We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

potential breakthrough for Ethereum ETF in the U.S.

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

potential breakthrough for Ethereum ETF in the U.S.

Clearing Corporation, a pivotal step towards potential approval by the U.S. Securities and Exchange Commission. Although currently inactive on the DTCC website, this listing follows a similar move for Franklin Templeton’s spot ETH ETF a month prior, signaling a growing trend in the ETF space.

The SEC’s recent engagement with major exchanges like Nasdaq to update spot Ether ETF applications has sparked speculation of a policy shift, possibly influenced by political factors and the crypto community’s lobbying efforts. Crypto lawyer Jake Chervinsky highlighted the role of politics in policy-making, suggesting that the crypto sector’s political gains may be swaying the Biden administration’s stance.

With the SEC’s final decision on the VanEck spot Ether ETF due on May 23, the recent request for financial managers to amend their filings has been interpreted by some analysts as a positive sign, increasing the likelihood of approval. This development marks a significant moment for the cryptocurrency industry, as it awaits the SEC’s verdict with bated breath.

Buterin endorses ZK ‘Likes’ for enhanced privacy on Farcaster

Ethereum co-founder Vitalik Buterin has proposed the adoption of zero-knowledge (ZK) proofs for ‘Likes’ on the decentralized social media platform Farcaster. This move aims to address the issue of preference falsification, where users misrepresent their true preferences due to social pressures or fear of backlash. ZK proofs would allow users to like content anonymously, proving the action without revealing their identity.

Buterin’s suggestion comes in response to Farcaster’s privacy shift, where engineer Haofei announced the platform’s decision to make ‘Likes’ private. The rationale is to prevent the negative social dynamics that public likes can foster, such as discouraging users from liking controversial content. The change is expected to improve user experience by refining the platform’s recommendation algorithms based on genuine user preferences.

The community’s reaction to the privacy shift and Buterin’s ZK proposal has been mixed, with some advocating for even more privacy in social media interactions.

bipartisan support for crypto regulation bill in U.S. House

The U.S. House of Representatives has passed the Financial Innovation and Technology for the 21st Century (FIT21) Act with a notable bipartisan majority. The bill, which aims to clarify the regulatory framework for digital assets, received a vote of 279 to 136. The FIT21 Act seeks to define the roles of SEC and CFTC in overseeing the crypto sector.

Despite the broad support, some representatives, such as Maxine Waters, voiced concerns that the bill could deregulate the industry excessively, potentially leading to a market crash. The bill’s passage in the House is a significant step toward establishing a clear regulatory environment for digital assets, which has been a contentious issue within the U.S. financial regulatory agencies.

The FIT21 Act’s approval comes at a critical time as the House also considers the Central Bank Digital Currency Anti-Surveillance State Act. This legislative activity underscores the increasing focus on digital assets during an election year, with both President Biden and former President Trump expected to debate on related policies. The crypto community now looks to the Senate for the next phase of the FIT21 Act’s legislative journey.

Metaplanet stock skyrockets, outperforms all Japanese equities

Metaplanet, a Japan-based investment firm, has seen its stock price skyrocket following a strategy similar to that of MicroStrategy’s Bitcoin investment playbook. Over the past week, the company’s shares have surged by 158%, making it the highest gainer among all Japanese stocks. The price per share has risen to 93 Japanese yen, marking a 127% increase in just two days. This rapid growth has prompted the Tokyo Stock Exchange to halt trading twice in the last week due to circuit breaker rules.

The company’s market capitalization is now on the verge of reaching $1 billion, standing at 14.8 billion Japanese yen. Metaplanet’s stock surge has been so significant that it breached the Tokyo Stock Exchange’s daily limit rules, which state that stocks priced below 100 yen can only increase by a maximum of 30 yen per day. Dylan LeClair, the firm’s Director of Bitcoin Strategy, celebrated the achievement, noting that Metaplanet has been the “best-performing stock in Japan” for two consecutive days.

Metaplanet’s aggressive Bitcoin acquisition strategy, which has seen it accumulate 117.7 Bitcoin worth $7.2 million, has been in response to Japan’s economic challenges, including high government debt levels, negative real interest rates, and a depreciating yen. The firm’s stock has risen 389% since the announcement of its Bitcoin strategy on April 8.

Bollinger Bands vs. Keltner Channels – what’s the difference?

Unlock the power of ATR indicators for sharper trading decisions! 📊✨

Did you know you can enhance your trading analysis by combining Bollinger Bands and Keltner Channels? These two indicators, though similar in showcasing volatility, use different calculations and complement each other perfectly.

🔍 Key Differences:

- Bollinger Bands: Utilize the SMA to create three lines that adjust more rapidly to price changes.

- Keltner Channels: Offer a steadier view with lines based on the ATR, typically using a default setting of 20 periods.

📉 Keltner Channels Explained:

- Middle Line: Represents the ATR, calculated by dividing the highest by the lowest price over a certain period.

- Upper & Lower Bands: Derived by multiplying the ATR by a factor and adding/subtracting this from the ATR to form the bands.

📈 Why Combine Them?

Overlaying Bollinger Bands (green area) and Keltner Channels (blue area) can provide stronger confirmations and a clearer picture of market squeezes. Just ensure both indicators use the same settings for optimal results.

Want to dive deeper into how these powerful tools can transform your trading strategy? Check out our detailed article now! 💡

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

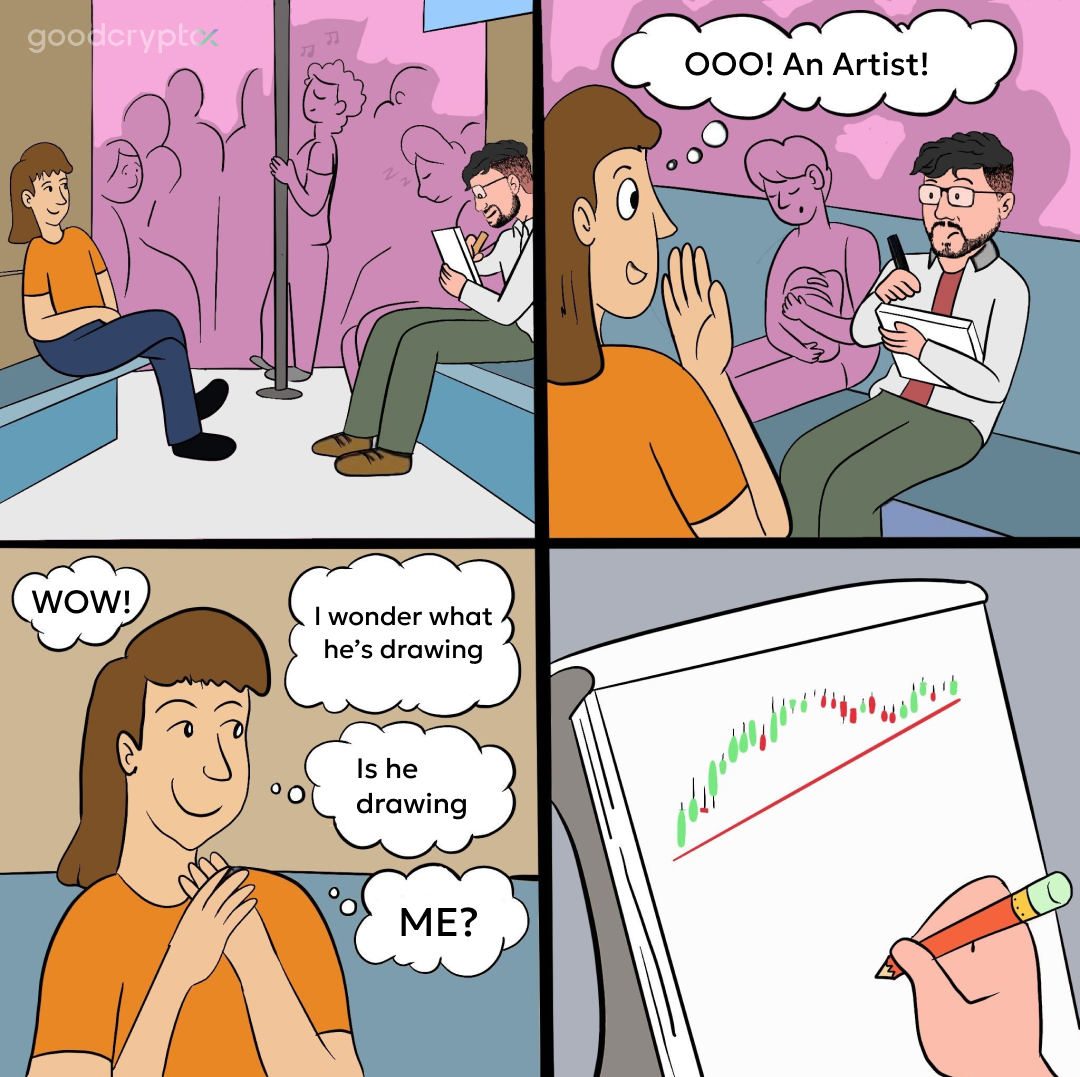

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

May 23, 2024