The crypto market is on the extreme run, and it seems like the small on-chain gems, especially memecoins, are once again starting their moves. While they could bring you unimaginable returns, DEX (on-chain) trading requires a lot of knowledge, experience, and time to discover new gems and enter trades. This is where the on-chain sniper bot from goodcryptoX comes in handy.

It allows you to track the entire token universe using multiple advanced criteria like liquidity change, the number of experienced token holders, price changes, and more as well as to automatically buy new gems or send alerts, whenever any new token matches your predefined criteria. Although currently, our gem 💎 sniper bot supports only a test mode, enabling you to paper-test sniping strategies on goodcryptoX, once we add trading mode, you will be able to apply the acquired knowledge in the crypto market and turn it into green digits for your portfolio.

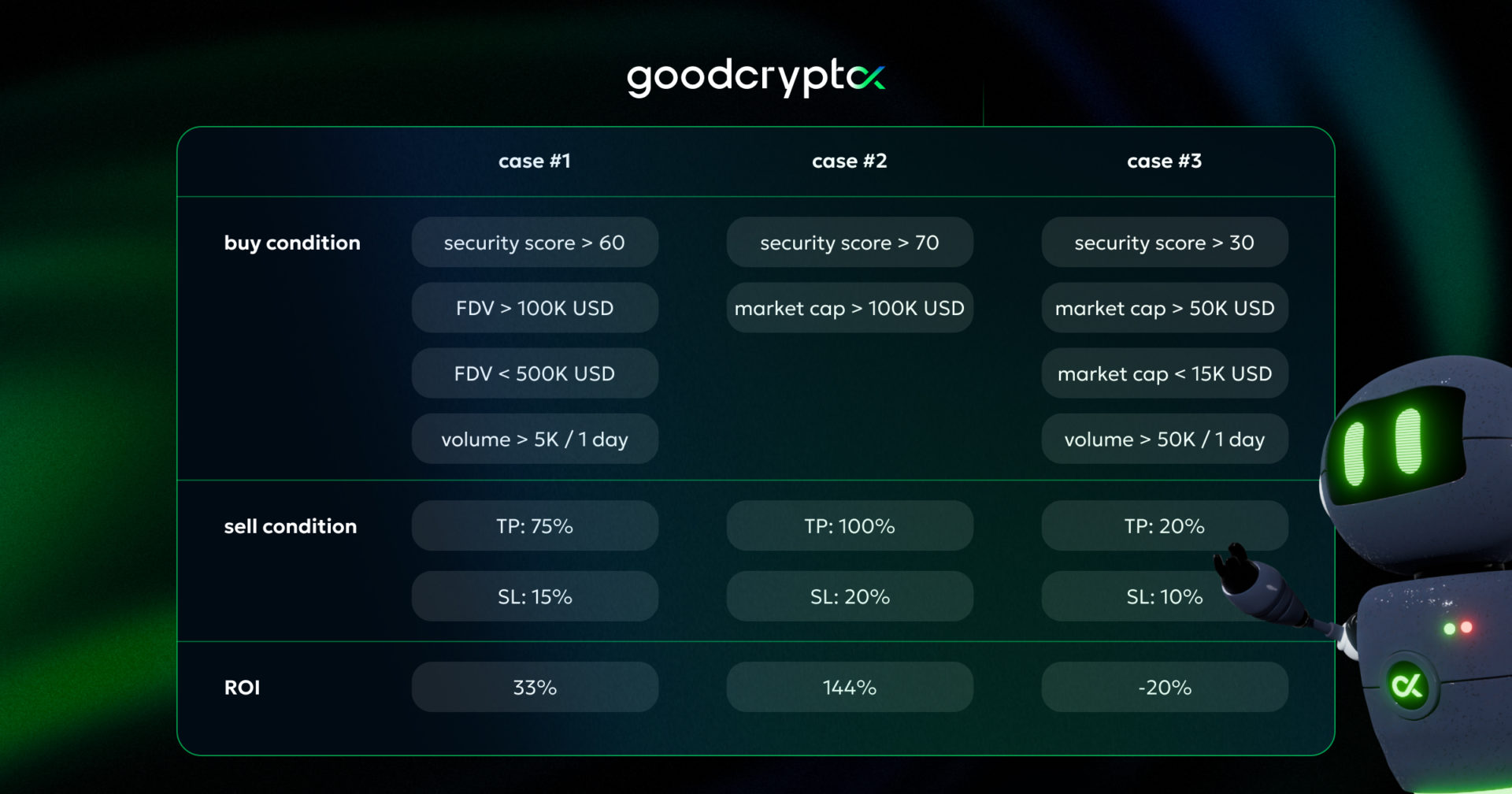

To help you better understand key takeaways from on-chain sniping, we’ve prepared a comprehensive review of sniper bot trading cases, shared by one of our users. Here is a short overview of the cases we have reviewed today:

Sniping case #1

Let’s begin with a solid 33% ROI trading case that has been running for almost 1 month now.

As you can see from the name, the user filtered out tokens with excessively high or low FDV numbers to catch promising low-cap currencies while avoiding pump-and-dump tokens, which are often associated with very low market cap coins. The user then set a security score of 60+ to avoid malicious token contracts and required at least 5K USD in trading volume just to ensure the coin was “alive” and capable of upward movement.

When it comes to on-chain trading, it’s crucial not only to rely on stats and numbers but also to protect yourself from potential malicious actions against your funds or wallet. That is why we recommend setting a minimum security score benchmark of at least 1 or higher, as coins with a score of 0 often fall into the exploit danger category. If you still decide to purchase such tokens, we suggest reviewing their smart contracts using a honeypot detector or other contract scanning tools.

While setting appropriate token filters is vital for success, implementing a solid risk management strategy is equally critical if you want to make your gem sniper bot profitable. In this case, the TP and SL ratio was set at 1:5 (15% to 75%), meaning that one successful trade could offset losses from five failed ones. As we dive deeper into the other cases, you’ll see how setting wider TP and SL orders can be just as important as maintaining a good TP-to-SL ratio for optimizing your trades.

Sniping case #2

Now, let’s explore another and much more successful case with an impressive 144% ROI generated over the past month.

Unlike the previous sniper bot, this one took a more flexible approach to metrics, requiring only a minimum $100K market cap for tokens rather than the stricter $100K-$500K FDV limitation. The user also applied the additional criteria of a minimum of $5,000 in daily trading volume for each coin.

Still, as you can see on the screenshot, the results of this case were much more successful, and the main reasons include:

- No FDV limitations. By avoiding the maximum FDV, the bot included more liquid tokens with a higher market capitalization in the list of potential coins to buy. This reduces the volatility risk, as tokens with higher market caps are generally less prone to extreme price swings, decreasing the chance of triggering the SL order right away, while subsequently diversifying the bot’s portfolio.

- Wider TP and SL levels, allowing the user to stay in trades longer, and better realize the potential of memecoins. Since on-chain tokens typically have lower capitalization and liquidity compared to CEX-traded coins, they are much more volatile, thus requiring more space to see their prices’ retracements.

This is a clear example of the balance between manual and automatic approaches, where the user filtered out the most “dangerous” and “dead’ tokens while leaving room for the bot to execute trades effectively and generate pretty impressive returns.

Sniping case #3

Finally, let’s review a non-profitable trading case with -20% ROI and analyze main setup mistakes to avoid them in the future.

While the screenshot displays the main setups, let’s move on the potential reasons for the bot’s underperformance and nail it down for the future:

- Tight SL and TP orders. Tokens with an extremely low market cap of $50K–$150K and a relatively high trading volume of $50K+ are significantly more volatile than the set 10% SL ratio. This often results in the bot being knocked out of the market before it has a chance to turn a profit. Furthermore, even if such token pumps occur as anticipated, the gains secured by a 20% TP order are typically insufficient to recover losses from previous trades. In general, a bot would need at least a 50% win rate to avoid ending up in a loss.

- Low TP: SL ratio, suggesting profits were fixed too early, preventing the bot from recovering losses from previous trades with a single successful trade.

Conclusion

Sniper bot, as the entire DEX trading niche, is a double-edged sword. It can bring you massive returns but only if paired with proper sniping and risk management strategies. Additionally, it requires a significant investment of time to analyze data and identify gems at the right moment.

Our gems sniper bot is specifically designed to make your trading more time and capital-efficient, offering unique trading features, previously unimaginable in the DEX trading world:

- Exclusive opportunity for on-chain paper trading and your gem sniping strategies improvement before entering the real crypto market;

- Ability to send you notifications whenever a new coin matches your screening criteria;

- Trade mode for sniper bot is coming soon, enabling you to not only test out but also implement and earn profits from your strategies in live trading.

In today’s sniper bot reviews, we explored some notable cases with impressive returns. However, these examples represent only a fraction of the metrics and strategies that our test sniper bot offers. We encourage you to experiment with new configurations – after all, it’s a risk-free way to gain valuable knowledge in DEX trading and improve your sniping strategies.

You can also share and discuss your experience of using the goodcryptoX gem sniper bot with us and other community members in our Telegram chat. We welcome any new ideas, experiences, and questions!