We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Prior to the OP unlock, Wintermute transfers $4 million worth of optimism tokens to Binance

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Bybit, a cryptocurrency exchange, leaves Canada due to a “recent regulatory development”

Cryptocurrency exchange Bybit has announced that it will temporarily pause its products and services for residents and nationals of Canada due to recent regulatory developments. Starting from May 31, Bybit will no longer accept account opening applications from Canadians. Existing users will have until July 31 to make deposits and adjust their positions, while services will be phased out, and any remaining positions will be liquidated after September 30.

Bybit did not provide specific details regarding the regulatory changes in Canada that prompted its market exit. However, it mentioned that the Ontario Securities Commission had previously imposed financial penalties against the exchange in June 2022. Bybit also stated its intention to introduce mandatory Know Your Customer requirements for all users from May 2023.

Prior to the OP unlock, Wintermute transfers $4 million worth of optimism tokens to Binance

Wintermute, a decentralized finance (DeFi) platform, has transferred its Optimism (OP) tokens to a wallet on the Binance exchange in preparation for the upcoming token unlock. The unlock is set to release $587 million worth of tokens into the market.

On May 31, a total of 386 million OP tokens will be unlocked for early contributors and investors, accounting for 9% of the total supply. This influx of tokens is expected to increase the circulating supply by over 100%.

In anticipation of the unlock, Wintermute’s wallet has already transferred 2.651 million OP tokens, equivalent to $4.31 million, to Binance in the past two days. The tokens were sold for approximately $1.63 per OP.

Wintermute had acquired a total of 21.31 million OP tokens from exchanges Binance and Coinbase at an average price of $1.01. Out of these tokens, the company has already sold 5.9 million for $10.6 million while retaining 15.37 million OP tokens valued at around $23.4 million at the current time.

30% of Nansen’s employees are laid off

Blockchain analytics platform Nansen has made the difficult decision to reduce its workforce by 30%. CEO Alex Svanevik announced on Twitter that the company had to take this step for two main reasons.

Firstly, during its initial years, Nansen experienced rapid scaling, leading to the organization taking on areas not aligned with its core strategy.

Secondly, the challenging year for crypto markets played a role in the layoffs. Despite efforts to diversify revenue streams, Nansen’s cost base remained relatively high compared to its current position. Svanevik emphasized the importance of building a sustainable business while acknowledging that the company has several years of financial runway.

Affected employees will be provided with severance packages in recognition of their contributions.

Security company finds $500M flaw in Tron multisig accounts

A zero-day vulnerability has been discovered in Tron multisig accounts by the research team at dWallet Labs. This vulnerability allows an attacker to bypass the multi-signature mechanism and sign transactions with just a single signature.

The research team highlighted that this vulnerability could have affected approximately $500 million worth of assets held in Tron multisig accounts, as it completely undermines the security provided by the multisig feature in TRON.

Multisignature wallets require multiple signers to approve transactions and facilitate the movement of funds, enabling joint accounts in the crypto space. Each signer possesses their own keys, and a specific threshold is required for transaction approval.

The vulnerability in Tron’s multisig implementation allows the generation of multiple valid signatures for the same message using non-deterministic nonces of the attacker’s choice. By exploiting this flaw, signers can “double vote” or sign twice, as Tron focuses on ensuring the signatures’ uniqueness rather than the signers’ uniqueness.

The CEO of dWallet Labs, Omer Sadika, stated that the fix for this vulnerability is straightforward: verifying the address instead of the number of signatures.

The researchers responsibly reported the vulnerability to Tron in February, and the issue was promptly addressed and fixed shortly after.

What Is the Fibonacci Sequence Trading Strategy Used For?

By leveraging the fixed lines of support and resistance Fibonacci offers, you can employ automated trading strategies based on the Fibonacci sequence. Utilizing the Fibonacci sequence in trading enables you to identify precise market entry and exit points, empowering you to establish conditions for automated orders through our GoodCrypto app. In addition, incorporating the Fibonacci sequence in crypto enables you to effectively seek out pullbacks and breakouts, enhancing your ability to execute low-risk profit strategies.

In the provided example, observe the Bitcoin chart utilizing the Fibonacci sequence, which facilitates profit-taking from price swings. Breakouts serve as buy signals, with the target being the subsequent Fibonacci retracement level. Conversely, breaking down from Fibonacci sequence levels offers opportunities for short entries or enables the placement of stop losses as a safeguard against potential fakeouts.

Discover the meaning of Fibonacci retracement numbers, draw crypto retracement using the GoodCrypto tool, and apply automatic retracement with real examples in crypto markets.

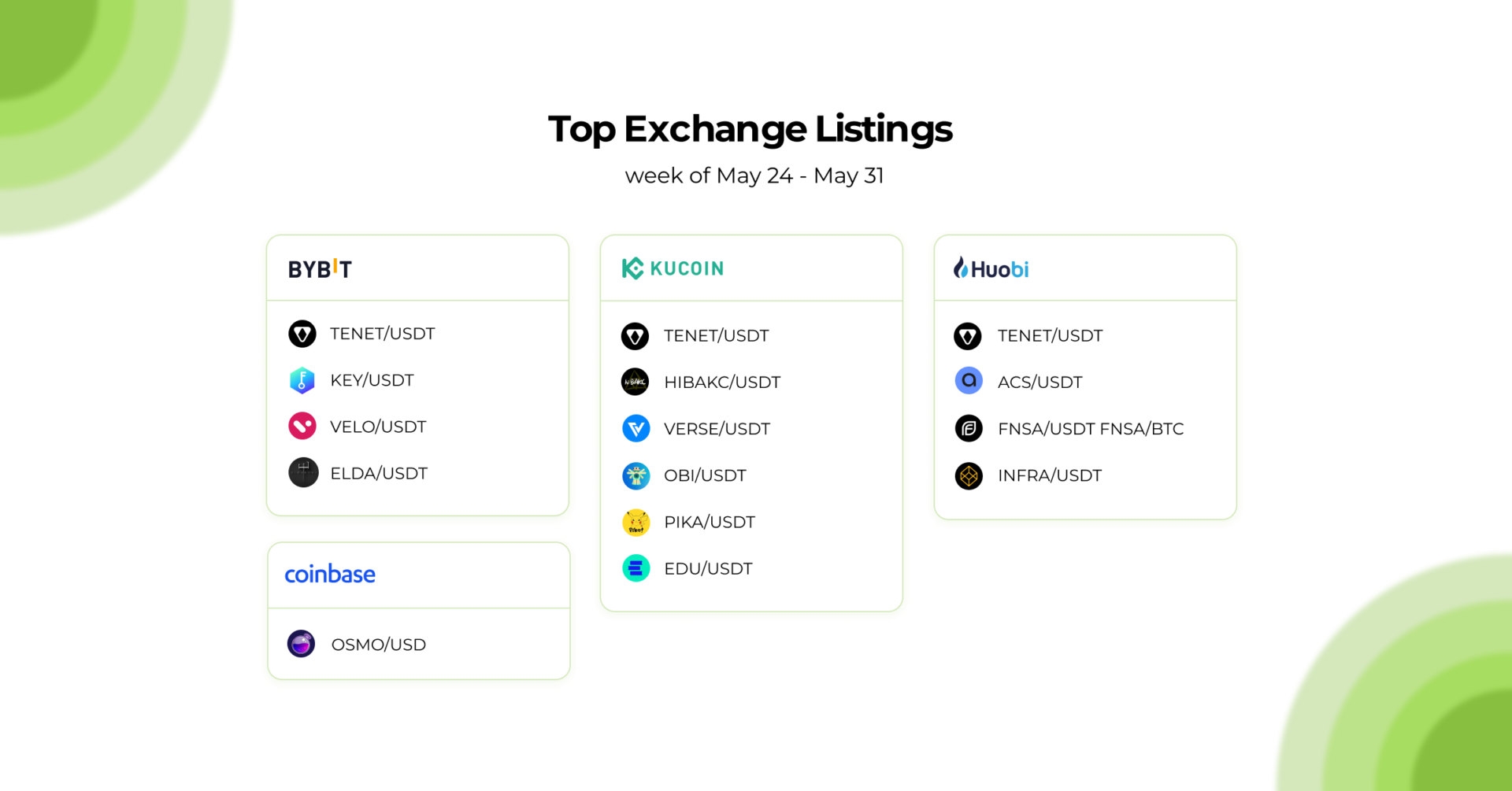

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

June 1, 2023