Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

According to reports, FTX is thinking about buying Celsius’s assets

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

According to reports, FTX is thinking about buying Celsius’s assets

According to reports, cryptocurrency exchange FTX, run by crypto millionaire Sam Bankman-Fried (SBF), is considering purchasing assets from the insolvent lender Celsius Network to save it. Coincidentally, the news was released on the same day that Alex Mashinsky submitted his resignation as CEO of Celsius.

“I regret that my continued role as CEO has become an increasing distraction, and I am very sorry about the difficult financial circumstances members of our community are facing,” assisted Mashinsky in defending his choice. By purchasing Celsius’s assets, FTX would be signalling its intention to salvage the loan company, just like FTX US did for Voyager when it secured the winning bid of almost $1.4 billion.

Bloomberg mentioned FTX’s interest in Celsius Network in a story based on information from a source familiar with SBF’s deal-making. But as of this writing, neither side has released an official comment.

In what appears to be a significant reorganization effort, Brett Harrison resigned as president of FTX US and will soon assume an advising position.

“Until then, I’ll be assisting Sam [Bankman-Fried] and the team with this transition to ensure FTX ends the year with all its characteristic momentum,” Harrison stated.

Blockchain company accuses Coinbase of violating its patents in $350 million lawsuit

Veritaseum Capital is suing the Coinbase crypto exchange for patent infringement on their blockchain-based software. The firm is seeking $350 million in damages.

According to Veritaseum, Coinbase leveraged the patent for many of its blockchain infrastructure services since it focuses on “novel devices, systems, and methods” that allow parties to “enforce value transfer agreements” with “little or no trust” in one another:

“Defendant’s infringing activities include but are not limited to its website […] Coinbase Android mobile wallet […] iOS mobile wallet […] its Coinbase Cloud, Coinbase Commerce APIs, Query and Transact, Participate, Delegate and Validator software, Coinbase Pay, Coinbase Wallet and Coinbase Operated Public Validators.”

The legal team added that because the patent applies to proof-of-stake (PoS) and proof-of-work (PoW) blockchains, it may be possible to transmit cryptocurrency payments, services for trading, and staking on chains that use both consensus processes.

Veritaseum Capital “sustained damages as a direct and proximate result,” while Coinbase “gained substantial profits by virtue of its infringement,” which was used to support the $350 million number.

Binance Global Law Enforcement Training Program officially launches a year after beginning operations

In a blog post published on Tuesday, Binance declared the creation of its Global Law Enforcement Training Program. Since the company’s investigative team has been providing law enforcement training for the past year, the program’s launch may be viewed as retroactive.

According to the official blog, Binance increased the size of its research team a year ago and has since performed one-day workshops in many regions. The goal of the training was to aid law enforcement in investigating and prosecuting financial and cybercrimes.

Additionally, the team asserts that it has answered in an average of three days to over 27,000 inquiries from law enforcement since November. Tigran Gambaryan, who served as a special investigator in the cybercrimes branch of the United States Internal Revenue Service before joining Binance in September, is the team’s worldwide director of intelligence and investigations. According to Gambaryan’s statement:

“We are seeing an increased demand for training to help educate on and combat crypto crimes. To meet that demand, we have bolstered our team to conduct more training and work hand-in-hand with regulators across the globe.”

Ignore CBDCs and focus on BTC and stablecoins instead

Bitcoin (BTC) and stablecoins are being promoted as alternatives to central bank digital currencies (CBDCs) by the American research tank Bitcoin Policy Institute.

A white paper published on Tuesday claims that CBDCs will deprive the public of financial autonomy, privacy, and freedom. Its authors include executive director of the Texas Bitcoin Foundation Natalie Smolenski and former Kraken growth lead Dan Held.

Smolenski and Held claimed that since government infrastructure is a “target of constant and escalating cyberattacks,” CBDCs would essentially “provide governments with direct access to every transaction […] conducted by any individual anywhere in the world.” They added that this could then be made available for “global perusal.”

A further claim made by the duo was that CBDCs will provide governments with the ability to “prohibit, require, disincentivize, incentivize, or reverse transactions, making them tools of financial censorship and control.“

One of the author’s main concerns with CBDCs is the lack of knowledge by governments, combined with potential privacy breaches and control, which is one of the reasons why previous talks surrounding CBDCs in the U.S. have been defined by disagreement and misunderstanding.

Smoothed Moving Average Indicators for Crypto Trading

Compared to Simple Moving Average (SMA), the Smoothed Moving Average (SMMA) is a more complicated instrument. Trend research is a little bit more focused, thanks to this specific cryptocurrency indicator. The SMMA indicator takes one step further and incorporates more historical data, whereas SMA aggregates just the closing prices in a recent time. This innovation aids in filtering out market noise, which eliminates short-term changes that could provide erroneous signals.

The 20 SMA is represented by the purple line on the body of the chart, while the 20 SMA is represented by the blue line.

Your trading habits will determine which indicators are best for trading cryptocurrencies. Dive into Day and Swing Trading Indicators Guide to find more tips for your profitable investing in crypto.

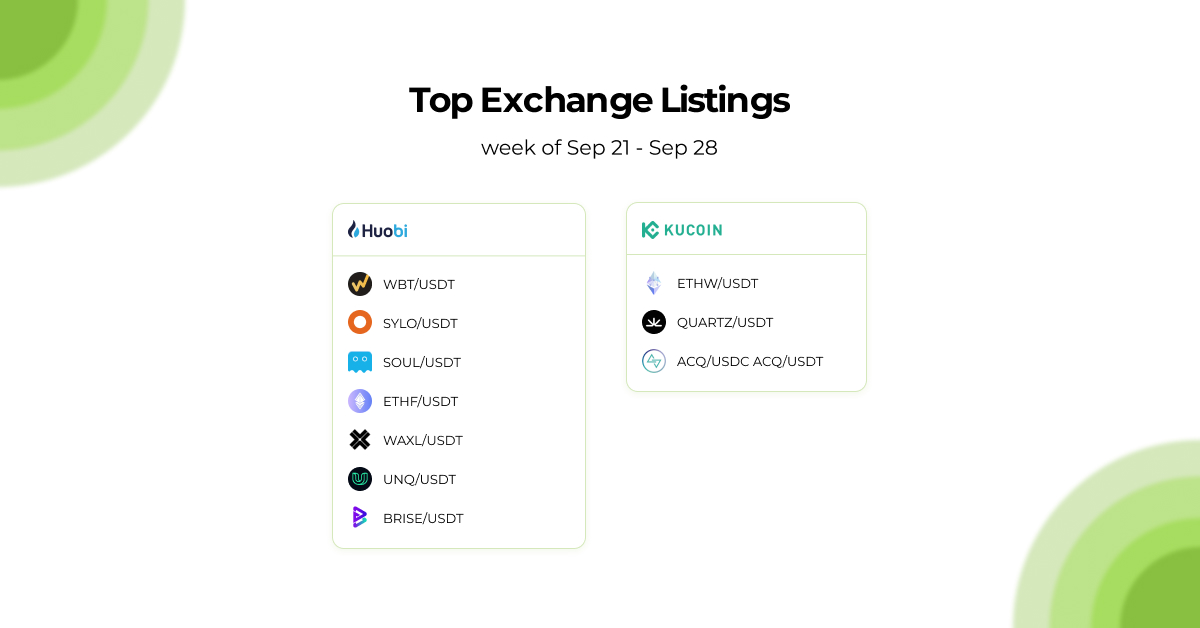

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

September 29, 2022