We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Grid Bot User Guide

Intro

Any trader along the way, regardless of his/her proficiency level or trading regularity, strives to improve the stability of trading, increase profitability, and eventually face the need to automate recurring trading processes. Moreover, increased volatility and high risks of amplitude movements have always been a part of the crypto market, which of course is another challenge to overcome while achieving a stable growth of PnL. In this guide, we will take a look at such a versatile yet efficient trading tool as Grid bot, which solves a lot of problems in regular trading, and surf through the different strategies of its application for turning any movement in the market into a profitable opportunity. Let’s get to the bottom of it!

How Does the Grid Bot Work?

Grid Bot Basics

The Grid bot is the best assistant for any trader when dealing with a flat market. Such market phases as accumulation or distribution are often associated with periods (sometimes very prolonged) when there is no clear trend direction on the chart, and the chaotic price movements constantly change the structure, breaking the short-term trends. Trading manually in such a flat and boring market is always very exhausting, unpredictable, and quite risky.

Nevertheless, that flat phase of the market still can bring you decent profits if you perform algo trading with the Grid bot by GoodCrypto.

Here are the key advantages of the Grid bot:

- Stable trading in ranges. The Grid bot offers a reliable way to perform multiple trades and take maximum profits under market conditions where manual trading is extremely difficult and risky.

- Risk control. The bot always works with a strictly set risk management and operates without being influenced by emotions, which results in positive performance over a distance.

- Strategies for all market conditions. You can easily customize your bot to suit any price movement scenario in the market.

- Flexibility. The Grid bot could be customized to any trading approach and suit any trading preferences. You can set the distance between levels, the number of grid levels, the activation price, and other parameters to align with your trading strategy.

Good Crypto Grid bots can be used in a unified manner on all of the 35 spot and derivative crypto exchanges available in the app.

Let’s take a look at three main Grid Bot strategies you can use to skyrocket your profits.

Grid Bot Strategies

To maximize flexibility and capitalize on a wide range of “trending” scenarios in the market, the Grid bot offers you a set of three pre-programmed strategies to choose from in the settings. Let`s dive into each of them.

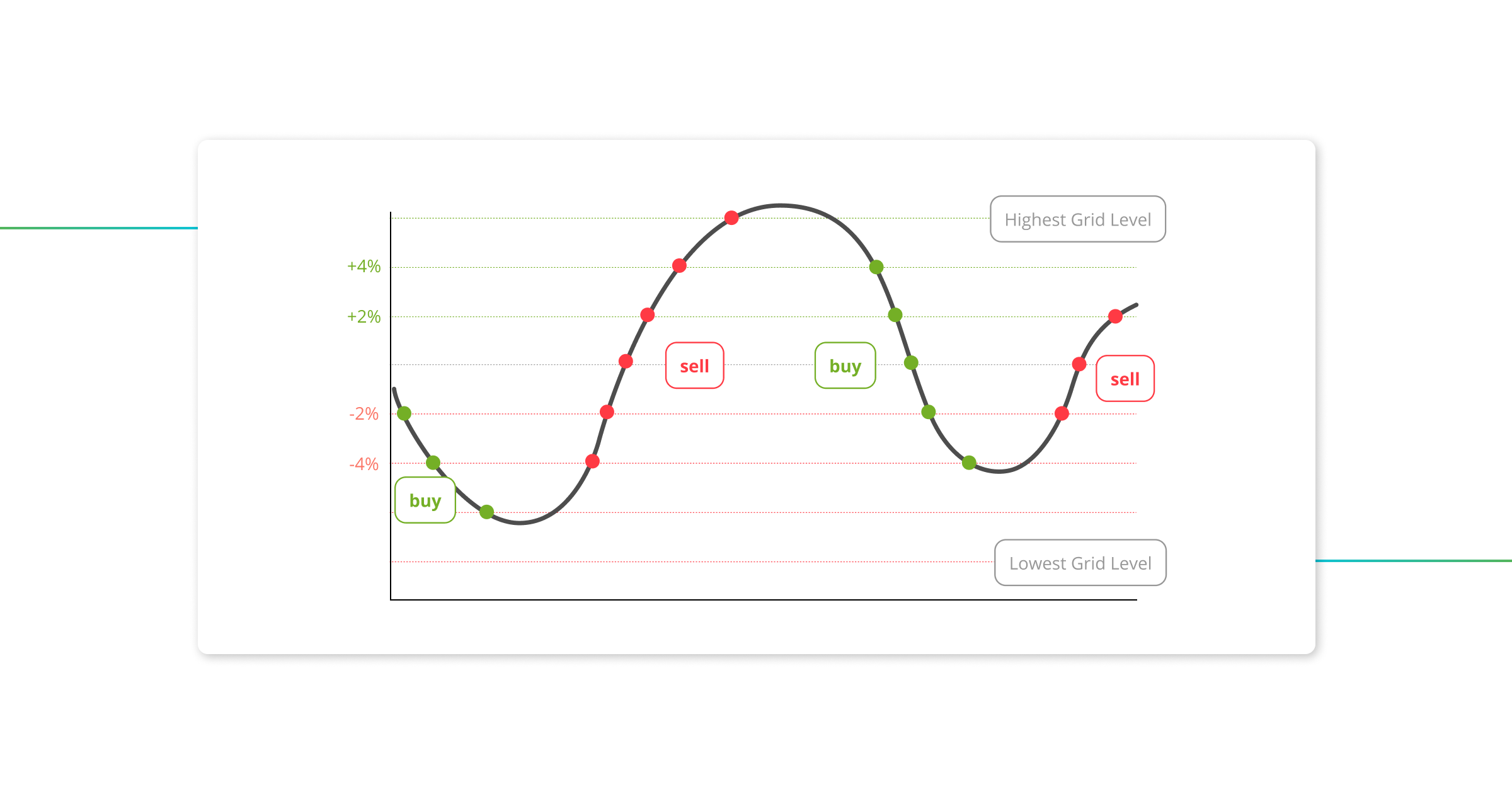

In the Neutral mode, the bot will use a grid of Limit orders of the same size. It operates within the chosen price range, executing Buy and Sell orders and bringing you a stable profit.

In Neutral mode, the bot operates without a predefined position while the price hovers around the Entry level. Once a Buy order is filled, a Sell order is placed on the grid level above. Conversely, if a Sell order is executed a Buy order is placed one grid level below.

The Grid configuration is fully adjustable, allowing you to specify the price range, number of orders, and order size before launching the bot. The bot will remain in the market until it reaches the Take Profit target or until manually stopped.

Note: The bot performs best when the price stays within the specified range, particularly near the entry-level (Neutral line). Of course, it is highly recommended to use a Stop Loss trigger to limit the risks in case the price will leave the range. Exiting the range could result in losses in both upward and downward directions.

If you believe that the market will be mainly dominated by an uptrend, the Long Grid Bot is the most suitable choice for you.

By choosing a Long option in the settings, the fundamental principles remain the same: the grid will execute trades from one level to another aiming to generate profits. In this Long mode, the bot will initially place Buy orders on all levels, starting with a Long position (as Buy orders above market price will immediately fill) and have a Neutral (zero) position if the price moves above the grid.

However, if the bot exits the range while following the bullish trend, you have the potential to catch a solid profit compared to using a Neutral mode.

The Long Grid Bot is optimized to take advantage of upward market movements and can yield higher returns when the market trend aligns with your expectations. By opting for the Long Grid Bot in a predominantly uptrending market, you can enhance your profit potential and capitalize on bullish price movements more effectively than with the Neutral mode.

The Short Grid bot operates with similar mechanics but in reverse. This bot in short mode will initially place Sell orders on all levels, generating profits by moving within a range during a falling trend. The Grid in Short mode will effectively start with an initial Short position and will have a Neutral (zero) position if the price falls below the grid.

In this mode, the bot can provide you with profits when the price is declining, even if it moves outside the predefined range. However, it’s important to note that Grid bot in Short mode can bring you losses if the price starts to move upwards.

Okay, we have covered the strategies and their key points, let’s now take a look at the different settings of the bot within the interface.

Grid Bot Settings

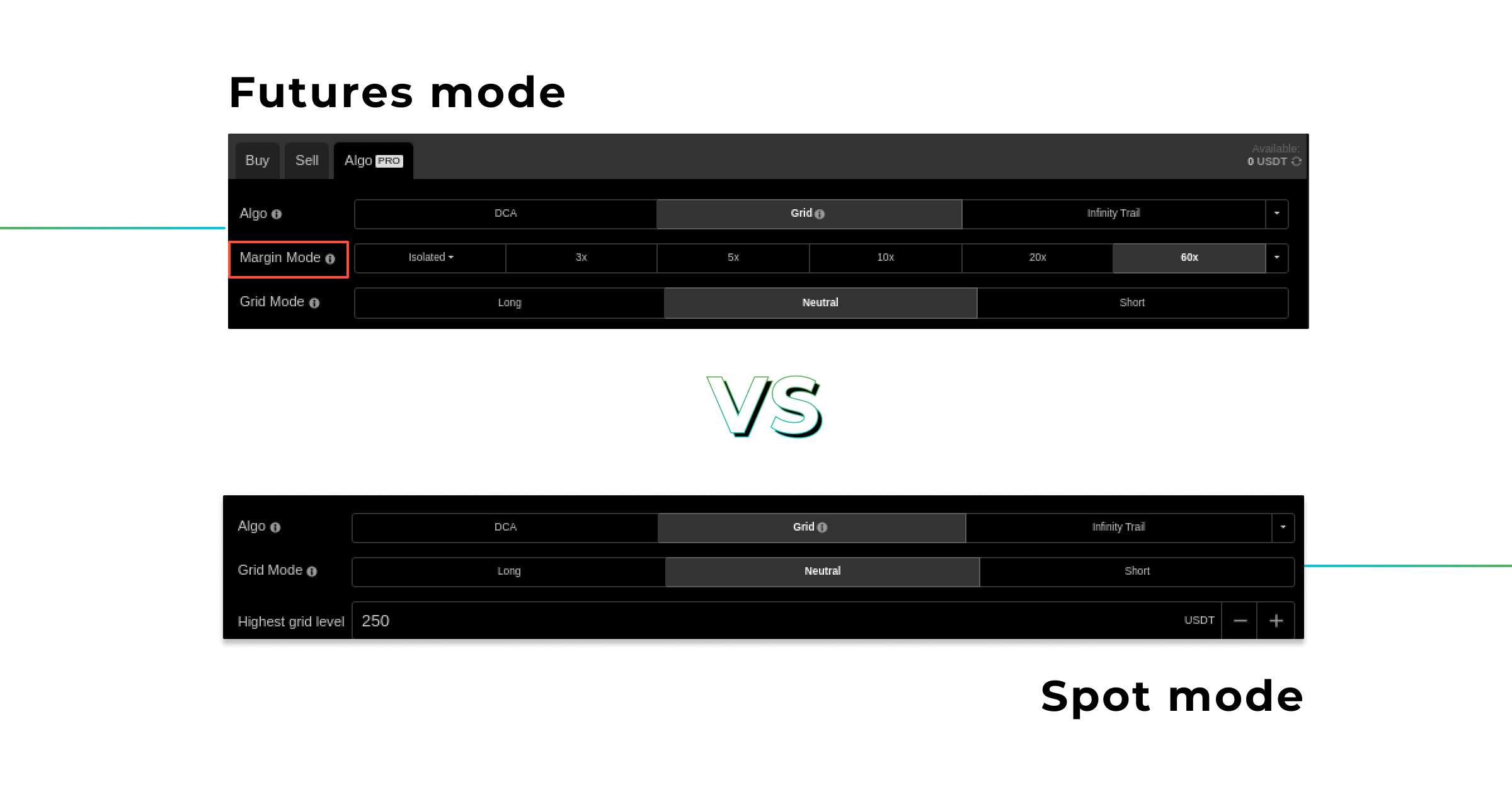

The algo settings start with adjusting a grid range you want to trade within. By the way, any type of Grid bot can be launched on both, Spot and Futures markets.

Key difference between the Spot & Futures setup fields

1. Leveraged trading and margin selection are available only for Futures trading;

2. Trading on the Spot will require the Base currency of the asset you are trading on to enable the bot to execute sell orders. This principle is described in detail in the Order Size and Funds Needed section below. While trading on Futures you will need only Quoted currency, and in our case it is USDT.

So, let’s take a look at each of the fields separately:

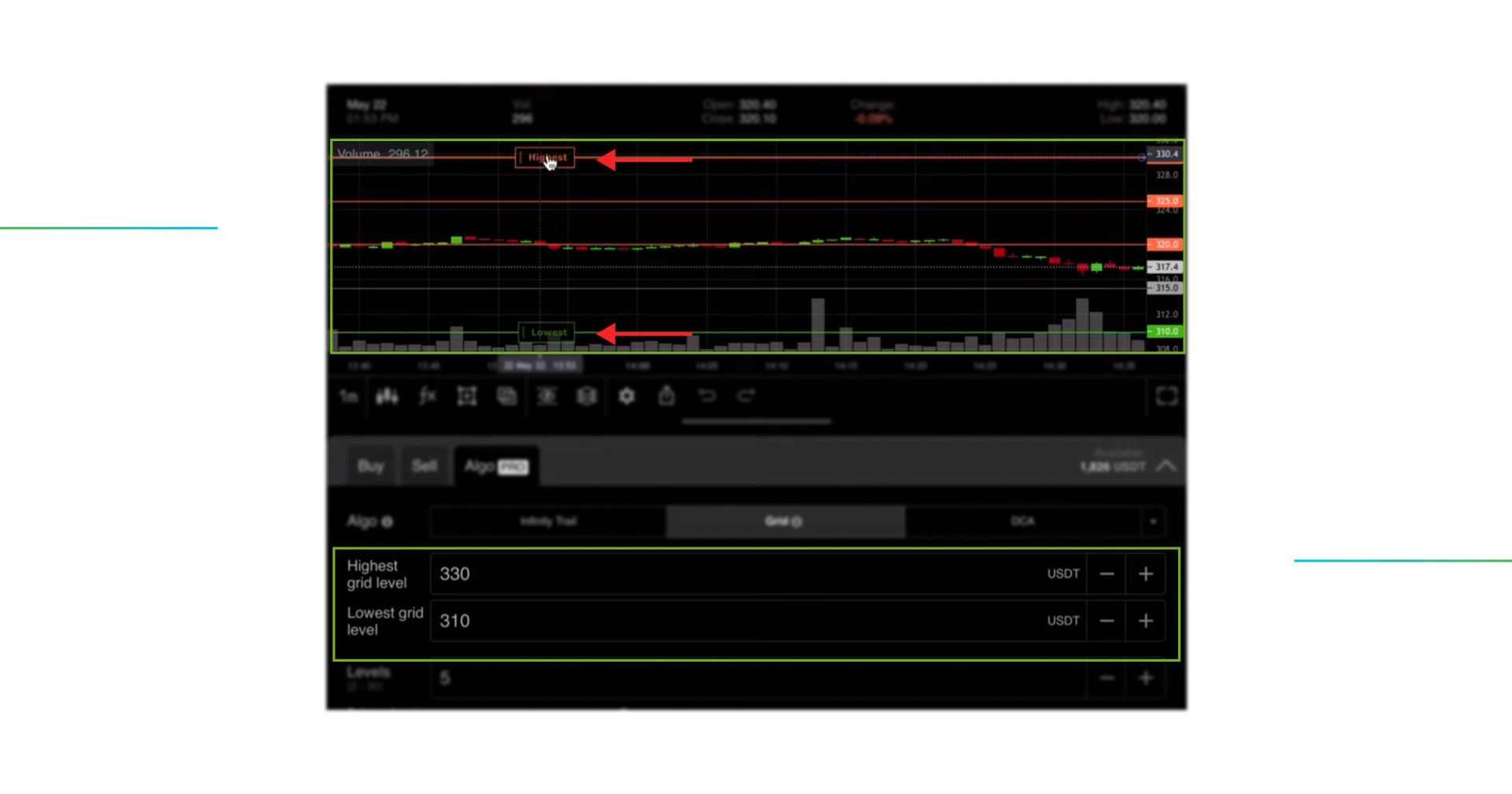

Highest Level / Lowest Level

First, you have to define the Highest level (the last Sell order of the grid) and Lowest level (the last Buy order of the grid). Such levels can be set either manually or by dragging them directly on the chart.

Leverage and a Hedge Mode

Some exchanges allow you to run the bots simultaneously in different directions, which enables the implementation of a hedging strategy by running Long and Short positions at the same time. To enable this option, you can click the appropriate button in the Position section below the Chart block.

In order to ensure that the opposing strategy works properly, it is important to use an equal leverage parameter.

Futures Trading. The main difference between trading with a Grid on a Spot or Futures market lies in the ability to utilize leverage and the associated risk of being liquidated. Leverage can amplify both potential profits and losses, so it is crucial to be careful when planning your trading strategy and use S/L triggers when setting up your bots.

Number of Levels & PnL per Level

You can specify any number of levels in Grid from 2 to 100 (if using 2X Addons). The number of levels and the amount of funds you invest in the bot will determine the actual PnL of each level (which is calculated automatically and displayed in the PnL per level field).

The number of levels in the selected range also determines the frequency of trades execution by the bot, which also depends on the strategy and goals you are following.

PnL per Level

The PnL of each level always depends on the nuances of your bot’s configuration, such as the range width, the number of levels, and the size of the order, and reflects the potential amount of profit you will receive from the execution of the order from level to level.

For example, within the same range, you can set more levels, and the cost (PnL) of each level will decrease. Alternatively, you can make the grid less frequent with the cost of each level increasing in a linear manner.

The difference (spread) in the PnL per level indication is determined by the execution of the order at different parts of the grid, either at the top or bottom. This is because the profit obtained varies in percentage, proportional to the difference in the asset’s price across the levels.

Note. In some cases, when the distance between levels is too small, the PnL per level could be negative. It means that the fees and commissions charged by the exchange for executing trades exceed the expected profit from the trade.

Trading Fees

The execution of each order has a commission (trading fee) charged by an exchange, which impacts the final profitability of the bot. You must take it into account in advance. When selecting the number of levels of your Grid, you can see an approximate PnL per level, taking into account the commission charges. Please, note that GoodCrypto doesn’t charge any commissions for the execution of orders.

Additionally, the amount of trading fees displayed is based on the basic fees-Tier on the exchange. If you have an advanced fee Tier, then your actual PnL will be higher. This also applies to the use of an exchange’s native token to pay commissions. (e.g. BNB on Binance).

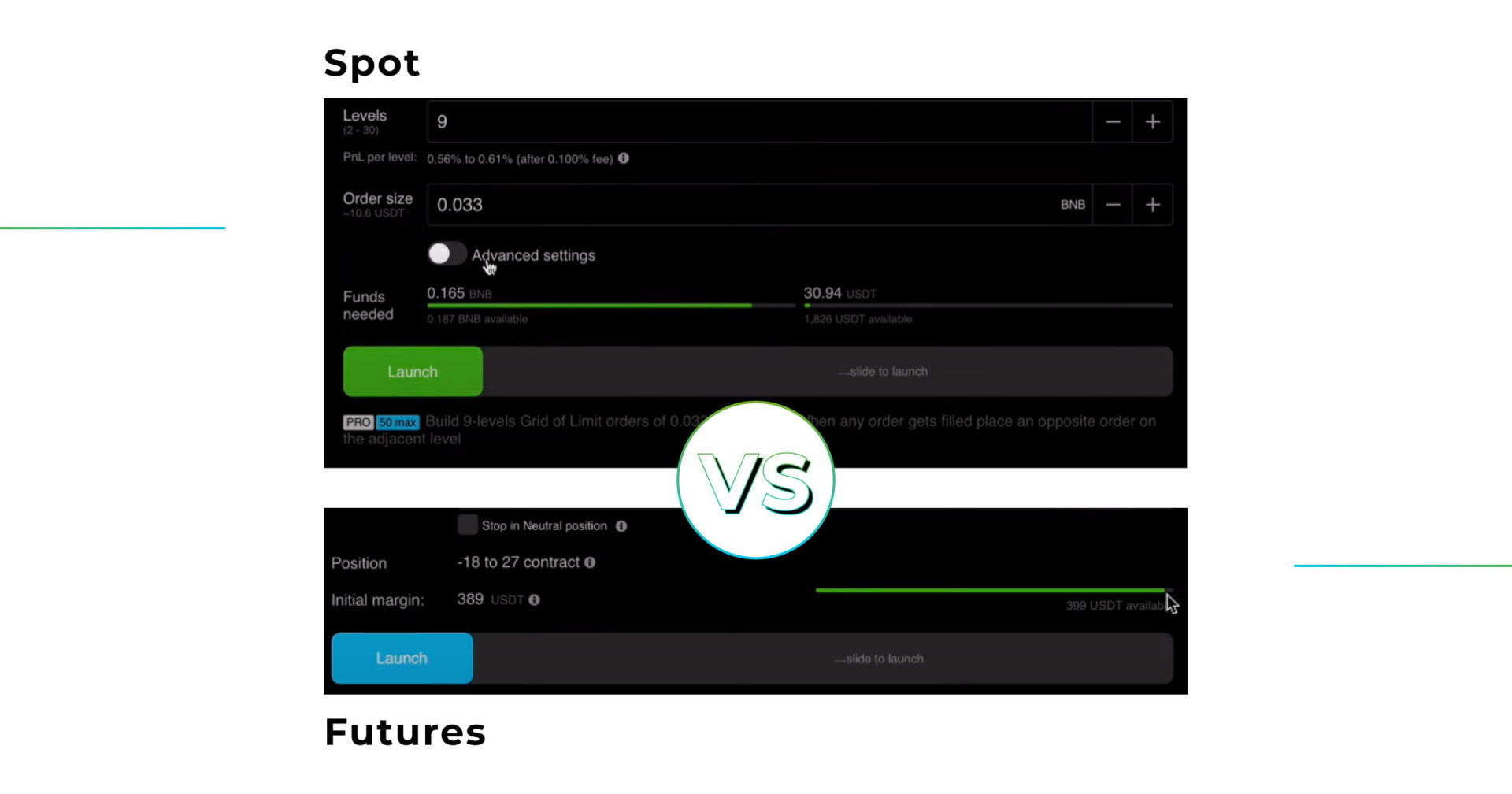

Order Size and Funds Needed

The “Order size” means the amount of funds that will be used by the bot to execute each level of the grid.

The “Funds Needed” field displays the proportion of currencies you need to launch the bot with pre-configured parameters. The balance between the funds will be visualized on the bars and depends on your chosen trading method (Spot or Futures) and the type of your trading strategy.

When trading on the Spot market, you will need a Base currency (e.g. BNB or BTC) for executing Sell orders to distribute the asset across appropriate Sell levels. Additionally, the Quoted currency (e.g. USDT or BUSD) is necessary for executing Buy orders.

In our case, as shown on the screen above, we’d need to own some of the base currency (BNB) as the collateral for the Sell trades and the quoted currency (USDT) for Buy trades.

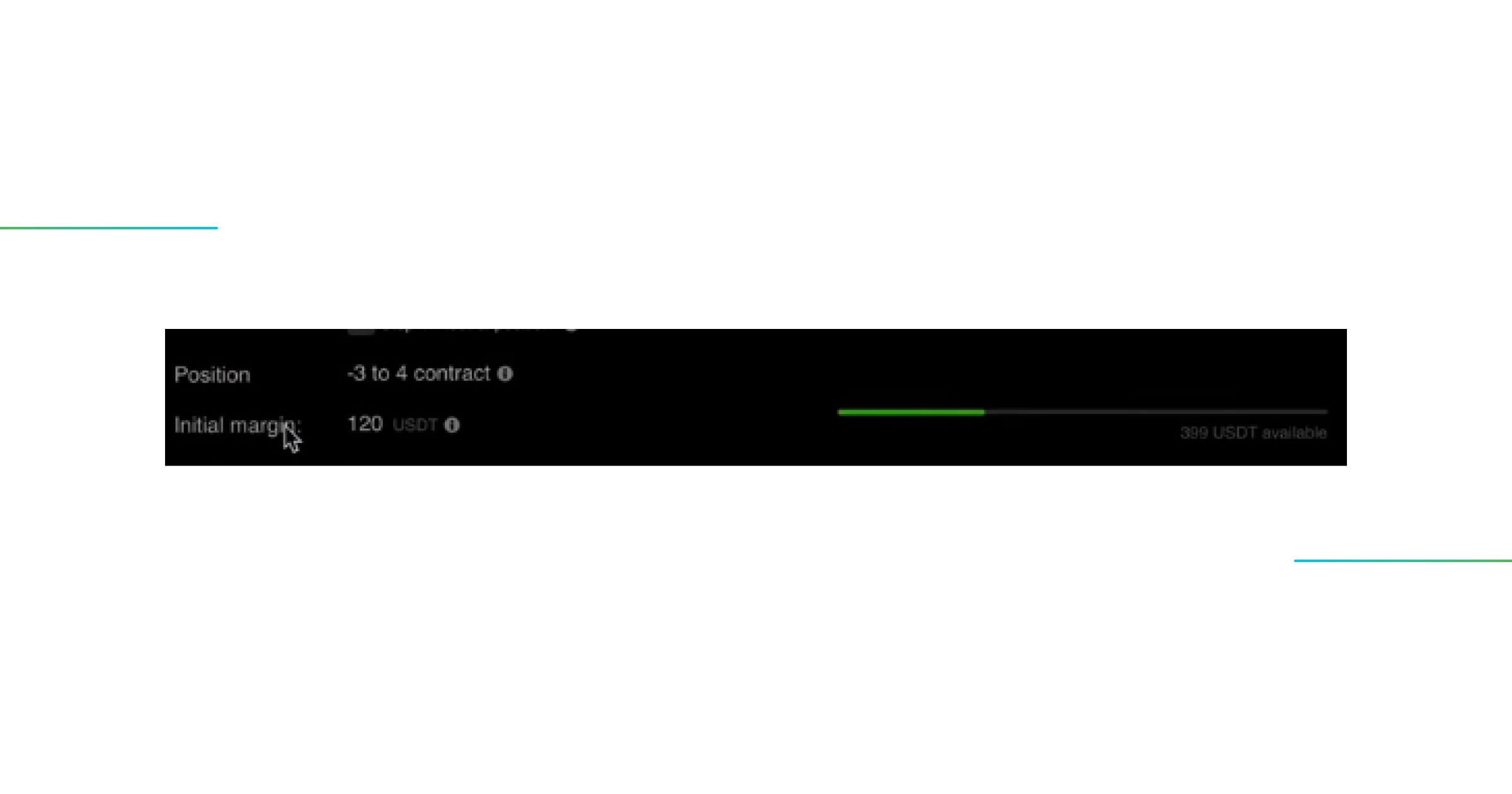

If you plan to trade on Futures, you will only need USDT on your account. The amount of funds needed to carry out your strategy is displayed in the Initial Margin field with a corresponding graphical bar.

Activation Price

Once you have configured your bot, you can run it at the market price, or you can manually enter the price level you are interested in by using the Activation price field. In this case, your bot will enter the market only after the chosen price level is reached. It all depends on your strategy.

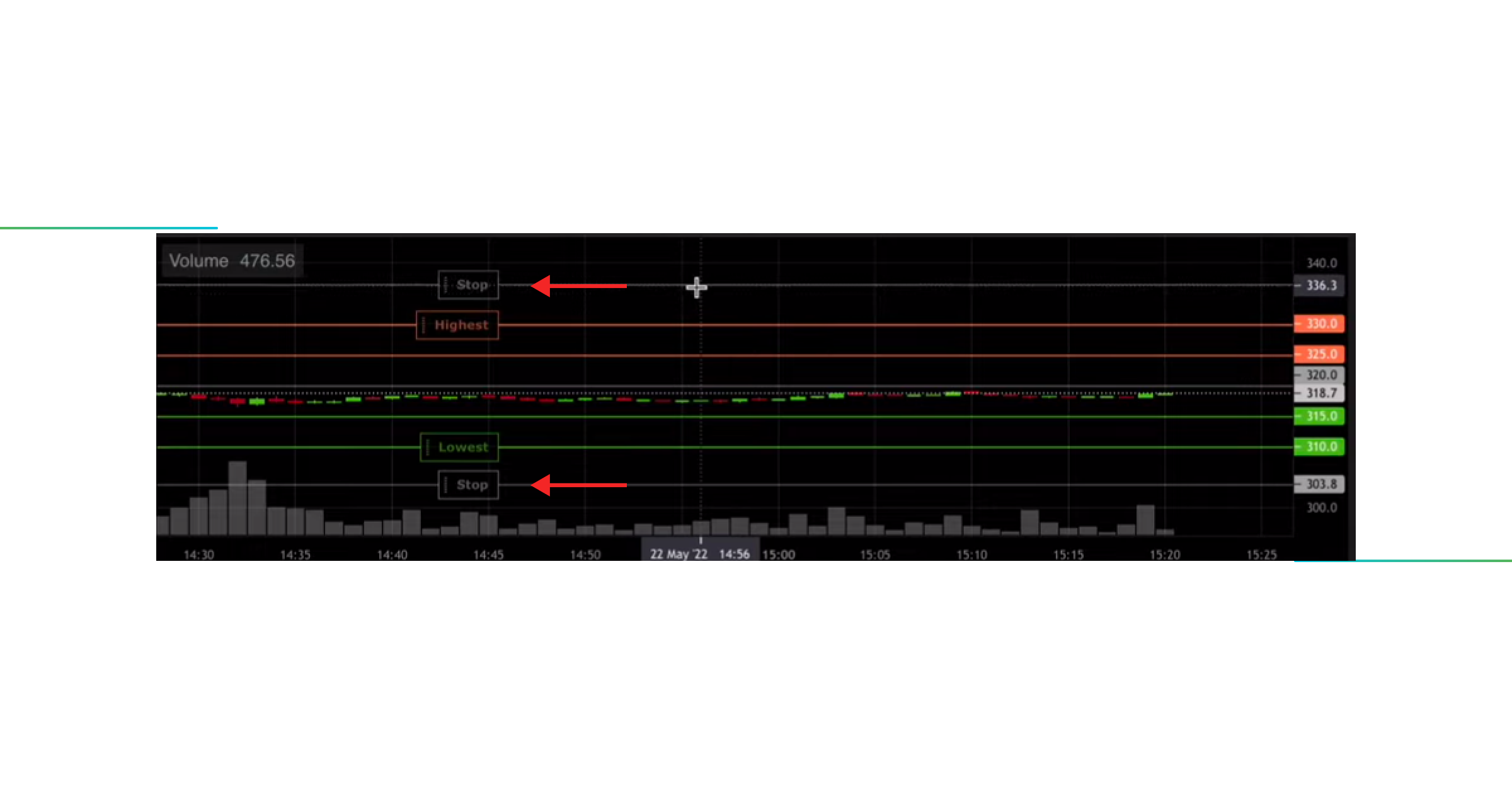

Setting the Stop Loss

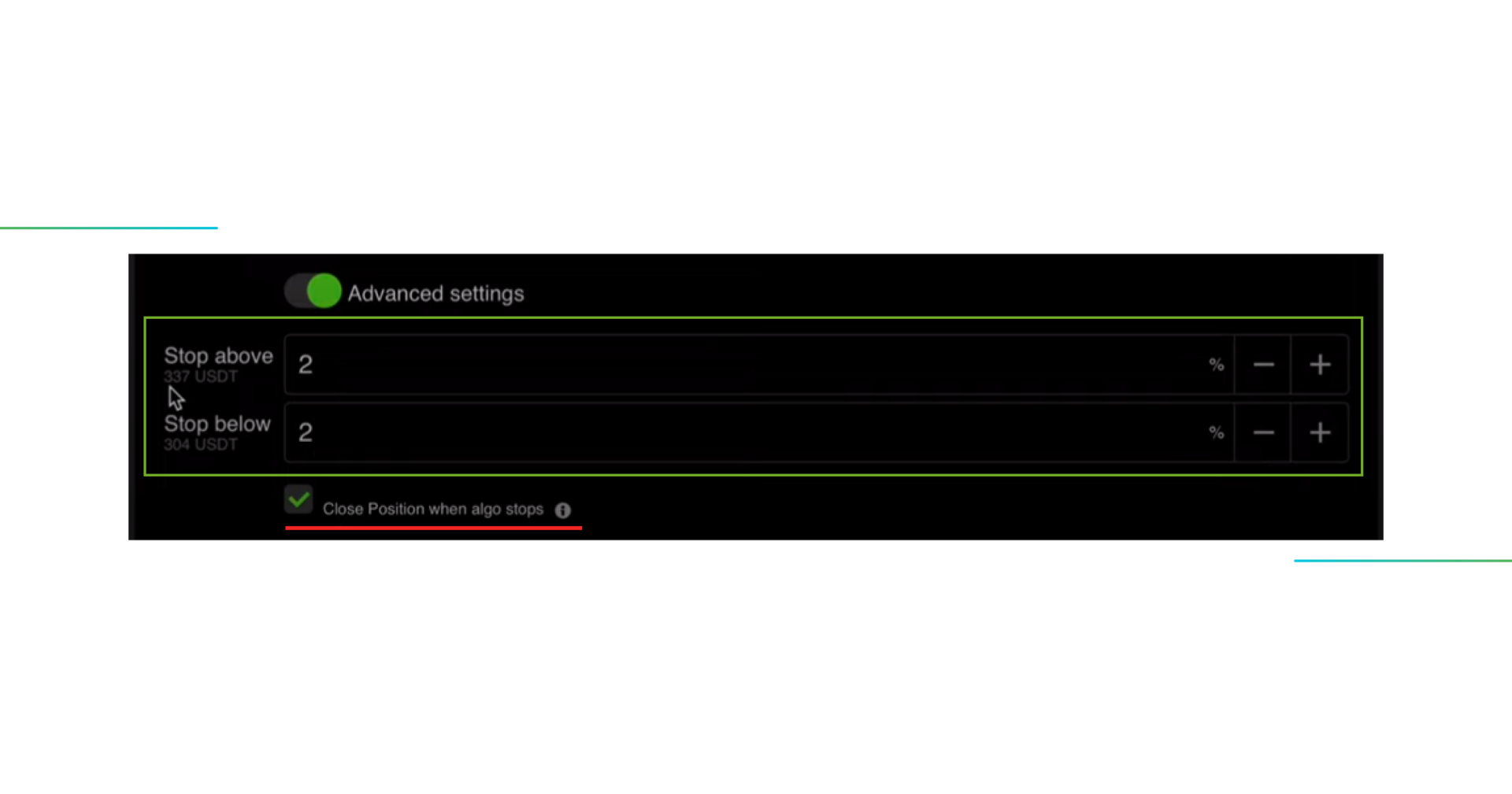

The primary risk associated with the Grid bot is when the price moves out of the selected range. In such cases, you may end up holding a position with a negative PnL. To mitigate potential losses or even a liquidation with a total deposit loss if trading Derivatives, it is recommended to use the advanced settings that include Stop Above and a Stop Below triggers.

Such “Above and Below” Stop Loss orders are the distance parameters that indicate the percentage from the highest or lowest grid level. When the price surpasses these thresholds, all the orders within that grid will be closed by the bot. You can attach or modify this parameter before launching the bot or even while it is running.

Note. An activated checkbox in the “Close Position when algo stops” parameter means that the bot will close all the orders and also a position with Market Order (will sell all the coins locked in the bot at the current market price) if one of the Stop Levels is hit or any other reason. However, if Take Profit is reached, the position will be closed even if this setting is turned off. This box could be checked or unchecked even while the bot is running, depending on the strategy or your trading purposes.

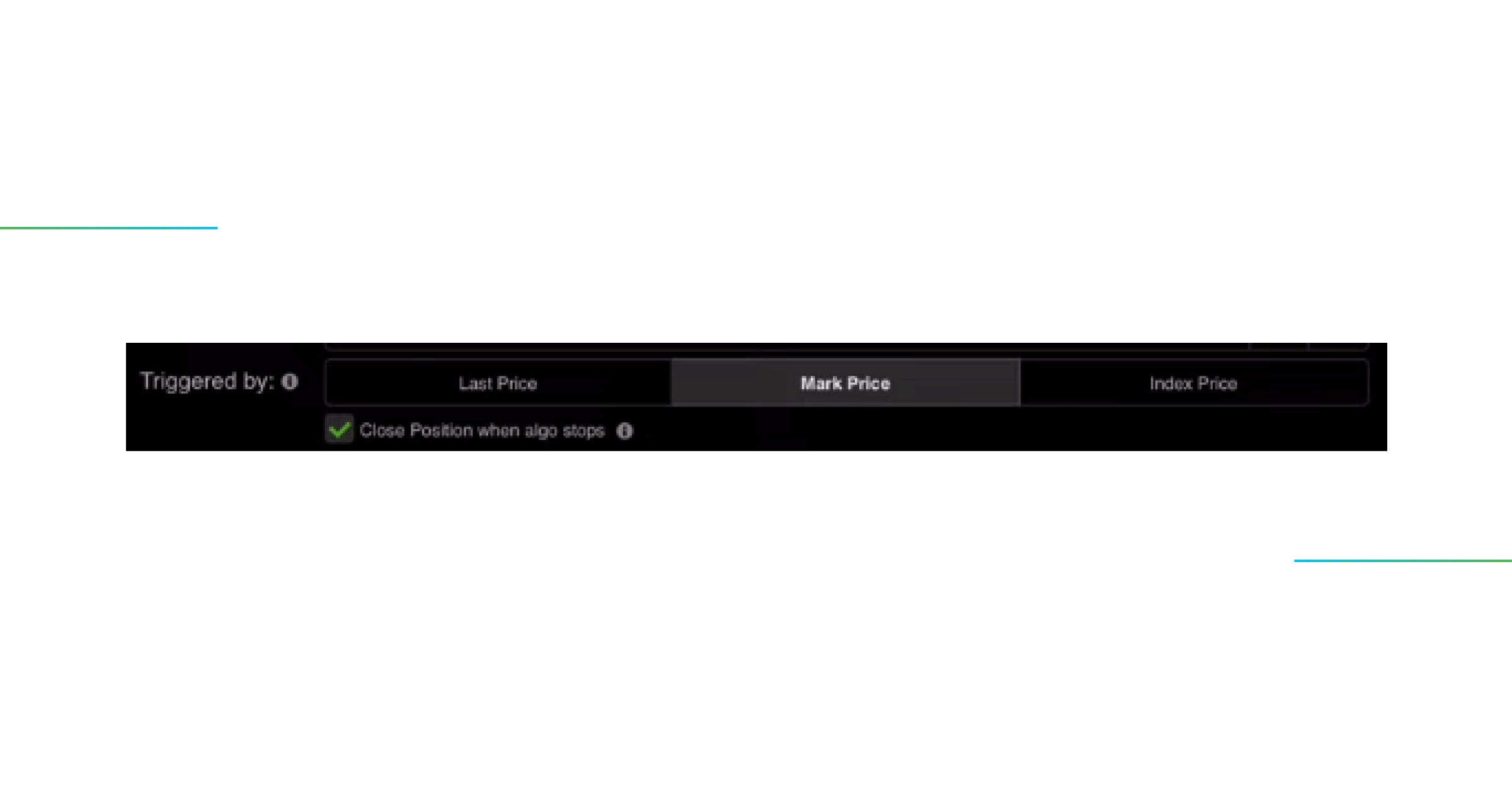

Mark, Index, and Last price as Stop triggers

In the latest update, we have introduced a new feature that allows you to trigger a Stop Loss based on different price parameters.

- By selecting the “Last Price” option, the Stop Loss trigger will be synchronized with the current price on the current exchange;

- Whereas you choose the “Mark Price” or “Index Price” parameter, the Stop Loss trigger will be aligned with the price of the asset across multiple exchanges (typically 2-3 or more). This functionality aims to prevent liquidations caused by price spikes on a specific exchange, providing more robust risk management.

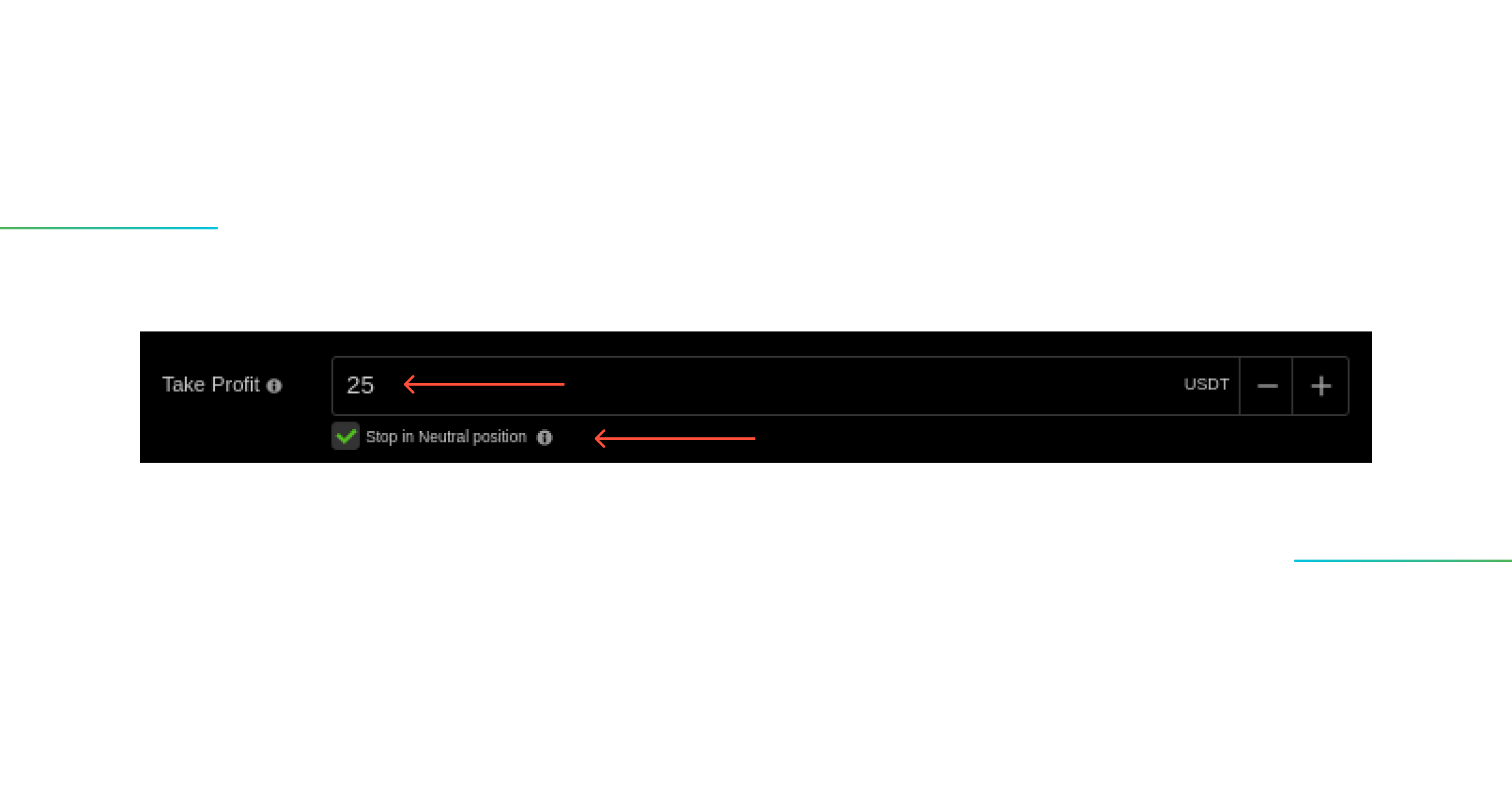

Take Profit Parameter

The Take Profit parameter can be set either before the Grid launching or while the bot is running.

Note!

1. You can also activate a checkbox “Stop in Neutral position”, it means that the Algo will stop the next time its position becomes Neutral (touch zero/entry level).

2. If combined with Take Profit – the Algo will stop if its position becomes neutral only AFTER the Take Profit target is reached. This option can also be activated when the Algo is already running.

Margin of Safety (or how to stay in safe and profit)

A useful tip. It is very important not to use all the margin available on your account when setting up your Grid. Keep some extra funds on your deposit to be able to cover the fees and price deviations. By the way, the most optimal scenario to take the risks under control is not to exceed in trades the benchmark of 80% of the funds available. Using a margin of 50-60% of your deposit would be a super safe option.

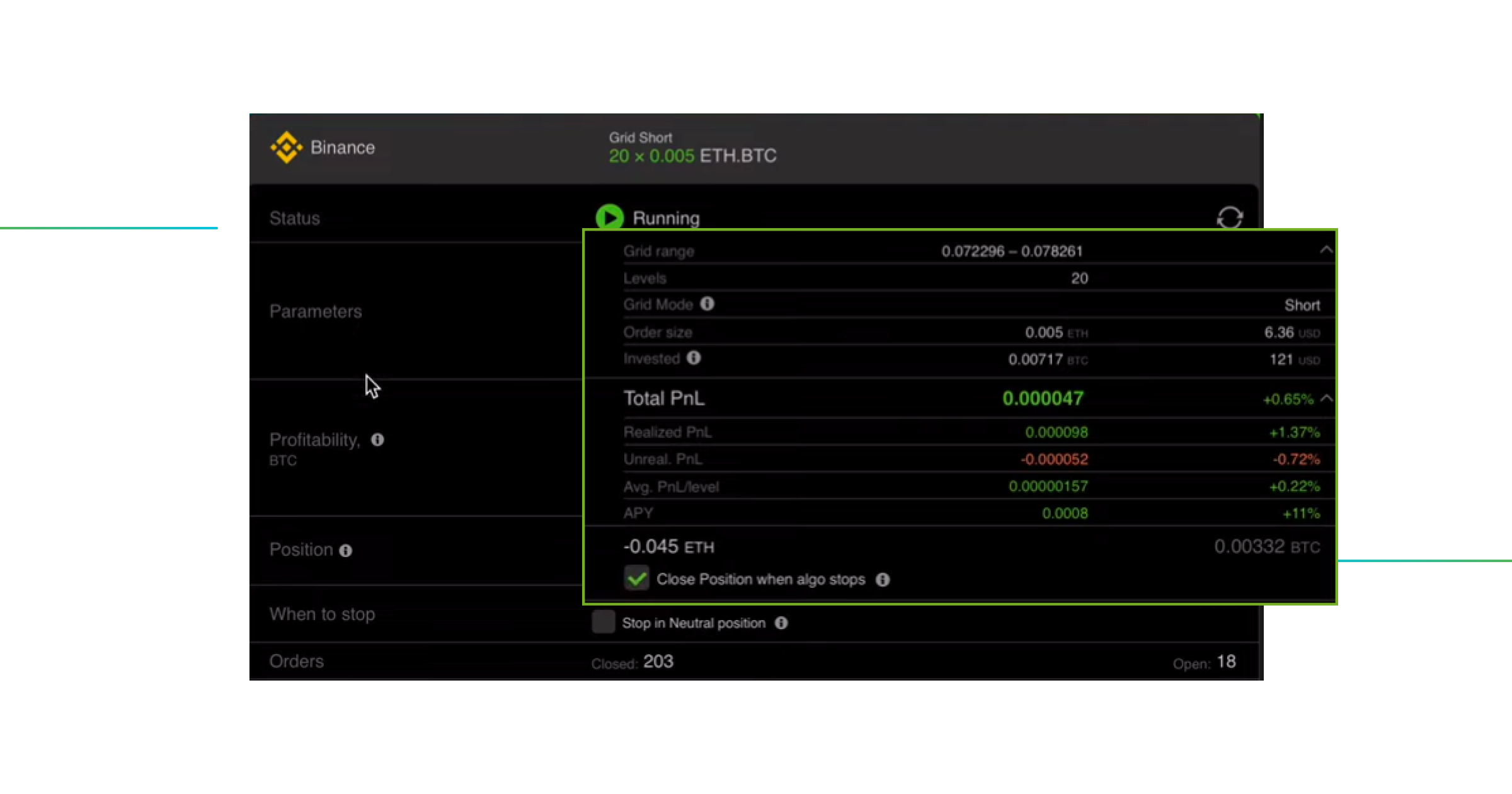

Active Bot Features

Here is the performance (Profitability) block that you will see when the bot is launched. It contains detailed and useful information, such as:

- Current “Total PnL”: This shows the actual total Profit and Loss, which is the sum of both realized and unrealized PnL from trades.

- “Realized PnL”: This indicates the profit generated from closed positions.

- “Unrealized PnL”: This variable shows the amount of profit or loss that could be realized if you close the position right now. It is a useful criterion to determine if it is a good time to stop the bot or not.

- “Average PnL Level”: This indicates the cost (size) of each open/closed level.

- Reflected “APY”: This is a dynamic index of the percentage of profitability, with a recalculation of the bot’s current performance over a long period.

Grid Trading Advice from GoodCrypto

It is highly recommended to avoid manual intervention in the bot while it is running, and it is preferable not to engage in simultaneous trading on the same asset. Creating a separate account specifically for bot trading is considered an ideal scenario.

The reason for this recommendation is that the bot opens virtual positions, which are reflected in a single list of opened orders, and by mistake could be touched, which will cause an error and closing of the bot, and could lead to losses.

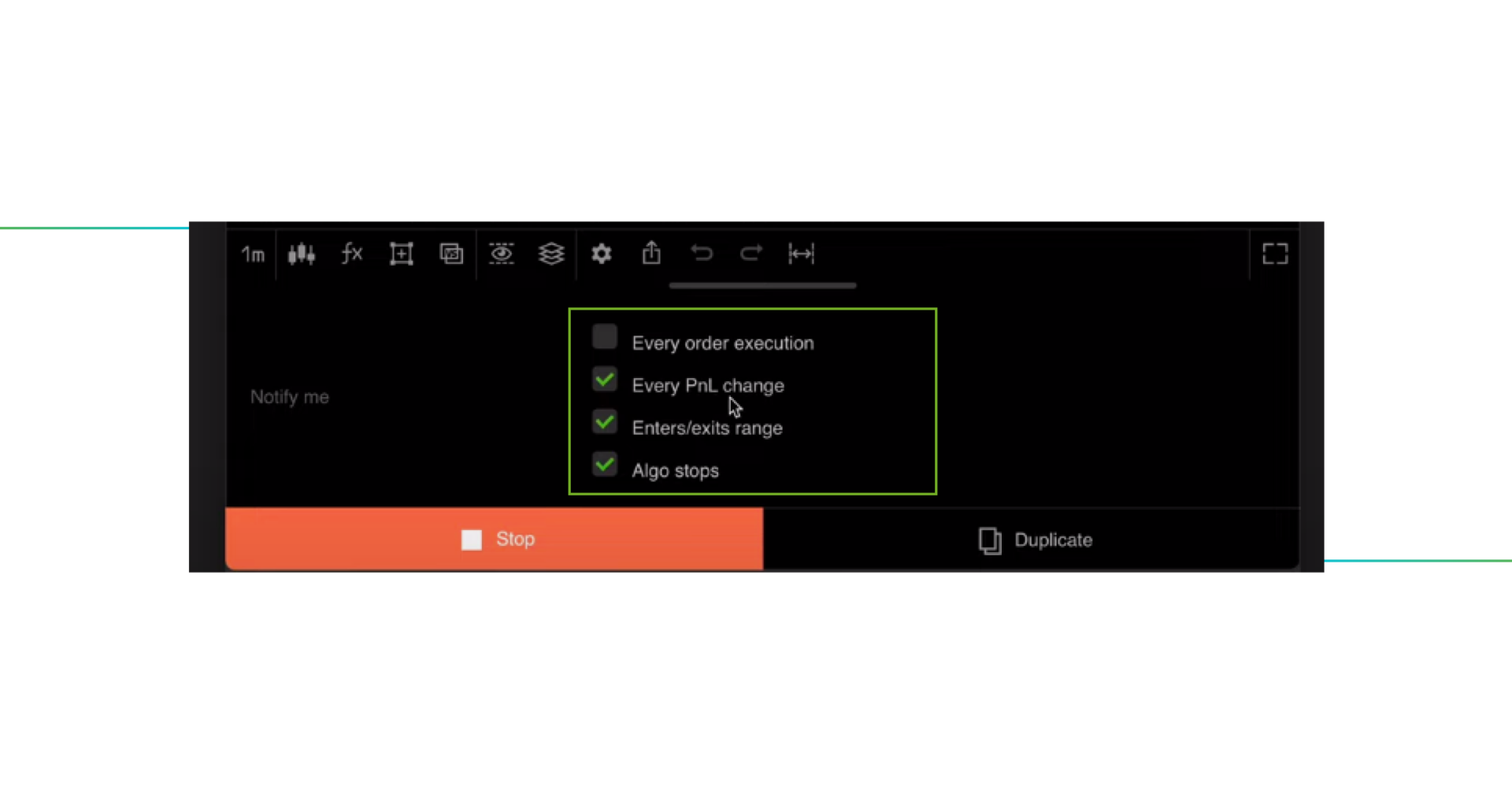

Notification Settings

While your Grid bot is running, you will have the option to customize the push notifications you wish to receive regarding its performance. In the detail section of the bot, you can configure the notifications to alert you in the following scenarios:

- Every order execution

- With every PnL change

- When the bot Enters / Exits the range

- When Algo stops

Conclusion

To sum up, the Grid Bot offered by GoodCrypto provides traders with a robust and efficient solution to level up their trading experience, automate a plethora of trading processes while the market is ranging, and maximize earnings with a lower risk. This unique but completely simple tool, can be utilized in both Spot and Futures markets, across 36 leading crypto exchanges available in the app.

Seize all profitable trading opportunities by integrating GoodCrypto’s Grid bots into your everyday trading activities! Take the biggest advantages of the algo trading in the best all-in-one trading app, in just a few clicks, and discover:

- 3 customizable top-notch trading strategies with a variety of profitable opportunities for the ranging markets.

- Safe and reliable trading progress due to strict risk management.

- Sustained long-term high performance.

Run your first Grid bot with a test period, and you`ll definitely note a remarkable difference in performance compared to manual trading.

Get the App. Get Started

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

October 18, 2023