We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Zero-knowledge Polygon EVM Rollup tries to make Web3 transactions less expensive

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Zero-knowledge Polygon EVM Rollup tries to make Web3 transactions less expensive

The debut of Polygon zkEVM, or zero-knowledge Ethereum Virtual Machine, a layer-2 scaling solution targeted at lowering transaction costs and enhancing scalability, was announced by Polygon, a Web3 infrastructure on the Ethereum blockchain.

Using the zero-knowledge cryptographic protocol, also known as the zk proof, the new zero-knowledge (ZK) scaling solution, Polygon zkEVM, runs entirely with existing Ethereum (ETH)-based smart contracts, developer tools, and wallets. Before sending numerous transactions to the Ethereum blockchain as a single transaction, Polygon combines them using the zk proof algorithm.

To lower the gas prices, several senders can engage in a single transaction since the zk proof can transmit numerous transactions within a single transaction. Combining transactions in bundles reduces the gas fees compared to sending the transactions separately across the Ethereum blockchain.

Launch of S&P risk-controlled Bitcoin and Ether ETPs by 21Shares

21Shares is attempting to match the S&P Dow Jones indices’ benchmarks despite the over 50% decline in the cryptocurrency markets this year. The new Ether ETPs are a new risk-adjusted cryptocurrency investment product.

To reduce volatility, the Swiss cryptocurrency investing company 21Shares has introduced two new exchange-traded products (ETPs). ETPs expose investors to the two largest cryptocurrencies, Bitcoin (BTC) and Ether (ETH).

On July 20, the Swiss SIX Exchange will begin trading the 21Shares S&P Risk Controlled Bitcoin Index ETP and 21Shares S&P Risk Controlled Ethereum Index ETP. The company said on Wednesday that the ETPs would trade under the tickers SPBTC and SPETH.

Both ETPs aim for a volatility level of 40%, which is attained by dynamically reallocating assets or adding more assets to the USD as volatility increases. The products modify the exposure to the underlying index and dynamically allocate to U.S. dollars to mirror the benchmarks of S&P indexes that manage risk.

Su Zhu, the founder of Three Arrows Capital, is suing his company for $5 million

The narrative surrounding Three Arrows Capital’s bankruptcy has taken an unexpected turn. Clients of the business discovered that one of the hedge fund’s founders had put his name on the list of creditors suing 3AC. Su Zhu sued his own firm for $5 million.

Soldman Gachs, a Twitter user, discovered the details after researching the creditor lists for hedge funds. When perusing the list of unhappy clients, he was shocked to see paperwork with the name Su Zhu. The corporation notified the “victim” of the organization’s liquidation procedure in the letter.

If the market cycle repeats, crypto winter will last 250 days

According to Grayscale Investment’s most recent Insight Report, the current bear market officially began in June 2022 and might endure another 250 days if past market cycles are any clue.

Grayscale observes that the cyclical fluctuations of cryptocurrency markets are similar to those of their traditional equivalents. For example, market cycles for bitcoin (BTC) typically span 4 years or 1,275 days. When the realized price of bitcoin falls below the going market price, the business considers a cycle to have begun.

The total of all assets at their original purchase prices divided by the asset’s market capitalization yields the realized price. This indicates how many positions — if any — are lucrative. According to Grayscale, the current bear market began on June 13 when the realized price of BTC crossed below market price.

The company thinks this offers a fantastic investment opportunity, which, if past cycles are any indication, will extend for another 250 days starting in July.

Bollinger Bands Explained

When examining the SMA (Simple Moving Average), the Bollinger Bands will quickly indicate the market’s direction (the red line in the example). In addition, the Bollinger Bands consist of an upper and a lower Bollinger Band (the blue lines in the example). A squeeze happens when the range of Bollinger Bands is constrained. We might anticipate a very turbulent market when this range is wide.

- SMA shows the direction of the short-term price.

- The more significant the difference between the upper and lower bands, the more Volatility

Tip: Before you decide on a trading strategy, be sure to determine whether or not the market is bearish or bullish. It’s critical to employ the right system for market sentiment. Knowing the market sentiment will also let you know which signals will be helpful and which won’t.

Explore one of the most widely used technical indicators with a Complete Guide for Traders exemplified by Good Crypto Charts.

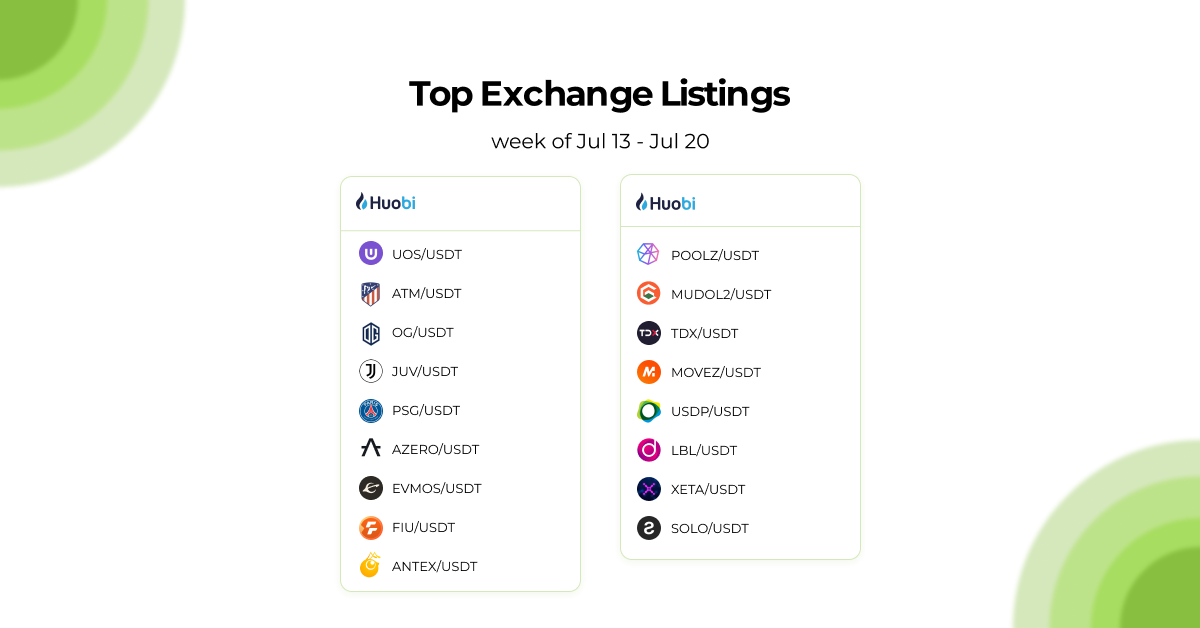

Receive an instant notification when a new coin is listed with the Good Crypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!

Share this post:

July 21, 2022