Discover the power of MEXC with GoodCrypto! Advanced tools like bots, trailing stops, and smart TA signals and TradingView webhooks at your fingertips.

Trailing Stop Loss and Trailing Take Profit Orders Explained

Thriving in the unpredictable realm of crypto trading demands a solid grasp of essential tools and strategies that mitigate risk and maximize profits. Among these, Trailing Stop Loss and Trailing Take Profit orders stand out as secret weapons, ready to fortify your trading endeavors. This article will be your guide to understanding these tools and how they can elevate your trading game.

But first, let’s briefly remind ourselves of what trailing stop orders are and how they work.

What is a Trailing Stop Order?

Whether you’re seeking strategic entry points or aiming to optimize your profit-taking strategy, trailing stops emerge as a valuable tool. They provide you with the ability to ride the market as long as it moves in your favor, allowing you to buy precisely as downtrends reverse and sell once uptrends lose momentum.

This advanced order tracks the crypto market price and features a Stop (order trigger) that trails the market price at a specified distance, known as the Trailing Distance, when it moves in your chosen direction, but remains in place when the price moves in the opposite way. Once the market price touches the Stop threshold, it promptly activates the underlying Market or Limit order, directing it to the exchange for execution. This robust tool empowers traders to optimize their crypto trading strategy and seize every market opportunity that arises. For more in-depth information, check out our detailed guide and discover all the benefits of trading with Trailing Stops via the GoodCrypto app.

In GoodCrypto, you can not only attach Stop Loss and Take Profit orders but also their improved versions: Trailing Stop Loss and Trailing Take Profit orders. Let’s delve deeper into these features.

Trailing Stop Loss Order Explained

Trailing Stop Loss is a dynamic and invaluable order that empowers traders to navigate the volatile crypto trading world with greater confidence. It adjusts with the market price to help you minimize potential losses and protect your hard-earned gains.

When It acts as a Stop Loss it’s aimed at not limiting your upside. As long as the price goes in your direction, your potential accepted losses will keep reducing (actually staying the same): The trailing stop loss order will keep moving the Stop Loss up, making sure that you exit with a profit, which would be higher than with application of traditional (static) stop loss, when the price trend finally reverses.

Let’s delve into how this advanced tool operates.

When initiating a trade, you set an initial stop price, typically a percentage (e.g., 10%) below your entry price. This acts as your safety net, determining the maximum loss you’re willing to accept. As the market moves in your favor, the Trailing Stop Loss order follows a fixed percentage above the asset’s lowest price since you placed the order.

A standout feature of the Trailing Stop Loss is its ability to move along with the market price. As the market price rises, the Trailing Stop Loss adjusts accordingly, maintaining a protective gap between the current market price and your set stop price. This feature safeguards your gains, ensuring your hard-earned profits are preserved even in case of a market reversal.

Example: You bought BTC at $10,000 and set Trailing Stop Loss at 10%. If the market immediately falls 10%, Trailing Stop Loss will sell at $9,000, similarly to a common (static) Stop Loss order. If the market, instead, goes up to $11,111, Trailing Stop Loss will move to $10,000 ($11,111 – 10%).

If the market suddenly shifts against your position, the Trailing Stop Loss remains at the highest price reached. It activates only when the price retraces by the preset Trailing Distance percentage, allowing you to exit the trade with either a profit or a limited loss.

In some scenarios, if the market continues favoring your position, the Trailing Stop Loss may surpass your entry price, becoming a kind of Trailing Take Profit order. If the price retraces and touches this level, the order executes as a Take Profit order, securing your profit instantly.

In summary, Trailing Stop Loss is a versatile tool that empowers you to seize the opportunities presented by trending markets while keeping a protective safety net in place. It’s a balancing act between risk and reward, allowing traders to optimize their profits while mitigating potential losses. Whether you’re an experienced trader or new to the world of cryptocurrencies, the Trailing Stop Loss is a game-changing addition to your trading toolkit.

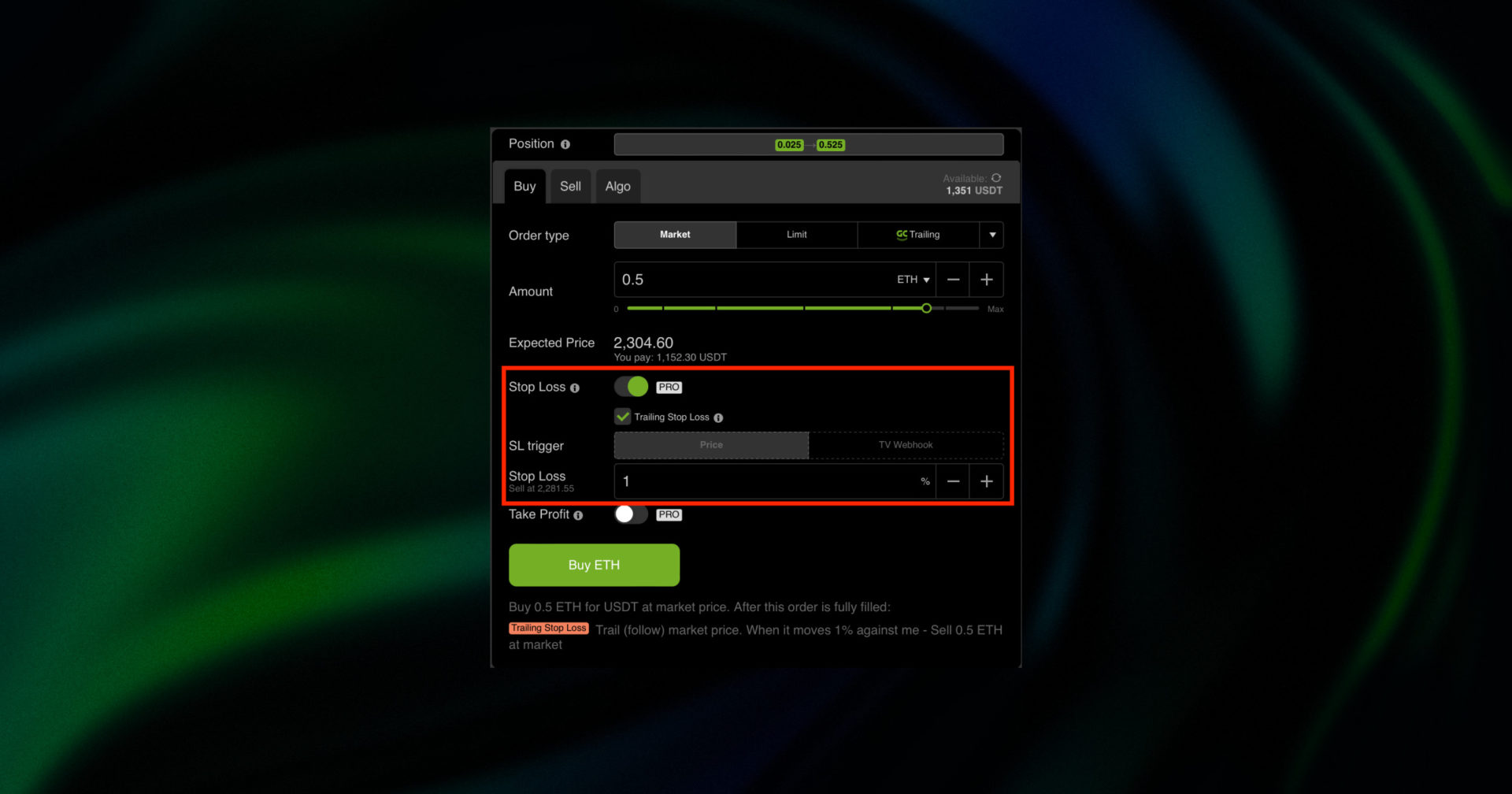

Trailing Stop Loss Settings

Setting up a Trailing Stop Loss order is as easy as setting a regular Stop Loss:

- Simply choose a market Sell/Buy or limit Sell/Buy order.

- Enter the amount of the coin you want to buy or sell, then navigate down to check the Stop Loss toggle.

- Choose the Trailing Stop Loss option instead of the regular Stop Loss, and enter a percentage (e.g., 0.5%) below your entry price.

- Finally, place the order.

If the price moves in your favor, the Trailing Stop Loss will automatically follow it at the chosen percentage distance, potentially improving your exit price. In case the market price moves against you, the Trailing Stop Loss will remain in place.

Let’s now take a look at Trailing Take Profit basics.

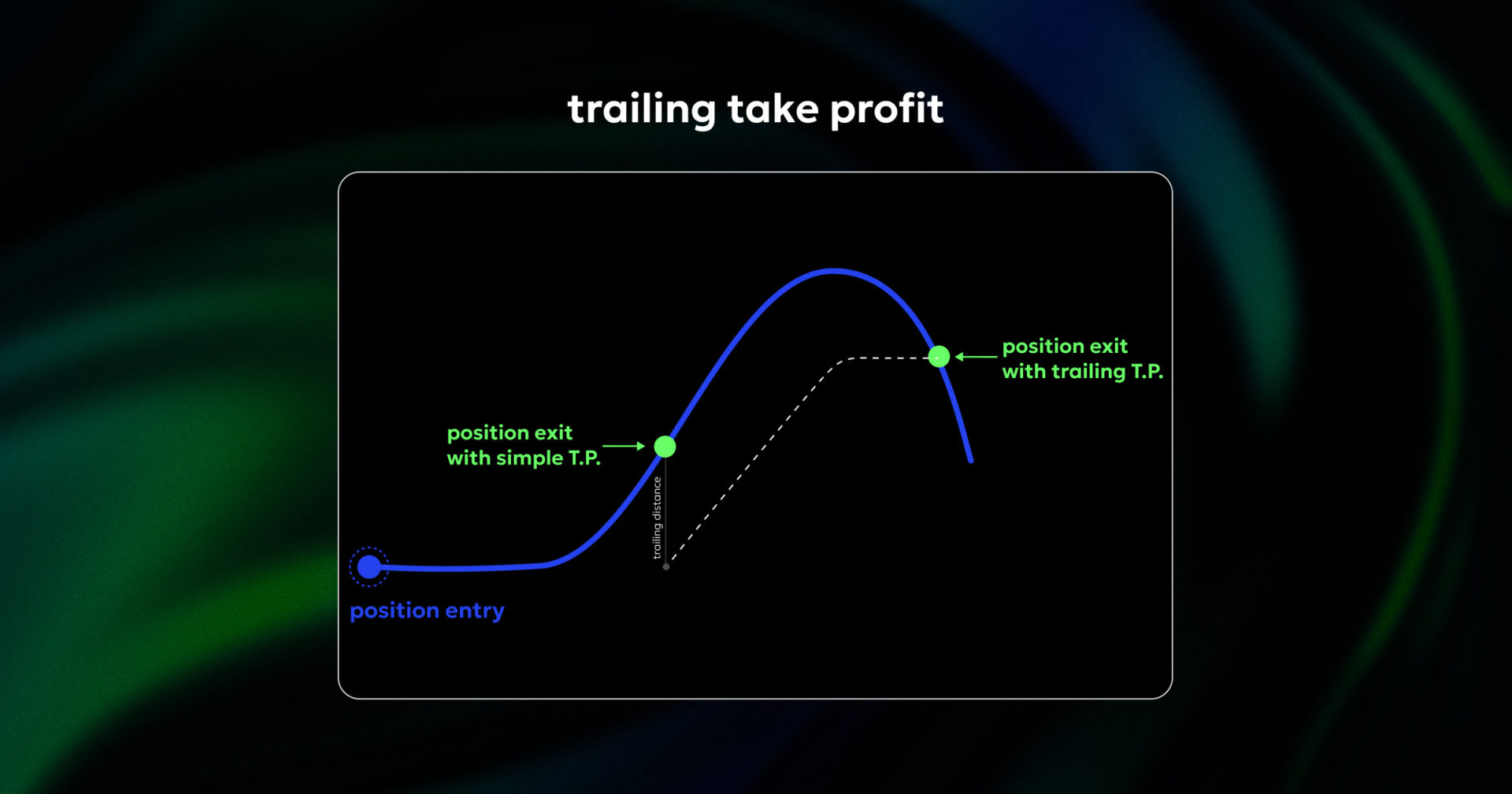

Exploring Trailing Take Profit

Trailing Take Profit is a close cousin of Trailing Stop Loss, and works exactly the same but in reverse. The difference is that Trailing Take Profit will only activate (start trailing) once market price has improved enough to ensure you will at least break even if the price goes against you once Trailing Take Profit activates.

Let’s dive into how this feature works.

Much like its counterpart, Trailing Take Profit begins by setting an initial take profit price, often a percentage (e.g., 10%) above your entry price and Trailing Distance. This serves as the target price at which you aim to lock in your gains. As the market moves favorably, the Trailing Take Profit order adjusts, maintaining a fixed percentage above the asset’s lowest price since the order was placed.

When the market price rises, the Trailing Take Profit order adjusts accordingly. This creates a buffer between the current market price and your desired take profit level, ensuring you capture profits as the market evolves.

Example: You bought BTC at $10,000 and set Trailing Take Profit with a 10% Trailing Distance. Your Trailing Take Profit will activate (start trailing) when the market price rises to $11,111. Its trigger will initially be set at $10,000 ($11,111 – 10%) which also happens to be your breakeven price. When the price goes higher than this 10%, it will be your extra profit that will be fixed only in case of trend reversal and price drop by Trailing Distance (10%).

One of the exceptional advantages of Trailing Take Profit is its flexibility. It allows you to capitalize on favorable price movements without the need for constant manual adjustments to your take profit level. This means that even if you step away from the charts, your profits are well protected.

Just like Trailing Stop Loss, Trailing Take Profit is designed to adapt to ever-changing market conditions. It helps you maintain a profitable position while safeguarding your earnings. Even in the face of a market reversal, the take profit level remains steady, protecting your hard-earned gains.

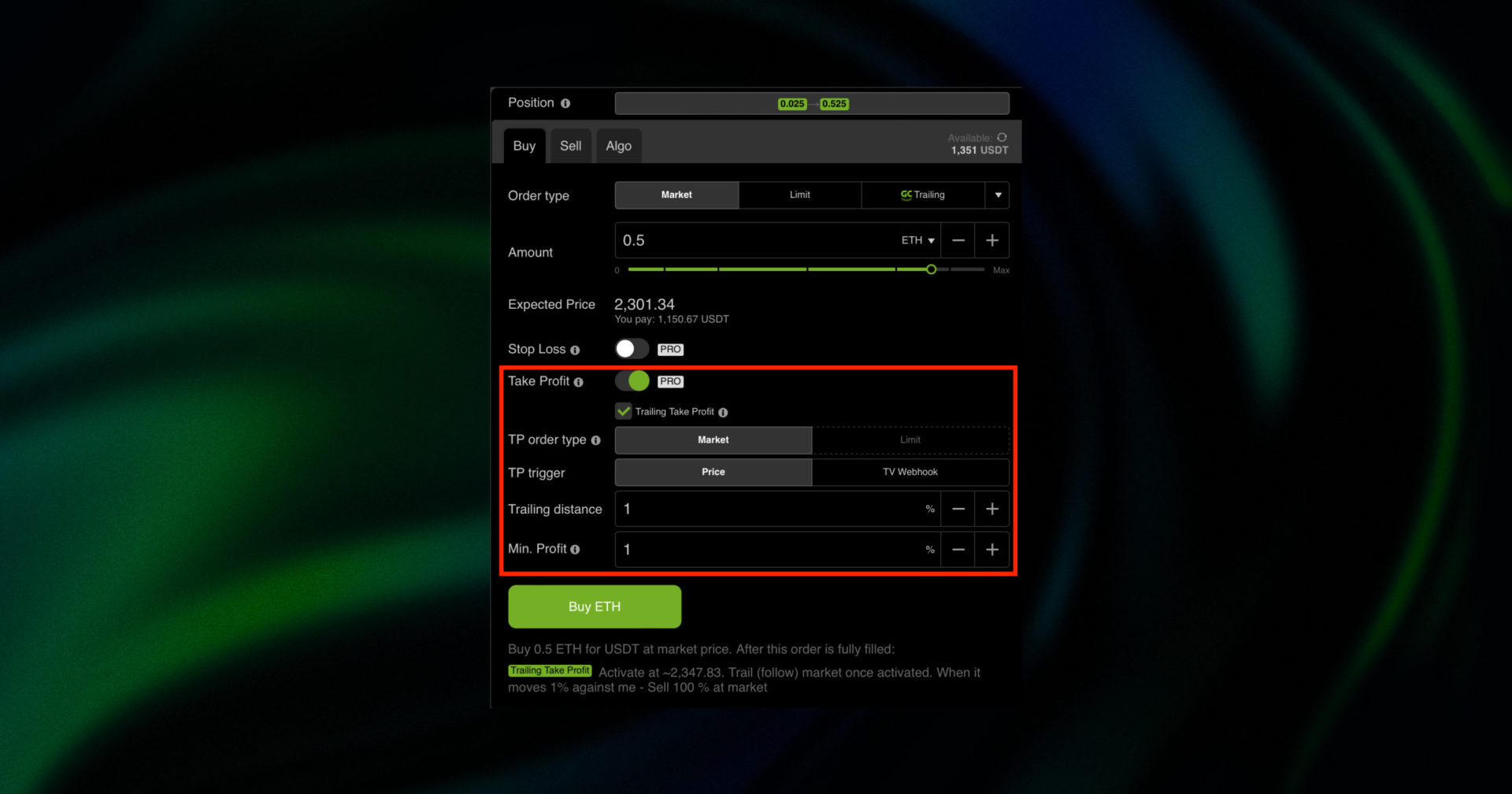

Trailing Take Profit Settings

Similar to setting up a Trailing Stop Loss, configuring Trailing Take Profit is a straightforward process. When initiating a position, navigate to the Take Profit settings. Instead of specifying a regular Take Profit target, opt for the Trailing Take Profit option and enter a percentage (e.g., 0.5%) above your entry price.

You can choose between a Limit or Market order for Trailing Take Profit. A Limit order protects against price slippage and often saves on trading fees, while a Market order doesn’t freeze your balances while waiting for the trigger.

When attached, Trailing Take Profit will dynamically adjust as the market moves in your favor. As the price continues to rise, your profit target will automatically trail along, enabling you to capture additional gains in a trending market.

By default, Trailing Take Profit activates once the market price improves enough to place its trigger at your breakeven price. If you set a min. Profit higher than 0, Trailing Take Profit will wait for further market price improvement to trigger at your chosen min. Profit level.

You can also use Trailing Take Profit and Trailing Stop Loss simultaneously.

Concurrent Trailing Take Profit & Trailing Stop Loss

Traditionally, traders had to choose between a trailing stop loss or a trailing take profit when placing an order. With the innovative features offered by the GoodCrypto app, traders can now harness the power of both concurrently. However, it’s worth noting that the addition of Trailing Stop Loss is only available when a Market order is chosen for Trailing Take Profit.

In our video walkthrough, you can discover the strategic use of both features for a more dynamic and flexible trading experience. Witness the step-by-step process of launching an order with specific trailing distances and learn how to seamlessly incorporate this advanced tool into your strategy.

Conclusion

In the fast-paced world of cryptocurrency trading, Trailing Stop Loss and Trailing Take Profit orders are indispensable tools that empower traders to navigate the markets with confidence. By understanding how these features work and when to apply them, you can effectively manage risk, lock in profits, and achieve greater success in your trading endeavors. Whether you’re a seasoned trader or a crypto newbie, integrating these dynamic orders into your strategy can make a substantial difference in your trading results.

Get the App. Get Started

Keep your portfolio in your pocket. Trade at any time, from anywhere, on any exchange and get the latest market insight & custom notifications

Share this post:

February 22, 2024