- 1. Binance or Bitfinex: a Quick Overview

- 2. Bitfinex Review

- 3. Bitfinex New Account: Bitfinex Verification

- 4. Bitfinex Trading

- 5. Bitfinex Staking

- 6. Bitfinex Withdrawal: Bitfinex Withdrawal Fees

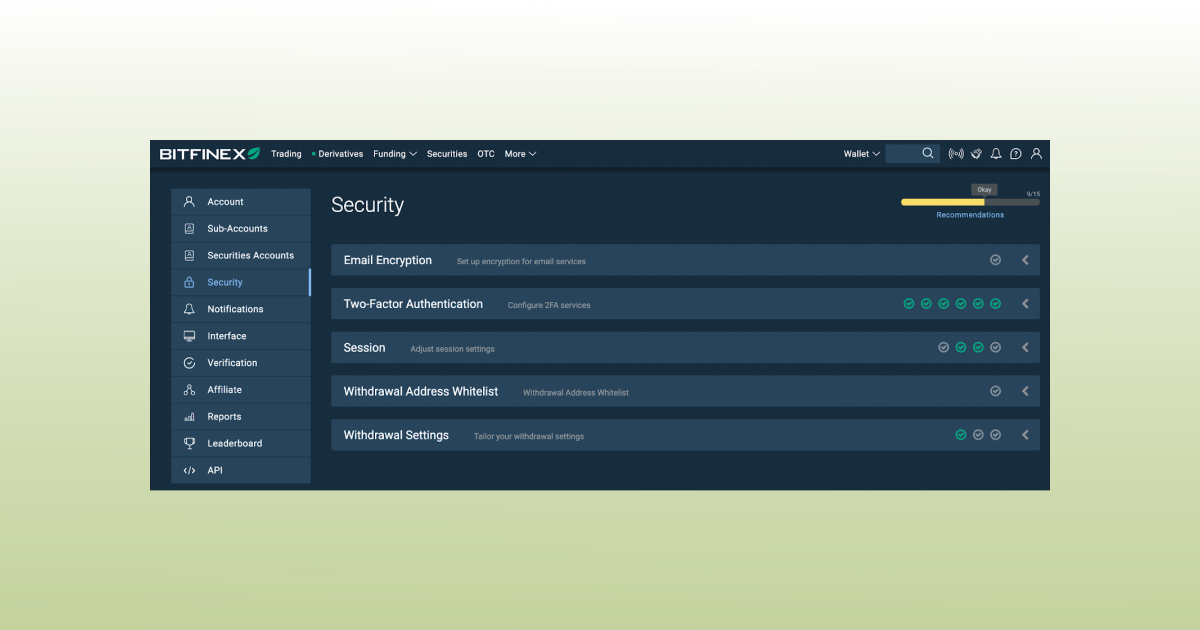

- 7. Bitfinex Security: Is Bitfinex safe?

- 8. Binance Review

- 9. Binance New Account: Binance Verification

- 10. Binance Trading

- 11. Binance Fees

- 12. Binance Security: Is Binance safe?

- 13. Bitfinex VS Binance: Comparison Table

- 14. Conclusion

- Bitfinex Maker/Taker Fees (0.1%-0.2%) are slightly higher than on Binance.com and Binance.US (0.1%-0.1%)

- Bitfinex restored its vitality after a dramatic breach while Binance has created such a system that is hard to breach

- Binance and Bitfinex have professional trading terminals, advanced charting functionality and mandatory KYC

- Bitfinex’s minimum withdrawal limit in fiat is $10k.

Binance or Bitfinex: a Quick Overview

Spoiler alert – Binance in many ways is a better exchange compared with the shy guy Bitfinex. It’s more secure, reputable, stable and resourceful as to insurance and different crypto features such as their own dex, defi staking, derivative types, mining pools and loans. While using Binance, you can pay in a dozen fiat currencies, use a debt or a credit card to purchase crypto or withdraw fiat and pay as low as 0.1-0.1% in maker’s and taker’s fees. So, who are those people, really, trading $1,074,439,261 per day on Bitfinex exchange and why are they doing this?

Well, there are a few reasons, actually, to still trade on Bitfinex. The platform has a valid support team that responds within 24 hours, the exchange’s P2P funding mechanism allowing unlimited funding is also great, the spread is quite tight, the variety of order types such as limit, market, stop and even trailing orders is impressive, the derivative analytics as it is presented on the website may be very useful and, in the whole, the in-built TradingView charting functionality doesn’t make the platform look bad. Indeed, professional traders could use it to suit themselves. Plus, habits die hard. Why change the platform you’ve been with since forever, deposited large amounts and withdrawn with no issues?

By standards of the cryptocurrency niche, Bitfinex is an old venue (2012), older than Binance (2017), and in the niche, such a longevity is well-respected. Even one of the greatest crypto hacks in history, the hack where more than one billion dollars was siphoned off, didn’t wipe Biftinex off the market, if not making it stronger, then at least antifragile. Binance didn’t have a chance to go through such a vigorous challenge and stay onboard.

So, wait a second, did you just start having lingering doubts? Then, the question is simple, but not easy. In the Bitfinex vs Binance battle, what is it going to be – the white and golden colors of Binance or the green leaf of Bitfinex logo?

Let’s see.

Bitfinex Review

So, what is Bitfinex? As we’ve mentioned above, Bitfinex is one of the oldest crypto trading venues in the niche. In fact, in 2012, when it was founded, 70% of all Bitcoin transactions worldwide were still handled by Mt. Gox, Hal Finney was living his final days and Bitcoin’s price remained at $5.27!

The exchange saw the light of day in Hong Kong. Raphael Nicolle, a controversial BitcoinTalk blogger known as “unclescrooge”, started it. However, the start wasn’t too smooth. The rumor has it that Nicolle used the Bitcoinica code to launch Bitfinex. Later, after allegedly partaking in a few Ponzi schemes, Nicolle left the exchange, and in 2013, Jean Louis van der Velde joined the venue as CEO, focusing on implementation of a strict set of AML/KYC rules. Interestingly, there’s still not much information on people working for Bitfinex, including the CEO, who, in his own words, “never uses / reads LinkedIn”.

Jean Louis van der Velde, CEO of Bitfinex.

Source: Businessweekly

Van der Velde’s approach didn’t keep Bitfinex exchange far away from a series of hackers’ attacks, though, and, eventually, led to the notorious breach in 2016 when 120,000 Bitcoins were stolen by cyber criminals.

Also, as a result of insolvency allegations, a lawsuit was filed by the New York General Attorney regarding Bitfinex’s malicious activity in association with Tether where they supposedly tried to cover up to $850 million in losses.

That being said, the problems with the law made it hard for Bitfinex to offer its services to the U.S. traders, and now only users living outside of the States can trade on this platform. Go and install either an app for iOS or Android, customize the trading interface by composing different elements or using different colors and don’t forget to get a full verification before withdrawing a minimum of $10k – yes, this is the minimum fiat withdrawal limit on Bitfinex.

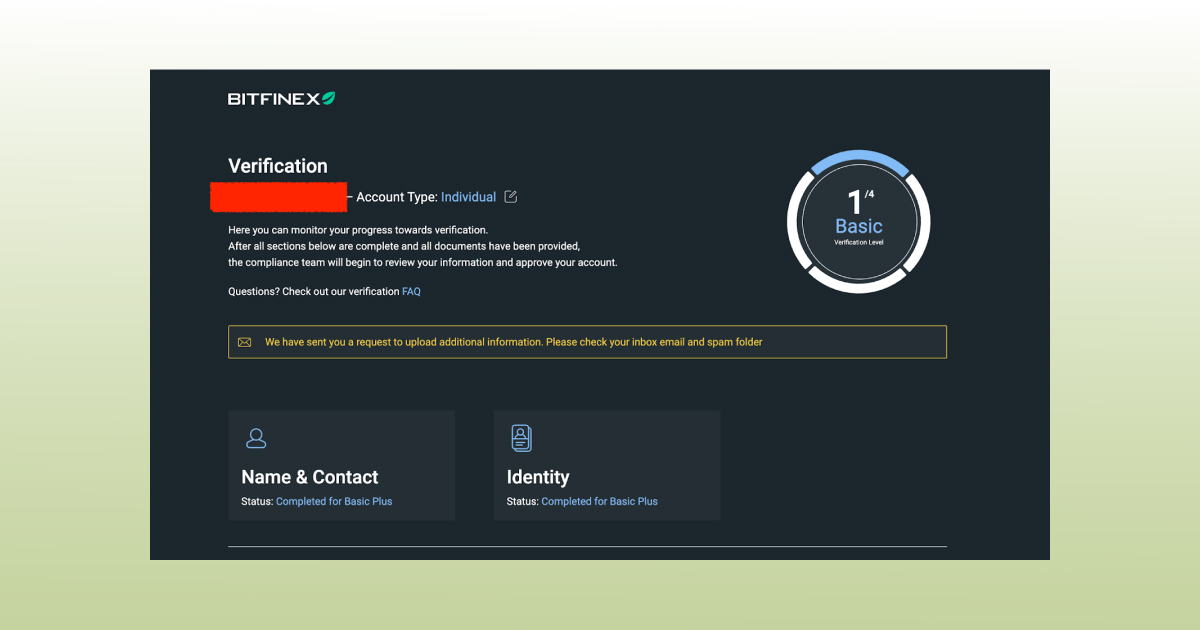

Bitfinex New Account: Bitfinex Verification

Bitfinex verification page

Do you want to learn more about Bitfinex verification? Honestly speaking, in this section of our review, we’ll basically present the same piece of information given in the official manual of the exchange, so if you click the Bitfinex page – good choice, but if you stay, you might have some exclusive long-lasting crypto fun later on. So, are you intrigued already?

You’re probably not new to crypto. You know that when it comes down to digital currency exchanges it’s considered good form to offer a few verification levels to new users, to the extent that suits all of them. But this “suits them all” thing doesn’t, of course, happen in real life very often.

For example, Coinbase Pro and Gemini are great trading venues. But while allowing you the best security tools in the industry, they hardly let you safeguard your anonymity. It’s sort of a compromise where you tell them the story of your life in exchange for the FDIC insurance covering up to $250k in your account.

It’s understandable, though, considering the fact they cooperate with the government. Transparency, in this case, is always the price to pay.

However, some veteran exchanges sympathize with the pain of revealing personal data, and if you’re faithful to the spirit of the cypherpunks – individuals advocating widespread use of strong cryptography and privacy-enhancing technologies since at least the late 1980s – these exchanges offer you to disclose only a few chunks of information.

Bitfinex exchange is one of the latter ones. There are four verification levels available on this exchange: Basic, Basic Plus, Intermediate and Full, and each of them increases your vulnerability slightly more than the previous one.

Once your account is created, you automatically get the Basic status, which requires your name and contact details as well as allows you to deposit and withdraw most listed coins, make exchange and margin trades, provide margin funding and access the Bitfinex over the counter (OTC) market.

And yet, there are some things you’re not allowed to do with the Basic level obtained, for example, bankwires or derivative trading.

To activate these options, you will have to upgrade to Intermediate or Full status. Take a look at the table to get the gist:

| Basic | Basic Plus | Intermediate | Full | |

| Trading and Lending |

|

|

||

| Exchange Trading* |

✔ |

✔ | ✔ |

✔ |

| Margin Trading* |

|

✔** |

✔ |

|

| OTC Trading* |

✔ |

✔ | ✔ |

✔ |

| Derivatives Trading*** |

|

✔ |

✔ |

|

| Margin Funding |

|

✔** |

✔ |

|

| Lending Pro |

|

✔** |

✔ |

|

| Bitfinex Borrow |

|

✔** |

✔ |

|

| Increase position |

|

✔** |

✔ |

|

| Deposits and Withdrawals |

|

|

||

| Crypto transfers* |

✔ |

✔ | ✔ |

✔ |

| Tether tokens and other stable tokens* |

|

✔ |

✔ |

|

| Bank wires (Fiat transfers)¹ |

|

✔ |

✔ |

|

| No maximum withdrawal limit |

✔ |

✔ | ✔ |

✔ |

| Faster crypto deposits² |

|

✔ |

✔ |

|

| Other features |

|

|

||

| Bitfinex Pulse |

|

✔ | ✔ |

✔ |

| Multipliers in Affiliate Program |

|

✔ | ✔ |

✔ |

| Participate in Competitions**** |

|

✔ |

✔ |

|

| Bitrefill |

✔ |

✔ | ✔ |

✔ |

| Staking Rewards |

✔ |

✔ | ✔ |

✔ |

| Bitfinex Pay |

|

✔ |

✔ |

|

| UNUS SED LEO discounts*** |

|

✔ |

✔ |

|

| Security | ||||

| Earlier withdrawal hold lift | ✔ | ✔ |

The table is taken from the Bitfinex website

* Certain tokens necessitate at least the Intermediate level and may be restricted to specific jurisdictions; check the requirements for each token.

** Intermediate verification is required to access Margin Trading, Margin Funding, Lending Pro, Bitfinex Borrow, and Increase Position. This applies to users who created an account after March 1, 2022. Basic Plus verification is required for accounts created between January 1st, 2022 and March 1st, 2022. Accounts created before these dates will be able to continue without having to upgrade their verification levels.

*** Restrictions applied in certain jurisdictions.

**** Restrictions applied in certain jurisdictions.

So, you probably already know what to do without us breathing down our obvious advice into your neck: just take a look at the table above and see for yourself if the Bitfinex exchange has got the trading options you’re looking for. Then, decide if you’re ready to disclose your personal information in return for the perks the exchange offers.

For example, if you’re not a fan of information overload on top of BitMEX and are fine with futures contract types on Bitfinex, in order to start trading derivatives, be prepared to add not only your official photo ID, selfie and phone number for verification purposes, but also the second official photo identification and proof of address.

Here’s the explanation on how to identify yourself on any level: whether you’re a corporate or an individual client, you can upgrade your account on Bitfinex to get a wider set of digital assets and trading features. Simply go to the verification page and start the process right now.

To upgrade to the Basic Plus Verification Level, upload your:

- Official Photo ID;

- Biometric photo (selfie);

- Phone Number.

To upgrade to the Intermediate Verification Level, upload:

- All information in Basic Plus Verification Level;

- Second official photo identification;

- Proof of Address.

To upgrade to the Full Verification Level, upload:

- All information in Intermediate verification level, and:

- Financial statement.

Take note of the fact that you will need the full-verification level in order to withdraw or deposit fiat.

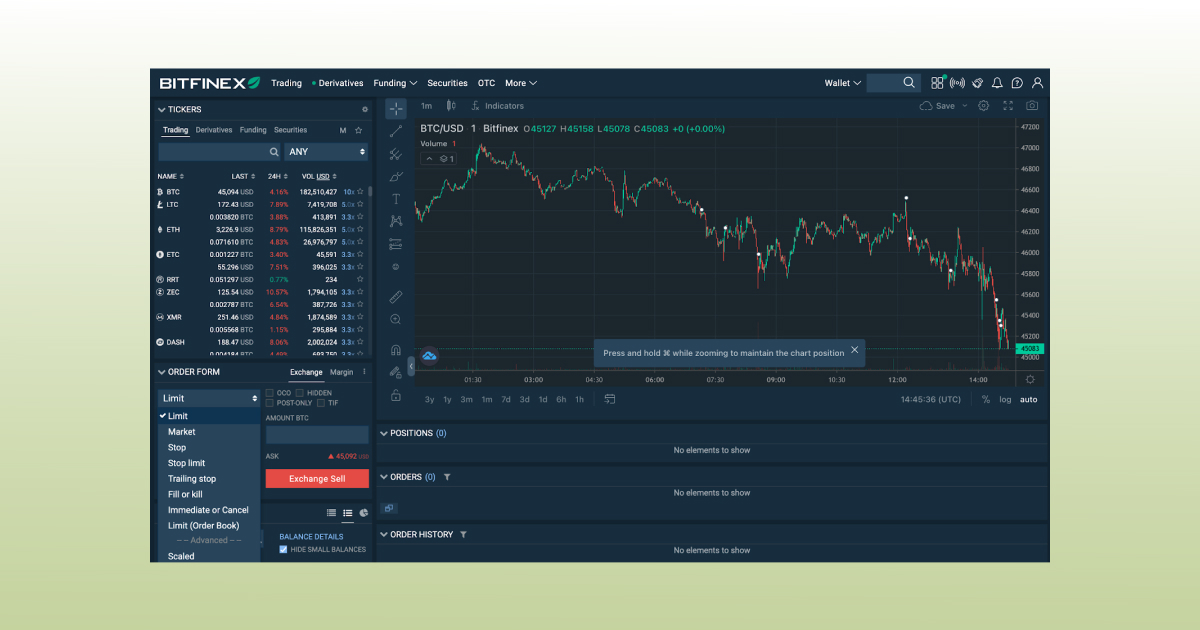

Bitfinex Trading

Bitfinex Spot Trading

Before diving deep into spot trading on Bitfinex, let’s remind you one very important fact again: only fully-verified users can withdraw fiat from the platform with the minimum withdrawal amount of 10,000 USD/EUR/GBP, 1,000,000 JPY, and 75,000 CNH. If you’re interested in withdrawal fees, click to the Bitfinex Withdrawal: Bitfinex Withdrawal Fees section of this article right at once.

Yes, you’ve heard right, you cannot withdraw less than $10k even if you want to. Of course, with digital coins, it’s not the same – withdraw as little crypto as you like considering the fees, but remember that with fiat currencies, it is different.

Compared to Binance and other cryptocurrency exchanges, Bitfinex withdrawal limits are a huge disadvantage, so decide whether you’re ready to go for it or not. It’s clear that a lot of people are not going to like it, and together with the controversial reputation of the venue, this might make you turn your back on Bitfinex.

However, if $10k is not a huge amount for you, keep reading, maybe you will find a few things that can get you interested.

If you compare Bitfinex’s trading interface to Bitfinex alternatives, Kraken, Binance, Gemini or Coinbase, then, it looks a little bit more professional. Gemini and Coinbase are simplified, Kraken is quirky as to the team’s non-traditional approach to interfaces and the layout of their professional terminal. And even Binance might be falling behind Bitfinex in some areas. For example, it doesn’t have the same amount of order types and the news feed.

Bitfinex spot trading page

The 24h trading volume of the exchange, as of July 2022, is around $218,231,873, the number of markets is 341, with more than 170 coins and five fiat currencies, USD, EUR, GBP, JPY, and CNH. Sounds dreamy?

Let’s keep it real and quickly compare these numbers with Binance.com, which lists more than 600 coins, 1462 markets and more than 79 fiat currencies. The exchange’s 24h trading volume is around $108 million – click to the Binance spot trading section if you want to get a quick overview now.

So, yes, as you can see, Bitfinex is small compared to the top dog of the industry. However, here’s a quick analysis of one thing in particular that looks a little bit more impressive rather on Bitfinex than on Binance.

We’re talking about order types.

The most-used order types on the Hong Kong-based exchange include limit order, market order, stop order and trailing stop order.

Let’s define these order types, using the terminology given on the Bitfinex website:

- Limit (order book) order is an order that can be executed by clicking at a price on the order book.

- Market order is an order type that executes immediately against the best price available.

- Stop order is used to trigger a market sell when the market drops to your trigger (stop) price, or used to trigger a market buy if the market rises to your trigger (stop) price.

- Stop-limit order is a buy or a sell order that combines the features of a stop order with a limit order. When the stop price hits, the stop-limit order transforms into a limit order, which is executed at a predetermined price (or better).

- Trailing stop order provides flexibility over a stop order by executing once the market goes against you by a defined price, called the price distance.

- Fill or kill (FOK) order is an order that must be filled immediately in its entirety, at a specific price (or better), or it is cancelled (killed).

The variety of these orders is really majestic compared to manifold crypto exchanges that normally offer only market, stop and limit orders. Bitfinex even has a trailing order, which is huge and, in crypto, can only be found very rarely. For example, only one portfolio tracker and crypto trading app, Good Crypto, offers you Trailing Stop, Trailing Stop Limit, Reverse Trailing Stop, Trailing Take Profit, Trailing Stop Loss, Take Profit and, of course, often-used market, stop and limit orders. So, as you see, a trailing order on Bitfinex is kind of good news.

As you know, these days, many services offer TradingView functionality, so it’s no wonder that Bitfinex offers it, too. By contrast with Binance that not only has TradingView charts, but also the charts originally designed for them, Bitfinex only has TradingView. But let’s be honest, this popular tool with its multitude of indicators and graph types is quite enough, isn’t it?

This is what it looks like on Bitfinex – everything is just the way you like having it:

TradingView charts on Bitfinex

A black screen, a cup of coffee, a couple of hours of active trading and your day is done. So, how about the least pleasant part, Bitfinex fees? Here you go:

| Crypto to Crypto e.g. BTC/ETH |

Crypto to Stablecoin e.g. BTC/USDt |

Crypto to Fiat e.g. BTC/USD |

Derivatives e.g. BTCf0/USDt0 |

|

| Maker Fees | 0.1% | 0.1% | 0.1% | 0.02% |

| Taker Fees | 0.2% | 0.2% | 0.2% | 0.065% |

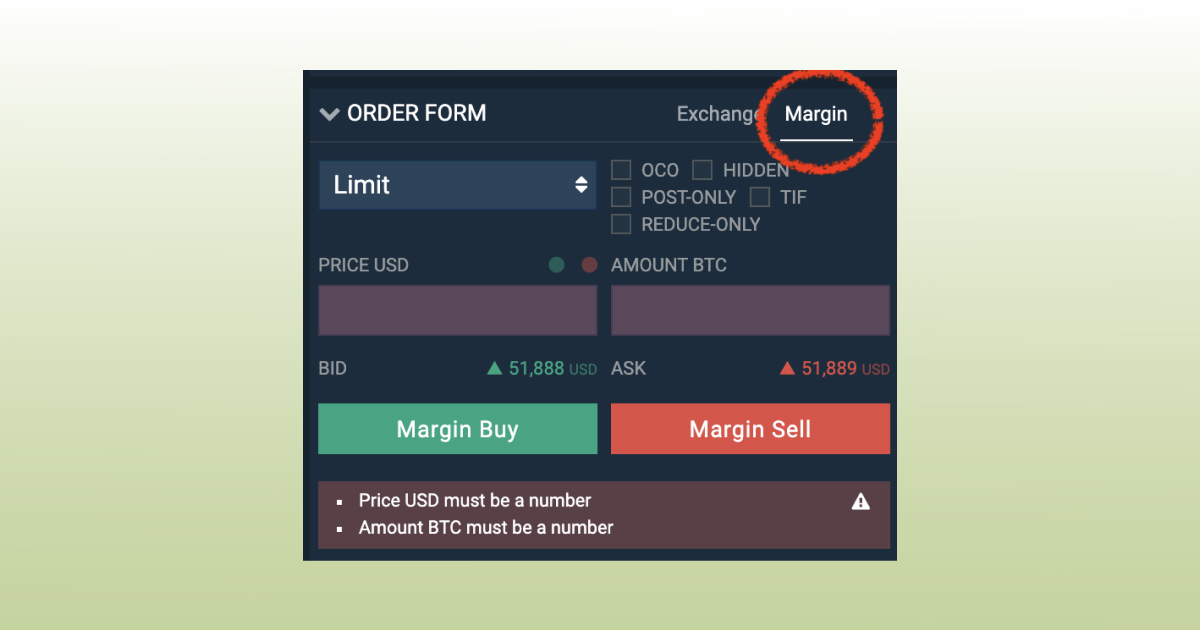

Bitfinex Margin Trading

Hello, margin trading, the activity not for all of us, just for the most wild of us. Compared to such top dogs as Coinbase, Gemini or Binance.US, margin trading is available on Bitfinex – but wait, why is it for the most wild of us? Simply because before even talking about margin trading we’re obliged to warn you: it’s a risky business where you have skin in the game.

While trading on margin, you use money borrowed from a third party to purchase a larger amount of assets, but if the market goes against you, you might as well lose even your initial collateral. So, you should be psychologically prepared to leave behind a pot of gold before going there, because it’s like a casino: you have a chance to win a lot, but the risk of losing is many times as large.

Bitfinex leverage trading – sometimes also called margin trading or leveraged trading – helps you trade with up to 10x leverage by receiving borrowed funds from the peer-to-peer (p2p) market, or, in other words, other users of the exchange.

How does that work when applied? The venue has a special funding platform where users provide their funds to the traders that want to trade on margin. Bitfinex funding gives access to manifold currencies including EUR, USD, JPY, BTC, ETH, USDt, DOGE, DASH, DAI, ALGO, LUNA, FIL, IOTA etc. 15.0% of the fees generated by active margin funding contracts goes to the exchange.

In order to leverage your position with the funds provided by other people, you will have to make sure first that you have at least 10% of initial margin and 5% of maintenance margin in your margin wallet.

Remember why it’s dangerous. When the net value of your account equity (margin wallet value + P/L+ funding cost) drops below 1.5x the maintenance margin of the value of your open positions – and it happens all the time – your positions will be forced-liquidated.

For example, with a margin position worth $500 USD and a maintenance margin value of 15%, the Margin Wallet net equity must not fall below $75 to prevent a forced liquidation.

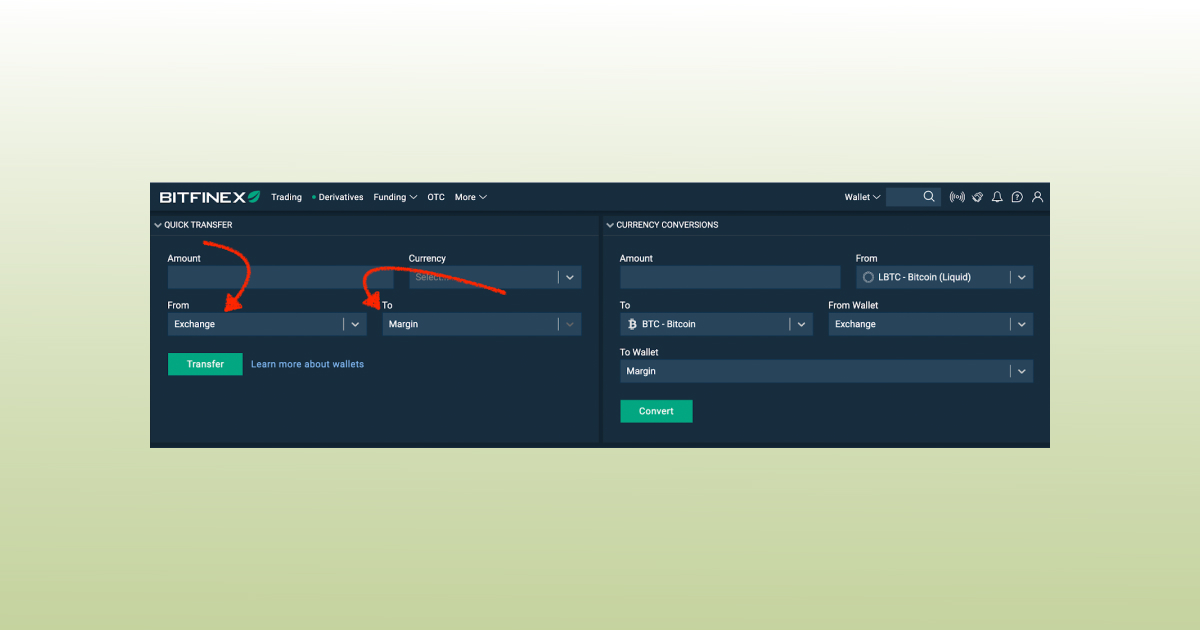

Don’t forget to switch to the margin account in your trading terminal

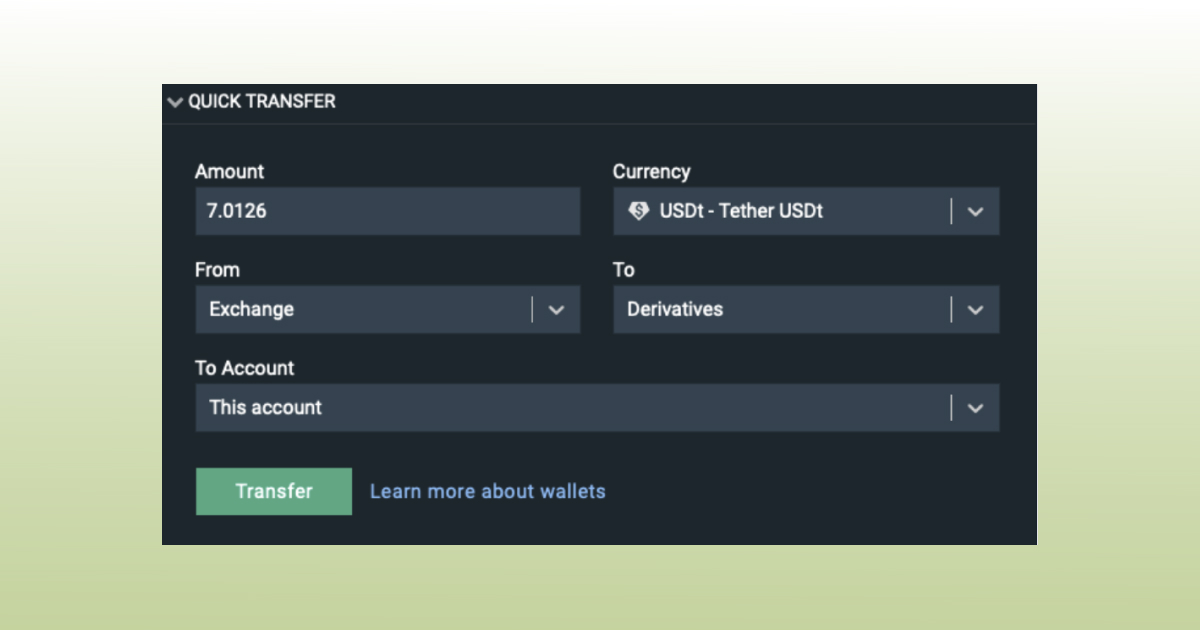

Note that in order to start trading on margin, you should transfer funds between your wallets as shown in the pic below, it only takes a few seconds:

Without transferring funds to your margin wallet, you will not be able to open a position

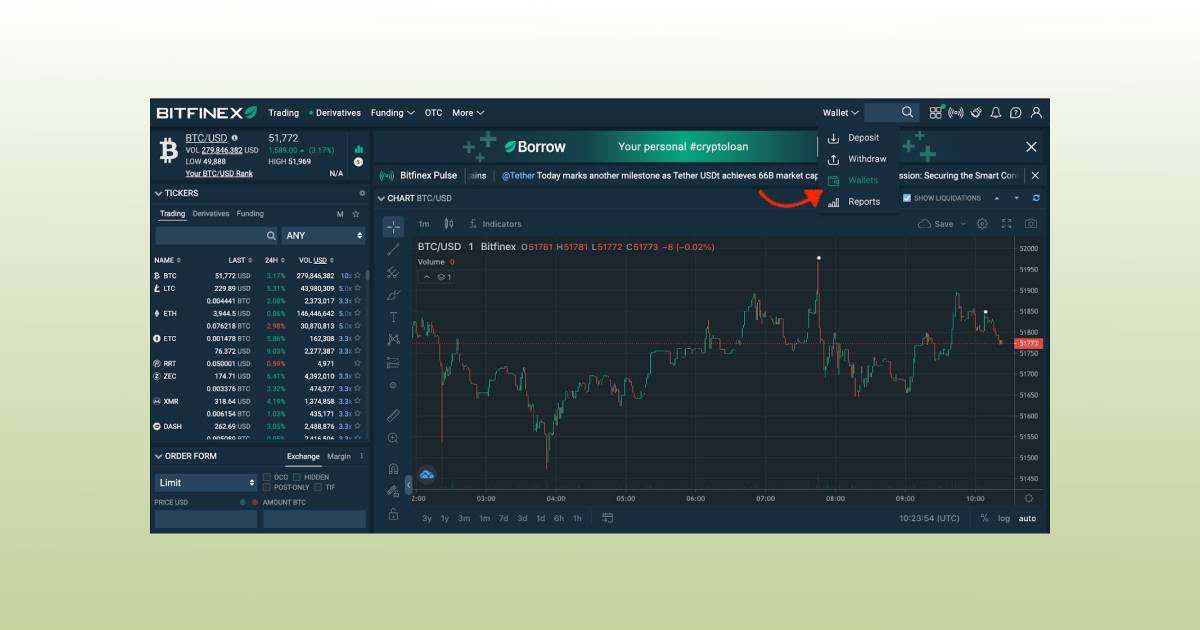

Don’t know where and how to find the Quick Transfer screen? Just click the Wallets tab in the Wallets drop down menu in the top-right corner of your trading terminal:

The menu with the wallets

If you have the Basic Plus and higher verification status, you can use Bitfinex Borrow and enter an order to borrow at the rate and duration of your choice. On the other hand, you can, of course, simply open a position in the trading terminal, and Bitfinex will take out funding for you at the best available rate at that time.

Please note that when it comes down to Bitfinex Borrow, a separate service on the Bitfinex exchange, your verification level determines the borrowing choices available to you. For example, you must have a full verification level to borrow fiat currencies.

In general there are many nuances you should get familiar with before using Bitfinex Borrow, so we suggest that you read the manual first.

Oh, wait, you don’t want to read the manual and would rather spend some time with kids? Here’s a short version: a minimum loan amount on Bitfinex Borrow is of $100 equivalent; the amount of borrowed funds varies depending on the type of collateral and the borrowed funds themselves; and the set of coins you can use as collateral includes but is not limited to the most popular fiat and cryptocurrencies.

Remember, you don’t need Bitfinex Borrow to open a margin position. It’s just an option. If you already have 10% of initial margin and 5% of maintenance margin in your margin wallet, you can start trading with leverage right now. The exchange will automatically open the position for you once you initiate an order.

Bitfinex Futures Trading

So, come clean now, have you started reading this article right from this section while trying to choose between KuCoin Futures, Binance Futures, BitMEX, Binance Futures, FTX and Bitfinex Futures?

Totally understandable. It’s such an exhausting job to look through manifold reviews like this one, trying to assemble the whole jigsaw puzzle in your head, especially when it comes down to trading futures in crypto. Hopefully, this one will add an extra piece to the big picture.

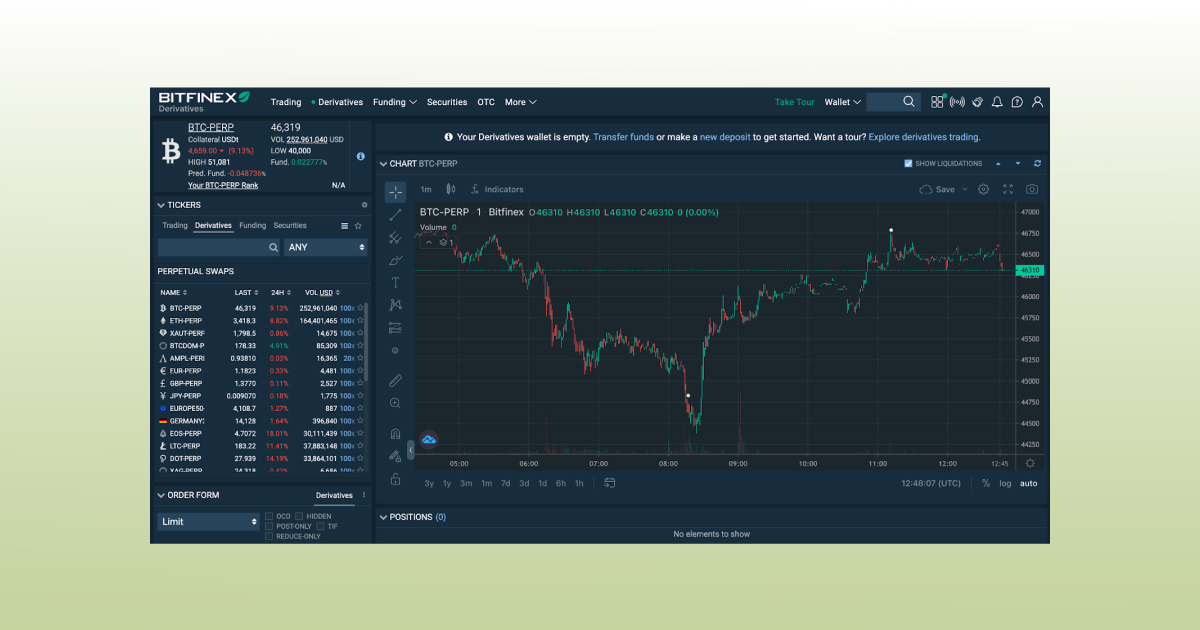

Futures trading interface on Bitfinex

On Bitfinex, there are only perpetual futures contracts available, meaning they don’t have an expiration date, and there’s no settlement, only funding every 8 hours. The list of contracts includes EUR-PERP, GBP-PERP, JPY-PERP, EUROPE50-PERP, GERMANY30-PERP, BTC-PERP, ETH-PERP, XAUT-PERP, BTCDOM-PERP, AMPL-PERP, EOS-PERP, LTC-PERP, DOT-PERP, XAG-PERP, IOT-PERP, LINK-PERP, UNI-PERP, ETHBTC-PERP, ADA-PERP, XLM-PERP, DOTBTC-PERP, LTCBTC-PERP, XAUT-BTC-PERP, DOGE-PERP, SOL-PERP, SUSHI-PERP, LUNA-PERP, FIL-PERP, AVAX-PERP. The funding is made three times per day, starting and ending within 0:00, 8:00, 16:00 (UTC).

Remember that a perpetual futures contract in crypto has its specifics. Such a contract is a bet, in fact, about the direction of an asset’s price. You see how in this case you don’t even need to have the actual asset in hand? You only need a derivative instrument you can buy on leverage in order to get funding every 8 hours.

In the era of automation and hundreds of open orders, the settlement of such “bets” happens under the hood: if there are more long positions, the holders of short positions are obliged to pay the funding fee, if there are more short positions, the holders of long positions will pay.

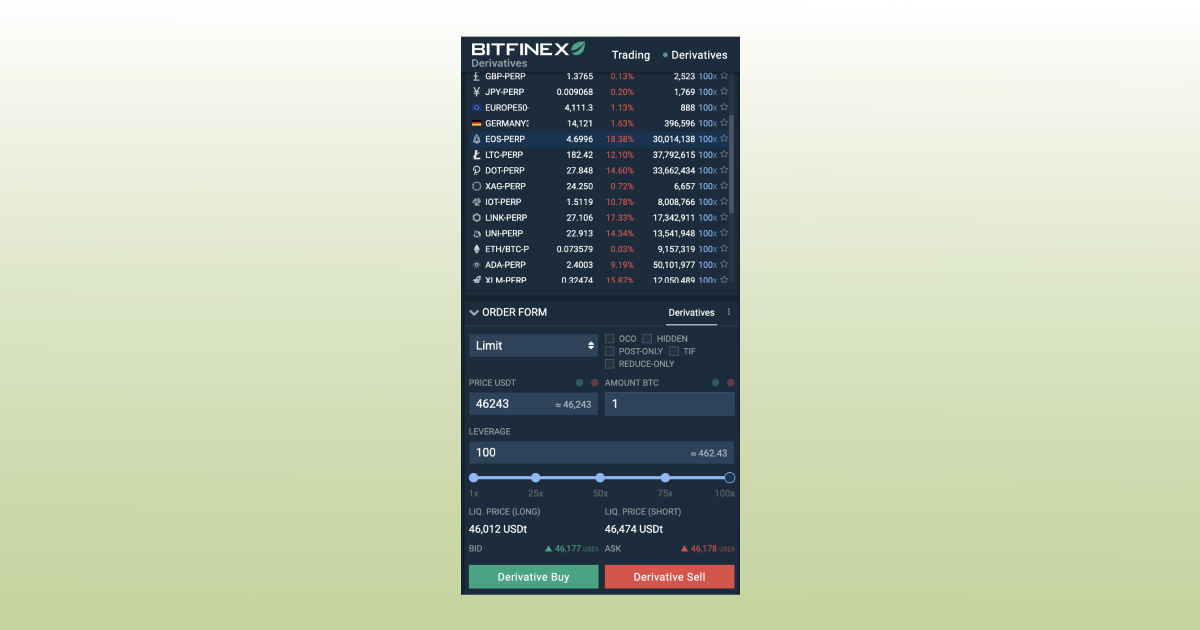

Because Bitfinex allows up to 100x leverage on BTC, ETH, XAU₮ and other perpetual contracts, you only need $462,43 to buy one BTC-PERP contract when BTC costs $46k.

So, you buy the contract, keep the position open and either receive your funding or pay the fee. How does the exchange decide what it is going to be? It depends on what kind of contract you have, long or short, and which side, “longs” or “shorts”, has the advantage in the number of open contracts.

But let’s parachute down from Disneyland for a sec – 100x leverage? Seriously? It’s an insane leverage, so we really don’t recommend you to play with the fire, because you can easily get liquidated.

Just take a look at the pic below to see the liquidation price for one BTC-PERP contract in both cases, whether you go short or long. Such volatility in crypto is more than possible.

Now, let’s suggest for a moment you don’t get liquidated in the first couple of days – haha – what about funding fees? All perpetual futures contracts, also called perpetual swaps, are settled solely in Tether (USDt).

What is the nature of Bitfinex swap trading? According to the exchange’s manual, to start trading derivatives, you must first convert your USD balances to USDt0 and transfer them to your derivatives wallet. This can be done via the “currency conversion” tool on the wallets page.

Down below, there’s a table with all the metrics you need to know when entering a position. For example, you can see green and red lines with a predicted funding rate for those who are about to win or lose “the bet”:

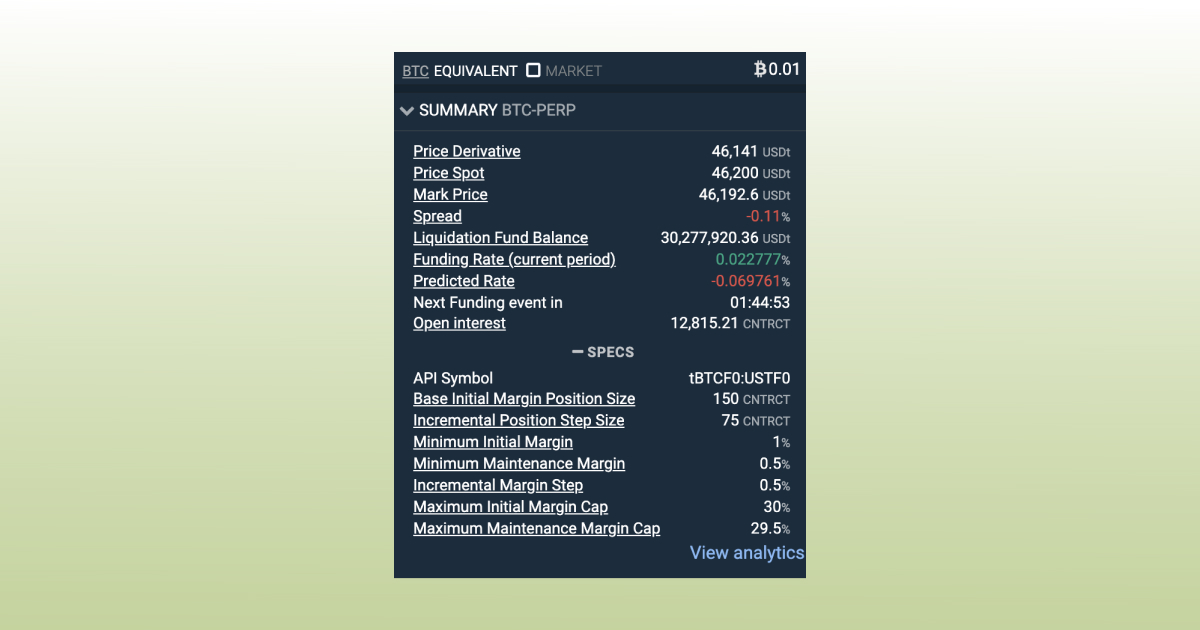

This is the BTC-PERP contract, and the funding rate here, 0.022777%, is what you’re about to get if you win the bet. The predicted rate of 0.069751% is the rate you’re about to pay if you keep the position open and lose.

The table is taken from Bitfinex

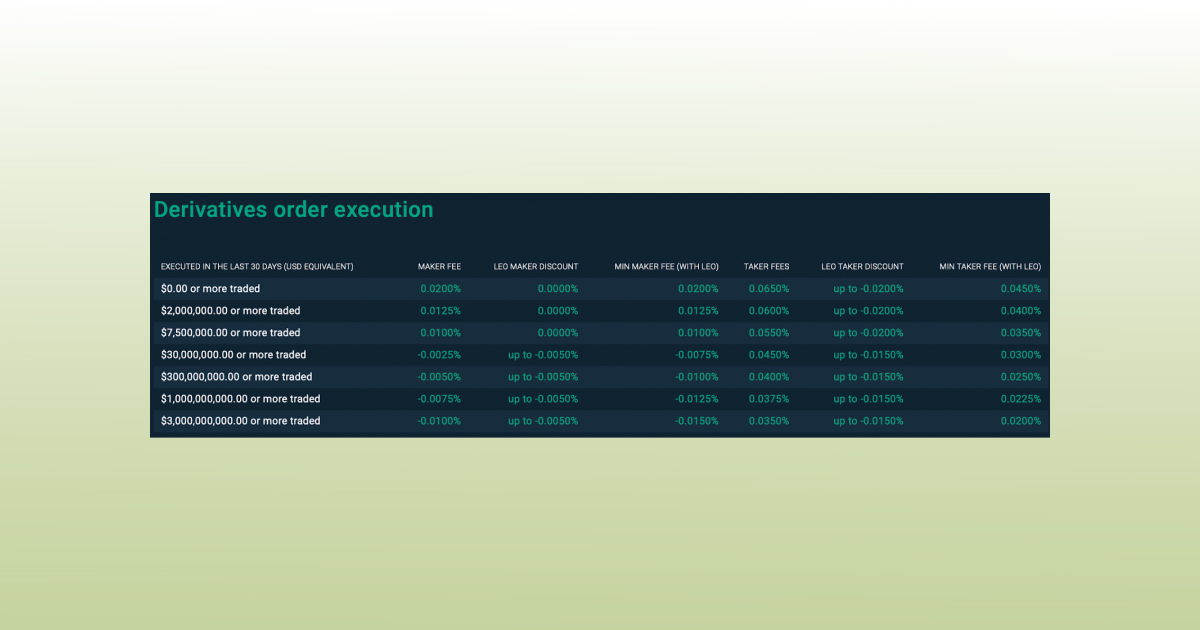

Don’t forget that just like with any other market, while trading derivatives on Bitfinex, you will also have to cover Maker and Taker fees while placing new orders to the order book.

Maker rebates are paid when you add liquidity to the order book by placing a limit order under the ticker price for buy and above the ticker price for sell.

Taker fees are paid when you remove liquidity from the order book by placing any order that is executed against an order of the order book.

If your 30-day trading volume is more than $1,000,000.00 or more, the fees will get smaller.

Bitfinex Staking

…and many more crypto assets, actually. Here’s a list of digital coins with an estimated annual staking reward given on the right side of the asset:

- TRON (TRX) 6-8%

- EOS (EOS) 0-3%

- TEZOS (XTZ) 3-5%

- COSMOS (ATOM) 1.5-3%

- SOLANA (SOL) up to 6.5%

- POLYGON (MATIC) 4.5% – 6%

- CARDANO (ADA) 4-5%

- POLKADOT (DOT) up to 7%

- ETHEREUM2 (ETH2) up to 10%

- KUSAMA (KSM) up to 8%

You can also stake Ethereum and Ethereum 2, but the estimated annual staking rewards will vary depending on the Ethereum protocol.

Do you have to pay fees for staking on Bitfinex? No, but depending on the service provider in some cases a portion of the reward can be retained.

You should remember, though, that staking rewards are distributed by the token network, and this is how the exchange cannot determine who receives the money. If you hold a certain amount of coins in your account, the mid-week snapshot taken by the engine might or might not result in you obtaining your bounty, it will depend on the requirement of the token network.

Bitfinex Withdrawal: Bitfinex Withdrawal Fees

Repeat actions make perfection. We’ve already mentioned in this article that your account should be fully verified before you attempt to withdraw a minimum of $10,000 USD/EUR/GBP, 1,000,000 JPY, and 75,000 CNH.

Sorry for that, but it’s kind of important. Bitfinex supports fiat currency withdrawals of US Dollar (USD), Euro (EUR), Great British Pound (GBP), Japanese Yen (JPY) and Chinese Yuan (CNH) but there is a withdrawal limit for fiat – no less than $10k.

Take a look at the withdrawal options available on this exchange – not so many options indeed, compared to Binance’s payment cards (credit/debit), cash transfers, bank transfers such as SEPA (within Eurozone) and faster payments (within the UK).

| Fee Type | Bitfinex trading fees |

|

A regular bank wire |

0.1% |

|

An express bank wire withdrawal |

1.0% |

|

ACH Transfer Withdrawal |

X |

|

ACH Transfer Deposit |

X |

|

Debit Card Withdrawal |

X |

|

Bitcoin |

0.0004 BTC |

|

Ethereum |

0.0011655 ETH |

|

Solana |

Free |

Don’t forget that your bank might also want to charge you a fee. But fill in the banking details carefully because if mistakes are made in the bank details provided by the customer, and if this results in the wire being returned, the exchange will charge you an extra handling fee. The Bitfinex fee in this case is $25.

By the way, according to Bitfinex, you can use MasterCard, Visa and UnionPay to purchase crypto. Using payment cards on Bitfinex, however, is a process that is finalized through third parties: OWNR and Mercuryo.

Bitfinex Security: Is Bitfinex safe?

Remember, in the section about verification we were discussing how you trade off your anonymity against the safety of such crypto exchanges as Gemini and Coinbase?

You and Bitfinex also kind of meet half-way on that front. Users of this trading venue are still allowed to keep their anonymity with starter verification levels, but in terms of security, oh, something wicked this way comes.

Once upon a time in 2016, 12,000 BTC worth of $1.344 billion, according to the statement of Bitfinex, were siphoned off from their accounts – which became one of the most mind-blowing hacks in the history of crypto trading, really. “This incident is a dark chapter in our exchange’s history,” the announcement states to further emphasize that Bitfinex is ready to reward not only any lead but the hackers themselves if they return the money.”

In fairness, the exchange has learned the lesson and addressed the security issues and vulnerabilities in the aftermath of the breach: it provided BFX tokens to all affected users where each token represented $1 of losses and gradually increased in value from $0.20 to almost $1.

Bitfinex has also continued to work with law enforcement agents in investigating the incident, and in February 2019, U.S. authorities recovered 27.66270285 BTC, which were converted to U.S. dollars and paid to RRT (Recovery Right Token) Holders.

Interestingly, the hackers, however clever they were, could never use their goblin gold, simply because all the leading exchanges, standing in solidarity, blacklisted their addresses and didn’t accept transfers. So the stolen funds remained untouched for four years – until recently.

These days, Bitfinex’s new approach includes a raft of measures aimed at protecting the users.

Security settings on Bitfinex

While adding 2FA, you can go with either Physical Security Key using FIDO Universal 2nd Factor (U2F) or Google’s Android or iPhone app for adding token-based 2FA. But if by any chance you enable both, U2F will take priority over Token 2FA.

With 2FA activated, you can watch logins, withdrawal confirmations, password changes, API key creation, security settings changes and sensitive account settings changes.

As to email encryption, the feature most loved by true cypherpunks, you can add your PGP key and give the go-ahead for PGP, Pretty Good Privacy, a data encryption and decryption program that provides cryptographic privacy and authentication for data communication.

You can also adjust your session settings. When logged in but inactive, you will be kicked out of the platform in 30 minutes. Somebody logged into your account? You’d be immediately notified via email with the details of the IP address logged in. If the IP address used to access your account changes on any request, all of your sessions will be immediately invalidated and you will be logged out. This prevents session hijacking.

It’s also possible to whitelist IP addresses by providing one or more IP addresses and/or specify an IP range.

Also, each login to your account is saved and can be audited, and these are not all security measures the exchange uses:

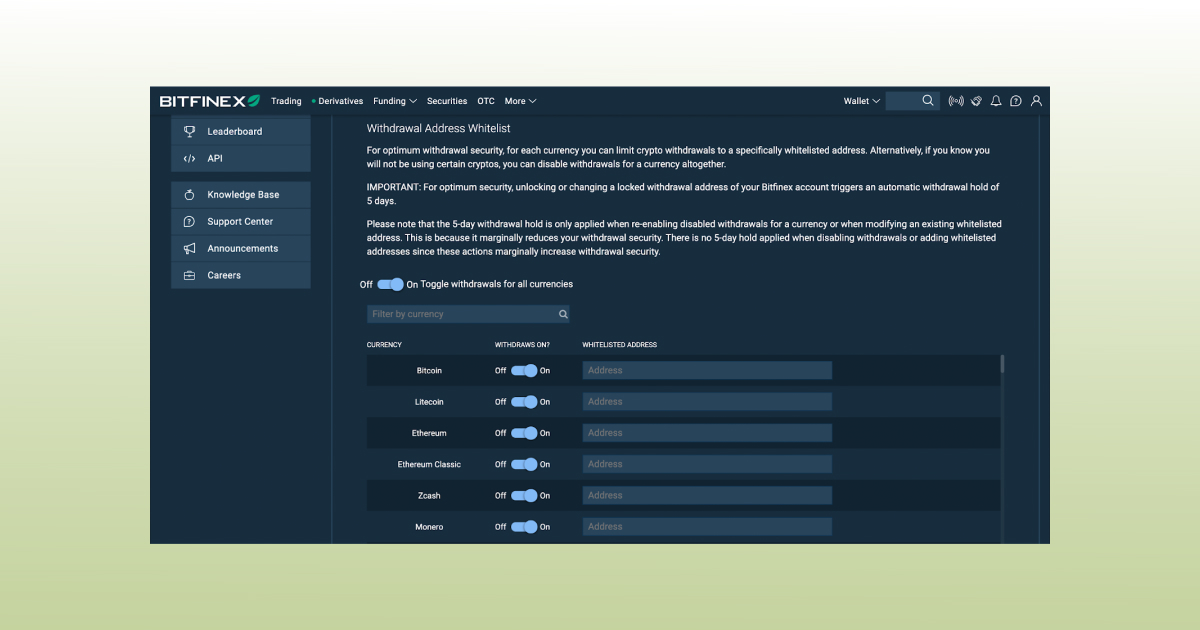

You can whitelist withdrawal addresses for different cryptocurrencies on Bitfinex

So, be safe, namaste… and good luck. As for us, we’re slowly moving to one of Bitfinex’s competitors, Binance.

Binance Review

Currently the largest cryptocurrency exchange in the world in terms of 24h trading volume, in 2017, Binance became one of the most successful ICOs that had raised $15 million. It sure sounds like a good Bitfinex alternative already, right?

The platform was founded by a famous Chinese-Canadian business executive Changpeng Zhao, commonly known as CZ, who was previously developing software for high-volume crypto trades and working for Blockchain.info.

CZ launched the Binance exchange in China but, as time went on, moved its servers and headquarters out of the country into Japan in advance of the Chinese government ban on cryptocurrency trading in September 2017. Taking all things together, the company had been pursuing the decentralized headquarters model up until recently, but in light of the current events, CZ has changed the approach – read on to learn why.

With its 5 million followers on Twitter, at its peak, Binance was adding 240,000 users an hour, but you can’t shine without attracting important people’s attention, right?

As of 2021, Binance is under investigation by both the United States Department of Justice and Internal Revenue Service on allegations of money laundering and tax offenses. Also, the UK’s Financial Conduct Authority ordered Binance to stop all regulated activity in the country in June 2021.

“Four years ago, when we started it,” CZ commented, “We wanted to embrace the decentralized model, so we wanted to have decentralized teams everywhere. But we do run one centralized exchange, which is the biggest part of our business. Now we have come to realize that for the regulators, we need to be centralized.”

Arguably, this is the first time in the history of the exchange that they hit such a rough patch. Up until this point, Binance had been attracting a large number of users from different places across the globe and was receiving praise all the time in manifold reviews. Probably, it’s their time to prove that they are strong enough to get through this challenge.

So, are they? Let’s learn from this Binance review!

Binance New Account: Binance Verification

The first and, probably, one of the most annoying parts in the process of registration on every crypto exchange is verification. Do you want to create a new account on Binance? Then, you’re up for some routine work – and, no, you can’t skip it if you want to sail through to the next round.

There are three verification levels on Binance: Verified, Verified Plus and Enterprise Verification. Here’s a table demonstrating benefits coming along with every new level. Just take a look and decide for yourself what perks are good enough for you:

| Verified | Verified Plus | Enterprise Verification | |

| Information Required |

|

|

|

| Features |

|

|

|

The table is taken from the Binance help page

If you don’t want to think long enough which Binance verification level suits you better, just remember that, generally, the Intermediate Level unties your hands so that you can withdraw $50k daily in fiat and 100 BTC in crypto.

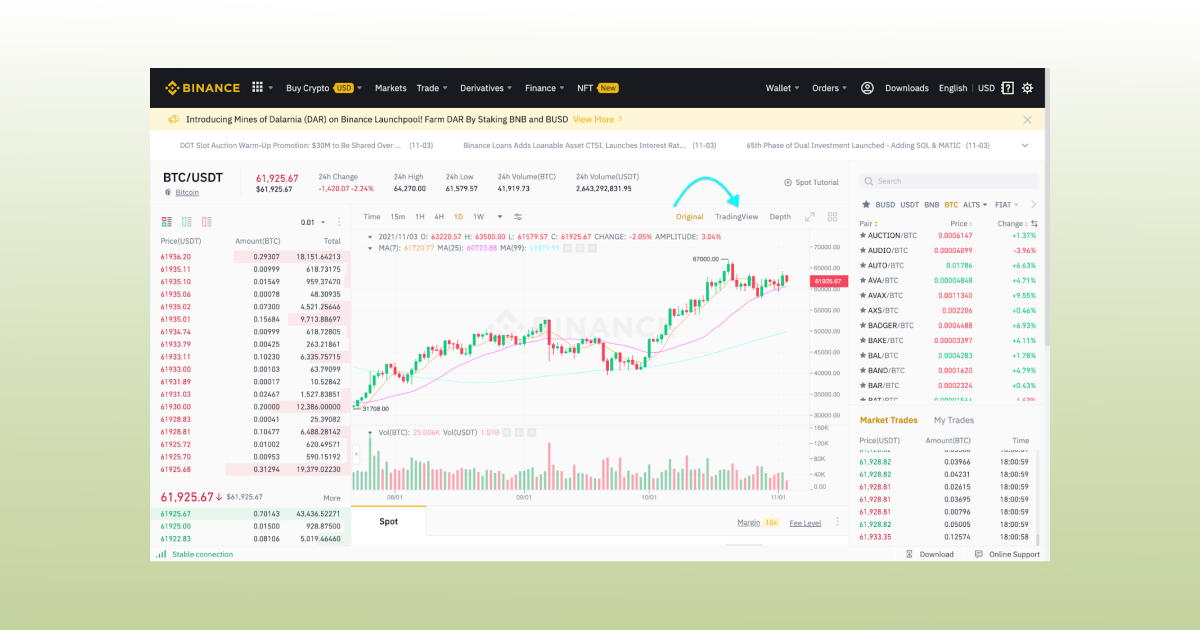

Binance Trading

The safest way to try your trading strategy, if you’re new, is to first experiment with small amounts of money. It’s hard to guarantee that you will learn how to trade on Binance after a couple of trades, but, at least, you’ll get your head around the interface of the platform.

Talking about interfaces, the interface on Binance is pretty straightforward: the order book on the left, the charts right in the middle and the list of the traded markets on the right. There are a few things you need to learn here, though. The what-you-see-is-what-you-get rule doesn’t really work on Binance.

You need to uncork the platform like a good old bottle of wine, actually. For example, Binance indicators are easy to discover if you know where to look. Just click the TradingView charts, and voila – all the indicators you normally have in TradingView have landed at the Binance airport.

The Binance exchange is bottomless, really, like dwarves’ halls under the mountains of Middle-earth. You name it, they have got it: spot trading, margin trading, futures trading, p2p trading, swap trading (like on Uniswap), landing, staking… Who says they can’t have it all?

They even have their own decentralized exchange (DEX), two blockchains (Binance Chain and Binance Smart Chain) and their own version of crypto gold, Binance cryptocurrency. The Binance coin is called BNB, so if you stock up on this coin, they will decrease your Binance trading fee in return.

Sounds interesting? To learn more on how to buy the Binance coin, just follow this link.

Binance.com

Spot Trading

So, let’s talk about the part where the crypto journey normally begins for every crypto trader: spot trading on Binance. Here’s a quick reminder for those of you who have forgotten. A spot market is called like that because this kind of trades are made “on the spot.” The trades are settled immediately, so the current market price of an asset is often referred to as the spot price.

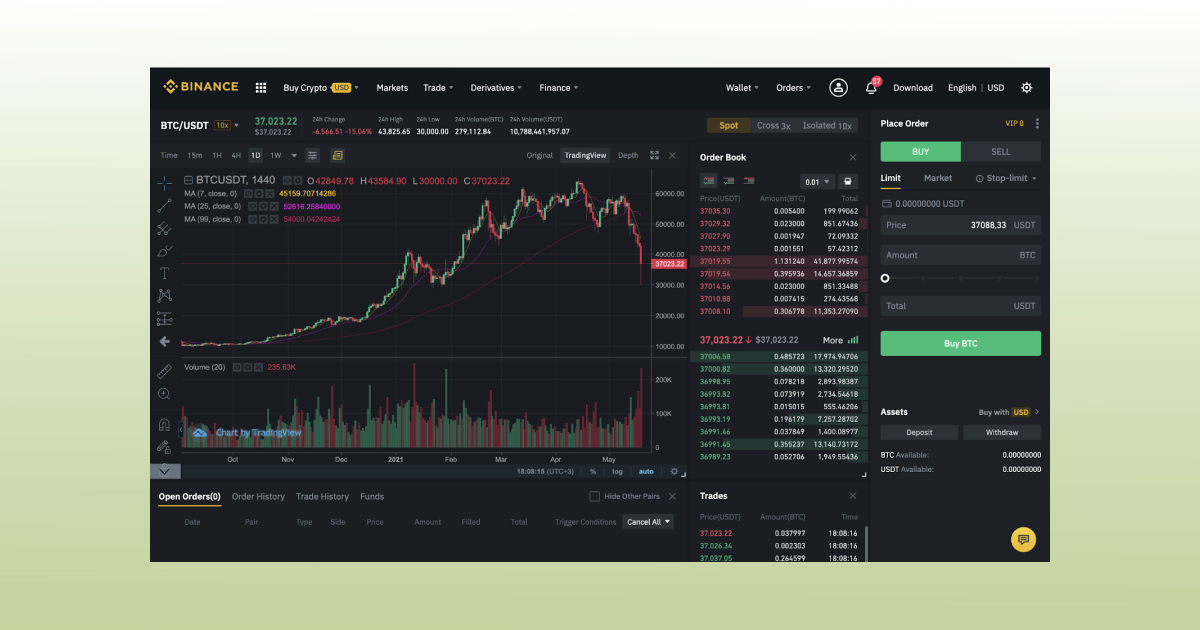

Again, here’s an interface you’re going to use if you’re about to do some Binance spot trading. This time, the theme is dark just for the fun of it and just to show that you can change the themes if you want to.

Simple interface on Binance for spot trading

Did you know that Binance actually offers a few interface types for spot trading? Here’s an advanced interface as it is:

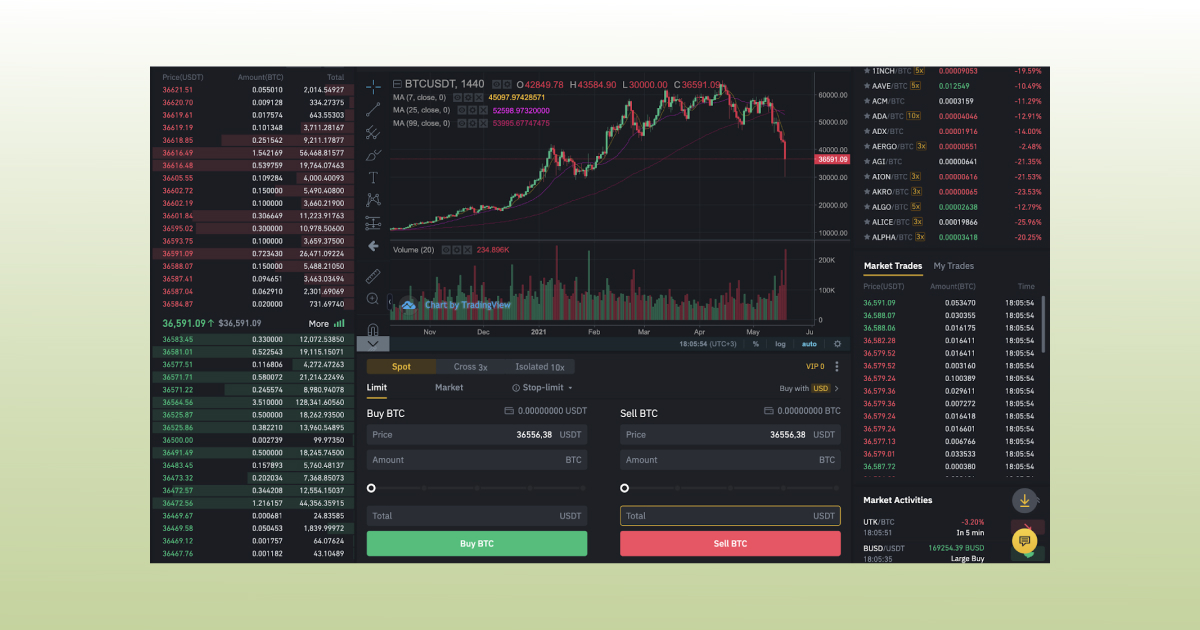

Advanced interface on Binance for spot trading

Now, let’s talk about order types. The range of orders on this platform brings no surprises and includes trailing orders, limit order, market order, stop-limit and OCO order types.

To enhance your Binance experience, install the Good Crypto App offering you Trailing Stop, Trailing Stop Limit, Reverse Trailing Stop, Trailing Take Profit, Trailing Stop Loss, Take Profit and, of course, often-used market, stop and limit orders. Connect the app to your account on the exchange via API key, track your portfolio across 30+ exchanges, monitor Uniswap gems and run the Infinity bot that will stop only when you want to stop. Just make sure to tell it your safe word – PnL drawdown limit. The balances don’t get locked until your orders are triggered. You can place as many orders as you like. As soon as one of your orders meets market conditions, it will be sent to the exchange.

A quick drill:

Limit order is an order that you place on the order book with a specific limit price.

Market order is an order to quickly buy or sell at the best available current price. The trading fee on the market order is always higher than on the limit one, so don’t lose sight of the fact.

Stop-limit follows the stop price and triggers a limit order when the stop price is reached.

One-cancels-the-other (OCO) order combines two market orders, where if one is fully or partially fulfilled, the other is canceled.

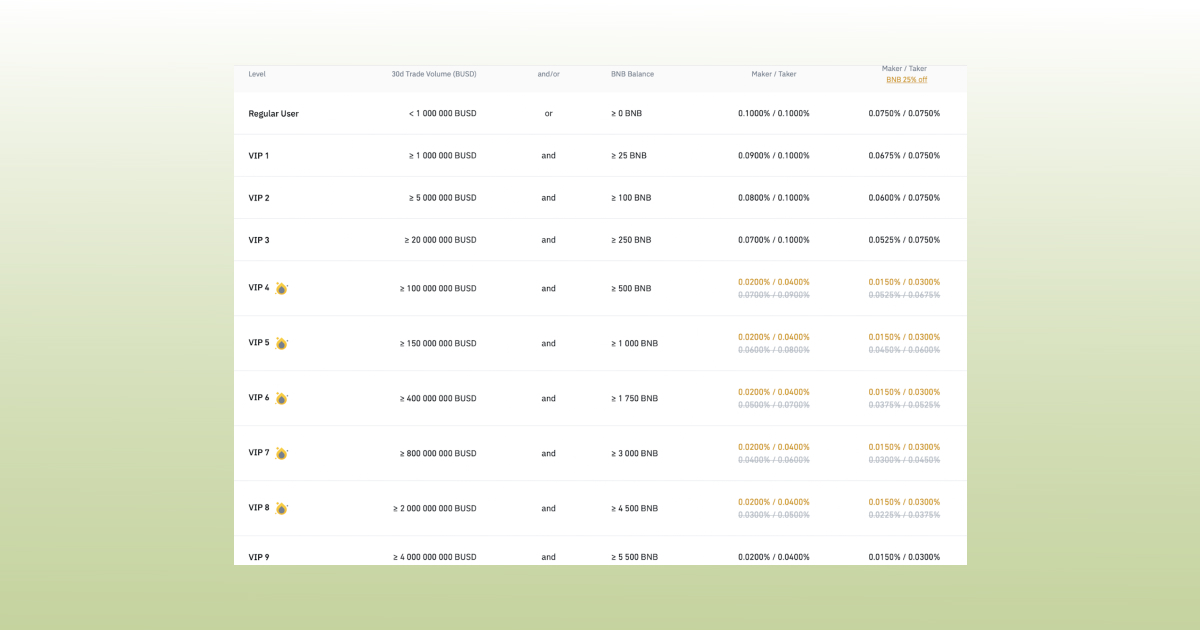

Now let’s take a peek at Binance trading fees, here is a detailed breakdown outlining each level:

Binance.com Spot Trading Fees

You can get familiar with all the latest spot trading fees on Binance.com by yourself.

Here’s the kicker: Binance.com lists more than 600 coins, 1462 markets and more than 79 fiat currencies.

Are you looking for something specific? On Binance, you’ll find almost any popular and well-established altcoin, such as Kusama, Polkadot, 1inch and Verge.

Binance Margin Trading

In case you forgot, margin trading is a trading type where you initially deposit money into your account to effectively borrow more money from an exchange or other traders. These other traders willingly lend you their money because you pay interest for using it, and the higher the demand for a particular coin, the higher is the interest.

It’s a win-win situation, really, for the margin trader and the borrower, because while buying on margin, you increase your trading power and potentially leverage profits. The funders get their interest in their turn.

It’s simple but not easy: while amplifying your possible profits, margin trading might also amplify your losses, so it’s dangerous, very, very dangerous and not for newbies – keep that in mind.

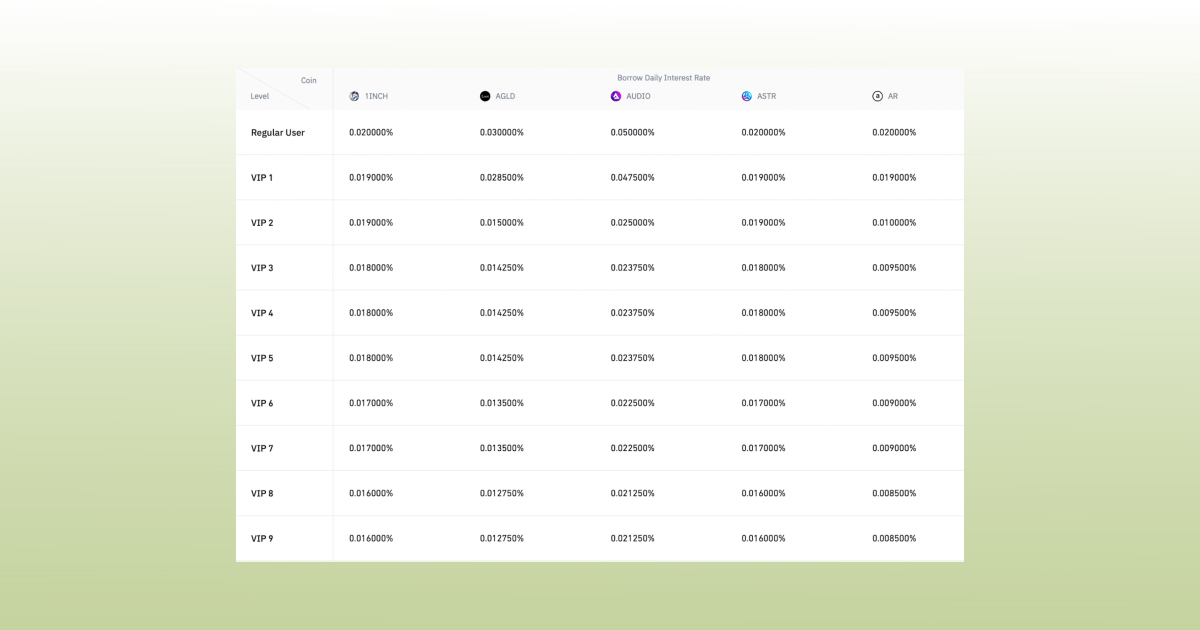

What about Binance margin trading, then? Do they have one? Of course, they do – here is a detailed breakdown outlining users’ levels:

Binance.com Margin Trading Fees

You can get familiar with all the latest margin trading fees on Binance.com by yourself.

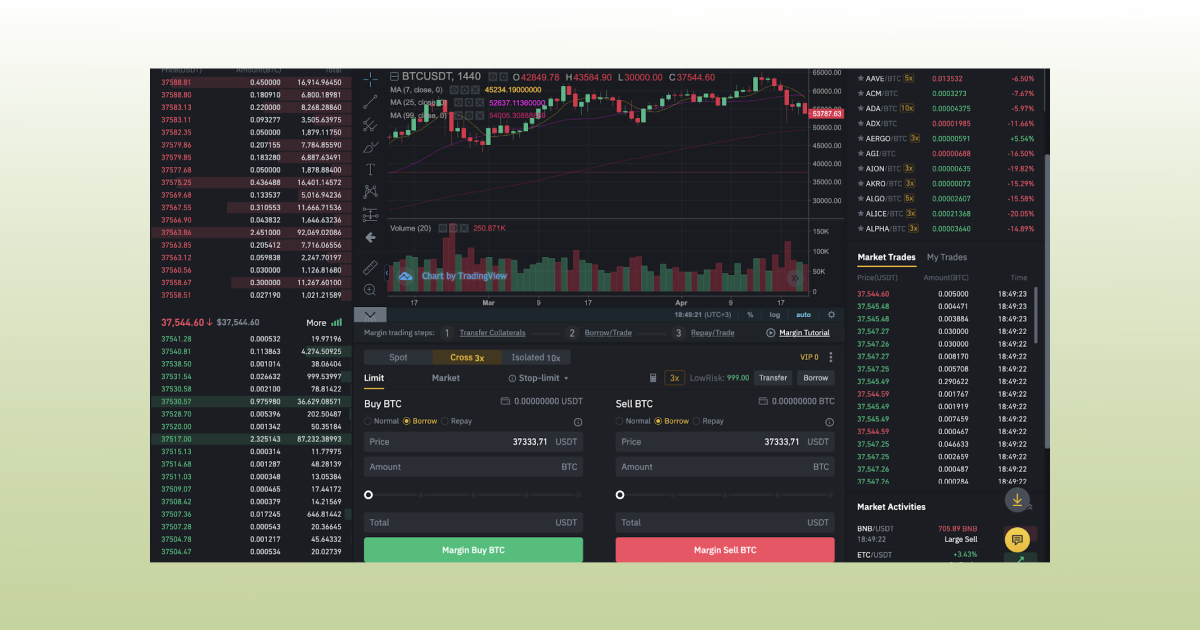

Binance margin trading interface

So, what is the fastest way to start margin trading on Binance? According to the Binance margin trading guide presented on their website, when your margin trading account is activated, transfer your funds from your regular Binance wallet to your margin wallet.

Depending on how much money you’ve got in your balance, you can borrow more or less funds to leverage your position. But the fixed rate is generally 5:1 (5x). That means that if you have 1 BTC, you can borrow 4 more.

Binance Futures Trading

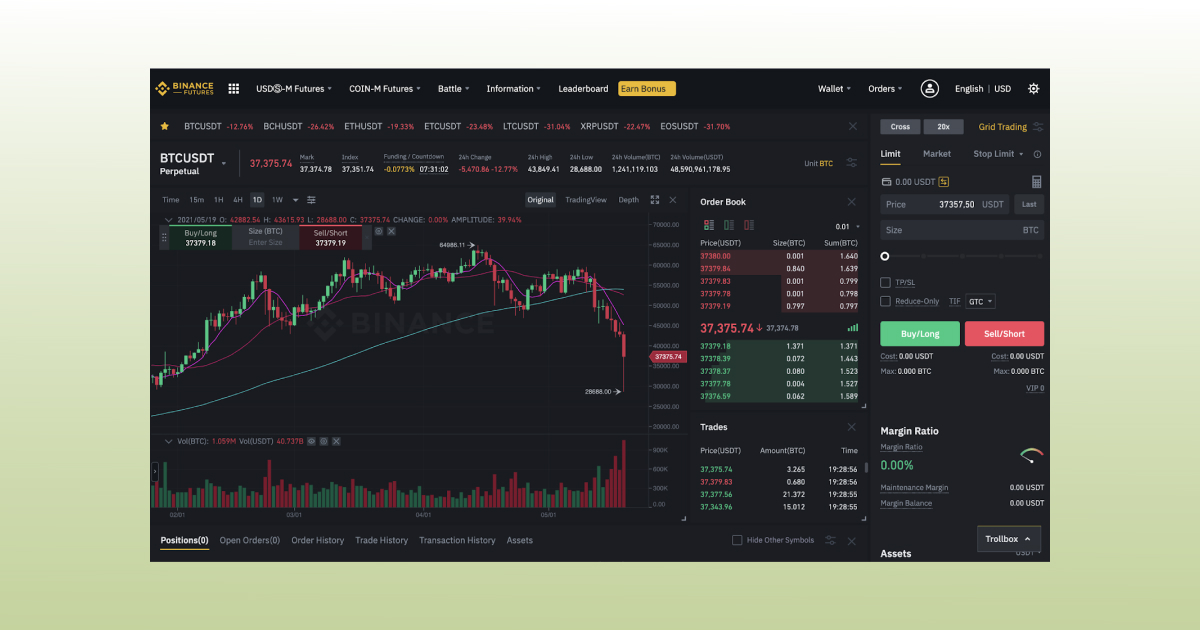

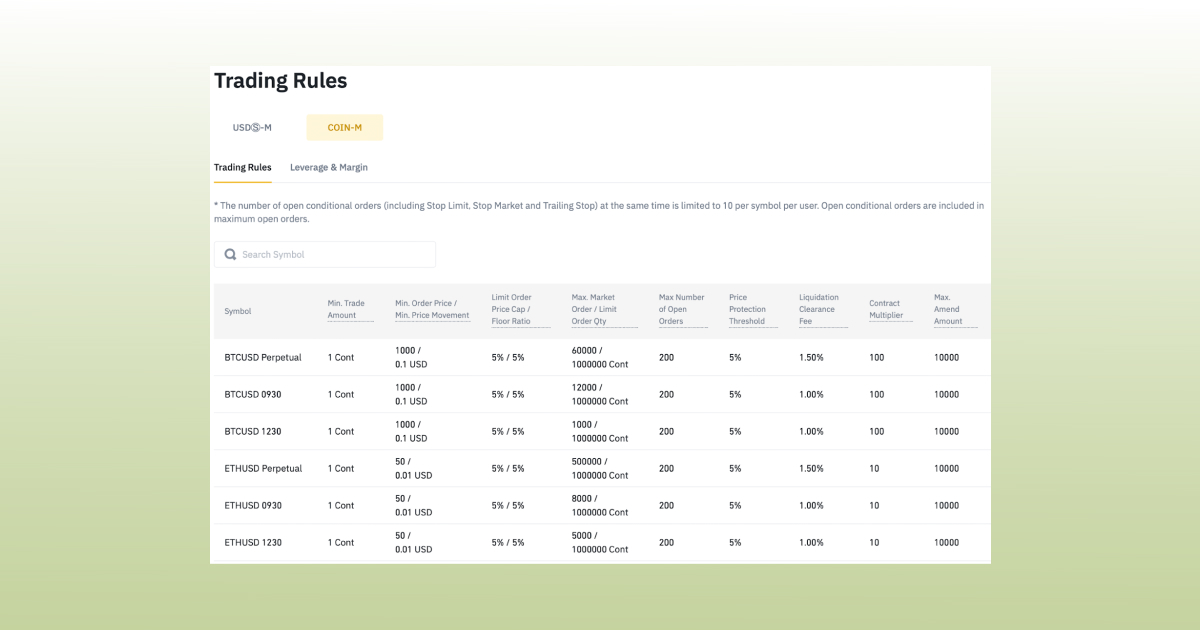

USDⓈ-M futures contracts on Binance have clear pricing rules and are settled either in USDT or BUSD

Futures in the crypto world are complex and interesting, because every crypto exchange might offer their own definition of what it is. Let’s see what Binance has come up with!

Binance considers futures contracts as agreements that bind traders to buy or sell assets in the future at a specific price and date. These financial instruments are frequently used by both hedgers and speculators as a way to potentially anticipate future price movements, either for hedging against risks or for making profits.

Futures trading is basically the same with margin trading except that you don’t use a real asset while buying and selling. In fact, you just buy a candy wrapper but with a higher leverage. As the Binance team nicely puts it in their guide, while trading futures, you can make a profit by using up to 125X leverage – (20x by default).

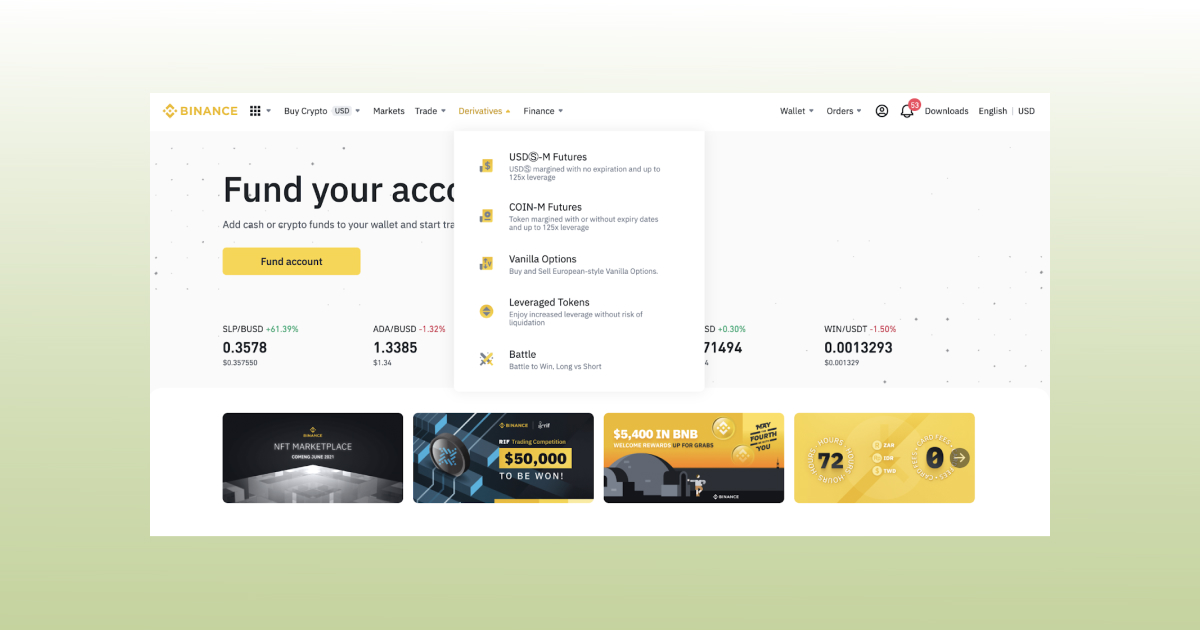

Binance.com derivative trading options

What’s the algorithm of trading futures on Binance? Click on the Derivatives tab, choose the futures type you want to trade and go wild using not only limit order, market order, stop limit order and stop market order, but also trailing stop order, a post-only order and limit TP/SL order specifically developed for Binance futures.

Binance cash-settled quarterly futures

Futures types on Binance.com include COIN-M Futures (quarterly), USDⓈ-M Futures (perpetual), Binance Leveraged Tokens (tokenized version of leveraged futures positions) and Binance Options (simplified version of traditional options).

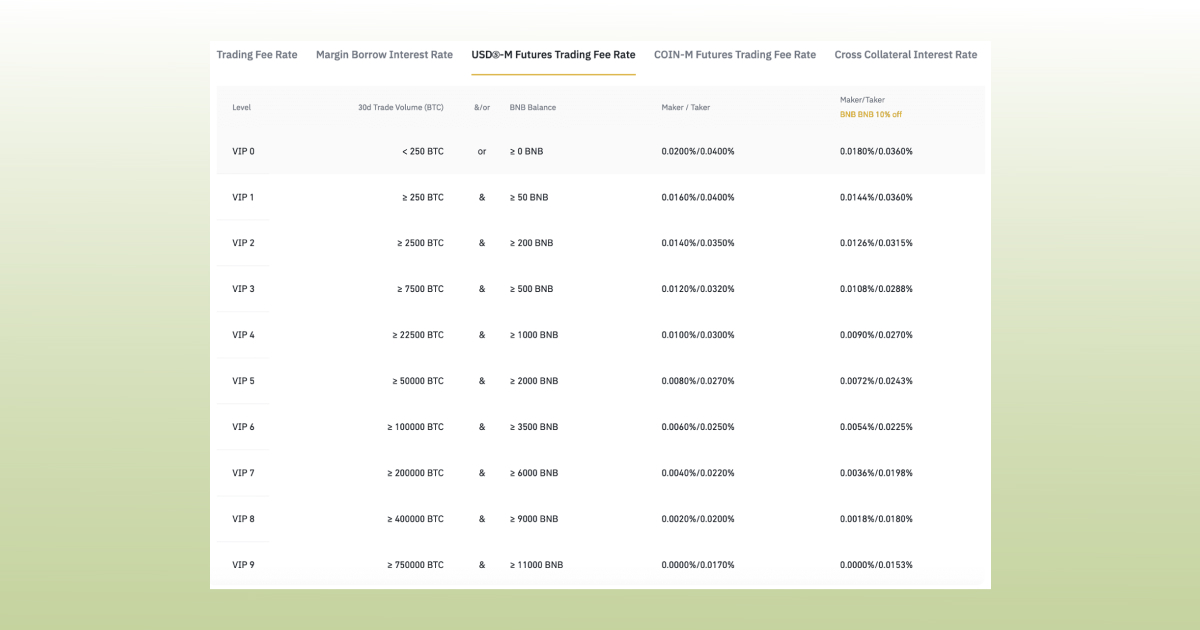

As to the Binance Futures fee schedule, here is a detailed breakdown for users’ different levels:

Fee schedule on Binance Futures

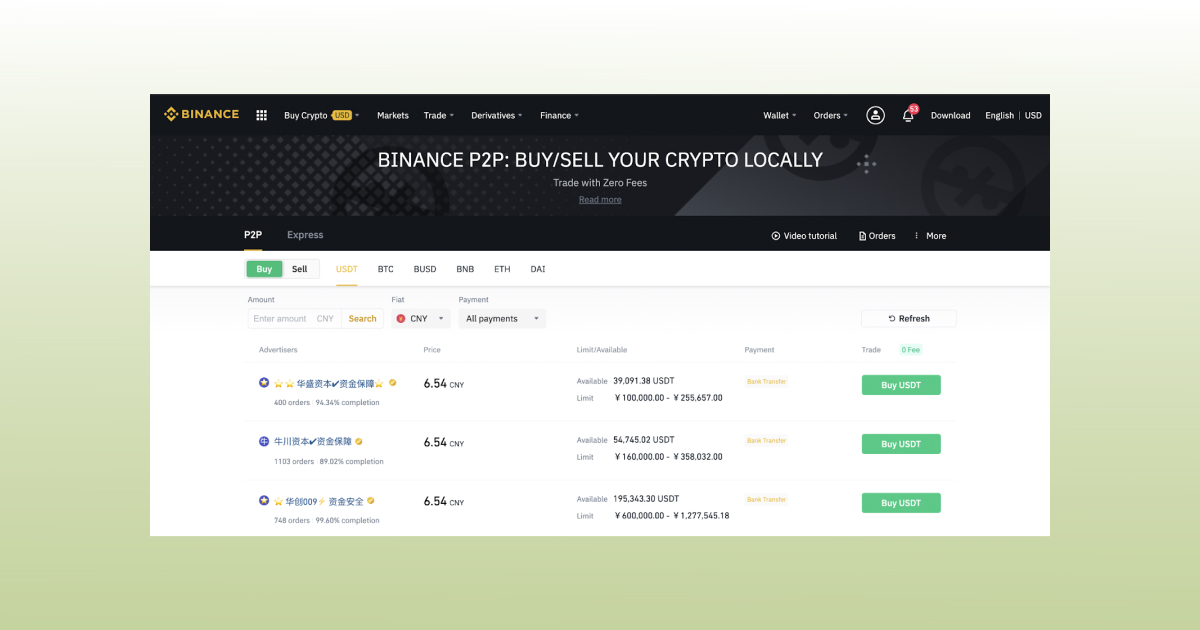

P2P Trading on Binance.com

Being a truly international venue, Binance.com gives you a chance to trade more than 70 fiat currencies with peers around the globe and use more than 300 payment methods. All that is possible thanks to p2p trading (peer-to-peer), a service on a decentralized platform whereby two individuals interact directly with each other, without intermediation by a third party.

According to Binance’s official page, you can buy crypto using your local currency, take advantage of a competitive price in your market and sell that crypto in other markets worldwide where people are willing to pay more for the same amount of crypto.

p2p trading on Binance.com

The good part is that Binance doesn’t charge any p2p fees for takers. You only pay blockchain commissions transacting with each other – but that’s a common place in the niche, right? However, depending on fiat markets and trading pairs, Binance charges 0% to 0.35% transaction fees to makers.

Interestingly, in 2020, Binance P2P processed $7 billion worth of transactions made through 3.8 million orders, with daily volumes reaching as high as $54 million.

Staking on Binance.com

Here comes staking, another type of activity you can engage with on the Binance crypto monolith.

You’re probably aware of the fact that the proof-of-stake mechanism allows blockchains to operate in a more energy-efficient way than the proof-of-work consensus. The algorithm incentivises participants to lock or “stake” as many coins as possible in their wallets.

By doing so, the users with the largest amounts of locked money validate the next block on the network and provide a certain level of decentralization. The more coins are locked up in the wallet, the more chances the owner of the wallet has to become a validator.

Binance staking is based on this concept, but, quite honestly, not only Binance.com offers this service. You can stake with Binance US, in Coinbase Wallet, on KuCoin… The exchanges like Binance aggregate staking algorithms and by doing that, allow you to choose whatever blockchain you like.

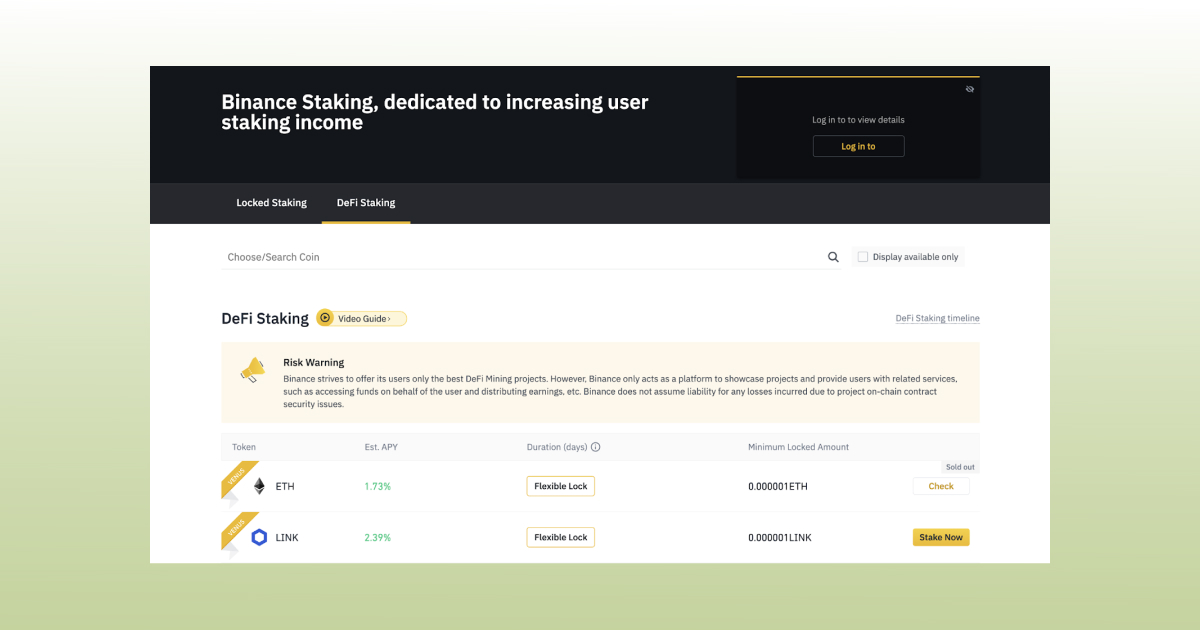

DeFi staking on Binance.com

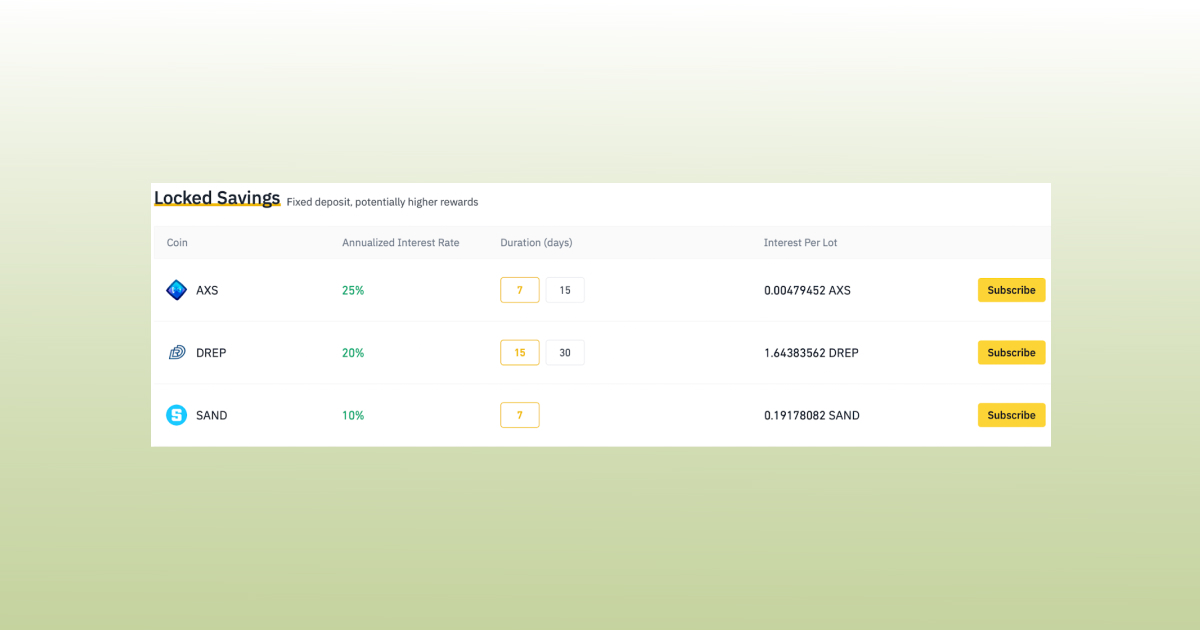

But let’s go back to Binance.com for a while. There are two staking types on this exchange: (1) locked staking and (2) DeFi staking.

Binance locked staking is the process of holding funds in a wallet that supports the operations of a traditional proof-of-stake blockchain. There are 55 locked staking products, as of now, including AVAX, DODO, IOTX, DASH, CELR etc. By the time of writing, AVAX’s estimated APY is, for example, 34.79%, while for DODO this number is 57.79%.

Binance DeFi staking acts on behalf of users who want to participate in certain DeFi products. The list of 11 DeFi staking products includes but is not limited to ETH, LINK, SXP, BNB and BUSD.

You should always keep these numbers in check, but, as of writing, an estimated APY (annual percentage yield) for staking Ethereum on Binance is 1.73%, LINK – 0,2% and SXP – 1%.

There are no fees for staking coins on Binance.

Lending on Binance.com

So, what about lending? When does it come in handy? Here’s an example.

Say, you have crypto but don’t want to trade it. At the same time, you realize that it’s not good just to keep your money untouched. Try some lending. How does that work? Lend your crypto assets to margin traders and, after withdrawing the loaned funds, receive a total amount plus daily interest.

There are 3 different lending products on Binance. Let’s take a look at all of them.

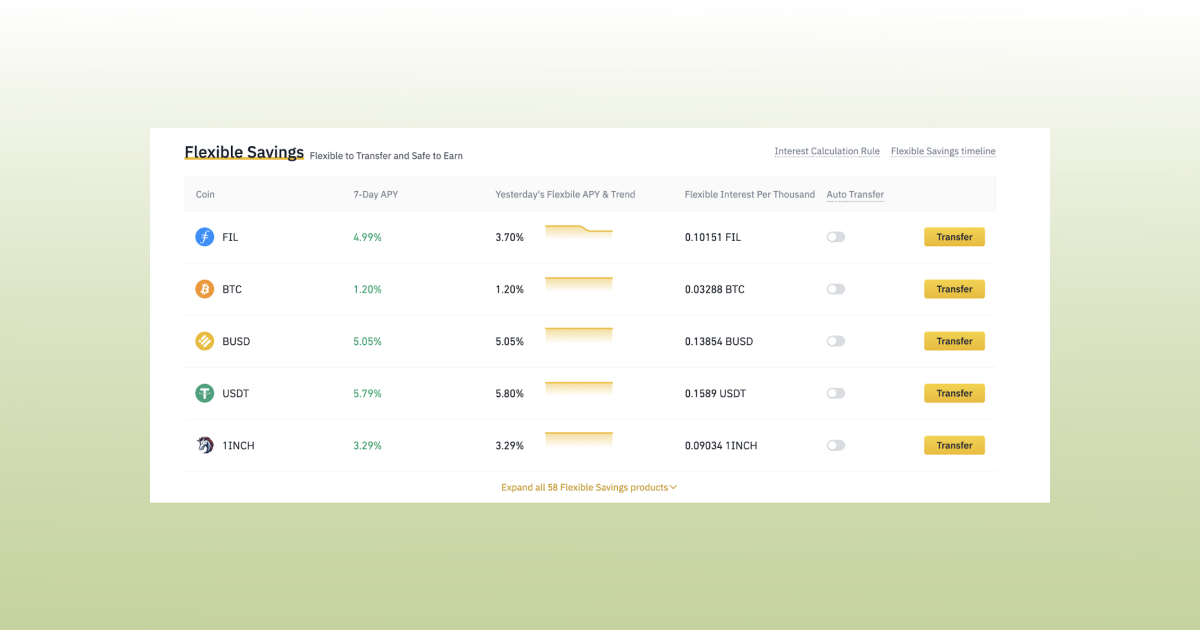

One of the lending products on Binance.com, Flexible Savings

Flexible Savings gives you flexibility to redeem your funds at any time. As an illustration, a 7-day yield on USDT will make 5.79% APY for the moment, and BTC only 1.2%.

One of the lending products on Binance.com, Locked Savings

Locked Savings is different to Flexible Savings in a way that the funds can be withdrawn only after a certain period of time. For example, for locking USDT for 7 days you will earn 6.31%. Note that the platform pays you more for staking coins for a locked period of time!

Is the juice worth the squeeze? The Binance platform incentivises you to stake coins in return for even more rewards when you use the Launchpool feature. Stake BNB in the BNB pool or BUSD in the BUSD pool and earn DAR. Stake DOT and earn ATA, stake BETH and earn DODO – hopefully, you get the gist: stake, Forrest, stake.

Binance.US

Even though Binance.com and Binance.US have almost the same titles, “almost” is the keyword here. It’s important to emphasize from the very beginning: these two venues are not the same venues, different teams develop them in different locations.

Plus, the variety of trading options on the American venue is much less than on its international counterpart. Have a look for yourself!

Spot Trading

Binance.US lists over 100 coins, 271 markets and one fiat currency, USD. Their general trading fee is 0.1%, while for buying and selling instantly you will have to pay 0.5%. If you use BNB to pay for trading fees, you will have to pay 25% less. Normally trading fees are determined by your 30-day trading volume and your daily balance just like on Binance.com.

If you want to learn more about the fee calculation on Binance.US, visit this page.

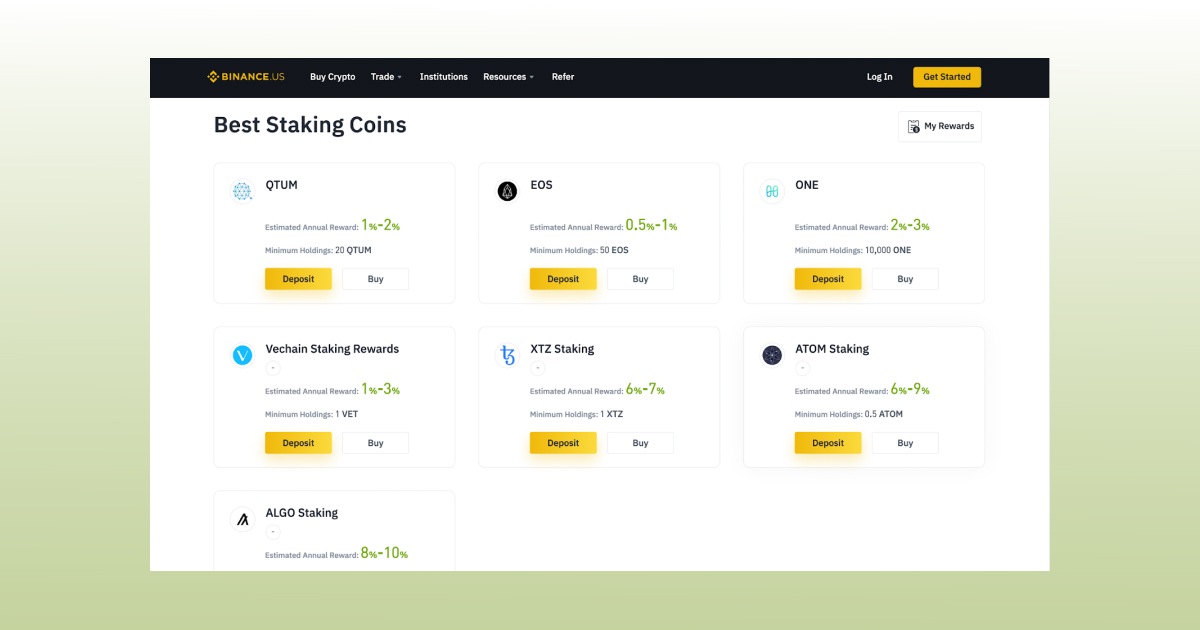

Staking

Binance.US currently supports staking for VET, XTZ, ATOM, EOS, ONE and ALGO.

Staking products on Binance.US

The exchange’s guide states that an estimated annual reward (akin to an APY) for staking the ALGO coin is overall 8%. It means that after a year of staking ALGO, you might earn that much. However, practically, for the period of 2021/08/01 – 2021/08/31 the estimated annual reward, as noted on the Binance US website, was 5.0077 %.

Binance further mentions that currently there are no lock-up periods. Staking rewards are calculated daily (hourly snapshots) and distributed monthly.

Binance Withdrawal: How to Withdraw From Binance

Binance.com

A Binance withdrawal will usually take between 30 to 60 minutes to complete if you withdraw crypto. However, the transaction might be delayed depending on the number of required network confirmations.

When it comes down to fiat, Instant Card Withdrawals allow Binance users to instantly withdraw money from their fiat wallets directly to their credit and debit cards – as long as they have Visa Fast Funds (Visa Direct) enabled.

According to Binance, not all card providers, however, support instant card withdrawals. If you don’t see your card listed as an option, this means your card does not support this function. Card eligibility requirements are created by your bank or card provider — please contact them for more information about enabling Visa Fast Funds (Visa Direct).

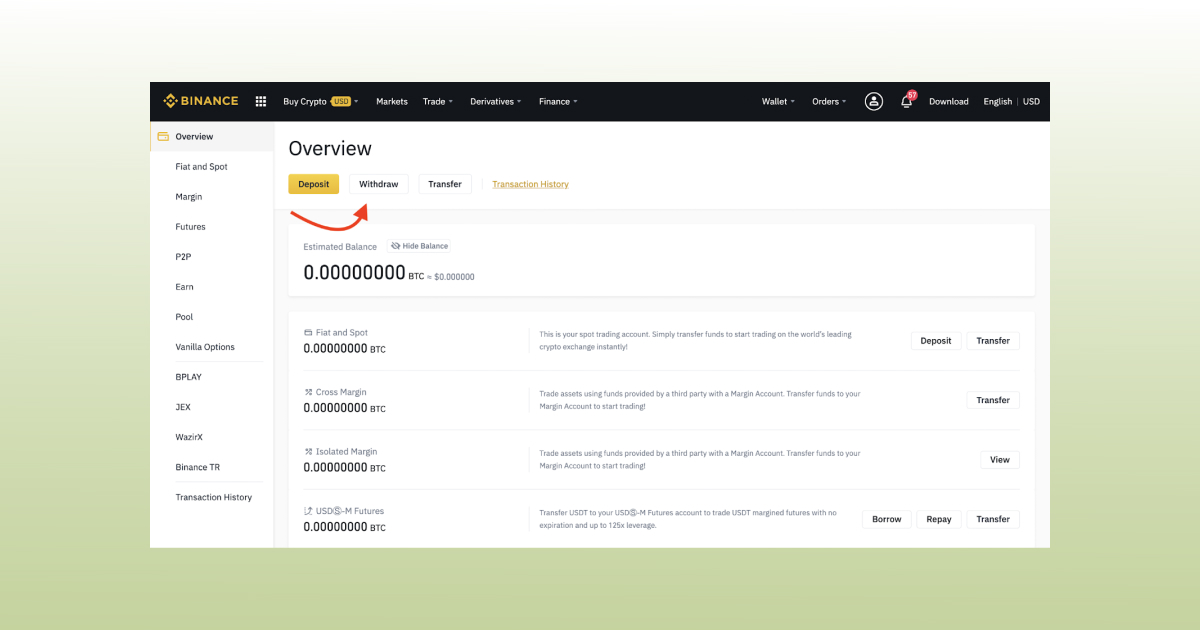

In general, withdrawal and deposit processes look somewhat familiar on the platform since you kind of have to use the same interfaces. So, if you don’t know how to put money into Binance or how to withdraw it, keep on reading.

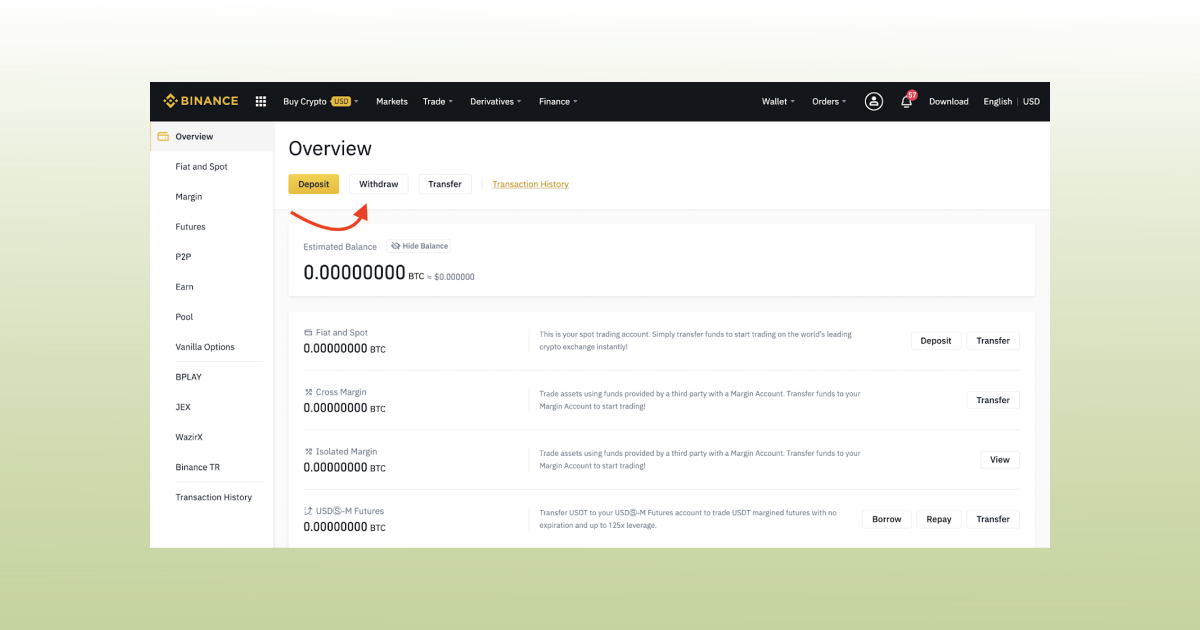

In order to deposit fiat, click on Wallet and, then, on Overview. You will see deposit and withdrawal options as shown below:

How to withdraw from Binance / how to deposit money into Binance

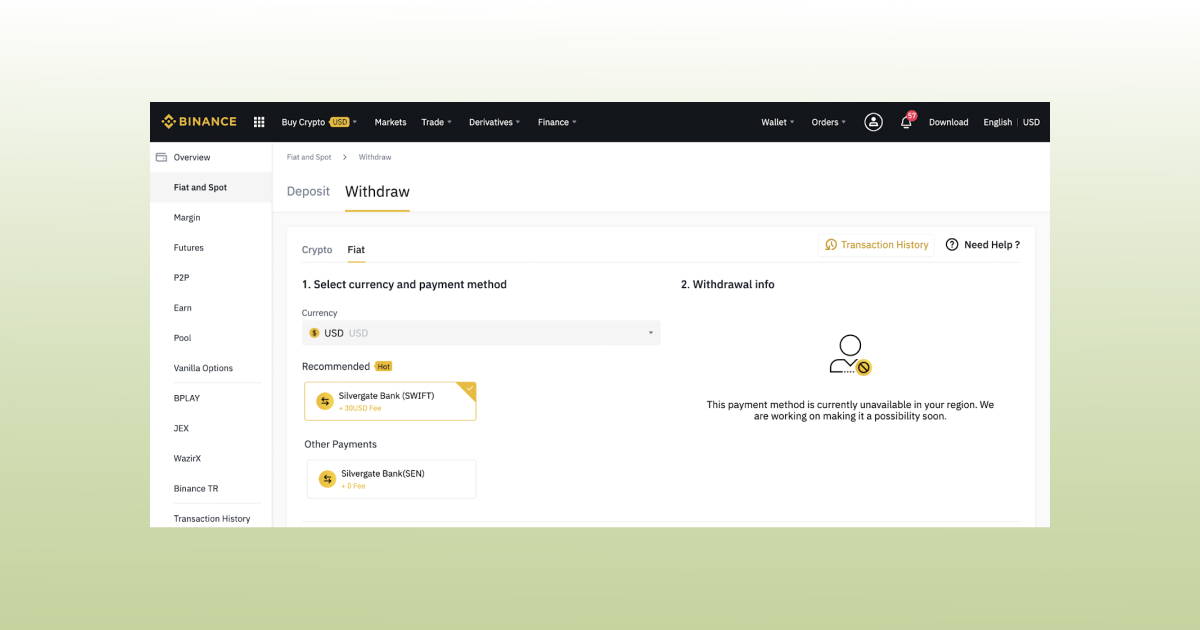

Basically, you can deposit different fiat currencies, such as USD or GBP, using Silvergate Bank (SWIFT).

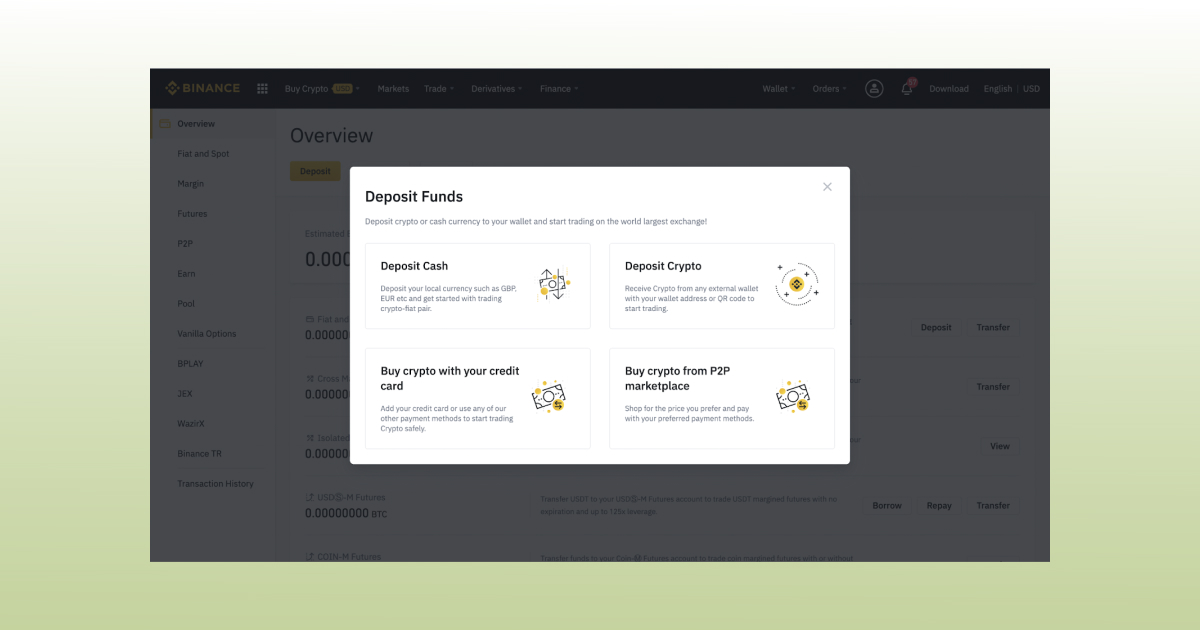

Also you can surely deposit crypto. Just click on the yellow button Deposit, and you will see this screen:

Once clicking “Deposit Crypto”, the platform will generate the public address you can use to deposit from any other crypto platform to Binance.

If you don’t know how to cash out on Binance, click the button Withdraw as shown below…

…and you’ll see the withdrawal options:

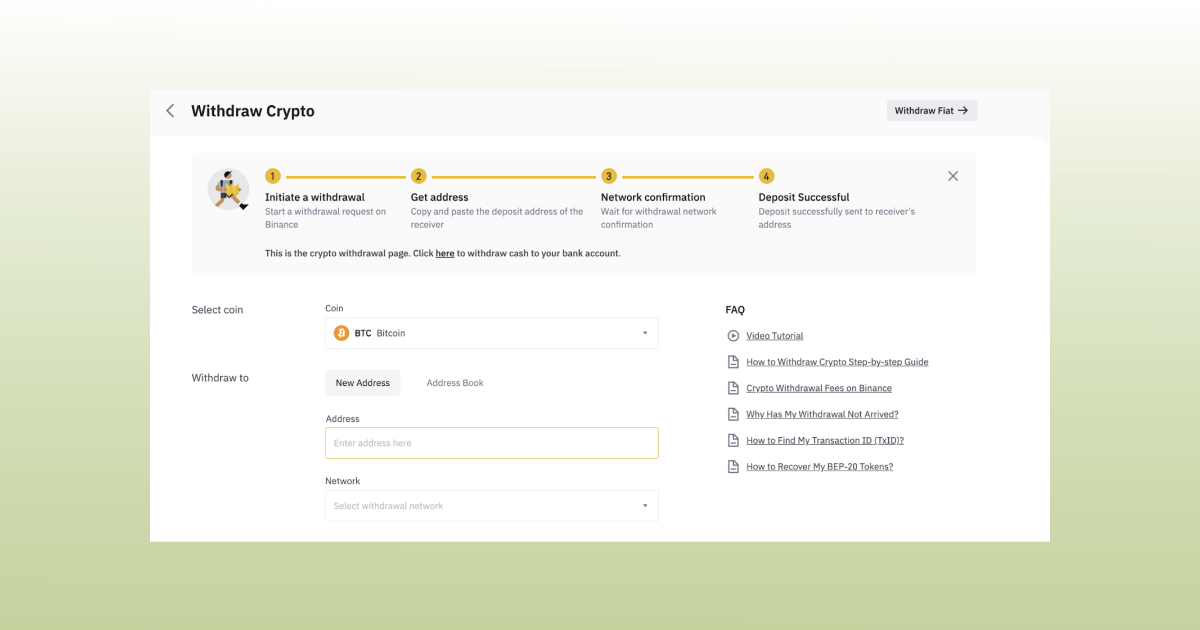

As you can see, you can withdraw either fiat using Silvergate or crypto once clicking on the button Crypto:

Now you can see a field to insert the public address of the wallet you want to transfer your money to.

Binance.US

Take a look at the set of benefits that goes with certain verification levels on Binance.US.

In addition to what is already put into the table down below, a fact worth mentioning is that only debit cards are available on top of the American branch of Binance, no credit cards are supported.

Another interesting thing about Binance.US is that with the basic verification status, you can only deposit one thousand dollars in fiat and up to five thousand dollars in crypto equivalent. In order to successfully complete the basic identification process on Binance.US, be prepared to activate 2FA – no worries, the whole thing doesn’t take long.

| KYC types | Verification time | Deposit & Withdrawal limit per day |

Purchases with a debit card | Bank transfers |

| Basic | Approx. 1 min | $1,000 USD | ✅ | ✅ |

| Advanced: ID-based or address-based | Approx. 5 mins |

Deposits (< $7.5 MM USD) Withdrawals (< $1 MM USD) |

✅ | ✅ |

| KYC types | Trading | Staking | OTC Trading | API Trading |

| Basic | Crypto pairs | |||

| Advanced: ID-based or address-based | Crypto pairs | ✅ | ✅ | ✅ |

Binance.US verification benefits

So, how long does Binance.US verification take? It is easy to come across some threads on Reddit where people discuss how it takes them up to 30 days to get verified on the platform, but in most cases, if your papers are valid, the process shouldn’t take more than 5 mins. If it does, don’t wait, submit a request to the support desk.

Binance Fees

Note that fees on crypto exchanges are subject to constant changes, so make sure to monitor them on a regular basis.

To get the most relevant Binance trading fees schedule on Binance.com, click this link. There, you will find all the fees needed, the Binance withdrawal fee including.

Fees on Binance.US are presented on their website, too.

| Maker Fees | Taker Fees | Deposit Fees | Withdrawal Fees | Debit/Credit Card Instant Buy Fees |

|

| Binance.com | 0.1% | 0.1% |

|

|

3.99% |

| Binance.US | 0.1% | 0.1% |

|

|

4.5% |

Binance Security: Is Binance safe?

All U.S. dollar deposits at Binance.US are held at custodial bank accounts and insured up to $250,000 for bank failure by the Federal Deposit Insurance Corp. But is the situation the same with the international branch?

In addition to such safety measures as 2FA verification, device management, address whitelisting and cold storage. Binance.com has an ace up its sleeve – the SaFu fund.

According to their website, in July 2018, they created the Secure Asset Fund for Users (SaFu) and began allocating 10% of all trading fees received into this fund to provide insurance to potential breaches. The funds are stored in secure hard wallets to be accessed only in cases of extreme emergency.

| Bounty Program | Stays Logged In | Funds in Cold Storage | SaFu | |

| Binance.com | ✅ | ❌ | “Vast Majority” | ✅ |

| Binance.US | ✅ | ❌ | “Vast Majority” | ❌ |

Here’s a good illustration of how the fund works. In 2019, the hackers were able to withdraw 7000 BTC in one transaction, and Binance used the SaFu fund to cover this incident in full. No user funds were affected. So, this smart approach to the platform long-term sustainability directly points at how safe Binance is.

Since Binance.US claims to use the same technologies as Binance.com we might expect them to use the same security measures – and as we know from the official page, “as a way to protect users’ funds, Binance only holds a small percentage of coins in its hot wallets. The remaining is kept in cold storage, disconnected from the Internet” – which means that probably the majority of user funds on Binance.US are stored in cold wallets, too.

As to the Binance.US bounty program, it pays rewards in BUSD. The international branch of the crypto exchange has the same program and states that “only vulnerabilities with a working proof of concept that shows how it can be exploited will be considered eligible for monetary rewards.”

Bitfinex VS Binance: Comparison Table

| Features | Bitfinex | Binance.com | Binance.US |

| Maker Fee/Taker Fee | 0.1% – 0.2% | 0.1% – 0.1% | 0.1% – 0.1% |

| Markets (trading pairs) | 341 | 1462 | 271 |

| Margin Trading | ✔️ | ✔️ | X |

| Futures Trading | ✔️ | ✔️ | X |

| Trading Volume 24hrs | $210,788,063 | $11,775,695,040 | $322,166,489 |

| Mobile App | Android, iOS | Android, iOS | Android, iOS |

| Trading in the US | X | X | ✔️ |

| Professional Trading Terminal | ✔️ | ✔️ | ✔️ |

| Advanced Charting tools | ✔️ | ✔️ | ✔️ |

| Advanced Order Types | ✔️ | ✔️ | X |

| Mandatory KYC | X | X | ✔️ |

| Federal Insurance | X | X | ✔️ |

| Fiat currencies | USD, EUR, GBP, JPY, CNH. | GBP, EUR, USD, JPY, CNH, UAH, CNY, AUD, and many other | USD |

| Fiat withdrawal to debit/credit card | X | ✔️ | ✔️ |

| Payment Methods Accepted | U.S. Bank Account, Debit Card Buy | U.S. Bank Account, Debit Card Buy | U.S. Bank Account, Debit Card Buy |

Conclusion

So, is it Binance or Bitfinex? What is it going to be? Hopefully, now you understand which exchange would suit you better. Binance is very popular and resourceful, but Bitfinex is old and offers great trading tools.

However, both exchanges have or recently have had problems with the law. The authorities don’t particularly like the fact that millions of dollars run through these trading venues on a daily basis without much governmental control.

Bitfinex is older than Binance, but Bitfinex’s trading fees are slightly higher, 0.1% – 0.2% against 0.1% – 0.1%. Plus, the number of trading pairs is higher on Binance.

Neither margin, nor futures trading is available on Binance.US, and yet Bitfinex.com and Binance.com offer these options.

The exchanges have professional trading terminals, advanced charting functionality, mandatory KYC and such payment methods as the U.S. Bank Account and Debit Card Buy. However, fiat withdrawal to a debit or credit card is not available on Bitfinex. Its’ minimum withdrawal limit is $10k, and federal insurance doesn’t cover your funds on Bitfinex as it does on Binance.US.

Bitfinex has a solid base of users because this exchange offers a set of advanced custom orders, which contrasts with Binance and other competitors. However, it’s important to also note that in the modern era you don’t have to be limited by the exchanges’ functionalities.

If you want to use a whole range of different trailing orders on your favourite exchange, say, on Binance, just use a third-party app, such as Good Crypto App. Good Crypto app not only offers regular order types for 30+ largest crypto exchanges, but also provides Trailing Stop Buy, Trailing Stop Limit Buy, Reverse Trailing Stop and Reverse Trailing Stop Limit.

The app sends you push notifications on order execution, significant price changes, deposits, transfers, daily portfolio summary, offers trade automation and tracks your portfolio.

Enhance your trading experience on Bitfinex or Binance by using Good Crypto on iOS or Android.