Every trader strives to find the right auxiliary tool useful in various market conditions to improve their trading performance. The DCA bot is one of these, allowing traders of all levels to automate their regular trading. Good Crypto enables you to customize a DCA bot for any trading strategy on the spot and futures market across the 36 biggest crypto exchanges.

In this article, we’ll break down each DCA bot’s variable and look at two main DCA modes, their setup instructions, and tiny important details to make the most profit from your trading activity.

The DCA Bot Basics

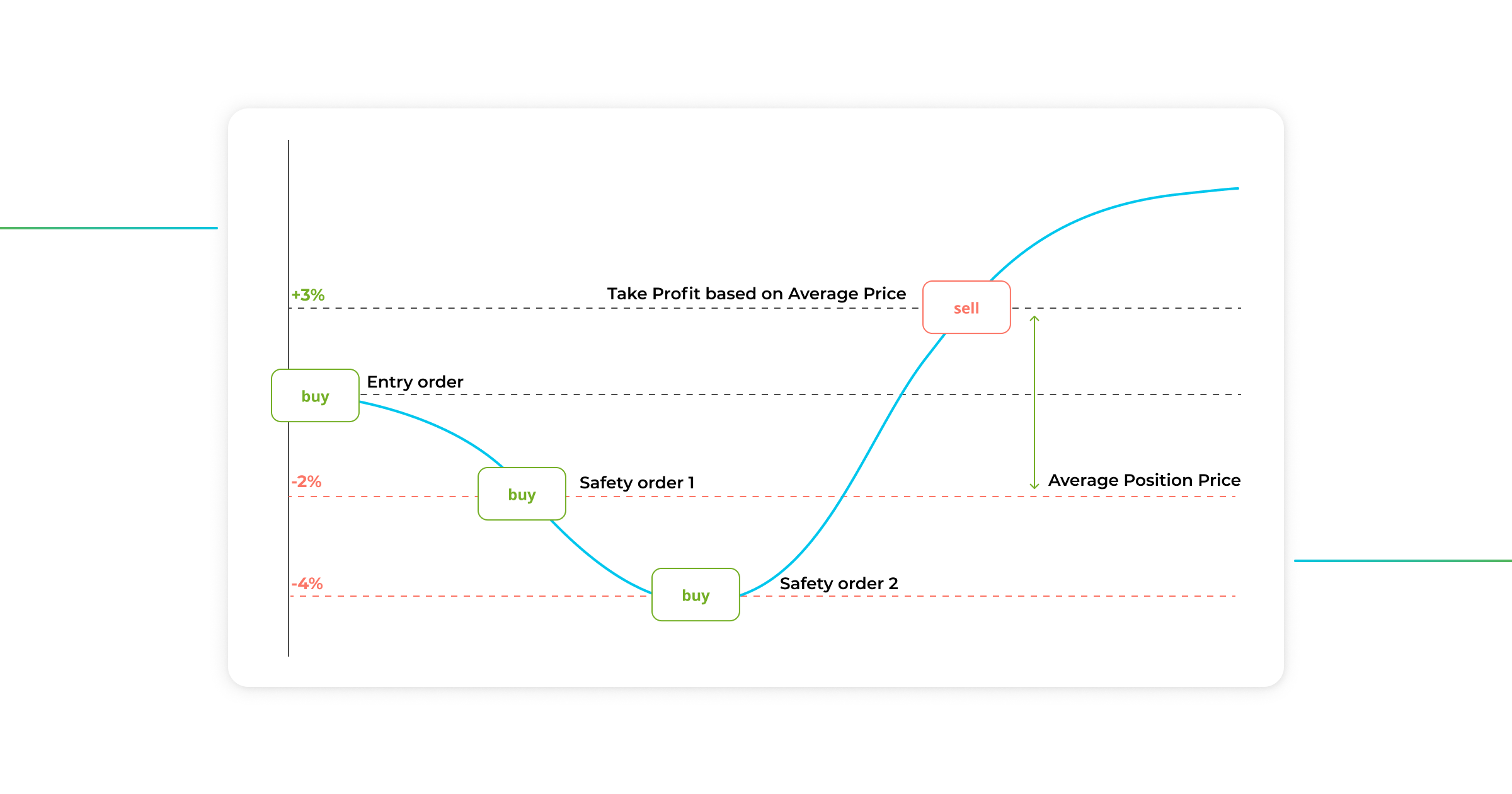

The DCA (Dollar Cost Averaging) is an extremely popular algo strategy based on gradually buying an asset during a price decline (or increase in case of shorting an asset on futures markets). It aims to average the position’s size and reduce risks for the trader. If the market moves against the initial position, the DCA strategy provides a better entry point and automatically adjusts the take profit and level to reflect your average position size.

Here are the main advantages of the DCA bot:

- Averaging position. The DCA bot allows you to average your position during a drawdown, helping to mitigate potential losses and increase the Take Profit success rate.

- Asset accumulation. The DCA bot is a simple way to accumulate assets over time at the best prices possible.

- Increased Average Profits. By using DCA as a multiple Take-Profit (in case you hold some assets you would like to sell, you can make it gradually and in parts, using the Spot DCA bot in Manual mode, where existing assets will be distributed with the Sell averaging orders), thereby you can rise the potential to achieve higher average profits.

- Stable profits with minimal risks. Even when trading in a tight range, the DCA bot can bring you consistent and stable profits while minimizing potential risks.

- Automated trading process: A DCA bot is a convenient way to automate your regular trading process.

We can’t wait to show you the benefits the Good Crypto DCA bot offers in different modes, so let’s move on. But before we dive in, let’s figure out how the DCA bot works in the GoodCrypto app.

How Does the DCA Bot Work?

The DCA bot opens a position with a Buy or Sell order while simultaneously placing a specified Take Profit order in the opposite direction. If the market moves against you, any DCA crypto trading bot (whether it’s a DCA Long or a DCA Short bot) will boost your chances of making a profit by placing additional Buy or Sell orders to average down your entry price. Simultaneously, the DCA crypto bot will automatically adjust your Take Profit to reflect the current size and average entry price of your position as these additional orders are executed.

With the DCA bot, almost any market scenario can potentially result in profit in your pocket. All you need to do is configure the bot according to the market cycle, taking an asset’s volatility into account and setting one of the preferred modes. Let’s explore these DCA modes in detail.

DCA Bot Trading Modes And Their Use Cases

GoodCrypto gives you supreme flexibility in configuring all variables to implement your detailed trading strategies in Manual mode and also provides you with complete automation in TA Signal (Auto) mode. Let’s take a look at the difference between these two DCA modes to help you choose the most suitable for you.

Manual Mode

Manual mode gives you full flexibility in configuring the DCA bot according to your trading strategy, taking into account even small details of the market situation.

In Manual mode, you can decide whether you want to go Long or Short:

- If DCA algo starts with a Buy order, it opens a Long position and places additional Buy orders at a lower price to average your entry price down.

- If it starts with a Sell order, it opens a Short position and places additional Sell orders at a higher price to average your entry price up.

Additionally, you can pre-configure with which type of order you wish to enter the market: Market order, Limit order, or a Trailing Stop. The DCA will enter an initial position with the selected order type. But further averaging orders will be Limit orders, regardless of the Entry order type.

All the setting fields with variables in the bot are the same in both Manual and Auto TA Singal modes.

Let’s take a look at three main cases for using the Manual Mode of the DCA bot.

Manual Use Case #1: Buying and Selling With DCA Bot

In the Manual mode, you can easily automate your Buy or Sell trades with the DCA bot. Simply choose whether you want to trade Long or Short, and when you launch the bot, it will immediately open an initial Buy or Sell order with pre-set Take Profit (T/P) and Stop Loss (S/L) parameters.

For instance, let’s say you have an idea to buy a specific asset at its current market price. However, if the price starts moving against you, there is a risk of incurring a loss. By using the DCA bot as an averaging tool, you can mitigate this risk and lower the average price of your position through a series of additional averaging buy orders, providing you with an opportunity to take the trade in profit as the market starts to bounce back.

Manual Use Case #2: Multiple Take Profits

The next case of using the DCA is a multiple Take Profit setup on Spot. If you have an asset on hand you want to sell. As the price rises, you can configure your DCA bot to do it in parts.

For example, you have 100 LINK tokens on hand and wish to sell them at the best possible price rather than at the market price. You set up your DCA bot to Sell and give it, for example, 5 levels with 20 tokens each, with a distance selected by you. In case of an upward price movement, you will sell 5 tokens at each level, obtaining a higher average price of your total Sell position.

Depending on the preferred strategy, you can sell the asset in equal parts or in different proportions. Additionally, you can choose a custom price step between the averaging (Sell) levels, allowing you to fine-tune your selling strategy based on market conditions and your profit objectives.

Manual Use Case #3: Accumulating Orders at Lower Prices

And, of course, the DCA bot is the best assistant for accumulating the asset you are interested in over time. You can program the bot for any parameters, specifying the conditions for buying price step, the overall position size and size of each averaging order, and Take Profit and Stop Loss %.

However, if you want to make your trading routine easier and do all these things automatically, you can choose a TA Signal mode.

Auto (TA Signal) DCA Bot Settings

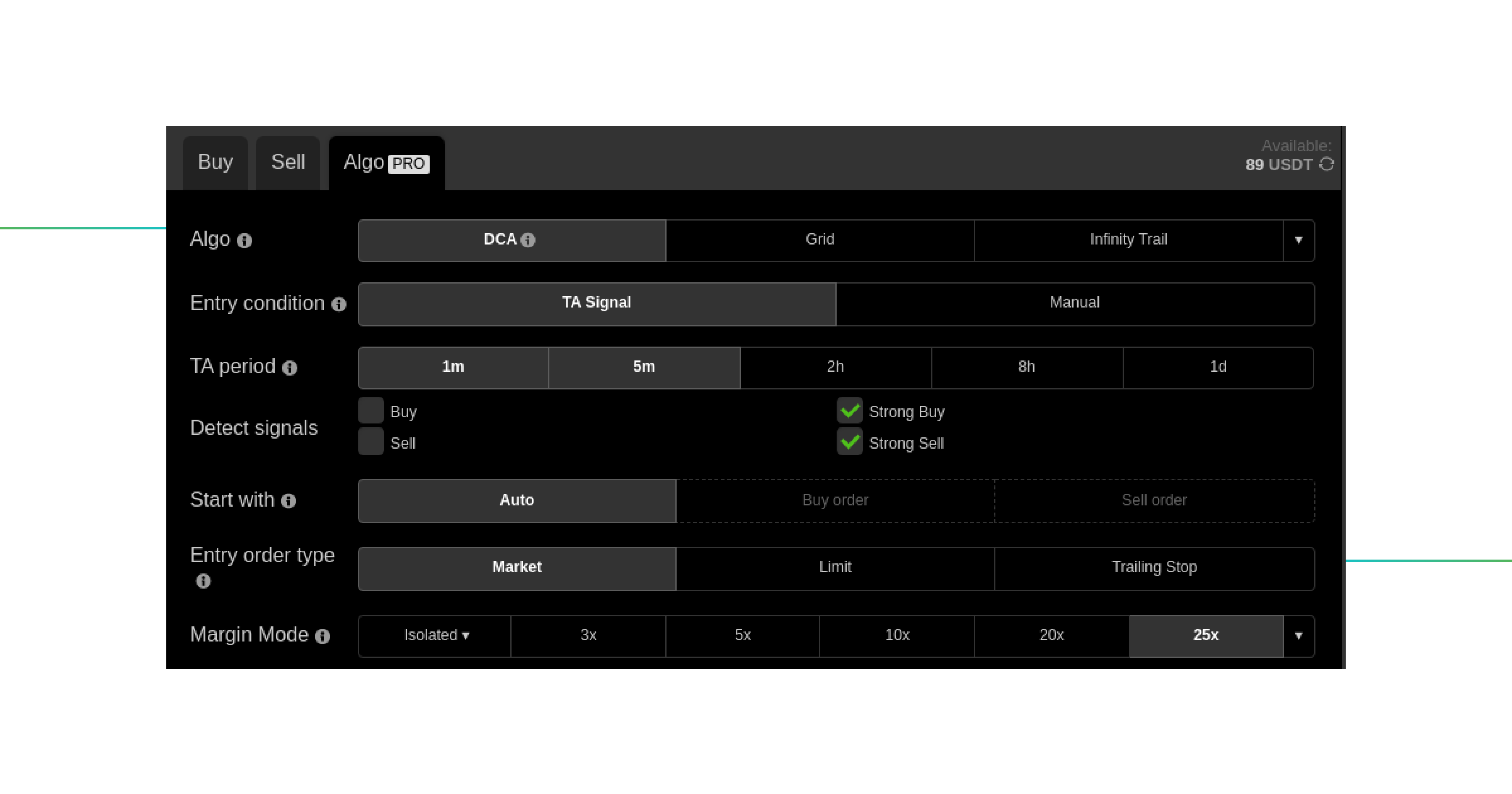

In the TA Signal (Auto) mode, the DCA bot relies on the technical analysis signals to select a direction (Buy or Sell) and moment for entry order and execute the subsequent trades. Utilizing a comprehensive set of 25 indicators, including 15 moving averages and 10 oscillators, it automatically identifies buying or selling opportunities and enters a trade when a specific signal arises.

When a Buy or a Sell signal aligns with your pre-selected criteria, the bot automatically opens a trade. Moreover, the bot can be adjusted to repeat such sequences each time it hits the Take Profit level, making your potential profits soar while also boosting your trade volume.

Let’s delve deeper into the DCA bot сonfiguration fields, particularly TA Signals mode parameters, and closely examine where all the magic happens.

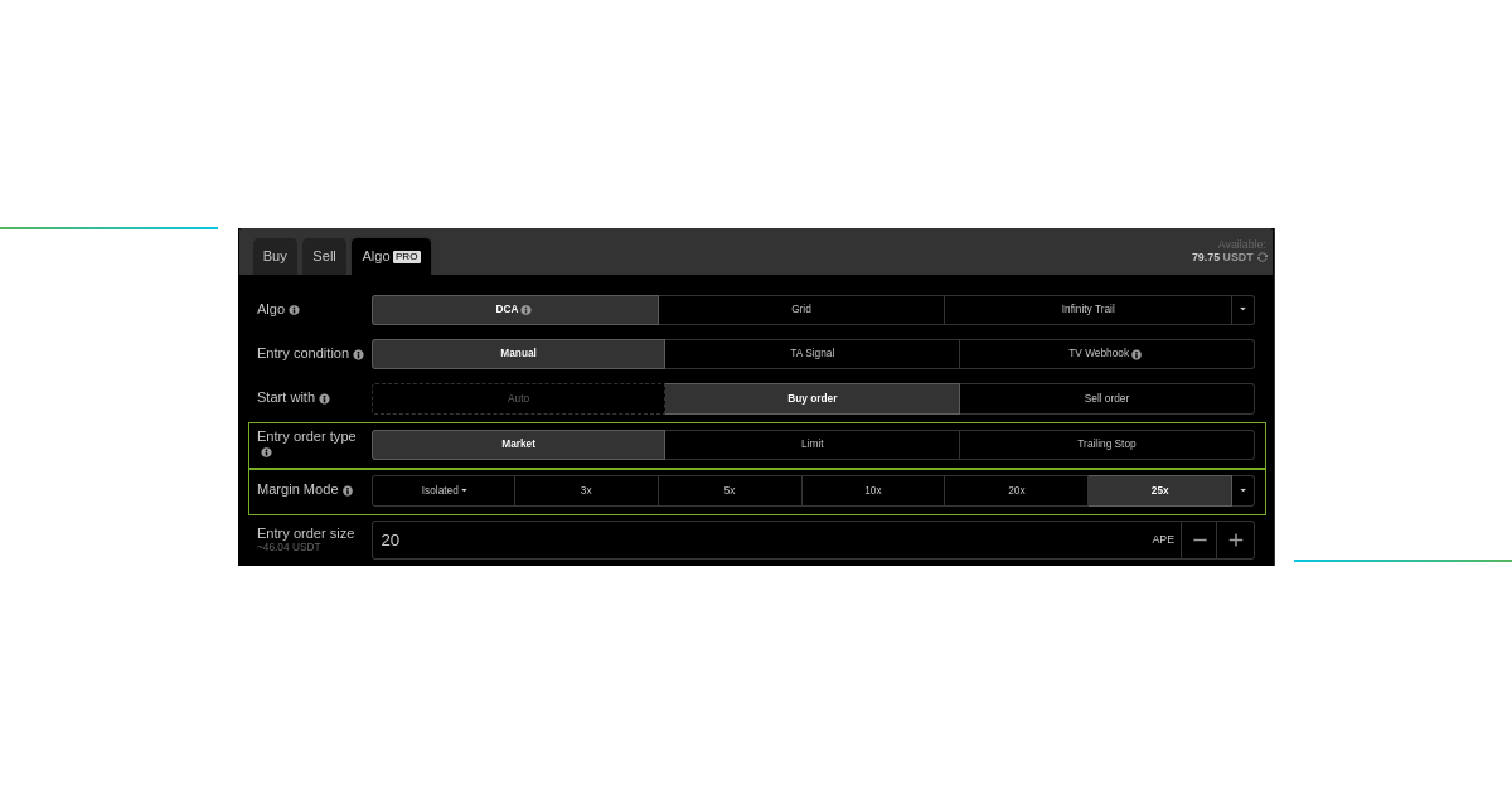

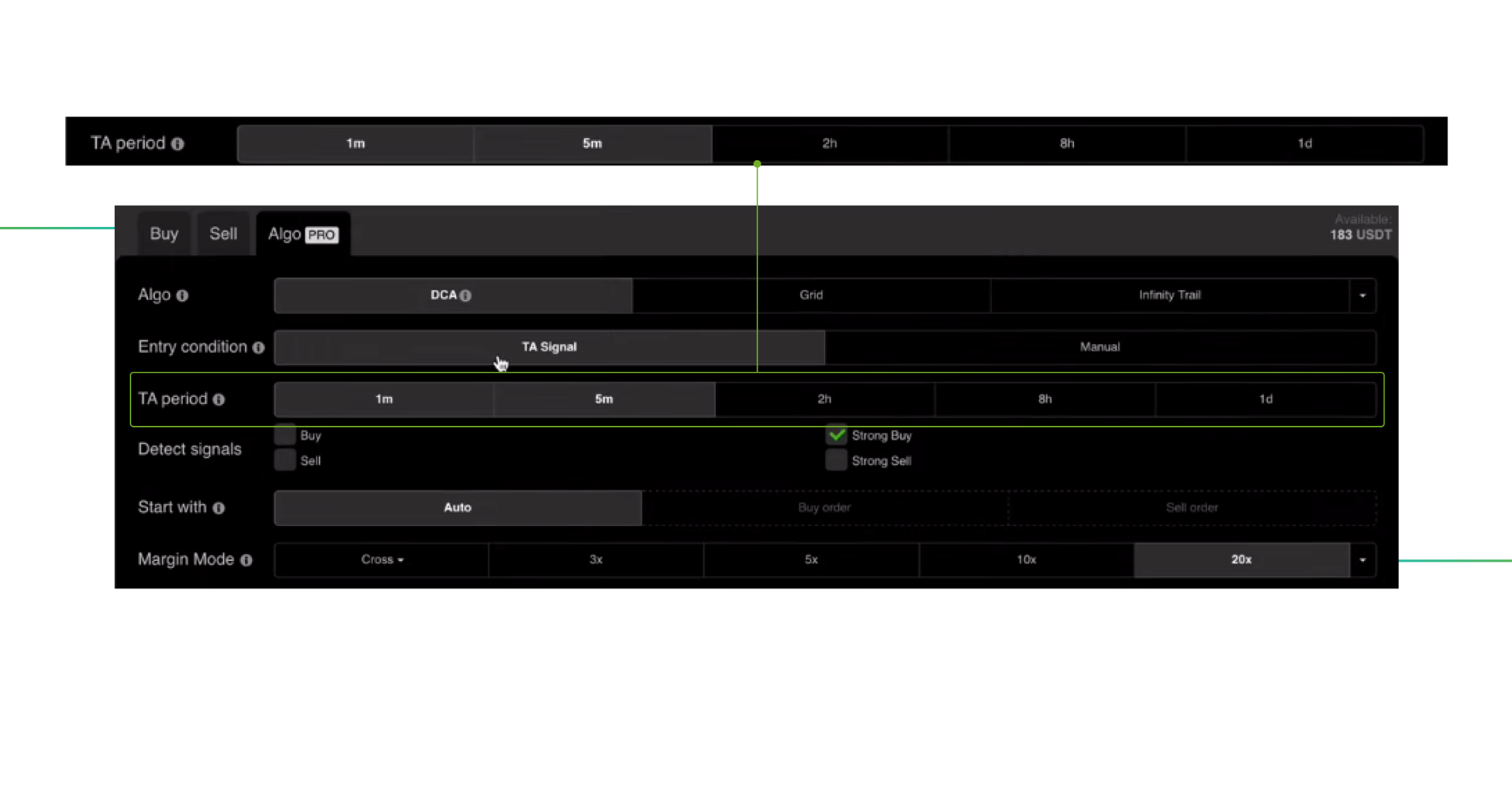

Here is the first configuration block, with the pre-set of pretty common input parameters we use for our DCA bots.

What is the reason why we choose such an exact combination?

- Time-saving and automation. By using the TA Signal mode, there is no need to analyze the market by yourself and wait for a long time for the right signal to trigger, weighing up the different factors for opening a trade.

In order to filter out excessive noise and focus on the most probable signals, we have selected only Strong Buy / Strong Sell signals. It helps to avoid being overwhelmed by a large number of signals in low time frames and allows the bot to prioritize signals with a higher probability of success.

Signal Periods in TA Signals Mode

Here is the first configuration field, which differs the Auto Signal mode from the Manual one. Here you can set the bot’s reaction period (TA Period), which determines the timeframe of signals based on which the DCA bot will trigger Buy or Sell orders. As you can see on the screenshot, the Good Crypto DCA bot allows trading in TA mode based on signals at the following timeframes:

- 1m

- 5m

- 2h

- 8h

- 1d

The selection of the appropriate TA signal period always depends on the specific objectives of your trading strategy, considering whether you are working on lower timeframes or analyzing price swings on higher timeframes.

An important point to note. The greater % of price movement you want to catch on your targets, the higher timeframes for TA Signals should be used.

Types of Margin (Available only on Derivatives Markets (Futures)

Our first screen ends with the Margin mode settings. The bot can be launched in one of two different types of margin:

- Cross-margin

- Isolated margin

In the Isolated margin mode, the bot will only use the funds you invested in a particular trade. This approach ensures that your exposure and risk are limited to the allocated funds for that trade.

Alternatively, while launching the DCA in Cross-Margin mode, the bot will use the entire amount of funds available on your account (futures or spot) as collateral for the position. That can be extremely risky, especially in case of insufficient collateral in moments when the market is going against you. Given the potential risks associated with Cross-Margin mode, we recommend using Isolated Margin mode whenever possible.

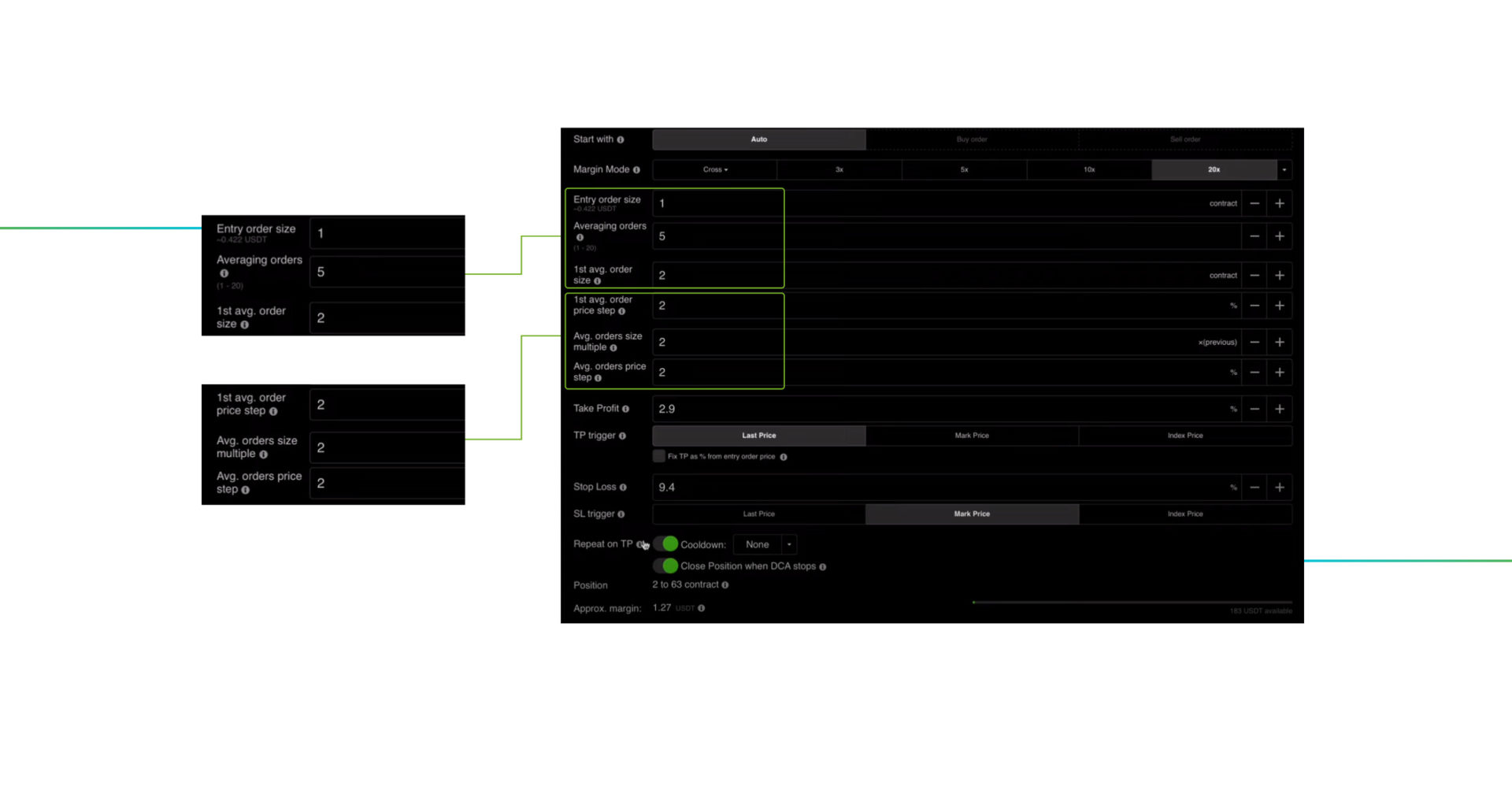

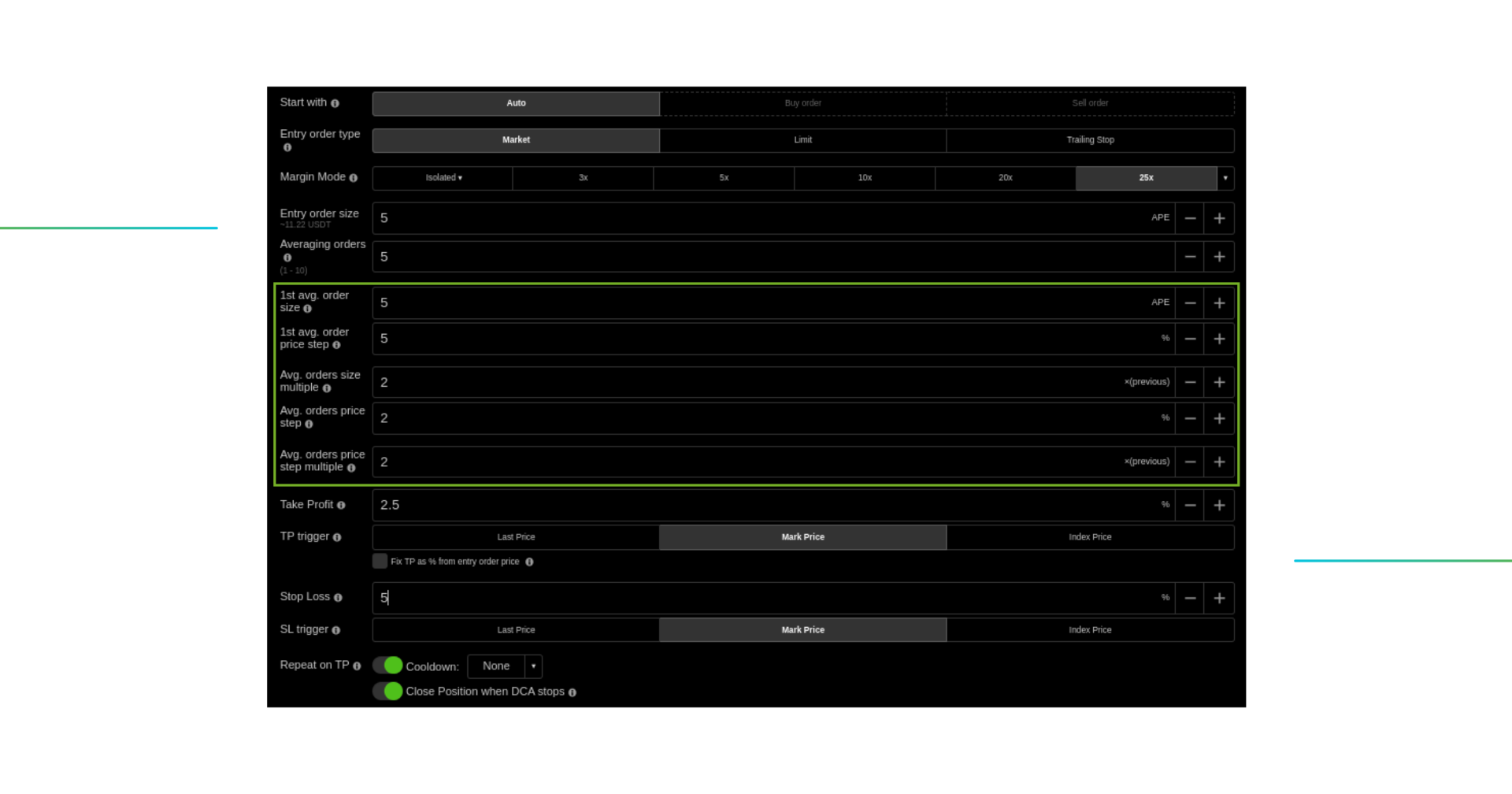

Let’s move on to the second screen and take a look at the base configuration fields of your future trade to understand their purpose:

Entry order size

This parameter allows you to determine the size of your initial position. For maximum flexibility in trading, you can set a separate different value for both variables, for the Entry order and the 1st averaging order. It gives you complete freedom in the implementation flexibility and how you can configure strategies using your DCA bot.

Averaging orders

This parameter defines the number of averaging or “safety” orders you want to place to average your entry price down or up if the market moves against you. It can range from 1 to 20, depending on your subscription tier. In our case, we used an Algo 2x Add-on to enhance the power of our bot, where the number of averaging levels reaches the maximum value of 20. A higher number of averaging levels potentially increases your profit potential.

1st avg. order size

The first order the bot will execute after the launch is the Entry order. The next (the 1st averaging order) is the first order that will be opened in case the price starts to move against your position. GoodCrypto allows you to adjust any size of the 1st averaging order to provide you with additional flexibility to customize your trading process as much as possible. Furthermore, the sizes of all other averaging orders will be set as a multiple of this order size.

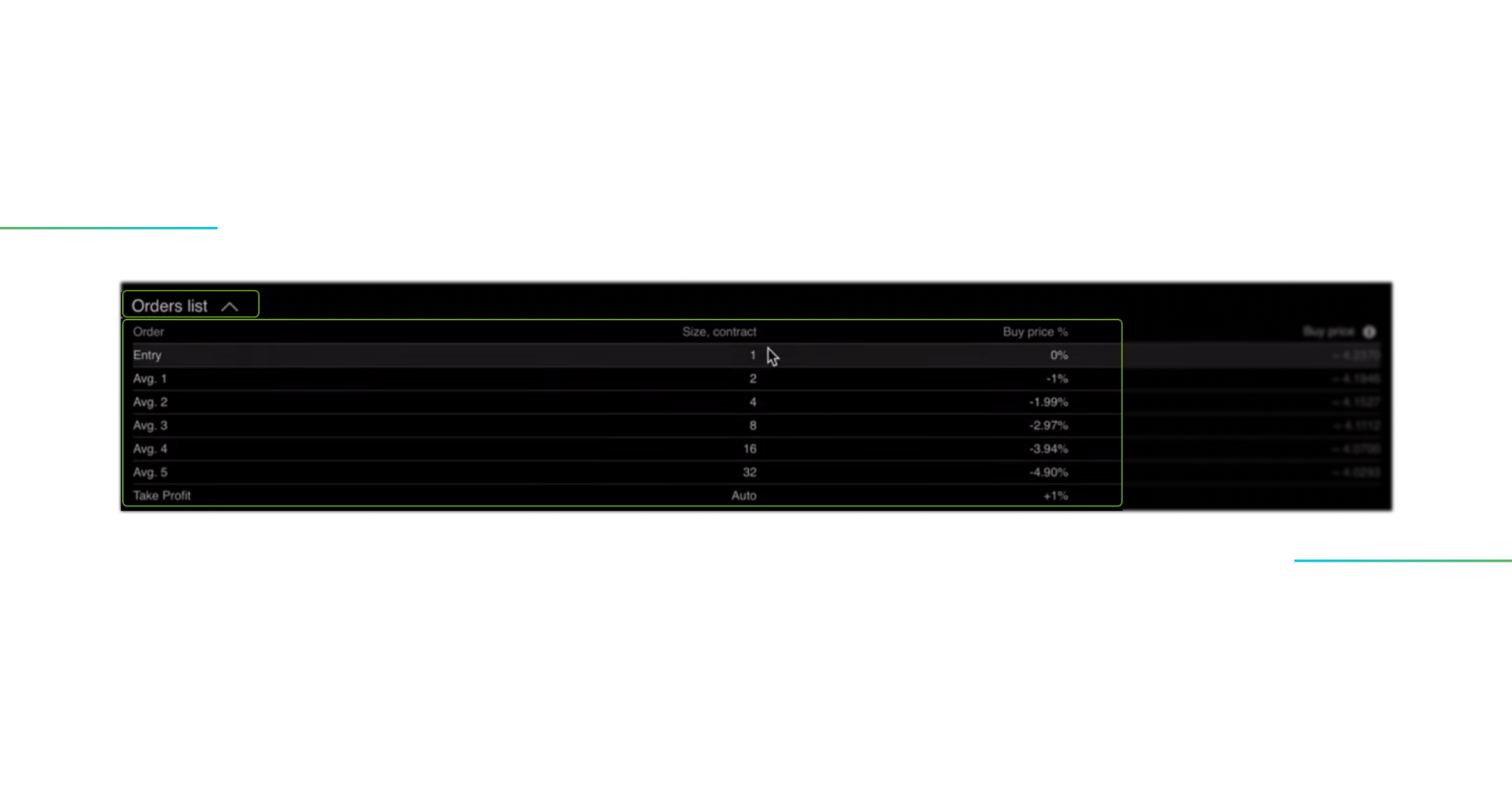

Example: You want to set up a martingale strategy (doubling size at every level). You set your entry order size to 1, first averaging order size to 2 and averaging orders size multiple to 2.

You can check the results of your setup in the Orders list at the bottom of the settings block.

1st avg. order price step

This parameter signifies the distance from the Entry order price to your first averaging order. It can be set to any distance within the price limits of the exchange. All other averaging orders will be placed at an equal % distance (averaging orders price step).

Example: You want to place your first averaging order at 10% from the entry price and place other averaging orders at every 5% thereon. You set your 1st averaging order price step to 10% and Averaging orders price step to 5%.

You can check the results of your setup in the Orders list at the bottom of the settings block.

Avg. order price step

The average order price step represents the equal distance between your averaging orders in percentages. It is a variable parameter for customizing your strategy and achieving the perfect risk/reward balance in the cycle between averaging and taking profits. So, to keep hitting the T/P as often as possible and not overstay in long trades, you should set an appropriate distance between the averaging orders. (Otherwise, using a large T/P distance will keep you in a trade for a long time without taking an interim profit, reducing your PnL over a period of time.)

In this way, averaging will proceed with a reasonable frequency, optimizing the average value of your position and updating the TP value, thereby increasing the probability of closing as many trades as possible with a profit.

Avg. orders size multiple

The average orders size multiple parameter allows you to configure the size change of each subsequent averaging order after the 1st avg. order (i.e., levels 2, 3, etc.). If the multiple is set to 1, all averaging orders will equal the 1st averaging order. You can specify any multiplier you want. For example, such a value as x2 (or any other value >1) will lead to doubling the size of each subsequent avg. level, respecting the size of the 1st.avg.order parameter. Alternatively, you can use the value <1, for e.g., x 0.5, to decrease the size of each subsequent avg. level. The choice of such an averaging approach depends on your trading vision or preferences and whether your strategy accepts aggressive averaging.

In our case, we have set the parameter to 2, meaning that each subsequent averaging order will have a volume multiplied by 2 compared to the previous one (e.g., 2, 4, 8, 16, 32, etc.).

Example: You set your first averaging order size to 2 and averaging orders size multiple to 3. Your 2nd averaging order size will be 2×3=6, 3rd averaging order size will be 6×3=18, etc.

You can check the results of your setup in the Orders list at the bottom of the settings block.

Avg. orders price step multiple

This variable defines the distance of each averaging order as a multiple of the distance of the previous averaging order.

If the multiple is set to 1, all averaging orders will be placed at the distance (between each other) equal to the Averaging orders price step. If the multiple is >1, the distance will increase with each order. If the multiple is <1, the distance will decrease.

Example: You set the Averaging orders price step to 1% and the Averaging orders price step multiple to 2. Your 2nd averaging order will be placed at 1% from the 1st averaging order, the 3rd averaging order placed at 2% (1%x2) from the 2nd, and the 4th – at 4% (2%x2) from the 3rd, etc.

You can check the results of your setup in the Orders list at the bottom of the settings block.

Take Profit

The Take Profit parameter is one of the most important configuration fields in ensuring profitability and effective risk management in the long-time run with your pre-configured DCA bot settings.

By setting the distance of the T/P trigger (in our case, 0.8%), you establish the desired profit level at which the bot will automatically close the position and secure the profits.

Note. When launching your DCA bot in the TA Signal (Auto) mode, you have the option to enable the Repeat on TP feature. When enabled, the bot will automatically repeat the sequences each time it reaches the Take Profit. Furthermore, you have the option to set a Cooldown period, which determines the duration of time the bot will remain out of the market after hitting a Take Profit.

Useful tip. Setting a short distance for the Take Profit allows you to work within a narrow price range, enabling multiple trades to be executed in a relatively short period of time. It can be advantageous for capturing frequent price movements and capitalizing on market volatility.

Fix T/P as a %-distance from the entry order price. If this option is selected, the Take Profit will be set at the chosen percentage distance from the entry order price, and it will remain fixed even when the averaging orders are executed. This option is particularly beneficial for accumulating an asset on the Spot market. It allows you to buy the asset at lower prices as it becomes cheaper and hold it until the price reaches a certain level you are interested in

So, let’s proceed, with the second most important criterion in trading, the Stop Loss trigger.

Stop Loss

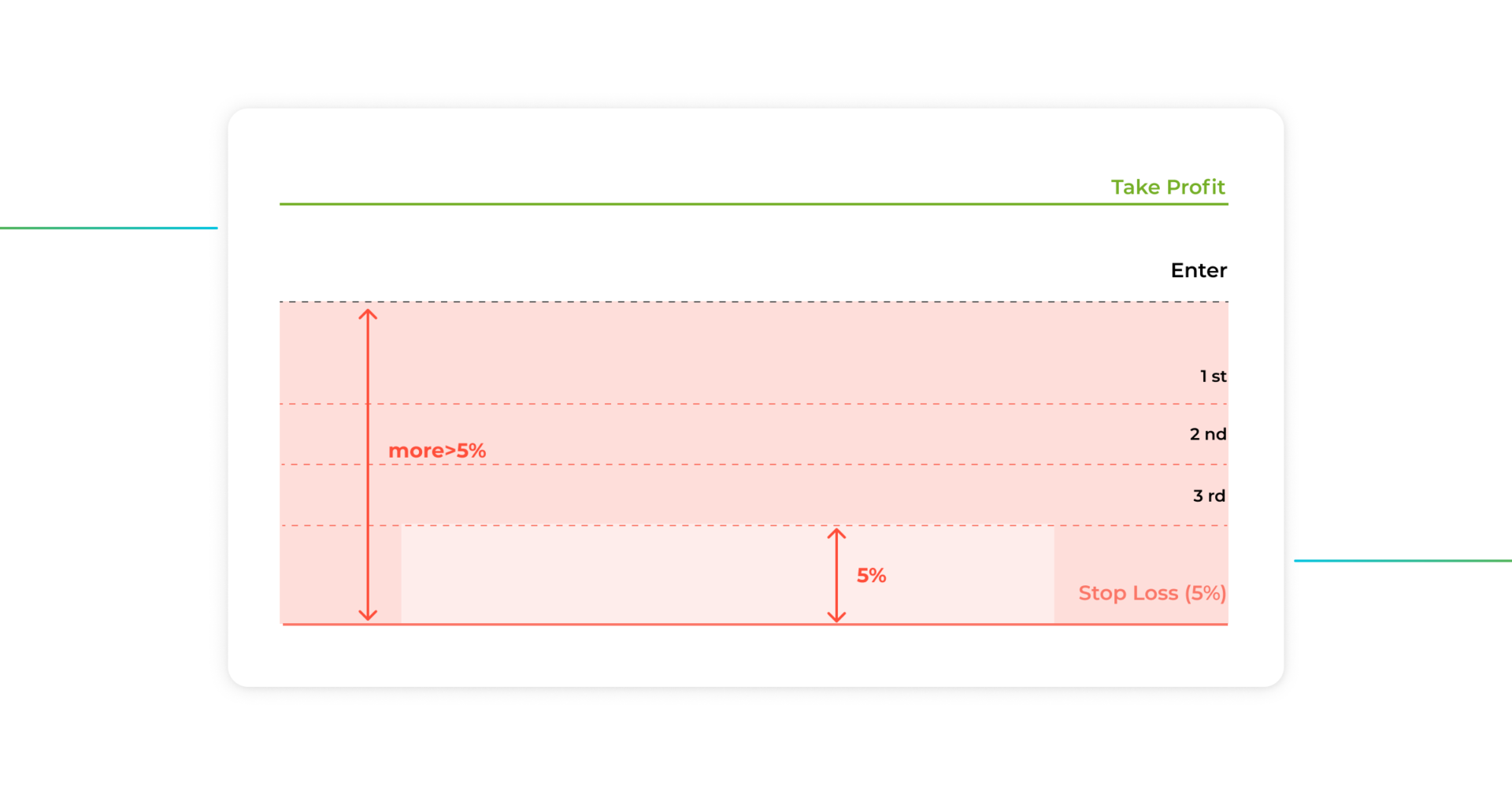

The Stop Loss trigger is the most important thing any successful trader pays attention to in the highly volatile crypto market. Setting an appropriate Stop Loss level is essential for managing risk and minimizing potential losses, and it should be placed below the last averaging level to protect your position. You can set the distance for the Stop Loss as a percentage according to your money management strategy.

Note. Stop Loss is set at % distance from the last averaging order. But this % does not represent your total loss in case Stop Loss is reached. The number of averaging orders, size, and price defines your total loss. When triggered, Stop Loss is sent to the exchange as a Market order.

For example, let’s say you have 5 avg. orders with a 1% distance between them. You set a Stop Loss of 5%, meaning if the market moves against you and reaches the level of Stop Loss trigger, the total loss would be approximately 14.13%. For your convenience, we have also added the calculation of this variable to the DCA Bot Cheat Sheet.

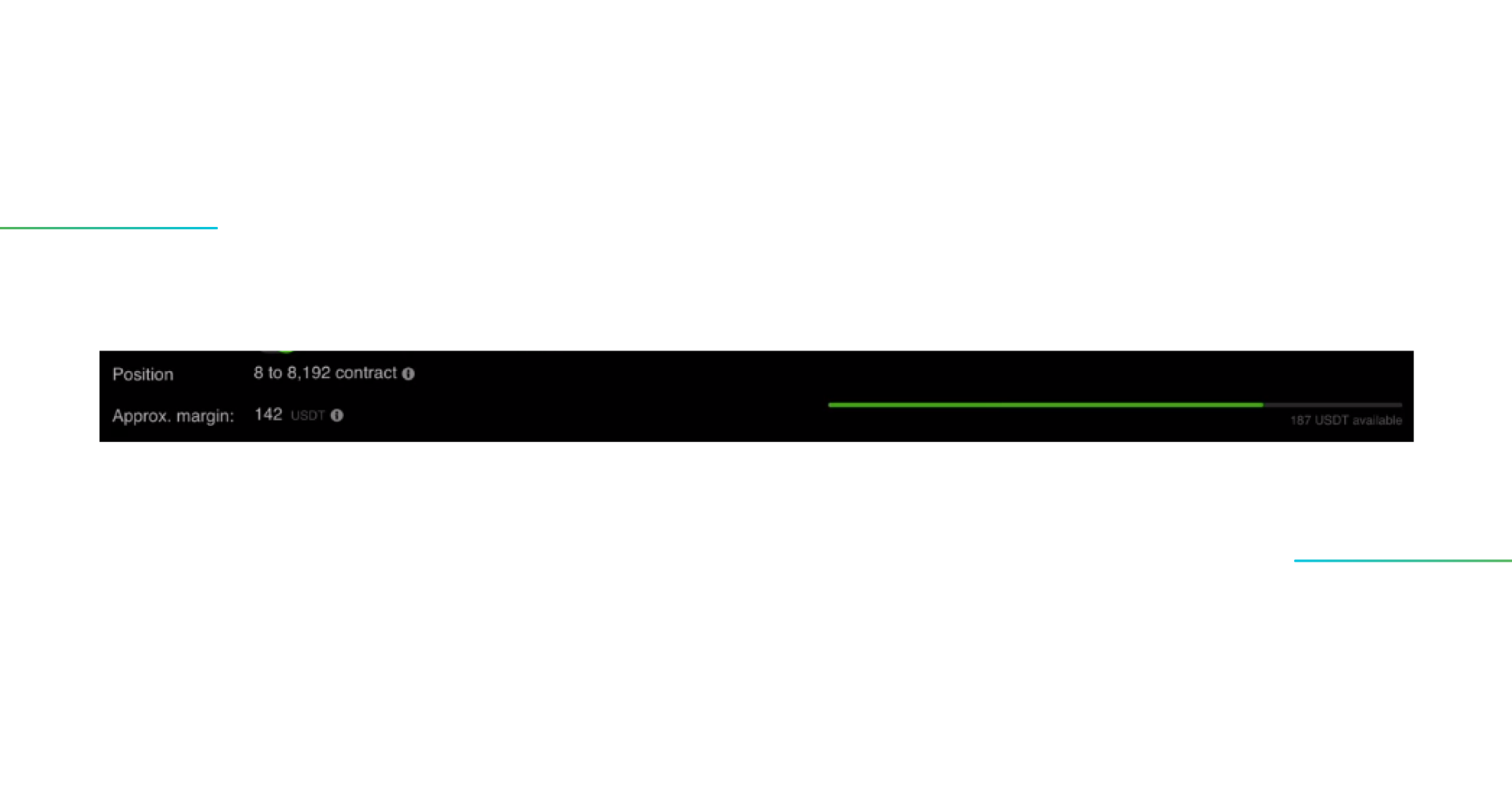

Approximate Margin (Derivatives)/ Funds needed (Spot)

Finally, we have the “Approximate Margin” field (while trading on Futures markets and the “Funds needed” field while trading on Spot markets, which reflects the maximum amount of funds required to launch the bot with pre-configured parameters, according to the selected leverage. Remember, keeping a certain reserve of funds for the price movement is always recommended, ensuring that the bot has collateral for additional orders and will not close due to insufficient funds. Also, it will prevent you from premature position liquidation by an exchange.

That concludes the main DCA settings fields for now. However, an important aspect to consider is calculating your Take Profit correctly while averaging to establish a robust and sustainable trading strategy. Let’s take a closer look.

The Weird Magic of the DCA Take Profit

Now we want to discuss the crucial aspect of maintaining profitability in DCA, which is important to understand: the concept and logic behind the “dynamic” Take Profit (T/P) while averaging.

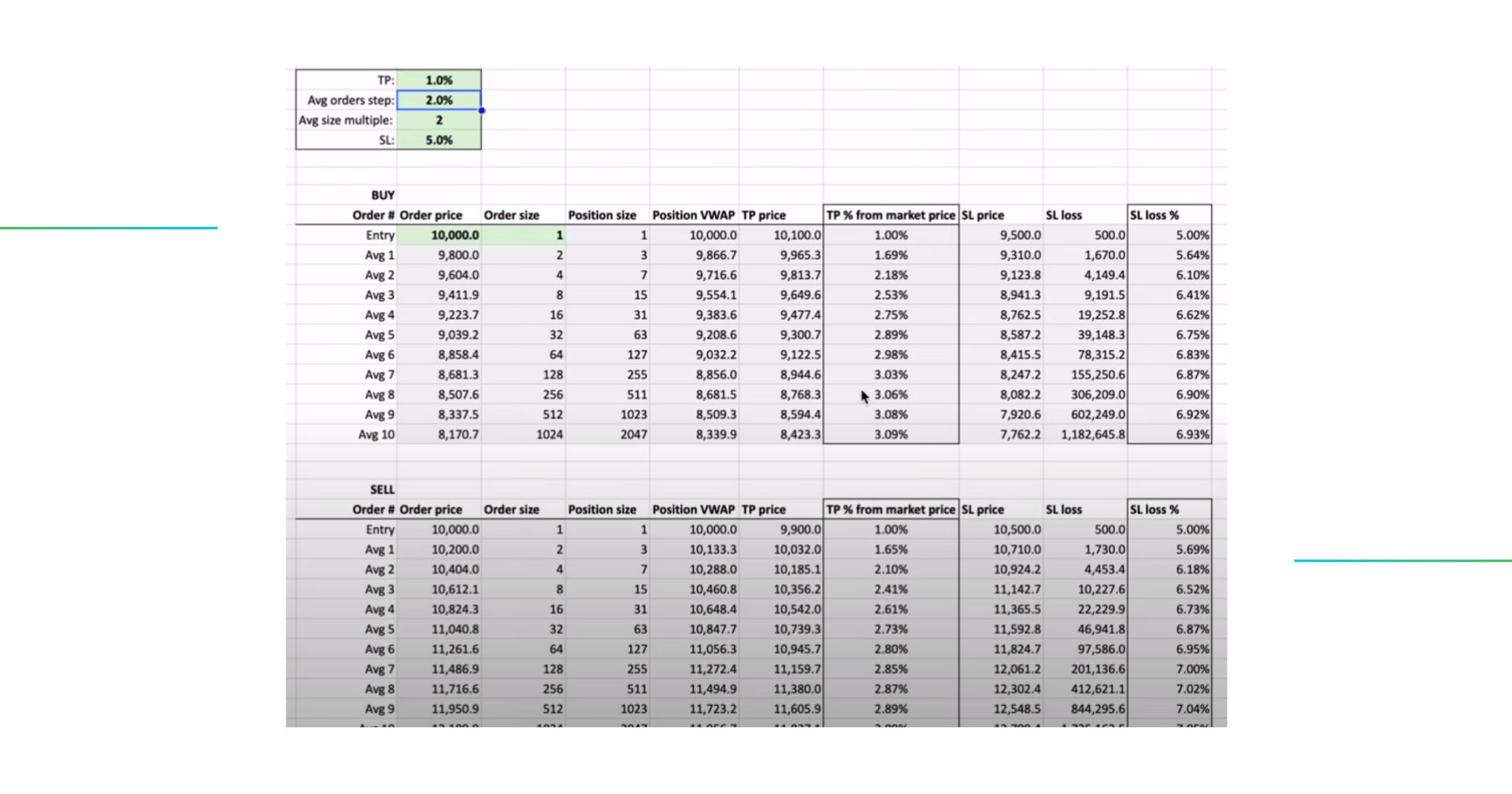

Important note. As the averaging orders are executed, the distance between the average position price and the T/P trigger remains constant, while the distance between the average price of your position and the current market price increases as a percentage.

For example, you’ve launched the bot with an initial T/P of 1%. With the first averaging order, the distance in % of T/P will remain the same. However, as the second averaging order is executed, the T/P distance will increase to 1.69%. With the third averaging order, it will rise to 2.18%, and so forth. This dynamic adjustment depends on your position variables, and in order to follow the process better, we have created a table for you.

The DCA Bot Cheat Sheet will help you determine the optimal final Take Profit (T/P) level that aligns with your strategy. By referring to the table, you can ensure that the bot consistently reaches the desired T/P level and avoids remaining in long trades during significant price pullbacks. It serves as a valuable tool to guide your trading decisions and maximize your trading performance.

Conclusion

The DCA Crypto Bot is a powerful solution for traders looking to enhance their trading process, automate their crypto investment strategies, and maximize profits with minimal risk. This versatile tool can be applied to trade various cryptocurrencies and is suitable for both Spot and Futures markets.

Explore the expanding trading opportunities by applying GoodCrypto`s DCA bots to your day-to-day trading:

- reduce the average cost of a position (in case of the drawdowns)

- a higher average selling price of your asset (using as a multiple Take Profit)

- full flexibility to adjust the bot in the Manual mode

- completely autonomous profit gain in the Auto TA Signal mode

- strict and defined risk management

- highly-performing results in the long-term period

Just run your first DCA bot in the test period, and you’ll notice a significant difference in performance compared to manual trading.