We’re proud to be the first to launch a DCA bot for DEXs! Enjoy the same DCA trading experience you’re used to on CEXs but with no technical limitations.

U.S. makes progress in trade war negotiations. FED holds rates steady despite Trump’s demand

Hello there! 👋

The crypto market continues to delight with a steady recovery, but what drove prices higher this week? Let’s find out in this weekly digest 👇

quick weekly news

U.S. makes progress in trade war negotiations

The main reason the markets showed signs of life this week was progress in trade war talks between the U.S., China, and the UK.

Starting with the UK, President Trump posted on Truth Social that the U.S. is set to sign a trade deal with the United Kingdom, which he described as the “first of many.” While details are not yet available, he claimed it would be a “major trade deal.”

On the same day, the BBC reported that China and the U.S. are scheduled to hold trade war talks in Switzerland from May 9 to 12. Chinese Vice Premier He Lifeng will represent China, while U.S. Treasury Secretary Scott Bessent and U.S. Trade Representative (USTR) Jamieson Greer will represent Washington.

“My sense is that this will be about de-escalation, not a big trade deal. But we’ve got to de-escalate before we can move forward,” Scott Bessent said in a recent Fox News interview. This is certainly a positive sign, as the U.S. is currently imposing 145% tariffs on all goods from China, while China has set 125% tariffs on U.S. products.

At these levels, such high tariffs make it nearly impossible for companies in either country to export their goods. In effect, this has halted nearly all trade between the world’s two largest economies.

FED holds rates steady despite Trump’s demand

However, until Trump’s tariff situation fully cools off, economists are preparing for worst-case scenarios in the U.S. economy. As a result, during yesterday’s Federal Reserve monetary policy meeting, Jerome Powell announced that interest rates will remain unchanged.

The main reason behind this decision is the potential consequences U.S. markets could face in the coming months due to the ongoing tariff situation. Powell stated that inflation “has come down a great deal but has been running above our 2% longer-term objective.” Typically, even without reaching the exact target, most central banks would begin gradually lowering rates. However, due to the risk of a potential inflation spike in the near future, the Fed is exercising caution.

He also noted that households and businesses have shown a “sharp decline in sentiment” as a result of the Trump tariffs.

Still, Powell emphasized that “despite heightened uncertainty, the economy is still in a solid position,” which is why he currently sees no reason to cut rates. Nevertheless, he added that if the economic situation deteriorates rapidly, he may reconsider the Fed’s interest rate policy.

Arizona and Texas to form crypto reserves

Meanwhile, U.S. states are taking another step forward in crypto adoption.

On May 7, Arizona Governor Katie Hobbs signed House Bill 2749 into law, allowing the state to claim ownership of abandoned digital assets. A wallet will be considered unclaimed if the owner fails to respond to communications for three years. The confiscated assets will be transferred to the Bitcoin and Digital Asset Reserve Fund, and the state’s custodians will be permitted to stake the crypto to earn rewards or even receive airdrops.

At the same time, a Texas House Committee has passed a bill to establish a Bitcoin reserve, which now awaits a full floor vote before heading to the governor’s desk. Senate Bill 21 (SB 21) proposes the creation of the “Texas Strategic Bitcoin Reserve,” to be managed by the state’s comptroller, Glenn Hegar. He would be authorized to invest in digital assets with a market capitalization of at least $500 billion over the past twelve months. Currently, Bitcoin is the only cryptocurrency that meets this criterion.

Ethereum launches Pectra upgrade

On March 7th, 2025, Ethereum developers launched the long-awaited Pectra update on mainnet. The main improvements focused on enhancing the network’s user experience, reducing Layer 2 (L2) fee costs, and increasing the scalability of the Layer 1 (L1) chain. Here are some of the most notable changes:

- Transaction fee flexibility: According to Nexo’s description of the Pectra update, users can now pay gas fees not only in $ETH but also in other assets such as $USDT.

- Transaction batching: Ethereum can now execute multiple transactions in batches, improving efficiency.

- Signing multiple transactions: Users can now sign multiple transactions at once. However, this feature has raised concerns about the potential impact on wallet security.

- Doubling blob count for L2s: The Ethereum chain has increased the blob limit for L2s from 3 (target) and 6 (max) to 6 and 9 per block. This change is expected to reduce fees and improve processing speed for Layer 2 users.

- Extended staking period: The staking withdrawal deadline has been extended from 2032 to 2048.

Despite these advancements, Ethereum hasn’t seen significant price growth following the Pectra mainnet launch. The long-term impact of the update on the $ETH token remains uncertain. To be fair, last year’s Dencun update also aimed to optimize L2 scalability, but it ultimately contributed to a decline in Ethereum’s market capitalization and on-chain liquidity, as more users migrated to L2s.

bollinger bands: a complete guide for traders by GoodCrypto

📈 Bollinger Bands are a volatility-based technical indicator that helps traders identify market conditions, trend strength, and potential breakout zones. Built from a moving average and standard deviations, they offer a dynamic range to read price action effectively.

How to read BB like a pro:

🔸 Price hits upper band: means strong uptrend or potential overbought condition;

🔸 Price hits lower band: can signal a strong downtrend or a potential oversold condition;

🔸 Bands contract (squeeze): this scenario suggests that volatility is low and a breakout may be coming.

🔥 Markets are getting “back on track”, but so do volatility and unexpected shakeouts. Master Bollinger Bands with the ultimate guide by GoodCrypto and be one step ahead of the market conditions. 🚀

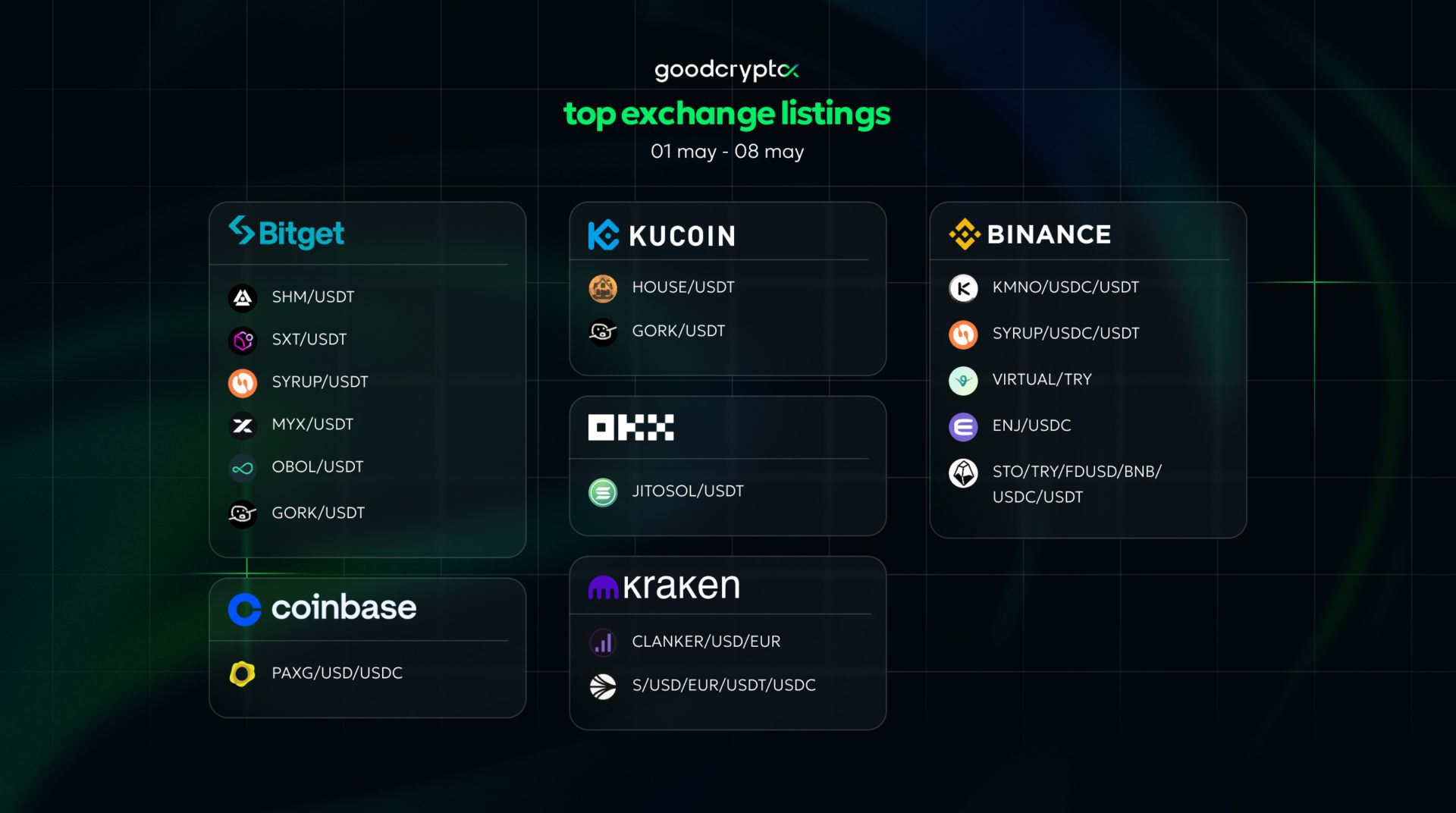

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto app!

Share this post:

May 8, 2025