If you’re tired of trying to keep up with the unpredictable cryptocurrency market, then it’s time to let the Infinity Trailing Bot by GoodCrypto work its magic. This bot is designed to catch and profit from large swings up or down, allowing you to earn big when the market moves in your favor.

The Infinity Trailing Bot is a unique tool that helps traders make the most of the volatile market. With two different styles of the Trailing bot to choose from, you can find the perfect setup for your unique needs and trading style. So whether you’re new to trading or a seasoned pro, our Trailing bot can help you stay on top of the ever-changing crypto market and capitalize on the volatility.

Let’s dive into what Infinity Trailing Bot is.

Infinity Trailing Bot Basics

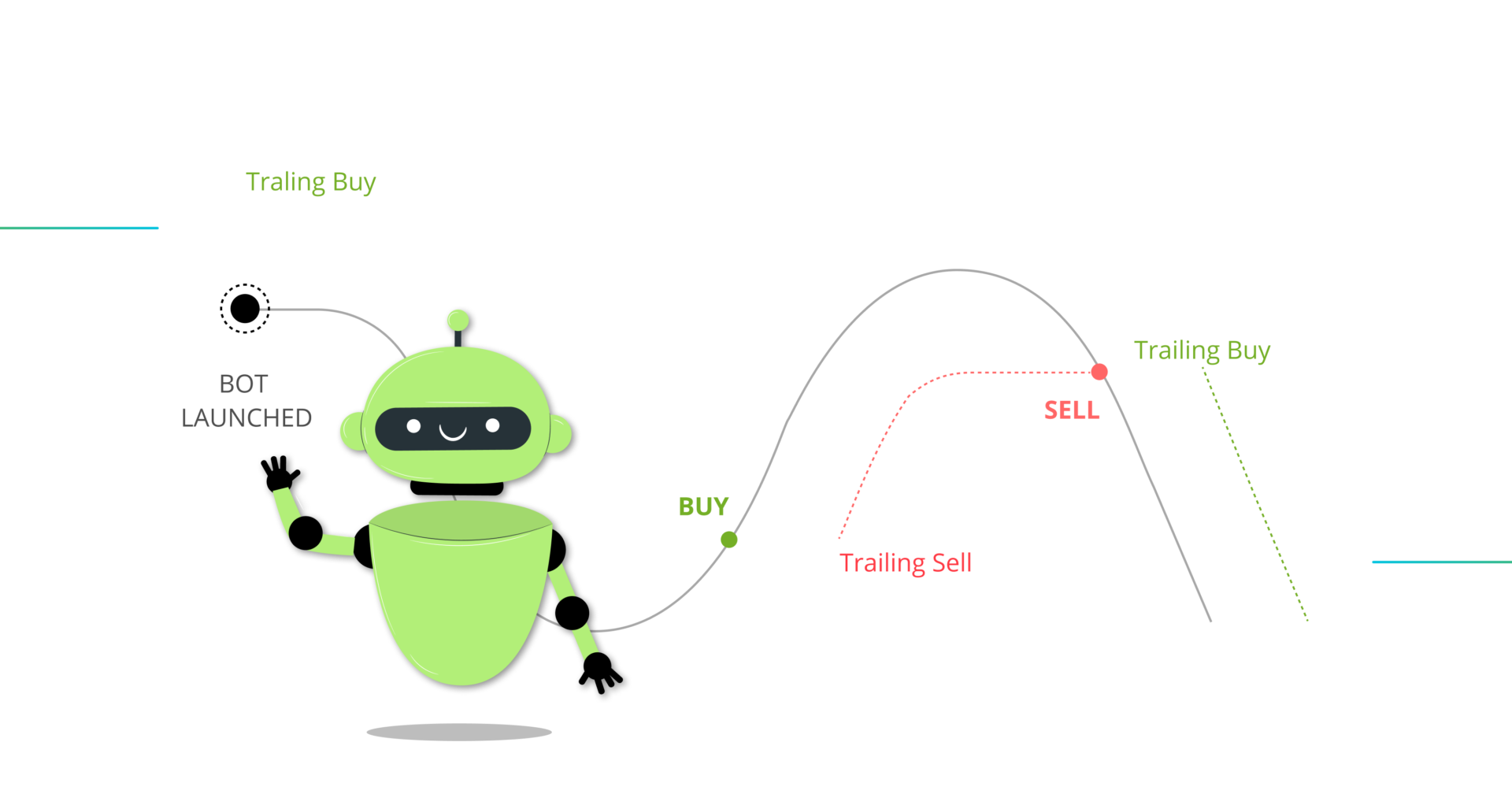

The Infinity Trailing bot automates Trailing Stop Buy and Sell sequence. All you need to do to set it up is to specify your preferred Trailing Distance for position entry and exit based on the observed volatility. From there, the trading algorithm takes over, repeatedly sending Buy and Sell Trailing Orders until your PnL target is reached, or you manually stop the algorithm.

GoodCrypto offers two types of Infinity Trailing Bots: one that sends a Trailing order to exit the position right after it has been opened and another one that waits for the market price to improve enough to ensure it only exits at a profit before sending the exit order. While their setup only differs in that the “only exit at a profit” checkbox is On or Off, it essentially makes them two different algorithms. A third type that enters and exits on technical signals is in development and promises to be a powerful tool, but it has not been released yet.

Let’s take a closer look at the Infinity Trailing algorithm with “only exit at a profit” mode Off first.

Infinity Trail With “Only Exit at Profit” OFF

Infinity Trailing Bot with “only exit at a profit” mode OFF is designed to catch and profit from large swings up or down in the cryptocurrency market, as that is when Trailing Stops are most useful. Therefore, it is recommended to run it on high-volatility pairs or during times of high volatility. This bot needs a ‘different kind’ of volatility than Grid, which profits from multiple small in-range fluctuations, as the Infinity Trailing Bot profits from large swings up or down that Grids may lose money on.

It is important to be prepared that Infinity Trailing Bot may lose a small amount with each trade while the market delivers small-scale in-range volatility, and it can go on for a while. However, Infinity Trail will cover those losses and earn on top whenever there is a large swing. For example, with a 1% trailing distance, it may lose a small amount 9 times in a row but will make it back and more when the market goes up or down 5-10%. Thus, patience is key with this setup.

The mechanics of the Infinity Trailing Bot is defined by the underlying Trailing Stop orders that the bot uses to both enter and exit its positions. Once you understand how they work, Infinity Trail will hold no secrets from you. We have created a complete guide to Trailing Stop orders – we encourage you to read it.

Even without diving deep into the Trailing Stop orders inner workings, you can employ a simple intuition when setting up the Infinity Trail, as its behavior will always be defined by the Trailing Distance that you choose:

- Infinity Trail will follow (trail) the market price when it moves in your favor, i.e., goes down if you are buying or up if you are selling;

- While doing so, the Bot will essentially disregard any price movements that are less than your chosen Trailing distance;

- Infinity Trailing Bot will lose on any price move that is greater than your chosen Trailing distance but lower than 2x your Trailing distance;

- The Bot will generate profit on any price move greater than 2x Trailing distance.

The above assumes that you choose the same Trailing distance for both entry and exit orders – which should be your default choice in most cases.

So, how to choose the right Trailing Distance? The general rule of thumb is that the more volatile the trading pair is, the higher your Trailing distance should be. One could think of 1% being the default choice for ‘default volatility.’ For a non-volatile instrument, you would probably be better off with a lower distance than that. And for the high volatility, you’d need something much higher.

Here are a couple of examples of successful setups that will give you a feel of which Trailing distance might be right for which situations:

- During the wild market conditions of May 2021, where volatility soared and 20-30% price swings became the norm, Infinity Trail generated impressive profits on SHIB.USDT with a Trailing distance of 10%.

- Throughout the relatively quiet bull run of the second half of 2021, Infinity Trails delivered consistent profits for solid 6 months on ETH.USDT and BTC.USDT utilizing a tight 1% Trailing distance.

!!! A useful shortcut to selecting the optimal Trailing distance relative to volatility is to set up several Infinity Trailing Bots on the same instrument with different trailing distances such as 0.5%, 1%, 3%, and 10%, run them for a while, then stop the worst performing ones and let the winners run.

Now that we have a basic understanding of how the vanilla Infinity Trailing Bot works let’s explore how to set it up for maximum benefit:

-

Choose an instrument with the potential for significant price swings, but ensure it is liquid enough to prevent losses on price slippage.

-

Opt for a Trailing distance that is high enough to disregard that specific instrument’s “regular” or “normal” price volatility. By doing so, you can avoid unnecessary and frequent trading that may result in a loss.

-

Remember to wait patiently for directional price movements that are double your selected Trailing distance.

Infinity Trail With “Only Exit at Profit” ON

Infinity Trailing Bot with “only exit at a profit” mode On is designed to ensure that the bot won’t close positions at a loss (excluding fees and slippage), giving you more control over your investments.

In this mode, Infinity Trailing Bot waits for the price to reach the level of your “entry price + exit trailing distance” before activating the exit order. This means that you can stay in a position for as long as it takes until the price reaches your desired profit level.

Thus, we do not recommend running the bot in this mode on Derivatives, as this may result in liquidation. Instead, run it on Spot instruments that you are comfortable holding for the long term. For instance, if you’re a Bitcoin or Ethereum holder, you can use Infinity Trailing Bot with the ‘only exit at a profit’ option ON to add to your holdings instead of just buying the coins outright.

In the best-case scenario, if the price of the coins climbs by leaps and bounds, you will profit from the volatility along the way, making more than by simply holding the coins. And in case their price catapulted at any given moment, you will not miss the move, as the bot will enter the position right after it exits the previous one – so you’ll only miss the percentage of your trailing distance on any sudden price surge but will capture the rest of the move!

Think of it as a Trailing Grid of 2 levels that follows the price up and is always in range if it goes up, enhanced by Trailing Stops instead of Limit orders.

Now, in the worst-case scenario where the price goes down after buying with Infinity Trailing Bot, you’ll still have bought BTC with a Trailing Stop order, which is one of the better ways to buy anyway. You can simply HODL it until the price comes back up – it’s as easy as that.

Infinity Trailing Bot with “only exit at a profit” mode On is a great tool for hodlers that want to benefit from market volatility without the risk of missing a sudden price move up.

Conclusion

In conclusion, GoodCrypto’s Infinity Trailing Bot is a powerful tool for traders looking to maximize profit in a volatile crypto market. By choosing the right mode and setting up an Infinity Trailing Bot with the correct trailing distance, traders can catch and profit from large swings up or down.

With a bit of patience and the right strategy, Infinity Trailing Bot can be a valuable addition to any trader’s toolkit. It offers traders the opportunity to catch and profit from high volatility, ensuring that they never miss out on any significant price moves.