We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

ETH futures open interest hits ATH. Stables trading volume surges to $1.8T

Hey, there! 👋

Over the past seven days, there has been some interesting crypto news, bringing even more optimism to the market. Let’s dive in 👇

quick weekly news

Ether futures open interest hits all-time high

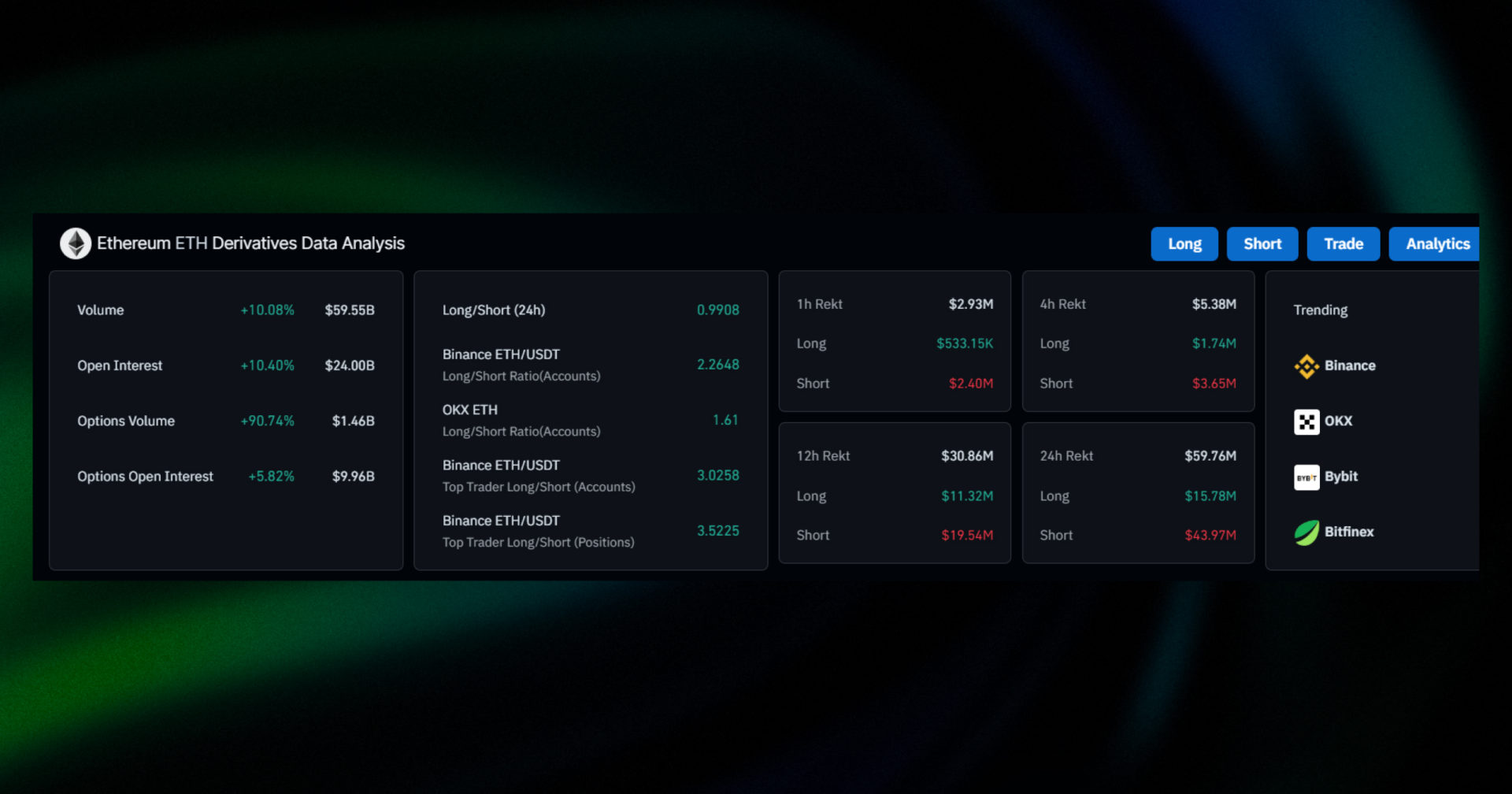

Over the past 7 days, Ethereum perpetual open interest surged by 15%, climbing to the $24B mark as of November 28.

Source: CoinGlass

According to CoinGlass, this is an ATH number for perpetual open interest in Ethereum, while the last ATH of perpetual open interest was recorded in May 2024, when $ETH was priced near $3,900 per coin. Notably, a few months ago, in August 2024, Bitcoin’s futures open interest stood at $31.2B.

However, high demand for leverage does not inherently indicate bullish sentiment for the asset in the mid-term, despite the expectations of retail investors. A disproportionate number of longs or shorts often results in a market move in the opposite direction due to liquidation cascades. For example, when the majority of positions are long, downward market pressure can trigger a liquidation cascade, forcing the market to go lower until the balance is restored.

Still, according to CoinGlass, the open interest on Ethereum is currently prorated on both sides in approximately a 1:1 ratio, even though top traders on prominent CEXs indicate a 2:1 or 3:1 ratio in favor of longs.

Source: CoinGlass

Stablecoin trading volume surges to $1.8T in November

According to the CCData monthly report, the trading volume of stablecoins on centralized exchanges surged to $1.8B in November 2024, rising by over 77.5%.

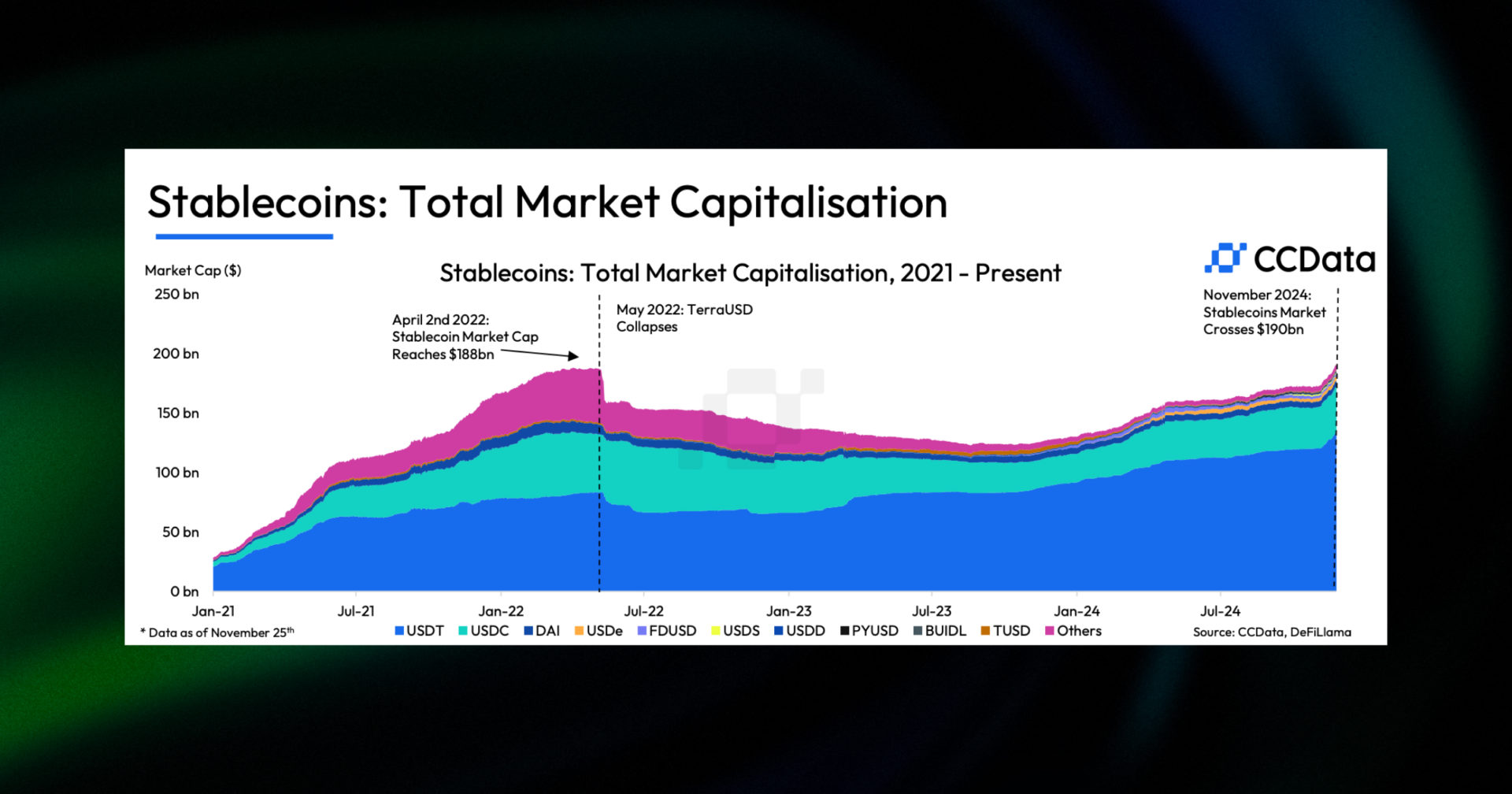

The stablecoins for a little bit more than a year have been continuously recovering after the collapse of Terra’s TerraUSD in 2022, gaining back the trust of investors in those types of digital assets. Even despite the small decline in the crypto market domination from 7% in October to 5% in November, due to the recent surge in Bitcoin and other crypto, the industry has finally reached a new ATH market capitalization of over $190B, breaking the last record of $188B in April 2nd, 2022, right before the Terra Luna collapse.

Notably, Tether continues to dominate the market of stablecoins and continues to show an impressive performance, growing its market cap by over 10%, approximately $133B. As of now, it accounts for almost 70% of the stablecoin market, while Circle ($USDC) ranks 2nd with a 12.1% growth to $38.9B market cap.

Source: CoinTelegraph

However, one of the biggest performers in the industry has been Ethena—a synthetic dollar stablecoin powered by internet-native yield. It implements an algorithmic delta-hedging trading strategy to generate yield entirely on-chain. Although it is often compared to the collapsed Terra Luna algorithmic stablecoin, its relatively high-yield opportunities (around 22% APY as of now) and the innovative concept of a censorship-resistant stablecoin appear more attractive to investors.

Meanwhile, the biggest losers in the industry have been First Digital USD ($FDUSD) and $DAI, even though the former was actively promoted by Binance, offering token launchpools in the $FDUSD and $BNB staking pools.

Altseason delayed due to lack of fresh retail capital

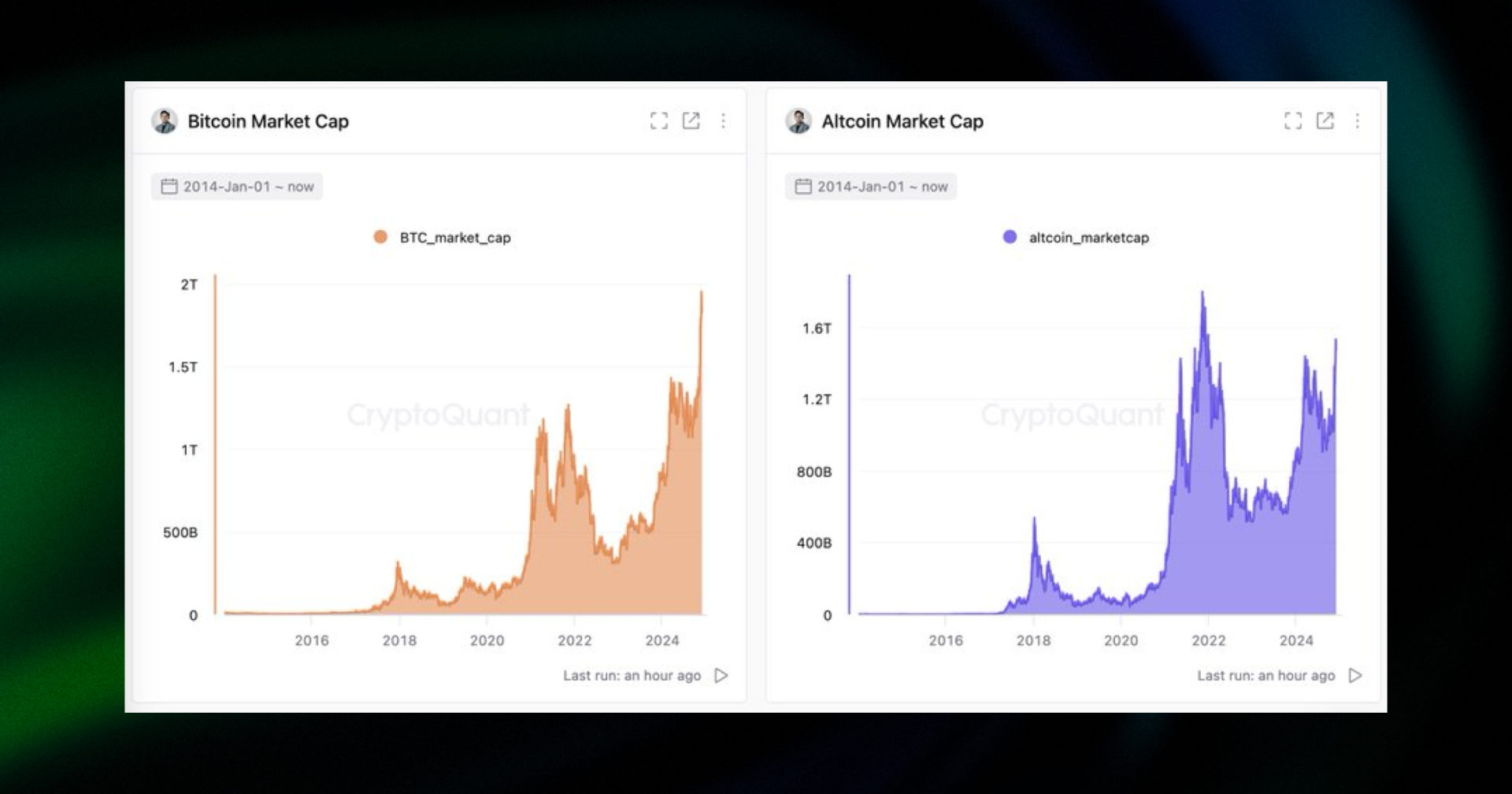

CryptoQuant founder and CEO Ki Young Ju recently claimed that the altseason in this bull run might be delayed, as the crypto market will require fresh retail investor capital for it to occur. In recent months, crypto ETFs have dominated the agenda, and most of the gains have come from new institutional inflows, with little participation from retail investors.

“For altcoins to reach a new all-time high market capitalization, they will require a significant influx of fresh capital to crypto exchanges. The altcoin market cap below its previous ATH indicates reduced fresh liquidity from new exchange users.”

Source: Ki Young Ju

The main issue with institutional inflows is that while they bring massive capital into the crypto market and incentivize further adoption, according to Ki Young Ju, they are unlikely to rotate gains from blue-chip assets like BTC or Ether into altcoins. He also noted that altcoins need to develop a more robust strategy for attracting new liquidity into their tokens without relying on Bitcoin’s movements. Despite this, he concluded that there is still a chance for altcoins to thrive, and he remains bullish on their future.

Bitwise files for 10 Crypto Index Fund ETF with the SEC

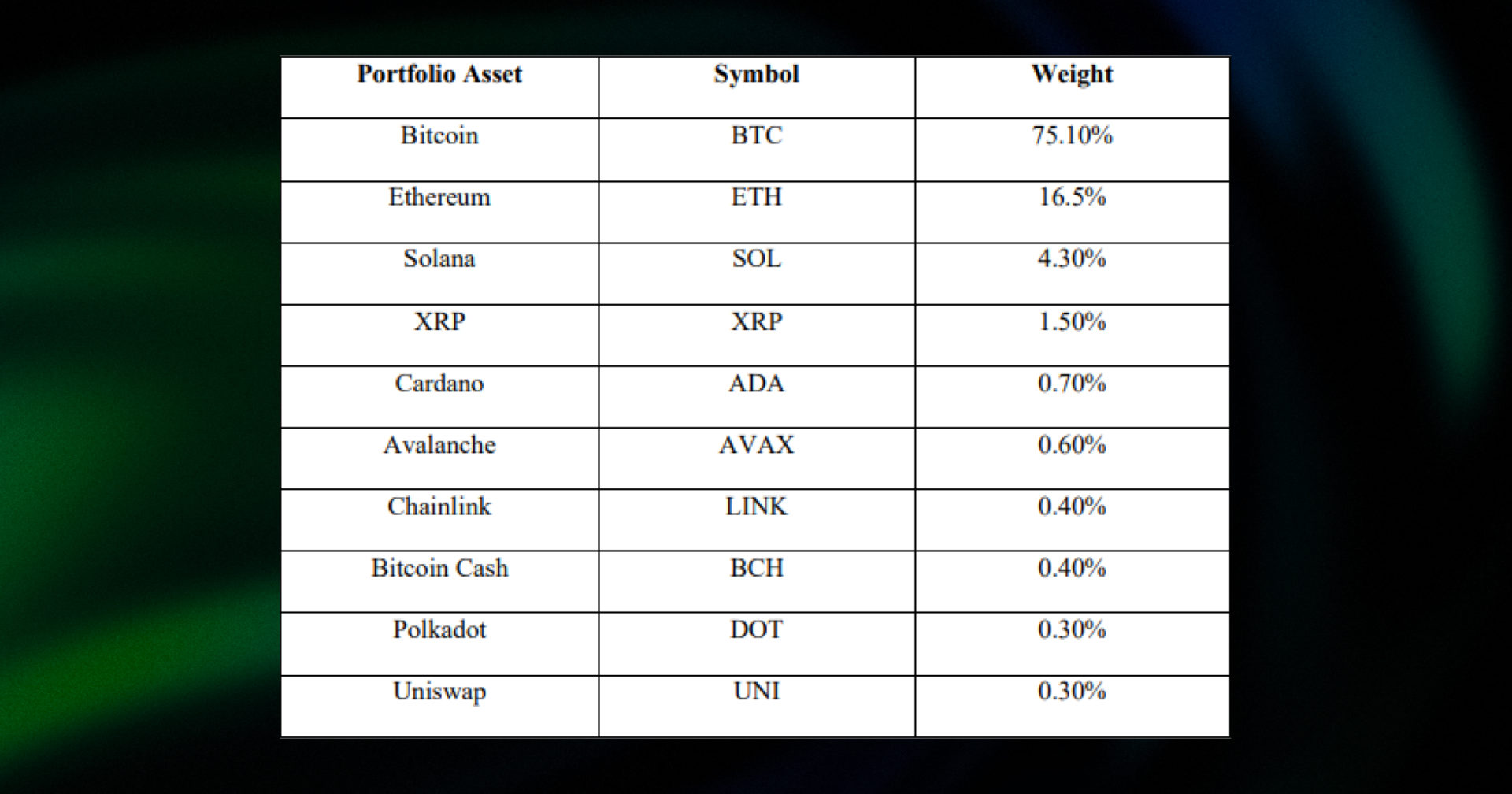

On November 27, the asset management company Bitwise filed with the U.S. Securities and Exchange Commission (SEC) to approve its 10 Crypto Index Fund ETF as an exchange-traded product (ETP) on the New York Stock Exchange (NYSE) Arca.

According to the filing, the index fund aims to provide investors with indirect exposure to the underlying cryptocurrencies, while custodians will be responsible for holding and managing those assets. The report names Coinbase as a partner for the crypto component of the ETF, while the Bank of New York Mellon will serve as the custodian for the cash holdings of the ETP.

The Bitwise Crypto Index Fund will primarily be weighted toward Bitcoin and Ethereum but will also include assets such as Solana, Bitcoin Cash, Cardano, XRP, Avalanche, Chainlink, Uniswap, and Polkadot.

Source: Bitwise’s application

Traditionally, the SEC does not set a specific deadline to approve or reject such applications but has acknowledged this submission, giving it up to 240 days to either approve or dismiss the proposal.

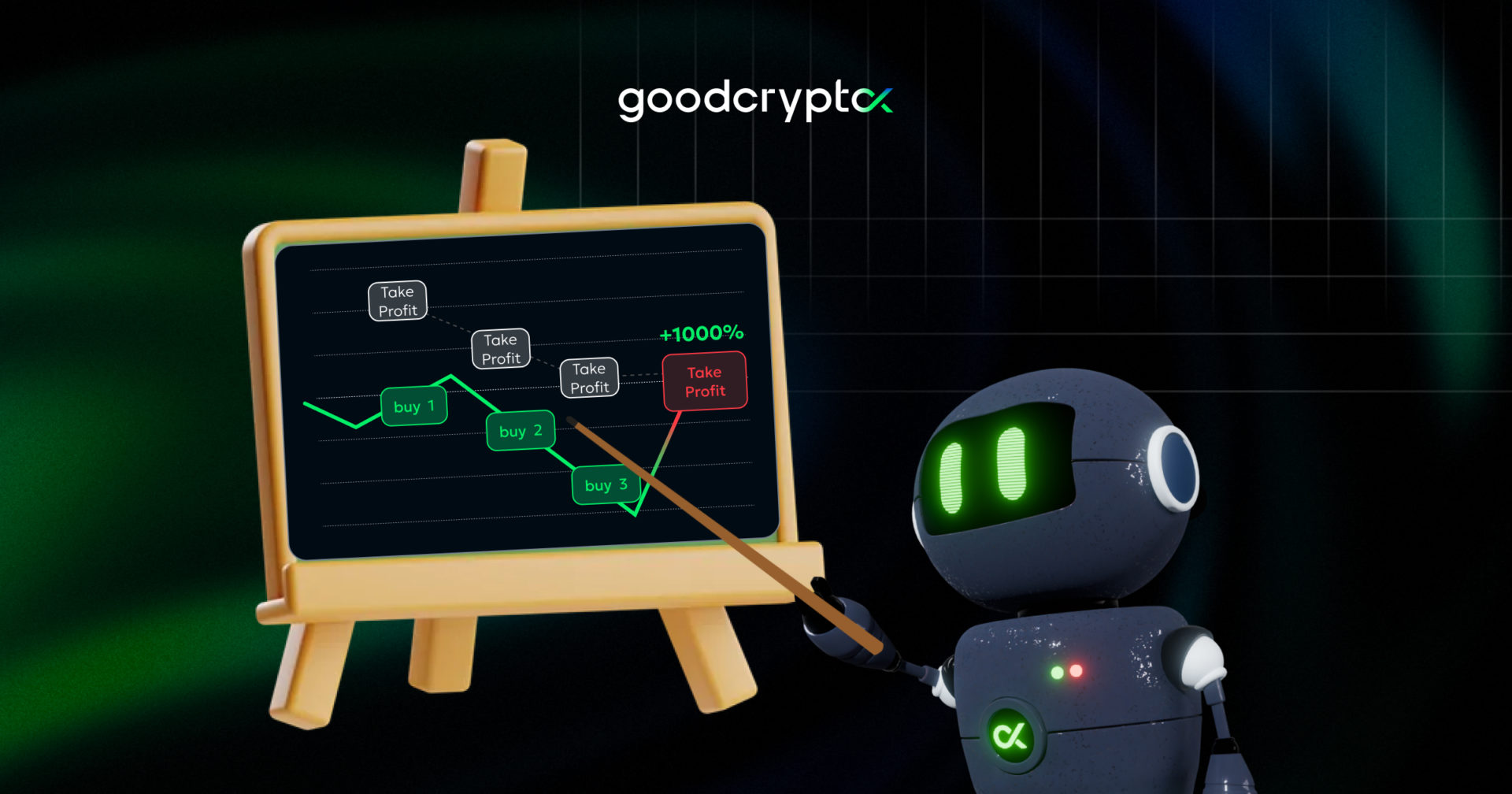

DCA trading case review by GoodCrypto

The crypto market is on an incredible run, and there’s no time to manually monitor and manage every trade to make the most of the current opportunities.

That’s where DCA trading bots come in—a reliable solution to automatically grow your portfolio’s value. However, using a DCA strategy isn’t without its challenges, and there are hidden pitfalls you might encounter along the way. To help you navigate these, our team has prepared an in-depth review of a real DCA bot trading case shared by one of our users. 📈

Discover the full details of their setup, gain comprehensive tips and tricks to improve your DCA trading, and strategy, and find out how our user managed to achieve an impressive 193% ROI in just six months of running the bot! 👇

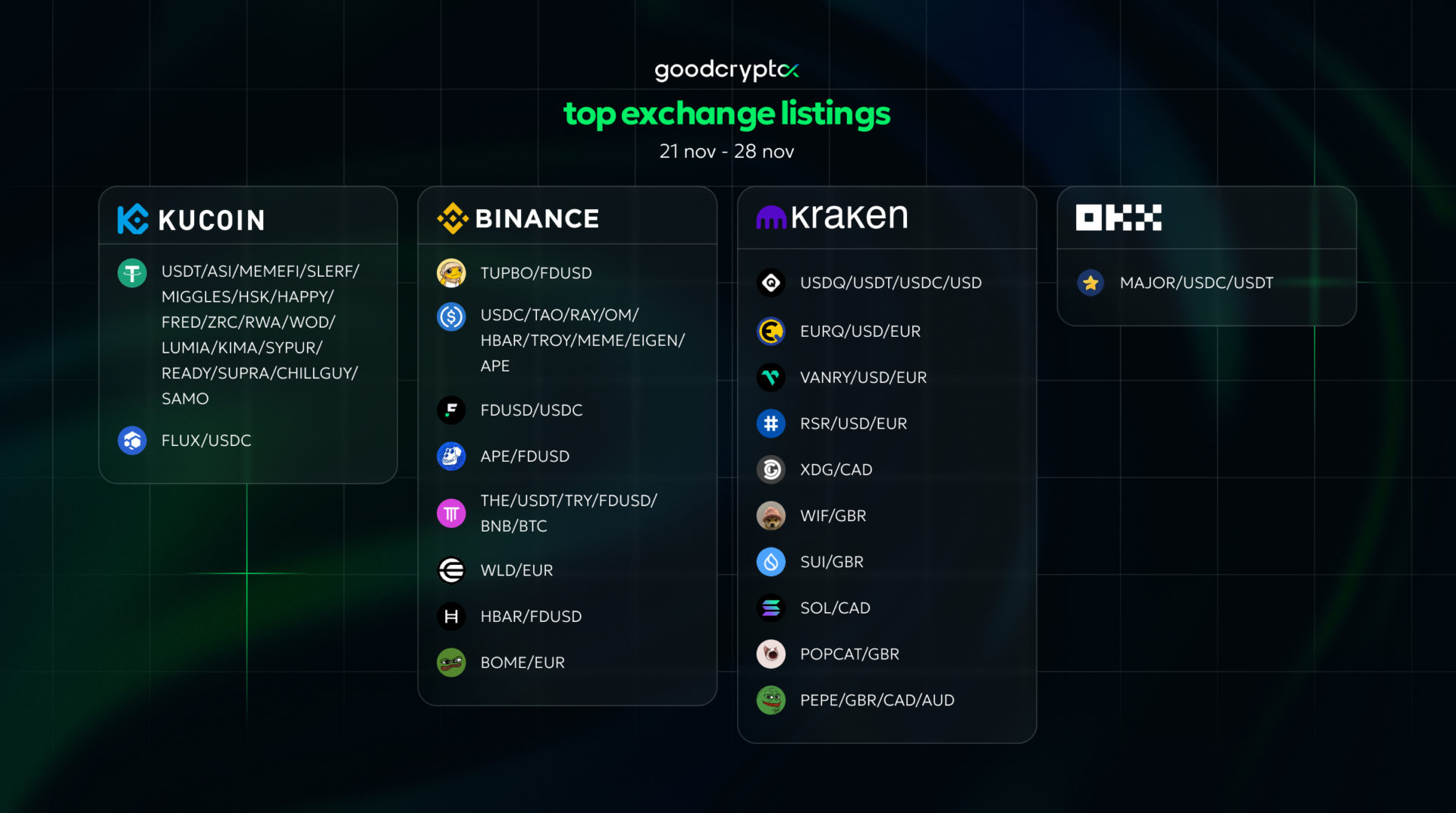

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

November 28, 2024