Hello everyone, this is our weekly crypto digest. Here you’ll find everything from a weekly market summary and top news to the hottest new listings on exchanges, and even memes to cheer you up. To get these updates as soon as we post them, follow us on Twitter.

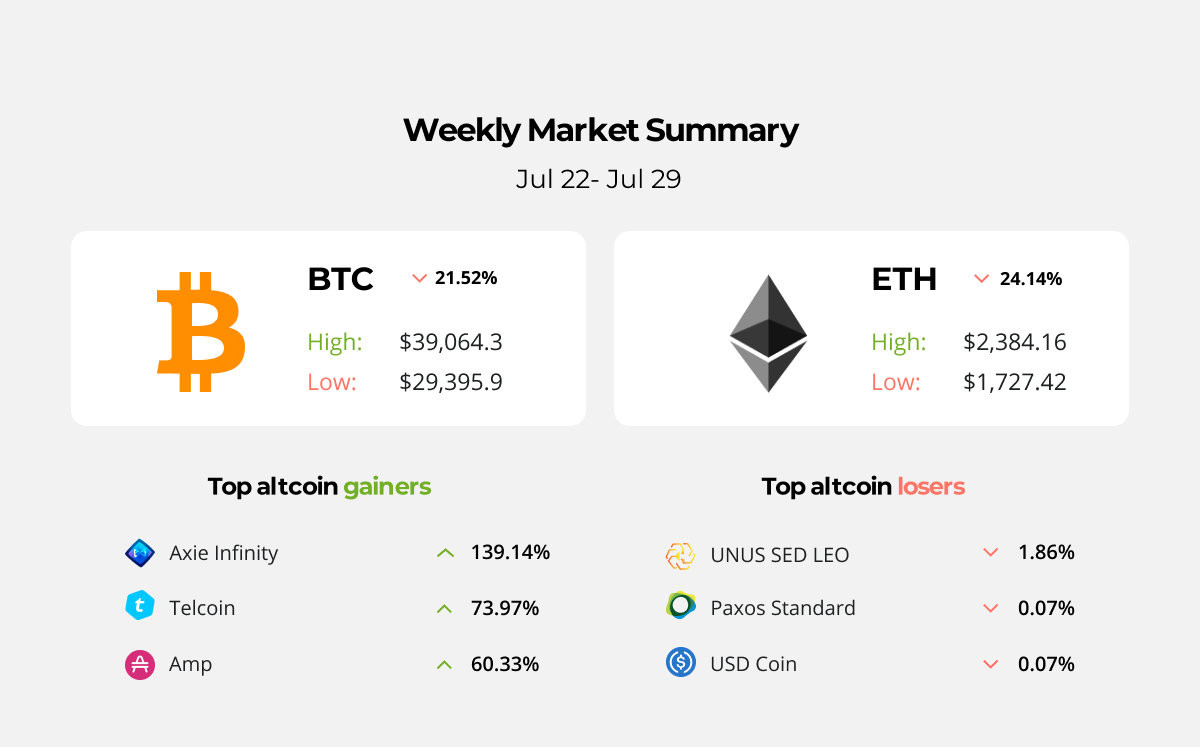

Weekly Market Summary

Binance exchange CEO Changpeng Zhao announced he wants to be licensed everywhere and is considering setting up several regional headquarters.

“We want to be licensed everywhere,” CZ said to Reuters, also adding that the exchange wants to “work with regulators everywhere.”

Binance also lowered withdrawal limits for users with only basic identity verification. From now, users who have completed only basic account verifications will be unable to withdraw more than 0.06 Bitcoin (BTC) per day, worth roughly $2,400 at the time of writing. Previously, the maximum daily withdrawal amount was capped at 2 BTC, or about $80,000.

Amazon denies reports of accepting Bitcoin as payment. Despite this, the firm is open to the possibility.

After Amazon firmly denied that it planned to accept cryptocurrency payments before the end of the year, Bitcoin has slightly cooled.

A spokesperson for the company told Reuters: “Notwithstanding our interest in the space, the speculation that has ensued around our specific plans for cryptocurrencies is not true. We remain focused on exploring what this could look like for customers shopping on Amazon.”

Quick weekly news:

- Binance’s CZ Is Looking for His Replacement

- Monero Has ‘Significant Bug’

- Tesla Holds on to Bitcoin But Reveals $23M Impairment Charge

- Bitcoin Returns to $40,000

Other notable events include

– Mastercard Launches New Start Path Cryptocurrency and Blockchain Program for Startups

– Ethereum surpasses Bitcoin in terms of ROI and trading volume growth

New Start Path Program for Startups

Mastercard announced the launch of a new worldwide startup engagement program called Start Path, which will help fast-growing digital assets, blockchain and cryptocurrency businesses.

Seven startups have joined the program as part of Mastercard’s digital assets work. This list includes GK8, Domain Money, Mintable, SupraOracles, STACS, Taurus, and Uphold, which together with Mastercard seek to expand and accelerate innovation around digital asset technology and making it safer and easier for people and institutions to buy, spend, and hold cryptocurrencies and digital assets.

Ethereum surpasses Bitcoin in terms of ROI and trading volume growth

According to a Coinbase report, ETH trading volume was $1.4 trillion for half a year, an increase of 1,461% from $92 billion in the second half of 2020. BTC trading volumes rose 489% to $2.1 trillion over the same period.

In addition, Ethereum surpassed Bitcoin, the S&P 500, and gold in return on investment, up 210% in six months.

Analysts associate such indicators with the rapid development of the DeFi sector, optimism about the transition to Proof-of-Stake, as well as with the activation of EIP-1559, which will allow burning part of the ETH paid as commissions.

It is well known that getting into the crypto market is an easy part. The hard one is to stay profitable. There are dozens, if not hundreds, of tools available to traders to enhance their results. Traders worldwide sometimes deploy dozens of software solutions, additional monitors, and whatnot to gain an edge over those on the other side of the trade. So the big question is: what tools are the most essential and are there any value-adding free tools for beginners?

In our article “Trading Cryptocurrency 101: What Tools Do You Need?” we answer the following questions.

– What are the right tools to support your day trading strategies?

– How to choose an exchange?

– Why do you need a Crypto Portfolio Tracker?

– Is it important to set real-time price alerts?

- Spot trading: There are two favorites at the spot trading front: Solana (SOL) and Bitcoin (BTC). Two top dogs have overtaken Ethereum (ETH) and Stacks (STX) to push them to third and fourth places.

- Derivatives: Bitcoin (BTC) and Ethereum (ETH) have also become the most traded currencies as to trading derivatives. Cardano (ADA) is following these two head to head with Axie Infinity (AXS) and SushiSwap (SUSHI) taking fourth and fifth places.

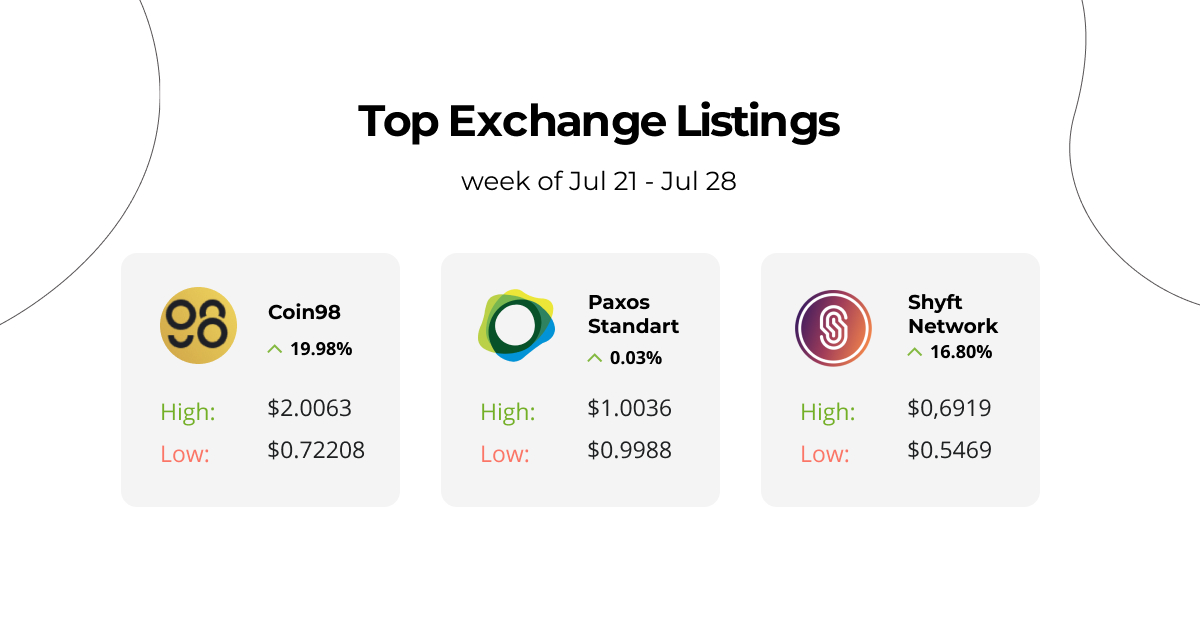

New Listings on CoinbasePro:

– Paxos Standard (PAX/USD PAX/USDT)

– Fetch.ai (FET/USDT FET/USD)

– Polygon (POLY/USD POLY/USDT)

– Harvest Finance (FARM/USD)

New Listings on Binance:

– Coin98 (C98/BTC C98/BNB C98/BUSD C98/USDT)

– QuickSwap (QUICK/BUSD QUICK/BNB QUICK/BTC)

– LTO Network (LTO/BUSD)

– DeXe (DEXE/USDT)

New Pairs on Kucoin:

– Shyft Network (SHFT/USDT)

– CoinBurp (BURP/USDT)

By the way, our PRO plan includes new Exchange Listing alerts for all 27 exchanges in our app. Become a PRO and receive an instant notification when a new coin is listed on Coinbase Pro, Binance, or an exchange of your choice!

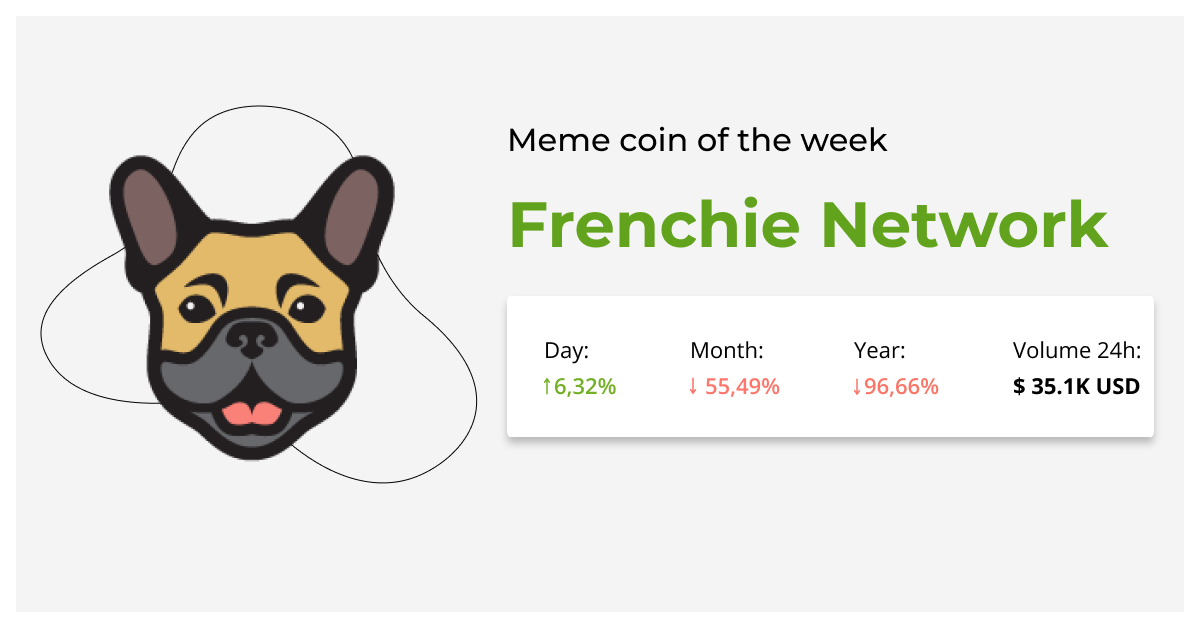

Frenchie goes by the ticker FREN. It is a simple BEP-20 smart contract with a burn function that has been professionally secured and audited.

It is planned that the Frenchie Network will be a smart-contract platform that is high-performing, scalable, and secure. It is designed to overcome the limitations of previous-generation blockchain platforms.

The Frenchie Network will be permissionless, decentralized, and open-source

🔍DYOR

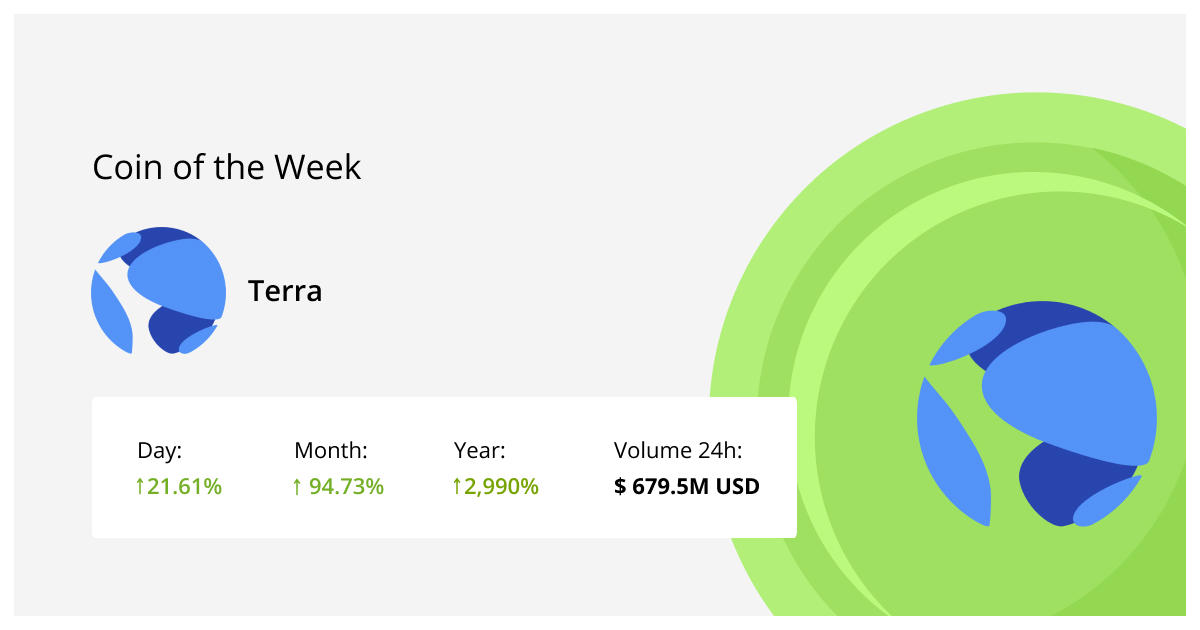

Terra is a Terraform Labs blockchain project that powers the startup’s cryptocurrencies and financial apps. These cryptocurrencies include the Terra U.S. Dollar or UST, which is pegged to the U.S. dollar through an algorithm. Terra is a stablecoin that aims to decrease the volatility that characterizes cryptocurrencies such as Bitcoin.

Terraform Labs intends to use Terra’s blockchain and related cryptocurrencies, including one pegged to the Korean won, to build a digital financial system free of big banks and fintech app developers.

😋Recent announcements:

What is Terra? Your guide to the hot cryptocurrency

Crypto investors like Terraform Labs so much, they’re committing $150 million to its ‘ecosystem’

3 reasons why Terra (LUNA) price rallied by 20%

We have prepared for you top-performing coins of July 29.

THORChain has managed to become the best performing asset among TOP-100, gaining 31.83% within the last 24 hours.

IOTA was the worst-performing asset among TOP-100 (again), losing 5.34% within the last 24 hours

To get up-to-date reports on gainers and losers during the week, follow us on Twitter.

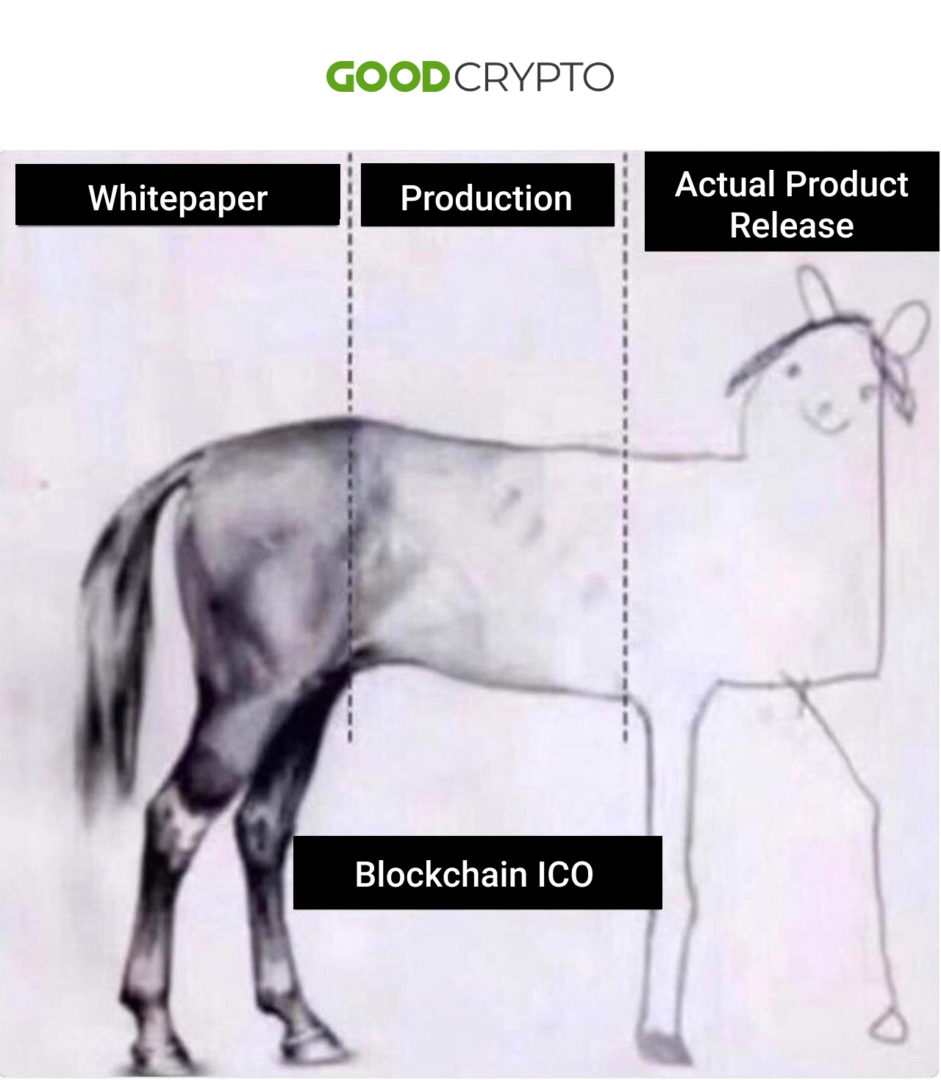

Top cryptomeme of the week

Expectation vs. Sad reality

We hope you found this digest useful and informative! If you want to be the first one to receive new crypto insights and stay up-to-date with the market, follow us on Twitter. Happy trading with the Good Crypto app!