Hello there! 👋

We have brought together the past week’s most notable events in this GoodCrypto digest. Let’s dive into the most important ones so you can stay up to date in the ever-evolving blockchain industry.

quick weekly news

MicroStrategy to raise $42B to buy Bitcoin

On October 30, 2024, MicroStrategy, one of the largest Bitcoin Treasury Company released a report of its holding performance for Q3 2024 and announced plans to raise $42B over the next three years.

According to that post, MicroStrategy owns the original cost basis and the market value of the Company’s bitcoin were $9.904B and $16.007B, which represents an average cost of the company’s acquired Bitcoins of approximately $39,266 per token while the price of the Bitcoin at the moment of conducting report was $63,463 (as of September 30). Notably, with the recent Bitcoin surge near its March 2024 ATH levels, MicroStrategy holdings have risen even more significantly if taking into the current 69K per Bitcoin price.

The company also recorded the achievement of a Year-to-date 2024 17.8% return while planning to reach a long-term target of 6% to 10% between 2025 to 2027. As explained in the report, the BTC Yield is the % change period-to-period of the ratio between the Company’s bitcoin holdings and its Assumed Diluted Shares Outstanding. However, it is important to note that this is not an operating performance or a financial or liquidity measure, but rather a way to rate the effectiveness of its strategy of acquiring coins in a manner the MicroStrategy believes is better for shareholders.

Finally, it plans to conduct an At-the-Market Equity Offering Program aiming to sell shares of its class A common stocks worth over $21B and raise an additional $21B in fixed-income securities totaling $42B. The quant volatility researcher Ryan McGinnis, commented on this announcement stating “This is escape velocity”, adding:

“$MSTR is not a Store of Value. $MSTR seems like a Monopoly of Value.”

Another one? Satoshi’s identity to be revealed Oct. 31, claims PR firm

On October 30, the unknown PR agency, London Live, claimed that it knew the true identity of the Bitcoin creator “Satoshi Nakamoto” inviting people to meet “Satoshi” in London on October 31st. According to the post from this agency, Nakamoto’s whitepaper which launched the world’s first crypto in 2008, has cited growing legal pressures which forced him to decide to stand out and “officially reveal his identity.”

To recall, Satoshi Nakamoto’s real identity is one of the biggest mysteries in the crypto industry, which has been active publicly for only two years after launching Bitcoin and then completely disappeared in Dec 2010. Since then, there have been multiple statements from various people claiming they know the true identity of Satoshi Nakamoto or who is a real creator of Bitcoin, yet none of them have been confirmed.

The London Live’s announcement has been met with much skepticism where the CoinTelegraph researched its website and press release, stating that the content there is inconsistent, had multiple broken links and grammar mistakes as well as stating that it most likely were AI-generated. Interestingly, the company’s official webpage lists Charles Anderson as a content manager as well as the firm’s “top Investigative Journalist,” which according to LinkedIn has been Satoshi Nakamoto’s “business partner, personal assistant, media manager and legal respective.”

Finally, the same man Anderson, has been planning to conduct a similar event in March 2022, but canceled it as there have been only two people registered an interest in attending. All this indicates that potentially hinting at the firm trying to gain some exposure rather than really revealing the true identity of Satoshi.

Polymarket presidential election odds rife with wash trading

Recently, Fortune crypto media stated in one of its posts that while Donald Trump got a significant advantage behind Kamala Harris’s chances to win in the US election, a significant part of Polymarket activity exhibited signs of wash trading.

It claimed that blockchain firms Chaos Labs and Inca Digital both shared their separate reports where the first company said wash trading constituted around one-third of trading volume on Polymarket’s presidential market, while the second one found that a “significant portion of the volume” on the platform could be potentially classified as a wash trading. According to Inca Digital, the actual transaction volume on the US election betting is around $1.75B, which comes into controversy with an “official” figure of $2.7B.

Meanwhile, Chaos Labs also noted a Polymarket’s discrepancy in the transaction volume calculation method of the platform and Chaos Labs, where the Polymarket counted shares for candidates in whole dollar amounts, despite shares trading well under $1. This is related to the specifics of the platform, where for example you can bet on the outcome that is most likely not to occur, has a 0.01% chance so its shares are worth $0.01. However, the Polymarket classifies this as a $1 worth of share which, of course artificially increases its nominal trading volume.

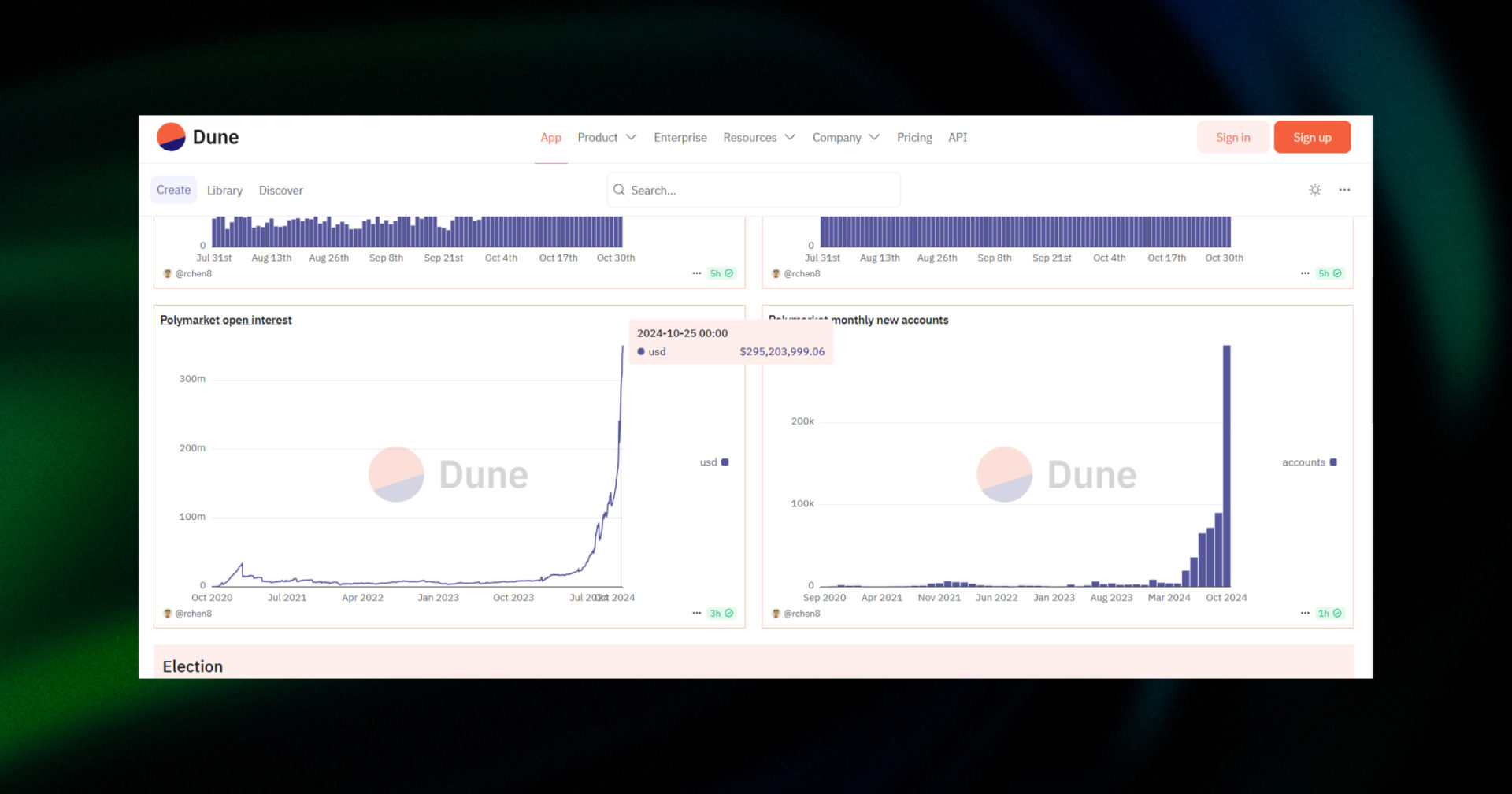

Finally, the blockchain analytics platform Dune reports open interest worth only around $300M which is much less than the nominal $2.7B trade volume. Such data continues to accumulate doubts about the reliability of the Polymarket’s data and assumes other market manipulations in the US elections polls as well among the crypto community.

Source: Dune

5% of US voters identify as single-issue crypto voters

Paradigm, in its October poll report stated that 5% of its respondents are “single issue” crypto voters, suggesting that the crypto voting block may be a decisive force for the upcoming US presidential election.

To conduct this poll, first Paradigm was asking US potential voters whether they invest in crypto, going to invest in crypto or haven’t and not going to invest in cryptocurrency. As a result, around 20% of all voters said they have been investing in crypto, more than 35% answered they are likely to do so in the future and the other 44% said they are not going to do so. Furthermore, 1% of voters say they have first invested in crypto in the last few weeks.

Then Paradigm decided to dig deeper into the 20% of the crypto voters and asked them if they identify themselves as a single-issue crypto voters, where ¼ of them answered positively, meaning that approximately 5% of all respondents treat crypto policy as the main issue they are voting for.

Source: Paradigm

In the context of a very tight competition between republican Donald Trump and democrat Kamala Harris nominees this may play the main role in this year’s election. Furthermore, Paradigm found out that among non-crypto voters, Kamala Harris leads 48% to 45% while among crypto users this poll is getting tied to the 47% from both Trump and Kamala’s sides.

However, considering the crypto community’s skepticism for Kamala’s future vision on crypto previously, now it looks like the vice-president of US aligns to Trump’s level.

gems 💎 sniper bot overview

Gems 💎 sniper bot is an advanced DEX Screener with the ability to snipe every token that matches your predefined criteria. It continuously tracks the entire token universe on all supported blockchains based on advanced coin metrics such as on-chain activity, price, volume, liquidity changes, buying pressure, number of experienced buyers, social following, and more.

Our sniper bot operates in the two main modes:

🔸 Test mode: Receive alerts once any token meets your specified criteria. Attach a virtual Take Profit and Stop Loss orders to find out how your trading strategy would have performed on the market

🔸 Trade mode (coming soon): Automatically purchases every token that reaches your predetermined criteria allowing you to snipe gems before anyone else. Configure a Take Profit and Stop Loss orders to the bot and transform the gems sniper bot into a fully automated profit maker with robust risk management.

Want to learn more about how to implement our new feature in your trading strategy? Check out the comprehensive gems 💎 sniper review! 👇

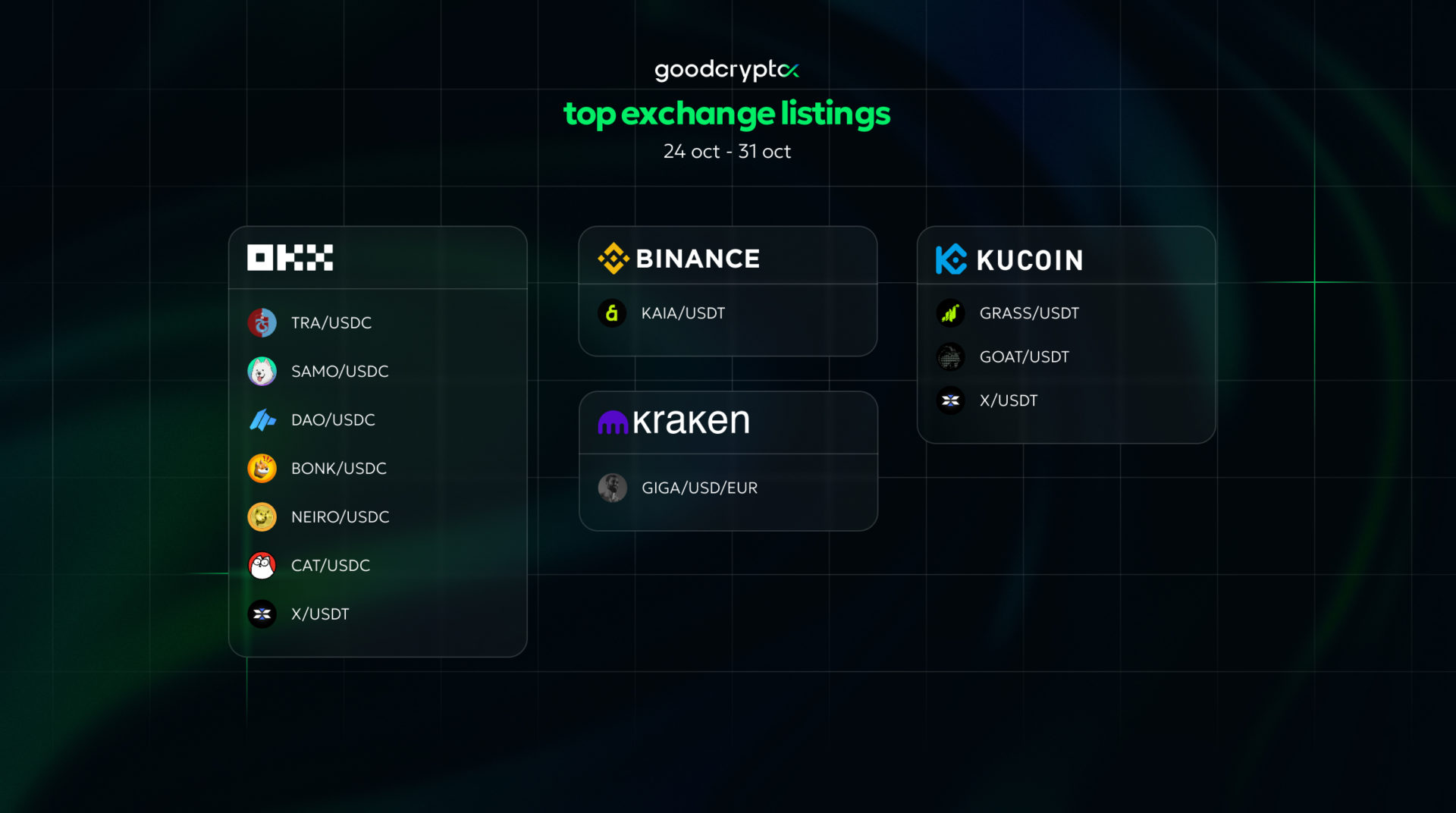

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!