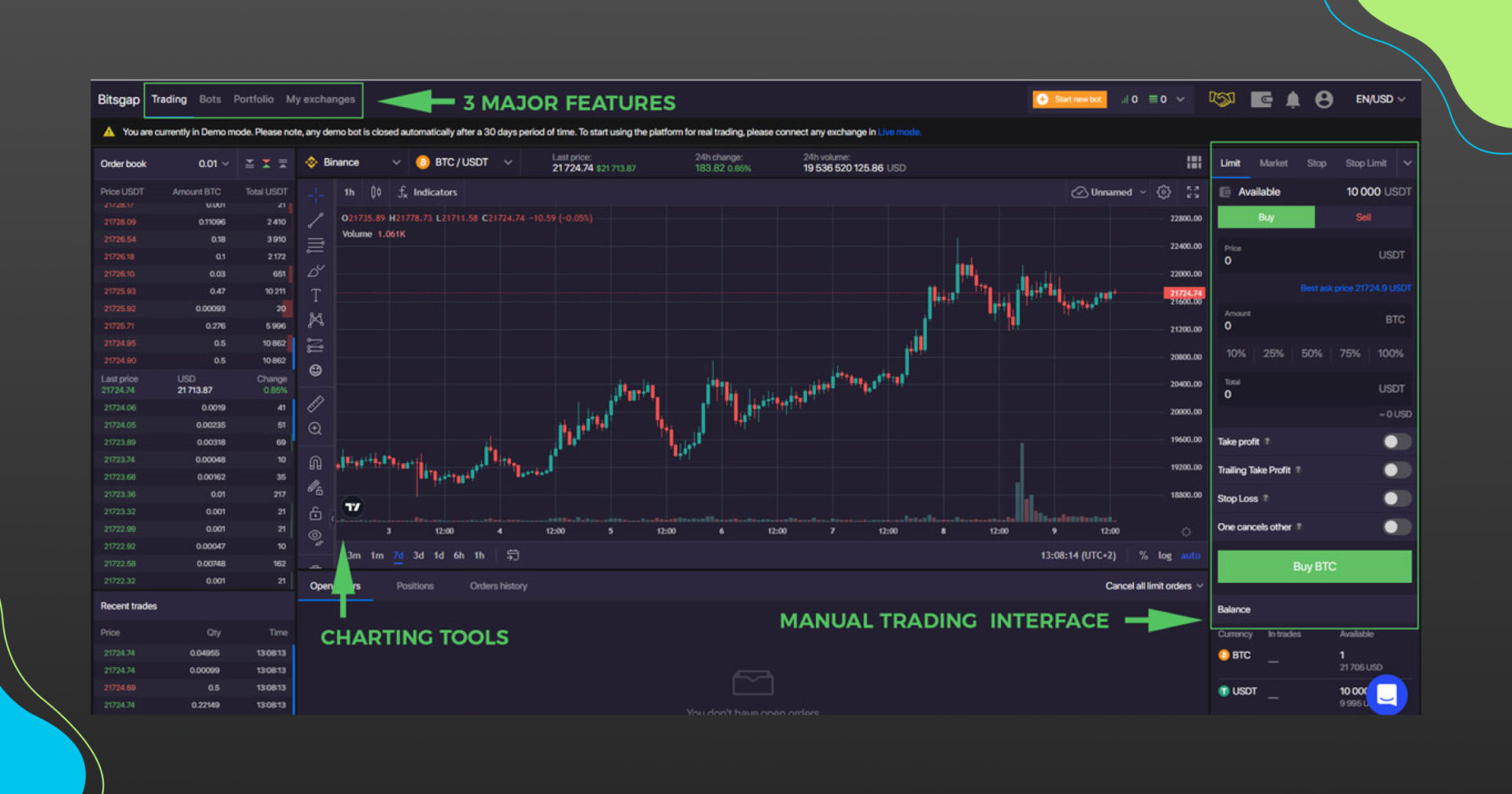

The Bitsgap interface is pretty straightforward and provides you with three major features:

- A trading (terminal) interface where you can set up smart trading orders manually.

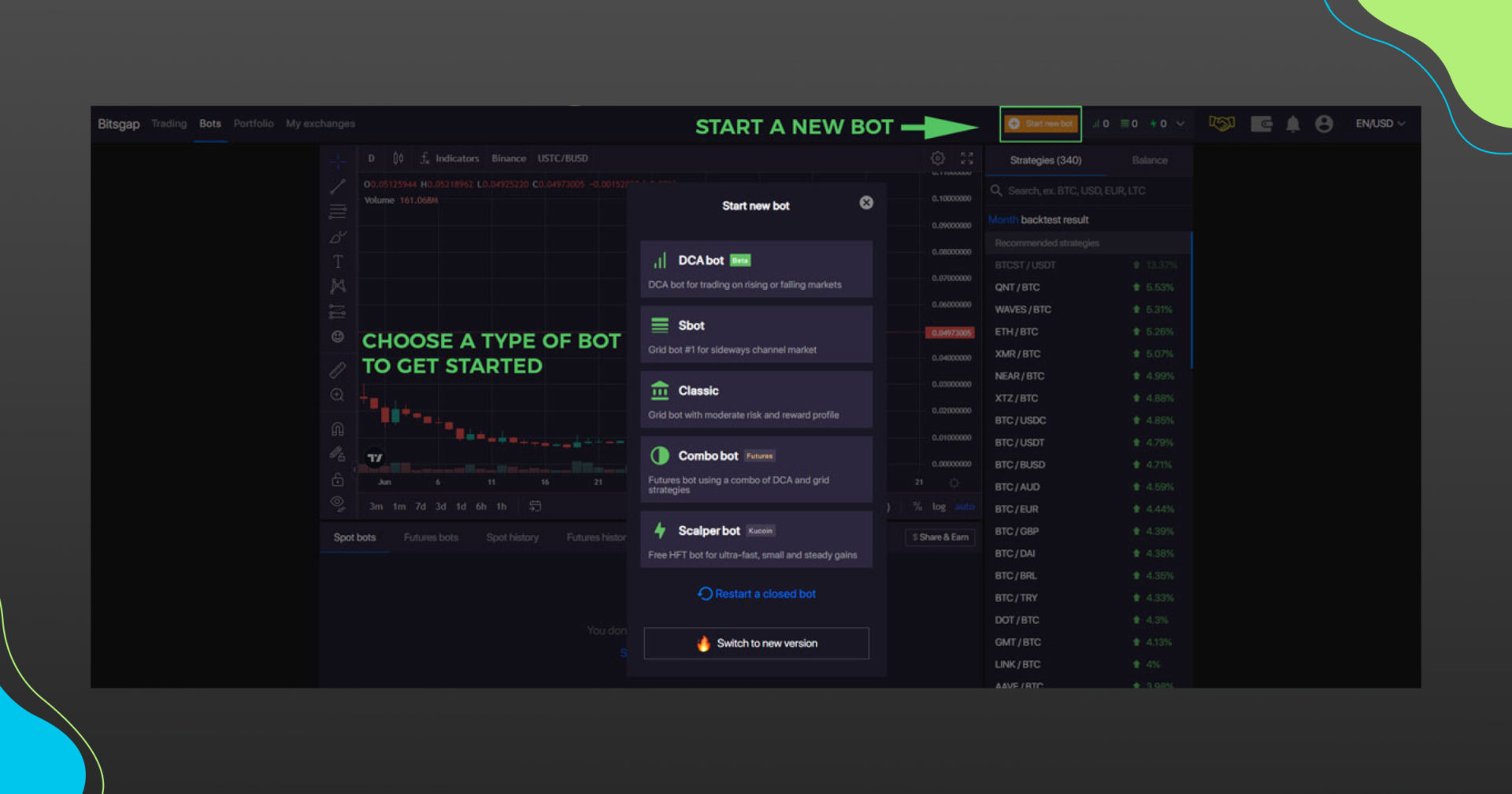

- A Bitsgap bots module where you can create different Bitsgap crypto bots including:

– Bitsgap DCA bot for trading on rising or falling markets.

– Bitsgap grid bots (Sbot & Classic) for trading sideway channel markets.

– A Bitsgap futures bot that combines DCA + grid trading.

– A Bitsgap scalper bot for making multiple small and recurrent profits.

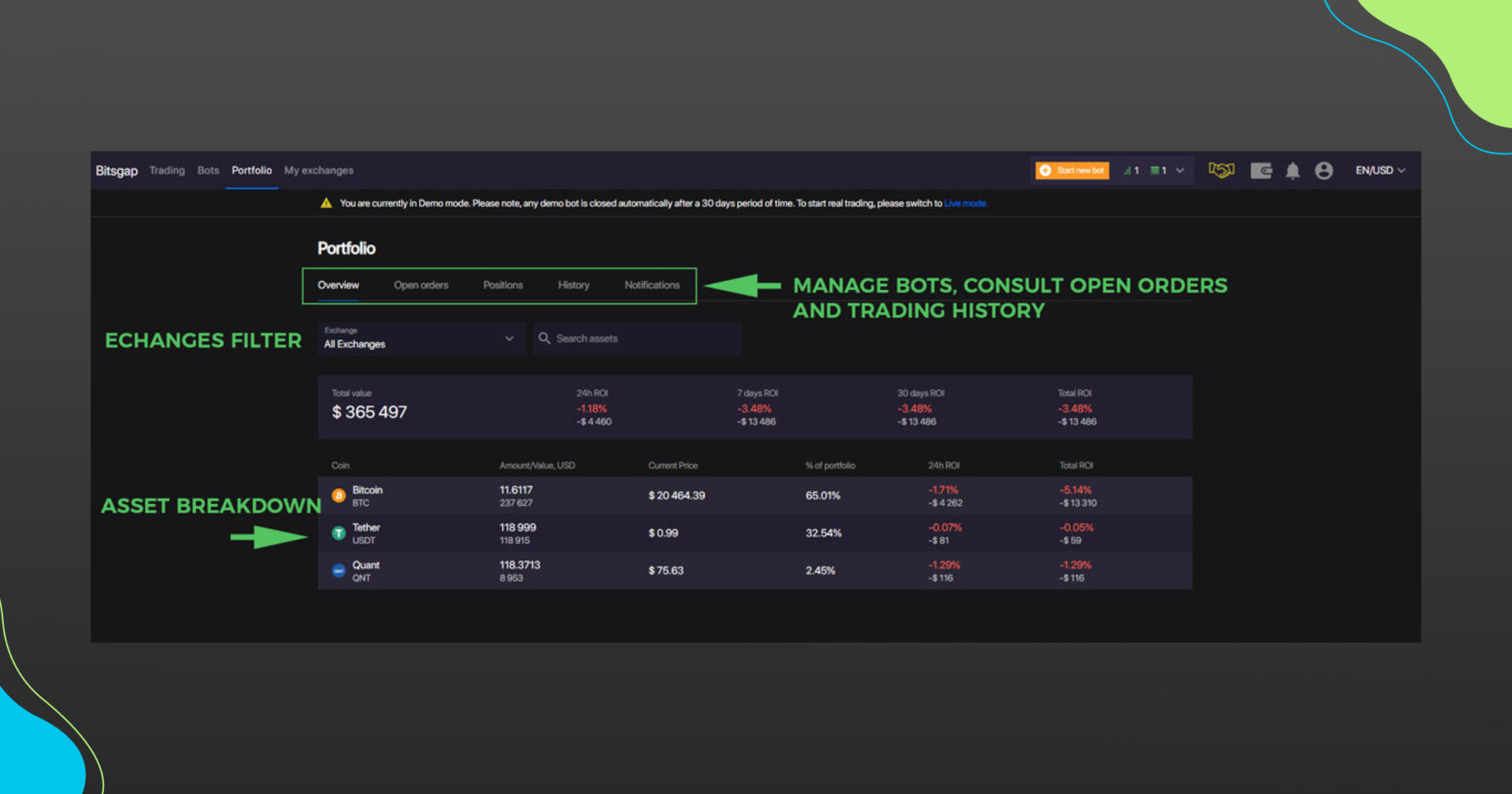

- A portfolio manager that allows you to view all your assets across your connected exchanges. This module also helps you manage your active bots and consult your open positions and trading history.

All in all, Bitsgap provides a complete set of features to make any trader’s life a lot easier.

Bitsgap Bot Diversity: How Do They Work?

As you might have noticed, there’s a wide range of crypto bots on Bitsgap, each one created to fit specific market conditions. This next section will detail each one of the cryptobots on Bitsgap and cover some of the Bitsgap bot settings that will help you maximize their usage.

Bitsgap Grid Bot Strategy

A major portion of the offering on Bitsgap is the Bitsgap grid trading. Grid trading is a range trading strategy that allows you to make profits by opening and closing positions repeatedly in a sideways-trending market.

For a Bitsgap grid bot to be effective, the price of an asset needs to range between two significant support and resistance price levels.

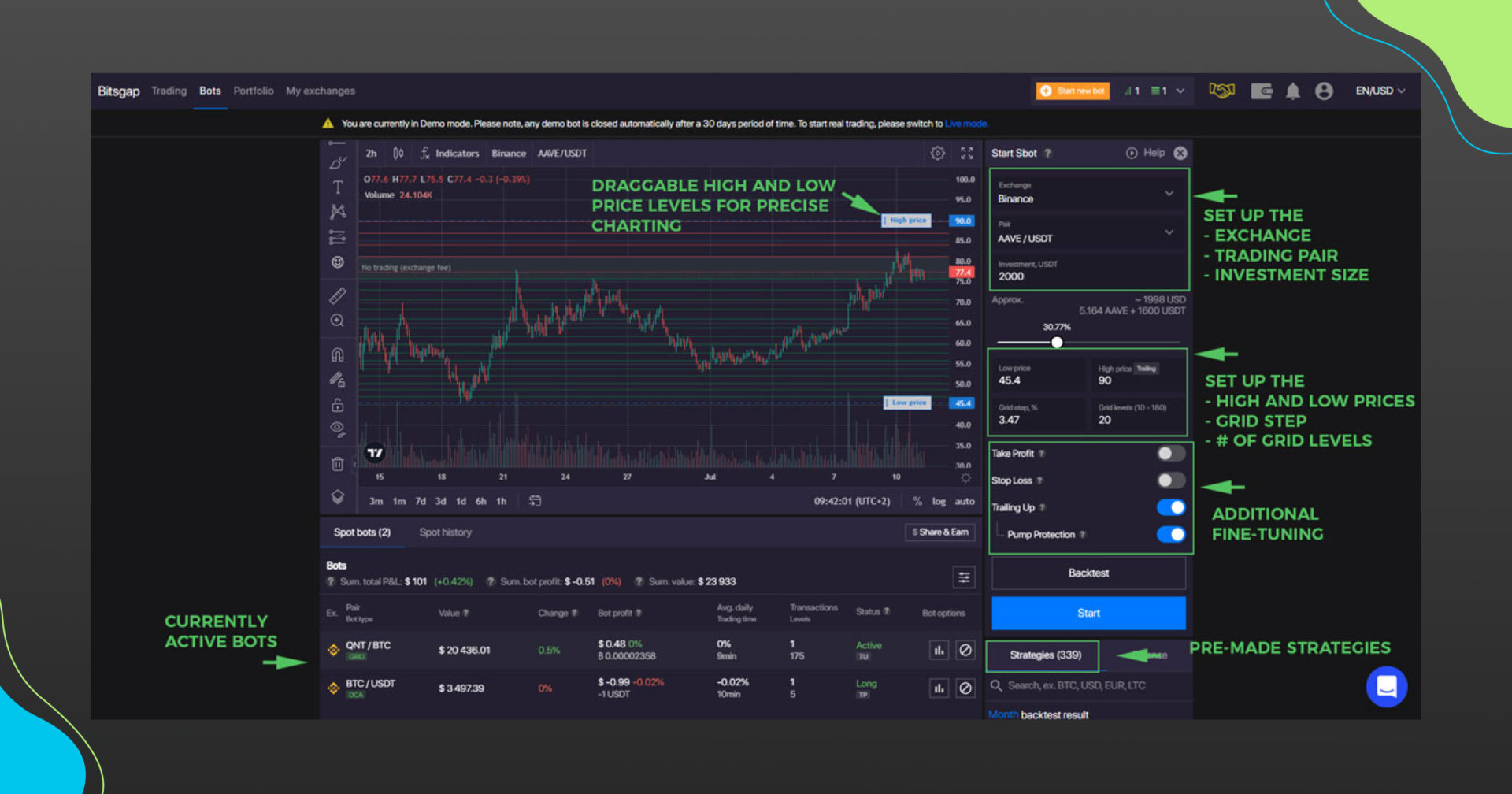

Since it only requires you to assess two major price levels, setting Bitsgap grid levels is one of the easiest bot strategies to set up. Here’s how the Bitsgap bot setup works for grid trading:

- First, you will need to select your crypto exchange, trading pair, and the amount you wish to delegate to this bot.

- The Bitsgap interface will allow you to set up your top and bottom levels for the range. You can do this by either inputting the price levels manually or dragging the level lines on the chart to your desired amount.

- The next step will be to determine the number of grid lines or the Bitsgap grid step in percentages. This will allow you to populate the grid with buy and sell levels.

- The red lines represent where the bot will sell, whereas the green lines show open orders where the bot will buy the asset.

- Note that the number of grid levels will also determine the minimum amount you will need to invest for this bot to start trading.

- The more grid levels you select, the closer the buy and sell orders will be. Hence, the bot will close orders more frequently, but with less consequential profits.

For getting a visual example of each point, look at the picture above.

To sum up, setting up a Bitsgap grid bot should be quite straightforward if you have basic knowledge of how to detect flat markets for range trading.

Bitsgap Scalper Bot

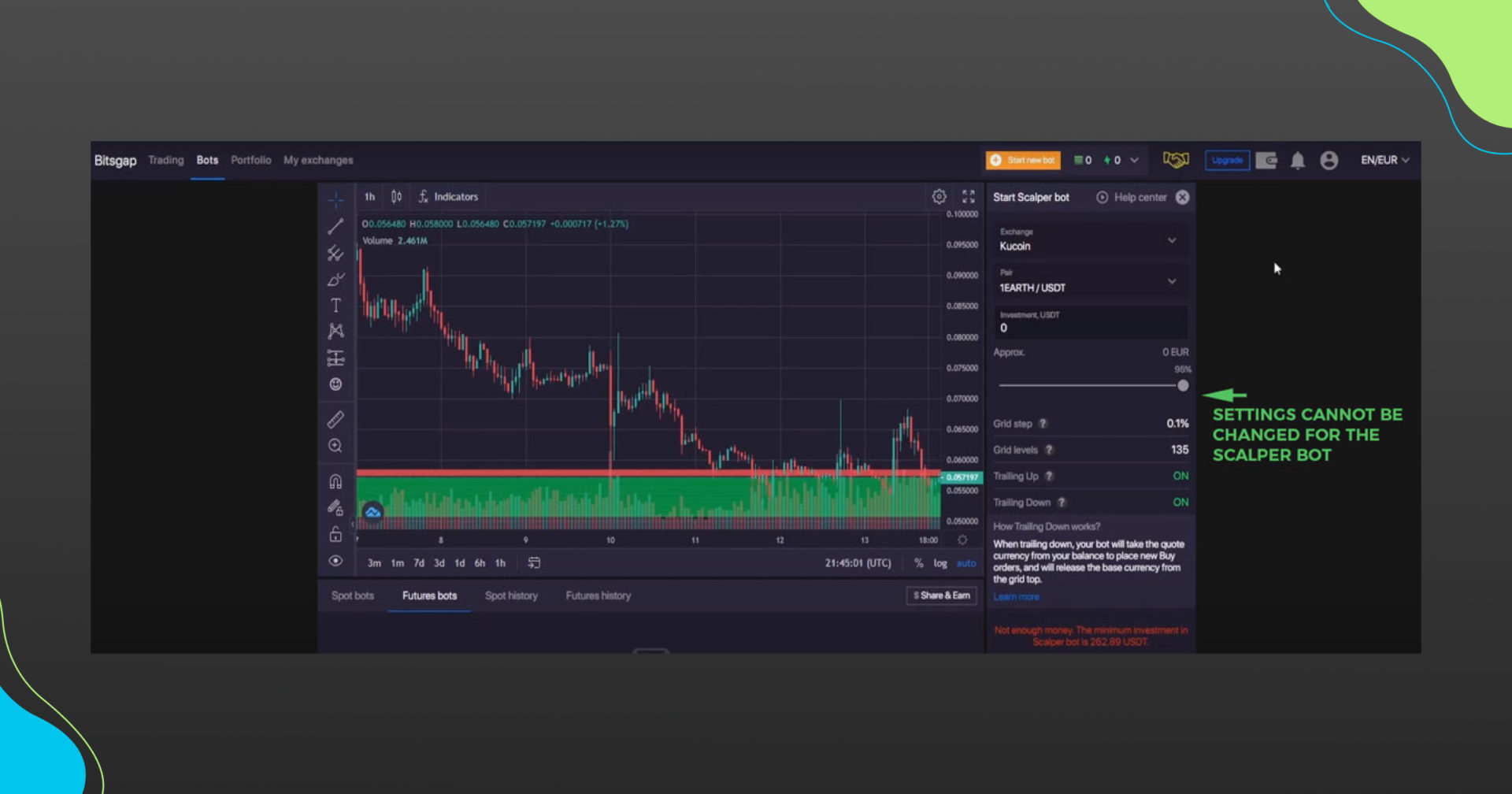

The Bitsgap scalping bot is a high-frequency grid bot available only on the KuCoin exchange. It allows you to make profits from minor price changes, which means that traders will use it to place hundreds of trades within a single day.

The scalper bot Bitsgap has one major difference from the previously reviewed grid bot. Here, the number of grid levels and grid steps are preset to respectively 120 levels and 0.1% step and cannot be modified. This ensures that the bot will execute a high number of trades with minimal profits that accumulate over time.

Theoretically, you can simulate a scalper bot on the other exchanges supported by Bitsgap by following these same settings. However, the accumulation of trading fees could negate your profits and even put you at a loss.

❗️PRO TIP: A good alternative to Kucoin would be the BUSD markets on Binance while the 0% commission is applied there.

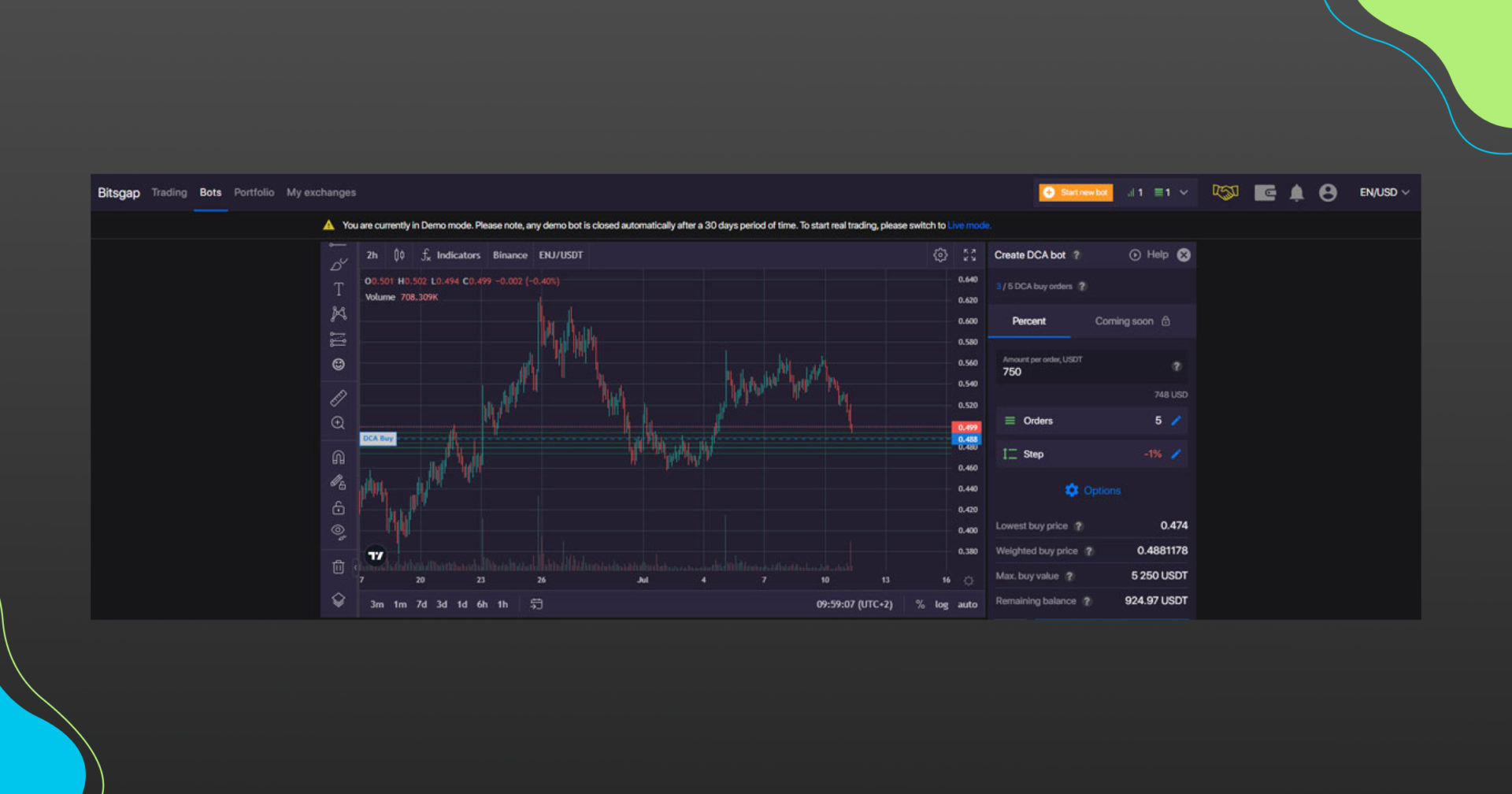

Bitsgap DCA Bot Strategy

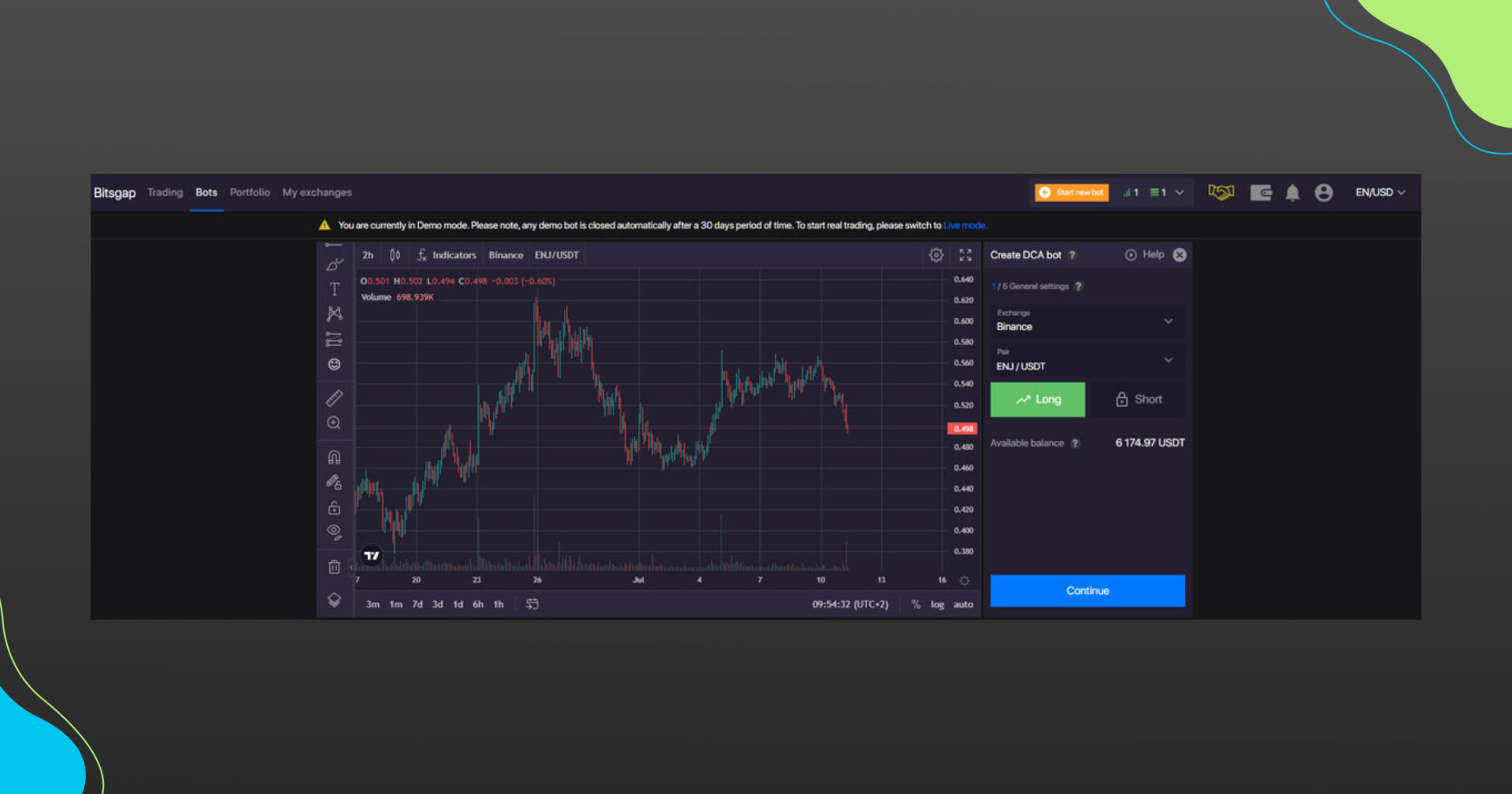

The Bitsgap DCA (dollar-cost average) bot allows you to take advantage of a trending market, upwards or downwards. The idea behind this bot is to accumulate your base currency over time, while simultaneously reducing its average price.

While the Bitsgap grid bot required only a basic understanding of technical analysis, the Bitsgap DCA bot is a bit more advanced in that regard. Setting it up will require you to go through these steps:

- General settings require you to choose your exchange, trading pair, and direction of your trade – long (uptrend) or short (downtrend).

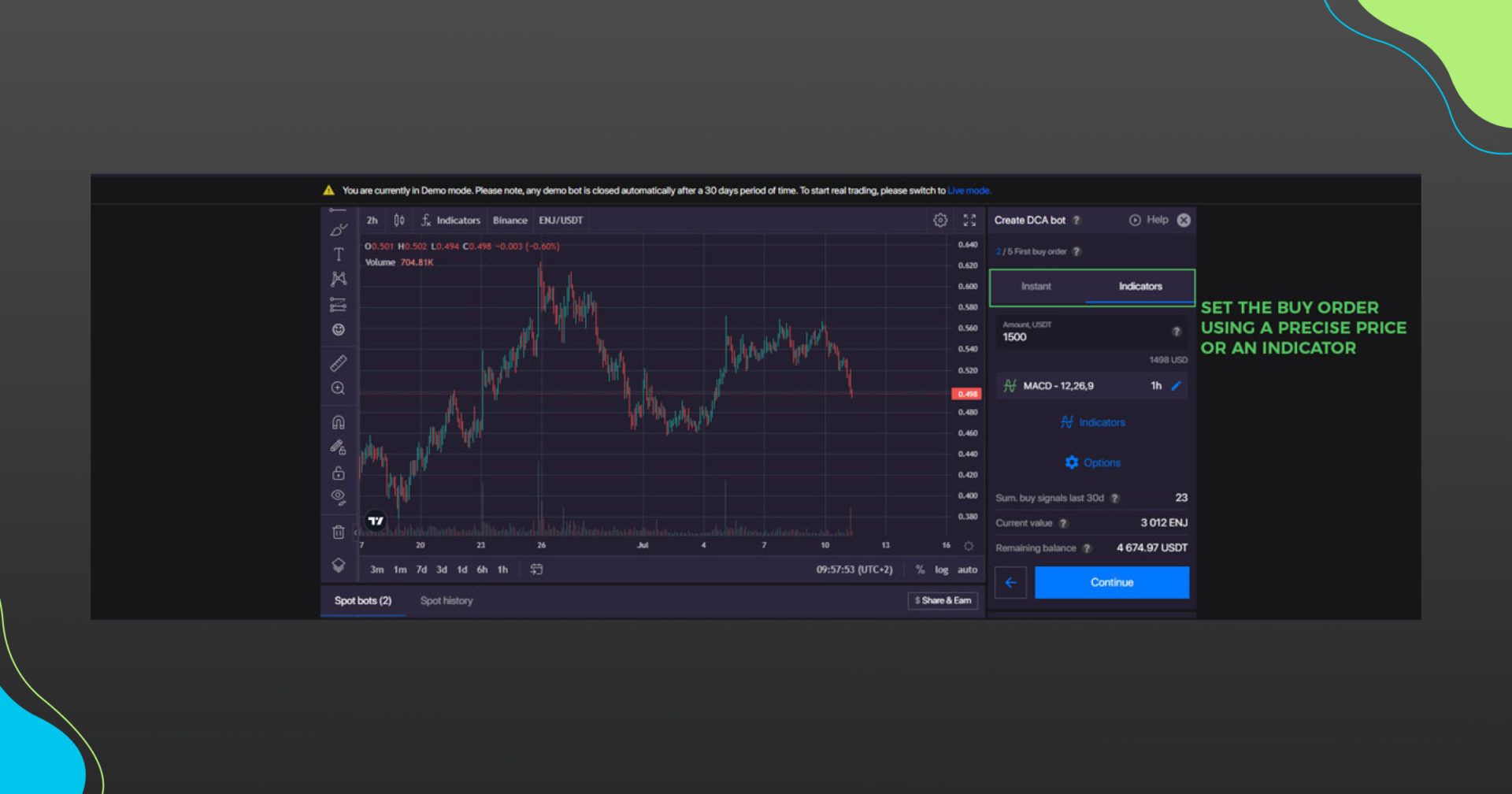

- In the next step, you will select the range of your first buy (for long) or sell (for short) order. It’s where things get a little more advanced as you can choose from:

- Instant – which allows you to set a range of minimum and maximum prices for executing your first buy order.

- Indicator – where you can select between three different indicators to determine the buy signal – MACD, RSI, or stochastic.

3. Next, you will be able to choose the order size, number of orders, and step % when the next order will be executed. Worth noting is that you can set the order size to dynamically adjust (grow or reduce) depending on performance.

As you might have noticed, the DCA bot requires some more advanced market knowledge to be set up effectively. It has a huge range of options that could make or break a trading strategy if not configured correctly.

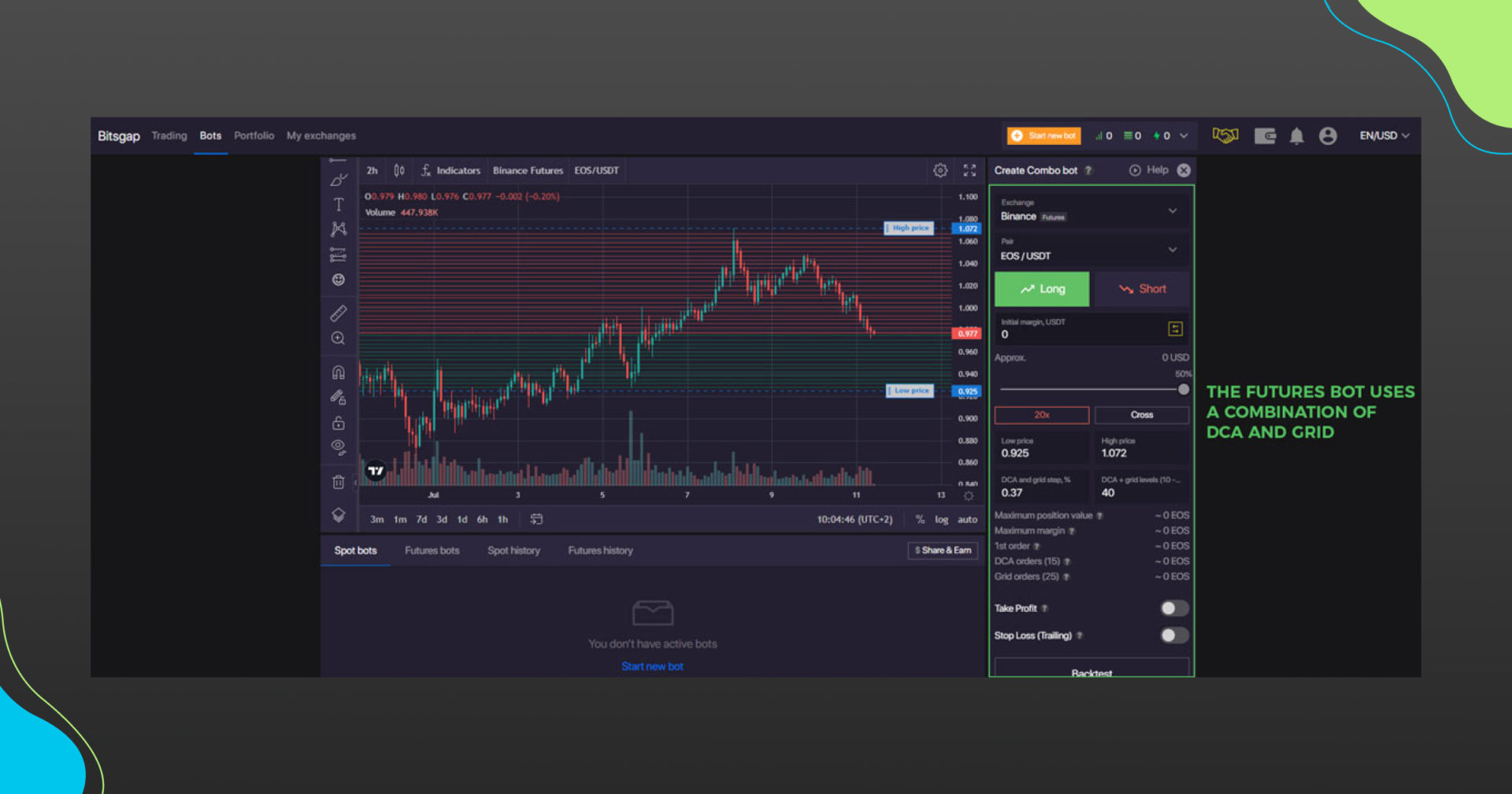

Bitsgap Futures Bot Strategy

As its name suggests, the Bitsgap futures bot allows you to participate in the futures markets on Binance. Futures trading allows you to buy and sell perpetual contracts on borrowed funds and increase your gains (or losses) exponentially.

Before you are able to use this feature, you will need to pass a test on Binance. This quiz will ensure you are aware of the risks of the futures market and understand how it works.

Once that is done, the Bitsgap futures trading bot will become available for use. The futures bot itself is a combination of a grid bot and a DCA bot. As such it borrows:

- The customizable top and bottom levels from the grid bot (draggable).

- The long or short direction of your trade from the DCA bot.

This bot will place both grid and DCA orders, providing you with two different methods for a Bitsgap take profit for bot.

Bitsgap Bot Personalization Options

The Bitsgap grid bot has several additional options that allow you to fine-tune your strategy:

- Activating the Bitsgap Take profit will allow you to close all positions when the change in quote currency is equal or above the set percentage.

- Stop loss orders will sell all base currency once a particular level is reached (e.g. top or bottom of your grid).

- Bitsgap trailing up or Bitsgap trailing down that allows you to follow the direction of the price and maximize profits.

Let’s have a closer look at each one of these advanced options that allow you to make your strategies more efficient.

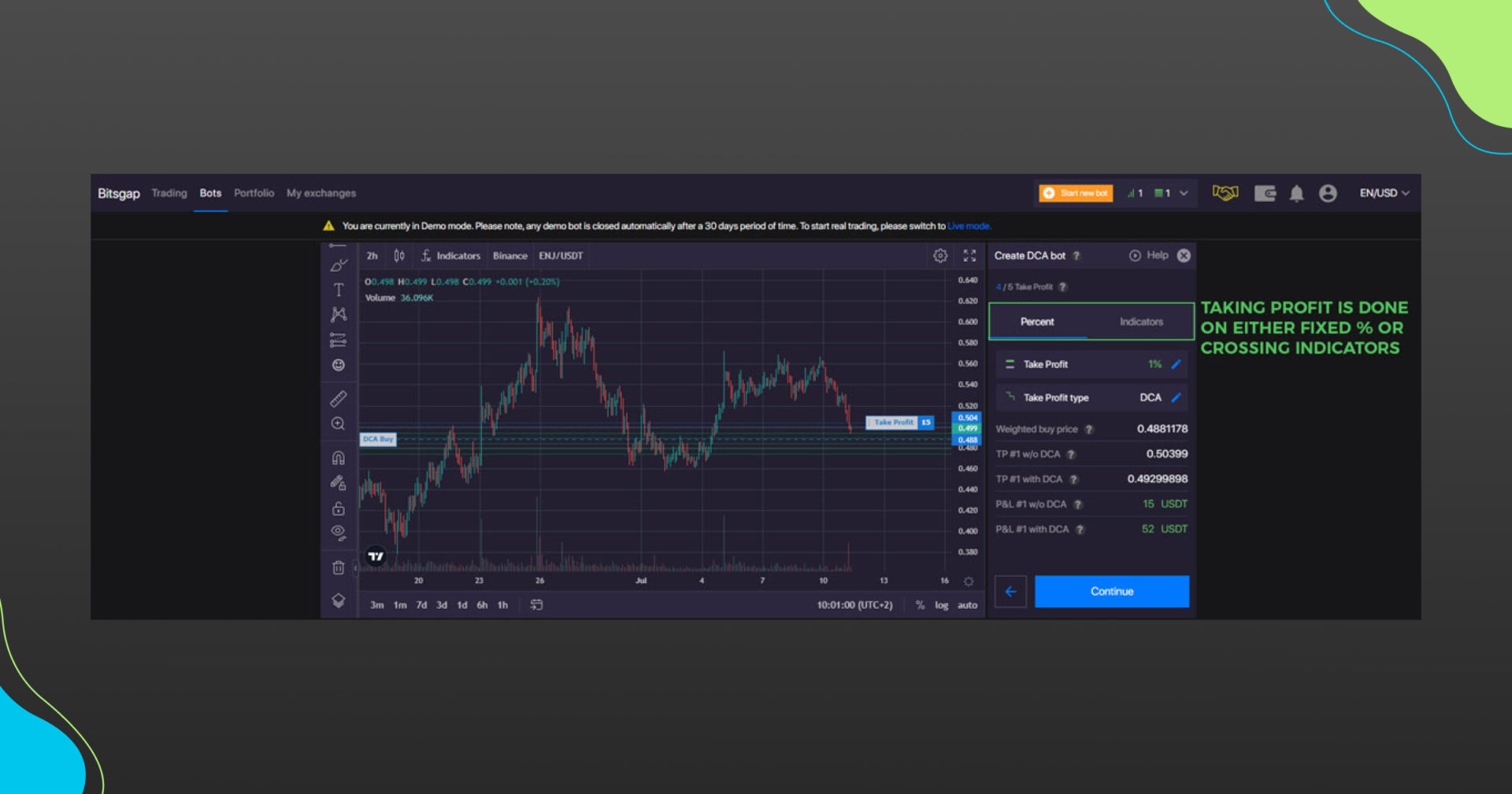

Bitsgap Take Profit: For Bots Included

The take profit for bots Bitsgap is an essential function that allows your bot to exit a position once it has met a certain profit threshold.

Bitsgap bots can use two different ways to calculate the take profit threshold:

- Fixed – where the bot closes position after a certain profit percentage has been reached, relative to the price of the first order.

- DCA – where it applies to a volume-weighted average price of all orders and represents a profit percentage in relation to this average.

In both cases, the Take profit option has the goal to ensure profits are secured in case the market changes direction.

Bitsgap Stop Loss Orders

Stop loss orders are essential when trading cryptocurrencies, and even more so when using bots. These orders serve to cease all trading activity if you start accumulating losses, allowing you peace of mind.

The volatile crypto market can quickly turn on you, which is why it’s good to see that the platform has integrated the stop loss in all their bots. When prices reach a specified stop-loss level, the bot sells all base currency and closes all orders.

However, what’s even more advantageous is that Bitsgap implements a Bitsgap trailing stop loss.

Bitsgap Trailing Orders

Trailing orders on Bitsgap allow you to increase your profits, as they allow the bot to dynamically adjust its targets with the market.

For the grid bot, the Bitsgap trailing take profit function will continue to open orders beyond the top of the grid. It will effectively move the entire grid upwards as the market price increases.

Consequently, the trailing take profit on Bitsgap will allow you to continue to make profits even if the range of the market shifts upwards or downwards.

This is true for the trailing stop loss as well, which will move together with the grid. So, unlike classical fixed stop loss orders you can set on the exchanges themselves, the trailing up Bitsgap and trailing down Bitsgap orders are dynamic.

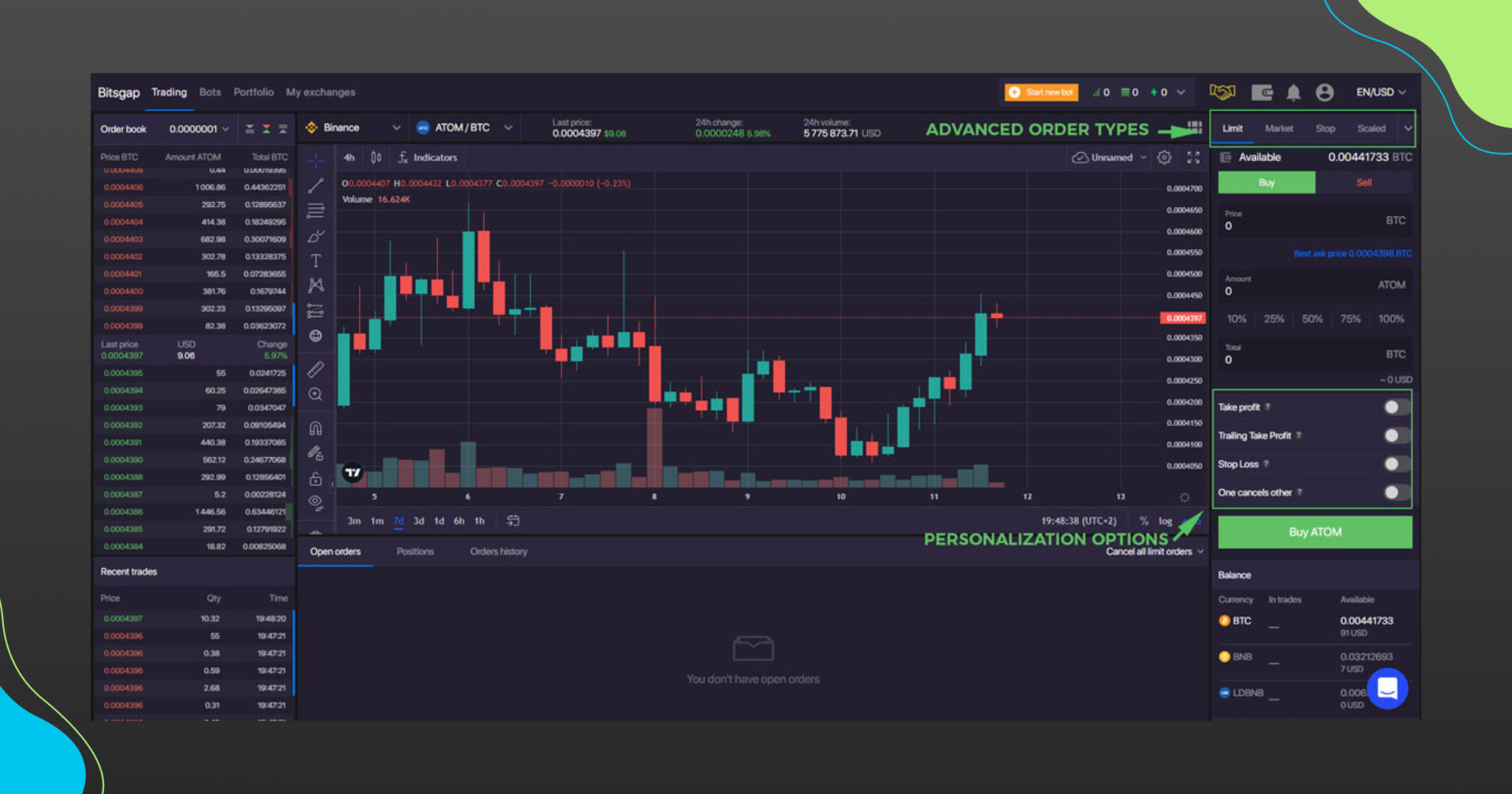

Bitsgap Smart Trading

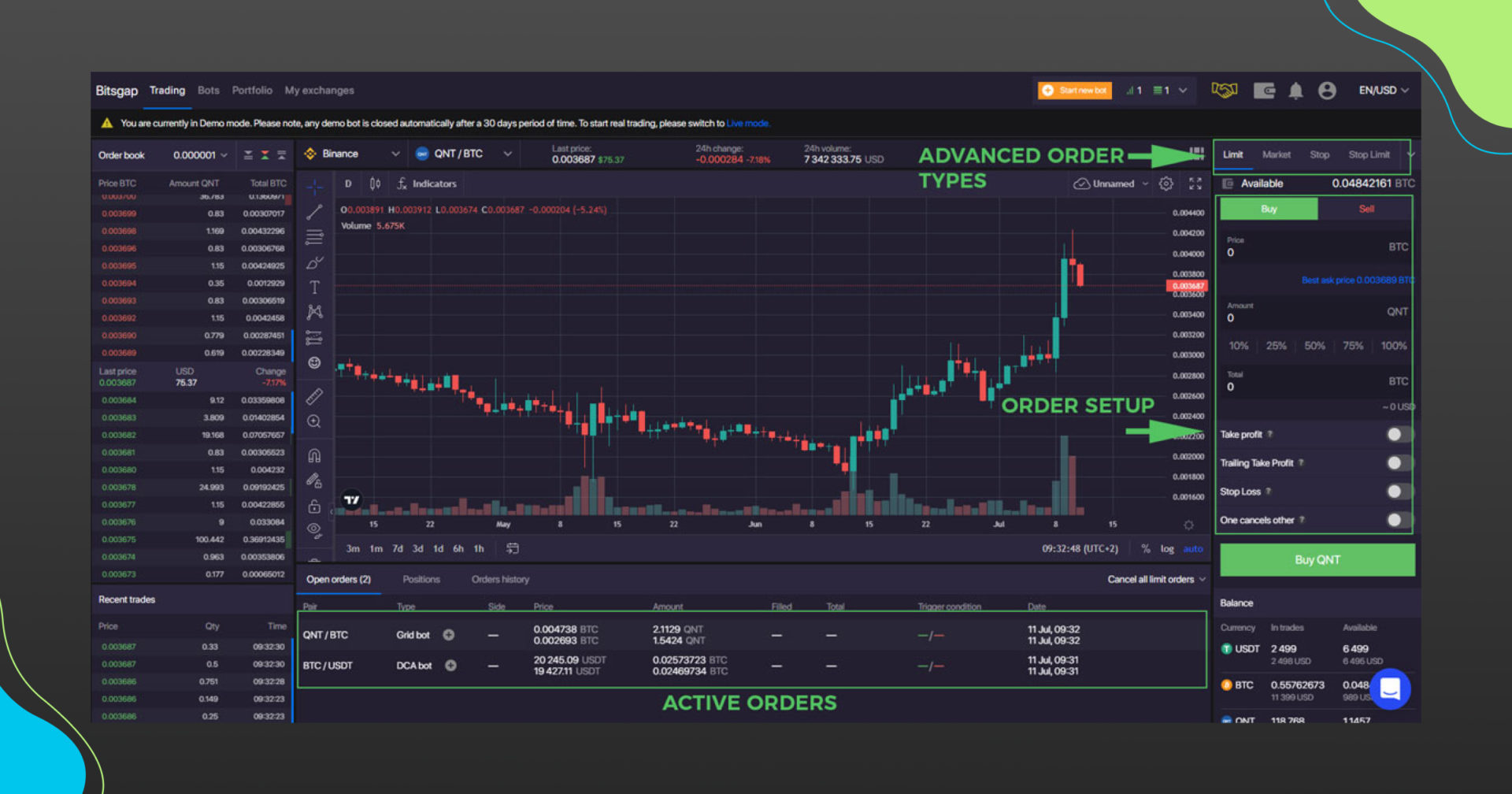

Bitsgap provides smart trading functions that are extended to both manual and automatic trading features. The smart trading terminal allows you to place manual orders on your connected exchange and take advantage of simple market orders such as limit, stop and market orders, as well as advanced order types like:

- TWAP (time-weighted average) which is a strategy of executing trades evenly over a specified time period.

- Scaled order, which places a series of limit orders over a price range and triggers buys as the price trends lower.

The terminal allows you to control, modify and cancel these orders whenever you need. What’s more, all of the order types can be additionally personalized by adding:

- Take profit – where a limit sell order is placed if it reaches a target price.

- Trailing take profit – once triggered, will follow the price and try to increase the profit.

- Stop loss – a market sell order if the price falls to a certain threshold.

- One cancels the other (OCO) – where two orders can be linked to one another and when one is triggered, the other is canceled.

All in all, the smart trading terminal on Bitsgap can easily become your go-to third-party interface for placing your daily trades.

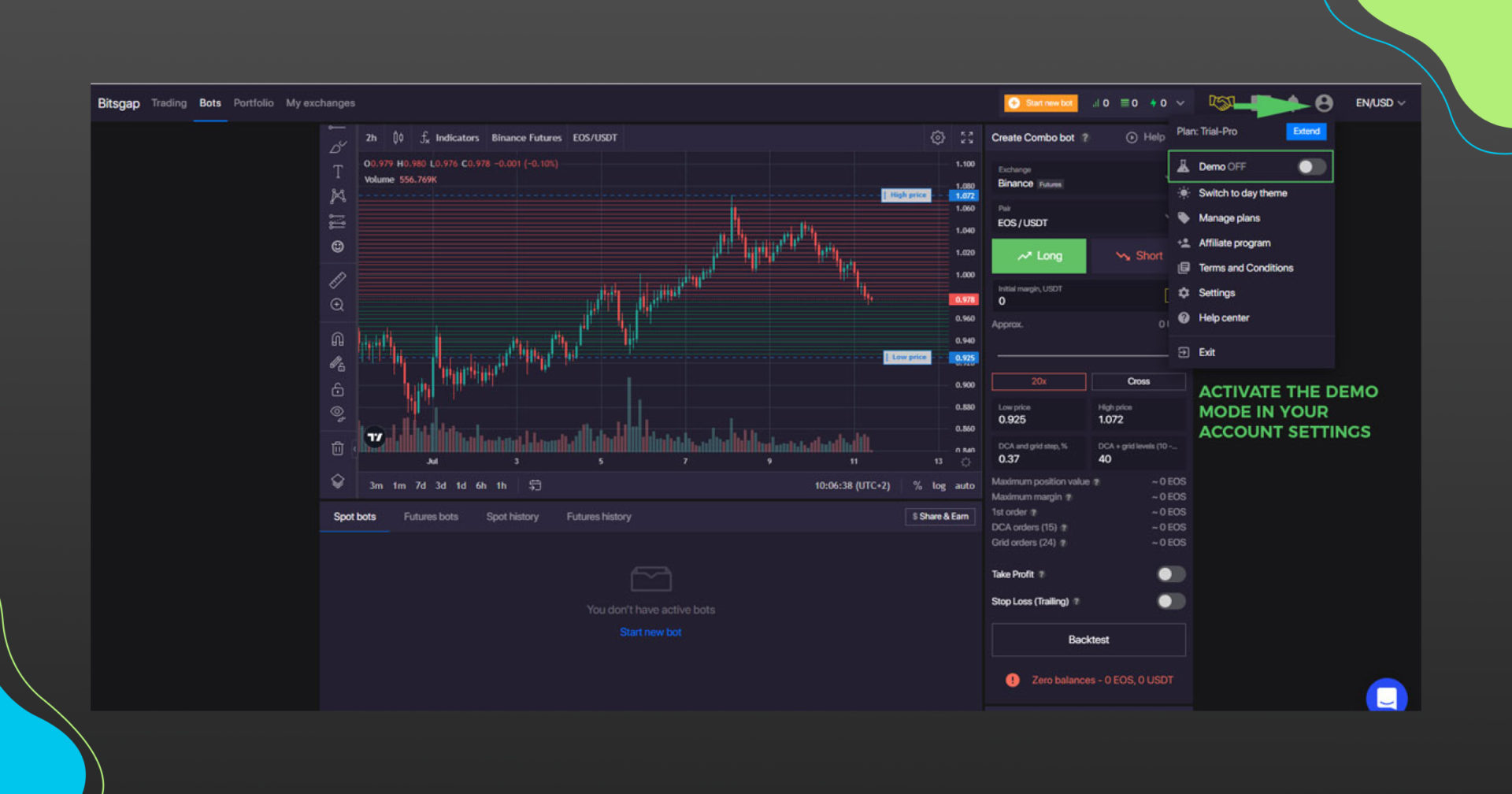

Bitsgap DEMO Feature

The Bitsgap demo feature is a handy option that allows you to test strategies without having to use real funds. By activating the Bitsgap demo mode in the settings, the app will provide you with virtual $30,000 on multiple popular exchanges. To activate the demo mode, follow the instructions on the picture below:

You will then be able to set up DCA and grid bots and test out their parameters to see how they will fare in real-world scenarios. Consequently, a Bitsgap demo account is incredibly useful when getting started with the platform or when you want to find the best strategy for day trading cryptocurrency.

❗️Note that Bitsgap demo trading will not provide you with the means to test the scalper bot on Kucoin or futures markets on Binance.

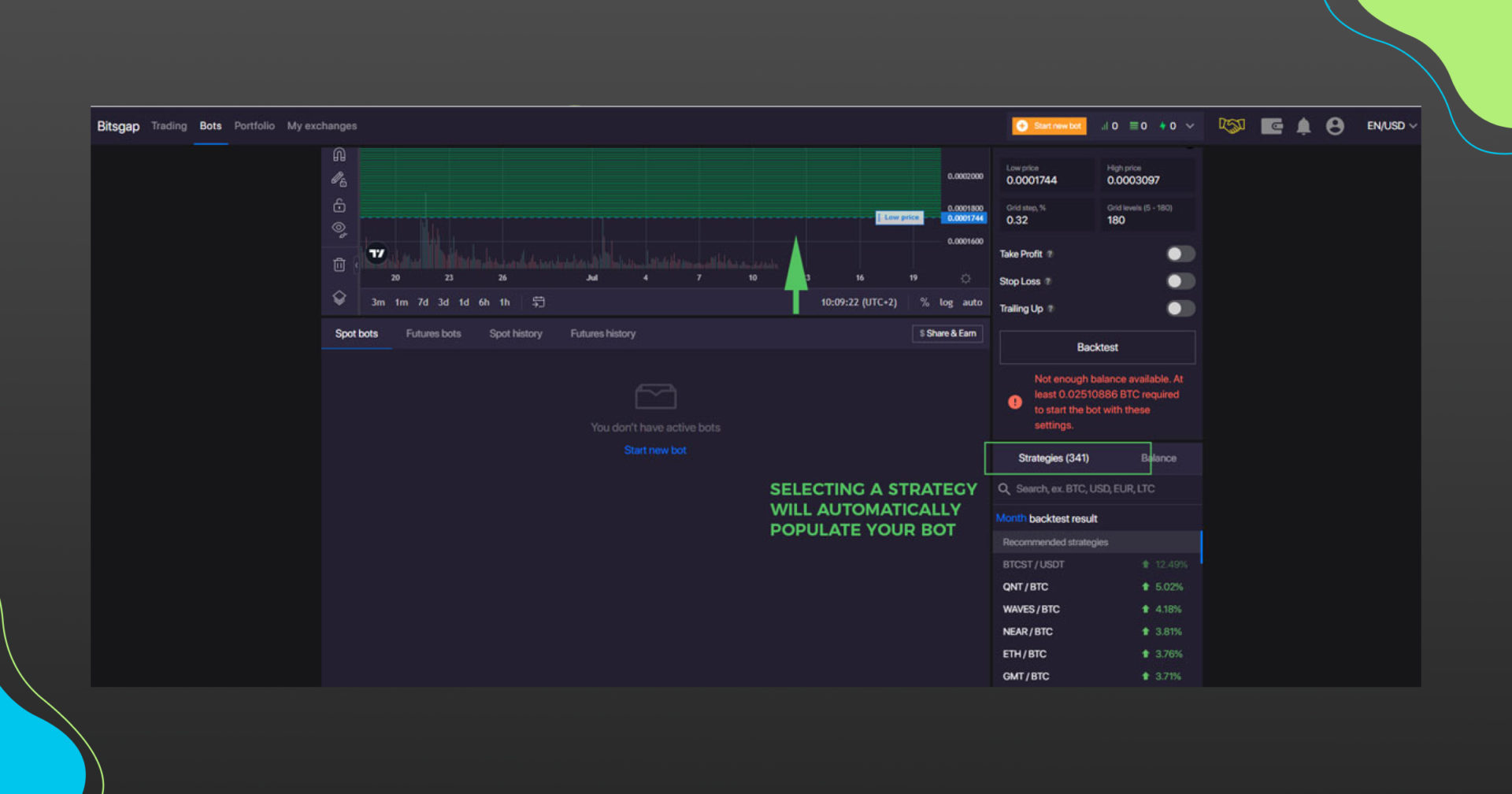

Bitsgap Signals: How Сan They be Useful?

The Bitsgap signals feature is an option that has been phased out by the team and completely removed from the program. This feature allowed the app to detect anomalies in the market and send you a Bitsgap signal that provided an opportunity for a market entry or exit.

That said, this feature has been replaced by far more useful tools including:

- Strategies – a list of proven strategies for different trading pairs that allow you to set up a bot in a single click. You can choose from hundreds of different trading pairs and bot setups

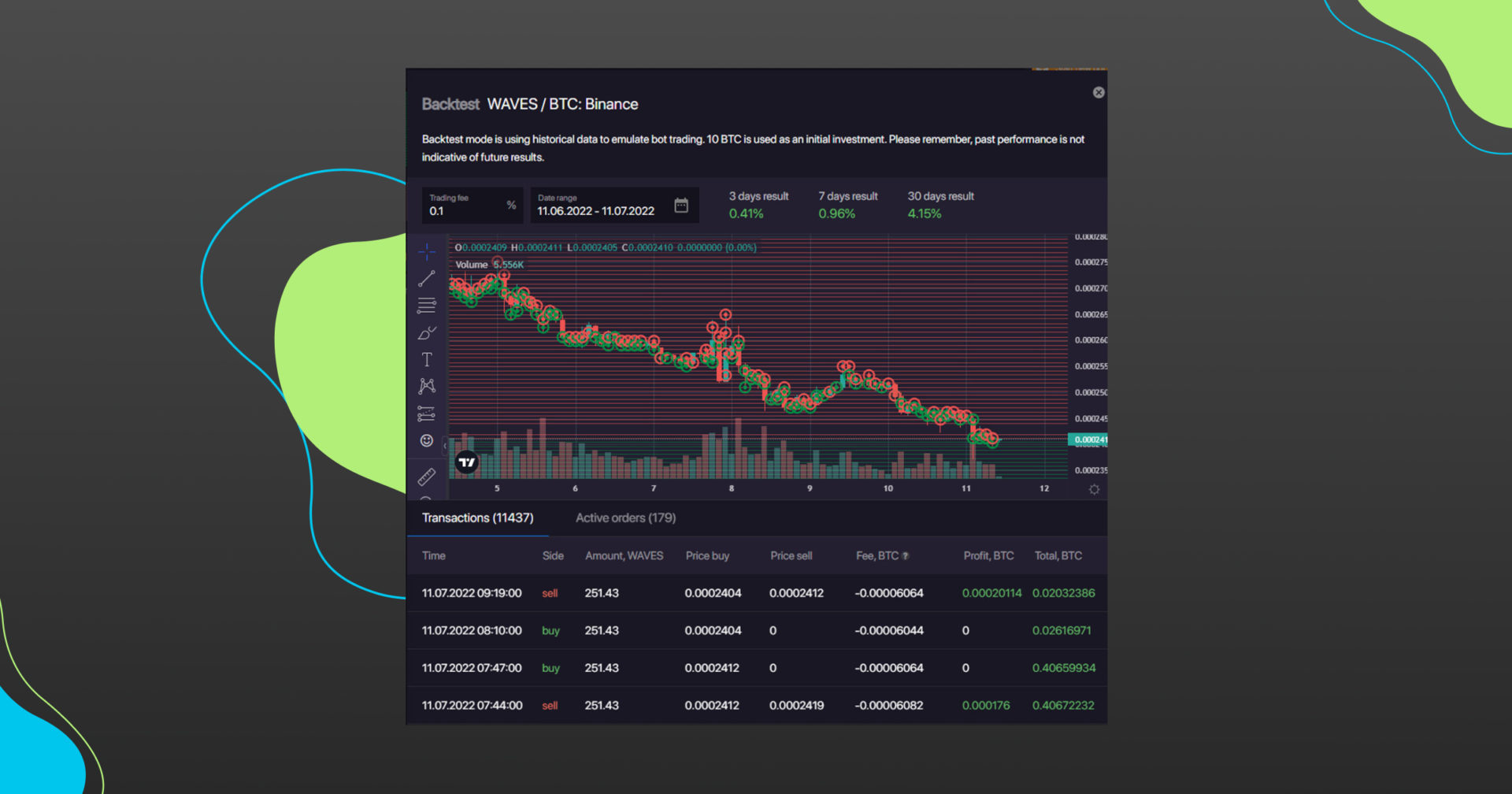

- Backtesting – a tool that allows you to test your bot setup on previous price action. Very handy to assess performance before launching the bot, especially if you are expecting the trend to persist.

All in all, while Bitsgap signals are gone, the app has replaced these with much more tools that have real usage cases.

Bitsgap Arbitrage

Bitsgap arbitrage is another feature from the app that the team removed over time due to high risks and low interest from traders. The Bitsgap arbitrage bot would require that you have assets on multiple exchanges so that it could take advantage of the price difference of the same asset on these platforms.

However, the arbitrage Bitsgap feature never really picked off and was ridden with issues due to trading and withdrawal fees of the exchanges themselves. Consequently, we are not able to give you a Bitsgap arbitrage review as the feature doesn’t exist anymore.

Bitsgap Strategy For Automated Trading

This Bitsgap trading bot review would be incomplete if we didn’t provide some Bitsgap strategy examples. Below are some Bitsgap strategies that you can use in different market conditions and adapt to different trading styles.

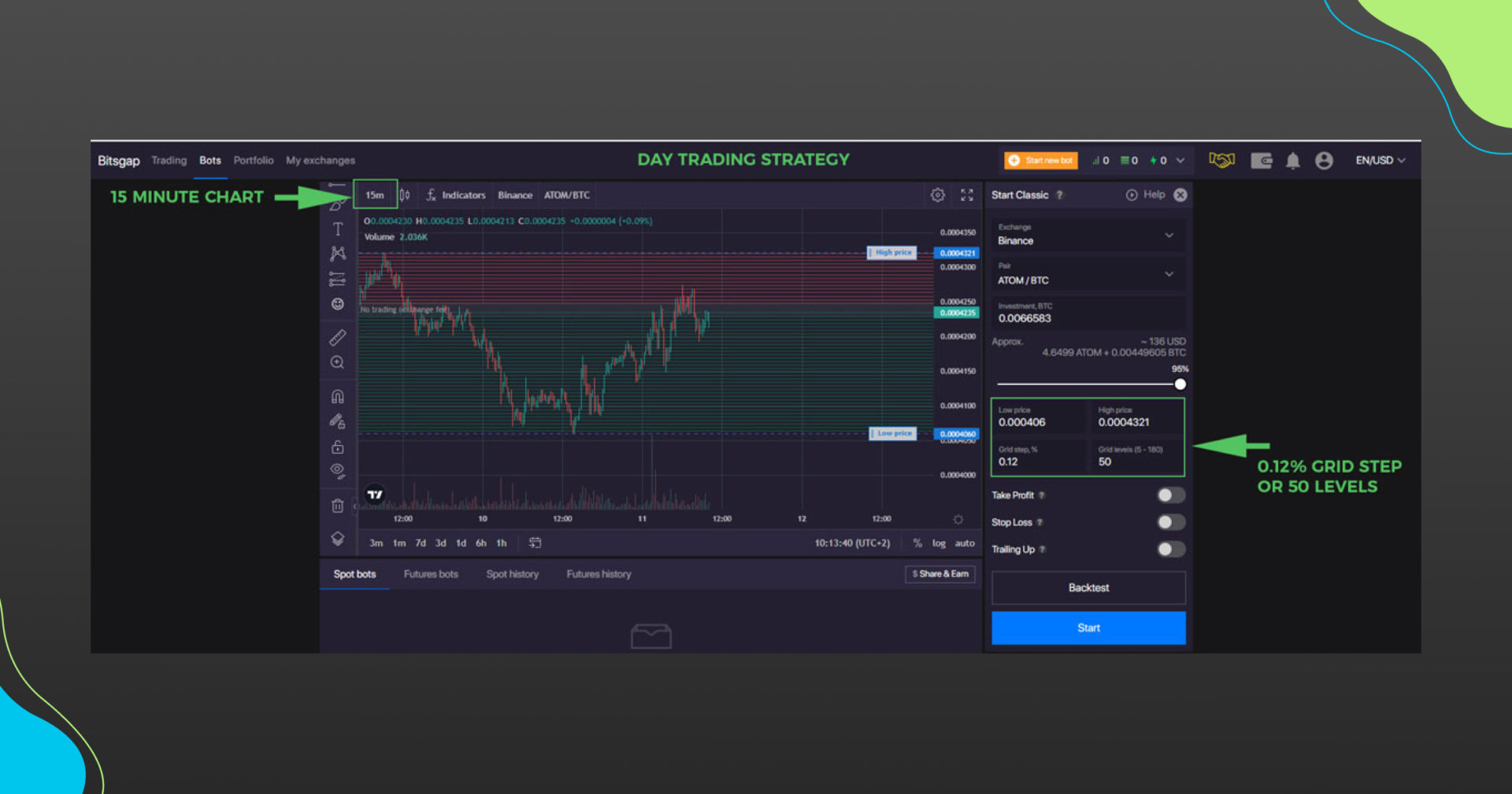

Strategy #1: Day Trading Crypto

There is no single best Bitsgap strategy for day trading crypto. There are thousands of bot setting combinations that can provide consistent results once you get the hang of it.

That said, the good thing about crypto day trading is that you can use both grid bots and DCA bots. Crypto day trading strategies in ranging markets will employ a grid trading bot. On the other hand, a day trading crypto strategy in a rising or falling market will utilize a DCA bot.

However, regardless of which Bitsgap bot strategy you are using, the best strategy for crypto day trading has a couple of go-to settings:

- Since the idea behind day trading strategy crypto is to make multiple trades within a single day, your bots need to be set for high frequency. This means small profit percentages and a higher order quantity (30+ grid levels).

- Day trading requires trading on a shorter timeframe. Consequently, you should optimally be setting up your charts between 5 and 15 minutes.

One bot that stands out as the embodiment of the simple day trading strategy is the scalper bot. However, it’s only available on Kucoin, which can be quite limiting.

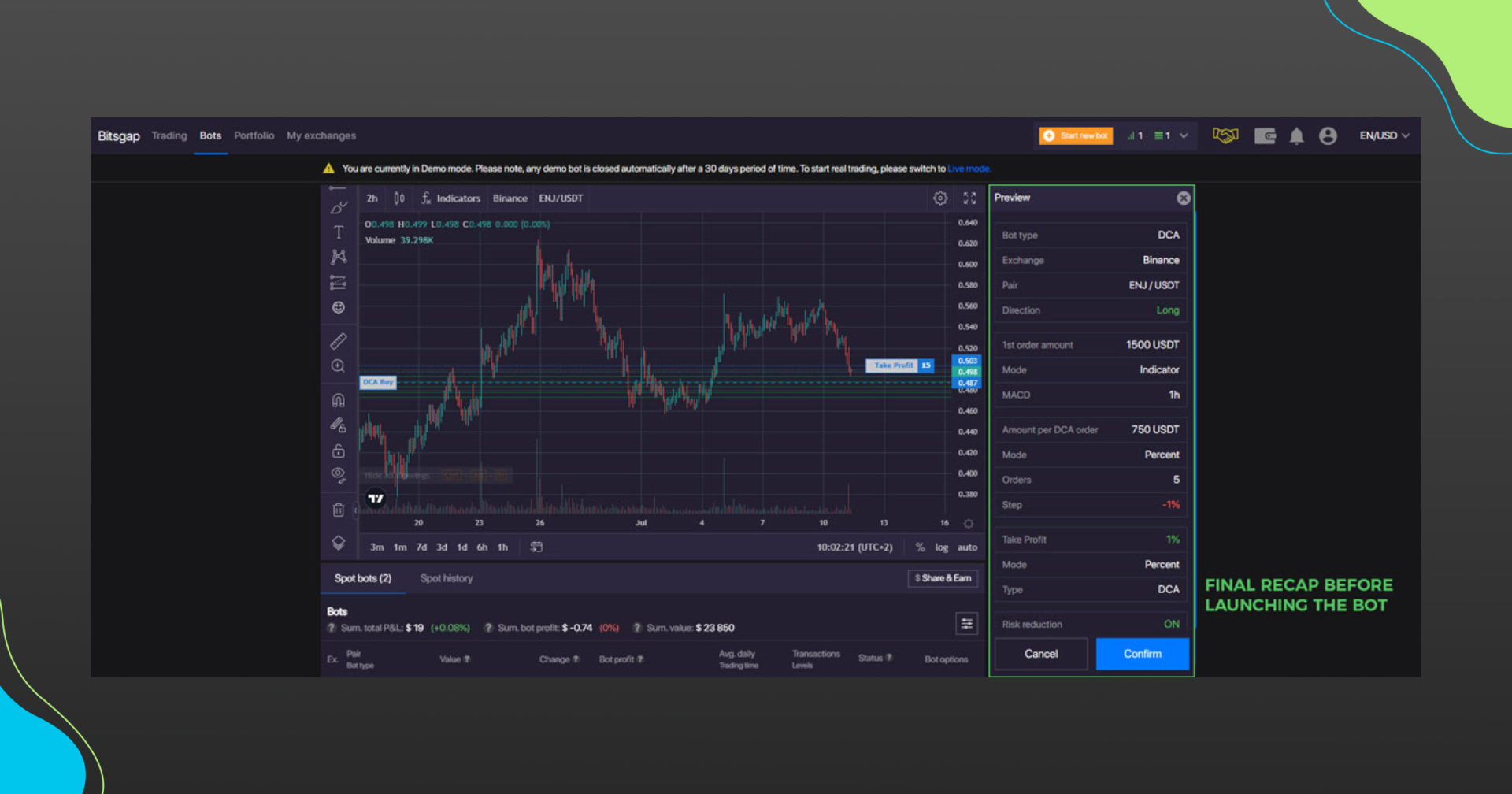

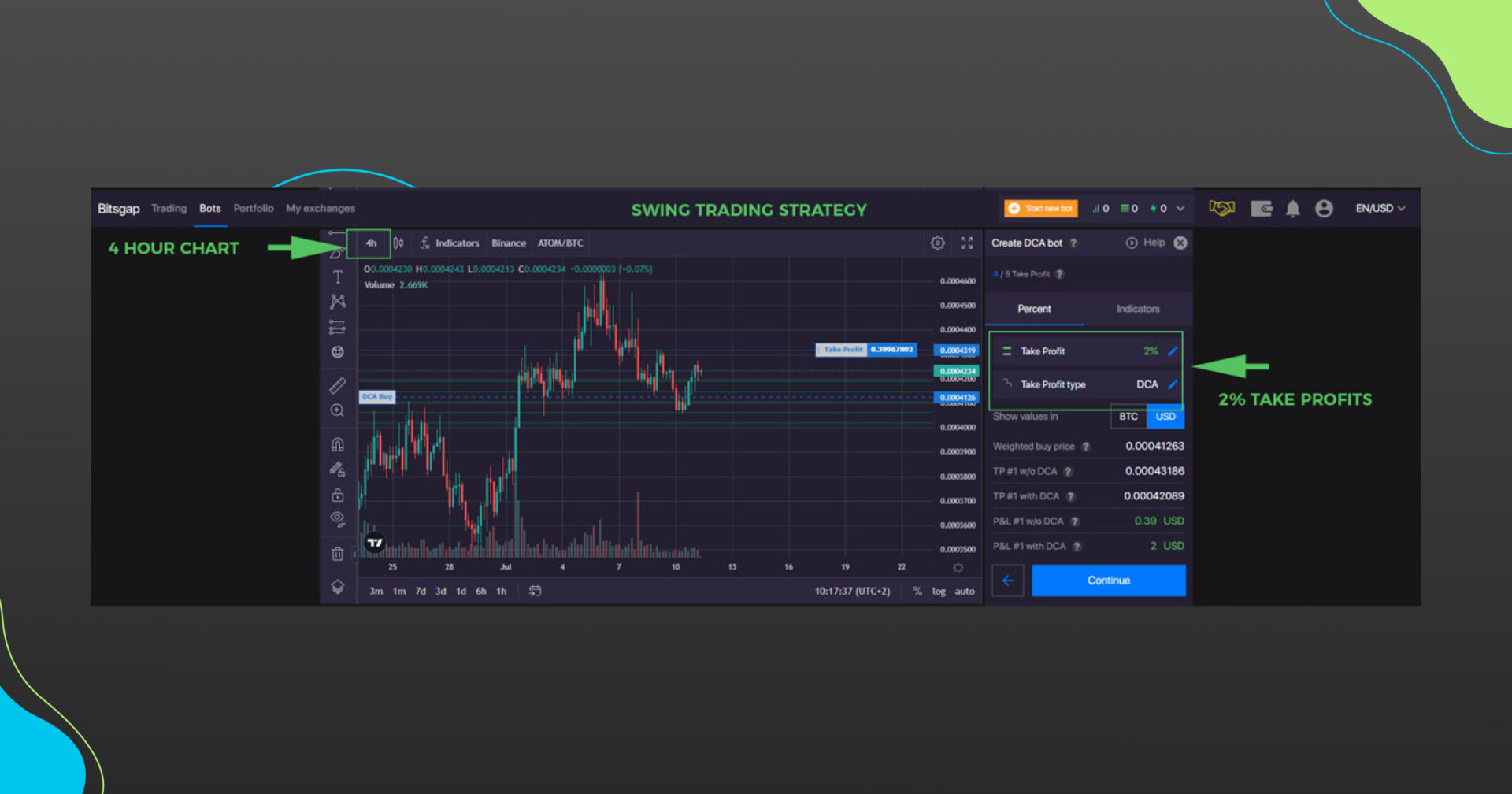

Strategy #2 Swing Trading Crypto

Swing trading crypto is a strategy that requires you to stretch out your trades over several days or even weeks. The idea behind crypto swing trading is to follow a market trend and take advantage of the price momentum. The DCA bot Bitsgap will help you accumulate assets while reducing their average price and taking profit at a given threshold.

Consequently, the best crypto swing trading strategy on Bitsgap will utilize the DCA swing trading crypto bot. Since swing crypto trading takes advantage of larger price movements:

- Your step percentages and take profit should be higher or equal to 1%.

- You should be charting your technical analysis on timeframes between 2 hours and 1 day.

To sum up, swing trading crypto strategies can be very lucrative once the market picks up momentum.

Strategy #3: Range Trading

Trading range in crypto is a perfect strategy when the market slows down and enters an accumulation phase. In these situations, a range trading strategy will consist of setting up a grid crypto bot Bitsgap that will trade between the top and bottom market levels.

Depending on the volatility of the market, range trading crypto can be equally done on shorter or longer timeframes. However, the best range trading strategy will be somewhere in the middle, with:

- Grid steps between 1% and 2%.

- Chart timeframe between 30 minutes and 1 hour.

The range market trading strategy requires the least preparation and analysis, making it perfect when starting out crypto bot trading.

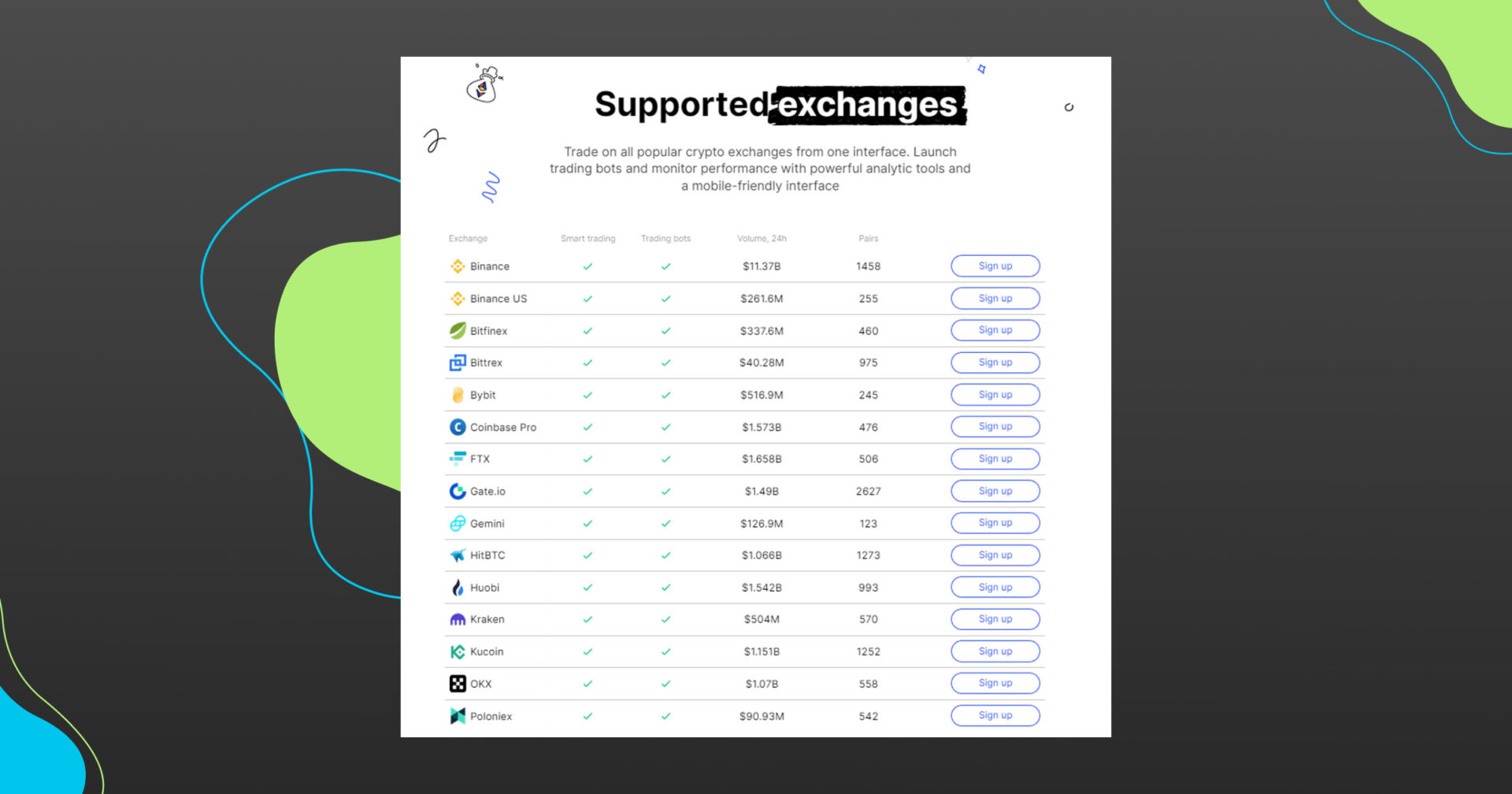

Bitsgap Supported Exchanges List

Bitsgap covers a decent amount of exchanges (15 total), including some of the biggest names in the industry. The Bitsgap supported exchanges are:

- Binance

- Binance US

- Bitfinex

- Bittrex

- Bybit

- Coinbase Pro

- FTX

- Gate.io

- Gemini

- HitBTC

- Huobi

- Kraken

- Kucoin

- OKX

- Poloniex

You might notice that smaller exchanges and decentralized platforms are not included in this list. While this list is quite decent, some competitors have a better offering.

As to which is the best exchange for Bitsgap, our choice would go towards Binance. It’s the only exchange that allows you to trade futures with Bitsgap, as well as spot.

Bitsgap Best Settings Review

So what are the Bitsgap best settings?

If you’ve read this far through our Bitsgap trading review, you should realize by now that there’s no such thing as best Bitsgap settings.

Depending on your trading style and market conditions, you will need to adapt your Bitsgap settings accordingly.

Bitsgap Login Procedure

Worth noting is that the Bitsgap login is fully streamlined, which is great for beginners. Creating a Bitsgap account requires a simple email confirmation procedure to get things rolling.

Finally, connecting your Bitsgap account to your favorite exchange is equally easy. The process involves a simple copy/paste of the API keys that your exchange will provide.

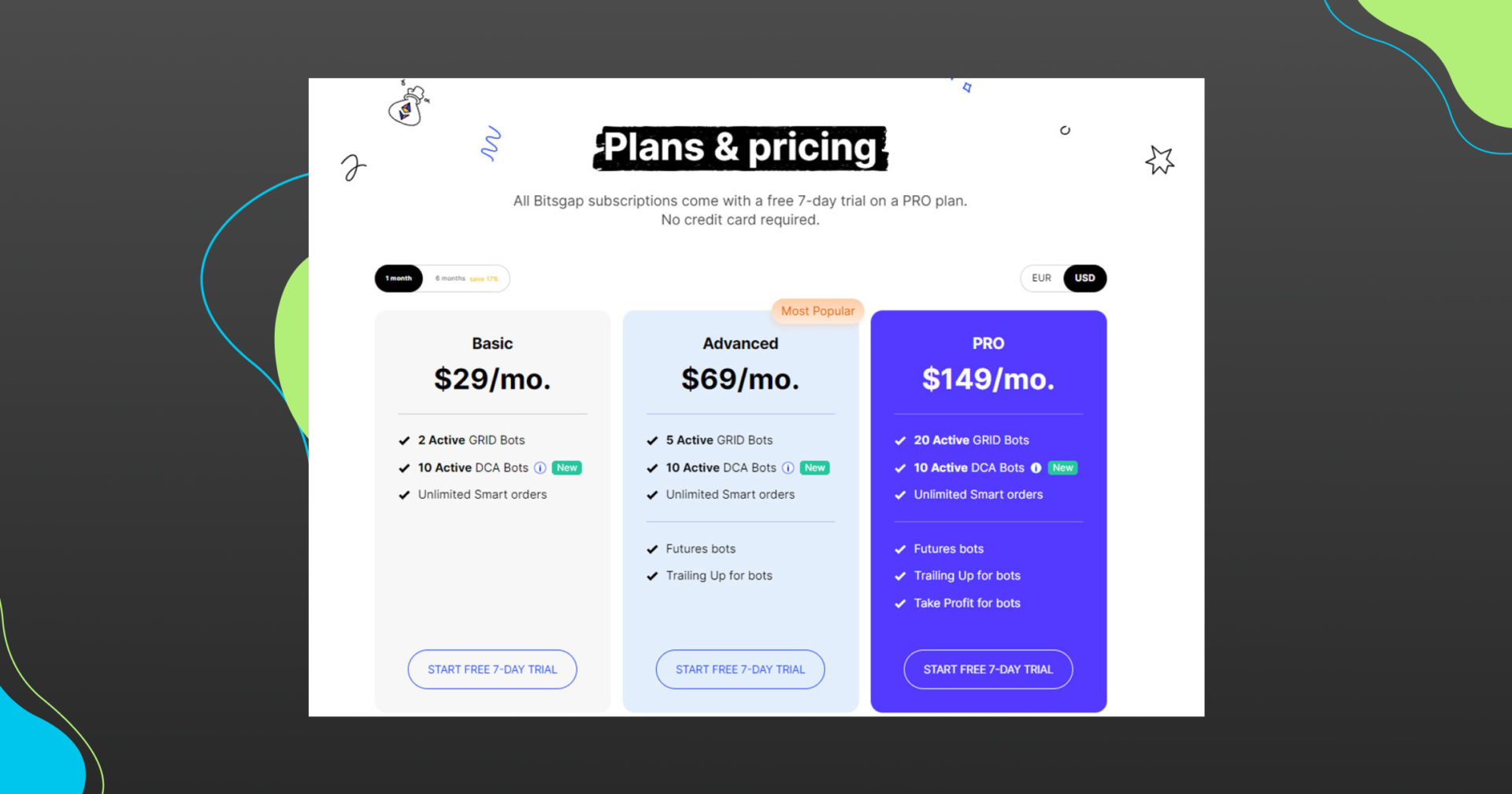

Bitsgap Plans and Pricing

Taking a closer look at the Bitsgap plans should allow us to answer the question “Is bitsgap worth it?”

First, we need to point out that there’s no Bitsgap free version. While the platform offers a Bitsgap free trial that lasts 7 days, once that period is over, you will need to upgrade to one of the paid plans.

Here’s how the Bitsgap pricing looks like:

- Basic Plan – $29/mo with 2 active grid bots, 10 DCA bots, and unlimited smart orders.

- Premium Plan – $69/mo with 5 active grid bots, 10 DCA bots, and unlimited smart orders. In addition, you get access to futures trading and trailing up for bots.

- Pro Plan – $149/mo with all of the features from the premium plan, 15 additional grid bots, and the take profit feature for bots.

Worth noting is that crucial features of the platform like trailing up and taking profit are behind a consequential paywall.

Bitsgap Taxes and Fees

Fortunately enough, there are no additional Bitsgap fees that will add up to the total Bitsgap cost, other than the monthly subscription. While you will need to pay the trading fees respective to each exchange, there’s no such thing as a Bitsgap trading fee.

Is Bitsgap Legit and Safe to Use?

If you are asking yourself is Bitsgap legit, note that the platform has been around since 2017. It has been providing bot trading services for over 5 years, proving it’s a legit business. What’s more, there have never been any complaints regarding the safety of the app.

Additionally, the app allows you to add extra layers of security to your account with 2-factor verification through an authenticator app and external hardware security keys. This should ensure that your account is accessible only by your person.

The Bitsgap API doesn’t allow the withdrawal of funds, and can only send signals to your exchange account. The platform encrypts this data with 2048-bit standard protocols and stores them on a secure network, protected by a firewall.

This makes Bitsgap safe to use, and connecting your exchange to it shouldn’t be a source of concern.

Bitsgap Competitors. What Is The Best Bitsgap Alternative?

To wrap up this Bitsgap review, let’s have a look at some of the Bitsgap competitors available on the market.

The Bitsgap price is on the steeper side compared to platforms that offer similar services. We can single out two major Bitsgap alternatives: 3Commas and our very own GoodCrypto app.

Both of these solutions are cheaper with 3Commas being $49/month. However, GoodCrypto is the real value deal here, as it costs only $9.99/mo. Moreover, GoodCrypto is a great alternative to Bitsgap as it provides nearly all of the premium features for a fraction of the price. The choice of Bitsgap vs GoodCrypto should be quite easy as our app offers:

- Smart trading which includes advanced orders and trailing stops (available only on the premium plan on Bitsgap).

- Spot trading with 10 infinity trail and grid bots on 30+ different exchanges.

- No less than 8 derivative exchanges where you can plug in your trading bots.

- Handy Android and iOS app that allows you to trade on the go and receive live alerts on the activities of your bots.

And much more.

All of this makes GoodCrypto a Bitsgap alternative worth considering.

Conclusion

Bitsgap remains one of the top crypto bot platforms on the market for a number of good reasons. The bots are easy to set up thanks to an intuitive interface and the platform provides handy features such as backtesting and ready-to-go strategies.

However, the fact remains that Bitsgap is quite expensive and you will need to pay the full price to access the most advanced features of the app. Moreover, it lacks a mobile version, which is quite essential in a volatile market such as crypto. GoodCrypto comes out as an all-in-one, affordable alternative with iOS, Android, or Web versions.

Also, read our complete 3commas Review.

Get the App. Get Started.

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

July 13, 2022