We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

USD Coin to Launch Natively on Base Network, Replacing Bridged Version

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

dYdX to Distribute $14.02 Million Worth of DYDX Tokens to Community and Traders

On August 29, the decentralized exchange (DEX) platform dYdX was set to release $14.02 million worth of its native DYDX tokens for distribution among its community treasury, traders, and liquidity providers.

This release included 6.52 million tokens, equivalent to 3.76% of the DYDX circulating supply. Among these tokens, 2.49 million DYDX tokens, valued at $5.36 million, were directed to the community treasury, supporting contributor grants, community initiatives, and liquidity mining.

The remaining tokens, 4.03 million DYDX, were divided between liquidity provider rewards (1.15 million tokens worth $2.47 million) and trading rewards (2.88 million tokens worth $6.18 million).

This event mirrored a similar unlock on August 1, employing the same fund allocation strategy. According to TokenUnlocks data, the investor pool holds the largest portion at 27.7%, trailed by trading rewards and the community treasury at 20.2% and 16.2%, respectively.

USD Coin to Launch Natively on Base Network, Replacing Bridged Version

Circle’s USD Coin (USDC) is set to launch natively on the Base network “next week,” as CEO Jeremy Allaire mentioned in an August 29 social media update. This new version will replace the current USD Base Coin (USDbC) that users utilize as an alternative.

Coinbase introduced the Base network on August 9, initially lacking a native version of USD Coin. Users could bridge USDC from Ethereum through an official bridge app to address this. The bridged token was named “USDbC” and was collateralized by native USDC locked on the Ethereum network.

The recent announcement on August 29 reveals Circle’s plan to issue USDC directly on the Base network, eliminating the necessity for a bridged coin associated with the Ethereum version.

Grayscale Scores Victory Against SEC in Bitcoin ETF Conversion Efforts

Grayscale Investments, a crypto asset manager, has achieved a significant victory against the U.S. Securities and Exchange Commission (SEC) in its pursuit of converting the Grayscale Bitcoin Trust (GBTC) into a listed Bitcoin exchange-traded fund (ETF). The SEC previously rejected the GBTC application, citing concerns about fraud prevention. Grayscale responded with a lawsuit, and the decision has now been overturned.

In recent court filings on August 29, U.S. Court of Appeals Circuit Judge Neomi Rao granted Grayscale’s petition for review and vacated the SEC’s order denying the GBTC listing application. Judge Rao had previously criticized the SEC for not explaining its decision clearly. However, this reversal doesn’t guarantee the eventual listing of a Grayscale spot Bitcoin ETF.

SEC Deadlines Approach for Seven Spot Bitcoin ETF Applications Amid Grayscale’s Victory

The U.S. Securities and Exchange Commission (SEC) faces upcoming deadlines for deciding on seven spot Bitcoin exchange-traded fund (ETF) applications, the latest being on September 4. This comes after its defeat against Grayscale Investments in a federal appeals court.

Bitwise’s ETF approval decision is due on September 1, while BlackRock, VanEck, Fidelity, Invesco, and Wisdomtree anticipate the SEC’s verdict on their funds by September 2, as indicated by SEC filings.

Valkyrie is set to receive the SEC’s response on September 4.

In an August 29 Bloomberg interview, analyst Seyffart noted that Grayscale’s victory “definitely” increases the likelihood of success for the next round of applicants. However, the exact timeline remains uncertain since the SEC can delay decisions and has two additional proposed deadlines for each fund before the final decision must be made on the 240th-day post-filing.

For the awaiting applicants, the final deadlines set by the SEC are all in mid-March of the following year.

Understanding the VPVR Indicator in Trading

The VPVR indicator represented as a histogram, showcases trading volume at different price levels within a defined timeframe. The height of each bar corresponds to trade volume, while the width represents the price range. Typically highlighting the most actively traded price zones, the VPVR is valuable for identifying support and resistance levels.

Among traders, the VPVR indicator holds a prominent status as the premier Volume Profile tool. These advanced VP indicators are regarded as highly valuable assets in trading, so don’t hesitate to learn more about them.

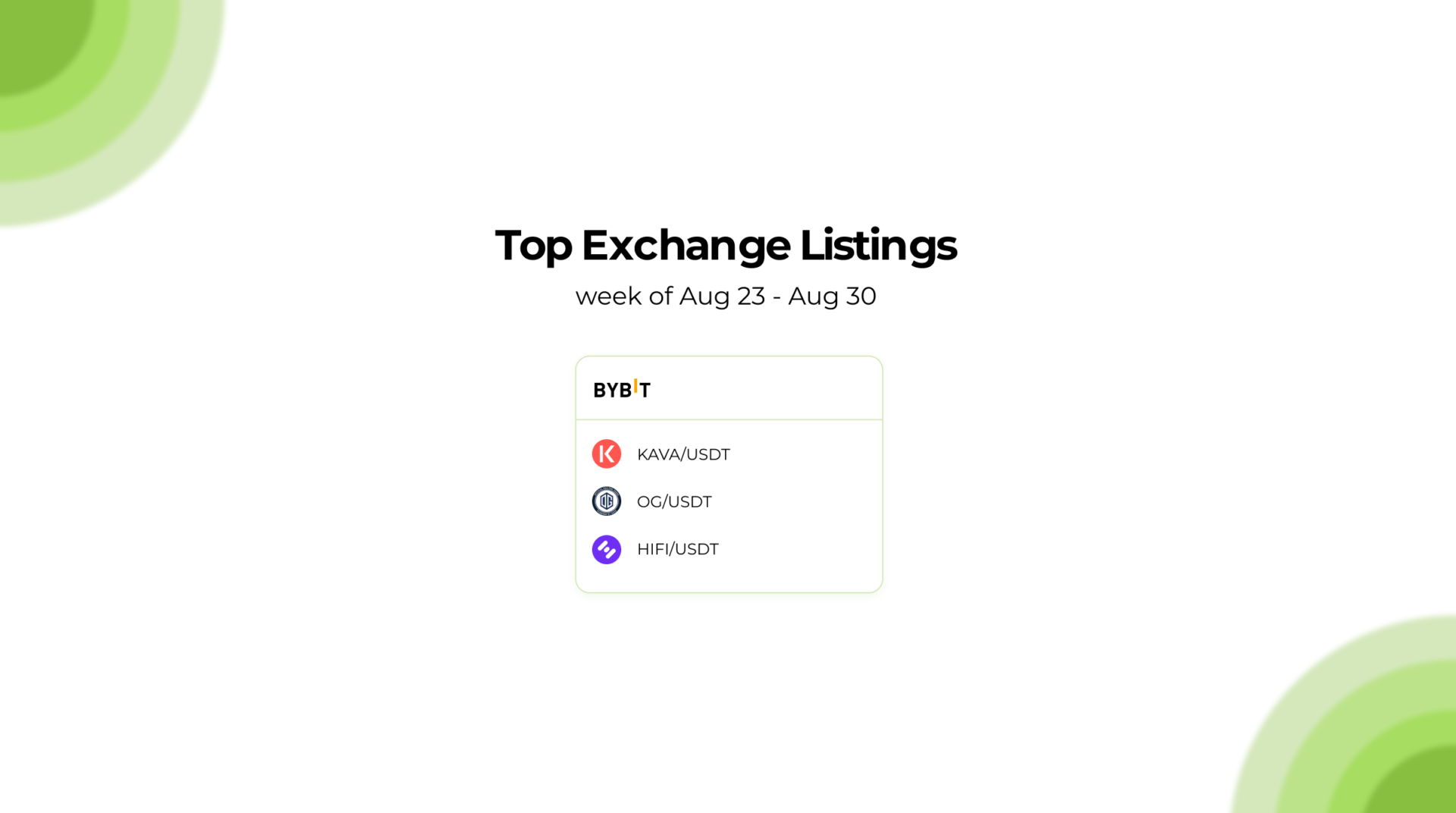

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

August 31, 2023