We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

Trump delays some tarrifs. White House to hold crypto summit on March 7

👋 Hey there!

Despite the negative sentiment coming from the previous month, the market finally has brought us some green candles this week. Let’s explore what happened and try to understand why 👇

quick weekly news

Trump’s White House crypto summit scheduled for March 7

Despite highly negative sentiment and FUD in the crypto market caused by U.S. trade wars and new tariff announcements, this weekend brought news of the imminent creation of a U.S. strategic crypto fund, which will include Bitcoin, Ethereum, Solana, Cardano, and XRP. This significantly pumped up the markets, yet they returned to their starting point within 24 hours.

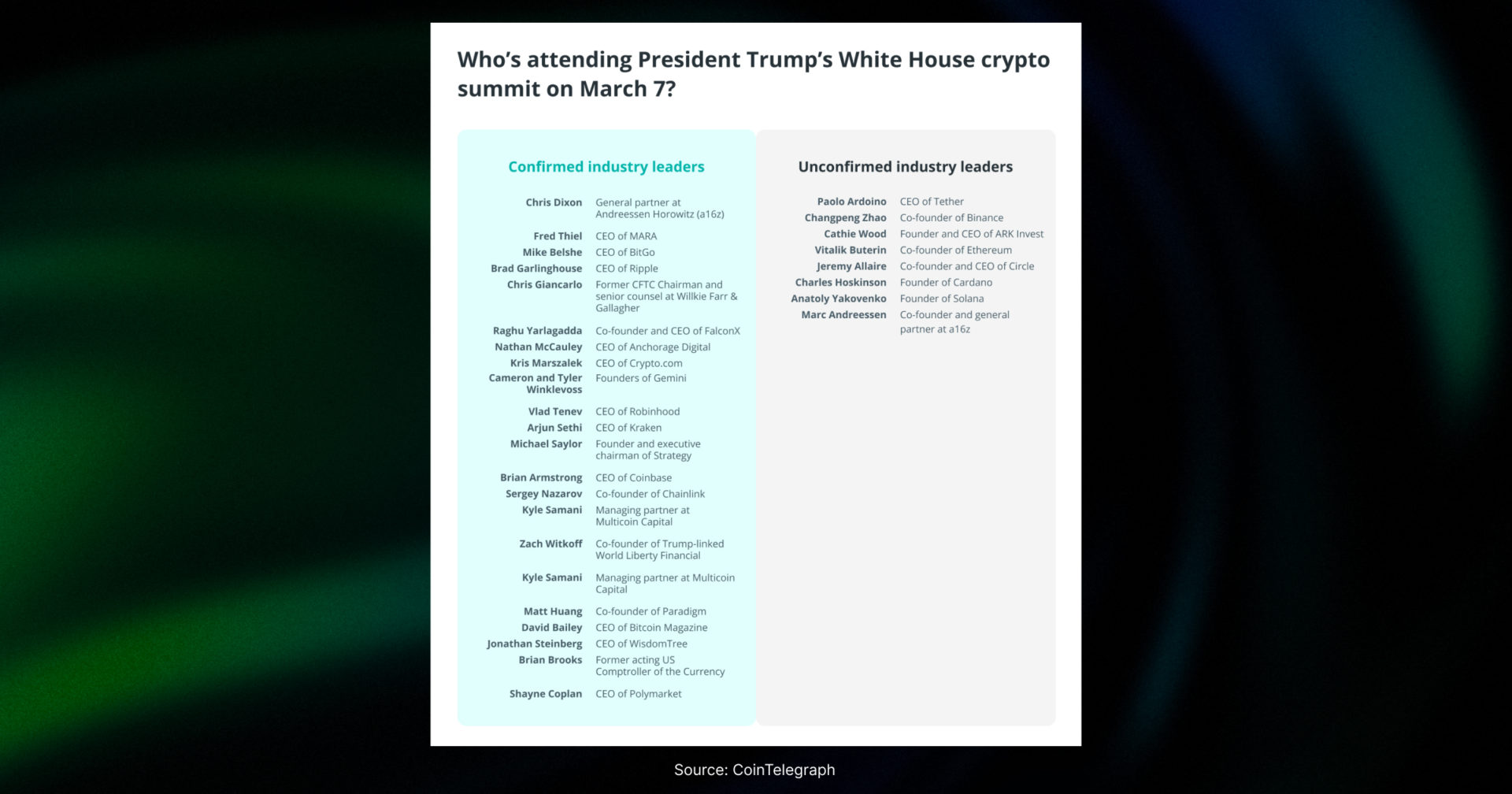

Nevertheless, following such announcements, the crypto community has been paying special attention to the upcoming crypto summit scheduled for March 7, where we will most likely see details about the U.S. strategic crypto fund from Donald Trump. Trump’s Commerce Secretary, Howard Lutnick confirmed details about the strategic crypto reserve will likely be shared after the meeting. He also noted that Bitcoin will likely hold a special place in the strategic crypto reserve and will significantly dominate over other assets.

According to Fox Business reporter Eleanor Terrett, over 25 participants, including members of the Presidential Working Group on Digital Assets, will be attending this roundtable.

Source: CoinTelegraph

The most notable confirmed participants include Michael Saylor – Executive Chairman of MicroStrategy, Brad Garlinghouse – CEO of Ripple, Brian Armstrong – CEO of Coinbas, and Sergey Nazarov – CEO of Chainlink. Meanwhile, the crypto community expects to see the founders of Solana, Cardano, and Ethereum in attendance, as all these projects were mentioned by Trump during his crypto fund announcement.

US trade war update

What’s more, there have been some positive developments on the tariff front, as Donald Trump announced a one-month delay on auto tariffs from Canada and Mexico. This potentially provided temporary relief to the crypto market, as such a tariff pause is less likely to have a severe impact on inflation compared to immediate auto tariffs.

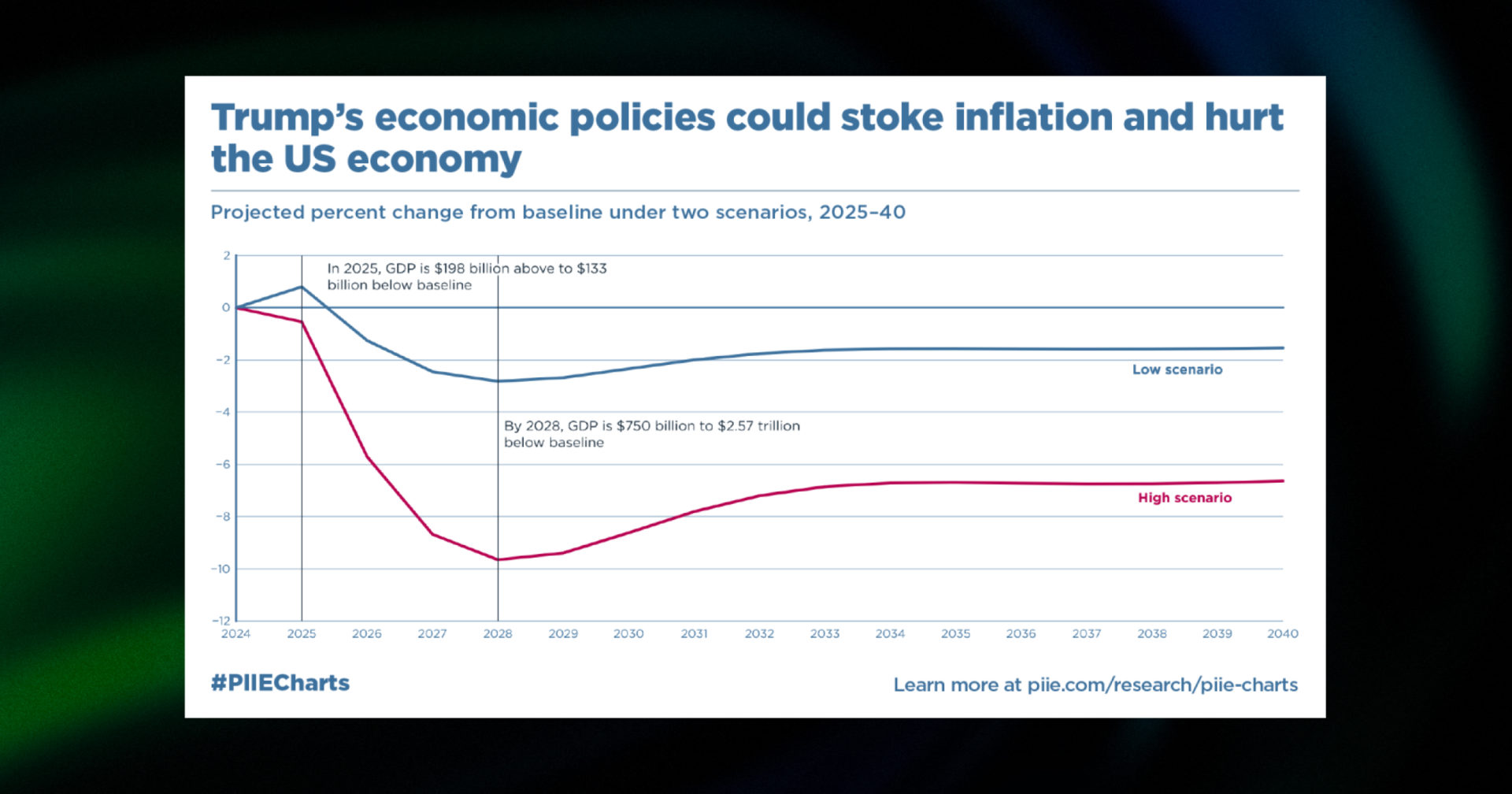

From an investor’s perspective, tariffs are generally seen as a negative factor in the short term, as they lead to rising prices and, subsequently, higher inflation in the country imposing them. Additionally, tariffs often trigger retaliatory measures from other nations. For example, Canada, a longtime ally of the U.S., has already introduced tariffs on $155B worth of imported goods and has stated that it will not reverse these measures until the U.S. removes all of its tariffs.

Rising tensions between the U.S. and its former allies and economic partners including Canada, Mexico, the EU, and potentially South Korea and Japan, which Trump also mentioned in his speech yesterday – are creating uncertainty in both the U.S. financial markets and the broader crypto market. Interestingly, tariffs and trade wars are also expected to impact U.S. GDP growth. According to the Peterson Institute for International Economics, GDP growth could decline by anywhere from $750B to $2.57T from the baseline by 2028 due to the tariffs.

Source: PIIE Charts

Nevertheless, the real impact of tariffs on inflation and GDP growth in the U.S. will only become evident sometime after their implementation.

Bitwise files to list a spot Aptos ETF

On March 5, crypto asset manager Bitwise filed an S-1 registration statement to list the Bitwise Aptos ETF, though there is still no information on where it will be listed. According to the filing, the ETF won’t include PoS staking, similar to filings for other L1 blockchain token ETFs like Solana and Ethereum. Additionally, Coinbase Custody will serve as the custodian for the Aptos ETF.

The filing was also spotted and confirmed by Aptos Labs itself, as it mentioned Bitwise on its X account. However, to further facilitate the approval process for the Bitwise Aptos ETF, the asset manager must also file a 19b-4 form to start the 240-day clock for the SEC to review the filing and announce its decision.

For context, Bitwise has been familiar with the Aptos token for quite some time, having already launched an Aptos Staking ETP on Switzerland’s SIX Swiss Exchange in November. The main reason for the growing attention toward Aptos is its initial reputation as a “Solana killer” when it launched. The Aptos blockchain aimed to outperform the current “Ethereum killer,” Solana, by offering even cheaper and faster transactions. Nevertheless, Aptos currently ranks only 36th in total crypto market capitalization, making it just one-nineteenth the size of Solana.

Mt. Gox wallet moves $1B Bitcoin amid market volatility

On March 6, blockchain monitoring platform Arkham Intelligence stated on X that the Mt. Gox crypto exchange had started moving 12,000 $BTC, worth nearly $1B. This marks the first transaction from Mt. Gox wallets in a month, with the only other significant movement occurring in December 2024, when the exchange transferred nearly 25,620 $BTC.

For context, Mt. Gox, a Japanese crypto exchange that went bankrupt in February 2014, announced the start of repayments to its users a decade after the infamous hack. This triggered massive FUD in the market, as many investors expected Mt. Gox users to sell their refunded Bitcoin, which had significantly appreciated in value over the last decade.

Originally, Mt. Gox set a repayment distribution deadline for October 2024 but later pushed it back by a year, now setting it for October 2025. Since August 2024, the exchange has repaid nearly $3B worth of BTC, with approximately $5.8B still remaining to be distributed. A new round of repayments from Mt. Gox could trigger another wave of FUD in the Bitcoin market, adding to the already negative sentiment caused by U.S. trade wars and tariffs.

However, this time, the impact of such news may be reduced, as a portion of the assets has already been distributed to former Mt. Gox users – nearly 34% of the total amount to be repaid. Additionally, the market capitalization of $BTC has nearly doubled since the repayment plans were first announced.

master DEX trading with our DCA bot video series

💎 The long-awaited DEX DCA bot has finally arrived and we are proud to be the first to bring the DCA bot on-chain. Check out our three-parted video review and discover:

🔸 Part 1: Key advantages of DEX DCA bot over CEXs;

🔸 Part 2: Step-by-step setup guide for configuring your bot;

🔸 Part 3: Comprehensive breakdown of a live DCA bot in action.

👍 Drop a like and subscribe, so we’ll keep bringing you even more valuable videos to level up your trading game! 👇

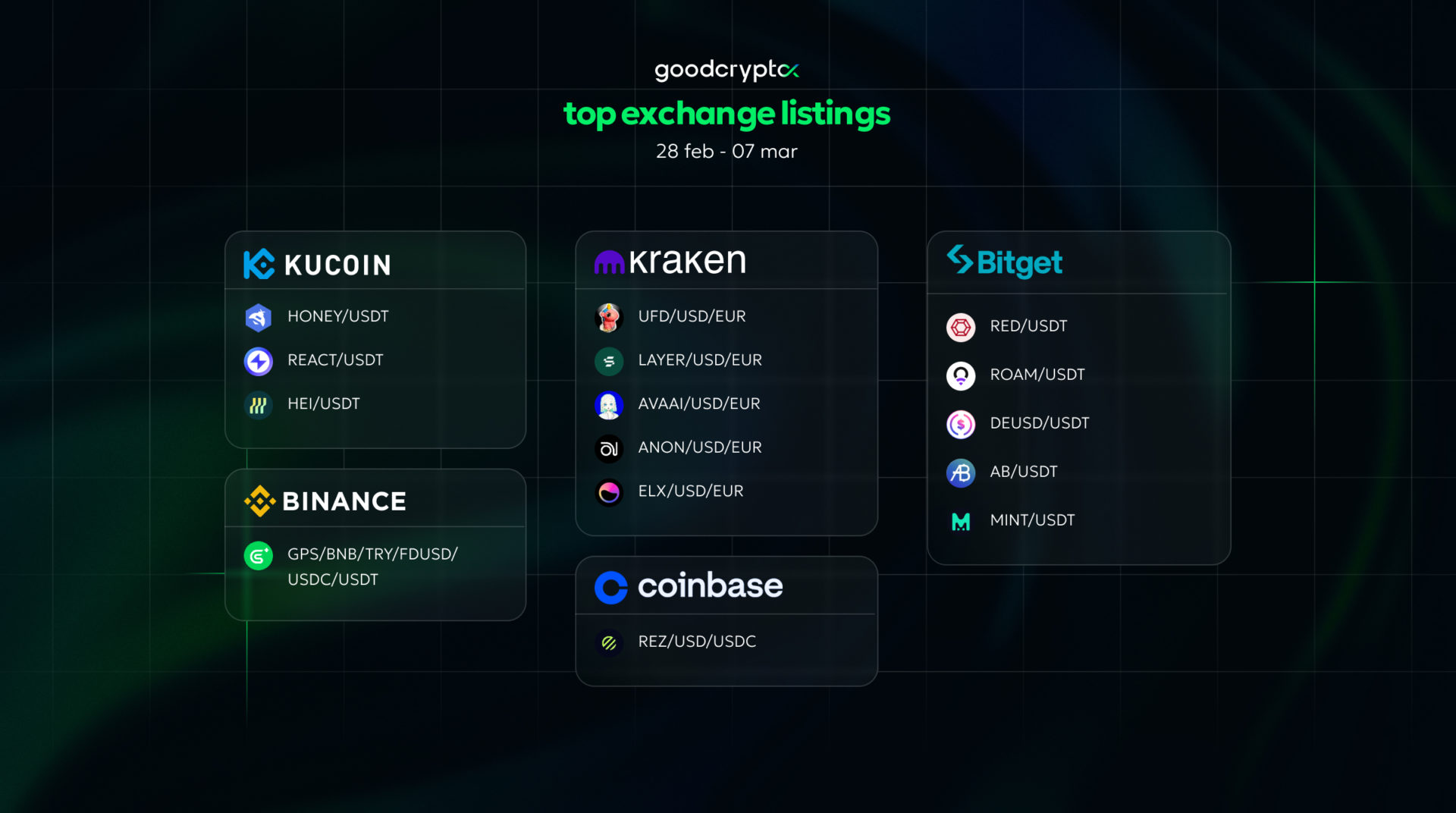

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

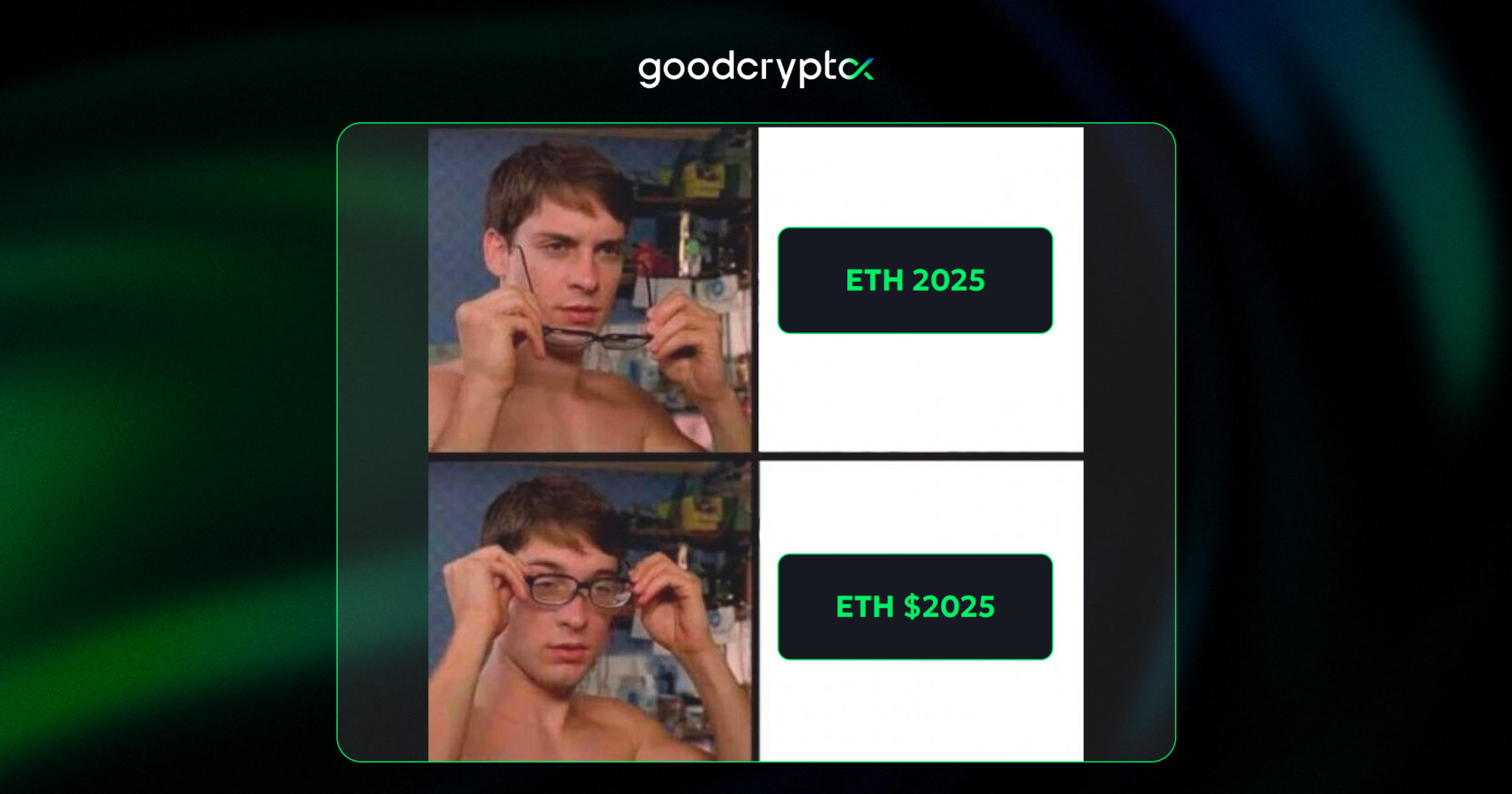

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

March 7, 2025