We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Tether invests in T-Bills, reducing its exposure to that market to zero

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

The attacker at Moola Market gives up the majority of $9M in loot in exchange for a $500K bounty

The Moola Market team tweeted on October 18 at roughly 6:00 PM UTC that it had suspended all activity while investigating the matter, had spoken to the police, and had promised the exploiter a bug reward in exchange for returning the funds within 24 hours.

The attacker initially bought about $45,000 worth of the low-liquidity native MOO token of the protocols and deposited it as collateral to borrow Celo, according to Web3 security firm Hacken’s analysis of the hack.

The attacker also contributed additional CELO, which was used as collateral to borrow more MOO, raising the cost of the token. As a result, the MOO token price surged by 6,400% due to the attacker’s repeated actions.

Five hours after confirming the issue, Moola Market announced that it had received just over 93% of the cash taken advantage of. The attacker reportedly kept the remaining funds and earned almost $500,000 as a bug reward.

Decentralized social network by Jack Dorsey with customizable algorithms and portable profiles

The program was first launched by Dorsey in December 2019 with a goal for social media users to have control over their data and move it from platform to platform without authorization. The announcement on October 18 comes almost three years later.

The new protocol, previously known as “ADX,” has been changed to “Authenticated Transfer Protocol” (or AT Protocol), and it is referred to as a “protocol for large-scale distributed social applications” that will support account portability, algorithmic choice, interoperability, and performance.

According to the protocol, domain names in the AT protocol, such as @alice.com, will manage user identity. These would then translate to cryptographic URLs to safeguard the user’s account and associated data.

Additionally, this information may be moved between providers “without losing any of your data or social graph.“

Tether invests in T-Bills instead of commercial paper, reducing its exposure to that market to zero

Tether Holdings Limited, the company that issues stablecoins, has reduced its exposure to commercial paper, resolving a long-standing issue with critics who have questioned the caliber of its reserves.

On October 13, Tether said that it had replaced those investments with US Treasury Bills and eliminated commercial paper from its reserves. “Reducing commercial papers to zero demonstrates Tether’s commitment to backing its tokens with the most secure reserves in the market,” the company said.

While Tether’s reserves have long been the subject of public scrutiny, its critics have concentrated on the makeup of its assets throughout the previous year. For example, Bloomberg opined in October 2021 that Tether could have excessive exposure to Chinese commercial debt at a time when China Evergrande Group, one of the nation’s top property developers, was on the verge of bankruptcy.

A company or financial institution may issue commercial paper, a short-term, unsecured debt obligation that often entails a greater credit risk.

In response to Texas’ objection to the Voyager sale, FTX is under investigation for securities breaches

The Texas regulators’ additional declaration is annexed to a protest the Texas Attorney General’s Office filed on October 14 against selling Voyager Digital assets to FTX.

Voyager Digital and FTX are accused of breaking Texas law in that objection. The state also asserts that “the proposed sale, or order approving the sale, attempts to limit the Debtors’ liability for unlawful […] conduct for which state-regulatory fines and penalties may apply.” In particular, the objection claimed that because Voyager Digital was not registered as a securities dealer in Texas, it carried out money transactions without a license.

Joseph Rotunda, the director of the SSB enforcement section, said in the declaration that using his own identity and Austin, Texas, address, he could download the FTX Trading app to his smartphone and open a yield-bearing account. In the US, FTX Trading doesn’t operate a business.

“FTX US should not be permitted to purchase the assets of the debtor unless or until the Securities Commissioner has an opportunity to determine whether FTX US is complying with the law,” Rotunda said in his conclusion.

Supertrend Indicator

When utilizing the supertrend indicator, you will see two lines separating two zones — one green and one red. The line’s color changes as the trend swings and flips from bullish to bearish or vice versa. The crossing point serves as a buy/sell signal indication and is known as:

- A sell signal is generated when the line changes from green to red.

- A purchase signal is produced when the line changes from red to green.

Set your stop loss level at the line itself.

Even though this is the most straightforward way to trade the supertrend signal, it doesn’t get much more difficult than this. Simply acknowledge that a supertrend is an accurate trend indicator. As a result, when the price is within range (not in a trend), it will produce misleading indications.

As a result, you must learn how to combine the supertrend indicator with other tools to avoid them, which we discuss below in this article.

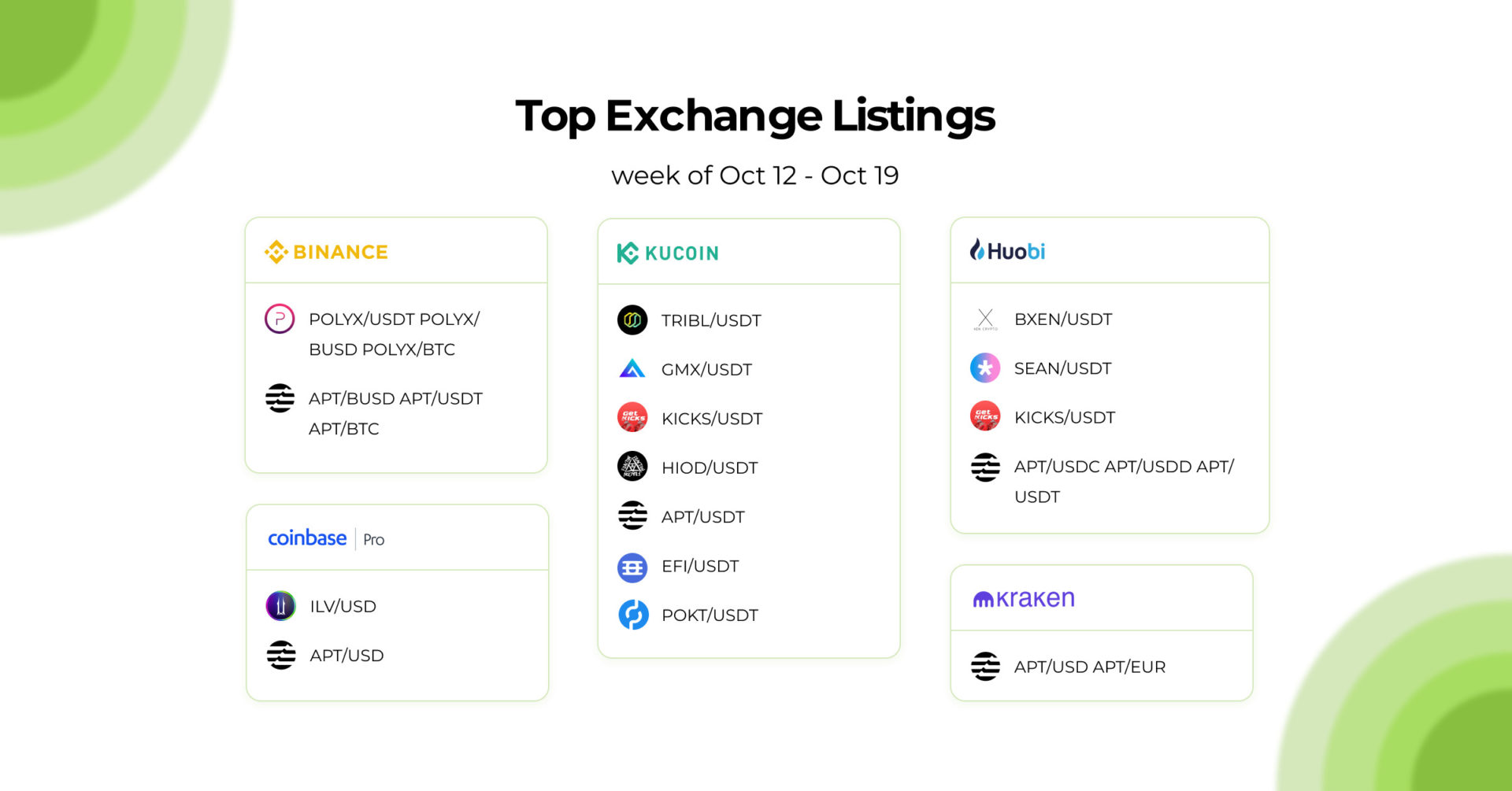

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

October 20, 2022