Hi there! Welcome to the weekly digest brought to you by the Good Crypto team. We know how important it is to be well-informed about the latest developments in the niche, so we have brought together the past week’s most exciting events. Below you will find the hottest news, the newest exchange listings, and even a meme to cheer you up. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Updated node software with Taproot support from the Bitcoin Lightning Network developer

Lightning Labs created the Lightning Network (LN). They also published a beta version of the Lightning Network Daemon (lnd), a fully functional implementation of the LN node that now includes support for the most recent protocol updates, such as Taproot and Musig2, among other enhancements.

The lnd software component manages several functions for the LN, including database management, payment invoice generation, and payment revocation, to mention a few. The most recent software version, lnd 0.15 beta (v0.15-beta), intends to empower developers by utilizing the most recent features of the Bitcoin network to provide solutions for new use cases.

Michael Levin, the product growth lead at Lightning Labs, stated in the announcement that more than 50 contributors helped the firm deliver its first release in 2022, adding that:

“This release gives complete Taproot support for the internal lnd wallet, making it one of the most advanced Taproot wallets today. Further, this release has support for an experimental Musig2 API compliant with the latest BIP draft.”

Anchorage introduces institutional investors to Ethereum staking

San Francisco-based digital platform Anchorage Digital owns the first federally regulated cryptocurrency bank, which will provide institutions the chance to stake Ethereum (ETH). This action anticipates the long-promised switchover of the Ethereum network from the proof-of-work (PoW) protocol to the proof-of-stake (PoS) protocol.

Anchorage declared on Tuesday that it would allow institutions to participate in ETH staking, which involves being compensated for validating transactions on the Ethereum network. Co-founder and president of Anchorage Digital, Diogo Mónica, described staking as advantageous for both the ecosystem and institutional investors:

“By paving the way for institutions to stake their Ethereum, we’re providing heightened legitimacy to market-tested assets–and in the process, eliminating any hot wallet risks for institutions looking to generate new earnings from crypto.”

480 Bitcoin are purchased by MicroStrategy amid a market downturn

Despite of recent setbacks, business analytics company MicroStrategy has increased its holdings in Bitcoin (BTC), reiterating CEO Michael Saylor’s strong perspective on the digital asset.

Microstrategy revealed that it had purchased an additional 480 BTC at an average cost of about $20,817 in a Form 8-K filing with the Securities and Exchange Commission (SEC) of the United States. Additionally, $10 million in cash was used for the entire acquisition.

The most significant corporate Bitcoin holder, MicroStrategy, currently possesses 129,699 BTC due to the acquisition. Its interests are worth around $3.98 billion in total.

Crypto winter ETP is 21Shares’ response to the weak market

In response to the present bear market, 21Shares, a worldwide issuer of cryptocurrency exchange-traded products (ETPs), has introduced investing instruments that are specifically geared at the coming winter. In order to provide low-cost exposure to Bitcoin (BTC) to the recent market sell-off, the business launched the 21Shares Bitcoin Core ETP (CBTC).

With a total expense ratio chosen to mirror the 21 million ceiling on Bitcoin, the physically-backed Bitcoin ETP began trading on the SIX Swiss Exchange on Wednesday. The company claims that CBTC’s ratio is 44 basis points lower than the next-lowest product available.

How to trade based on Moving Averages?

Have you ever used Trailing Stop Order? Maybe you already know all the intricacies of this type of trading. If not, we prepared for you a short but informative video with Trailing Stop Order Basics – https://bit.ly/3ucjAxQ

In this video, you will find explanations of:

✔️ What is Trailing Stop

✔️ Trailing Buy order

✔️ Trailing Sell order

✔️ Trailing Stop basics

You will also become familiar with:

✔️ Launching Trailing Stop Buy on FTX BTC.USD

✔️ Launching Trailing Stop Sell on FTX BTC.USD

✔️ Using Trailing Stop to Enter a position

✔️ Using Trailing Stop to Exit a position

☝️ Follow the link to find a more detailed explanation in our Guide to Trailing Stop Orders – https://bit.ly/3y58DQ0

Make sure to Subscribe GoodCrypto YouTube channel for more crypto trading tips. Hit the 🔔 to be the first who’ll know new hacks!

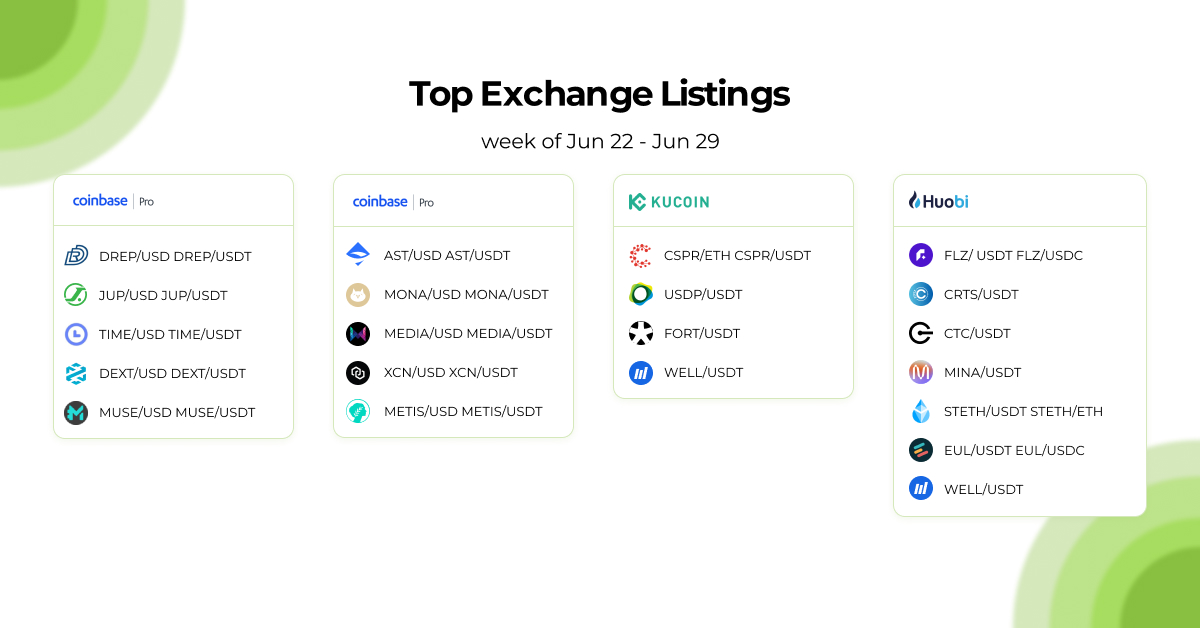

Receive an instant notification when a new coin is listed with the Good Crypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!