We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Binance claims to have $63 billion in reserves and adds 11 coins to PoR

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Once the Utah DAO Act is passed, DAO is given legal status in the US

The Utah State Legislature has passed Act HB 357, known as the Utah Decentralized Autonomous Organizations Act (Utah DAO Act), which provides legal recognition and limited liability to DAOs by framing them as “Utah LLDs.”

The act resulted in combined efforts by the Digital Innovation Taskforce and the Utah Blockchain Legislature and was approved on March 1, 2023, after passing through the Senate and House committees. The law defines ownership of DAOs and safeguards DAO-compliant anonymity through bylaws while introducing quality assurance DAO protocols to ensure apparent nuances in tax treatment and updated DAO functionalities.

Joni Pirovich, a blockchain and digital assets tax adviser who collaborated with the Digital Innovation Taskforce, tweeted “This is a huge step for DAO innovation as the Act is based on the @coalaglobal DAO Model Law, and will become effective from January 2024.”

The DAO law aims to allow maximum flexibility for innovation and recognizes that DAOs are transnational entities. It can offer technological guarantees equivalent to the protections laws seek to protect by requiring manual reporting processes. However, there were significant concerns by the Utah Blockchain Legislature, and compromises were reached to pass the act. One of the issues was the anonymity and unaccountability of DAOs, which was addressed through a compromise that requires DAOs to divulge an incorporator while maintaining anonymity.

While MyAlgo updates its warning, Algodex informs that a “malicious” actor has access to his wallet

MyAlgo, a wallet provider based on Algorand, has once again advised its users to withdraw their funds following a security breach in February that seems to remain unresolved.

Meanwhile, Algodex, a decentralized exchange, disclosed that a malicious actor had infiltrated a company wallet on March 5 which “appears to be similar to what is currently happening in the Algorand ecosystem.”

According to the exchange, the attacker had taken $25,000 in ALGX tokens from the wallet connected to Algodex’s liquidity rewards program, which was responsible for providing extra liquidity to the ALGX token.

However, the total loss from the theft was less than $55,000, and Algodex users and the liquidity of ALGX were unaffected.

MyAlgo renewed its warnings to users to withdraw their assets or rekey their funds to new accounts due to the security breach that resulted in losses of around $9.2 million in February.

Binance claims to have $63 billion in reserves and adds 11 coins to PoR

Binance, a cryptocurrency exchange, has included 11 additional tokens in its proof-of-reserves (PoR) report, per a March 7 announcement. These new tokens include Enjin Coin, Chromia, Dogecoin, 1inch Network, Hashflow, PowerPool, SSV.network, WazirX, The Graph, Curve DAO Token, and Mask Network.

Binance claims to have over $63 billion in 24 assets in its PoR system, with the largest assets being Tether, Bitcoin, and Ether. However, experts have cautioned that PoR has its limitations, such as the absence of information on leverage and collateralization, and proof-of-liabilities, which can only be addressed by accompanying financial statements.

Binance claims that its PoR approach employs Merkle trees to sum up on-chain data, ensuring that user assets are held in its custody in a 1:1 ratio. In February 2023, the exchange updated its PoR system with ZK-SNARKs, which the company claims will “enhance the privacy and security of user data throughout the verification process.”

A Bitcoin ATM company allegedly made money through cryptocurrency fraud by using unregistered kiosks

A Bitcoin technology firm, Bitcoin of America, and its executives have been indicted for allegedly running over 50 unlicensed crypto kiosks in Ohio and knowingly benefiting from cryptocurrency scams.

The company and three executives are facing charges of money laundering, conspiracy, and other crimes related to the operation of the kiosks. Prosecutors allege that the company’s systems lacked anti-money laundering protections, enabling scammers to transfer funds from users’ crypto wallets.

The victims were directed to the firm’s ATMs and instructed to put cash into the machines in exchange for Bitcoin in a wallet they thought was theirs but had no control over. The firm allegedly pocketed a 20% transfer fee each time this occurred, even after learning they were fraudulent.

The indictment also accuses the company of making “written misrepresentations regarding the nature of their business to government agencies,” allowing it to run the kiosks without a money transfer license.

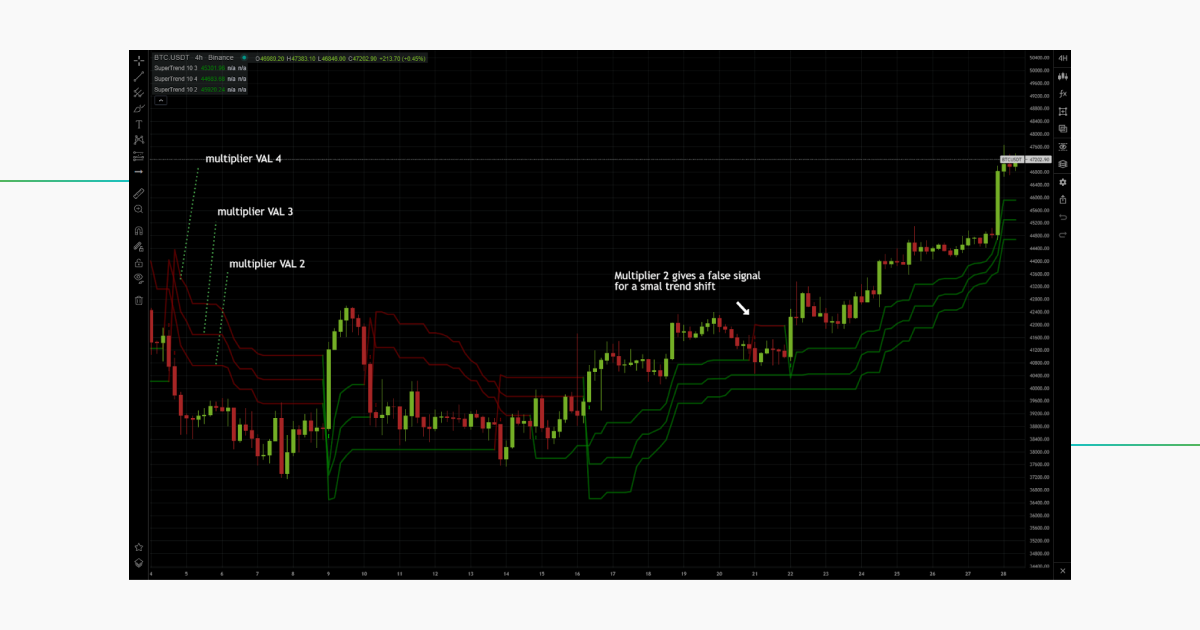

What supertrend settings are most effective for trading crypto?

Novice traders should stick to the default settings of the ART supertrend indicator – a multiplier of 3 and a setting of 10. Traders consider these parameters reliable across various timeframes, including intraday and multiday trading. If you modify these settings without understanding what you are doing, it can cause misleading signals and erratic behavior.

However, it’s still possible to fine-tune the indicator by keeping the multiplier close to 3. For instance, a larger multiplier (4) follows the trend from a distance, while a smaller one (2) stays closer to the price and changes more quickly. However, this can produce a false signal due to high BTC volatility.

In specific scenarios, adjusting the supertrend indicator settings can be advantageous. For example, for swing trading and avoiding false signals from price spikes, a multiplier of 3.5 can be used.

Experimenting with various settings and timeframes can help you identify the best parameters for your trading style and risk tolerance. Then, once you have determined the optimal supertrend indicator settings, you can apply them to your trading strategy.

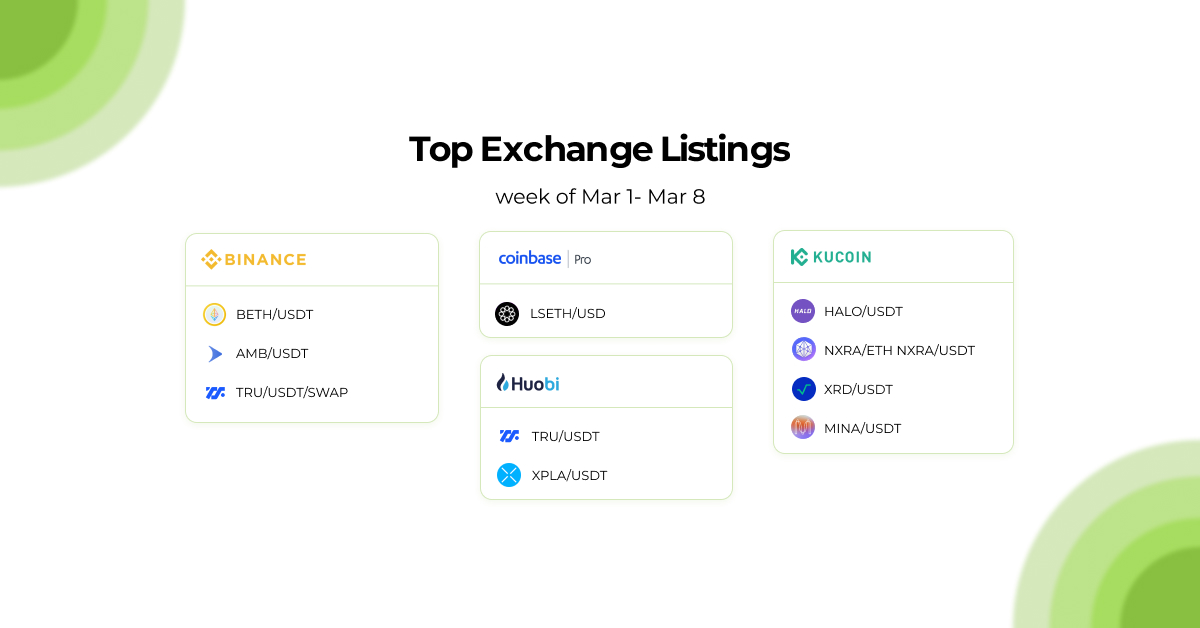

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

March 9, 2023