Hello there! 👋

This week we have seen some really important crypto events staggering the market. Let’s recall the most noteworthy ones in this weekly digest by GoodCrypto. If you’d like to stay updated on the crypto market, follow us on Twitter.

quick weekly news

Telegram CEO Pavel Durov was charged and released, barred from leaving France

On August 28, the CEO of Telegram and a key influencer of the TON blockchain, Pavel Durov, was released from custody after being arrested on August 24 by French authorities and placed under judicial supervision following a court appearance. He was barred from leaving France and was required to post bail of 5 million euros ($5.5M) to secure his release. Police delivered Durov to court immediately after he arrived at the northern French airport on August 24.

Initially, authorities claimed that the arrest was not politically motivated but was part of a judicial investigation from July “against a person unnamed.” The investigation involved multiple accusations, including fraud, drug trafficking, cyberbullying, facilitating the spread of child pornography, enabling illicit activities, and organizing crimes—all related to Telegram moderation issues.

Additionally, Durov has recently been accused by Swiss authorities of physically abusing children in a case unrelated to the French investigation. After Pavel’s arrest in Paris, India also launched an investigation into the Telegram CEO, charging him with complicity in distributing child pornography, drug trafficking, and fraud via the Telegram app.

This has caused significant concern among some crypto key opinion leaders (KOLs), such as Vitalik Buterin, and even Russian government representatives like Dmitry Peskov. Many are deeply worried about “the future of software and communications freedom in Europe.”

TON back online after second DOGS-related outage in 36 hours

The Open Network (TON) blockchain is finally back online after experiencing its second outage related to the airdrop and listing of the TON-based project $DOGS. At 7:17 pm UTC on Aug. 28, the network went down and remained non-functional until 1:00 am UTC on Aug. 29, resulting in nearly 6 hours of downtime for the TON chain.

It’s important to note that this is not the first time the TON chain has gone down due to a surge in on-chain activity related to the $DOGS airdrop and listing on major centralized exchanges, according to market commentators and official representatives of TON. The first breakdown occurred around 11:00 pm UTC on Aug. 27, when the network stopped producing blocks for approximately six hours before coming back online at 5:30 am UTC on Aug. 28. In total, the TON network has been inoperable for around 12 hours within the last 36 hours.

According to CoinMarketCap, $DOGS currently ranks 8th by trading volume among all cryptocurrencies, boasting over $1.4 billion in the last 24 hours. Its official Telegram channels have approximately 17 million subscribers, a number achieved within just two months of operation.

Fed’s ‘sugar high’ may propel Bitcoin surge — Arthur Hayes

On August 28, Arthur Hayes, co-founder of the prominent crypto exchange BitMEX, released a new essay titled “Sugar High,” which presents his vision regarding future market movements and Federal Reserve (FED) actions.

In the essay, Hayes stated that while decreasing inflation and lowering interest rates are bullish signs for equity and crypto markets, these effects are more short-term “sugar high” rather than long-term effects, Hayes’ article delves into the yen carry trade strategy, explaining that investors borrow money in yen, typically at low interest rates, to invest in higher-yielding opportunities in other currencies.

He argues that cutting interest rates will strengthen the Japanese cryptocurrency market and negatively impact the carry trade strategy and overall financial markets. According to Hayes, the only way to continue stimulating the markets is for the FED to “raise the quantity of money”, which he believes the government is likely to do. Otherwise, he envisions that the effect of cutting interest rates will be reversed, leading to further market corrections until the FED begins printing more money.

Crypto.com, Standard Chartered partner for global fiat services

The Singapore-based cryptocurrency exchange Crypto.com has partnered with Standard Chartered Bank to offer its clients trading in United States dollars, euros, and United Arab Emirates dirhams on its platform. In an interview, Karl Mohan, Global Head of Banking Partnerships and General Manager of MEA and APAC at Crypto.com, stated that this is a win-win situation for both companies.

According to a post by Cointelegraph, this partnership will enable users in over 90 countries to deposit and withdraw the aforementioned fiat currencies via the Crypto.com app. The new service will first be available to customers in the UAE, supported by Dubai’s Virtual Assets Regulatory Authority (VARA) regulatory framework, before expanding to other countries.

It is worth noting that the Dubai region is considered one of the strictest in terms of consumer protection. For instance, in 2022, Dubai’s VARA made it mandatory for marketers and promoters to provide clearer advertisements to ensure better consumer protection. A year later, the UAE established a new law requiring institutions engaged in crypto activities to secure a license and approval from the regulator to avoid facing heavy sanctions from the government.

How to read Ichimoku Cloud?

The Ichimoku Cloud is one of the most powerful trading indicators, providing insights into the past, present, and possible future movements of the market. It consists of three main components: the cloud, which projects future trends based on past data; the Tenkan Sen and Kijun Sen, which display current market movements; and the Chikou Span, which represents past price action.

How to Read the Indicator? 🤔

🔸 Cloud Placement: If the price is above the cloud, it’s a bullish indicator for the market. If it’s below, then bearish.

🔸 Cloud Color: If the cloud is green, the price is likely to move up soon. If the cloud is red, the price is likely to move down.

🔸 Tenkan and Kijun Sen: If the Tenkan Sen and Kijun Sen are above the cloud, it’s a positive sign, conversely, if they are below the cloud, it’s a negative sign. Additionally, if the Tenkan Sen is above the Kijun Sen, it’s considered bullish, and if it’s below, then bearish.

🔸 Chikou Span: If the Chikou Span is above the cloud, the market is likely to go up. If it’s below, the market is likely to go down.

Want to learn more about the Ichimoku Cloud? Read our comprehensive indicator review and discover how to implement this effective tool in your trading strategy! 📈

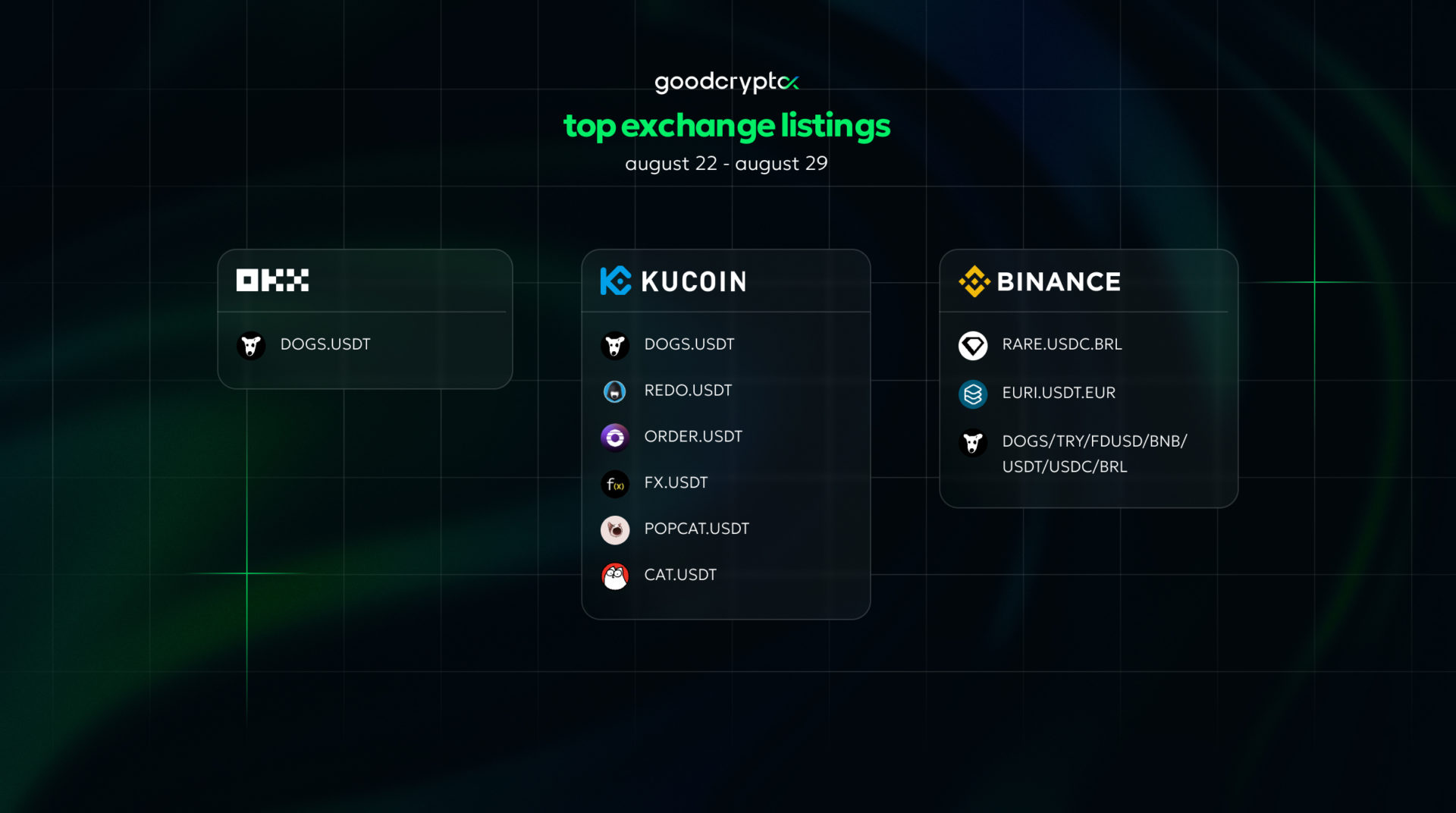

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!