We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

DCA Bot Case Study #1: The Miracle of Stable and Profitable Trading

Dollar Cost Averaging (DCA) bot has become an increasingly popular trading tool due to its convenience, the versatility of its modes, and trading efficiency. DCA strategies are very helpful for traders desiring to maximize the stable profit generation in any market occasion while minimizing the risks of possible loss in case of market volatility.

With the advent of DCA crypto bots, the concept of stable yet profitable trading has become a more widespread story. The reason is that the DCA algorithm facilitates the accumulation/distribution of the position by giving a trader an opportunity to do it in stages, with additional levels of averaging. If you are buying an asset – get a chance to average on drawdowns; if you want to sell – make it stepwise, as the price rises.

The DCA bot opens up the ability to automate an investment and trading strategy, making it simple and accessible for any user regardless of their proficiency level.

So, let`s dive into the details of how this rocket-powered tool works and take a closer look at all the fine points of the DCA bot adjustment. And the best way to do it is by examining one of our first DCA trading cases.

How DCA Bot Can Give You an Explosive Growth?

Let’s talk about the basics. The DCA is a proven investment and trading tool for any timeframe that can help you build capital over time. By using the DCA Bot, you can successfully accumulate assets you are interested in, when the market gives you a chance to buy them at the best possible prices and take advantage of their further growth potential by selling assets at the best moments. Besides, it enables traders to generate sustainable profits in a completely automated way, especially during periods of high market volatility with minimal risks.

To cater to a wide range of trading scenarios and strategies, GoodCrypto offers two DCA bot modes:

- Manual mode: this mode gives you full control over moments for market entry and exit, as well as the flexibility of averaging orders configuration. Use it for maximum customization of your investment and trading approach at various market cycles and accumulating assets at the best possible prices.

- Auto (TA Signal): a fully-automated mode in which the algorithm relies on aggregated signals from 25 technical indicators (15 MA and 10 Oscillators) at different timeframes to pick the most potential entry and exit points to generate profit autonomously.

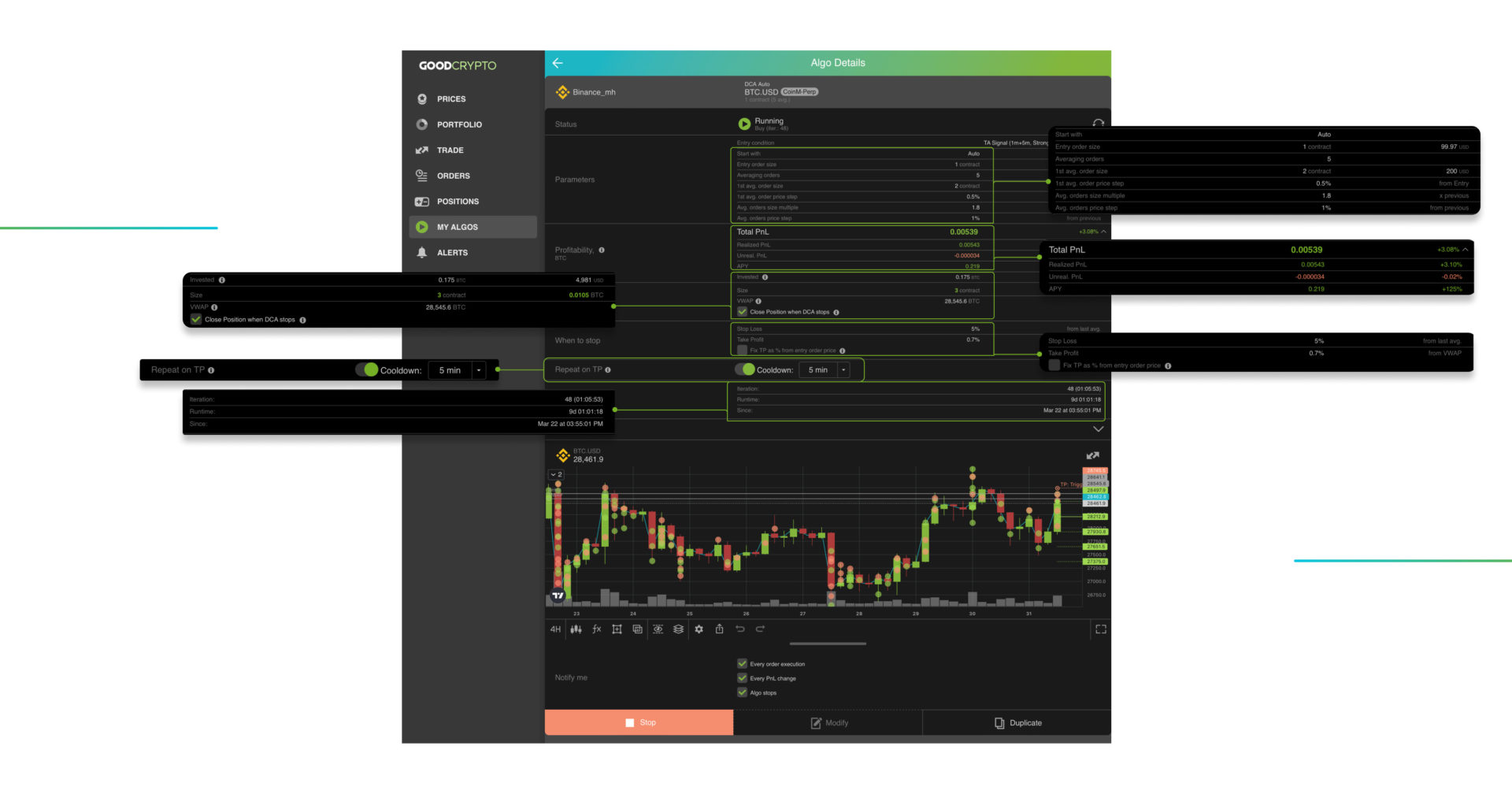

Our DCA User Case on BTC.USD

We’d like to share with you an example of one of the very first DCA Bots launched on Binance Spot, BTC.USD pair, with the following starter conditions:

- The bot was launched in Auto (TA Signal) mode, with Strong Buy & Strong Sell parameters activated (we`ve set signals from M1/M5 timeframes).

- We started with an initial order size of 99.97$ (100$). (Note: an entry order size = the size of 1 contract, as a further measuring unit of every averaging level). Then we specified the 1st averaging order in the amount of 2 contracts (200$), which is double the amount of the initial order size in our case. It serves as an additional point for being able to fine-tune the bot to your strategy if required.

- Further, we have specified a value of 1.8 as a multiplier. This means, that each subsequent averaging order after the 1st avg.order (i.e. levels 2, 3, etc.) will be multiplied by 1.8 of the volume of the previous one. (ex. 2, 3.6, 6.48, 11.66, etc)

- We set up 5 averaging orders in total, with a 1st avg.order price step of 0.5% (the distance between the initial order), and a 1% price step between the avg.orders (between the subsequent averaging orders)

- The 1st avg.order price step is a unique feature for more flexibility in the configuration of the DCA to gain the most overwhelming results in any circumstance.

- We used S/L of 5%, and a T/P of 0.7%.

Note. In the Take Profit field, we`ve set the option to repeat the sequences when a profit is reached. We used a rather short Take Profit in order most likely to hit the trades in a short period, and to avoid long trades in case of triggering averaging orders.

In our case, the DCA made 48 iterations (meaning 48 cycles where the T/P level was hit in a row), in just 9 days and realized a profit of 0.00539 BTC (approx. 150$) by the closing time. It is more than 3%, with a 125% APY rate.

In rough numbers, we got an impressive growth of nearly 60% to our initial investment (~$250) by using x20 leverage (the leveraged position was $4,961).

Note. The bot uses the funds invested gradually, only if it passes all the averaging levels. So, keep an eye on the sufficient level of collateral on your account balance.

As you can see, the DCA bot is an extremely powerful tool for passive profit generation. Whether you spot potential opportunities in a market that you want to catch, you can fully capitalize on the bot’s flexible settings available in the Manual mode. Alternatively, you can put the bot in Auto TA Signal mode and let the algorithms work on your behalf. We have provided you with a great case study that demonstrates the effectiveness of the bot not only in the trending markets but also within tight ranges.

Conclusion

Overall, the DCA Crypto Bot is an excellent tool for investors looking for optimization of their cryptocurrency investments, and traders desiring to automate their trading strategies and do so with minimal risk. Such DCA Bot strategy can be applied to trade any cryptocurrency and is equally effective on Spot and Futures markets.

Using the DCA bots, you`ll get a plethora of trading advantages, such as:

- cost averaging potential (in case of the drawdowns)

- higher average price while selling an asset (using as a multiple Take Profit)

- deep flexibility of adjustments in the Manual mode

- complete automation in the Auto TA Signal mode

- exact risk management control

- exponentially rising results in the long-term period

With all of its features, it’s no wonder why the GoodCrypto`s DCA Crypto Bot has become so popular.

Just try to run your first DCA bot, even in a test period, and you will instantly feel the difference in efficiency compared to manual trading.

Get the App. Get Started

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

May 10, 2023