Hey fam!

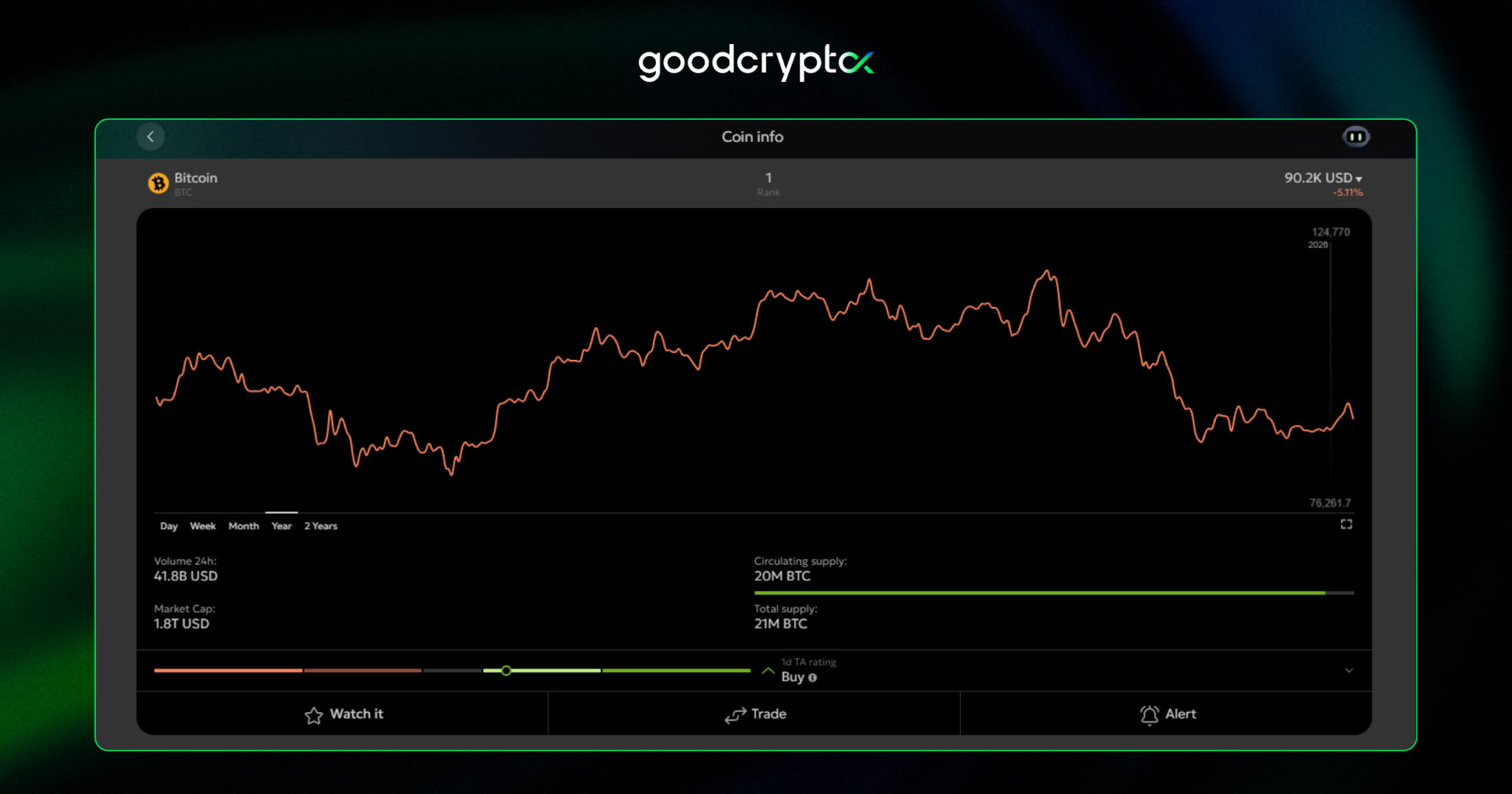

Since the New Year, the crypto market has shown some hope, with numerous positive headlines and green candles. Let’s take a look at what happened over the past seven days:

quick weekly news

Binance taps historic gold rally by launching commodities futures markets

First, the market was excited by Binance’s move into traditional markets, as it announced plans to support TradFi perpetual contracts. According to the blog post, the platform will begin by offering perpetual trading for gold and silver.

The XAU and XAG assets will be tradable in pairs against $USDT, with the platform promising to expand the list of available TradFi perpetual contracts soon. As a result, we can expect not only additional trading pairs for gold and silver but also new traditional assets to be added in the future.

As Jeff Li, VP of Product at Binance, said in an interview with PR Newswire, the integration aims to bridge the gap between crypto and traditional finance by creating new trading opportunities for users. This integration comes shortly after gold ended the year with approximately 67% growth in 2025, reaching a new all-time high near $4,500. By comparison, Bitcoin posted a -3.67% annual performance, while most altcoins declined even further.

MSCI will not exclude DATs from indexes

This week brought a wave of optimism to the Bitcoin market after MSCI unexpectedly decided not to exclude digital asset treasury (DATs) companies from its indexes.

The proposal to remove DATs from MSCI indexes in MSCI’s February 2026 report has been pressuring the market for a while already. Analysts from the BitcoinforCorporations group, which has been campaigning against the proposal, previously warned that excluding such companies could trigger up to $15B in capital outflows, with Strategy expected to be among the most impacted.

However, in a statement released on January 6, MSCI announced that it plans to launch a broader consultation on how non-operating companies should be treated across its indexes. The goal is to ensure consistency and alignment with the overall methodology of MSCI benchmarks. As a result, the index provider has chosen not to exclude digital asset treasury companies for now.

Digital asset treasury firms are companies that accumulate and manage cryptocurrencies, most notably Bitcoin, the largest digital asset by market capitalization. A potential exclusion would have significantly affected Bitcoin-focused treasury companies such as Strategy (formerly MicroStrategy), which regularly purchases BTC as part of its corporate strategy. Reduced index inclusion could have led to lower liquidity inflows into these firms and, by extension, into Bitcoin itself.

Morgan Stanley joins Bitcoin ETF rush

Adding to the positive news around Bitcoin, Morgan Stanley, the largest wealth management firm in the U.S., has filed for a Bitcoin ETF.

In October 2025, the firm updated its policies, allowing its advisors to begin pitching Bitcoin ETFs to clients, and signaling growing internal confidence in BTC as an investable asset. Now, investor demand appears strong and consistent enough for Morgan Stanley to move forward with launching its own ETF.

As Bitwise advisor and former Morgan Stanley analyst Jeff Park noted on X, this development suggests that the Bitcoin ETF market “is MUCH bigger than even crypto professionals anticipated, especially in terms of reaching NEW customers.” He added that there is enough untapped demand for firms to believe that a branded ETF product has clear commercial viability.

Park also highlighted that BlackRock’s Bitcoin ETF became the fastest ETF in history to reach $80B in assets under management, achieving this milestone in just one-fifth of the time it took Vanguard’s VOO, which previously held the record. According to him, this level of interest from both crypto-native and traditional finance investors shows that Bitcoin is not only financially important, but also “socially” important as a product offered to clients.

According to DefiLlama, since the launch of Bitcoin ETFs, the market has seen over $57B in inflows, representing approximately 3% of Bitcoin’s total market capitalization to date.

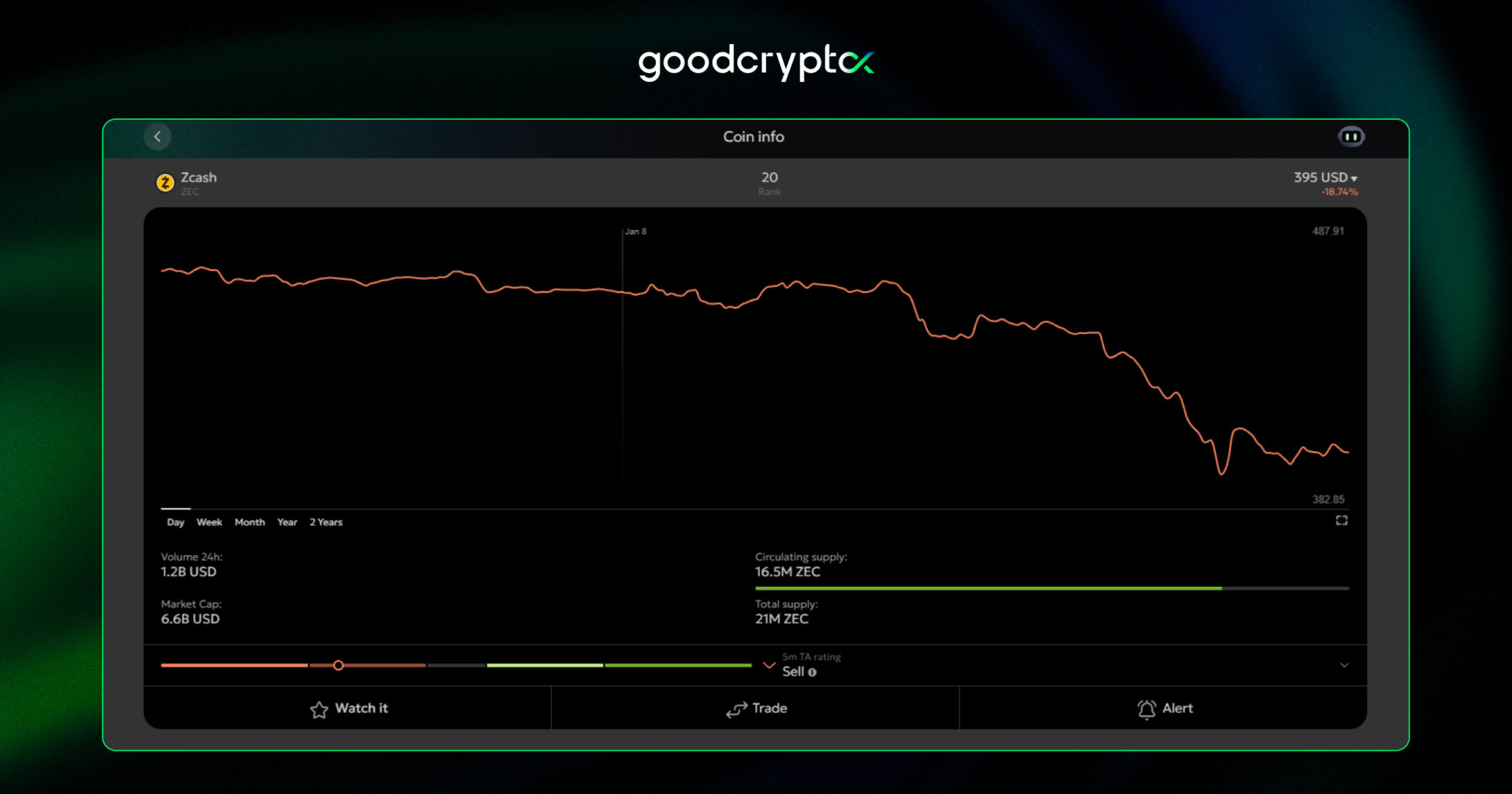

Zcash devs resign

Yet, not all the news for the market has been positive this week. On January 8, 2026, news unexpectedly emerged that the Electric Coin Company, the firm behind the privacy-focused blockchain and recently promoted token $ZEC, had resigned on January 7, 2026.

The decision followed a dispute with its parent non-profit board. As former Zcash CEO Josh Swihart reported, the Bootstrap board, an organization created to support Zcash by governing the Electric Coin Company, changed the terms of employment for the development team. According to Swihart, the new terms make it impossible for the team to perform their duties effectively.

As a result, he announced the launch of a new company that will retain the same development team structure with the same goal in mind: building “unstoppable private money.” Swihart also stated that the Zcash protocol itself will remain unaffected, but the loss of the development team raises concerns about the protocol’s future roadmap.

Following the announcement, $ZEC experienced an almost 19% price drop, as investors became cautious about the future of the Zcash protocol.

the MACD trading strategies

📊 The MACD (Moving Average Convergence Divergence) is a momentum indicator that highlights shifts in trend direction through moving average crossovers and histogram changes. It helps traders identify potential entries, exits, and reversals with greater precision. Here’s how you can use the MACD indicator:

- #1 MACD histogram and crossovers: Spot histogram and signal line crossovers to identify changes in market momentum;

- #2 MACD Divergences: Assess the strength of price action using bullish and bearish MACD divergences.

-

🔥 Want a more detailed explanation of MACD trading strategies? Check out the MACD indicator review by goodcryptoX!

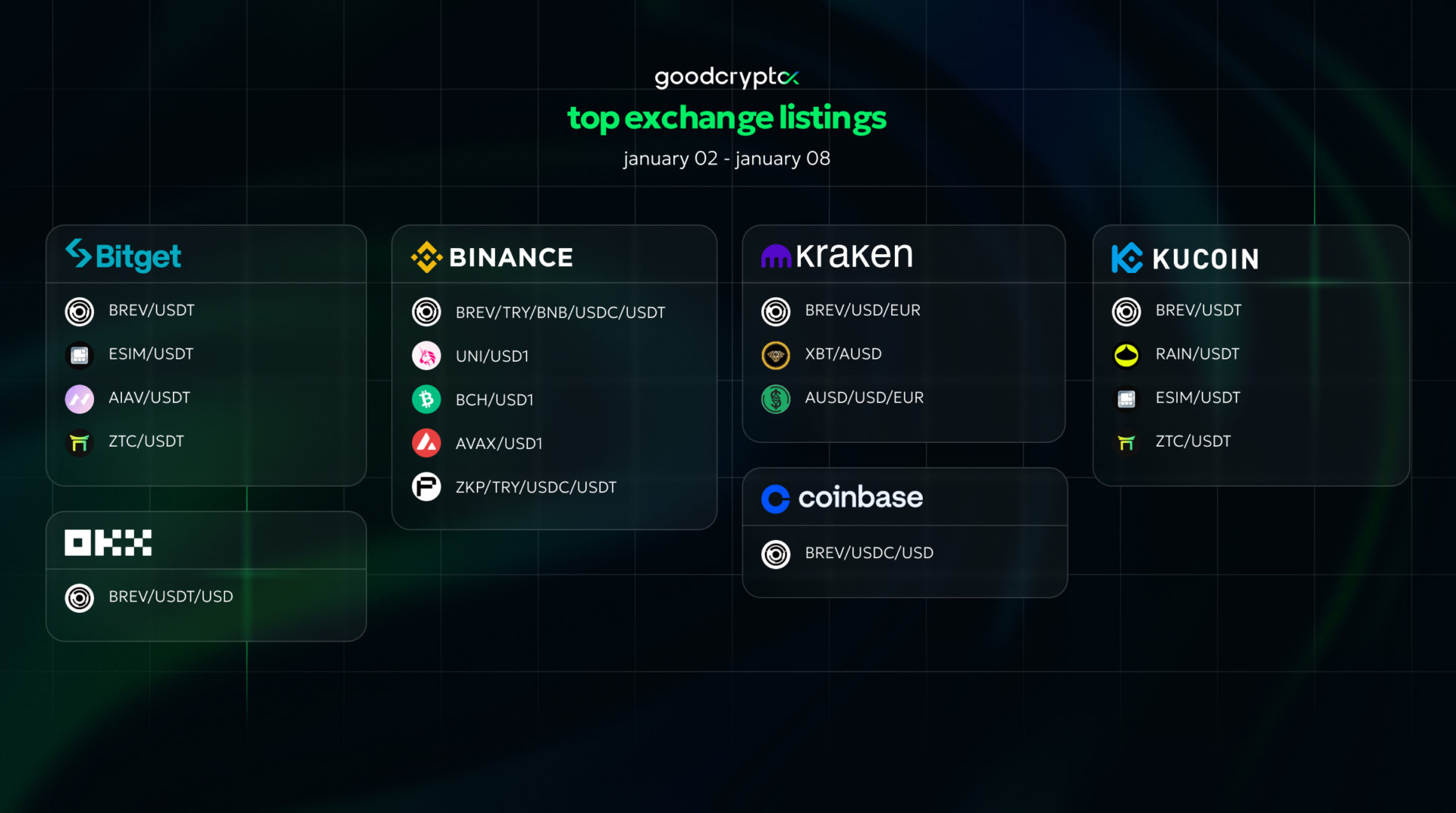

Receive an instant notification when a new coin is listed with goodcryptoX PRO plan.

top crypto meme of the week

We hope this digest was valuable and informative for you! If you want to be the first to receive new crypto insights and stay up-to-date with the market, follow us on Twitter or Telegram. Become a better trader with the goodcryptoX app!