We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Enhancing Your Trading Experience: A Deep Dive into a Trading Terminal

Technology is evolving rapidly, bringing significant changes to various aspects of our lives. This evolution has not spared the trading world, which has transitioned from traditional stock markets to the online realm. As a result, new tools like trading terminals have emerged.

The introduction of trading terminals has completely revolutionized the trading experience, making it faster and more convenient than ever before. Gone are the days when traders had to tirelessly make calls or go to brokers to check updates and execute trades. Trading terminals have emerged as a powerful tool that empowers traders, simplifying the trading process and making it more efficient whether they are trading in the traditional or crypto market. Nowadays, trades are executed in a snap of a finger, transforming trading into a seamless and exciting activity. So, let’s explore what trading terminal software is and how you can benefit from it.

What is Trading Terminal?

Understanding the trading terminal meaning is crucial when delving into the trading world. A trading terminal is a robust software that empowers traders to execute trades with enhanced effectiveness. In a nutshell, it is an interface containing various utilities and additional tools, and which is used above a trading engine provided by exchanges.

Beyond its core functionality, the trade terminal offers various advanced features, a wide selection of order types, algorithmic trading, current price information, order placement capabilities, comprehensive charting tools, customizable alerts, and technical signals. These advanced features are typically not available on most exchanges.

The terminals can be conveniently accessed through desktop or mobile apps, allowing you to monitor your PnL and trade across various financial markets anytime.

Stock Market vs Crypto Market

Trading terminals for traditional and cryptocurrency markets function on the same principle, but may differ depending on which market they serve. It is interesting to note that traditional stock markets and cryptocurrency markets have unique characteristics. So, let’s explore in detail how cryptocurrency market trading differs from traditional trading.

- Traditional trading focuses on classic securities such as stocks, options, futures, and currencies, whereas crypto trading is based on virtual digital currencies.

- In traditional financial markets, traders need an intermediary (aka broker) to conduct trades. In the crypto market, this role is fulfilled by crypto exchanges.

- Stock markets typically operate only on weekdays, with specific opening hours. If you place an order outside market hours, it will be executed once the market opens. Conversely, the crypto market operates 24/7, 365 days a year, providing trading opportunities around the clock.

- Stock markets are subject to strict regulations, including mandatory identity verification, securities laws, exchange regulations, and investor protection measures. In contrast, crypto regulation is relatively new and less stringent, despite many exchanges also require KYC and Anti-Money Laundering (AML) compliance.

Acknowledging these distinctions enables traders to effectively navigate the complexities of each market and make well-informed choices aligned with their unique trading goals and preferences. Trading terminals offer invaluable functions that empower traders in both traditional and cryptocurrency markets, enhancing their trading experience and expanding their potential for success.

Must-have Features for a Crypto Trading Terminal

Without using a crypto trading platform, numerous profitable opportunities may slip away. However, choosing the appropriate trading platform can be confusing, given the variety of options available. To simplify your decision-making process, we have compiled a checklist of essential tools and functions of the trading terminal, enabling you to fully leverage its potential:

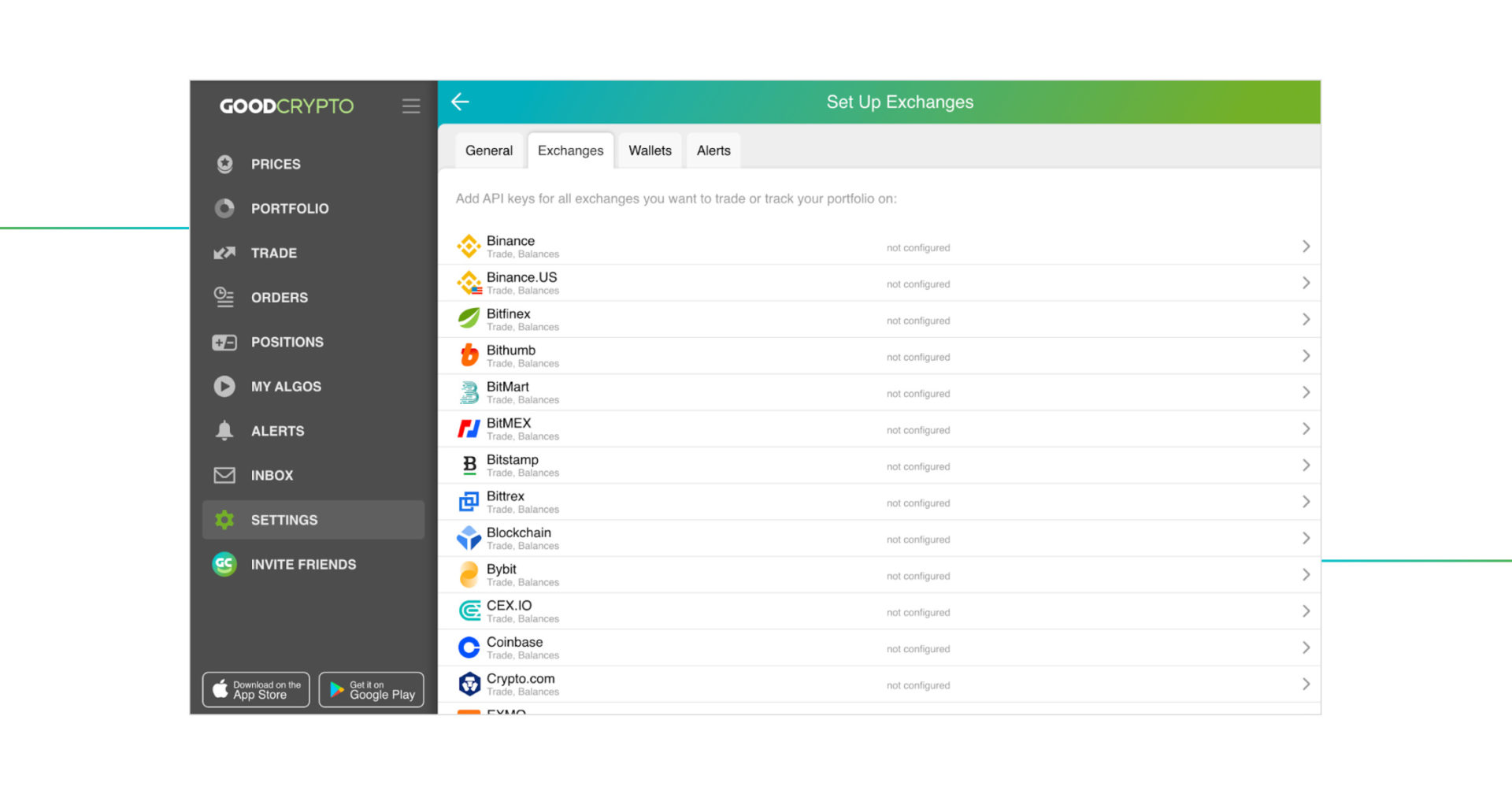

- Connectivity to Exchanges: Evaluate the number of prominent exchanges integrated with your preferred trading terminal. The greater number of supported exchanges enables simultaneous trading on all of them, ensuring you won’t miss out on profitable opportunities elsewhere.

- Advanced Trading Tools: To enhance your profits, consider utilizing a trading terminal that provides access to a range of valuable tools. Look for various advanced order types such as Trailing Stop, Take Profit, Stop Limit, Stop Loss, Trailing Take Profit, Trailing Stop Loss, and more. By incorporating these advanced order types in alignment with your trading strategy, you can simplify your trading process, optimize your trading outcomes, and minimize potential losses.

- Automated Trading: The crypto market operates around the clock, making algorithmic trading invaluable. Some trading terminals offer exclusive automated crypto trading bots that are not available on other platforms. These crypto trading bots execute trades day and night, seizing every opportunity to generate profits without the constant need for market monitoring. Algo trading with Grid, DCA (Dollar-Cost Averaging), or Infinity Trailing Bots can be a magic wand and a game changer in any market situation.

- Real-Time Market Data: With a trading terminal, searching for information from different sources is unnecessary. These apps offer users relevant real-time market data, such as prices, trading volume, market news, new token listings, order book depth, and much more.

- Smart notifications: Intelligent alert and notification systems are highly valuable. They keep you up to date about everything happening in the crypto market, from BTC price changes and order execution to daily market summaries. For example, in the GoodCrypto app you can tailor alerts and notifications, enabling you to capture profitable opportunities.

- Analytical Tools: The majority of trading terminals provide charting tools and trading signals, which are instrumental in gaining valuable insights into the market. These tools facilitate the analysis of price trends, pattern recognition, and the formulation of well-informed trading decisions grounded in technical analysis.

Considering these must-have features, you can select a trading terminal that meets your requirements and empowers you to excel in the dynamic world of crypto trading.

Advantages of Trading Terminals

You might be wondering: why use a trading terminal instead of trading cryptocurrencies directly on an exchange? While crypto exchanges provide a solid way to trade, their functionality may not fully align with your goal of enhancing your trading strategy. Typically, crypto exchanges lack access to advanced trading tools and intricate order types, often restricting users to basic market and limit orders.

Let’s delve into the advantages you can gain from top-tier trading terminals:

- Multiple Exchange Selection: You can securely connect various crypto exchanges via API keys and trade on them simultaneously. The more assets and trading pairs you have access to, the greater your potential for profitable opportunities.

- Enhanced Trading Tools: If you need more than market and limit orders, the array of robust advanced trading orders that are typically available in reputable trading terminals will undoubtedly catch your interest!

- All-in-one solution: The best trading terminals integrate portfolio management features to cater to traders’ convenience. The app consolidates all relevant information in one centralized platform, eliminating the need to navigate multiple platforms and exchanges to access your PnL data or monitor order statuses. Everything you require is just a few clicks away, providing a streamlined and hassle-free trading experience.

- Intuitive Interface: Some crypto exchanges have complicated and confusing interfaces, turning trading into a challenging quest. The top-tier trading terminals strive to offer a user-friendly interface, which significantly enhances the trading experience for maximum convenience and enjoyment. This ensures that even crypto newbies can easily place orders and enjoy a seamless trading experience.

Disadvantages of Crypto Trading Terminals

While using a trading terminal can enhance your trading and help you capture potential profitable opportunities, it’s important to be aware of certain drawbacks that come with it.

- Security: Trading terminals can be vulnerable to a variety of hacker attacks and may not properly protect user’s personal information, which may result in unauthorized account access and data breaches. Prioritize trading platforms that put security as a paramount concern. Avoid risking your personal data and funds by choosing unreliable trading terminals.

- Pricing Policy: While certain trading platforms may offer an extensive range of tools and features, they can come at a substantial cost. Conversely, platforms that provide free services often lack advanced functions. However, there is a silver lining – free trials. Typically, they are sufficient to familiarize oneself with the platform and determine if it is worth trading on.

- Skills and Knowledge Barrier: While placing orders may be easy even for beginners, harnessing the full potential of advanced trading tools requires expertise in configuring orders and trading bots correctly. This expertise is vital for executing profitable trades and minimizing losses. That’s why education plays a pivotal role in cryptocurrency trading. Fortunately, many platforms, such as GoodCrypto, offer educational materials such as blog articles, manuals, and guides tailored for newcomers to equip them with the essential knowledge needed for successful trading.

Now that you have acquired comprehensive knowledge about trading platforms and the myriad opportunities they offer, it is crucial to keep in mind that even advanced trading terminals cannot guarantee constant profits. Therefore, integrating risk management practices becomes a paramount activity. Striking a balance between maximizing gains and avoiding potential losses is essential when utilizing a trading terminal for your crypto trading endeavors.

GoodCrypto Trading Terminal Overview

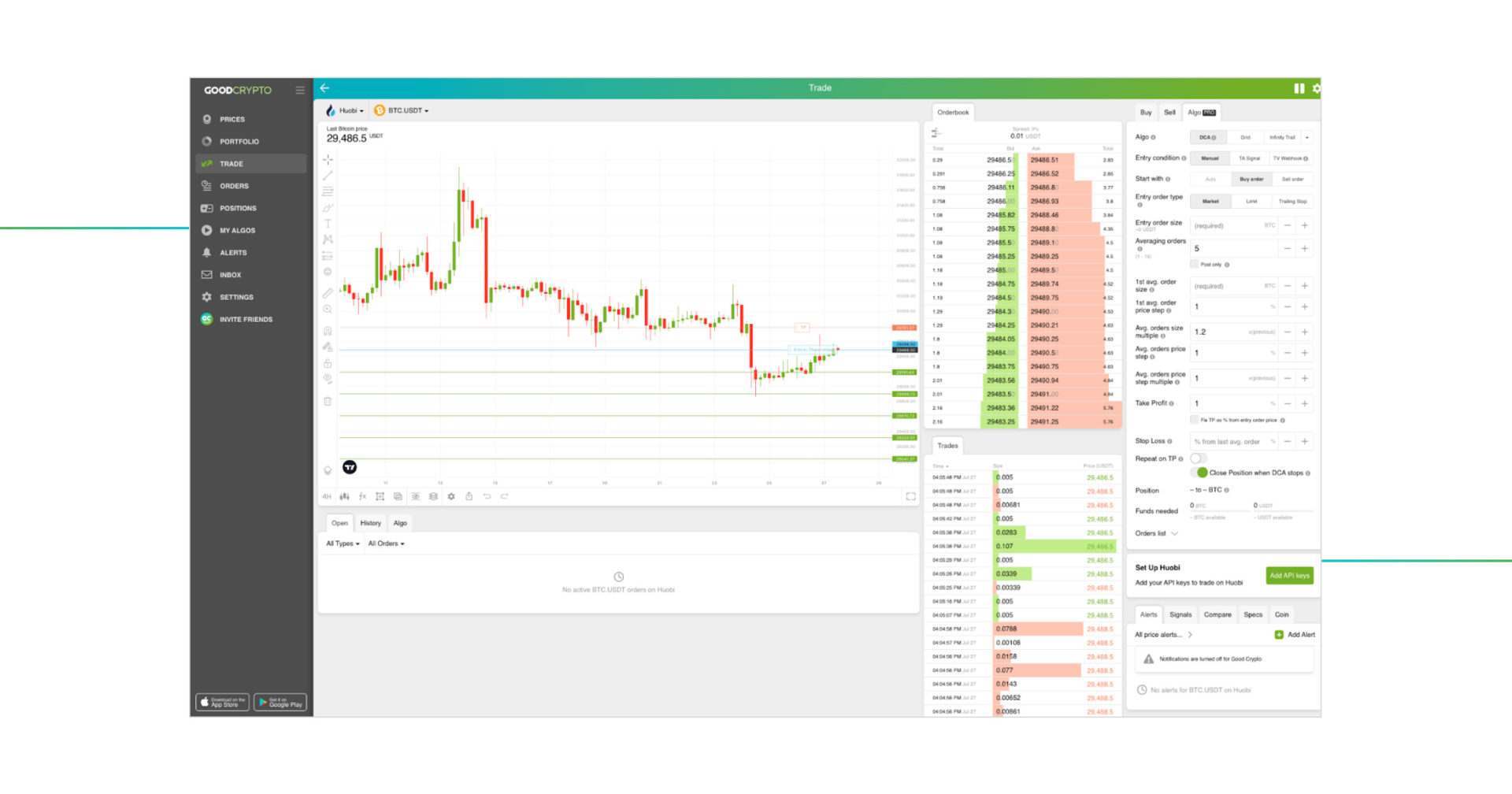

GoodCrypto is a multi-exchange trading terminal supporting 36 spot and derivative exchanges. We have taken into consideration all the pros and cons of trading terminals and created the real gem that can help you leverage and facilitate your trading. With Good Crypto, you can revolutionize your crypto trading journey with the best tools and features. Besides, the trading terminal has a user-friendly and intuitive interface to ensure a seamless trading experience.

How to Start Using GoodCrypto Trading Terminal?

You’re just a few clicks away from embarking on an unforgettable trading adventure. Here are two simple steps to get started:

- Create an Account: Sign up for a GoodCrypto account using the mobile (iOS or Android) or web apps. While there is a free version available, we recommend opting for a PRO subscription to unlock access to all the powerful tools and make the most of the app. GoodCrypto offers a 14-day free trial for you to explore all the features and use the app at the full blast.

- Connect Your Exchanges: Connect your preferred exchanges through API keys. GoodCrypto seamlessly integrates with 36 of the best crypto exchanges, including 27 spot and 9 futures exchanges, offering you a wide range of trading opportunities. Here are detailed guides on creating and adding API keys to your GoodCrypto to ensure a smooth setup process.

You can connect your favorite exchanges via API keys

With these steps completed, you’re ready to kickstart your trading journey! Whether you’re an experienced trader or a novice, GoodCrypto’s trading terminal is designed to meet your needs and exceed your expectations. For an even better experience, explore our blog, where you’ll find a wealth of valuable information on trading strategies, manuals and educational guides for technical analysis.

GoodCrypto Trading Terminal Features

Now, let’s dive into the top-notch features that make GoodCrypto’s trading terminal exceptional:

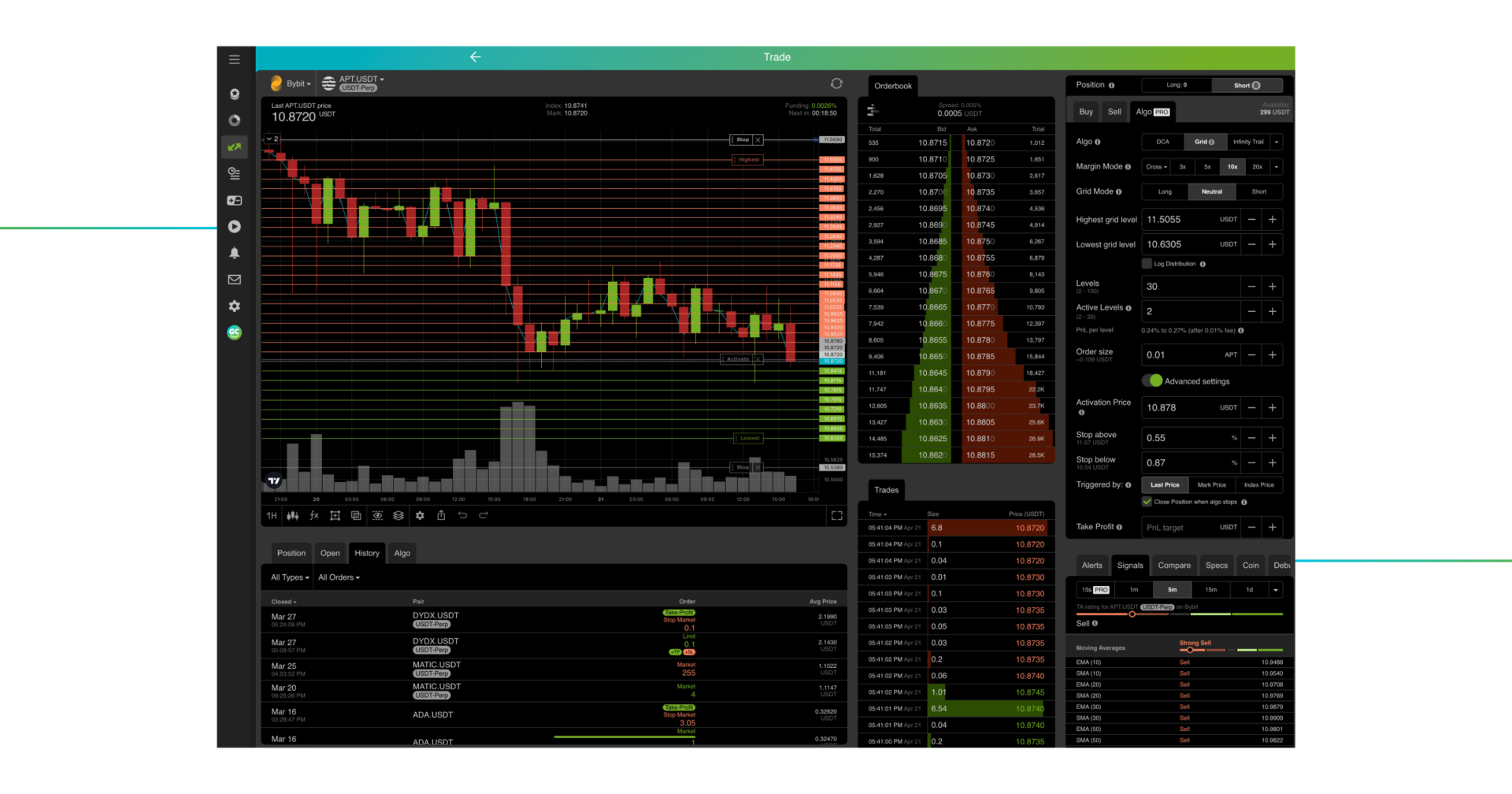

1. Algo Trading. GoodCrypto offers various automated trading bots for every market situation:

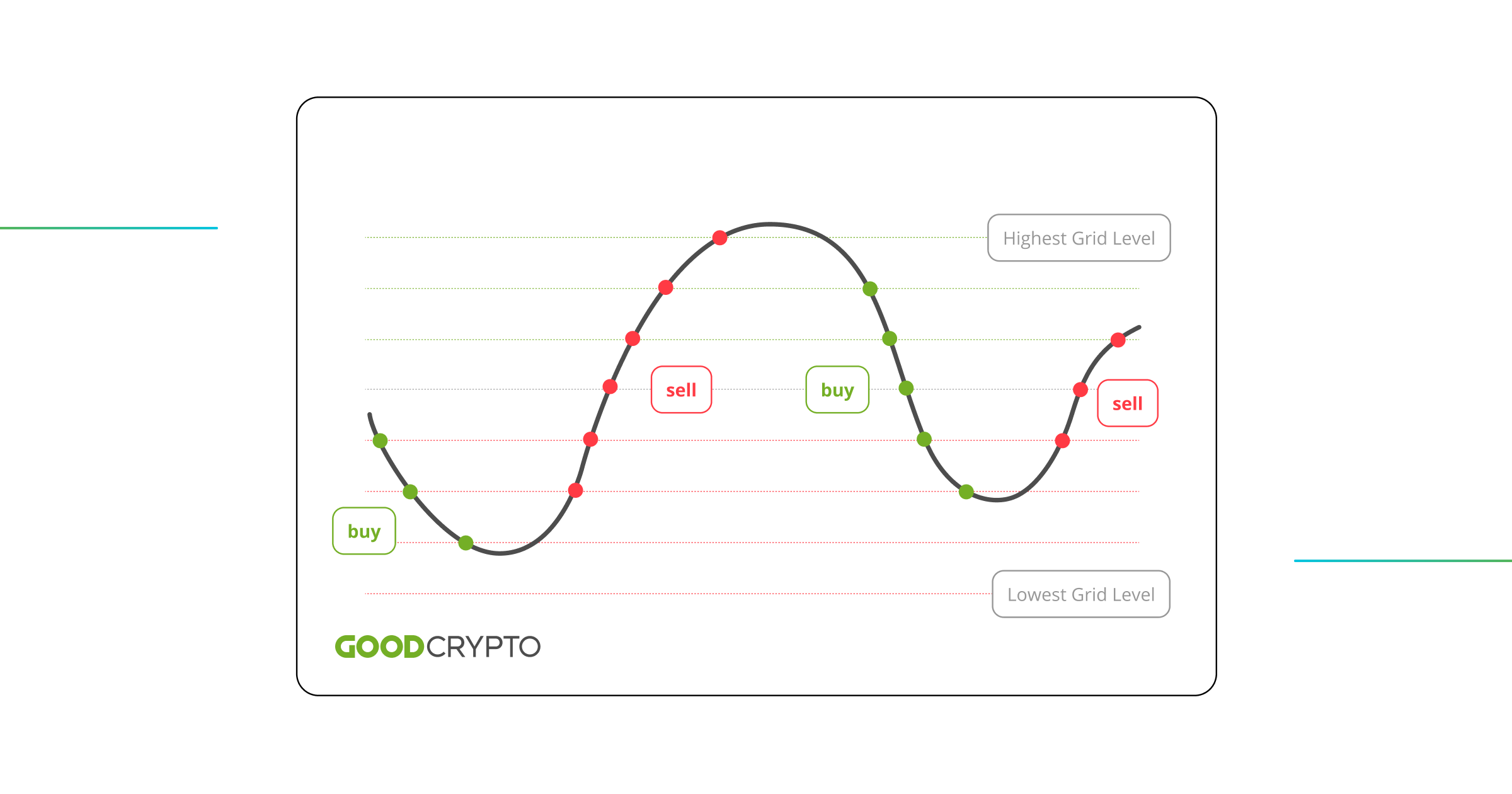

- Grid Bot is an algorithmic trading strategy created to capitalize on price movements within a range.

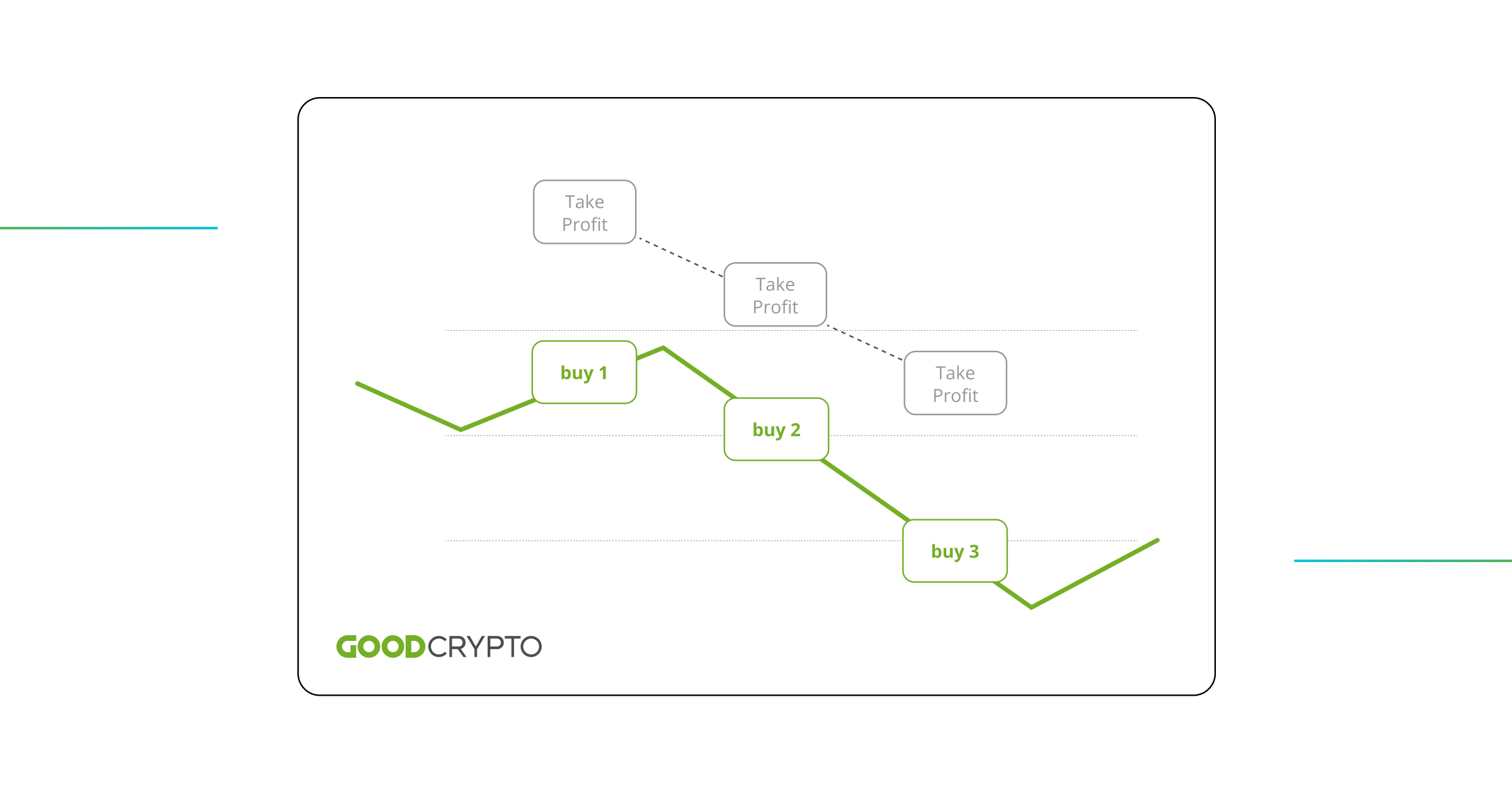

- DCA bot is designed to average the entry price in trades by continually buying or selling assets as market conditions fluctuate. This bot is useful for both middle and long-term positions, and it automatically recalculates entry prices and take profit levels if the market is moving against the trader. Depending on the market cycle, traders can choose between Long and Short DCA modes to optimize their trading strategy. In the Long DCA mode, the bot initiates a buy order, and if the price starts to decrease, it will automatically purchase more at specific price levels, effectively lowering the average purchase price of the asset. Conversely, the Short DCA mode begins with a sell order and sells more as the price rises against the trader

Moreover, in TA Signal (Auto) mode, the bot can execute trades based on technical analysis signals – Buy/Sell or Strong Buy/Strong Sell. GoodCrypto employs 25 technical indicators based on 15 moving averages and 10 oscillators to identify the perfect moments to enter or exit trades. You can learn DCA bot basics in our comprehensive guide or check out DCA bot case study to get the full picture of how this bot works.

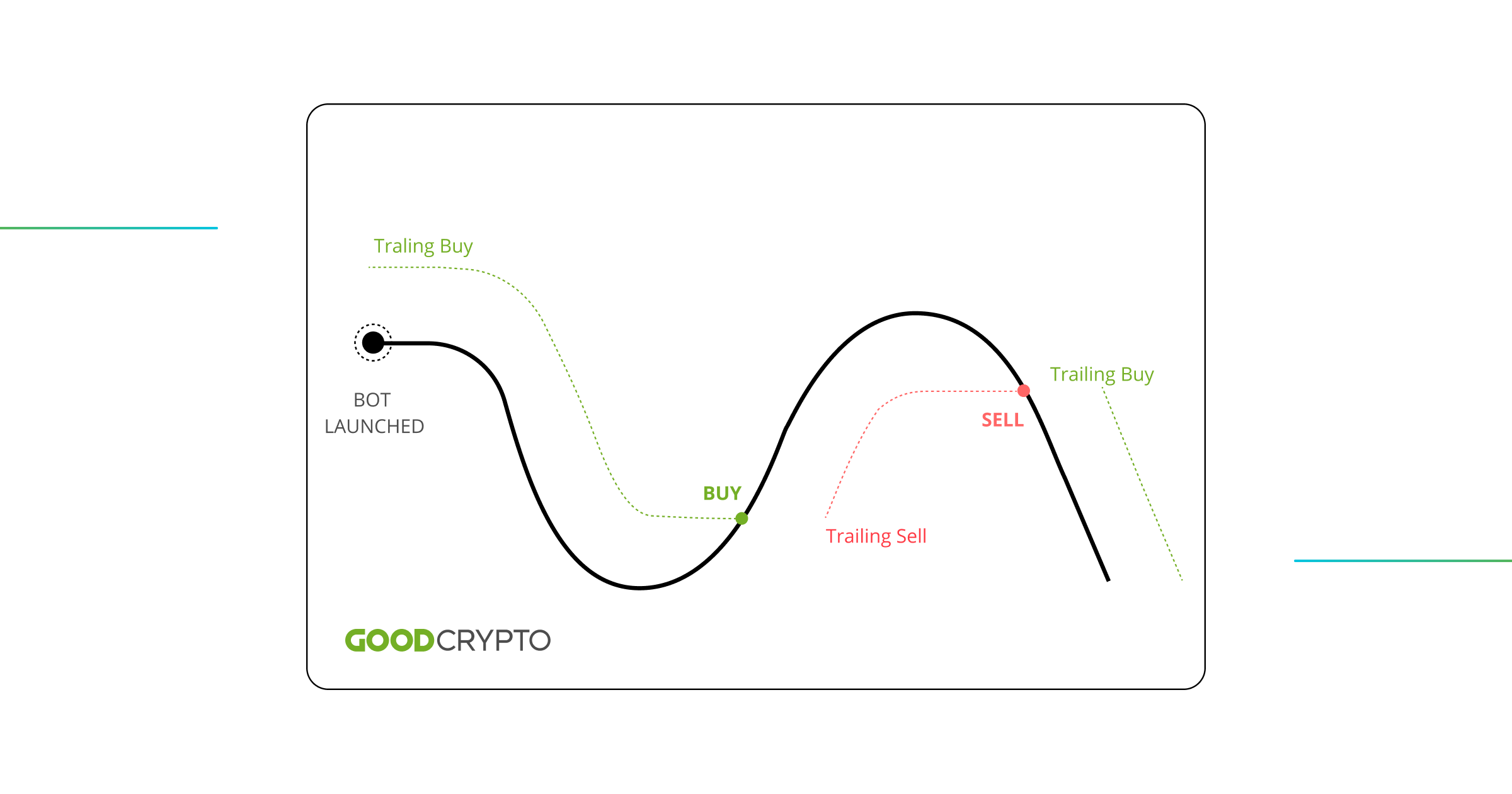

- Infinity Trailing Bot is an advanced trading strategy designed to capitalize on market volatility and trend movements. This bot automatically manages Trailing Stop orders, allowing traders to capture large market swings. Traders can set the Trailing Distance based on the current market volatility, and the bot will then execute trades accordingly. The algorithm will operate until it reaches a predefined profit target or is manually stopped.

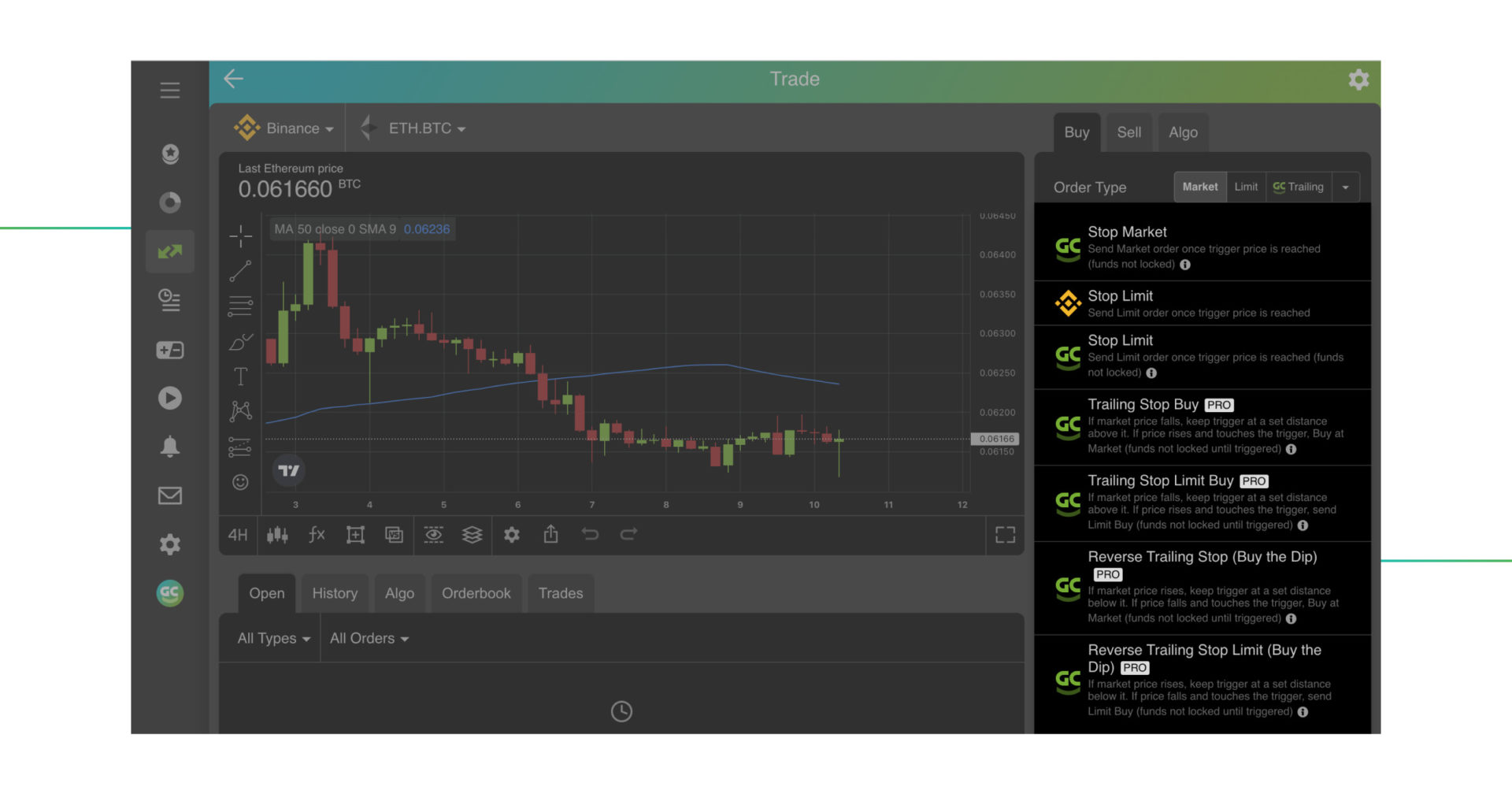

2. Cutting-Edge Order Types: Say goodbye to basic Market and Limit orders. GoodCrypto offers advanced orders, such as Trailing Stop, flexible Stop Loss, and Take Profit combinations so that traders can unlock limitless possibilities for profitable trading:

- Trailing Buy is ideal for entering long positions. It follows the market price downward and triggers a buy order when the price rises by the specified Trailing Distance, allowing traders to buy at a lower price when the price trend reverses.

- For exiting long positions, use the Trailing Sell order. It follows the market price upward and triggers a sell order when the price falls by the set Trailing Distance, maximizing profits by exiting precisely when the price trend reverses.

- Trailing Stop Loss order acts both as a stop loss and a take profit, ensuring that your potential profit increases as long as the price moves in your favor.

- Traders can use Trailing Take Profit to gain extra profit compared to a regular take profit order, as it can be activated above the initial buying price. The order will be executed when the trend reverses, and the price falls by the trailing distance, increasing the chances of capturing an uptrend.

- Also, GoodCrypto offers Stop Loss and Take Profit Combos, which allow traders to attach stop loss and take profit orders to their trades. The cherry on top – the order doesn’t lock your balance until triggered.

Dive into our article on Trailing Stop orders and apply your newfound knowledge in executing your first advanced order.

3. Technical Analysis Signals will help identify the best entry and exit points. Intelligent TA Signals are driven by 15 Moving Averages (MAs) and 10 Oscillators, empowering users to make informed trading decisions.

4. Integrated TradingView Webhooks are an excellent tool to elevate your trading experience. Execute or cancel orders and initiate trading bots based on TradingView technical signals. This cutting-edge tool simplifies and streamlines your trading strategy, ensuring a seamless and stress-free trading process.

With GoodCrypto’s trading terminal, you have access to a world of possibilities to enhance your trading journey. Enjoy the adventure!

Is GoodCrypto Trading Terminal Safe?

For any crypto-related project, security should be the paramount priority. That’s why GoodCrypto is making a 200% effort to ensure that the trading terminal is secure and reliable. To achieve safe and secure trading, the GoodCrypto team employs the following security measures:

- On-device API key encryption

GoodCrypto encrypts API keys on the user’s device using 2048-bit asymmetric encryption. Then these keys are transmitted securely via SSL (Secure Sockets Layer). Once received, they are stored in an encrypted and firewalled server environment and never sent back to the client. - Multi-tiered server security architecture

The backend services of GoodCrypto employ multi-tiered security measures. All connections to the platform are encrypted to ensure the security of every user’s trading experience. Backend services are categorized and kept separately encrypted and firewalled environments to prevent unauthorized access. - Multi-layer account security

GoodCrypto has implemented multiple layers of security to protect user accounts. The account activity is monitored to detect any suspicious actions. - Regular security audits

The app undergoes regular security audits conducted by leading cybersecurity experts. These audits assess various aspects of security, including the application’s code, server architecture, and internal processes. - Cooperation with white-hat hackers

GoodCrypto has an ongoing bug bounty program that incentivizes white-hat hackers (ethical hackers) to identify and report security vulnerabilities. By engaging with ethical hackers, we aim to proactively discover and address potential threats and vulnerabilities before malicious actors can exploit them. - User data encryption and depersonalization

User data, including personal information, is encrypted on the user’s device. This data is stored in encrypted depersonalized databases, which means that even if an attacker gains access to the data, it would be challenging to link it back to specific individuals.

As you can see, for the GoodCrypto team, security is the top priority, so you can execute trades on the most secure and reliable app.

GoodCrypto app – the Best Platform for Crypto Trading

GoodCrypto is the best platform for crypto trading as it combines trading terminal and portfolio management. Designed to enhance your crypto trading experience, it empowers you to achieve consistent profits while minimizing trading stress and potential risks. Discover the unmatched capabilities of GoodCrypto, the ultimate crypto app that caters to both novice and experienced traders.

Besides cutting-edge trading tools, GoodCrypto offers various advantages:

- Streamlined Portfolio Tracking: Stay in control of your trades and transactions in real-time, providing you with up-to-date insights into your portfolio.

- Lucrative Affiliate Program: Maximize your earnings with GoodCrypto’s affiliate program. Earn up to 50% of your referrals’ subscription spending and receive up to $10 for every $1M traded on the platform. Referees also enjoy a 25% discount on annual subscriptions.

- Sleek and User-Friendly Interface: Set up even the most advanced trading tools easily on GoodCrypto’s platform. Its simple and intuitive interface ensures a seamless trading experience.

GoodCrypto offers cutting-edge trading tools on 36 spot and derivatives exchanges, and the app is available on the web, Android, and IOS for a seamless trading experience. The icing on the cake – all these advanced features won’t cost you an arm and a leg! Check it out yourself in our Plans section to ensure that it’s the best deal on the market. Besides, you can give the app a test drive with our 14-day free trial to ensure that GoodCrypto is a one-stop solution for your trading needs.

Tap into the potential of GoodCrypto, the leading choice for traders seeking a comprehensive and reliable solution for crypto trading. But less talking, more trading!

Get the App. Get Started

Keep your portfolio in your pocket. Take advantage of market opportunities with our advanced orders and automated trading strategies. Keep up with the market with our smart alerts.

Share this post:

November 7, 2023