We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Bitcoin miners set new annual record, raking in $44M in a single day

Hello!

Check out the latest highlights from the past week in our Good Crypto digest. For real-time updates, follow us on Twitter or Telegram.

quick weekly news

Bitcoin miners set new annual record, raking in $44M in a single day

The Bitcoin mining community hit a major milestone on November 12, reaching an annual all-time high by earning over $44 million from block rewards and transaction fees. This revenue stems from confirming Bitcoin transactions and creating new blocks using advanced mining rigs. Miners currently gain 6.25 BTC per successful block, alongside transaction fees.

This achievement marks the first time in 2023 that daily Bitcoin mining rewards surpassed $44 million, matching figures last observed in April 2022, according to data from blockchain.com. However, between April 2022 and November 2023, various factors caused a decline in global Bitcoin mining revenue. These included a prolonged bear market, negative investor sentiment due to scams and ecosystem collapse, and restrictive regulations limiting Bitcoin transactions for investors.

In the third quarter of 2023, Marathon Digital Holdings, a Bitcoin mining company, saw its revenue shoot up by 670%. At the same time, they ramped up their Bitcoin production almost five times over.

XRP jumps then dumps on faked BlackRock XRP trust filing

During late November 13, a BlackRock filing hinting at the creation of an XRP exchange-traded product caused XRP to surge by 12%. This sudden spike occurred after reports surfaced about a Delaware filing revealing BlackRock’s registration for the “iShares XRP Trust,” signaling a potential ETF launch.

Within 30 minutes of this news, XRP peaked at $0.73. However, the gains swiftly vanished within the next 30 minutes as Bloomberg’s ETF analyst Eric Balchunas confirmed the filing as fake following discussions with BlackRock.

BlackRock showed it’s looking beyond just Bitcoin by aiming to launch an ETF for Ether, a different cryptocurrency. This news came after they filed for this new kind of ETF on November 9. Despite the confusion caused by the fake listing, Seyffart, a commentator, confirmed that the Ether ETF is real.

security experts warn: billions in crypto are at risk due to vulnerable old wallets

A cybersecurity company called Unciphered found an issue they named “Randstorm.” It might affect lots of crypto wallets made from 2011 to 2015 using web browsers.

This problem could impact wallets made with BitcoinJS and similar projects, possibly putting millions of wallets and about $2.1 billion in crypto assets at risk, according to Unciphered. They’re worried that this issue could also affect other cryptocurrencies like Dogecoin (DOGE), Litecoin (LTC), and Zcash (ZEC).

Also, the company mentioned that millions of people have been alerted about this problem. For anyone using crypto wallets created between 2011 and 2015, the company suggests moving their assets to newer wallets created more recently.

tech titans Microsoft, Tencent, and more team up in Decentralized Infura Network

Microsoft, Tencent, and 16 other major Web2 companies have teamed up with Consensys to decentralize the Infura network, a critical access point for Ethereum in the decentralized finance (DeFi) sector. These partnerships aim to boost decentralization within the Infura network, a move crucial in preventing service disruptions for Web3 services like MetaMask that rely on it.

The Decentralized Infura Network (DIN), slated for launch in Q4, intends to tackle the centralization issue within Infura, which is currently under Consensys’ control, posing a single point of failure.

RSI strategy: signals on a trending market

The crypto RSI chart above showcases a method focused on spotting overbought and oversold signals while the market remains within a range. It’s important to note that relying solely on an oversold signal to buy is risky, as markets can continue to drop even after such signals appear.

Relying solely on RSI isn’t recommended for developing a trading strategy. However, it serves as a valuable tool for decision-making and gaining insight. Combining RSI with different types of Moving Averages and Bollinger Bands indicator can help confirm signals and lead to more informed trading decisions.

Curious about other strategies? Explore more to enhance your trading expertise!

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

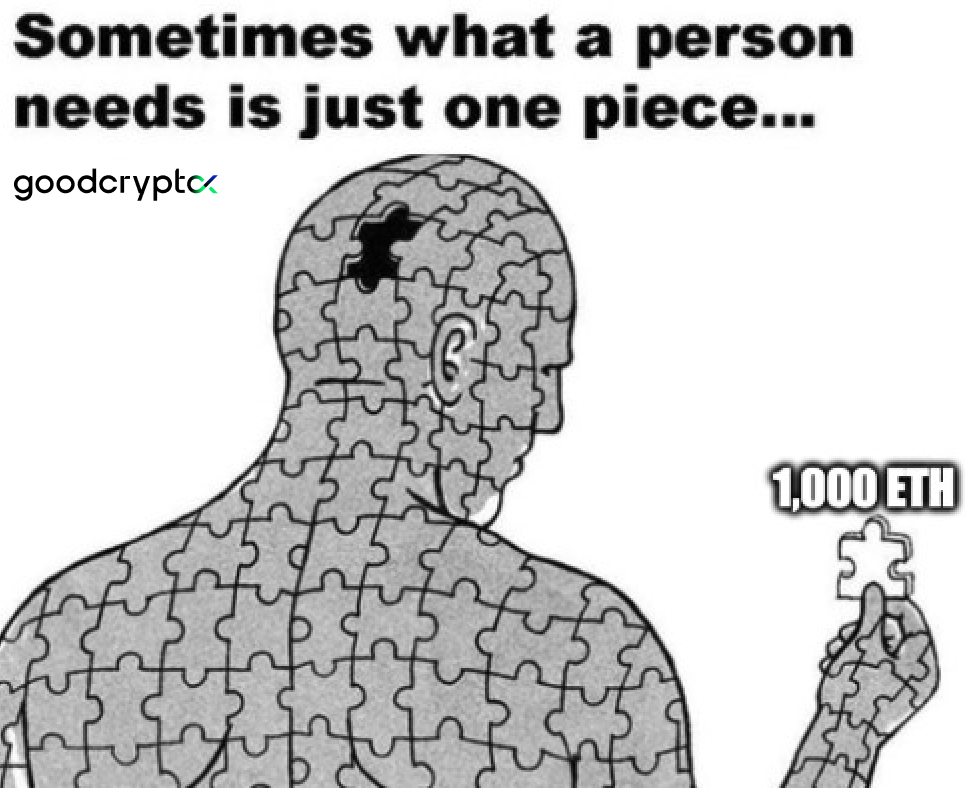

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

November 17, 2023