We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

trader flips $13k into $2m with new memecoin craze

Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want these updates as soon as we post them, follow us on Twitter.

quick weekly news

trader flips $13k into $2m with new memecoin craze

In a stunning display of the memecoin mania, a savvy crypto trader transformed a $13,000 investment into a staggering $2 million in just one hour on April 3. This financial feat was achieved through the purchase of the newly launched memecoin Donotfomoew (MOEW) on decentralized exchanges, with the trader initially buying 499.9 million MOEW tokens using 4 Ether. The token’s value soared shortly after its release, allowing the trader to sell a portion for 99 ETH and retain a significant holding valued at $1.76 million.

MOEW was introduced by Bitget Wallet as a light-hearted experiment to test the influence of memes in the crypto space. Despite the wallet’s cautionary stance, advising against purchasing the token, MOEW’s value surged, reaching a market capitalization of $31 million. Bitget Wallet emphasized that half of the MOEW supply was permanently locked for liquidity provision, while the other half was set aside for airdrop distribution, ensuring the wallet retained none.

The broader memecoin landscape continues to thrive, with both established coins like Dogecoin and Shiba Inu, as well as newcomers on the Solana and Base blockchains, experiencing significant value increases. This trend is exemplified by the Jeo Boden token, a parody memecoin on Solana, which has hit a $250 million market cap. Additionally, a memecoin associated with Taiwanese celebrity Machi Big Brother saw dramatic price movements following a $40 million presale, highlighting the ongoing bull market’s appetite for such assets.

BIS, central banks launch “Project Agora” for CBDC and tokenization

The Bank for International Settlements (BIS) has joined forces with seven central banks, including those from France, Japan, South Korea, Mexico, Switzerland, the UK, and the US Federal Reserve, to investigate the potential of asset tokenization in the financial system. The collaboration, known as “Project Agora,” aims to develop a centralized platform that leverages a unified ledger to facilitate cross-border payments and transfers using tokenized forms of both commercial bank deposits and central bank money. The project promises to address current inefficiencies in international payments, which are often hampered by varying legal, regulatory, and technical standards.

“Project Agora” will explore the use of smart contracts and programmability within the existing two-tier monetary system to enhance its functionality. BIS has indicated that the initiative will involve a significant public-private partnership, with forthcoming guidelines for private banks to participate. BIS’ economic adviser, Hyun Song Shin, highlighted the benefits of tokenization in maintaining accurate records and enforcing transfer rules within a central bank’s framework. Cecilia Skingsley, head of the BIS Innovation Hub, also emphasized the goal of creating a common payment infrastructure that ensures compatibility across different payment systems, ledgers, and digital currencies.

The BIS has been actively engaging with the latest developments in cryptocurrency and financial centralization. Recently, the BIS Innovation Hub announced six new projects focused on cybersecurity, anti-financial crime measures, central bank digital currencies (CBDCs), and green finance.

Wormhole airdrop chaos: scams and spoofs emerge

Wormhole, a cross-chain bridge platform, recently conducted an airdrop of its W tokens valued at over $800 million, which quickly attracted scammers and spoof tokens. The event, which aimed to distribute tokens to select users, was marred by fraudulent accounts and malicious links, including those from hacked profiles like that of Wormhole founder Robinson Burkey. The airdrop was part of a larger strategy to launch the W token, which started trading at $1.66 and reached a market cap of nearly $3 billion.

The W token’s value has since dipped by 19.5%, trading at around $1.34. Despite this, the airdrop’s total value remains significant, with 674 million tokens allocated for the event based on the protocol’s eligibility criteria. Currently, the W token is available on the Solana network, with plans to expand to the Ethereum network as an ERC-20 token and other layer-2 networks in the future.

The hype around the Wormhole airdrop also gave rise to a parody memecoin called “warmhole,” which saw its value skyrocket from $100,000 to $8.3 million in less than six hours – an 83,000% increase. This phenomenon underscores the volatile and often whimsical nature of the crypto market, where even joke coins can achieve substantial valuations in a short period.

$2b Silk Road Bitcoin shifted by DOJ

Approximately $2 billion worth of Bitcoin, previously confiscated by the U.S. Department of Justice (DOJ) in connection with the Silk Road online marketplace, has been transferred to a new wallet. The initial movement involved a small test transaction to a Coinbase Prime address, followed by a significant transfer of 30,174 BTC. This Bitcoin was part of the assets seized from James Zhong, who was found guilty in 2022 of wire fraud for illegally acquiring Bitcoin from Silk Road.

Zhong had appropriated over 50,000 BTC from Silk Road back in 2012, and during a 2021 raid on his residence, U.S. officials uncovered hardware wallets with the stolen Bitcoin, including one ingeniously hidden within a popcorn tin. The majority of the confiscated cryptocurrency was moved to the wallet that executed the large transaction on April 2, 2023.

This latest transaction comes after the U.S. government reported the sale of about 9,861 BTC from Zhong’s seized assets for over $215 million in March 2023, leaving an estimated 40,000 BTC still in their possession. The transfer occurred amidst a market downturn, with Bitcoin’s price falling over 7% to $65,475. The Silk Road marketplace, which facilitated the trade of illegal goods and was shut down over a decade ago, led to the arrest and life imprisonment of its founder, Ross Ulbricht, in 2013.

downtrend and uptrend Fibonacci retracement strategy

Fibonacci retracement is a key technical tool used by traders to predict future price levels by identifying potential support and resistance points. It’s based on the idea that markets move in predictable patterns, retracing a portion of their gains before continuing in the original direction.

Here’s how to apply it:

🔝 In an uptrend, attach the Fibonacci tool to the swing low and drag it to the swing high.

🔻 For a downtrend, reverse the process – start from the swing high and pull down to the swing low.

Take the MATIC/USD chart, for instance. By drawing Fibonacci lines from the low to the high, we spot a potential long position if the price breaks the 0.382 level ($2.4). The aim? A 9% gain at the 0.236 Fib level ($2.6). Set a stop loss just below the 0.382 level (-1.5%) to protect your trade.

Flip the script for downtrends to find strategic short-selling and buyback levels.

🚀 Check out our comprehensive article on Fibonacci retracement at GoodCrypto and elevate your trading knowledge. Dive into the details and start applying Fibonacci to your trading strategy today!

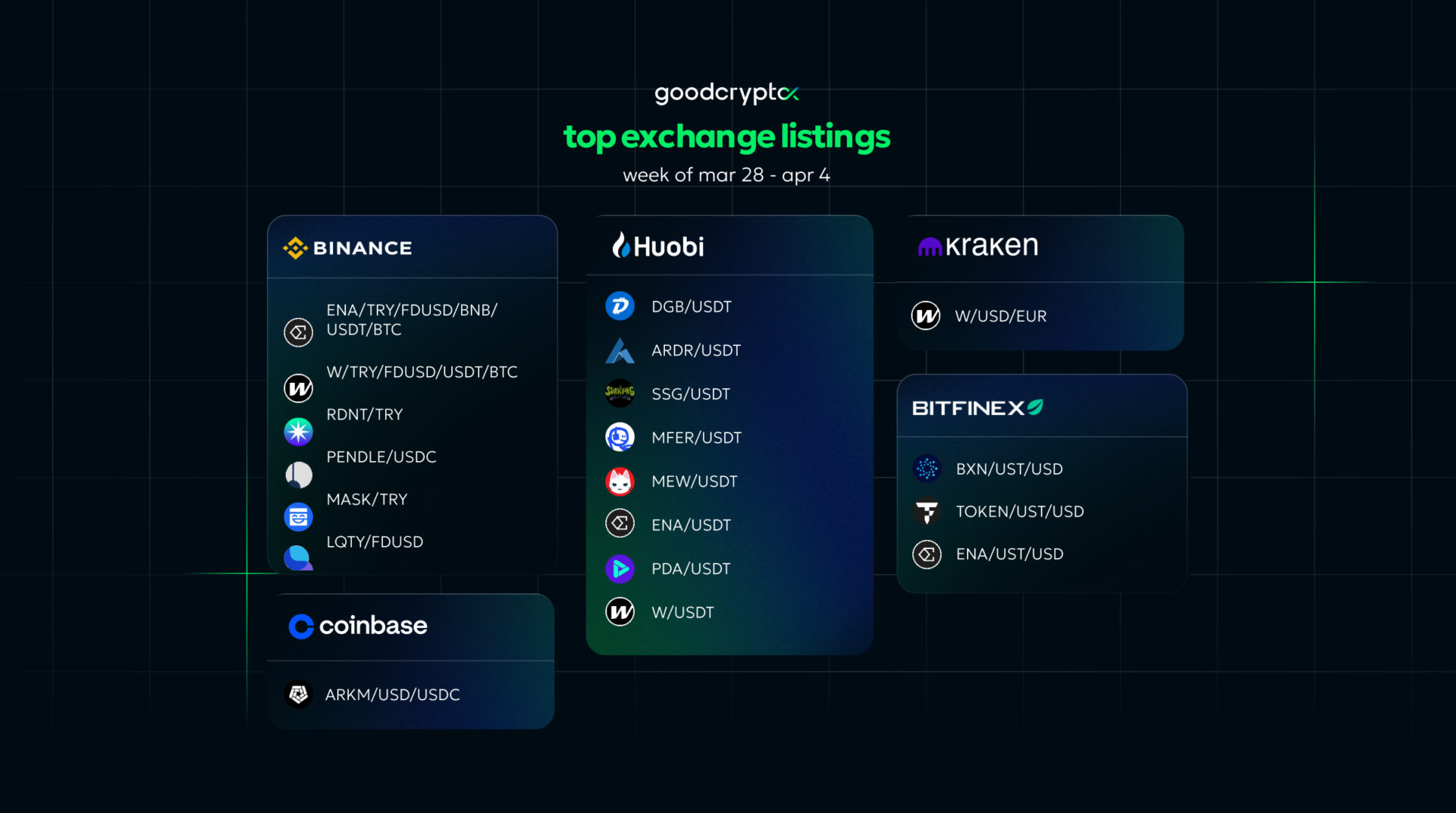

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

April 4, 2024