We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Uncensored financial data from BlockFi purportedly indicates $1.2 billion in FTX exposure

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Mango Markets sues Avraham Eisenberg for damages and interest totaling $47 million

In a complaint made on January 25, Einseberg is accused of abusing its platform in October 2022 to steal millions of dollars worth of bitcoins, according to the United States District Court for the Southern District of New York.

The claim seeks interest from the period of the attack and damages totaling $47 million.

Additionally, it requested that the court revoke and declare “invalid and unenforceable” a contract Eisenberg and Mango’s associated DAO entered into.

The arrangement arose from a governance proposal Eisenberg filed, asking the DAO to permit them to retain $47 million in exchange for Mango Markets agreeing not to file a criminal complaint for the theft of its funds.

Mango Labs claimed Eisenberg “was not engaged in lawful bargaining” in their most recent complaint, adding:

“[Eisenberg] forced Mango DAO to enter into an unenforceable settlement agreement—under duress—purporting to release depositors’ claims against him and precluding them from pursuing a criminal investigation.”

On October 11, 2022, a hacker stole almost $117 million from Mango Markets’ bank account by altering the native MNGO token’s price oracle data, enabling them to take out loans with insufficient collateral.

Eisenberg then identified himself as the assailant. He asserted that the exploit was “legal open market actions, using the protocol as designed” and a “highly profitable trading strategy.”

Creditors might be paid with a brand-new “Celsius token”

According to a Jan. 24 Bloomberg article that cites a video court session as its source of information, bankrupt crypto lending company Celsius may create its own coin to compensate creditors.

Ross M. Kwasteniet, an attorney for Celsius, reportedly informed the court that the company is talking with its creditors on how to restart the platform and fairly repay them. A “publicly-traded company that is properly licensed” would be the new, relaunched version, which would ostensibly give creditors more money than merely liquidating the business. In addition, the reformed company would “issue a new token to creditors as part of a payout plan” if creditors and the court authorized it.

According to the article, the plan’s specifics will be submitted to the court this week.

CelsiusFacts, a regular updater on the subject on Twitter, also asserted to have discovered specifics of the restructuring plan. In a statement released on January 24, Celsius Network stated that it intended to go public and engage “third-party services” to guarantee that it complied with American financial laws. Users may withdraw up to $7,500 in claims, or 95% of the total, whichever is less. Celcius will create a new token to cover the remaining 5% or sums beyond $7,500.

Robinhood’s Twitter account is hacked and used to spread fraudulent tokens

On January 25, many cryptocurrency Twitter users noted that Robinhood had tweeted to its 1.1 million followers to buy a token dubbed “RBH” on the Binance Smart Chain for $0.0005. Before the post was deleted, at least 10 individuals had purchased the hoax token for about $1,000, according to Conor Grogan, head of product business operations at Coinbase.

CEO Changpeng Zhao said that the account mentioned in the tweet had been locked by the company’s security team “pending further investigations,” most likely as a result of the mention of Binance. The tweet has vanished from Robinhood’s account.

“Always have critical thinking even [if] the account looks or is real,” said CZ.

Uncensored financial data from BlockFi purportedly indicates $1.2 billion in FTX exposure

Unredacted documents reveal that as of Jan. 14, BlockFi had $415.9 million in assets related to FTX and a staggering $831.3 million in loans to Alameda, according to a Jan. 24 article from CNBC.

The formerly classified financials were made public as part of a presentation created by M3 Partners, a creditor committee advisor who acknowledged the paperwork was posted incorrectly.

The creditor committee objected BlockFi’s request for $12.3 million in retention payments for crucial personnel because of the company’s meager operations and assets. This is addressed in the appropriately redacted Nov. 24 statement.

The passages that have been censored comprise “trade secret[s] or confidential research, development, or commercial information,” according to a later filing.

BlockFi’s attorneys stated $355 million was blocked on FTX and $680 owed to Alameda on November 29 on the first day of the bankruptcy court; however, after that time, the value of the funds has climbed along with the price of Bitcoin.

An Example of Trading Strategies Using Ascending Triangle Patterns

The bullish ascending triangle in the example leads to a continuation of the trend. However, in contrast to the resistance, which is still linear, the candles are making higher lows.

You may anticipate the breakout price objective at the ascending triangle’s opening. In our case, the price difference at the entrance of the cryptographic triangle pattern is about $2,000.

When the price exits the bullish ascending triangle, your take profit level is about $2,000 above the breakout guarantees that earnings are maximized before a potential market decline.

This article discusses some of the most popular cryptocurrency chart patterns experienced traders regularly employ.

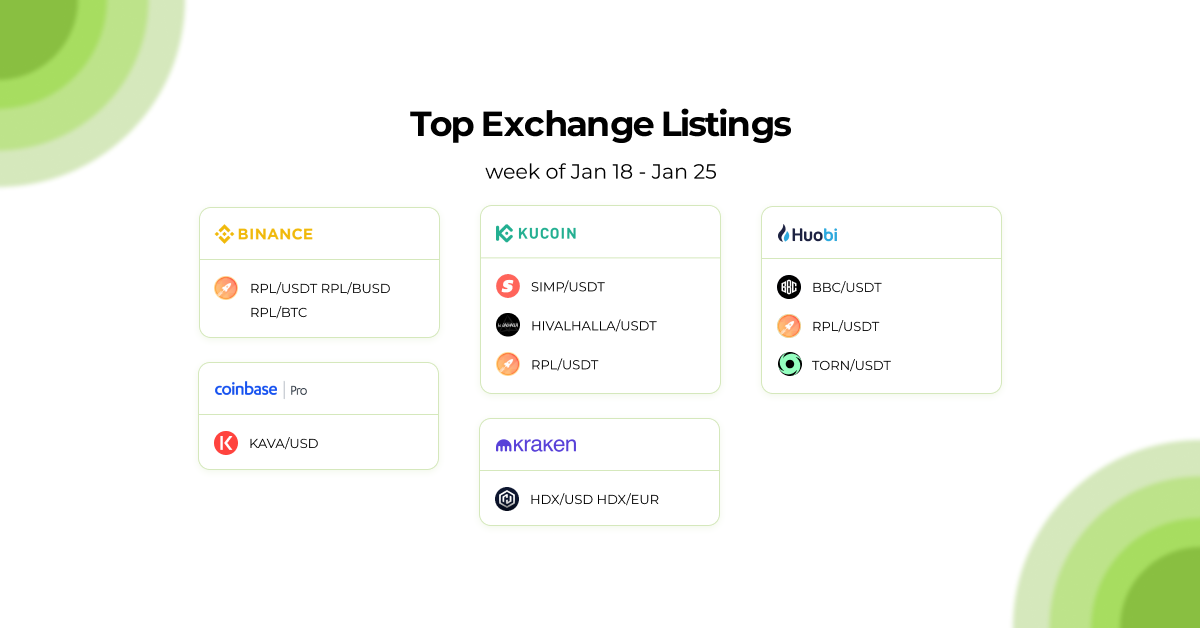

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

January 26, 2023