Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

When $2.88B is allegedly being laundered, Europol seizes $46M from a cryptocurrency mixer

On March 15, Europol, also known as The European Union Agency for Law Enforcement Cooperation, confiscated assets of the cryptocurrency mixer, ChipMixer, for its alleged involvement in money laundering activities. The total assets seized include 1,909.4 Bitcoin in 55 transactions worth 44.2 million euros ($46 million). In addition, decentralized finance analyst ZachXBT claimed on November 25, 2022, that after a $372 million exploit, the hacker(s) of the defunct cryptocurrency exchange FTX laundered 360 BTC ($5.9 million) using ChipMixer.

Furthermore, after authorities seized four servers hosting the application, the ChipMixer website was shut down. Europol alleges that since its establishment in 2017, the application has laundered over 2.73 billion euros. According to law enforcement officials, ChipMixer specialized in “mixing or cutting trails related to virtual currency assets.” Its software blocked the blockchain trail of funds, which was attractive to cybercriminals seeking to launder illegal proceeds from criminal activities.

Law enforcement stated that the majority of the laundered funds were connected to dark web markets, ransomware groups, illicit goods trafficking, procurement of child sexual exploitation material, and stolen crypto assets. The bad actors deposited funds to ChipMixer and then turned them into small tokens called “chips,” the chips get mixed, and the mixer now cloaks the initial trail of funds.

Law enforcement officials noted that ransomware groups, like Zeppelin, SunCrypt, Mamba, Dharma, or Lockbit, have also used ChipMixer’s services to launder ransom payments. Additionally, authorities are investigating the possibility that some of the crypto assets stolen after the bankruptcy of a large crypto exchange in 2022 were laundered via ChipMixer.

The Shanghai update was successfully tested. However, there were some problems

The Shapella hard fork has been successfully implemented on the Goerli testnet, the final test before Ethereum validators can withdraw their Ether from the Beacon Chain. However, there were some issues during the process, as some testnet validators did not upgrade their client software before the Goerli fork, which slowed down the deposit processing.

Ethereum core developer Tim Beiko attributed this to the need for incentives for testnet validators to upgrade since Goerli ETH is worthless. Still, he expects proper adjustments to be made before the fork on the Ethereum mainnet.

Shapella comprises five different EIPs, with EIP-4895 being the most anticipated since it enables staked ETH from the Beacon Chain to be pushed to the execution layer. Shapella is a significant step forward for Ethereum’s proof-of-stake system. The Shapella upgrade is expected to take effect on the Ethereum mainnet in early April after some delays in preparing the Sepolia and Goerli testnets.

The hard fork will enable partial and complete withdrawals, potentially unlocking 17.6 million ETH, equivalent to over $30 billion at current prices.

Before it failed, Signature Bank was under investigation for money laundering

Reportedly, before its collapse, Signature Bank was being investigated by two U.S. government bodies over potential money laundering by its clients. According to a March 15 Bloomberg report citing anonymous sources, the Justice Department examined whether Signature took enough measures to detect money laundering.

The regulator was concerned whether the bank was preemptively monitoring transactions for “signs of criminality” and properly vetting account holders. The Securities and Exchange Commission was also conducting a separate probe into the bank, but details of the investigation were not reported. It is unclear when the investigations began and what effect, if any, they had on the recent decision by New York state regulators to close the bank.

Signature and its staff have not been accused of wrongdoing. The investigations may be finalized without any charges or further action by the SEC or the Department of Justice. A March 14 class action lawsuit by Signature shareholders was filed against the bank and former executives for claiming to be financially strong three days before it was forcibly closed.

Barney Frank, a former board member of Signature Bank, said that regulators wanted “to send a very strong anti-crypto message” and that the bank became the “poster boy” as there was “no insolvency based on the fundamentals.”

Around $195 million was stolen from Euler Finance in a flash loan assault

On March 13, Euler Finance, an Ethereum-based noncustodial lending protocol, experienced a flash loan attack resulting in the theft of millions of Dai, USD Coin, staked Ether, and wrapped Bitcoin. The exploiter carried out multiple transactions and stole nearly $196 million, making it the largest hack of 2023.

Meta Seluth, a crypto analytic firm, suggests this attack correlates with a month-ago deflation attack. Before launching the attack, the attacker used a multichain bridge to transfer funds from the Binance Smart Chain to Ethereum.

ZachXBT, another on-chain investigator, confirmed the similarities between this and the previous attack. As a result, Euler Finance acknowledged the attack and is working with security professionals and law enforcement to resolve the issue.

Slowmist, a blockchain security firm, analyzed the attack and found that the exploiter used flash loans to trigger liquidation and donated the funds to a reserved address. The attacker then conducted a self-liquidation to collect any remaining assets.

The attack’s success was due to funds being donated without undergoing a liquidity check and the soft liquidation logic being triggered by high leverage, allowing the liquidator to obtain most of the collateral funds.

Gustavo Gonzalez, a solutions developer at OpenZeppelin, revealed that the exploit occurred in one transaction, utilizing flash loans from AAVE, and was made possible due to a bug in one of Euler’s smart contracts.

What distinguishes Trailing Stop Market orders from Trailing Stop Limit orders?

Trailing Stop orders are essentially Trailing Stop Market orders that function like Trailing Stop Limit orders until the trigger price is met. When that happens, a Trailing Stop order sends a Market order to the exchange, while a Trailing Stop Limit order places a Limit order.

Using a Trailing Stop (Market) order as a Stop Loss and/or Take Profit ensures immediate execution when triggered. However, if the price experiences a sharp movement, there’s a possibility that the order might fill at a higher/lower price than the trigger price.

On the other hand, a Trailing Stop Limit order guarantees the order’s price when it fills. However, if the price sharply moves past the limit price, there’s a chance that the order won’t fill and will remain in the order book after triggering.

Therefore, deciding between a Trailing Stop (Market) and Trailing Stop Limit order is a tradeoff between execution and price certainty.

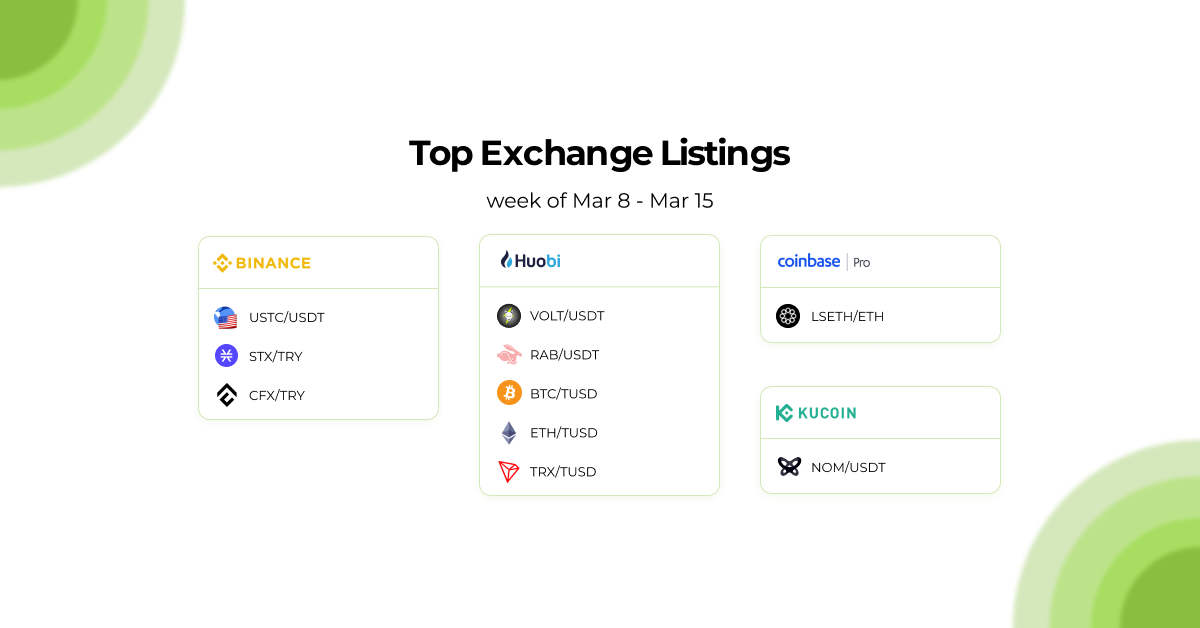

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!