Hi there!

We have brought together the past week’s most exciting events in this Good Crypto digest. If you want to get these updates as soon as we post them, follow us on Twitter or Telegram.

Quick weekly news

Tether CTO Paolo Ardoino denies borrowing from Celsius

Paolo Ardoino, the CTO at Tether and Bitfinex, took to Twitter on January 31st to clear the air about Tether’s relationship with Celsius. The tweet was in response to a recent bankruptcy examiner report for Celsius, which mistakenly listed Tether as one of the firms that borrowed from Celsius.

However, according to Ardoino, Tether has “never borrowed from Celsius.” The report mentioned on page 183 that “Celsius’s loans to Tether were twice its credit limit” and that Tether’s exposure grew to over $2 billion, causing concern for Celsius’s risk committee.

Ardoino suggests that there may have been a mix-up in the wording in the examiner report and that it should have read “Celsius loans from Tether” instead of “Celsius loans to Tether.” He called it either a typo or a mischaracterization.

In conclusion, Tether denies any exposure to the troubled Celsius and cleared the air through a Twitter thread started by Financial Times reporter Kadhim Shubber.

Celsius releases a list of users who can withdraw the majority of assets

On Jan. 31, the firm released an official update on upcoming withdrawals, detailing the process and providing a list of users eligible to withdraw approximately 94% of qualified custody assets.

The update came in the form of a 1,411-page court filing with the United States Bankruptcy Court for the Southern District of New York, where the firm outlined the withdrawal process and listed the full names of all eligible users, alongside the type and amount of crypto assets owed to them.

Celsius emphasized that before any withdrawals are processed, eligible users will need to update their accounts with the necessary information related to Anti-Money Laundering and Know Your Customer policies. The firm stated, “Unless and until an eligible user updates his or her account with the required account updates, such eligible user will be unable to withdraw his or her distributable custody assets from the debtors’ platform.”

The cryptocurrency firm also added that the required information for withdrawal includes details about the destination address for the withdrawal. The firm’s move to initiate a withdrawal process for its users comes as a step towards resolving the issue that arose when the firm stopped withdrawals in June 2022.

Apple’s App Store now offers a decentralized Twitter alternative

On January 31, the Damus team announced the approval to its 11,500 Twitter followers, claiming that the Big Tech player had previously rejected it at least three times.

Soon after, Jack Dorsey, co-founder of Twitter and a contributor to Nostr, informed his 6.5 million followers of the development, calling it a “milestone” moment for open-source protocols.

The messaging service is based on Nostr, a decentralized network that, among other things, supports encrypted end-to-end private chat and bills itself as the “social network you control.”

It intends to develop into an uncensored social media network. According to a post from Protos on January 27, it also supports built-in payments using the Bitcoin layer-2 Lightning Network.

The network has no servers. Instead, Nostr broadcasts communications through decentralized relays.

Elon Musk wants to include cryptocurrency in the Twitter payments system

According to two people familiar with Twitter’s intentions, the payments function would initially handle fiat currencies but will be designed to allow cryptocurrencies should the chance arise, the Financial Times reported on January 30.

As part of Musk’s declared goal to turn Twitter into an “everything app,” Twitter has long hinted at introducing payments to the social media network.

However, it still needs to be determined if these payments would use blockchain or crypto tech, even though the Twitter CEO sees cryptocurrency as playing a significant role on Twitter.

What is The Best Time to Day Trade Cryptos

Day trading in crypto involves a trader attempting to benefit from short-term price changes in specific cryptocurrencies, either through buying or selling crypto assets as Contracts for Difference (CFDs). This type of trading is referred to as “intraday,” as all positions must be opened and closed within a single trading day and not carried over to the next. While the crypto market operates 24/7, some brokers restrict trading on weekends. Some brokers offer weekend trading options if you’re a crypto trader looking for greater flexibility.

Don’t miss out on the latest insights and strategies for day trading crypto – read the full article and take your trading to the next level!

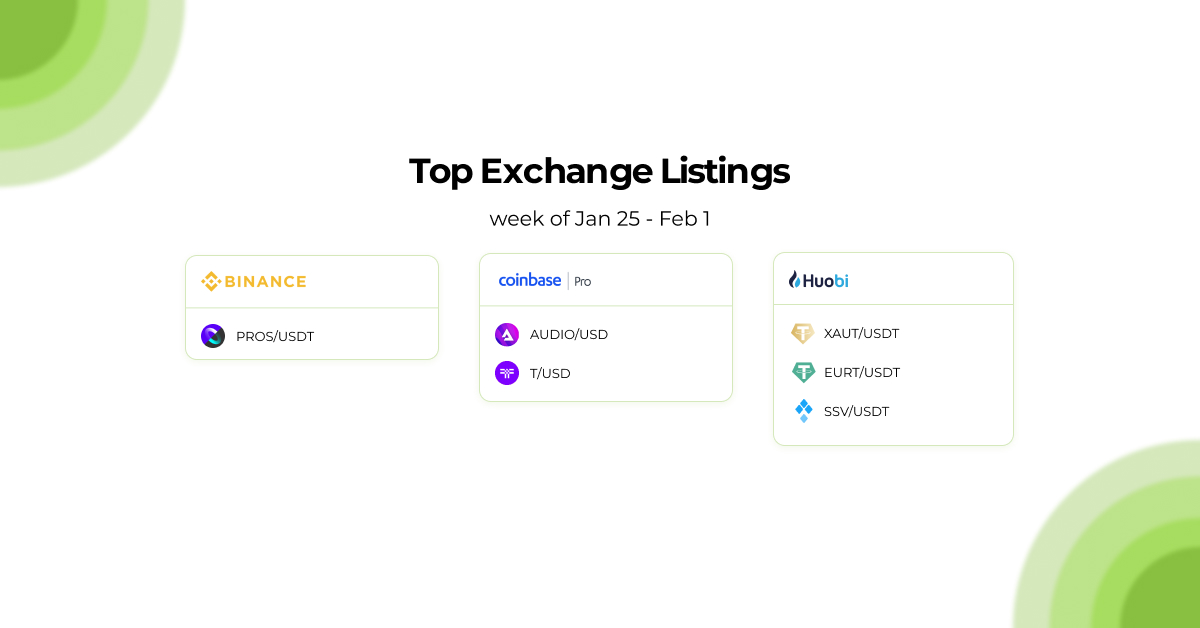

Receive an instant notification when a new coin is listed with GoodCrypto’s PRO plan.

Top Crypto Meme of the Week

We hope this digest was valuable and informative for you! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the Good Crypto App!