Hey traders! 👋

This week brought both positive and shady events for the Web3 industry. Let’s explore them today in the weekly digest by GoodCrypto to stay up to date on the crypto market. If you’d like to stay updated, follow us on Twitter.

quick weekly news

BTC whales not in sufficient profit to dump on market

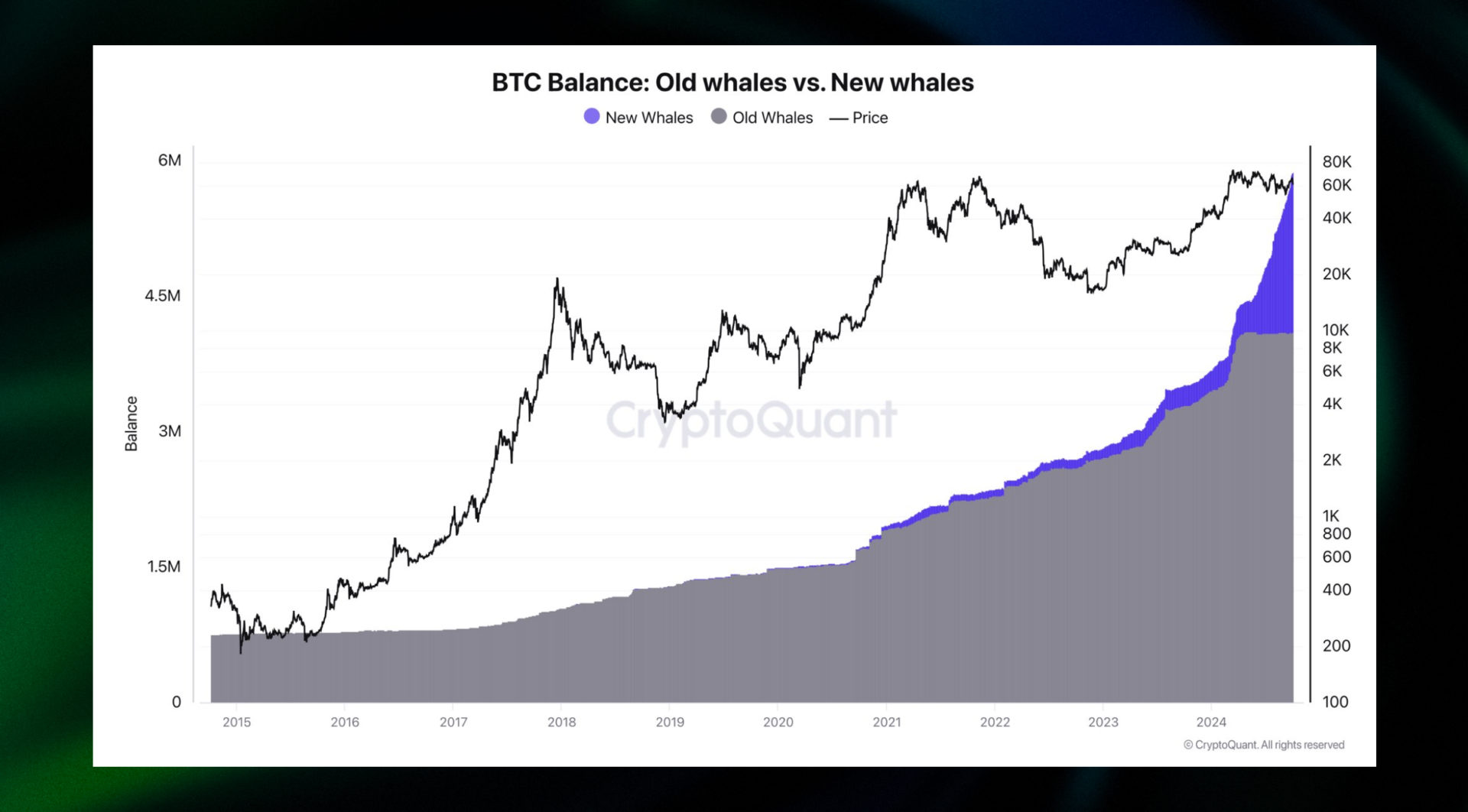

On October 2nd, 2024, the Founder of CryptoQuant and data analyst, Ki Young Ju, released a post suggesting that the current Bitcoin price hasn’t brought significant returns for most new Bitcoin whales. Therefore, it is unlikely they will sell their positions at this rate.

To clarify, by “new whales,” the analyst refers to whale wallet addresses that are less than 5 months old. According to the graph he presented, despite Bitcoin’s price trading in the range of $60K to $70K over the past 5 months, the number of whales accumulating Bitcoin has grown significantly.

Source: Ki Young Ju on X

In his opinion, this is why the whales will continue accumulating Bitcoin, pushing the price of $BTC up until there is an inflow of retail liquidity, at which point they may dump their holdings.

For context, on October 1st, 2024, Bitcoin dropped by almost $4,000 in one day following escalating tensions in the Middle East between Israel and Iran. On the same day, Bitcoin ETFs recorded their highest monthly outflow of over $243M. Some traders, including Roman_Trading, even expect Bitcoin to dip to $54,000 before a potential reversal.

Fidelity Ethereum ETF records largest daily outflows since launch

Continuing from the news of large inflows on October 1st, 2024, one of the largest ETH ETF holders, Fidelity, recorded its largest daily outflow since the ETF’s launch in July 2024.

The news was reported by the investment fund Fairside Investors, which stated in its report that total negative flows amounted to $48.6 million, with FETH, ETHE, and ETHW contributing $25 million, $26.6 million, and $0.9 million in outflows, respectively. The only ETFs that saw inflows that day were 21Shares’ Core Ethereum ETF (CETH) and the VanEck Ethereum ETF (ETHV), bringing in $1.2 million and $2.7 million, respectively.

Source: Fairside investors

Notably, Grayscale’s ETHE, the largest ETF by market cap, has been exerting additional selling pressure on Ethereum since the first day of its conversion. To clarify, ETHE existed in the U.S. long before the approval of Ethereum ETFs in July 2024, in the form of the Grayscale Ethereum Trust, and was later converted into an ETF. So far, ETHE has caused nearly $3 billion in outflows over the past three months, and there are currently no clear signs of this selling pressure easing.

As of October 2nd, total ETH ETFs’ outflows amounted to -$552.2 million over the past three months.

Tron Network posts record $577M revenue in Q3

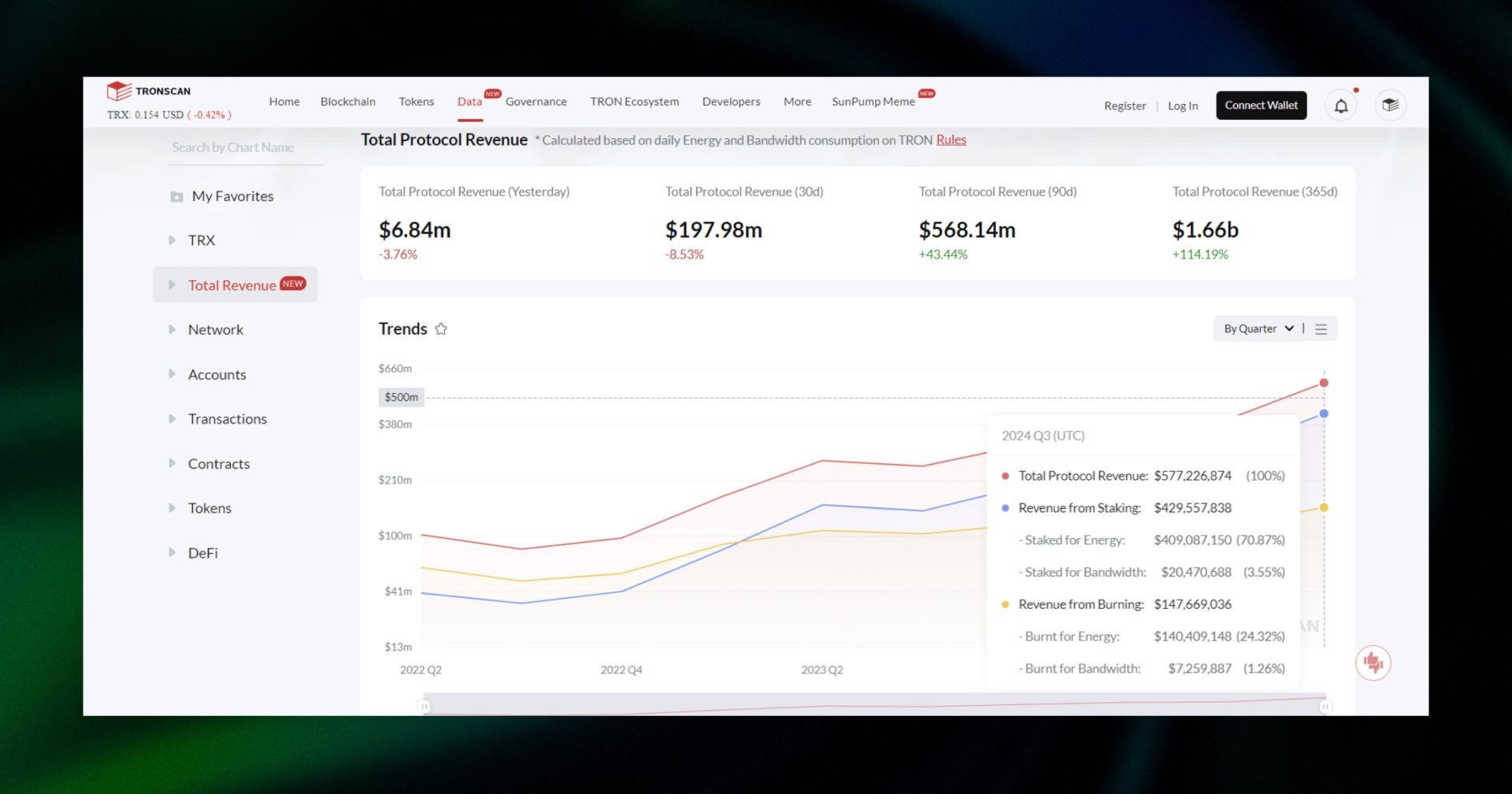

Recently, Tronscan published data on Tron blockchain’s revenue for Q3 2024.

According to the chart, Tron saw a record-high revenue of over $577 million, surpassing Bitcoin and Ethereum’s revenue for the same period. Data from Token Terminal shows that Ethereum’s revenue over the past 90 days reached $257 million, while Solana generated around $104 million, and Bitcoin recorded $55 million in revenue.

Source: Tronscan

Interestingly, blockchain networks generate income through a complex mix of fees, revenue streams, and other technical avenues. For instance, Tron’s significant revenue could be attributed to its growing stablecoin activity and a recent surge in the memecoin market on its network.

According to DeFiLlama, Tron is the second largest blockchain after Ethereum for stablecoins, holding around 35% of the total $172 billion stablecoin market cap. It has become a popular tool for users in South America and Africa, where high inflation and currency devaluation push people toward more stable assets like USDT or USDC.

Additionally, Justin Sun’s recent initiative to attract memecoin traders to the Tron network has also contributed to the growing fees and, consequently, the platform’s revenue. Since its launch on August 9, 2024, the SunPump initiative has generated over $5.4 million in revenue, which has also boosted Tron’s overall revenue.

Ripple CEO on SEC appeal: ‘We’ll fight in court for as long as we need’

In the context of the new appeal from the SEC (Securities and Exchange Commission), which could extend into early 2026, Ripple Labs’ CEO commented that they are ready to fight the United States Securities and Exchange Commission in court.

“While we’ll fight in court for as long as we need to, let’s be clear: XRP’s status as a non-security is the law of the land today,” he said in his recent post on X.

To recall, in July 2024, New York District Court Judge Analisa Torres stated that XRP was not a security because the digital asset failed to satisfy all the conditions listed in the SEC’s Howey test to classify a financial asset as an investment contract. This ruling ended Ripple’s lawsuit, which had lasted since 2020 and was widely regarded as a victory for XRP.

Now, the SEC has filed a notice of appeal in the Ripple lawsuit, seeking to overturn Judge Analisa Torres’ ruling. However, some Ripple executives had anticipated such a development, with XRP’s Chief Legal Officer, Stuart Alderoty, writing on X that the SEC’s appeal was “disappointing, but not surprising.” He also added that Ripple is “evaluating whether to file a cross-appeal.”

In response to this news, the $XRP token has dropped by over 11% within the past 24 hours, according to CoinMarketCap.

how to read Bollinger Bands indicator?

Bollinger Bands (BB) are one of the most commonly used indicators that help traders determine whether the market is overbought or oversold, as well as if the market is trending or ranging.

How to read the indicator? 🤔

The BB gives you an immediate sense of market direction when looking at the SMA. Additionally, by observing the width of the BB, you can spot potential squeezes as the width tightens. On the other hand, when the width is wide, the market is expected to be highly volatile.

To determine whether the market is trending or ranging, follow this logic:

🔸 If the price is constantly bouncing between the bands, the market is ranging;

🔸 If the price is consistently above the SMA and hitting the upper band for an extended period, the market is trending.

Want to find out more about Bollinger Bands and trading strategies with this powerful tool? Read our in-depth Bollinger Bands review! 📈

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!