Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

Pressure from regulators and Shapella’s upgrading caused a decline in Ethereum staking deposits

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Elon Musk purchases hundreds of GPUs for his Twitter AI project

The CEO of SpaceX, Tesla, and Twitter, Elon Musk, made headlines for calling for a halt to artificial intelligence (AI) development due to societal concerns. Still, he appears to be moving forward with his plans for AI infrastructure.

According to a report from Business Insider, Musk has recently purchased around 10,000 graphics processing units (GPUs) for an AI project at Twitter, which he plans to use to detect and highlight public opinion manipulation. While the project is reportedly in its early stages and its definite role in generative AI is unclear, purchasing such a large quantity of GPUs shows Musk’s commitment.

In addition, Twitter has recently acquired new talent in the AI field, including engineers Igor Babuschkin and Manuel Kroiss, who previously worked at DeepMind, an AI research subsidiary of Google’s parent company, Alphabet.

In the event of a closure, Ren Protocol transfers all assets to FTX Debtors’ wallet

Ren Protocol has announced that FTX, Alameda, and their affiliates have authorized the transfer of all Ren Protocol’s crypto assets to FTX Debtors’ wallets to safeguard their assets in case of a potential shutdown of their systems and infrastructure.

The move comes as Ren Protocol seeks to push interoperability within the DeFi space, with CEO Taiyang Zhang saying that the Alameda acquisition would expedite the decentralization of its technologies.

However, FTX and Alameda Research experienced one of the biggest collapses in crypto history last year. As a result, Ren Protocol advised its users to unwrap their tokens in the Ren 1.0 network and return them to the main chains.

Pressure from regulators and Shapella’s upgrading caused a decline in Ethereum staking deposits

According to on-chain analytics provider Glassnode, Ethereum staking deposits have decreased slightly in recent weeks due to increased regulatory pressure and the upcoming Shapella upgrade on April 12.

Glassnode’s data reveals that deposit activities are currently low, and financial regulators in the United States have been putting pressure on crypto. The Shapella hard fork will enable the phased release of ETH staked on the Beacon Chain, causing the dip in Ethereum staking deposits. As a result, major centralized exchanges such as Coinbase, Binance, and Kraken have lost a lot of market share to the liquid staking platform Lido.

Lido currently accounts for almost a third of the total amount of ETH staked, around $11 billion from the 5.9 million ETH on the platform. Lido takes a 10% commission and offers the potential of earning additional yields on DeFi platforms through its staking token Lido Staked ETH (stETH).

According to Ultrasound. Money, there are currently 18.1 million ETH staked in total, representing 15% of the entire supply, and this will be slowly released for withdrawal in the weeks and months following the Shapella upgrade.

OpenAI introduces a bug bounty program to address system flaws

OpenAI has launched a “Bug Bounty Program” to address privacy and cybersecurity concerns, offering rewards to security researchers for identifying and addressing vulnerabilities in its systems. OpenAI partnered with Bugcrowd, a bug bounty platform, to manage the submission and reward process.

The program aims to keep OpenAI’s technology and company secure, and rewards range from $200 to $20,000 based on the severity and impact of the reported issues. The program launch follows a data breach OpenAI experienced on March 20, and the company believes that expertise and vigilance will directly impact keeping its systems secure and ensuring users’ security.

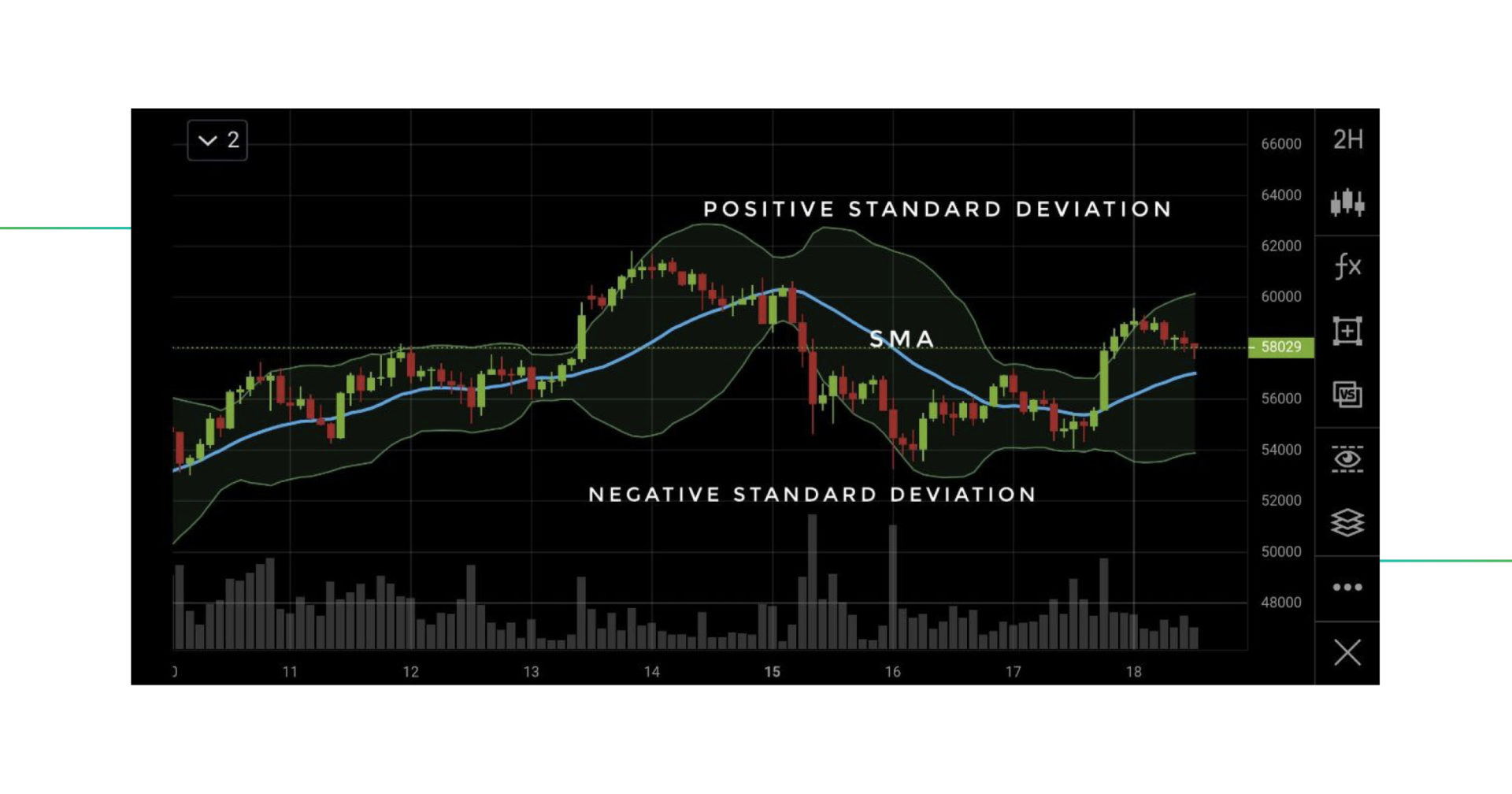

How do Bollinger Bands work?

The article explains that Bollinger Bands consist of a Simple Moving Average (SMA) line based on the last 20 periods and two lines that define the upper and lower bands using standard deviations from the SMA. The volatility of the SMA determines the width of the bands.

💡Pro Tip: Stronger signals can be obtained from Bollinger Bands using a longer/higher SMA. By adjusting the settings, more insights can be gained. However, the longer the SMA period, the fewer signals are generated, resulting in a tradeoff between quantity and quality.

Explore one of the currently most widely used technical indicators with this article!

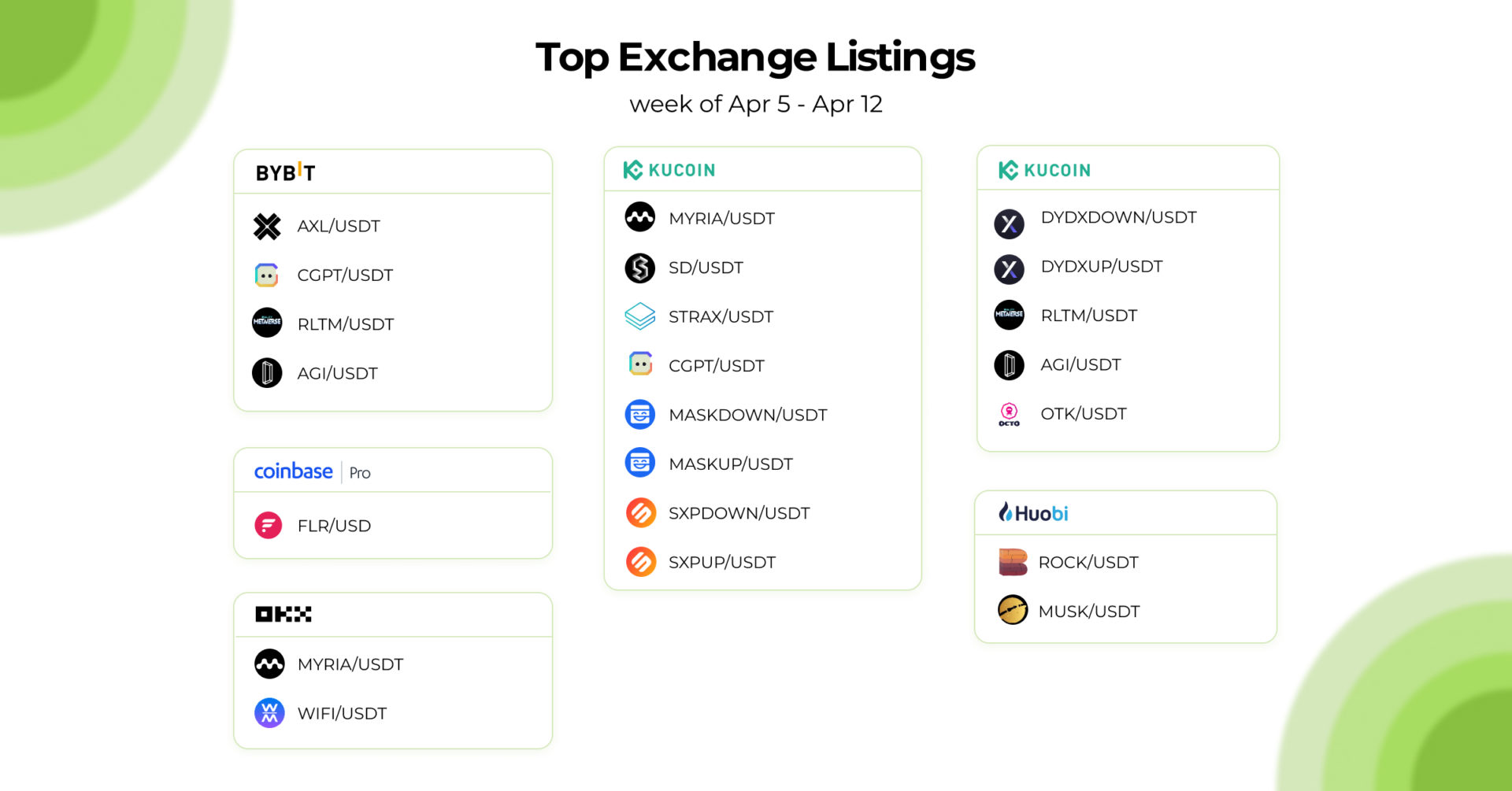

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

April 13, 2023