We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Voyager Digital presents a Chapter 11 recovery strategy and files for bankruptcy

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

In June, Core Scientific liquidated Bitcoin holdings totalling $167 million

Core Scientific, a cryptocurrency mining company, located in the United States, sold more than 7,000 Bitcoin (BTC) in June to pay for servers, expand its data storage, and pay off debt.

Core Scientific stated that it had sold 7,202 BTC, or about $167 million worth, of Bitcoin in June at an average price of $23,000. After the transaction, the company had 1,959 BTC, or 21% of its total holdings, and $132 million cash on June 30, a decrease of more than 75% from its stated 8,058 BTC holdings as of May 31.

The company claims that it purchased ASIC servers using the money from the cryptocurrency sale, set up debt repayment plans, and invested in more data center space. According to the corporation, as of June 30, self-mining accounted for 57% of its data center capacity and cryptocurrency mining activities, or more than 180,000 servers. In June, it produced 1,106 BTC.

“Our industry is enduring tremendous stress as capital markets have weakened, interest rates are rising and the economy deals with historic inflation,” stated Mike Levitt, CEO. “Our company has successfully endured downturns in the past, and we are confident in our ability to navigate the current market turmoil.”

Voyager Digital presents a Chapter 11 recovery strategy and files for bankruptcy

Voyager Digital, a cryptocurrency exchange, has suspended trading, withdrawals, and deposits for a few days. Voyager Digital has now filed for Chapter 11 bankruptcy in the Southern District Court of New York, which is liable for between $1 billion and $10 billion worth of assets to more than 100,000 creditors.

The ailing cryptocurrency exchange didn’t waste any time following the American holiday and declared bankruptcy on Tuesday. Voyager said that the change is a part of a “Plan of Reorganization.” When the strategy implemented, consumers can access their accounts once more, and Voyager will “return value to customers.”

Voyager CEO described its proposed strategy, under which clients holding cryptocurrency in their accounts will get the following:

- a mix of cryptocurrency

- money recovered from Three Arrows Capital (3AC)

- common shares in the newly reformed business

- Voyager tokens

Following user backlash, Bitstamp abandons its inactivity fee plan

Last week, Bitstamp took the “hard decision” to charge a monthly fee to inactive customers with lower balances. Things are now being walked back.

The Luxembourg-based cryptocurrency exchange said it is abandoning the plan in response to intense criticism. Bitstamp CEO JB Graftieaux stated, “We have heard the response from our customers.” “We have taken everyone’s concerns onboard and have decided to cancel the Inactivity Fee.”

If 12 months passed without their making any trades, deposits, or withdrawals, it was intended to impose a 10-euro monthly tax on non-U.S. clients with balances of less than 200 euros. The charge would have started to apply on August 1.

Users of Bitstamp were not happy.

SOL investor charges Solana Labs, Multicoin for breaking securities law

Key members of the Solana ecosystem are accused in a class-action lawsuit filed last week in California of illegally benefitting off SOL, the blockchain’s native token, which the lawsuit claims are unregistered securities.

The lawsuit claimed, “The cornerstone of the value of SOL securities is the sum of Solana Labs, Solana Foundation, and [Anatoly] Yakovenko’s management and implementation of the Solana blockchain.” In their analysis, SOL was characterized as a highly centralized cryptocurrency that favored its insiders at the expense of regular traders.

California citizen Mark Young purchased SOL in the late summer of 2021 and named Solana Labs, the Solana Foundation, Anatoly Yakovenko of Solana, Multicoin Capital, Kyle Samani of Multicoin, and trading desk FalconX in the lawsuit.

A representative for Solana declined to comment. A request for feedback from Multicoin and FalconX did not receive a prompt response.

Launching Grid Algo on Spot exchange

We put together a great video for you to understand the Grid Bot basics. If you are just getting started, watch from the beginning to get set up – https://bit.ly/3NHNCAt

For advanced traders, you can skip to the middle of the video, where the juicy stuff starts.

Learn the basic features with more advanced functionality in this tutorial on How to Launch the Grid Bot by Good Crypto – https://bit.ly/3NQfLW6

Make sure to Subscribe GoodCrypto YouTube channel for more crypto trading tips. Hit the 🔔 to be the first who’ll know new hacks!

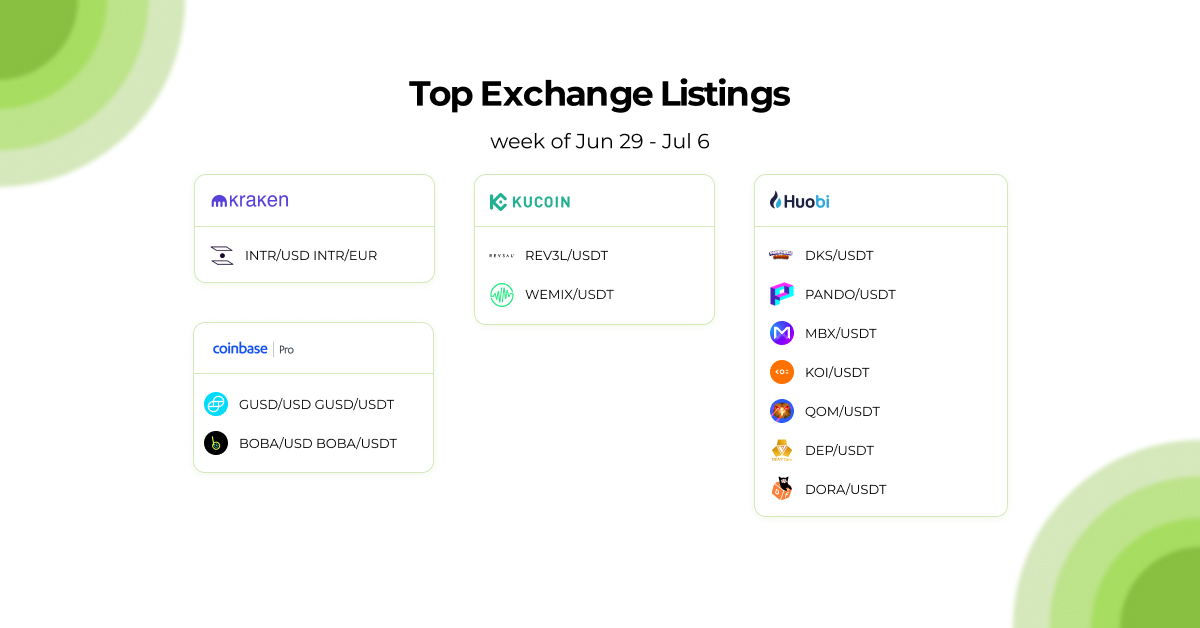

Receive an instant notification when a new coin is listed with the Good Crypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

July 7, 2022