👋 Hey, fellow traders!

Another week, another challenge for crypto HODLers and traders – but why is that? 🤔 Let’s dive into what happened in the industry over the past week and see if there’s any hope for a brighter future ahead! 👇

quick weekly news

“Liberation Day” of America

Nearly 24 hours ago, U.S. President Donald Trump held a multi-hour meeting with top U.S. economists to discuss the implementation of reciprocal tariffs on imports from other countries. He described this as a “Liberation Day” for America and later held a public press conference to announce new tariff rates for nearly every U.S. trade partner.

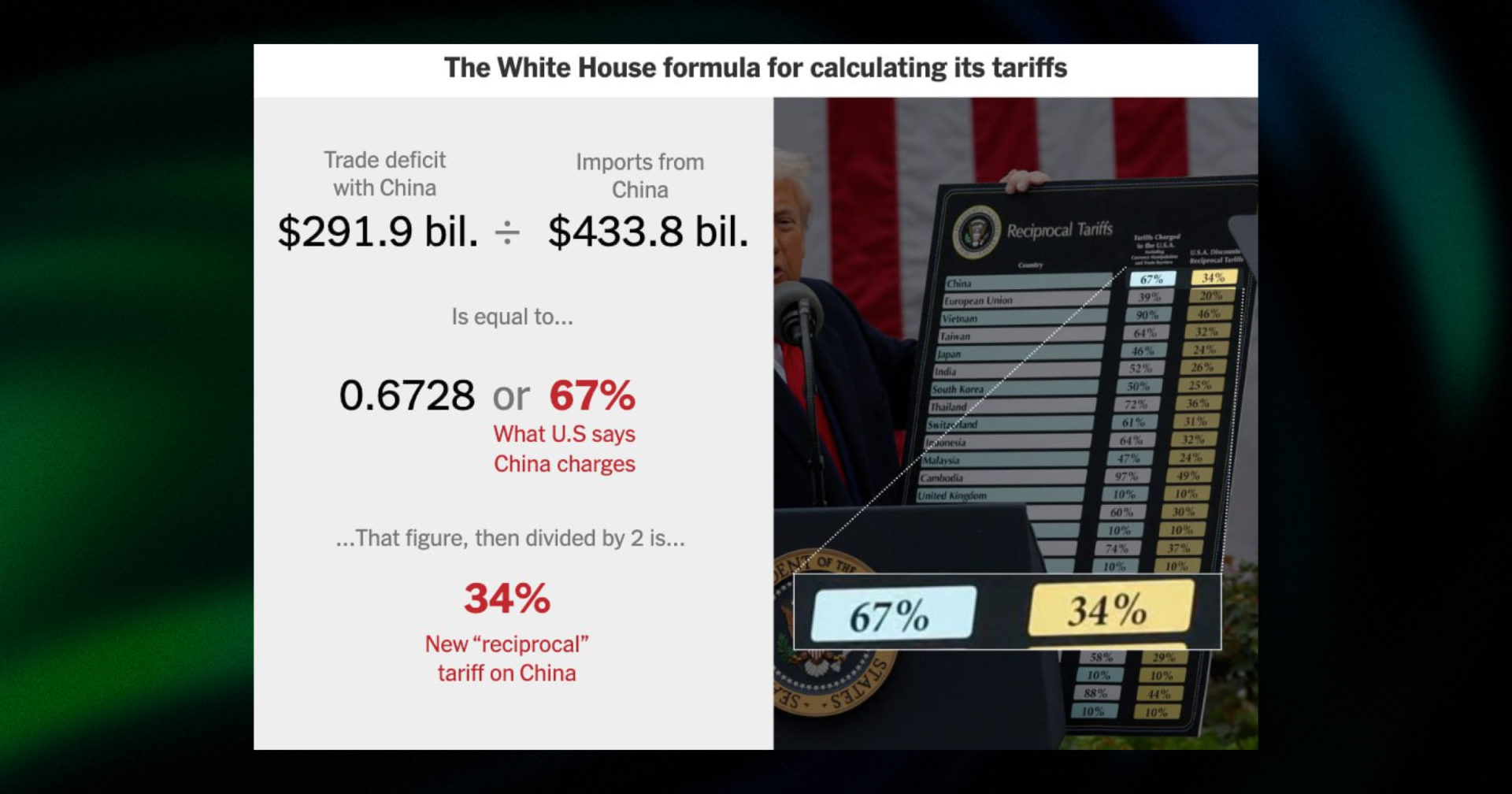

Source: CoinTelegraph

According to Trump, a reciprocal tariffs table was introduced, outlining each country’s tariff rates alongside the corresponding U.S. response. The table covered tariffs for over 50 countries, while those not explicitly mentioned but actively trading with the U.S. would face a base 10% import tariff.

Trump justified the move by citing existing tariffs imposed by other nations, which he claimed have been unfairly exploiting the United States. He also emphasized his goal of bringing manufacturing jobs back to America, stating:

“From 1789 to 1913, we were a tariff-backed nation. The United States was proportionately the wealthiest it has ever been. So wealthy, in fact, that in the 1880s, they established a commission to decide what they were going to do with the vast sums of money they were collecting.”

While Trump framed tariffs as something foreign countries must pay when exporting to the U.S., the real-world impact remains uncertain. Many experts argue that companies are more likely to increase their prices, passing the cost to American consumers, which could fuel inflation rather than generate additional revenue for the U.S. government.

Additionally, the methodology behind the new tariff rates appears questionable. Instead of basing the rates on actual tariffs imposed on American exports, the administration seemingly calculated them based on the U.S. trade deficit, aiming to reduce imports of foreign goods. While this might help shrink the trade deficit, it could also reduce economic activity in the short to mid-term.

The long-term impact remains uncertain, as relocating manufacturing is a multi-year process requiring substantial investment. Businesses need policy consistency before committing to such moves. However, critics argue that the Trump administration’s inconsistent trade policies create uncertainty, making companies hesitant to shift production to the U.S.

Bitcoin price can hit $250K in 2025 if Fed shifts to QE: Arthur Hayes

On the other side of the tariff debate, ex-CEO and co-founder of BitMEX, Arthur Hayes, released a “The BBC” essay, arguing that Bitcoin has a chance of hitting $250K if the FED launches QE (quantitative easing).

In his essay, he explained how Donald Trump’s new trade policies, aimed at reducing the trade deficit, are unlikely to be sufficient to support market growth while significantly driving up inflation. As Arthur Hayes claimed in his post, the FED’s 2% inflation target is unachievable, especially in the current tariff war situation.

Thus, the FED might be forced to soften its monetary policy through quantitative easing, meaning it would purchase U.S. bonds, or, to put it simply, print more money – to prevent severe economic problems in the country. The increasing money supply would likely boost the U.S. stock market and, most importantly, the crypto market, according to Arthur Hayes.

Furthermore, considering Bitcoin’s growing adoption in the U.S., there is a strong possibility that an increased money supply would impact the crypto market – especially if U.S. states introduce a Bitcoin bill aimed at protecting themselves from inflation.

US states keep pushing BTC bills forward

As Bitcoin adoption continues, multiple U.S. states, Alabama, Minnesota, and West Virginia, are taking steps toward integrating BTC into their payment systems and reserves.

Starting with West Virginia, State Senator Chris Rose stated that the state’s Bitcoin reserve is intended to provide greater sovereignty from the federal government and freedom from CBDCs. He also mentioned that a bill he sponsored, introduced in February 2025, would allow the state treasury to invest up to 10% of public funds in precious metals, stablecoins, or any digital asset with a market capitalization of at least $750M over the past 12 months.

With this initiative, the senator aims to establish a solid foundation for Bitcoin adoption in the state while avoiding memecoins and alleviating concerns among those unfamiliar with digital assets.

Meanwhile, Alabama and Minnesota are also advancing bills to establish Bitcoin reserves. According to BitcoinLaw, these states have become the 25th and 26th to join the Bitcoin adoption race, which is currently led by Arizona.

FDUSD stablecoin depegs following insolvency claims by Justin Sun

Finally, it’s worth mentioning the recent $FDUSD depeg.

Yesterday, on April 3rd, 2025, Tron and HTX CEO Justin Sun claimed on X that First Digital Trust (FDT), the Binance-backed issuer of $FDUSD stablecoin, is “insolvent and unable to fulfill client fund redemptions.” He alleged that multiple loopholes exist in the company’s internal risk management, financial system, and trust licensing, making it a dangerous investment.

Shortly after the announcement, $FDUSD depegged from its original $1 price, dropping nearly 10% to $0.91 per $FDUSD. This led to a $200B loss in its pre-post market capitalization. However, the price eventually recovered to its normal 1:1 peg with the U.S. dollar.

In response, First Digital Trust took to social media, denying Justin Sun’s allegations and calling them “completely false.” The company reassured users that every $FDUSD is fully backed by U.S. Treasury bills, stating:

“The exact ISIN numbers of all reserves backing FDUSD are set out in our attestation report and clearly accounted for.”

Additionally, First Digital Trust now plans to take legal action against Sun for his claims, stating:

“This is a typical Justin Sun smear campaign aimed at attacking a competitor to his business.”

how to trade with trend lines by GoodCrypto

📈 A trend line connects swing highs and lows, showing market direction and key price levels. Acting as a floor or ceiling for price movement, it helps you spot support, resistance, and breakout opportunities to level up your trades.

How to draw a trend line:

🔸 A valid trend line must connect at least two swing highs or lows, with more touches making it stronger;

🔸 Trend lines should be drawn based only on closed candles, not wicks;

🔸 The trend line should never pass through a candle body, ensuring it stays accurate.

Now that you understand how to draw the right trend lines, isn’t it time to put them into practice? We got you on this one. Check out our fully detailed guide on how to take advantage of trend lines by GoodCrypto. 💪

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!